Bentley Investment Group: Tuesday August 25, 2009

Diunggah oleh

bentleyinvestmentgroupDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Bentley Investment Group: Tuesday August 25, 2009

Diunggah oleh

bentleyinvestmentgroupHak Cipta:

Format Tersedia

Bentley Investment Group

Tuesday August 25, 2009

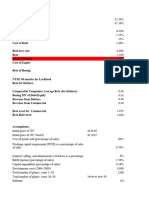

Adjusted Adjusted Current % of

Current Positions Ticker Shares Current Value Gain/Loss Gain/ Loss %

Price Value Price Portfolio

Cash 399,035.35 80.69%

Financials

0.00 0.00 0.00% 0.00 0.00%

Healthcare

Health Care Select Sector SPDR XLV 558 25.24 14083.70 28.88 16115.04 3.26% 2,031.34 14.42%

SPDR S&P Biotech XBI 152 47.30 7189.84 54.22 8241.44 1.67% 1,051.60 14.63%

21273.54 24356.48 4.93% 3,082.94 14.49%

Consumers

iShares Dow Jones US Consumer Services IYC 333 45.24 15064.25 50.20 16716.60 3.38% 1,652.35 10.97%

Consumer Discretionry Select Sector SPDR XLY 633 23.50 14873.60 26.40 16711.20 3.38% 1,837.60 12.35%

29937.86 33427.80 6.76% 3,489.95 11.66%

Materials/Industrials

0.00 0.00 0.00% 0.00 0.00%

Oil /Energy/Utilities

0.00 0.00 0.00% 0.00 0.00%

Technology

iShares S&P North Amer Technology IGM 523 39.65 20734.75 47.17 24669.91 4.99% 3,935.16 18.98%

Semiconductor HOLDRs SMH 524 19.85 10400.35 24.91 13052.84 2.64% 2,652.49 25.50%

31135.11 37722.75 7.63% 6,587.64 21.16%

Totals $ 494,542.38 100%

Performance Fiscal YTD TTM Std Sharpe Treynor

TTM Return Beta*

Metrics Return Dev Ratio** Ratio***

BIG 1.69% -15.35% 7.99% 0.17 -2.32 -1.10

Wilshire 5000 12.16% -18.66% 33.65% 1 -0.65 -0.22

*Beta of BIG calculated by a regression of the BIG Portfolio weekly returns versus the Wilshire 5000 weekly returns

**Sharpe Ratio calculated by the TTM BIG Portfolio Return less the 10 year US Treasury over TTM standard deviation

***Treynor Ratio calculated by the TTM BIG Portfolio Return less the 10 year US Treasury over calculated Beta

Anda mungkin juga menyukai

- Microsoft ValuationDokumen4 halamanMicrosoft ValuationcorvettejrwBelum ada peringkat

- Broadcom Financial AnalysisDokumen68 halamanBroadcom Financial AnalysisKipley_Pereles_5949Belum ada peringkat

- DCFTemplateDokumen5 halamanDCFTemplateRob Keith100% (1)

- NYSF Walmart Templatev2Dokumen49 halamanNYSF Walmart Templatev2Avinash Ganesan100% (1)

- WF - MLP Primer VDokumen196 halamanWF - MLP Primer VElianaBakerBelum ada peringkat

- CFP Mock Test Investment PlanningDokumen7 halamanCFP Mock Test Investment PlanningDeep Shikha100% (4)

- Year Stock A's Returns, Ra Stock B's Returns, RB: Realized Rates of ReturnsDokumen2 halamanYear Stock A's Returns, Ra Stock B's Returns, RB: Realized Rates of ReturnsArgie Mae Salvador100% (1)

- AmeriTrade Case StudyDokumen3 halamanAmeriTrade Case StudyTracy PhanBelum ada peringkat

- Comparative Analysis of Mutual Fund SchemesDokumen101 halamanComparative Analysis of Mutual Fund Schemesvipulgupta1988100% (4)

- How to use the DCF model tutorialDokumen9 halamanHow to use the DCF model tutorialTanya SinghBelum ada peringkat

