Ar CR Journals

Diunggah oleh

Dana A Daspit ConteDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Ar CR Journals

Diunggah oleh

Dana A Daspit ConteHak Cipta:

Format Tersedia

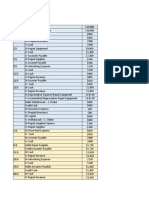

CASH RECEIPTS & SALES JOURNAL EXAMPLE

TAXABLE SALES NON-TAX LAY- STORE CUSTOMER BAL ON

INV # CASH DISC

SALE TAX SALE AWAY CREDIT NAME ACCT

1152 K. TURNER

$331.37 $1050.00 $81.37 $0 $0 ($800.00) $0 ($800.00)

1205 K. TURNER

$400.00 $ 400.00 ($400.00)

NOTE:

Original Lay-Away posting to sales journal is a ($?.00) credit on both Sales Journal &

Lay-Away Ledger Card. This Original Lay-Away amount equals the Balance Due on

the account after posting the entire sale as per above example. All other payments simply

debit the bank and debit the Lay-Away amount as per above example.

On the Lay-Away Ledger Card, follow the same rule as per above example.

/var/www/apps/scribd/scribd/tmp/scratch3/16805406.doc

Anda mungkin juga menyukai

- How Do They Do It? Paper Bills Edition - Money Learning for Kids | Children's Growing Up & Facts of Life BooksDari EverandHow Do They Do It? Paper Bills Edition - Money Learning for Kids | Children's Growing Up & Facts of Life BooksBelum ada peringkat

- Book 1Dokumen45 halamanBook 1ZULFA SYAMBelum ada peringkat

- d81c3440-6768-4228-9198-57080fee42a7_9b50d6d3b8dadbf1f6674058a7a0c4e2ef276181b4858435b00ba7f9e2fee74aDokumen7 halamand81c3440-6768-4228-9198-57080fee42a7_9b50d6d3b8dadbf1f6674058a7a0c4e2ef276181b4858435b00ba7f9e2fee74aXavi Solis ValdezBelum ada peringkat

- 1st Bank ReconcilationDokumen84 halaman1st Bank ReconcilationJemal SeidBelum ada peringkat

- Bookkeeping - Course Notes (2022)Dokumen1 halamanBookkeeping - Course Notes (2022)Karan KhannaBelum ada peringkat

- Estimated Closing Costs and Terminology Buyers 01-03-2018Dokumen4 halamanEstimated Closing Costs and Terminology Buyers 01-03-2018Shay HataBelum ada peringkat

- Accounting 1Dokumen88 halamanAccounting 1Rina Angeles EndozoBelum ada peringkat

- 2023 01Dokumen7 halaman2023 01Shuvendu ShilBelum ada peringkat

- Account No: 931850463 Monthly Statement Period: MAY - 2021Dokumen6 halamanAccount No: 931850463 Monthly Statement Period: MAY - 2021Muhammad Riza Nor RohmanBelum ada peringkat

- Act110 Requirement ExcelDokumen47 halamanAct110 Requirement ExcelCydney BrianneBelum ada peringkat

- Airline Management AnalysisDokumen17 halamanAirline Management AnalysisJerry John Ayayi AyiteyBelum ada peringkat

- PT Amanah Latihan LSPDokumen79 halamanPT Amanah Latihan LSPDragrexsBelum ada peringkat

- 6c Deposit Totals Are Balanced With Internal RecordsDokumen2 halaman6c Deposit Totals Are Balanced With Internal Recordsapi-279228567Belum ada peringkat

- PE ACCO5305 NHOM 8 chưa hoàn chỉnhDokumen9 halamanPE ACCO5305 NHOM 8 chưa hoàn chỉnhKhánh HàBelum ada peringkat

- Double-Entry BookkeepingDokumen8 halamanDouble-Entry BookkeepingzahidkhanBelum ada peringkat

- Operating (Revenue) Expenses & Losses Brief Description:: Suresh G. Lalwani - Managerial Accounting Page 1 of 1Dokumen1 halamanOperating (Revenue) Expenses & Losses Brief Description:: Suresh G. Lalwani - Managerial Accounting Page 1 of 1akanksha chauhanBelum ada peringkat

- BFARDokumen8 halamanBFARasdfBelum ada peringkat

- Akuntansi KeuanganDokumen8 halamanAkuntansi KeuanganFredi Dwi SusantoBelum ada peringkat

- Thank You For Your Recent Visit 16-07-2019, 06:14: Subject: From: Date: ToDokumen4 halamanThank You For Your Recent Visit 16-07-2019, 06:14: Subject: From: Date: ToDavid RobertsBelum ada peringkat

