MRS Tax Incidence Report 2013

Diunggah oleh

Melinda JoyceDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

MRS Tax Incidence Report 2013

Diunggah oleh

Melinda JoyceHak Cipta:

Format Tersedia

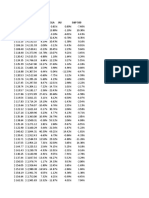

Maine Resident Income Tax in 2013, Old Law and LD 1495

Old law LD 1495

Individual Tax Individual Tax Change in Tax Percent Families Tax Average Families Tax Average Families with

Tax Liability Percentage Liability Percentage Liability Tax with Tax Decrease Tax with Tax Increase Tax Tax Increase

Expanded Income Families ($ MIL) Distribution ($ MIL) Distribution ($ MIL) Change Decrease ($ MIL) Decrease Increase ($ MIL) Increase (percent)

-$ Infinity <= 14594 138,657 $4.907 0.3% -$7.690 -0.6% -$12.597 -256.7% 138,519 -$12.598 -$91.0 138 $0.001 $8.0 0.1%

14594 <= 20835 69,314 $7.143 0.5% $1.014 0.1% -$6.129 -85.8% 69,028 -$6.134 -$88.9 286 $0.005 $16.8 0.4%

20835 <= 27658 69,355 $14.965 1.0% $9.345 0.7% -$5.621 -37.6% 68,904 -$5.650 -$82.0 451 $0.029 $65.3 0.6%

27658 <= 35970 69,290 $34.099 2.4% $27.457 2.1% -$6.642 -19.5% 68,043 -$6.842 -$100.6 1,247 $0.201 $160.8 1.8%

35970 <= 47389 69,329 $62.624 4.4% $55.978 4.2% -$6.646 -10.6% 65,546 -$7.437 -$113.5 3,783 $0.791 $209.2 5.5%

47389 <= 62853 69,318 $105.787 7.4% $99.159 7.5% -$6.628 -6.3% 62,966 -$8.600 -$136.6 6,352 $1.972 $310.4 9.2%

62853 <= 83757 69,324 $156.184 10.9% $150.287 11.3% -$5.897 -3.8% 59,527 -$9.364 -$157.3 9,797 $3.466 $353.8 14.1%

83757 <= 119293 69,322 $265.870 18.6% $258.461 19.4% -$7.409 -2.8% 56,875 -$13.561 -$238.4 12,447 $6.153 $494.3 18.0%

119293 <= $ Infinity 69,323 $777.009 54.4% $735.668 55.3% -$41.342 -5.3% 53,190 -$64.690 -$1,216.2 16,055 $23.348 $1,454.3 23.2%

Totals 693,232 $1,428.589 100.0% $1,329.678 100.0% -$98.911 -6.9% 642,597 -$134.877 -$209.9 50,557 $35.966 $711.4 7.3%

Top Decile Decomposition: 90-95, 95-99, and 99+ :

119293 <= 159211 34,662 $205.753 14.4% $202.223 15.2% -$3.531 -1.7% 27,224 -$9.506 -$349.2 7,432 $5.975 $804.0 21.4%

159211 <= 350810 27,730 $284.307 19.9% $279.049 21.0% -$5.258 -1.8% 20,301 -$15.196 -$748.5 7,400 $9.938 $1,343.0 26.7%

350810 <= $ Infinity 6,931 $286.949 20.1% $254.396 19.1% -$32.553 -11.3% 5,664 -$39.988 -$7,059.5 1,223 $7.435 $6,078.9 17.6%

Maine Revenue Services

Economic Research Division

Maine Resident Sales Tax in FY 2013, Old Law and LD 1495

Old law LD 1495

Individual Tax Individual Tax Change in Tax Percent Families Tax Average

Tax Liability Percentage Liability Percentage Liability Tax with Tax Increase Tax

Expanded Income Families ($ MIL) Distribution ($ MIL) Distribution ($ MIL) Change Increase ($ MIL) Increase

