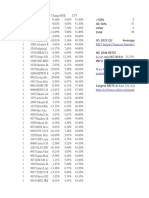

Average Return by Asset Class & Annual Return of MAAKL Funds-2012

Diunggah oleh

Gina Hong HongDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Average Return by Asset Class & Annual Return of MAAKL Funds-2012

Diunggah oleh

Gina Hong HongHak Cipta:

Format Tersedia

Average Return By Asset Class - Unit Trust Funds In Malaysia

2003

EQ MSIA SM & MID CAP

Strictly for internal circulation only

2008 2009

REITS

2004

EQ MSIA

2005

BOND MYR

2006

MIXED ASSET MYR FLEXIBLE

2007

EQ MSIA SM & MID CAP

2010

EQ MSIA SM & MID CAP

2011

EQUITY INDONESIA

2012

REITS

MONEY MKT

33.39

EQ MSIA

8.51

MIXED ASSET MYR FLEXIBLE

5.66

MONEY MKT

27.82

EQ MSIA SM & MID CAP

43.15

EQ MSIA

2.97

BOND MYR

60.50

EQ AP EX-JAPAN

23.89

EQ MSIA

5.84

BOND MYR

29.32

EQ MSIA SM & MID CAP

24.14

EQ AP EX-JAPAN

7.42

MIXED ASSET MYR BAL - MALAYSIA

2.51

MIXED ASSET MYR BAL - MALAYSIA

27.34

EQ MSIA

35.59

MIXED ASSET MYR FLEXIBLE

1.87

MIXED ASSET MYR BAL - MALAYSIA

51.29

EQ GREATER CHINA

19.87

MIXED ASSET MYR FLEXIBLE

5.74

MONEY MKT

13.17

EQ AP EX-JAPAN

21.27

MIXED ASSET MYR BAL - MALAYSIA

7.75

BOND MYR

-4.24

EQ AP EX-JAPAN

22.98

EQ AP EX-JAPAN

29.12

EQ AP EX-JAPAN

-23.91

MIXED ASSET MYR FLEXIBLE

46.11

EQ MSIA SM & MID CAP

14.04

MIXED ASSET MYR BAL - MALAYSIA

2.75

MIXED ASSET MYR BAL - MALAYSIA

11.12

EQ GREATER CHINA

17.94

BOND MYR

7.09

EQ AP EX-JAPAN

-9.57

EQ MSIA

23.40

MIXED ASSET MYR BAL - MALAYSIA

24.06

MIXED ASSET MYR BAL - MALAYSIA

-28.16

EQ MSIA

40.03

EQ MSIA

13.00

REITS

3.12

EQ MSIA

11.11

EQ MSIA

3.73

MONEY MKT

3.01

EQ MSIA SM & MID CAP

8.51

MIXED ASSET MYR FLEXIBLE

18.21

BOND MYR

26.66

BOND MYR

-33.40

EQ MSIA SM & MID CAP

36.34

MIXED ASSET MYR FLEXIBLE

7.84

BOND MYR

1.92

MIXED ASSET MYR FLEXIBLE

10.25

MIXED ASSET MYR FLEXIBLE

2.50

4.29

MONEY MKT

-3.71

EQ MSIA SM & MID CAP

5.96

MONEY MKT

2.97

MONEY MKT

-35.12

EQ AP EX-JAPAN

27.74

MIXED ASSET MYR BAL - MALAYSIA

5.84

EQ AP EX-JAPAN

-1.89

EQ MSIA SM & MID CAP

9.81

EQUITY INDONESIA

2.69

-13.62

3.16

2.86

REITS

-40.75

REITS

26.58

BOND MYR

5.37

EQUITY NORTH AMERICA

-4.11

EQUITY NORTH AMERICA

8.48

MIXED ASSET MYR BAL - MALAYSIA

-1.23

-46.23

EQ GREATER CHINA

5.58

MONEY MKT

2.34

MONEY MKT

-6.23

REITS

7.61

EQUITY NORTH AMERICA

-46.57

2.10

2.15

EQ GREATER CHINA

-14.54

EQ AP EX-JAPAN

6.91

BOND MYR

-4.03

-14.29

EQ GREATER CHINA

4.51

MONEY MKT

-19.49

2.55

3rd Party Funds Source: Lipper IM

This document is not intended to be an offer or invitation to subscribe or purchase of Funds. The information contained herein has been obtained from sources believed in good faith to be reliable. However, we make no representation as to the accuracy or completeness of any information contained herein or otherwise provided by us. Past performances of the Funds are not an indication of future performance and prices may go down as well as up. This presentation is for internal circulation only and it is not meant for distribution to third parties. It may not be reproduced, distributed or published by any recipient for any purpose.

