Worksheet

Diunggah oleh

Suszie SueDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Worksheet

Diunggah oleh

Suszie SueHak Cipta:

Format Tersedia

Manual Accounting Practice Set Coffee & Caf Supplier, US GAAP Edition 3

Feedback: Worksheet

This is a feedback page. Please review this page carefully because later pages in this practice set build on the feedback provided here. After you have reviewed your feedback page, click Continue at the bottom of this page to move on to the next page of your practice set.

Your progress

Your grading

Your grading outcome (still in progress) Awarded Total Points (prior to this page) Points (on this page) Points (after this page) Total 698 74 ! 767 82 277

772 1,126

Completed:

64% (approximately)

Remaining pages will take: up to 6.5 hours

The time frames we provide are a guide only. It may take you more or less time to complete each step.

Now that you have completed the June bank reconciliation process, you are asked to complete the worksheet for Bean Counters Coffeehouse. The worksheet is an internal document that exists outside the journals and ledgers. It is often used in the manual accounting system to help record adjusting entries and prepare financial statements. After you have prepared the worksheet, in the next section of the practice set you will be asked to use the completed worksheet to help journalize and post adjusting entries to general ledger. You will also use this worksheet to assist you in preparing the financial statements for Bean Counters Coffeehouse in a later section of this practice set. The details of the end of month adjustments for June are as follows: Office Furniture owned by the business: original purchase price was $7,000, estimated useful life was 5 years, and estimated residual value was $1,000 at the end of the useful life. Depreciation is calculated on a monthly basis using the straight line method. The monthly depreciation charge is calculated as the yearly depreciation expense divided by the number of months in a year. Office Equipment owned by the business: original purchase price was $48,000, estimated useful life was 10 years, and estimated residual value was $5,500 at the end of the useful life. Depreciation is calculated on a monthly basis using the straight line method. The monthly depreciation charge is calculated as the yearly depreciation expense divided by the number of months in a year. Electricity expense for the month of June is estimated to be $969. The water usage for the month of June is estimated to be $235. Sales staff work every single day during the week including weekends and are not paid until the end of each two weeks. Wages were last paid up to and including June 28. Wages incurred after that day (from June 29 to June 30 inclusive) are estimated to have been $720 per day. Interest expense incurred during the month of June but not yet paid to ZNZ Bank for the bank loan is $240. Interest earned from short-term investments in MRMC Bank for the month of June is $110. Office supplies totalling $2,483 are still on hand at June 30. 2 months of rent remained pre-paid at the start of June. 3 months of advertising remained pre-paid at the start of June. 5 months of insurance remained pre-paid at the start of June. When calculating the portion of prepayments that expire during the month of June, you are asked to assume that an equal amount of expense is incurred per month. Instructions for worksheet Complete all columns in the worksheet. To do this, you need to use the account balances provided in the general ledger to fill out the Unadjusted Trial Balance columns. You are also required to calculate the end of month adjustments for June and enter them into the worksheet before completing the remaining columns. Note that not all boxes in each column of the worksheet will need to be filled. After taking a physical count of inventory, the balance of inventory on hand as at June 30 is $64,665. You will need to use this information to complete both the Income Statement and the Balance Sheet columns of the worksheet. Hint: This information will assist you in calculating cost of goods sold under the periodic inventory system. Remember to enter all answers to the nearest whole dollar. Back-On-Track functionality Please note that any answers from previous pages carried through onto this page (either on the page or in a popup information page) have been reset, if necessary, to the correct answers. Your particular answers from previous pages are no longer shown. If you want to print this page, please read and follow the special printing information to ensure you can print the worksheet in full.

(Q=831.worksheetQuestion)

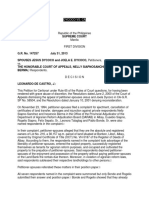

Bean Counters Coffeehouse

Worksheet

For the month ended June 30, 2012

Acct. Account Name No. 100 Cash 102 Short-term Investments 110 ARC - Accounts Receivable Control 112 Interest Receivable 120 Merchandise Inventory 130 Office Supplies 140 Prepaid Rent 141 Prepaid Advertising 142 Prepaid Insurance 150 Office Furniture 151 Accum Depn: Office Furniture 160 Office Equipment 161 Accum Depn: Office Equipment 210 APC - Accounts Payable Control 220 Wages Payable 221 Electricity Payable 222 Water Payable 225 Interest Payable 250 Bank Loan Payable 300 Common Stock 301 Retained Earnings 400 Sales Revenue 401 Sales Returns and Allowances 402 Sales Discounts 403 Interest Revenue 500 Purchases 501 Purchase Returns and Allowances 502 Purchase Discounts 511 Advertising Expense 516 Wages Expense 540 Rent Expense 541 Electricity Expense 542 Water Expense 543 Insurance Expense