- AirThread CalcDokumen15 halamanAirThread CalcSwati VermaBelum ada peringkat

- Air Thread ConnectionsDokumen31 halamanAir Thread ConnectionsJasdeep SinghBelum ada peringkat

- Airthread SolutionDokumen30 halamanAirthread SolutionSrikanth VasantadaBelum ada peringkat

- Corporate Actions: A Guide to Securities Event ManagementDari EverandCorporate Actions: A Guide to Securities Event ManagementBelum ada peringkat

- Cost of Capital Case Study at AmeritradeDokumen5 halamanCost of Capital Case Study at Ameritradeyvasisht3100% (1)

- Project Top Glove CompletedDokumen45 halamanProject Top Glove CompletedWan Chee57% (7)

- July 2009 Return SheetsDokumen3 halamanJuly 2009 Return SheetsbentleyinvestmentgroupBelum ada peringkat

- Lettuce ProductionDokumen14 halamanLettuce ProductionJay ArBelum ada peringkat

- Tata Motors One PagersDokumen1 halamanTata Motors One PagersdidwaniasBelum ada peringkat

- BetasDokumen7 halamanBetasWendy FernándezBelum ada peringkat

- Performance of Infosys For The First Quarter Ended June 30, 2004Dokumen29 halamanPerformance of Infosys For The First Quarter Ended June 30, 2004Suryansh SinghBelum ada peringkat

- Airtel DividdendDokumen6 halamanAirtel DividdendRishab KatariaBelum ada peringkat

- Business Profile Viz-a-Viz Target and Achievements As OnDokumen3 halamanBusiness Profile Viz-a-Viz Target and Achievements As OnJunaid BakshiBelum ada peringkat

- TechnoFunda Excel AnalysisDokumen27 halamanTechnoFunda Excel AnalysisPrasad VeesamshettyBelum ada peringkat

- The ValuEngine Weekly Is An Investor Education Newsletter Focused OnDokumen8 halamanThe ValuEngine Weekly Is An Investor Education Newsletter Focused OnValuEngine.comBelum ada peringkat

- Adj Adj Return Security Name Weight in Fund Weight in Index Industr yDokumen3 halamanAdj Adj Return Security Name Weight in Fund Weight in Index Industr yKien HoangBelum ada peringkat

- Vardhman Textiles LTD Industry:Textiles - Spinning/Cotton/Blended Yarn - Ring SPGDokumen5 halamanVardhman Textiles LTD Industry:Textiles - Spinning/Cotton/Blended Yarn - Ring SPGshyamalmishra1988Belum ada peringkat

- DISH TV India - Financial Model - May 28 2010Dokumen29 halamanDISH TV India - Financial Model - May 28 2010Sandeep HsBelum ada peringkat

- Valuation: Beta and WACCDokumen4 halamanValuation: Beta and WACCnityaBelum ada peringkat

- Marriot CaseStudyDokumen17 halamanMarriot CaseStudySambhav SamBelum ada peringkat

- Technofunda Investing Excel Analysis - Version 2.0: Watch Screener TutorialDokumen37 halamanTechnofunda Investing Excel Analysis - Version 2.0: Watch Screener TutorialVipulBelum ada peringkat

- The ValuEngine Weekly Is An Investor Education Newsletter Focused OnDokumen12 halamanThe ValuEngine Weekly Is An Investor Education Newsletter Focused OnValuEngine.comBelum ada peringkat

- RocheDokumen5 halamanRochePrattouBelum ada peringkat

- Civilian Labor Force ProfileDokumen2 halamanCivilian Labor Force Profilefariasr23Belum ada peringkat

- Airthread Acquisition Operating AssumptionsDokumen27 halamanAirthread Acquisition Operating AssumptionsnidhidBelum ada peringkat

- BoeingDokumen11 halamanBoeingPreksha GulatiBelum ada peringkat

- Microsoft Vs Intuit ValuationDokumen4 halamanMicrosoft Vs Intuit ValuationcorvettejrwBelum ada peringkat

- RatioDokumen11 halamanRatioAnant BothraBelum ada peringkat

- Workshop On Business SimulationDokumen16 halamanWorkshop On Business SimulationANCHAL SINGHBelum ada peringkat