Annual Return - MAAKL's Funds

2003

PROGRESS

Strictly for internal circulation only

2006

VALUE

2004

EQUITY INDEX

2005

AS-SAAD

2007

PROGRESS

2008

AS-SAAD

2009

ASIA PACIFIC REIT

2010

VALUE

2011

HW FLEXI

2012

ASIA PACIFIC REIT

35.16

GROWTH

23.76

AL-FAID

7.67

BOND

32.56

ML-FLEXI

60.06

VALUE

3.79

MONEY MKT

58.39

PACIFIC

30.79

HW FLEXI

10.94

CM-SHARIAH FLEXI

26.26

HW FLEXI

24.78

SYARIAH INDEX

18.76

BALANCED

5.41

SYARIAH INDEX

29.35

PROGRESS

50.55

GROWTH

3.30

AL-MA'MUN

57.79

CM-FLEXI

27.81

DIVIDEND

7.55

DIVIDEND

19.03

AL-FAUZAN

21.14

EQUITY INDEX

10.71

SYARIAH INDEX

3.76

MONEY MKT

29.27

GROWTH

47.67

AL-FAID

3.20

BOND

52.98

REGULAR SAVINGS

27.69

PROGRESS

7.53

REGULAR SAVINGS

16.89

DIVIDEND

20.11

VALUE

10.26

BOND

3.38

EQUITY INDEX

28.77

AL-FAID

46.96

SYARIAH INDEX

2.85

HW FLEXI

49.85

PROGRESS

27.55

AL-FAUZAN

7.44

BOND

16.88

SHARIAH PROGRESS

19.38

BALANCED

9.35

GROWTH

-1.15

AL-FAID

28.18

SYARIAH INDEX

38.43

REGULAR SAVINGS

-17.82

AL-UMRAN

48.58

VALUE

24.89

GROWTH

5.33

SYARIAH INDEX

16.61

PROGRESS

16.10

BOND

8.14

AS-SAAD

-2.63

BALANCED

25.25

PACIFIC

36.81

AL-FAUZAN

-18.03

DIVIDEND

47.54

SHARIAH ASIA PACIFIC

24.51

REGULAR SAVINGS

4.73

AS-SAAD

15.57

PACIFIC

3.61

7.94

VALUE

-3.14

PROGRESS

24.07

REGULAR SAVINGS

34.78

DIVIDEND

-20.14

AL-FAUZAN

47.50

GROWTH

24.28

CM-FLEXI

4.65

EQUITY INDEX

14.37

SYARIAH INDEX

2.82

PROGRESS

-5.02

REGULAR SAVINGS

22.76

EQUITY INDEX

32.71

EQUITY INDEX

-20.83

BALANCED

46.21

ML-FLEXI

23.62

AL-FAID

4.00

BALANCED

14.16

CM-SHARIAH FLEXI

1.82

-5.47

VALUE

22.25

AL-FAUZAN

29.58

AL-UMRAN

-24.30

GROWTH

43.19

EQUITY INDEX

21.78

EQUITY INDEX

3.97

MONEY MKT

13.50

CM-FLEXI

-9.19

GROWTH

20.90

BALANCED

22.66

ML-FLEXI

-29.94

EQUITY INDEX

41.39

HW FLEXI

21.25

SYARIAH INDEX

2.90

AL-MA'MUN

13.19

EQUITY INDEX

-10.58

11.03

BOND

20.48

BALANCED

-31.53

AL-FAID

39.38

BALANCED

17.30

CM-SHARIAH FLEXI

2.77

AL-UMRAN

12.38

REGULAR SAVINGS

4.34

AS-SAAD

18.95

PACIFIC

-33.18

VALUE

36.78

SYARIAH INDEX

17.08

AL-UMRAN

2.66

GROWTH

10.44

GREATER CHINA

3.63

MONEY MKT

18.80

BOND

-34.44

SYARIAH INDEX

35.87

AL-FAID

16.95

ASIA PACIFIC REIT

2.65

AL-FAUZAN

9.78

AL-FAID

2.85

3.84

MONEY MKT

-35.80

REGULAR SAVINGS

34.50

CM-SHARIAH FLEXI

16.03

BALANCED

2.13

CM-FLEXI

9.68

SHARIAH ASIA PACIFIC

3.08

AS-SAAD

-36.47

CM-SHARIAH FLEXI

32.23

DIVIDEND

11.54

ML-FLEXI

1.78

AL-FAID

9.41

VALUE

2.99

-36.54

ASIA PACIFIC REIT

30.38

AL-UMRAN

8.95

SHARIAH ASIA PACIFIC

-0.57

ASIA PACIFIC REIT

8.85

ML-FLEXI

-37.78

ML-FLEXI

27.59

GREATER CHINA

5.09

AS-SAAD

-1.50

VALUE

8.21

BALANCED

-38.78

PROGRESS

23.59

AL-FAUZAN

4.26