Unadjusted Trial Balance Debit

86688 22000 5707 0 78860

Adjustments Debit Credit

Adjusted Trial Balance Debit

86688 22000 5707 0 78860

Income Statement Debit Credit

Balance Sheet Debit

86688 22000 5707 0 78860

Credit

Credit

Credit

5283 5000 12000 3500 7000 2100 48000 18771 1260 0 0 0 0 48000 65000 111560 50838 2921 80 160 5283 2253 47 0 10661 0 0 0 0 4000 1440 2500 969 235 700

2800 2500 4000 700

2483 2500 8000 2800 7000

2483 2500 8000 2800 7000 2200 2200 48000 19125 1260 1260 1440 969 235 240 48000 65000 111560 50838 2921 80 160 160 5283 2253 47 2253 47 4000 12101 2500 969 235 700

100 48000 354 19125

1440 969 235 240

1440 969 235 240 48000 65000 111560 50838 2921 80

5283

4000 12101 2500 969 235 700

544 Office Supplies Expense 545 Salary Expense 560 Depn Expense: Office Furniture 561 Depn Expense: Office Equipment 571 Interest Expense 572 Admin. Expense - Bank Charges Totals

0 7000 0 0 0 6 297983 299989

2483

2483 7000

2483 7000 100 354 240 6 284202 38972 53298 264038 250029

100 354 240

100 354 240 6

13021

13338

322135

Net income or loss Totals

14326 53298 53298 264038

14009 264038

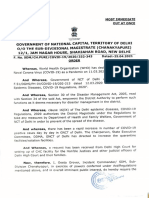

Feedback

Bean Counters Coffeehouse

Worksheet

For the month ended June 30, 2012

Unadjusted Trial Balance Debit 100 102 110 112 120 130 140 141 142 150 151 160 161 210 220 221 222 225 250 300 301 400 401 402 403 500 501 502 511 516 540 541 542 543 Cash Short-term Investments ARC - Accounts Receivable Control Interest Receivable Merchandise Inventory Office Supplies Prepaid Rent Prepaid Advertising Prepaid Insurance Office Furniture Accum Depn: Office Furniture Office Equipment Accum Depn: Office Equipment APC - Accounts Payable Control Wages Payable Electricity Payable Water Payable Interest Payable Bank Loan Payable Common Stock Retained Earnings Sales Revenue Sales Returns and Allowances Sales Discounts Interest Revenue Purchases Purchase Returns and Allowances Purchase Discounts Advertising Expense Wages Expense Rent Expense Electricity Expense Water Expense Insurance Expense 10,661 5,283 2,253 47 4,000 1,440 2,500 969 235 700 4,000 12,101 2,500 969 235 700 2,921 80 160 110 5,283 2,253 47 4,000 12,101 2,500 969 235 700 48,000 65,000 111,560 50,838 2,921 80 270 5,283 2,253 47 48,000 18,771 1,260 1,440 969 235 240 354 78,860 5,283 5,000 12,000 3,500 7,000 2,100 100 48,000 19,125 1,260 1,440 969 235 240 48,000 65,000 111,560 50,838 2,921 80 270 50,838 2,800 2,500 4,000 700 86,688 22,000 5,707 110 Credit Adjustments Debit Credit Adjusted Trial Balance Debit 86,688 22,000 5,707 110 78,860 2,483 2,500 8,000 2,800 7,000 2,200 48,000 19,125 1,260 1,440 969 235 240 48,000 65,000 111,560 78,860 64,665 Credit Income Statement Debit Credit Balance Sheet Debit 86,688 22,000 5,707 110 64,665 2,483 2,500 8,000 2,800 7,000 2,200 Credit

Acct. No.

Account Name

544 545 560 561 571 572

Office Supplies Expense Salary Expense Depn Expense: Office Furniture Depn Expense: Office Equipment Interest Expense Admin. Expense - Bank Charges Totals 6 299,989 299,989 7,000

2,800

2,800 7,000

2,800 7,000 100 354 240 6 303,437 118,149 118,073 249,953 250,029

100 354 240

100 354 240 6

13,448

13,448

303,437

Net income or loss Totals 118,149

76 118,149

76 250,029 250,029

Manual Accounting Practice Set Coffee & Caf Supplier, US GAAP Edition 3 (VCU3m) 2010 Perdisco / latin /. v., learn thoroughly http://www.perdisco.com Terms Of Use | Privacy Policy | Monday, May 07, 2012, 06:37

Anda mungkin juga menyukai

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- End of Month PostingDokumen10 halamanEnd of Month PostingSuszie Sue93% (14)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Post-Closing Trial BalanceDokumen3 halamanPost-Closing Trial BalanceSuszie Sue70% (10)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Reversing EntriesDokumen11 halamanReversing EntriesSuszie SueBelum ada peringkat

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Schedules of AccountsDokumen3 halamanSchedules of AccountsSuszie Sue83% (6)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- AccountingDokumen2 halamanAccountingSuszie SueBelum ada peringkat

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- CH 5Dokumen2 halamanCH 5Suszie SueBelum ada peringkat

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Chapter 16 IMSMDokumen49 halamanChapter 16 IMSMZachary Thomas CarneyBelum ada peringkat

