Variance Analysis

Diunggah oleh

Lara Lewis AchillesDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Variance Analysis

Diunggah oleh

Lara Lewis AchillesHak Cipta:

Format Tersedia

4.

award:

7 out of 7.00 points

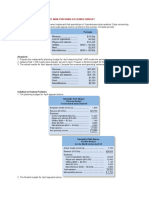

Problem 10-9 Comprehensive Variance Analysis [LO1, LO2, LO3]

Portland Company's Ironton Plant produces precast ingots for industrial use. Carlos Santiago, who was recently appointed general manager of the Ironton Plant, has just been handed the plants contribution format income statement for October. The statement is shown below: Sales (8,000 ingots) Variable expenses: Variable cost of goods sold* Variable selling expenses Total variable expenses Contribution margin Fixed expenses: Manufacturing overhead Selling and administrative Total fixed expenses Net operating income (loss) $ Budgeted $ 290,000 Actual $ 290,000

104,400 20,000 124,400 165,600

124,770 20,000 144,770 145,230

68,000 86,000 154,000 11,600 $

68,000 86,000 154,000 (8,770)

*Contains direct materials, direct labor, and variable manufacturing overhead. Mr. Santiago was shocked to see the loss for the month, particularly because sales were exactly as budgeted. He stated, "I sure hope the plant has a standard cost system in operation. If it doesn't, I won't have the slightest idea of where to start looking for the problem." The plant does use a standard cost system, with the following standard variable cost per ingot: Standard Quantity or Hours 3.6 pounds 0.5 hours 0.4 hours* Standard Price or Rate $2.20 per pound $7.70 per hour $3.20 per hour Standard Cost $ 7.92 3.85 1.28 13.05

Direct materials Direct labor Variable manufacturing overhead Total standard variable cost

*Based on machine-hours. During October the plant produced 8,000 ingots and incurred the following costs: a. Purchased 33,800 pounds of materials at a cost of $2.65 per pound. There were no raw materials in inventory at the beginning of the month.

b. Used 28,600 pounds of materials in production. (Finished goods and work in process inventories are insignificant and can be ignored.) c. Worked 4,600 direct labor-hours at a cost of $7.40 per hour. d. Incurred a total variable manufacturing overhead cost of $12,600 for the month. A total of 3,500 machine-hours was recorded. It is the companys policy to close all variances to cost of goods sold on a monthly basis. Required: 1. Compute the following variances for October: a. Direct materials price and quantity variances. (Input all amounts as positive values. Leave no cells blank - be certain to enter "0" wherever required. Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Omit the "$" sign in your response.)

Materials price variance Materials quantity variance

$ 15,210 $ 440

U F

b. Direct labor rate and efficiency variances. (Input all amounts as positive values. Leave no cells blank - be certain to enter "0" wherever required. Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Omit the "$" sign in your response.)

Labor rate variance Labor efficiency variance

$ 1,380 $ 4,620

F U

c. Variable overhead rate and efficiency variances. (Input all amounts as positive values. Do not round your intermediate calculations. Leave no cells blank - be certain to enter "0" wherever required. Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Omit the "$" sign in your response.)

Variable overhead rate variance Variable overhead efficiency variance

$ 1,400 $ 960

U U

2a. Summarize the variances that you computed in (1) above by showing the net overall favorable or unfavorable variance for October. (Input the amount as a positive value. Leave no cells blank be certain to enter "0" wherever required. Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Omit the "$" sign in your response.) Net variance $ 20,370 U

3. Pick out the two most significant variances that you computed in (1) above. (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer.) Materials price variance

Labor efficiency variance Variable overhead efficiency variance Labor rate variance Variable overhead rate variance Materials quantity variance

Anda mungkin juga menyukai

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsDari EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsBelum ada peringkat

- Economic and Business Forecasting: Analyzing and Interpreting Econometric ResultsDari EverandEconomic and Business Forecasting: Analyzing and Interpreting Econometric ResultsBelum ada peringkat

