Outline Report 2012

Diunggah oleh

Mary Margarett BoadoDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Outline Report 2012

Diunggah oleh

Mary Margarett BoadoHak Cipta:

Format Tersedia

APPROACH and TECHNIQUES IN BUDGETING: THE PHILIPPINES EXPERIENCE INTRODUCTION Budgeting approaches and techniques in many developing countries,

, the Philippines particularly. It is difficult to think of local budgeting practices which cannot be traced to American concepts. In the, Philippines experienced today American influence in local fiscal administration in most apparent in the area of budgeting.

ORIENTATION IN BUDGETING A.) Control Orientation in Budgeting; is the process of enforcing limitations and conditions set in the budget and in appropriations, and of securing compliance with spending restrictions imposed by central authorities B.) Management Orientation in Budgeting; involves the use of budgetary authority at both agency and central levels to ensure the efficient use of staff and other resources in the conduct of authorized activities. C.) Planning Orientation in Budgeting; refers to the process of determining public objectives and the evaluation of alternative programs. LINE ITEM BUDGETING The line item budgeting, a manifestation of process budgeting is incremental, fragmented, non-programmatic and sequential In this type of budgeting there is little explicit consideration of objectives and policies and almost no search for alternatives. By Robert Golenblewski:

- the line- item is a product of many factorings beginning at low organization levels whose request we aggregated and perhaps trimmed as they rose through an hierarchy. - the line- item budget lessens the top executives control over planning and programming.

There are 10 advantages of line- item budget approach 1.) It enables central authorities to control inputs; that is, to control the cost of inputs before the expenditure is made of obligated. 2.) It provides external control by legislators and central monitors who are not beholden to a particular agency. 3.)Line-item control is specifically effective for salaries and purchases, which together account for the bulk of state government spending perhaps 90 percent or more in some instances. 4.)Control is Uniform. Each agency is governed by the same accounts and standards. 5.)Control is comprehensive. 6.) Control is exact; must be imposed with pinpoint precision 7.)Control is routine; the records upon which control is built are required in the ordinary course of activity 8.)There are multiple opportunities for control. 9.)Both aggregate and detailed control are promoted 10.)Line item controls establish the basis for budget cutting. To bring budget into a desired relationship LINE-ITEM BUDGET The Philippines with the line-item budget marked a distinctive niche in the evolution of the various approaches in the countrys budgetary system. Through the line-item budget, the lawmakers were able to pinpoint objects of future choice, especially those referring to new positions. Thus even before actual authorization of agency budget estimates, compromises had already been bonded with various legislators. It is formulated on the basis of work to be done or services to be provided by the government and presents these together with their costs. A performance budget is in essence a work-plan of the government which specifies the concrete proposals to be accomplished during the financial year.

A. COMPONENTS 1.) Functional and Activity Classifications =performance budgeting places considerable emphasis redesigning expenditure accounts and grouping expenses into functional and activity categories. =functions such as public safety, health and transportation. 2.) Performance Measurements =measurement is essential to the success of performance budgeting. Performance measurements generally are derivatives of cost accounting and scientific management. Adopted from cost accounting are methods of measuring the total or partial cost of each unit of production or service whom scientific management, techniques for relating units input to quantities of output. 3.) Performance Reports = reports are a special type of performance measurement, a retrospective assessment of what was accomplished with budgeted resources. The performance report can either be an interim-audit or a post-audit of work and costs. Advantages of Performance Report 1.) It gives more comprehensive and reliable information to the chief executive, the legislative body and the general public on the policies of government. 2.)It helps individual legislators to understand what the government is doing and what the costs are; 3.)It improves legislative examination of budgetary requirements and enables the legislative financial committees to decide more easily the basic expenditure each year. 4.)It makes possible the submission and consideration of the budget for a shorter length of time 5.)It enables, the administration to place responsibility upon subordinate officials for the clear execution of the provisions made by the legislative. 6.)It permits effective performance in reporting on budgeting and management. B. ATTITUDE TOWARDS PERFORMANCE BUDGET Performance budgeting was marginal utility to the budget participants who followed their routines although cognizant of the need for change. Least affected

and least interested were those on the periphery of budget life: legislators, operating officials, and governors. Performance budgeting meant the elevation of management concerns to central prominence. Performance budgeting also meant abandoning control traditions in which the budget examiners had strong interests and over which they served as guardians. The Philippines government enthusiastically requested United States experts to introduce the concept to the country.

