Analyzing notes receivable, allowance for doubtful accounts, and depreciation expense

Diunggah oleh

Kean Christopher GandalalDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Analyzing notes receivable, allowance for doubtful accounts, and depreciation expense

Diunggah oleh

Kean Christopher GandalalHak Cipta:

Format Tersedia

1.

On December 31, 2010, Flint Corporation sold for $75,000 an old machine having an original cost of

$135,000 and a book value of $60,000. The terms of the sale were as follows:

$15,000 down payment

$30,000 payable on December 31 each of the next two years

The agreement of sale made no mention of interest; however, 9% would be a fair rate for this type of

transaction. What should be the amount of the notes receivable net of the unamortized discount on

December 31, 2010 rounded to the nearest dollar? (The present value of an ordinary annuity of 1 at

9% for 2 years is 1.75911.)

a.

b.

c.

d.

$52,773.

$67,773.

$60,000.

$105,546.

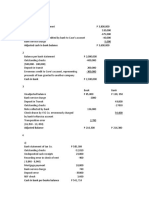

2. Vasguez Corporation had a 1/1/10 balance in the Allowance for Doubtful Accounts of $20,000. During

2010, it wrote off $14,400 of accounts and collected $4,200 on accounts previously written off. The

balance in Accounts Receivable was $400,000 at 1/1 and $480,000 at 12/31. At 12/31/10, Vasguez

estimates that 5% of accounts receivable will prove to be uncollectible. What is Bad Debt Expense for

2010?

a.

b.

c.

d.

$4,000.

$14,200.

$18,400.

$24,000.

$480,000 .05 [$20,000 ($14,400 $4,200)] = $14,200.

Use the following information for questions 3 through 5.

Jamison Corp.'s balance sheet accounts as of December 31, 2011 and 2010 and information relating to 2011

activities are presented below.

December 31,

2011

2010

Assets

Cash

$ 440,000

$ 200,000

Short-term investments

600,000

Accounts receivable (net)

1,020,000

1,020,000

Inventory

1,380,000

1,200,000

Long-term investments

400,000

600,000

Plant assets

3,400,000

2,000,000

Accumulated depreciation

(900,000)

(900,000)

Patent

180,000

200,000

Total assets

$6,520,000

$4,320,000

Liabilities and Stockholders' Equity

Accounts payable and accrued liabilities

$1,660,000

$1,440,000

Notes payable (nontrade)

580,000

Common stock, $10 par

1,600,000

1,400,000

Additional paid-in capital

800,000

500,000

Retained earnings

1,880,000

980,000

Total liabilities and stockholders' equity

$6,520,000

$4,320,000

Information relating to 2011 activities:

Net income for 2011 was $1,500,000.

Cash dividends of $600,000 were declared and paid in 2011.

Equipment costing $1,000,000 and having a carrying amount of $320,000 was sold in 2011 for $360,000.

A long-term investment was sold in 2011 for $320,000. There were no other transactions affecting longterm investments in 2011.

20,000 shares of common stock were issued in 2011 for $25 a share.

Short-term investments consist of treasury bills maturing on 6/30/12.

3. Net cash provided by Jamisons 2011 operating activities was

a. $1,500,000.

b. $2,120,000.

c. $2,080,000.

d. $2,160,000.

c

$1,500,000 $180,000 + ($900,000 $900,000 + $680,000) - ($360,000 $320,000) +

$20,000 + $220,000 ($320,000 $200,000) = $2,080,000.

4. Net cash used in Jamisons 2011 investing activities was

a. $2,320,000.

b. $1,820,000.

c. $1,680,000.

d. $1,720,000.

a

$320,000 + $360,000 ($3,400,000 + $1,000,000 $2,000,000) $600,000 = $2,320,000.

5. Net cash provided by Jamisons 2011 financing activities was

a. $480,000.

b. $520,000.

c. $1,080,000.

d. $1,680,000.

a

20,000 $25 = $500,000

$500,000 + $580,000 $600,000 = $480,000.

