P&G January 1995 - June 2013

Diunggah oleh

Gus VegaHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

P&G January 1995 - June 2013

Diunggah oleh

Gus VegaHak Cipta:

Format Tersedia

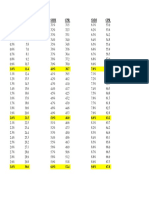

Procter & Gamble Company Stock Daily Return from 2005 (January) - 2013 (June)

60.0%

50.0%

40.0%

30.0%

20.0%

10.0%

Methodology: As shown by Dr. Colby Wright, PhD - Marriott School - Brigham Young University

9.7%

7.8%

5.9%

4.0%

2.1%

0.2%

-1.7%

-3.6%

-5.5%

-7.4%

-9.3%

-11.2%

-13.1%

-15.0%

-17.0%

-18.9%

-20.8%

-22.7%

-24.6%

-26.5%

-28.4%

-30.3%

0.0%

-32.2%

68 95 99 Return

Lower

UP

68%

-14%

35%

95%

-38%

60%

99%

-62%

84%

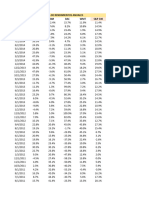

Daily Histogram

Bin #

Value

Count

%

1 -36.0109%

0.0215%

1

2 -34.11%

0.0000%

3 -32.20%

0.0000%

4 -30.29%

0.0000%

5 -28.39%

0.0000%

6 -26.48%

0.0000%

7 -24.58%

0.0000%

8 -22.67%

0.0000%

9 -20.76%

0.0000%

10 -18.86%

0.0000%

11 -16.95%

0.0000%

12 -15.05%

0.0000%

13 -13.14%

0.0000%

14 -11.23%

0.0000%

15

0.0430%

-9.33%

2

16

0.1074%

-7.42%

5

17

0.2793%

-5.52%

13

18

0.6874%

-3.61%

32

19

6.6380%

-1.70%

309

20

0.20%

2,293 49.2589%

21

2.11%

1,709 36.7132%

22

5.2417%

4.01%

244

23

0.7734%

5.92%

36

24

0.1719%

7.83%

8

25

9.7314%

0.0644%

3

4,655

100.00%

PG Daily Return Distribution 1995- June 2013

-34.1%

Daily

Annually

0.043% 10.789%

1.542% 24.382%

-2.919

67.907

-36.0%

Media

Std Dev

Skewness

Kurtosis

Anda mungkin juga menyukai

- USB Jan 1995 - June 2013Dokumen1 halamanUSB Jan 1995 - June 2013Gus VegaBelum ada peringkat

- WFC January 1995 - June 2013Dokumen1 halamanWFC January 1995 - June 2013Gus VegaBelum ada peringkat

- WFC January 1995 - June 2013Dokumen1 halamanWFC January 1995 - June 2013Gus VegaBelum ada peringkat

- Walmart Jan 1995 June 2013Dokumen1 halamanWalmart Jan 1995 June 2013Gus VegaBelum ada peringkat

- Coca Cola January 1995 - June 2013Dokumen1 halamanCoca Cola January 1995 - June 2013Gus VegaBelum ada peringkat

- Coca Cola January 1995 - June 2013Dokumen1 halamanCoca Cola January 1995 - June 2013Gus VegaBelum ada peringkat

- IBM January 1995 - June 2013Dokumen1 halamanIBM January 1995 - June 2013Gus VegaBelum ada peringkat

- Roic Revenue Growth: Appendix 1: Key Business DriversDokumen7 halamanRoic Revenue Growth: Appendix 1: Key Business DriversPeter LiBelum ada peringkat

- Ejemplo - Riesgo y RendimientoDokumen24 halamanEjemplo - Riesgo y RendimientoMiguel GBelum ada peringkat

- Phys 0213 PsDokumen2 halamanPhys 0213 PsNonoyTaclinoBelum ada peringkat

- Tabelas Distribuicoes Z T 2018marco29Dokumen1 halamanTabelas Distribuicoes Z T 2018marco29profdonizettiBelum ada peringkat