BOND

-1.73

INDONESIA EQUITY

8.17

GROWTH

-39.32

CM-FLEXI

19.57

AS-SAAD

3.28

US EQUITY

-1.86

PROGRESS

7.78

AL-UMRAN

-43.03

PACIFIC

5.25

BOND

2.34

MONEY MKT

-4.73

US EQUITY

6.41

BOND

-46.32

4.78

AL-MA'MUN

2.19

AL-MA'MUN

-6.23

ML-FLEXI

4.89

AS-SAAD

2.37

MONEY MKT

2.00

PACIFIC

-9.20

SHARIAH ASIA PACIFIC

4.41

US EQUITY

2.16

-0.76

GREATER CHINA

-10.08

PACIFIC

3.63

AL-MA'MUN

-4.83

-14.37

GREATER CHINA

2.86

MONEY MKT

-17.96

2.74

INDONESIA EQUITY

0.97 Above average return

Source: Lipper IM

This document is not intended to be an offer or invitation to subscribe or purchase of Funds. The information contained herein has been obtained from sources believed in good faith to be reliable. However, we make no representation as to the accuracy or completeness of any information contained herein or otherwise provided by us. Past performances of the Funds are not an indication of future performance and prices may go down as well as up. This presentation is for internal circulation only and it is not meant for distribution to third parties. It may not be reproduced, distributed or published by any recipient for any purpose.

Anda mungkin juga menyukai

- Mutual Funds Association of Pakistan: Asset Management Companies (Amcs) in PakistanDokumen5 halamanMutual Funds Association of Pakistan: Asset Management Companies (Amcs) in PakistanMuhammad Khuram ShahzadBelum ada peringkat

- All Equity Funds 05 Sep 2021 1038Dokumen2 halamanAll Equity Funds 05 Sep 2021 1038AlexBelum ada peringkat

- All Equity Funds 05 Sep 2021 1038Dokumen2 halamanAll Equity Funds 05 Sep 2021 1038AlexBelum ada peringkat

- All Hybrid Funds 03 Sep 2021 1112Dokumen4 halamanAll Hybrid Funds 03 Sep 2021 1112AlexBelum ada peringkat

- Nse Market Report: August 3, 2020Dokumen1 halamanNse Market Report: August 3, 2020Vaite JamesBelum ada peringkat

- 29 Sep 2021Dokumen1 halaman29 Sep 2021Ke DataBelum ada peringkat

- 20th July, 2020Dokumen8 halaman20th July, 2020samuel debebeBelum ada peringkat

- Putnam Alternating Market LeadershipDokumen2 halamanPutnam Alternating Market LeadershipPutnam InvestmentsBelum ada peringkat

- Profitability Islamic BankingDokumen71 halamanProfitability Islamic BankingdedegepBelum ada peringkat

- Rekap SMD Phbs-1Dokumen68 halamanRekap SMD Phbs-1Achmad AlhusariBelum ada peringkat

- Perf LS FundDokumen4 halamanPerf LS Fundkren24Belum ada peringkat

- Weekly ReportDokumen8 halamanWeekly Reportvorahh79Belum ada peringkat

- 2023.7.31 MPCG Monthly Market InsightsDokumen6 halaman2023.7.31 MPCG Monthly Market Insightspdam.wkerBelum ada peringkat

- DCR 13th Jan 2024Dokumen29 halamanDCR 13th Jan 2024abhisekkoyal334Belum ada peringkat

- JM Daily - 23 Aug - EquityDokumen183 halamanJM Daily - 23 Aug - EquityPravin SinghBelum ada peringkat