6. Foxx Corp.'s comparative balance sheet at December 31, 2011 and 2010 reported accumulated

depreciation balances of $800,000 and $600,000, respectively. Property with a cost of $50,000 and a

carrying amount of $38,000 was the only property sold in 2011. Depreciation charged to operations in

2011 was

a. $188,000.

b. $200,000.

c. $212,000.

d. $224,000.

c

$800,000 $600,000 + ($50,000 $38,000) = $212,000.

7. Nagel Co.'s prepaid insurance was $90,000 at December 31, 2011 and $45,000 at December 31, 2010.

Insurance expense was $36,000 for 2011 and $27,000 for 2010. What amount of cash disbursements

for insurance would be reported in Nagel's 2011 net cash provided by operating activities presented on

a direct basis?

a. $99,000.

b. $81,000.

c. $54,000.

d. $36,000.

b

$90,000 + $36,000 $45,000 = $81,000.

Anda mungkin juga menyukai

- Cash QuizDokumen6 halamanCash QuizGwen Cabarse PansoyBelum ada peringkat

- 04b Receivables (Part 2)Dokumen6 halaman04b Receivables (Part 2)JEFFERSON CUTE100% (1)

- Intermediate Accounting - MidtermsDokumen9 halamanIntermediate Accounting - MidtermsKim Cristian MaañoBelum ada peringkat

- Loans and Receivables Sample Problems 2Dokumen2 halamanLoans and Receivables Sample Problems 2Bryce Bihag60% (5)

- Cash-And-Cash-Equivalent - Answers On HandoutDokumen6 halamanCash-And-Cash-Equivalent - Answers On HandoutElaine AntonioBelum ada peringkat

- Instruction. Encircle The Letter That Corresponds To Your Answer. Do Not Use Pencils. Avoid ErasuresDokumen6 halamanInstruction. Encircle The Letter That Corresponds To Your Answer. Do Not Use Pencils. Avoid ErasuresstillwinmsBelum ada peringkat

- Financial Accounting - ReceivablesDokumen7 halamanFinancial Accounting - ReceivablesKim Cristian MaañoBelum ada peringkat

- CVCITC Quiz 1: Calculating Cash and Cash EquivalentsDokumen10 halamanCVCITC Quiz 1: Calculating Cash and Cash EquivalentsTyrelle Dela CruzBelum ada peringkat

- Since Accountancy Is A Quota CourseDokumen1 halamanSince Accountancy Is A Quota Courselindsay boncodinBelum ada peringkat

- Proof of Cash (Adjusted Balance Method)Dokumen1 halamanProof of Cash (Adjusted Balance Method)Dio NolascoBelum ada peringkat

- Pamela Company #11Dokumen7 halamanPamela Company #11Yassi CurtisBelum ada peringkat

- A. TheoryDokumen10 halamanA. TheoryROMULO CUBID100% (1)

- NPV - HelicopterDokumen3 halamanNPV - HelicopterAarti J. Kaushal100% (1)

- LecDokumen12 halamanLecLorenaTuazonBelum ada peringkat

- Financial Reporting Chapter 1 Multiple ChoiceDokumen20 halamanFinancial Reporting Chapter 1 Multiple Choicekabirakhan200733% (3)

- Financial Accounitng 1Dokumen22 halamanFinancial Accounitng 1Roselie CuencaBelum ada peringkat

- Pract 1 - Exam2Dokumen2 halamanPract 1 - Exam2Sharmaine Rivera MiguelBelum ada peringkat

- Accy 102 Theory of Cash and ReceivablesDokumen11 halamanAccy 102 Theory of Cash and ReceivablesKent CondinoBelum ada peringkat

- Docshare - Tips - Cash and Cash Equivalents PDFDokumen10 halamanDocshare - Tips - Cash and Cash Equivalents PDFAMANDA0% (1)