- Revenues & Earnings: All Figures in US$ MillionDokumen4 halamanRevenues & Earnings: All Figures in US$ MillionenzoBelum ada peringkat

- The ValuEngine Weekly Is An Investor EducationDokumen11 halamanThe ValuEngine Weekly Is An Investor EducationValuEngine.comBelum ada peringkat

- Learn2Invest Session 10 - Asian Paints ValuationsDokumen8 halamanLearn2Invest Session 10 - Asian Paints ValuationsMadhur BathejaBelum ada peringkat

- Shares Trading Analysis For Last 6 MonthsDokumen18 halamanShares Trading Analysis For Last 6 Monthsnaheed aslamBelum ada peringkat

- MTD YtdDokumen350 halamanMTD YtdAmy Rose BotnandeBelum ada peringkat

- Group 3 CFEV 5th Assignment-Hansson-Private-LabelDokumen10 halamanGroup 3 CFEV 5th Assignment-Hansson-Private-LabelShashwat JhaBelum ada peringkat

- Key Performance Indicators (Kpis) : FormulaeDokumen4 halamanKey Performance Indicators (Kpis) : FormulaeAfshan AhmedBelum ada peringkat

- Excel BookDokumen6 halamanExcel Bookmoneesh 99Belum ada peringkat

- Competitors Bajaj MotorsDokumen11 halamanCompetitors Bajaj MotorsdeepaksikriBelum ada peringkat

- Hero Honda Motors Limited: Company Profile Mission Statement Board of Directors PromotersDokumen35 halamanHero Honda Motors Limited: Company Profile Mission Statement Board of Directors PromotersCharan KowtikwarBelum ada peringkat

- Stock Portfolio Tracker PDFDokumen20 halamanStock Portfolio Tracker PDFDean DsouzaBelum ada peringkat

- Financial Performance and Ratio Trends Over 4 YearsDokumen2 halamanFinancial Performance and Ratio Trends Over 4 YearsASHOK JAINBelum ada peringkat

- Inositolic MarketDokumen7 halamanInositolic Markethassan shahidBelum ada peringkat

- Satori Fund II LP Monthly Newsletter - 2023 06Dokumen7 halamanSatori Fund II LP Monthly Newsletter - 2023 06Anthony CastelliBelum ada peringkat

- SPEEDAV MOTOR PARTS HARDWARE PROFITABILITYDokumen23 halamanSPEEDAV MOTOR PARTS HARDWARE PROFITABILITYJay ArBelum ada peringkat

- Financial Analysis of Electricity, Pharmaceutical and Other IndustriesDokumen14 halamanFinancial Analysis of Electricity, Pharmaceutical and Other IndustriesArif RahmanBelum ada peringkat

- ValuEngine Weekly Newsletter February 12, 2010Dokumen12 halamanValuEngine Weekly Newsletter February 12, 2010ValuEngine.comBelum ada peringkat

- Jane's excess returns over market and fund QDokumen7 halamanJane's excess returns over market and fund QJosuaBelum ada peringkat

- Financial Table Analysis of ZaraDokumen9 halamanFinancial Table Analysis of ZaraCeren75% (4)

- Corporate Accounting ExcelDokumen6 halamanCorporate Accounting ExcelshrishtiBelum ada peringkat

- UTI Infrastructure Equity FundDokumen16 halamanUTI Infrastructure Equity FundArmstrong CapitalBelum ada peringkat

- IOL Chemicals & Pharmaceuticals Ltd. Company Report Card-StandaloneDokumen4 halamanIOL Chemicals & Pharmaceuticals Ltd. Company Report Card-StandaloneVenkatesh VasudevanBelum ada peringkat

- Chambal Fertilizers and Chemicals LimitedDokumen9 halamanChambal Fertilizers and Chemicals LimitedSoumalya GhoshBelum ada peringkat

- COMPARATIVE STATEMENT ANALYSISDokumen4 halamanCOMPARATIVE STATEMENT ANALYSISTARVEEN DuraiBelum ada peringkat

- SBI Technology Opportunities FundDokumen14 halamanSBI Technology Opportunities FundArmstrong CapitalBelum ada peringkat