C. THE PHILIPPINE EXPERIENCE IN PERFORMANCE BUDGETING Early 1950s the public fiscal management in the field of budgeting in the Philippine government took concerned efforts to improve the budgetary system. The move was towards a more systematic pattern of allocating available funds among competing public expenditure requirements. Performance budgeting was introduced in the Philippines as part of the package of reforms which was initiated during the incumbency of the Late President Ramon Magsaysay by the Economic Survey Mission headed by Daniel Bell in 1950. The budget, accounting and auditing modernization project was launched in July 1954, in collaboration with the United States. The passage of Republic Act No. 992 or the Revised Budget Act on June 4, 1954, formally launched the establishment of performance budgeting in the Philippines. (the modernization of the accounting system) The proponents of the abolition of performance budgeting were the same proponents for its abolition of performance budgeting were the same proponents for its abolition in 1953.

PROBLEMS in PERFORMANCE BUDGETING 1.) Lack or Absence of Performance Measurements -units of work measurement characterized performance budgeting. While line-item budgeting merely lists the items of expenditures, performance budgeting based on programs, projects and activities. Usually most critical problem. 2.)Personnel -performance budgeting is hampered by the lack or absence of personnel possessing necessary technical skills and competencies such as management and cost accounting.

3.)Organization -performance budgeting demanded no less than a restructuring of the governments organizational system. 4.)Legislature -failure to take into account the realities of the political system at the time performance budget was installed aggravated the problem PLANNING, PROGRAMMING AND BUDGETING SYSTEM Were originally developed by the Rand Corporation in Sta. Monica, California for use by the United States Air Force. 1961 PPBS was adopted PPBS is a result of 3 distinct but closely related current budget making; economic planning, efficiency in government, and moment of national economies to control cyclical fluctuations. It offers an answer to the classical question: How does government allocated resources appropriately and rationally without to a hit-and-miss procedure? Envisions the development cross-walk grids for the conversion of data from a planning to a management and control framework and back again JACK RABIN PPBS is a rational decision-making technique may be used to make more systematic decisions given a set of objects and information at hand. PPBS emphasizes the long benefits and costs of a program no the short tem. It involves cost benefit studies PPBS is on the uses of government expenditures and on outputs than on the dollar or peso amounts allocated by department or agency.

PPBS includes purpose of the system. The objective or output of government special programs and then to minimize the costs. PURPOSES OF PPBS 1.) Specification of objectives to be achieved 2.)Existence of a multi-year planning and programming process which incorporates and uses an information system to present data 3.)Selection of a decision from various alternatives to achieve program objectives

4.)Existence of analytic capability used by the agencys by permanent specialized staffs 5.)Existence of a budgeting process which can take broad program decisions 6.)Systematic use of analysis throughout the process PPBS: THE PHILLIPINE EXPERIENCE In the Philippines after the Declaration of Martial Law Sept. 21, 1972 PD No.1 called fro the reorganization of the entire government system. In accordance with the Integrated Reorganization Plan. As a result of the exposure to PPBS, Filipino scholars and experts read papers in seminars on the possible usefulness of PPBS in the country. No less than former Finance Minister Cesar Virata remarked on the possible usefulness of PPBS to less developed countries. Early proponents of PPBS in the Philippines avoided using the term to minimize negative reactions to another imported technique. They pronounced to call it the IBS or the Integrated Budget System.

AN ASSESSMENT OF PPBS Schick and Wildavsky have observed that PPBS has never influence governmental decisions according to its own principles Victor Thompson strongly marked that Science cannot solve social problems PPBS shifts decision making from congressmen to a handle of technocrats or econologist who may not be necessarily represent to general interest of the people.