- Amercian FuelDokumen8 halamanAmercian FuelAsh KaiBelum ada peringkat

- Question 1 (Accounting)Dokumen2 halamanQuestion 1 (Accounting)David DavidBelum ada peringkat

- QS12 - Midterm 2 Review SolutionDokumen7 halamanQS12 - Midterm 2 Review Solutionlyk0tex0% (1)

- Review Problem 1: Variance Analysis Using A Flexible Budget: RequiredDokumen12 halamanReview Problem 1: Variance Analysis Using A Flexible Budget: RequiredGraieszian LyraBelum ada peringkat

- Math PracticeDokumen3 halamanMath Practiceakmal_07Belum ada peringkat

- MGMT 027 Connect 04 HWDokumen7 halamanMGMT 027 Connect 04 HWSidra Khan100% (1)

- Practice - Chapter 7 - ACCT - 401Dokumen8 halamanPractice - Chapter 7 - ACCT - 401mohammed azizBelum ada peringkat

- 2010-08-08 144205 Acc1Dokumen3 halaman2010-08-08 144205 Acc1Ashish BhallaBelum ada peringkat

- TT08Dokumen8 halamanTT0822002837Belum ada peringkat

- Review ExercisesDokumen5 halamanReview ExercisesThy Tran HongBelum ada peringkat

- Fundamentals of Variance Analysis: Mcgraw-Hill/IrwinDokumen17 halamanFundamentals of Variance Analysis: Mcgraw-Hill/Irwinimran_chaudhryBelum ada peringkat

- Absorption and Variable Costing Reviewer EphDokumen4 halamanAbsorption and Variable Costing Reviewer Ephephraim100% (1)

- Long Test 2 Set BDokumen2 halamanLong Test 2 Set BMonica ReyesBelum ada peringkat

- Managerial Accounting by Garrison Appendix 12B34 MASDokumen29 halamanManagerial Accounting by Garrison Appendix 12B34 MASJoshua Hines0% (1)

- Coursehero Com Solved Miller Toy Company Manufactures A PlasticDokumen3 halamanCoursehero Com Solved Miller Toy Company Manufactures A PlasticAlphaBelum ada peringkat

- Management Accounting HWDokumen5 halamanManagement Accounting HWHw SolutionBelum ada peringkat

- Bca 423-Marginal Vs Absoption Costing.Dokumen8 halamanBca 423-Marginal Vs Absoption Costing.James GathaiyaBelum ada peringkat

- Lanen 3e, Chapter 17 Additional Topics in Variance Analysis: Learning ObjectivesDokumen12 halamanLanen 3e, Chapter 17 Additional Topics in Variance Analysis: Learning ObjectivesPhuong TaBelum ada peringkat

- 3. If the critical path is longer than 60 days, what is the least amount that Dr. Watage can spend and still achieve the schedule objective? How can he prove to the Pathminder Fund that this is the minimum cost alternative?Dokumen2 halaman3. If the critical path is longer than 60 days, what is the least amount that Dr. Watage can spend and still achieve the schedule objective? How can he prove to the Pathminder Fund that this is the minimum cost alternative?Jonathan Altamirano Burgos0% (1)

- Bài Tập Tự LuậnDokumen5 halamanBài Tập Tự Luậnhn0743644Belum ada peringkat

- MA 13.2 (No Solutions)Dokumen2 halamanMA 13.2 (No Solutions)Michael ComunelloBelum ada peringkat

- Chapter 7 PPT Version 2Dokumen61 halamanChapter 7 PPT Version 2islamasifBelum ada peringkat

- Practice ProblemsDokumen4 halamanPractice ProblemsshaiwanaBelum ada peringkat

- CVPDokumen8 halamanCVPJessica EntacBelum ada peringkat

- Financial Control - 2 - Variances - Additional Exercises With SolutionDokumen9 halamanFinancial Control - 2 - Variances - Additional Exercises With SolutionQuang Nhựt100% (1)