- Phinma - University of Iloilo Bam 006: Midterm Exam: Amount UncollectibleDokumen4 halamanPhinma - University of Iloilo Bam 006: Midterm Exam: Amount Uncollectiblehoneyjoy salapantanBelum ada peringkat

- Receivable Practice Problem 1Dokumen2 halamanReceivable Practice Problem 1ayeeeBelum ada peringkat

- P1 Day4 RMDokumen15 halamanP1 Day4 RMSharmaine Sur100% (1)

- Audit Prob Cash AnsDokumen7 halamanAudit Prob Cash AnsNoreen BinagBelum ada peringkat

- PAS 16 PPE GuideDokumen29 halamanPAS 16 PPE GuideArvin Garbo50% (2)

- ExDokumen5 halamanExMagdy KamelBelum ada peringkat

- Assignment No. 2 (Solution)Dokumen5 halamanAssignment No. 2 (Solution)Christine MalayoBelum ada peringkat

- Cash and Cash EquivalentDokumen8 halamanCash and Cash EquivalentApril ManaloBelum ada peringkat

- Quiz InventoriesDokumen2 halamanQuiz InventoriesKimboy Elizalde PanaguitonBelum ada peringkat

- 162 009Dokumen2 halaman162 009Angelli Lamique75% (4)

- Preparing Adjusting and Closing Journal EntriesDokumen84 halamanPreparing Adjusting and Closing Journal EntriesJozen RyanBelum ada peringkat

- Accounts ReceivablesDokumen10 halamanAccounts ReceivablesYenelyn Apistar Cambarijan0% (1)

- Notes Receivable Accounting: Initial Measurement, Subsequent Measurement & Treatment of Dishonored NotesDokumen104 halamanNotes Receivable Accounting: Initial Measurement, Subsequent Measurement & Treatment of Dishonored NotesXander Clock50% (2)

- Name: - : Problem 1Dokumen2 halamanName: - : Problem 1Samuel FerolinoBelum ada peringkat

- Bank Reconciliation Problems SolvedDokumen4 halamanBank Reconciliation Problems Solvedsharielles /Belum ada peringkat

- Intermediate Acctg A 1 10Dokumen10 halamanIntermediate Acctg A 1 10Leonila RiveraBelum ada peringkat

- Bank Recon Solutions Exercise 2 3Dokumen7 halamanBank Recon Solutions Exercise 2 3Kevin James Sedurifa OledanBelum ada peringkat

- ACCTG 211 Intermediate Accounting I Practice Set 2 Bank Reconciliation ProblemsDokumen1 halamanACCTG 211 Intermediate Accounting I Practice Set 2 Bank Reconciliation ProblemsjazonvaleraBelum ada peringkat

- Polytechnic University of The Philippines College of Accountancy Junior Philippine Institute of AccountantsDokumen15 halamanPolytechnic University of The Philippines College of Accountancy Junior Philippine Institute of AccountantsYassi CurtisBelum ada peringkat

- AP - Loans & ReceivablesDokumen11 halamanAP - Loans & ReceivablesDiane PascualBelum ada peringkat

- P1-PB. Sample Preboard Exam PDFDokumen12 halamanP1-PB. Sample Preboard Exam PDFAj VesquiraBelum ada peringkat

- Acct. 162 - EPS, BVPS, DividendsDokumen5 halamanAcct. 162 - EPS, BVPS, DividendsAngelli LamiqueBelum ada peringkat

- Semis Examination BDokumen12 halamanSemis Examination BCHENG50% (2)

- Chapter 1 Acctg 5Dokumen11 halamanChapter 1 Acctg 5Angelica MayBelum ada peringkat

- PS 1Dokumen4 halamanPS 1BlackRoseBelum ada peringkat

- Activity Based Costing ReviewerDokumen1 halamanActivity Based Costing ReviewerJonna LynneBelum ada peringkat