- Capaian Imut Yanis 2019Dokumen2 halamanCapaian Imut Yanis 2019puskesmas kunirBelum ada peringkat

- Tanque AcueductosDokumen3 halamanTanque AcueductosplguevarasBelum ada peringkat

- MCB RatiosDokumen26 halamanMCB RatiosSadia WallayatBelum ada peringkat

- Particulars FY15 FY16 FY17 FY18 FY19 RevenueDokumen14 halamanParticulars FY15 FY16 FY17 FY18 FY19 RevenueShivang KalraBelum ada peringkat

- Roche Group Financial DataDokumen43 halamanRoche Group Financial DataDryTvMusicBelum ada peringkat

- Borrador Entrega3Dokumen11 halamanBorrador Entrega3Matheo CristanchoBelum ada peringkat

- Metabical Case Analysis Metabical Case AnalysisDokumen4 halamanMetabical Case Analysis Metabical Case Analysisfatty acidBelum ada peringkat

- Peer Company COmparision For StartupsDokumen2 halamanPeer Company COmparision For StartupsBiki BhaiBelum ada peringkat

- 2019 Q4 Financial Statement ENDokumen17 halaman2019 Q4 Financial Statement ENPinkky GithaBelum ada peringkat

- Portfolio Optimization: BSRM Brac Beximco GP RAKDokumen27 halamanPortfolio Optimization: BSRM Brac Beximco GP RAKFarsia Binte AlamBelum ada peringkat

- Sample Exit Interview Survey: Graphical Rating ReportDokumen10 halamanSample Exit Interview Survey: Graphical Rating ReportIrfan ShaukatBelum ada peringkat

- BSY v3 Revenue ModelDokumen34 halamanBSY v3 Revenue Modeljazz.srishBelum ada peringkat

- Economic Efficiency 2013Dokumen8 halamanEconomic Efficiency 2013Taylor CottamBelum ada peringkat

- Shivam Khanna BM 019159 FmueDokumen10 halamanShivam Khanna BM 019159 FmueBerkshire Hathway coldBelum ada peringkat

- Shivam Khanna BM 019159 FmueDokumen10 halamanShivam Khanna BM 019159 FmueBerkshire Hathway coldBelum ada peringkat

- Comisiones ZurichDokumen6 halamanComisiones ZurichgrcretacottaBelum ada peringkat

- Transaction Cost AnalysisDokumen1 halamanTransaction Cost AnalysisstefanBelum ada peringkat

- UPS1Dokumen6 halamanUPS1Joana BarbaronaBelum ada peringkat

- Appendix C - Daily and Annual EnergyDokumen16 halamanAppendix C - Daily and Annual EnergyNaveed KhanBelum ada peringkat

- Keterangan 2015 2016 2017: Year To Year Anylisis Analisis Common SizeDokumen9 halamanKeterangan 2015 2016 2017: Year To Year Anylisis Analisis Common SizeSahirah Hafizhah TaqiyyahBelum ada peringkat

- Data Hasil Pemeriksaan Diff CountDokumen2 halamanData Hasil Pemeriksaan Diff CountIsa ComBelum ada peringkat

- MSSP - Guaranteed Surrender Value Factors - tcm47-71735Dokumen9 halamanMSSP - Guaranteed Surrender Value Factors - tcm47-71735Sheetal KumariBelum ada peringkat

- Age - Group Consumer - Behavior CrosstabulationDokumen5 halamanAge - Group Consumer - Behavior CrosstabulationhunnygoyalBelum ada peringkat

- DCF ModelDokumen51 halamanDCF Modelhugoe1969Belum ada peringkat

- Colgate, 4th February, 2013Dokumen10 halamanColgate, 4th February, 2013Angel BrokingBelum ada peringkat

- Apuntes 29-Oct-2020Dokumen13 halamanApuntes 29-Oct-2020Gabriel D. Diaz VargasBelum ada peringkat