-$ Infinity <= 14594 138,657 $43.382 5.3% $46.187 5.3% $2.805 6.5% 112,486 $2.805 $24.9

14594 <= 20835 69,314 $29.911 3.7% $31.936 3.7% $2.025 6.8% 55,884 $2.025 $36.2

20835 <= 27658 69,355 $39.849 4.9% $42.478 4.9% $2.629 6.6% 58,834 $2.629 $44.7

27658 <= 35970 69,290 $59.399 7.3% $63.551 7.3% $4.152 7.0% 64,997 $4.152 $63.9

35970 <= 47389 69,329 $69.298 8.5% $74.673 8.5% $5.375 7.8% 67,638 $5.375 $79.5

47389 <= 62853 69,318 $83.474 10.3% $89.975 10.3% $6.500 7.8% 68,518 $6.500 $94.9

62853 <= 83757 69,324 $92.359 11.4% $99.576 11.4% $7.217 7.8% 68,974 $7.217 $104.6

83757 <= 119293 69,322 $118.031 14.5% $127.313 14.6% $9.281 7.9% 69,294 $9.281 $133.9

119293 <= $ Infinity 69,323 $277.556 34.1% $299.130 34.2% $21.575 7.8% 69,323 $21.575 $311.2

Totals 693,232 $813.260 100.0% $874.818 100.0% $61.558 7.6% 635,948 $61.558 $96.8

Top Decile Decomposition: 90-95, 95-99, and 99+ :

119293 <= 159211 34,662 $83.017 10.2% $89.442 10.2% $6.425 7.7% 34,662 $6.425 $185.4

159211 <= 350810 27,730 $104.460 12.8% $112.564 12.9% $8.104 7.8% 27,730 $8.104 $292.3

350810 <= $ Infinity 6,931 $90.079 11.1% $97.124 11.1% $7.046 7.8% 6,931 $7.046 $1,016.5

Maine Revenue Services

Economic Research Division

732.67 790.52 57.85

$3.711

111.00% 110.66% 106.42%

1.06

-$ Infinity <= 13342 133,133 $38.485 5.3% $41.077 5.2% $2.592 6.7% ### $2.592 $24.3

13342 <= 19046 66,585 $26.677 3.6% $28.535 3.6% $1.857 7.0% ### $1.857 $35.3

19046 <= 25325 66,534 $35.011 4.8% $37.401 4.7% $2.391 6.8% ### $2.391 $42.3

25325 <= 32834 66,562 $53.643 7.3% $57.476 7.3% $3.833 7.1% ### $3.833 $61.0

32834 <= 44385 66,565 $63.462 8.7% $68.437 8.7% $4.975 7.8% ### $4.975 $76.4

44385 <= 58705 66,562 $75.548 10.3% $81.766 10.3% $6.218 8.2% ### $6.218 $94.5

58705 <= 79287 66,563 $87.678 12.0% $94.792 12.0% $7.114 8.1% ### $7.114 $107.3

79287 <= 114104 66,564 $105.242 14.4% $113.929 14.4% $8.687 8.3% ### $8.687 $130.5

114104 <= $ Infinity 66,561 $246.927 33.7% $267.108 33.8% $20.181 8.2% ### $20.181 $303.2

Totals 665,629 $732.673 100.0% $790.520 100.0% $57.848 7.9% ### $57.848 $95.0

Top Decile Decomposition: 90-95, 95-99, and 99+ :

114104 <= 152267 33,280 $75.068 10.2% $81.140 10.3% $6.073 8.1% ### $6.073 $182.5

152267 <= 333388 26,625 $94.299 12.9% $101.968 12.9% $7.669 8.1% ### $7.669 $288.0

333388 <= $ Infinity 6,656 $77.561 10.6% $84.001 10.6% $6.440 8.3% ### $6.440 $967.6