- Bank Deposits and Cash EquivalentsDokumen6 halamanBank Deposits and Cash EquivalentsPamela Mae PlatonBelum ada peringkat

- Notes ReceiDokumen2 halamanNotes ReceiDIANE EDRABelum ada peringkat

- Chap 013Dokumen667 halamanChap 013Rhaine ArimaBelum ada peringkat

- MA CUP Questions (PracticeDokumen9 halamanMA CUP Questions (PracticeFlor Danielle Querubin100% (1)

- CashDokumen16 halamanCashJemson YandugBelum ada peringkat

- Sample Problems Cash and Cash EquivalentsDokumen28 halamanSample Problems Cash and Cash EquivalentskrizzmaaaayBelum ada peringkat

- File 7595477826281120346Dokumen13 halamanFile 7595477826281120346sunshineBelum ada peringkat

- Problem 1 Youngish Company Reported The Follo: ASSIGNMENT: Sheet of PaperDokumen1 halamanProblem 1 Youngish Company Reported The Follo: ASSIGNMENT: Sheet of PaperEj Balbz100% (1)

- Conceptual Framework and Accounting Standards: Janesene N. Sol MWF 1:00-2:00 PMDokumen4 halamanConceptual Framework and Accounting Standards: Janesene N. Sol MWF 1:00-2:00 PMJanesene SolBelum ada peringkat

- Practical Accounting 1Dokumen11 halamanPractical Accounting 1Jomar VillenaBelum ada peringkat

- Computational Multiple Choice Questions on Cash and ReceivablesDokumen18 halamanComputational Multiple Choice Questions on Cash and ReceivablesAndrin LlemosBelum ada peringkat

- 1 Cash Dividends On The 10 Par Value Common Stock PDFDokumen2 halaman1 Cash Dividends On The 10 Par Value Common Stock PDFHassan JanBelum ada peringkat

- Accounting Web TestDokumen5 halamanAccounting Web TestZhou Tian Yang100% (1)

- General Fund Trial Balances and TransactionsDokumen9 halamanGeneral Fund Trial Balances and TransactionsAbdii Dhufeera100% (2)

- ACCT 3001 Exams 1 and 2 All QuestionsDokumen7 halamanACCT 3001 Exams 1 and 2 All QuestionsRegine VegaBelum ada peringkat

- JCPC 2011 0062 JudgmentDokumen18 halamanJCPC 2011 0062 JudgmentKean Christopher GandalalBelum ada peringkat

- Life ProjectDokumen2 halamanLife ProjectKean Christopher GandalalBelum ada peringkat

- Common Law Reasoning and Institutions Essay Topics 2011/12Dokumen1 halamanCommon Law Reasoning and Institutions Essay Topics 2011/12Kean Christopher GandalalBelum ada peringkat

- HM1800 ManualDokumen68 halamanHM1800 ManualKean Christopher GandalalBelum ada peringkat

- Checklist of Key Figures: Kieso Intermediate Accounting: IFRS EditionDokumen2 halamanChecklist of Key Figures: Kieso Intermediate Accounting: IFRS EditionMike WarrelBelum ada peringkat

- Practice 2AssetAcquisitionDokumen11 halamanPractice 2AssetAcquisitionEllen KokaliBelum ada peringkat

- NFL Annual Report 2011-2012Dokumen108 halamanNFL Annual Report 2011-2012prabhjotbhangalBelum ada peringkat

- Project Report On Financial Performance of Life Insurance CompanyDokumen11 halamanProject Report On Financial Performance of Life Insurance CompanyMasters VinodBelum ada peringkat

- Project EXIDEDokumen52 halamanProject EXIDErasiljohnson100% (1)

- Excel Model The Body Shop International PLC 2001: An Introduction To Financial ModelingDokumen29 halamanExcel Model The Body Shop International PLC 2001: An Introduction To Financial Modelingalka murarka33% (6)

- Lecture Files For Quiz 1 PDFDokumen28 halamanLecture Files For Quiz 1 PDFpppppBelum ada peringkat