- Trade Performance and Fund Flow Week Ended 9 February 2024-258Dokumen5 halamanTrade Performance and Fund Flow Week Ended 9 February 2024-258Shabandi MnBelum ada peringkat

- REIT Industry Financial Snapshot - Monthly REIT DataDokumen4 halamanREIT Industry Financial Snapshot - Monthly REIT Databafsvideo4Belum ada peringkat

- Summary BenchmarkDokumen28 halamanSummary BenchmarkADBelum ada peringkat

- 1 MarketingDokumen32 halaman1 MarketingRishabh BhadialBelum ada peringkat

- Sep-18 Dec-18: Mutual FundsDokumen4 halamanSep-18 Dec-18: Mutual FundsNILESHBelum ada peringkat

- HDFC Equity FundsDokumen2 halamanHDFC Equity FundsAmit MalikBelum ada peringkat

- ImportDokumen7 halamanImportHasbi NozBelum ada peringkat

- Sprott-7 2009 Performance SummaryDokumen1 halamanSprott-7 2009 Performance Summarymarketfolly.comBelum ada peringkat

- SSC CHSL Result For Tier I 2017Dokumen970 halamanSSC CHSL Result For Tier I 2017TopRankersBelum ada peringkat

- Comex: 25 February 2013Dokumen8 halamanComex: 25 February 2013api-196234891Belum ada peringkat

- Weekend Megabetplus Regular Coupon: Saturday, 21 January, 2017Dokumen45 halamanWeekend Megabetplus Regular Coupon: Saturday, 21 January, 2017Kakouris AndreasBelum ada peringkat

- EQUITY - Focused Funds For APR - JUNE 2020-1Dokumen2 halamanEQUITY - Focused Funds For APR - JUNE 2020-1Raj PatilBelum ada peringkat

- The Power House of Information For All Mutual Funds: Fund BarometerDokumen41 halamanThe Power House of Information For All Mutual Funds: Fund Barometerlenkapradipta_2000Belum ada peringkat

- Public Sector Mutual Fund in IndiDokumen3 halamanPublic Sector Mutual Fund in Indiamitraj1207Belum ada peringkat

- Fund Select April 2012+Dokumen27 halamanFund Select April 2012+shak8883Belum ada peringkat

- Mdi MarksDokumen370 halamanMdi MarksNitin VashishtBelum ada peringkat

- B06XZS2MNBDokumen30 halamanB06XZS2MNBChanBelum ada peringkat

- Qly Male 17122019 PDFDokumen1.304 halamanQly Male 17122019 PDFAbhay SinghBelum ada peringkat

- Chinese Language Students Lust of KuDokumen9 halamanChinese Language Students Lust of Kuriaz nezamBelum ada peringkat

- Lamp-1 Laporan Perhitungan StrukturDokumen7 halamanLamp-1 Laporan Perhitungan StrukturRafijrin KantunihanBelum ada peringkat

- Non-Handicap Draw AnalysisDokumen6 halamanNon-Handicap Draw AnalysisFloat KgbBelum ada peringkat

- Midweek Megabetplus Regular Coupon: Friday, 27 October, 2017Dokumen45 halamanMidweek Megabetplus Regular Coupon: Friday, 27 October, 2017Kakouris AndreasBelum ada peringkat

- Nov PMS PerformanceDokumen3 halamanNov PMS PerformanceYASHBelum ada peringkat

- Performance Report For May MonthDokumen3 halamanPerformance Report For May MonthSujeshBelum ada peringkat

- Grades For 942 Funds For PublicationDokumen38 halamanGrades For 942 Funds For PublicationforbesadminBelum ada peringkat

- Friday 16/03/2018Dokumen75 halamanFriday 16/03/2018Kakouris AndreasBelum ada peringkat

- Mutual FundDokumen8 halamanMutual FundMayur khambhatiBelum ada peringkat

- BetaDokumen1 halamanBetaalirazajokarBelum ada peringkat

- South Coast ApprovedDokumen64 halamanSouth Coast ApprovedSoka.co.keBelum ada peringkat

- Junior Engineer (C & E) Exam., 2011 (Civil) Marks of The Qualified - Non-Qualified C (PDFDrive)Dokumen246 halamanJunior Engineer (C & E) Exam., 2011 (Civil) Marks of The Qualified - Non-Qualified C (PDFDrive)mohamad hajjBelum ada peringkat