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Dinosaurs: A Concise Natural History Topic QuestionsDokumen11 halamanDinosaurs: A Concise Natural History Topic QuestionsSuszie SueBelum ada peringkat

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Operations Management Chapter 8 CaseDokumen6 halamanOperations Management Chapter 8 CaseSuszie Sue50% (2)

- Capstone Simulation Final Evaluation PresentationDokumen15 halamanCapstone Simulation Final Evaluation PresentationwerfsdfsseBelum ada peringkat

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Physical Chemistry 2nd Edition Ball Solution ManualDokumen17 halamanPhysical Chemistry 2nd Edition Ball Solution Manualrobyn96% (28)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- Vidyadeepam Dec 2019 FinalDokumen46 halamanVidyadeepam Dec 2019 FinalAjit kumarBelum ada peringkat

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- 2011 Property MCQ With Suggested Answers PDFDokumen2 halaman2011 Property MCQ With Suggested Answers PDFJacinto Jr JameroBelum ada peringkat

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- Human Rights Project, 2018Dokumen25 halamanHuman Rights Project, 2018Vishal Jain100% (3)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- State EmergencyDokumen28 halamanState EmergencyVicky DBelum ada peringkat

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Melanin What Makes Black People Black! by Llaila Afrika PDFDokumen37 halamanMelanin What Makes Black People Black! by Llaila Afrika PDFjeyserenity100% (25)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- Dycoco Vs CADokumen9 halamanDycoco Vs CASuho KimBelum ada peringkat

- OFS - Installation GuideDokumen11 halamanOFS - Installation GuideAnatolii Skliaruk100% (1)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- CP 3Dokumen14 halamanCP 3aaapppaaapppBelum ada peringkat

- Audit Fraud MemoDokumen16 halamanAudit Fraud MemoManish AggarwalBelum ada peringkat

- Report PDFDokumen3 halamanReport PDFHarsh PatelBelum ada peringkat

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- NCL 2017-2020Dokumen1 halamanNCL 2017-2020Anjali NagareBelum ada peringkat

- Number: CIPT Passing Score: 800 Time Limit: 120 Min File Version: 1Dokumen30 halamanNumber: CIPT Passing Score: 800 Time Limit: 120 Min File Version: 1Mohamed Fazila Abd RahmanBelum ada peringkat

- Iso-Iec 19770-1Dokumen2 halamanIso-Iec 19770-1Ajai Srivastava50% (2)

- Oda Hyperionplanning 1899066Dokumen11 halamanOda Hyperionplanning 1899066Parmit ChoudhuryBelum ada peringkat

- Mackey Appeal Filing (Redacted)Dokumen36 halamanMackey Appeal Filing (Redacted)David PinsenBelum ada peringkat

- Gum What Was Done by Someone-Passive VoiceDokumen3 halamanGum What Was Done by Someone-Passive VoiceIgnacioBelum ada peringkat

- E1 2 Patent Searches - Activity TemplateDokumen21 halamanE1 2 Patent Searches - Activity Templateapi-248496741Belum ada peringkat

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- The Dark Side of Stock Market - The Reality of #ShareMarketDokumen12 halamanThe Dark Side of Stock Market - The Reality of #ShareMarketAadesh kumar Soni nayakBelum ada peringkat

- Covid Care FacilityDokumen5 halamanCovid Care FacilityNDTVBelum ada peringkat

- Memo Writing WorkshopDokumen17 halamanMemo Writing Workshopkcope412Belum ada peringkat

- Landlord/Tenant BasicsDokumen48 halamanLandlord/Tenant BasicsAlva ApostolBelum ada peringkat

- Travelling in The EUDokumen2 halamanTravelling in The EUJacBelum ada peringkat

- Cso Application FormDokumen3 halamanCso Application Formmark jefferson borromeo100% (1)

- Project 2 - Group 3 - Kanani Dreibus Courtney Fukushima Vivian Hy Brandon Lee Ilene Tam and Jessica WadaDokumen13 halamanProject 2 - Group 3 - Kanani Dreibus Courtney Fukushima Vivian Hy Brandon Lee Ilene Tam and Jessica Wadaapi-259672497Belum ada peringkat

- Property OutlineDokumen9 halamanProperty OutlineFCBelum ada peringkat

- Certified List of Candidates For Congressional and Local Positions For The May 13, 2013 2013 National, Local and Armm ElectionsDokumen2 halamanCertified List of Candidates For Congressional and Local Positions For The May 13, 2013 2013 National, Local and Armm ElectionsSunStar Philippine NewsBelum ada peringkat

- Service Bulletin Atr72: Transmittal Sheet Revision No. 12Dokumen17 halamanService Bulletin Atr72: Transmittal Sheet Revision No. 12Pradeep K sBelum ada peringkat

- Ib Assignment FinalDokumen7 halamanIb Assignment FinalGaurav MandalBelum ada peringkat

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Eng 122 PPT ReportingDokumen23 halamanEng 122 PPT ReportingCatherine PedrosoBelum ada peringkat