- HSC - Notes (Finance)Dokumen13 halamanHSC - Notes (Finance)Devinna GraceBelum ada peringkat

- Keajaiban Takaful Wanita MAA Takaful BHD.: Khas Buat, Puan Ellysa (Umur 31 Tahun)Dokumen17 halamanKeajaiban Takaful Wanita MAA Takaful BHD.: Khas Buat, Puan Ellysa (Umur 31 Tahun)onlajerBelum ada peringkat

- Pecking Order When "Style"Dokumen52 halamanPecking Order When "Style"Akshay RawatBelum ada peringkat

- Chapter 18 Investment in AssociateDokumen5 halamanChapter 18 Investment in AssociateEllen MaskariñoBelum ada peringkat

- Research Proposal On PTCLDokumen9 halamanResearch Proposal On PTCLSajid AlyasBelum ada peringkat

- Business Model ComparisonDokumen2 halamanBusiness Model ComparisonFisehaBelum ada peringkat

- TFCO LapKeu2020 - NewDokumen107 halamanTFCO LapKeu2020 - Newmuniya altezaBelum ada peringkat

- Sugmya - Corporate PPT - Nov'22 - DebtDokumen18 halamanSugmya - Corporate PPT - Nov'22 - DebtGaurav SukhijaBelum ada peringkat

- Makalah Paper Noun Phrase (English Economy)Dokumen11 halamanMakalah Paper Noun Phrase (English Economy)Ines AlissaBelum ada peringkat

- Module 6 - Worksheet and Financial Statements Part IIDokumen4 halamanModule 6 - Worksheet and Financial Statements Part IIMJ San Pedro100% (2)

- Business CombinationDokumen10 halamanBusiness CombinationCloudKielGuiang0% (1)

- Secret Sauce A2 (2020-2021)Dokumen49 halamanSecret Sauce A2 (2020-2021)Eman TahirBelum ada peringkat

- MAT Software Solutions Pvt. Ltd. 040-66462382, Pavani Prestige, Above RS Brothers, AmeerpetDokumen9 halamanMAT Software Solutions Pvt. Ltd. 040-66462382, Pavani Prestige, Above RS Brothers, Ameerpetsiddique85Belum ada peringkat

- Fundamental Analysis of Media and Entertainment StocksDokumen17 halamanFundamental Analysis of Media and Entertainment StocksShashank PalBelum ada peringkat

- HW 0309Dokumen3 halamanHW 0309Ajeng RaraBelum ada peringkat

- Monthly fund updates for September 2020Dokumen59 halamanMonthly fund updates for September 2020dideshsBelum ada peringkat

- Activity 6B CapStructure FinmaDokumen4 halamanActivity 6B CapStructure FinmaDiomela BionganBelum ada peringkat

- Chapter 13 - Financial Asset at Fair ValueDokumen10 halamanChapter 13 - Financial Asset at Fair ValueMark LopezBelum ada peringkat

- Ratio Analysis of Colgate PalmoliveDokumen19 halamanRatio Analysis of Colgate Palmolivewan nur anisahBelum ada peringkat

- Isabela State University: MA 112 - Conceptual Framework & Accounting Standards - Chapter 1Dokumen18 halamanIsabela State University: MA 112 - Conceptual Framework & Accounting Standards - Chapter 1Chraze GBBelum ada peringkat

- 6-8 Jack and Jill Answer KeyDokumen2 halaman6-8 Jack and Jill Answer KeyAngelica Macaspac100% (1)

- Valuation of Bonds and Stocks ExplainedDokumen19 halamanValuation of Bonds and Stocks ExplainedShaneen Angelique MoralesBelum ada peringkat

- Engro CorDokumen28 halamanEngro CorAbBelum ada peringkat

- Shabbir AhmadDokumen2 halamanShabbir AhmadEkhlas AmmariBelum ada peringkat