- JM Daily - 23 Aug - DebtDokumen373 halamanJM Daily - 23 Aug - DebtPravin SinghBelum ada peringkat

- Sourabh Kumar 2Dokumen4 halamanSourabh Kumar 2Sourabh KumarBelum ada peringkat

- Mint Delhi Mint 17Dokumen1 halamanMint Delhi Mint 17Kedar KulkarniBelum ada peringkat

- Nse Market Report: Week Ended July 30, 2020Dokumen1 halamanNse Market Report: Week Ended July 30, 2020Vaite JamesBelum ada peringkat

- Interest Earned Other Income Mar-10 Mar-09 Mar-08 Mar-10 Year YearDokumen12 halamanInterest Earned Other Income Mar-10 Mar-09 Mar-08 Mar-10 Year YearAditya MehtaBelum ada peringkat

- Teknik Mudah ForexDokumen72 halamanTeknik Mudah Forexacap71193Belum ada peringkat

- Comex: 26 February 2013Dokumen8 halamanComex: 26 February 2013api-196234891Belum ada peringkat

- 08 March 2021 - Weekly ETF Round UpDokumen3 halaman08 March 2021 - Weekly ETF Round UpSeelan GovenderBelum ada peringkat

- Daftar Nilai Try Out Usbk TAHUN PELAJARAN 2017/2018 Kelas Vi SDN Balongsari IDokumen1 halamanDaftar Nilai Try Out Usbk TAHUN PELAJARAN 2017/2018 Kelas Vi SDN Balongsari IFajr RifantyBelum ada peringkat

- Fondos IndexadosDokumen16 halamanFondos IndexadosnosequenombreusarBelum ada peringkat

- JS Income FundDokumen9 halamanJS Income Fundcoolbouy85Belum ada peringkat

- List of Employees NPF Security Services: S.No Name DesignationDokumen58 halamanList of Employees NPF Security Services: S.No Name Designationrizwanrahat7023Belum ada peringkat

- Mathematics Form 2 / Grade 7 Igcse (1 Exam Ratio & Proportions)Dokumen1 halamanMathematics Form 2 / Grade 7 Igcse (1 Exam Ratio & Proportions)Gina Hong HongBelum ada peringkat

- SPM Practice 1 (Arithmatic Progression) : Answering Exam QuestionsDokumen5 halamanSPM Practice 1 (Arithmatic Progression) : Answering Exam QuestionsGina Hong HongBelum ada peringkat

- What Are Phrasal VerbsDokumen19 halamanWhat Are Phrasal VerbsGina Hong HongBelum ada peringkat

- Big Properous YearDokumen2 halamanBig Properous YearGina Hong HongBelum ada peringkat

- Importance OF Competition Competition Among Plants FOR... : Interaction Among Living Things (1 - 2)Dokumen1 halamanImportance OF Competition Competition Among Plants FOR... : Interaction Among Living Things (1 - 2)Gina Hong HongBelum ada peringkat

- Tuition Schedule For Jack Khor 13/01/2015 04/02/2015: DAY Date Time Duration Details IN OUTDokumen2 halamanTuition Schedule For Jack Khor 13/01/2015 04/02/2015: DAY Date Time Duration Details IN OUTGina Hong HongBelum ada peringkat

- Chapter 1 Directed NumberDokumen18 halamanChapter 1 Directed NumberGina Hong HongBelum ada peringkat

- Exercise Form 2 Chapter 5 Ratios Rates Proportions IDokumen3 halamanExercise Form 2 Chapter 5 Ratios Rates Proportions IGina Hong HongBelum ada peringkat

- Mathematics Form 2 - Chapter 5Dokumen11 halamanMathematics Form 2 - Chapter 5Gina Hong HongBelum ada peringkat

- ShapiroDokumen34 halamanShapiroTanuj ShekharBelum ada peringkat

- Reaching Different Learning Styles ThrouDokumen29 halamanReaching Different Learning Styles ThrouKENNETH HERRERABelum ada peringkat

- CE 441 Foundation Engineering 05 07 2019Dokumen216 halamanCE 441 Foundation Engineering 05 07 2019Md. Azizul Hakim100% (1)

- FinTech RegTech and SupTech - What They Mean For Financial Supervision FINALDokumen19 halamanFinTech RegTech and SupTech - What They Mean For Financial Supervision FINALirvandi syahputraBelum ada peringkat