- QS12 - Midterm 2 ReviewDokumen5 halamanQS12 - Midterm 2 Reviewlyk0texBelum ada peringkat

- Acc 0Dokumen21 halamanAcc 0Ashish BhallaBelum ada peringkat

- F5 CKT Mock1Dokumen8 halamanF5 CKT Mock1OMID_JJBelum ada peringkat

- Akuntansi Ratna FixxxDokumen17 halamanAkuntansi Ratna Fixxxaditya muhammadBelum ada peringkat

- Managerial Accounting - WS4 Connect Homework GradedDokumen9 halamanManagerial Accounting - WS4 Connect Homework GradedJason HamiltonBelum ada peringkat

- CH 07B (Empty)Dokumen4 halamanCH 07B (Empty)Riley CareBelum ada peringkat

- W1 Assignment Chapter ProblemsDokumen2 halamanW1 Assignment Chapter ProblemsYvonne TotesoraBelum ada peringkat

- Exercise 1 - Cost Concepts-1Dokumen7 halamanExercise 1 - Cost Concepts-1Vincent PanisalesBelum ada peringkat

- Sample MidTerm MC With AnswersDokumen5 halamanSample MidTerm MC With Answersharristamhk100% (1)

- FinanceDokumen14 halamanFinanceJarvis Gych'Belum ada peringkat

- F2 Pre-Exam QuestionsDokumen7 halamanF2 Pre-Exam Questionsaddi420100% (1)

- Cost Behavior and CVPDokumen4 halamanCost Behavior and CVPChiodos OliverBelum ada peringkat

- Chapter 03 - QuestionsDokumen4 halamanChapter 03 - QuestionsgurnoorkaurgilllBelum ada peringkat

- Bài tập chương 6,7Dokumen3 halamanBài tập chương 6,7mentran.13112002Belum ada peringkat

- Chapter 7 Problems PDFDokumen18 halamanChapter 7 Problems PDFArham Sheikh100% (1)

- G4 ZAKARIA - Job Order Costing SystemDokumen6 halamanG4 ZAKARIA - Job Order Costing SystemZakaria HasaneenBelum ada peringkat

- Ch12 VarianceAnalysis QDokumen11 halamanCh12 VarianceAnalysis QUmairSadiqBelum ada peringkat

- Finals SolutionsDokumen9 halamanFinals Solutionsi_dreambig100% (3)

- Practice Sheet 8 - CH9 SolutionDokumen5 halamanPractice Sheet 8 - CH9 SolutionMuhammadBelum ada peringkat

- Assignment PM 1....Dokumen6 halamanAssignment PM 1....Muhammad Arslan QadirBelum ada peringkat

- Assignment PMDokumen3 halamanAssignment PMSyeda ToobaBelum ada peringkat

- Cost Draft 2Dokumen13 halamanCost Draft 2wynellamae100% (1)

- PracticeExam MA1 GarrisonDokumen15 halamanPracticeExam MA1 GarrisoncompuhpBelum ada peringkat

- Kompilasi Tugas Mandiri Bagian 2Dokumen4 halamanKompilasi Tugas Mandiri Bagian 2Januar Ashari0% (1)

- Marginal CostingDokumen9 halamanMarginal CostingSharika EpBelum ada peringkat

- Test 2 Sample Questions With Correct AnswersDokumen8 halamanTest 2 Sample Questions With Correct AnswersBayoumy ElyanBelum ada peringkat

- ComaDokumen21 halamanComamanojBelum ada peringkat

- Month Units Total CostsDokumen3 halamanMonth Units Total Costsaarti saxenaBelum ada peringkat

- Economic & Budget Forecast Workbook: Economic workbook with worksheetDari EverandEconomic & Budget Forecast Workbook: Economic workbook with worksheetBelum ada peringkat

- Electricity Measuring & Testing Instruments World Summary: Market Values & Financials by CountryDari EverandElectricity Measuring & Testing Instruments World Summary: Market Values & Financials by CountryBelum ada peringkat