- Financial Analysis Coles GroupDokumen5 halamanFinancial Analysis Coles GroupAmmar HassanBelum ada peringkat

- NPV Function: Discount Rate Time Periods 2 3 4 Cash Flows NPV $35.9Dokumen11 halamanNPV Function: Discount Rate Time Periods 2 3 4 Cash Flows NPV $35.9Ali Hussain Al SalmawiBelum ada peringkat

- Siemens Ltd liquidity, leverage, profitability and turnover ratios 2015-2014Dokumen12 halamanSiemens Ltd liquidity, leverage, profitability and turnover ratios 2015-2014seema vetalBelum ada peringkat

- R60 Introduction To Alternative Investments Q BankDokumen26 halamanR60 Introduction To Alternative Investments Q BankAhmedBelum ada peringkat

- Smallcases Investment Performance: A Returns-Based Factor Analysis by RAJAN RAJUDokumen18 halamanSmallcases Investment Performance: A Returns-Based Factor Analysis by RAJAN RAJUabhishekBelum ada peringkat

- UGBA103 Final Fall 2016Dokumen5 halamanUGBA103 Final Fall 2016Billy bobBelum ada peringkat

- IAPM MCQs MergedDokumen70 halamanIAPM MCQs Mergedsinan1600officialBelum ada peringkat

- Ramco Cements Ltd's financial performance analysis over 2017-2020Dokumen4 halamanRamco Cements Ltd's financial performance analysis over 2017-2020Somil GuptaBelum ada peringkat

- 1027254029106262Dokumen2 halaman1027254029106262Vano DiehlBelum ada peringkat

- Finance quiz answers and explanationsDokumen26 halamanFinance quiz answers and explanationsNazim Shahzad100% (1)

- 13 Ch08 ProblemsDokumen12 halaman13 Ch08 ProblemsAnonymous TFkK5qWBelum ada peringkat

- Systematic Risk and Expected ReturnsDokumen37 halamanSystematic Risk and Expected ReturnsPurple AppleBelum ada peringkat

- Appendix B Solutions To Concept ChecksDokumen31 halamanAppendix B Solutions To Concept Checkshellochinp100% (1)

- Evaluation of Present Scenario and Estimation of Future Prospects of Portfolio ManagementDokumen35 halamanEvaluation of Present Scenario and Estimation of Future Prospects of Portfolio ManagementMayura Telang100% (1)

- University Student Investment Banking Resume TemplateDokumen1 halamanUniversity Student Investment Banking Resume Templateiduncan91Belum ada peringkat

- Estimating Beta and WACC of HULDokumen10 halamanEstimating Beta and WACC of HULSumedh BhagwatBelum ada peringkat

- Case Study SPBLDokumen18 halamanCase Study SPBLMonirul IslamBelum ada peringkat

- Final Exam For Corporate Finance Module - Term 16.2.A Part 1: Short-Answer QuestionsDokumen3 halamanFinal Exam For Corporate Finance Module - Term 16.2.A Part 1: Short-Answer QuestionsHuân NguyễnBelum ada peringkat

- Questions Valuation - Interview PDFDokumen13 halamanQuestions Valuation - Interview PDFRodri GallegoBelum ada peringkat

- CAPM MentoringDokumen8 halamanCAPM MentoringKashish AroraBelum ada peringkat

- FINA 410 - Exercises (NOV)Dokumen7 halamanFINA 410 - Exercises (NOV)said100% (1)

- Cost of Capital PDFDokumen37 halamanCost of Capital PDFBala RanganathBelum ada peringkat

- SFA Solved Question Bank As Per July 2022Dokumen19 halamanSFA Solved Question Bank As Per July 2022Abhijat MittalBelum ada peringkat

- Flirting With Risk: Get Custom PaperDokumen2 halamanFlirting With Risk: Get Custom PaperAkash PandeyBelum ada peringkat

- Mrigank Mauli SAPM CIA 3Dokumen14 halamanMrigank Mauli SAPM CIA 3Mrigank MauliBelum ada peringkat

- Sample Exam QuestionsDokumen16 halamanSample Exam QuestionsMadina SuleimenovaBelum ada peringkat