ZERO BASED BUDGETING (ZBB) APPROACH A.) Introduction and Definition of Concept -zero based budgeting approach revolutionized the budgetary systems in both developed and developing countries. The ZBB concept could be traced back to 1924 in the United States. - Peter A. Phyrr = an operating, planning and budgeting process which requires manager to justify his entire budget in detail and shifts the burden of proof to each manager to justify why he should spend any money. -for uninitiated the term zero base in budgeting connotes a negative impression

B.) Features and Objective of ZBB The Main Features of ZBB a.)It is a total budget approach b.)It is a budget based on need not want c.) It reallocates resources d.)It identifies alternative ways and levels or performance and funding Objective of ZBB a.)Strengthen the present performance budgeting system by the application of systematic analysis b.)Eliminate or reduce the funding of low-priority activities c.)Improve the quality of management and budget information d.)Encourage the application of improved BASIC ZBB TERMS 1.) Decision Unit major activity, group related activities, cost center which requires significant managerial decisions on performance and funding levels. 2.)Decision Level level of organization responsible for analyzing, reviewing, ranking, and grouping activity justification document. Levels of Performance and Funding a.)CURRENT LEVEL b.) MINIMUM LEVEL c.)ENHANCEMENT LEVEL THE ZBB PROCESS 1.) Development and issuance of agency planning assumption and policy guidelines 2.)Identification of decision units 3.) Identification of objectives for each decision units 4.) Identification of evaluation of alternative methods of accomplishing objectives.

5.)Analysis of different levels of performance and funding 6.)Preparation of Activity justification documents or decision packages 7.)Ranking of activities at various performance and funding levels 8.)Consolidation of activity justification documents and accomplishment standard budget preparation forms. ZBB IN THE PHILLiPINES In directing the application of the ZBB approach during the CY 1978 budget analysis then Acting Budget Commissioner Laya ask analysts to establish bench marks for outlays category: (a) personal services (b) maintenance and operating expenses and (c) equipment.

Justifications for adopting ZBB in the Philippine Budget System 1.) Lack of managerial involvement in budgeting 2.)Limited priority setting of projects and activities 3.)Lack of performance measurements and cost benefit analysis 4.)Unnecessary spending 5.)Weak planning and budgeting linkage 6.)Inadequate probing of organization and methods of operation 7.)Ineffective allocation of Resources APPRAISAL OF ZBB In the Philippines top officials waxed enthusiasm about ZBB innovations. Significantly, no less than former Budget Minister Laya remarked that the basis for ZBB is not really zero. Armand V. Fabella ( Chairman of the Presidential Commission on Reorganization) = that ZBB is still incremental because decisions are still made at the margin that is in identifying different levels of effort.

Weaknesses or constraints in full implementation of ZBB in the Philippine system a.)Support from top management b.)Translation of the concepts

c.)Management of the system TOP MANAGEMENT of the OFFICE of the Budget and Management Claudio has added certain requirements; 1.)Clear cut organizational structure 2.)Clearly stated functions 3.)Objectives of the department of bureau 4.)Competent managers 5.)Well-defined guidelines and planning assumptions WEAKNESSES OF ZBB a.)Insufficient training of agency personnel on the intricacies of implementing ZBB b.)Lack of guidance in implementing ZBB c.)Lack of central staff fully trained in ZBB d.)Lack of appreciation and real support from department heads e.)Emphasis on forms or too much paperwork f.)Difficulty of translating or operationalizing the ZBB concepts to more comprehensible, concrete terms CONCLUSION There is nothing inherently wrong with adapting budgetary approaches from other countries. After all, one cannot quarrel with a concept. Still, there have been very serious problems in adapting these approaches. The case of performance budgeting it the most interesting in the sense that it took more than twenty years before it could be substantially implemented. Secondly, budgetary decisions are made directly by the President in response to crises, unprogrammed needs and so on. Thirdly , the very real problems of a developing country like Philippines on the political, economic and administrative fronts have made it difficult to implement sophisticated technology. The diligent efforts that went into the institutionalized of these various approaches cannot be minimized. Still the search for an effective approach continues.