- HABT Model 5Dokumen20 halamanHABT Model 5Naman PriyadarshiBelum ada peringkat

- The Unidentified Industries - Residency - CaseDokumen4 halamanThe Unidentified Industries - Residency - CaseDBBelum ada peringkat

- Casa Growth Drives Robust Liquidity Position: (RP Billion) Jun-19 Dec-19 Mar-20 Jun-20 Yoy Ytd QoqDokumen3 halamanCasa Growth Drives Robust Liquidity Position: (RP Billion) Jun-19 Dec-19 Mar-20 Jun-20 Yoy Ytd QoqErica ZulianaBelum ada peringkat

- Investments Problem SetDokumen5 halamanInvestments Problem Setzer0fxz8209Belum ada peringkat

- Excel 8 - Performance MeasurementDokumen11 halamanExcel 8 - Performance MeasurementHassaan ImranBelum ada peringkat

- Syndicate 3 - Analisa Ratio IndustriDokumen5 halamanSyndicate 3 - Analisa Ratio IndustriMarkus100% (1)

- Comisiones Multiproductos.Dokumen3 halamanComisiones Multiproductos.larry.01.laysBelum ada peringkat

- V1 - MAP Virtual Meeting - Evaluation StatsDokumen130 halamanV1 - MAP Virtual Meeting - Evaluation StatsAxel LoraBelum ada peringkat

- Healthcare &technology Investment: Vision, Strategy& OpportunitiesDokumen27 halamanHealthcare &technology Investment: Vision, Strategy& Opportunitiesmucahidkaplan1907Belum ada peringkat

- Year Nominal Return Inflation Real Rate of Return VarianceDokumen14 halamanYear Nominal Return Inflation Real Rate of Return VarianceKunal NakumBelum ada peringkat

- Data For Ratio Detective ExerciseDokumen1 halamanData For Ratio Detective ExercisemaritaputriBelum ada peringkat

- 1m CPRDokumen1 halaman1m CPRbuckybad2Belum ada peringkat

- Session 11 Portfolio OptimizationDokumen6 halamanSession 11 Portfolio Optimizationpayal mittalBelum ada peringkat

- Sucursal Ruta Seguimiento Datos Iniciales Escaneo Compra Vs PronDokumen9 halamanSucursal Ruta Seguimiento Datos Iniciales Escaneo Compra Vs PronjoseBelum ada peringkat

- Ratios Tell A StoryDokumen3 halamanRatios Tell A StoryJose Arturo Rodriguez AlemanBelum ada peringkat

- IE255 Tables BookletDokumen107 halamanIE255 Tables BookletMuhammad AdilBelum ada peringkat

- Alaska Airlines - SummaryDokumen7 halamanAlaska Airlines - SummaryhrBelum ada peringkat

- MCRSDokumen9 halamanMCRSMercedes Isla VertizBelum ada peringkat

- XLS EngDokumen4 halamanXLS EngShubhangi JainBelum ada peringkat

- BiDokumen1 halamanBiLeongDWBelum ada peringkat

- Roches ExcelDokumen4 halamanRoches ExcelJaydeep SheteBelum ada peringkat

- Next Generation Demand Management: People, Process, Analytics, and TechnologyDari EverandNext Generation Demand Management: People, Process, Analytics, and TechnologyBelum ada peringkat

- Coca Cola January 1995 - June 2013Dokumen1 halamanCoca Cola January 1995 - June 2013Gus VegaBelum ada peringkat

- IBM January 1995 - June 2013Dokumen1 halamanIBM January 1995 - June 2013Gus VegaBelum ada peringkat

- Employment Nos. June 2013 - HispanicsDokumen3 halamanEmployment Nos. June 2013 - HispanicsGus VegaBelum ada peringkat

- Idb - Country Strategy With BoliviaDokumen56 halamanIdb - Country Strategy With BoliviaGus VegaBelum ada peringkat

- Yield Curve July 22 2013BDokumen1 halamanYield Curve July 22 2013BGus VegaBelum ada peringkat

- US Debt March 31 2013Dokumen2 halamanUS Debt March 31 2013Gus VegaBelum ada peringkat