Structure of The Indian Cement Industry

Diunggah oleh

rattolamanJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Structure of The Indian Cement Industry

Diunggah oleh

rattolamanHak Cipta:

Format Tersedia

Structure of the Indian Cement Industry The structure of the industry can be viewed as fragmented, although the concentration

at the top has increased, as the top 10 players control around 73% of market share, which was 70% during 1990-91, whereas the other 27% of market share is distributed among 32 players. This is also confirmed by the results of Herfindahl Index (HI). The HI is a measure of industry concentration equal to the sum of the squared market shares of the firms in the industry and an indicator of amount of competition among them. The Herfindahl index is defined as the sum of the squares of the market shares of each individual firm. As such, the index can range from 0 to 100, moving from a huge number of very small firms to a single monopolistic producer. Increases in the Herfindahl index generally indicate a decrease in competition and an increase of market power, whereas decreases indicate the opposite. In the paper we assume that total market size in India is the sum of total sales by all the listed Cement companies in India. Our calculations show a very low value of Herfindahl index in the cement industry in India, indicating a very high competition and a low market power. High level of competition in the cement industry is a result of the low entry barriers and the ready availability of technology.

Top 10 Major Players in Cement Industry - 2008-09 Market Company Name Player 1 Grasim Industries Ltd. 2 A C C Ltd 3 Udaipur Cement Works Ltd 4 Ambuja Cements Ltd. 5 Century Textiles & Inds. Ltd 6 India Cements Ltd 7 Shree Cement Ltd 8 Madras Cements Ltd. 9 Birla Corporation Ltd 10 Dalmia Cement (Bharat) Ltd 11 Rest TOTAL % Market Market Share Share2 16.7 278.89 11.2 9.9 9.8 5.9 5.2 4.3 4 2.8 2.7 27.5 100 125.44 98.01 96.04 34.81 27.04 18.49 16 7.84 7.29 756.25 1466.1

Anda mungkin juga menyukai

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- Chemalite SolutionHBSDokumen10 halamanChemalite SolutionHBSManoj Singh0% (1)

- Chemalite SolutionHBSDokumen10 halamanChemalite SolutionHBSManoj Singh0% (1)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- 5 6278459935768444990 PDFDokumen74 halaman5 6278459935768444990 PDFRajesh RathodBelum ada peringkat

- EOL AR 2008-09-Revised PDFDokumen122 halamanEOL AR 2008-09-Revised PDFrattolamanBelum ada peringkat

- Coking Spread From NPRADokumen12 halamanCoking Spread From NPRArattolamanBelum ada peringkat

- Eol 2009-10Dokumen67 halamanEol 2009-10rattolamanBelum ada peringkat

- DNA Ahmedabad @AllIndianNewsPaper4u PDFDokumen14 halamanDNA Ahmedabad @AllIndianNewsPaper4u PDFrattolamanBelum ada peringkat

- Gas HubDokumen44 halamanGas HubrattolamanBelum ada peringkat

- 2010 GARP ERP Sample QuestionsDokumen25 halaman2010 GARP ERP Sample QuestionsBhuvanBelum ada peringkat

- Oligopolistic Competition Using CSF-HobsDokumen11 halamanOligopolistic Competition Using CSF-HobsrattolamanBelum ada peringkat

- Communication and Teaching Learning ProcessDokumen18 halamanCommunication and Teaching Learning ProcessrattolamanBelum ada peringkat

- Global Gap Cetf Annexure - IIIDokumen4 halamanGlobal Gap Cetf Annexure - IIIrattolamanBelum ada peringkat

- Erp Study Guide Changes 2014Dokumen12 halamanErp Study Guide Changes 2014rattolamanBelum ada peringkat

- Oligopolistic Competition Using CSF-HobsDokumen11 halamanOligopolistic Competition Using CSF-HobsrattolamanBelum ada peringkat

- India May Boost Oil Import From IranDokumen2 halamanIndia May Boost Oil Import From IranrattolamanBelum ada peringkat

- Cement GlobalDokumen40 halamanCement Globalkvk0812Belum ada peringkat

- India May Boost Oil Import From IranDokumen2 halamanIndia May Boost Oil Import From IranrattolamanBelum ada peringkat

- Tata Tele Net WorthDokumen1 halamanTata Tele Net WorthrattolamanBelum ada peringkat

- Tainted Past: A Look Back at The Fodder ScamDokumen1 halamanTainted Past: A Look Back at The Fodder ScamrattolamanBelum ada peringkat

- SM 1Dokumen245 halamanSM 1rattolaman100% (1)

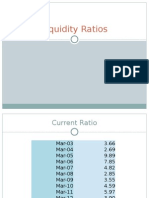

- Nestle Ratio AnalysisDokumen29 halamanNestle Ratio AnalysisrattolamanBelum ada peringkat

- Structure of The Indian Cement IndustryDokumen1 halamanStructure of The Indian Cement IndustryrattolamanBelum ada peringkat

- BoilerDokumen32 halamanBoilerrkm15789Belum ada peringkat

- BPCL ERP Implementation Case AnalysisDokumen11 halamanBPCL ERP Implementation Case Analysisrattolaman100% (1)

- Accounting Book ContentsDokumen11 halamanAccounting Book Contentsrattolaman0% (1)

- ICRA-Indian O&G UpstreamDokumen6 halamanICRA-Indian O&G UpstreamrattolamanBelum ada peringkat

- ECBsDokumen1 halamanECBsrattolamanBelum ada peringkat

- Castrol IndDokumen25 halamanCastrol IndShepherd John100% (1)