- Schedule of Charges Current AccountDokumen8 halamanSchedule of Charges Current AccountAshif RejaBelum ada peringkat

- Emailreceipt VerizonDokumen1 halamanEmailreceipt VerizonMichel GandhiBelum ada peringkat

- Abm-301 Ils-In-funda Na Balance Pati Patot PanablaDokumen120 halamanAbm-301 Ils-In-funda Na Balance Pati Patot PanablaBarney MabiniBelum ada peringkat

- Calculating your monthly cash flowDokumen5 halamanCalculating your monthly cash flowKSXBelum ada peringkat

- SALE TITLEDokumen1 halamanSALE TITLEperguntas?Belum ada peringkat

- CB Angela Manjarres PDFDokumen2 halamanCB Angela Manjarres PDFOlga Constanza Cruz NovalBelum ada peringkat

- CB Gelver ReyesDokumen2 halamanCB Gelver ReyesOlga Constanza Cruz NovalBelum ada peringkat

- Robinhood Account Statement for April 2021Dokumen11 halamanRobinhood Account Statement for April 2021adam burdBelum ada peringkat

- BSyS HojaModeloDokumen1 halamanBSyS HojaModelofelipevinuesaBelum ada peringkat

- Cash BookDokumen4 halamanCash Bookgautam48128Belum ada peringkat

- PM-excel Dashboard Templates 40Dokumen16 halamanPM-excel Dashboard Templates 40Hiền Vũ NgọcBelum ada peringkat

- Skywalker Co Journal Adjustments Income StatementDokumen3 halamanSkywalker Co Journal Adjustments Income StatementZhida PratamaBelum ada peringkat

- Cash Declaration RaashaDokumen95 halamanCash Declaration Raashamarkgalang.helencafeBelum ada peringkat

- Practica ContableDokumen9 halamanPractica ContableBerenice PatiñoBelum ada peringkat

- Individual AssignmentDokumen7 halamanIndividual AssignmentHamis MohamedBelum ada peringkat

- SEO-optimized title for a balance sheet document in SpanishDokumen6 halamanSEO-optimized title for a balance sheet document in SpanishDaniela RodríguezBelum ada peringkat

- Lat 7 Knight&lesserDokumen5 halamanLat 7 Knight&lesserNadratul Hasanah LubisBelum ada peringkat

- Accounting Basics: Debits, Credits, Journal EntriesDokumen30 halamanAccounting Basics: Debits, Credits, Journal Entriesteem teerutBelum ada peringkat

- Correction of ErrorsDokumen16 halamanCorrection of ErrorszahidkhanBelum ada peringkat

- Pacalna - The Fashion Rack Super FinalDokumen45 halamanPacalna - The Fashion Rack Super FinalAnifahchannie PacalnaBelum ada peringkat

- Key SAP document typesDokumen18 halamanKey SAP document typesKrishna KumarBelum ada peringkat

- Obc Sbi Gold N More Brochure PDFDokumen11 halamanObc Sbi Gold N More Brochure PDFRahul KainBelum ada peringkat

- Philippine Politics and Governance DLPDokumen6 halamanPhilippine Politics and Governance DLPDMarrie Abao Boniao-LabadanBelum ada peringkat

- vLookUp Lecture July 01Dokumen10 halamanvLookUp Lecture July 01Nathalia Alexandra PagulayanBelum ada peringkat

- U1911118 Final AssigmentDokumen5 halamanU1911118 Final AssigmentAziza 191x118Belum ada peringkat

- Copia de Customer-Service-DashboardDokumen16 halamanCopia de Customer-Service-DashboardHugo AlbertoBelum ada peringkat

- Client information, loan projections and third party paymentsDokumen2 halamanClient information, loan projections and third party paymentsOlga Constanza Cruz NovalBelum ada peringkat

- Cash Furniture Note Payable Account Receiable Store EquipmentDokumen6 halamanCash Furniture Note Payable Account Receiable Store EquipmentTrinh Duc Manh (k15 HL)Belum ada peringkat

- Razan - 12akl1 - CV AA KAMAYDokumen54 halamanRazan - 12akl1 - CV AA KAMAYrazan isfahandaBelum ada peringkat

- Scan Nov 02, 2022Dokumen6 halamanScan Nov 02, 2022Anthony GurnawanBelum ada peringkat

- PeriodicDokumen19 halamanPeriodicAlyssa Mae MarceloBelum ada peringkat

- Session 17 Journals 1 - Sales & PurchasesDokumen10 halamanSession 17 Journals 1 - Sales & Purchasesol.iv.e.a.gui.l.ar412Belum ada peringkat

- Bagas Putra Pranoto - 1810631030095 (Praktikum)Dokumen8 halamanBagas Putra Pranoto - 1810631030095 (Praktikum)Bagas putra pranotoBelum ada peringkat