- Fabricated Steel Plate Work World Summary: Market Values & Financials by CountryDari EverandFabricated Steel Plate Work World Summary: Market Values & Financials by CountryBelum ada peringkat

- 1-Jun 3-Jun 5-Jun 6-Jun 7-Jun 10-Jun 12-Jun 13-Jun 14-Jun 15-Jun 17-Jun 18-Jun 20-Jun 25-Jun 27-Jun 30-JunDokumen2 halaman1-Jun 3-Jun 5-Jun 6-Jun 7-Jun 10-Jun 12-Jun 13-Jun 14-Jun 15-Jun 17-Jun 18-Jun 20-Jun 25-Jun 27-Jun 30-JunLara Lewis AchillesBelum ada peringkat

- NewTracksDokumen1 halamanNewTracksLara Lewis AchillesBelum ada peringkat

- Cost Concepts and CVP AnalysisDokumen7 halamanCost Concepts and CVP AnalysisLara Lewis AchillesBelum ada peringkat

- Seatwork Acctg 1Dokumen8 halamanSeatwork Acctg 1Lara Lewis AchillesBelum ada peringkat

- AcctgDokumen14 halamanAcctgLara Lewis AchillesBelum ada peringkat

- Ceo and Chairman, Tesla NET WORTH: $20.5 BDokumen13 halamanCeo and Chairman, Tesla NET WORTH: $20.5 BLara Lewis AchillesBelum ada peringkat

- Rubric For Research PaperDokumen1 halamanRubric For Research PaperLara Lewis AchillesBelum ada peringkat

- Mock CPA Board Examinations (p2)Dokumen8 halamanMock CPA Board Examinations (p2)Lara Lewis Achilles100% (1)

- Assignment 6Dokumen8 halamanAssignment 6Lara Lewis AchillesBelum ada peringkat

- Adjusted Cash Balance Per Bank $ 17,170Dokumen2 halamanAdjusted Cash Balance Per Bank $ 17,170Lara Lewis AchillesBelum ada peringkat

- Fin Act - PUP-Manila - July 2009Dokumen8 halamanFin Act - PUP-Manila - July 2009Lara Lewis AchillesBelum ada peringkat

- Mock CPA Board Examinations (Mas)Dokumen8 halamanMock CPA Board Examinations (Mas)Lara Lewis Achilles100% (1)

- Closing Time - SemisonicDokumen1 halamanClosing Time - SemisonicLara Lewis AchillesBelum ada peringkat

- Reniexus Budget Project, 2010Dokumen1 halamanReniexus Budget Project, 2010Lara Lewis AchillesBelum ada peringkat

- NCR Cup Quiz 1Dokumen7 halamanNCR Cup Quiz 1Lara Lewis AchillesBelum ada peringkat

- NewTracksDokumen1 halamanNewTracksLara Lewis AchillesBelum ada peringkat

- Project SolutionDokumen11 halamanProject SolutionLara Lewis AchillesBelum ada peringkat

- Coll Per NSCB Region - CY 2012Dokumen6 halamanColl Per NSCB Region - CY 2012Lara Lewis AchillesBelum ada peringkat

- Strategic Capacity PlanningDokumen27 halamanStrategic Capacity PlanningAshish Chatrath78% (9)

- 5 Faces of OppressionDokumen17 halaman5 Faces of OppressionAna P LópezBelum ada peringkat

- Alchian, Demsetz, Stigler, Coase - Fall 2012 E1600 Class 2 NotesDokumen19 halamanAlchian, Demsetz, Stigler, Coase - Fall 2012 E1600 Class 2 NotesnieschopwitBelum ada peringkat

- 24 Nov 2021 Catawba CaseDokumen4 halaman24 Nov 2021 Catawba CaseZarana PatelBelum ada peringkat

- (Good) The Entrepreneur & Entrepreneurship A Neoclassical ApproachDokumen27 halaman(Good) The Entrepreneur & Entrepreneurship A Neoclassical ApproachSyaima SyaimaBelum ada peringkat