Anda mungkin juga menyukai

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- Philippines CuisineDokumen7 halamanPhilippines CuisineShiva DhatrakBelum ada peringkat

- Philippines Digital Economy Report 2020 A Better Normal Under COVID 19 Digitalizing The Philippine Economy NowDokumen134 halamanPhilippines Digital Economy Report 2020 A Better Normal Under COVID 19 Digitalizing The Philippine Economy NowJose Ramon G AlbertBelum ada peringkat

- Eating DisordersDokumen43 halamanEating DisordersMary Margarett Boado0% (1)

- Jose Rizal's Life and WritingsDokumen14 halamanJose Rizal's Life and WritingsKel B. SagunBelum ada peringkat

- Guntt ChartDokumen1 halamanGuntt ChartMary Margarett BoadoBelum ada peringkat

- CERTIFICATE G10 NewDokumen33 halamanCERTIFICATE G10 NewRobert Catapusan100% (1)

- NCP BSN 3rd Yr Psychiatric WardDokumen9 halamanNCP BSN 3rd Yr Psychiatric WardMary Margarett BoadoBelum ada peringkat

- Peg TemplateDokumen2 halamanPeg TemplateMary Margarett BoadoBelum ada peringkat

- Book AdultDokumen36 halamanBook AdultMary Margarett BoadoBelum ada peringkat

- A. General Survey:: H.Physical AssessmentDokumen7 halamanA. General Survey:: H.Physical AssessmentMary Margarett BoadoBelum ada peringkat

- Head NurseDokumen11 halamanHead Nursejannet20Belum ada peringkat

- Head NurseDokumen11 halamanHead Nursejannet20Belum ada peringkat

- Head NurseDokumen11 halamanHead Nursejannet20Belum ada peringkat

- Head NurseDokumen11 halamanHead Nursejannet20Belum ada peringkat

- Head NurseDokumen11 halamanHead Nursejannet20Belum ada peringkat

- Head NurseDokumen11 halamanHead Nursejannet20Belum ada peringkat

- Head NurseDokumen11 halamanHead Nursejannet20Belum ada peringkat

- Head NurseDokumen11 halamanHead Nursejannet20Belum ada peringkat

- Cervical Cancer NCPDokumen1 halamanCervical Cancer NCPCaren ReyesBelum ada peringkat

- Newww 9fDokumen2 halamanNewww 9fMary Margarett BoadoBelum ada peringkat

- ConsentsDokumen4 halamanConsentsMary Margarett BoadoBelum ada peringkat

- Cues/Needs Family Nursing ProblemsDokumen6 halamanCues/Needs Family Nursing ProblemsMary Margarett BoadoBelum ada peringkat

- Cerebellar Stroke 222Dokumen1 halamanCerebellar Stroke 222Mary Margarett BoadoBelum ada peringkat

- Case Study MargaDokumen6 halamanCase Study MargaMary Margarett BoadoBelum ada peringkat

- NEW Drugs BSN 3rd YrDokumen3 halamanNEW Drugs BSN 3rd YrMary Margarett BoadoBelum ada peringkat

- Nursing Care PlanDokumen10 halamanNursing Care PlanMary Margarett BoadoBelum ada peringkat

- AuthorDokumen1 halamanAuthorMary Margarett BoadoBelum ada peringkat

- Drug MDHDokumen13 halamanDrug MDHMary Margarett BoadoBelum ada peringkat

- Rheumatic Heart DiseaseDokumen11 halamanRheumatic Heart DiseaseMary Margarett BoadoBelum ada peringkat

- AuthorDokumen1 halamanAuthorMary Margarett BoadoBelum ada peringkat

- AuthorDokumen1 halamanAuthorMary Margarett BoadoBelum ada peringkat

- Reading in Philippine History Prelim ExamDokumen3 halamanReading in Philippine History Prelim ExamAngel Rose Dela CruzBelum ada peringkat