- Nri SocDokumen1 halamanNri SocRavi AhujaBelum ada peringkat

- Pasta Centre Business PlanDokumen15 halamanPasta Centre Business PlanZoya KhanBelum ada peringkat

- An Assignment On: The Journal Entry ProcedureDokumen4 halamanAn Assignment On: The Journal Entry ProcedureAshok JangirBelum ada peringkat

- 2918 Stanbic August TarrifsDokumen1 halaman2918 Stanbic August TarrifsNyamutatanga MakombeBelum ada peringkat

- Book 1Dokumen2 halamanBook 1GioBelum ada peringkat

- BalanceDokumen2 halamanBalancerobertito1568945Belum ada peringkat

- Journal, T Accounts, WorksheetDokumen10 halamanJournal, T Accounts, Worksheetkenneth coronelBelum ada peringkat

- Schedule M-2 PartnershipsDokumen2 halamanSchedule M-2 PartnershipsDana A Daspit ConteBelum ada peringkat

- Title Page 8Dokumen3 halamanTitle Page 8Dana A Daspit ConteBelum ada peringkat

- Fattach Get 5Dokumen3 halamanFattach Get 5Dana A Daspit ConteBelum ada peringkat

- Year-End Tax Plan1Dokumen1 halamanYear-End Tax Plan1Dana A Daspit ConteBelum ada peringkat

- TravelDokumen12 halamanTravelDana A Daspit ConteBelum ada peringkat

- Schedule M-2 Corporation Sub SDokumen2 halamanSchedule M-2 Corporation Sub SDana A Daspit ConteBelum ada peringkat

- Schedule of IRS Form AddendumDokumen1 halamanSchedule of IRS Form AddendumDana A Daspit ConteBelum ada peringkat

- Weekly Class Schedule1Dokumen1 halamanWeekly Class Schedule1Dana A Daspit ConteBelum ada peringkat

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- General JournalDokumen2 halamanGeneral JournalDana A Daspit ConteBelum ada peringkat

- Schedule M-2 Corporate Sub-SDokumen1 halamanSchedule M-2 Corporate Sub-SDana A Daspit ConteBelum ada peringkat

- Promissory NoteDokumen2 halamanPromissory NoteDana A Daspit ConteBelum ada peringkat

- Quick Finder 2008 Tax-OrganizerDokumen8 halamanQuick Finder 2008 Tax-OrganizerDana A Daspit ConteBelum ada peringkat

- Partnership Organizer Qsba-14Dokumen2 halamanPartnership Organizer Qsba-14Dana A Daspit ConteBelum ada peringkat

- 2005 Leased AutosDokumen15 halaman2005 Leased AutosDana A Daspit ConteBelum ada peringkat

- 2008 Tax OrganizerDokumen4 halaman2008 Tax OrganizerDana A Daspit ConteBelum ada peringkat

- GJE BLANK Qtrly RevisedDokumen2 halamanGJE BLANK Qtrly RevisedDana A Daspit ConteBelum ada peringkat

- EOY Check List BlankDokumen1 halamanEOY Check List BlankDana A Daspit ConteBelum ada peringkat

- pdf/accounting GLDokumen17 halamanpdf/accounting GLDana A Daspit ConteBelum ada peringkat

- Equipment Ledger CardDokumen5 halamanEquipment Ledger CardDana A Daspit ConteBelum ada peringkat

- SEMA4 Reimbursement FormDokumen2 halamanSEMA4 Reimbursement FormDana A Daspit ConteBelum ada peringkat

- Travel ExpenseDokumen1 halamanTravel ExpenseDana A Daspit ConteBelum ada peringkat

- Deprn WKSHTDokumen1 halamanDeprn WKSHTDana A Daspit ConteBelum ada peringkat

- Deprn WKSHTDokumen1 halamanDeprn WKSHTDana A Daspit ConteBelum ada peringkat

- Credit Card Tracker Template: L&M Business DesignsDokumen6 halamanCredit Card Tracker Template: L&M Business DesignsDana A Daspit ConteBelum ada peringkat

- Quick Books Year End Combo ChecklistDokumen4 halamanQuick Books Year End Combo ChecklistDana A Daspit ConteBelum ada peringkat

- Depreciation LegalDokumen2 halamanDepreciation LegalDana A Daspit ConteBelum ada peringkat

- Checkbook Register1Dokumen4 halamanCheckbook Register1prasaad08Belum ada peringkat

- Box Calendar Green 12monthDokumen1 halamanBox Calendar Green 12monthDana A Daspit ConteBelum ada peringkat

- Chart ofDokumen50 halamanChart ofDana A Daspit ConteBelum ada peringkat