- 220 - HRD - APEC Closing The Digital Skills Gap Report - RevDokumen41 halaman220 - HRD - APEC Closing The Digital Skills Gap Report - Revokky2006Belum ada peringkat

- ECO-20044 Marginal Product of Labor Final 1Dokumen4 halamanECO-20044 Marginal Product of Labor Final 1Tendesai SpearzBelum ada peringkat

- Economic GlobalizationDokumen5 halamanEconomic GlobalizationAadhityaBelum ada peringkat

- VariancesDokumen45 halamanVariancesanonBelum ada peringkat

- Classical Approaches To WorkDokumen45 halamanClassical Approaches To WorkSaaish Rao90% (10)

- Bharat Forge LTD., Pune. Variance Analysis Executive SummaryDokumen95 halamanBharat Forge LTD., Pune. Variance Analysis Executive SummaryPariBelum ada peringkat

- NEDA Determinants of Female LFP - Final Report - Oct15Dokumen69 halamanNEDA Determinants of Female LFP - Final Report - Oct15Jee SuyoBelum ada peringkat

- Susan Woodward - The Political Economy of Ethno-Nationalism in YugoslaviaDokumen20 halamanSusan Woodward - The Political Economy of Ethno-Nationalism in YugoslaviaStipe ĆurkovićBelum ada peringkat

- Report - A Study On Employee and Employer Relation at Apollo HospitalsDokumen55 halamanReport - A Study On Employee and Employer Relation at Apollo HospitalsNagaraju GuthikondaBelum ada peringkat

- Productivity and Work Study Techniques in Construction ProjectsDokumen19 halamanProductivity and Work Study Techniques in Construction Projectsajaymist21100% (1)

- Sip ProjectDokumen88 halamanSip ProjectSatyadarshi BhoiBelum ada peringkat

- Industrial Relations Course ContentDokumen41 halamanIndustrial Relations Course ContentVineeth S PanickerBelum ada peringkat

- ACC 122 SoftDokumen208 halamanACC 122 SoftJestine Franz GironBelum ada peringkat

- American Connector Company PresentationDokumen10 halamanAmerican Connector Company PresentationGhochuBelum ada peringkat

- ONtalent Selected Articles From DeloitteReviewDokumen168 halamanONtalent Selected Articles From DeloitteReviewDeloitte AnalyticsBelum ada peringkat

- Test Bank For Managing Human Resources 11th Edition Wayne CascioDokumen58 halamanTest Bank For Managing Human Resources 11th Edition Wayne CascioRichard Mcallen100% (33)

- Economic Essays Grade 12Dokumen56 halamanEconomic Essays Grade 12pleasuremaome06Belum ada peringkat

- PPCDokumen20 halamanPPCPrasanth ShanmugamBelum ada peringkat

- Caf-03 Cma Theory Notes Prepared by Fahad IrfanDokumen16 halamanCaf-03 Cma Theory Notes Prepared by Fahad IrfanHadeed HafeezBelum ada peringkat

- HRM GRP 2 Presentation - FinalDokumen41 halamanHRM GRP 2 Presentation - FinalLiezl Andrea Keith CastroBelum ada peringkat

- Strategies To Reduce UnemploymentDokumen12 halamanStrategies To Reduce Unemploymentsnijay100% (1)

- LibertarianismDokumen28 halamanLibertarianismapi-102485431Belum ada peringkat

- MUNRO 2019marx Theory of Land, Rent and CitiesDokumen226 halamanMUNRO 2019marx Theory of Land, Rent and CitiesgaboyhaBelum ada peringkat

- Racial Discrimination - Significance of The StudyDokumen2 halamanRacial Discrimination - Significance of The StudyGaia FujimaBelum ada peringkat

- Labour Based Notes DetailedDokumen118 halamanLabour Based Notes Detailedkevinlando800Belum ada peringkat