- Philippine Folk Dances - SdnameDokumen5 halamanPhilippine Folk Dances - Sdnameeds100% (22)

- No. Case Atty. Fabella's SignatureDokumen3 halamanNo. Case Atty. Fabella's SignatureIshBelum ada peringkat

- Activity 4 - Provincial Slogan TOLEDODokumen2 halamanActivity 4 - Provincial Slogan TOLEDOSharbette Ann ToledoBelum ada peringkat

- Talaan NG Mga Kalihim NG PilipinasDokumen2 halamanTalaan NG Mga Kalihim NG PilipinasRowel ManigbasBelum ada peringkat

- Activity 1. 19th Century Philippines - Rizal's ContextDokumen1 halamanActivity 1. 19th Century Philippines - Rizal's ContextJECHZ JACOB LOPEZBelum ada peringkat

- Bayan Muna: Ang Mata'y Alagaan (MATA)Dokumen6 halamanBayan Muna: Ang Mata'y Alagaan (MATA)ALEA CHRISCEL GARCIABelum ada peringkat

- Sariaya HistoryDokumen3 halamanSariaya HistoryArlene AbdulaBelum ada peringkat

- An Analysis of The Representation of The Aetas in Zoobic Safaru and Buhay Aeta PDFDokumen77 halamanAn Analysis of The Representation of The Aetas in Zoobic Safaru and Buhay Aeta PDFAxLs34nBelum ada peringkat

- Modern Arnis HistoryDokumen3 halamanModern Arnis HistoryGreen CrossBelum ada peringkat

- Philippine Media HistoryDokumen32 halamanPhilippine Media HistoryVince Dela CruzBelum ada peringkat

- Office of The Punong BarangayDokumen4 halamanOffice of The Punong Barangayfergie1trinidad100% (1)

- AfsafaDokumen2 halamanAfsafaCatherine MerillenoBelum ada peringkat

- Shall We WalkDokumen2 halamanShall We WalkRv JamesBelum ada peringkat

- Cadapan TransparnecyDokumen38 halamanCadapan TransparnecyEdjon PayongayongBelum ada peringkat

- Philacor Credit Corporation V. Commissioner of Internal RevenueDokumen10 halamanPhilacor Credit Corporation V. Commissioner of Internal RevenueCharity Gene AbuganBelum ada peringkat

- Fact Sheet On Msu BombingDokumen3 halamanFact Sheet On Msu BombingSalman RanawBelum ada peringkat

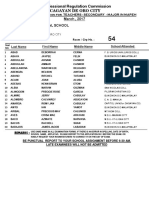

- ST ALOYSIUS GRADE 11 STUDENTS LISTDokumen65 halamanST ALOYSIUS GRADE 11 STUDENTS LISTemmanuel peraltaBelum ada peringkat

- Soul Boat (Abrera)Dokumen15 halamanSoul Boat (Abrera)MBelum ada peringkat

- # 1 Review and ImprovementDokumen13 halaman# 1 Review and ImprovementAngelina SantosBelum ada peringkat

- AGRI0417 Mla e PDFDokumen5 halamanAGRI0417 Mla e PDFPhilBoardResultsBelum ada peringkat

- 1st periodic-Frequency-of-Correct-BQBDokumen2 halaman1st periodic-Frequency-of-Correct-BQBMARIA MADONNA BUCAOBelum ada peringkat

- Certificate of Recognition Math ClubDokumen33 halamanCertificate of Recognition Math Clubimelda dolienteBelum ada peringkat

- Pliant Like The BambooDokumen2 halamanPliant Like The BambooJeremy MedranoBelum ada peringkat

- Mapeh PDFDokumen11 halamanMapeh PDFPRC BoardBelum ada peringkat

- Chapter 7 Related Events Before and After Rizal S DeathDokumen8 halamanChapter 7 Related Events Before and After Rizal S DeathShina GalvezBelum ada peringkat