- Foreclosure of REMDokumen10 halamanForeclosure of REMShanelle NapolesBelum ada peringkat

- Fashion Designing Sample Question Paper1Dokumen3 halamanFashion Designing Sample Question Paper1Aditi VermaBelum ada peringkat

- Sinamics gm150 sm150 Catalog d12 02 2020 enDokumen238 halamanSinamics gm150 sm150 Catalog d12 02 2020 enGo andWatchBelum ada peringkat

- Operational Business Suite Contract by SSNIT Signed in 2012Dokumen16 halamanOperational Business Suite Contract by SSNIT Signed in 2012GhanaWeb EditorialBelum ada peringkat

- Final Exam - Comprehensive - 10.24.16Dokumen5 halamanFinal Exam - Comprehensive - 10.24.16YamateBelum ada peringkat

- Network Administration and Mikrotik Router ConfigurationDokumen17 halamanNetwork Administration and Mikrotik Router ConfigurationbiswasjoyBelum ada peringkat

- 06 BuyLog2013 MoldedCaseCircBrkrsDokumen106 halaman06 BuyLog2013 MoldedCaseCircBrkrsmarbyBelum ada peringkat

- წყალტუბოს - სპა კურორტის განვითარების გეგმაDokumen16 halamanწყალტუბოს - სპა კურორტის განვითარების გეგმაReginfoBelum ada peringkat

- Hi Smith, Learn About US Sales Tax ExemptionDokumen2 halamanHi Smith, Learn About US Sales Tax Exemptionsmithmvuama5Belum ada peringkat

- Projek Rekabentuk Walkwaybridge 2014 - 15Dokumen6 halamanProjek Rekabentuk Walkwaybridge 2014 - 15HambaliBelum ada peringkat

- Hyster Forklift Class 5 Internal Combustion Engine Trucks g019 h13xm h12xm 12ec Service ManualsDokumen23 halamanHyster Forklift Class 5 Internal Combustion Engine Trucks g019 h13xm h12xm 12ec Service Manualsedwinodom070882sad100% (72)

- Guest AccountingDokumen8 halamanGuest Accountingjhen01gongonBelum ada peringkat

- Instrumentation and Control Important Questions and AnswersDokumen72 halamanInstrumentation and Control Important Questions and AnswersAjay67% (6)

- IMO Publication Catalogue List (June 2022)Dokumen17 halamanIMO Publication Catalogue List (June 2022)Seinn NuBelum ada peringkat

- Compose Testing CheatsheetDokumen1 halamanCompose Testing CheatsheetEstampados SIn ApellidoBelum ada peringkat

- BPI vs. Posadas, G.R. No. L - 34583, 1931Dokumen8 halamanBPI vs. Posadas, G.R. No. L - 34583, 1931Nikko AlelojoBelum ada peringkat

- Goat Farm ProjectDokumen44 halamanGoat Farm ProjectVipin Kushwaha83% (6)

- Juniper M5 M10 DatasheetDokumen6 halamanJuniper M5 M10 DatasheetMohammed Ali ZainBelum ada peringkat

- Indian Ordnance FactoryDokumen2 halamanIndian Ordnance FactoryAniket ChakiBelum ada peringkat

- Bid Submission SheetDokumen3 halamanBid Submission SheetARSE100% (1)

- Memorandum of AgreementDokumen6 halamanMemorandum of AgreementJomar JaymeBelum ada peringkat

- HK Magazine 03082013Dokumen56 halamanHK Magazine 03082013apparition9Belum ada peringkat

- KINDRED HEALTHCARE, INC 10-K (Annual Reports) 2009-02-25Dokumen329 halamanKINDRED HEALTHCARE, INC 10-K (Annual Reports) 2009-02-25http://secwatch.comBelum ada peringkat

- Di MCB DB Pricelist01!07!2018Dokumen1 halamanDi MCB DB Pricelist01!07!2018saurabhjerps231221Belum ada peringkat

- 1.2 Installation of SSH Keys On Linux-A Step-By Step GuideDokumen3 halaman1.2 Installation of SSH Keys On Linux-A Step-By Step GuideMada ChouchouBelum ada peringkat

- Revised Estimate Draft 24-12-2021Dokumen100 halamanRevised Estimate Draft 24-12-2021Reenu CherianBelum ada peringkat