-$ Infinity <= 13342 112.44%

13342 <= 19046 111.92%

19046 <= 25325 113.57%

25325 <= 32834 110.57%

32834 <= 44385 109.11%

44385 <= 58705 110.04%

58705 <= 79287 105.05%

79287 <= 114104 111.75%

114104 <= $ Infinity 111.99%

Totals 110.66%

Top Decile Decomposition: 90-95, 95-99, and 99+ :

114104 <= 152267 110.23%

152267 <= 333388 110.39%

333388 <= $ Infinity 115.62%

Combined Incidence (Sales and income Tax) in 2013, Old Law and LD 1495

Incidence analysis combines FY 2013 sales tax proposal and calendar year 2013 income tax proposal

Old law LD 1495

Individual Tax Individual Tax Change in Tax Percent Families Tax Average Families Tax Average Families with

Tax Liability Percentage Liability Percentage Liability Tax with Tax Decrease Tax with Tax Increase Tax Tax Increase

Expanded Income Families ($ MIL) Distribution ($ MIL) Distribution ($ MIL) Change Decrease ($ MIL) Decrease Increase ($ MIL) Increase (percent)

-$ Infinity <= 14594 138,657 $48.289 2.2% $38.497 1.7% -$9.793 -20.3% 137,917 -$9.812 -$71.1 740 $0.019 $25.6 0.5%

14594 <= 20835 69,314 $37.054 1.7% $32.950 1.5% -$4.104 -11.1% 65,989 -$4.167 -$63.1 3,325 $0.063 $18.9 4.8%

20835 <= 27658 69,355 $54.815 2.4% $51.822 2.4% -$2.992 -5.5% 58,099 -$3.256 -$56.0 11,256 $0.264 $23.5 16.2%

27658 <= 35970 69,290 $93.498 4.2% $91.008 4.1% -$2.490 -2.7% 45,958 -$3.125 -$68.0 23,332 $0.635 $27.2 33.7%

35970 <= 47389 69,329 $131.922 5.9% $130.651 5.9% -$1.270 -1.0% 47,934 -$3.008 -$62.8 21,395 $1.738 $81.2 30.9%

47389 <= 62853 69,318 $189.261 8.4% $189.134 8.6% -$0.127 -0.1% 44,434 -$3.409 -$76.7 24,884 $3.282 $131.9 35.9%

62853 <= 83757 69,324 $248.543 11.1% $249.862 11.3% $1.319 0.5% 42,661 -$3.850 -$90.2 26,663 $5.169 $193.9 38.5%

83757 <= 119293 69,322 $383.902 17.1% $385.774 17.5% $1.872 0.5% 45,010 -$6.674 -$148.3 24,312 $8.547 $351.5 35.1%

119293 <= $ Infinity 69,323 $1,054.566 47.0% $1,034.798 46.9% -$19.768 -1.9% 41,656 -$49.764 -$1,194.6 27,667 $29.996 $1,084.2 39.9%

Totals 693,232 $2,241.849 100.0% $2,204.496 100.0% -$37.353 -1.7% 529,658 -$87.066 -$164.4 163,574 $49.713 $303.9 23.6%

Top Decile Decomposition: 90-95, 95-99, and 99+ :

119293 <= 159211 34,662 $288.771 12.9% $291.665 13.2% $2.894 1.0% 21,134 -$4.969 -$235.1 13,527 $7.863 $581.3 39.0%

159211 <= 350810 27,730 $388.767 17.3% $391.613 17.8% $2.846 0.7% 15,883 -$9.964 -$627.3 11,847 $12.810 $1,081.3 42.7%

350810 <= $ Infinity 6,931 $377.028 16.8% $351.520 15.9% -$25.508 -6.8% 4,638 -$34.831 -$7,509.2 2,293 $9.323 $4,065.8 33.1%

Maine Revenue Services

Economic Research Division

MRS-TAX-INCIDENCE-REPORT-2013

SUMMARY OF MAINE REVENUE SERVICES ESTIMATE OF IMPACT OF LD 1495 "TAX REFORM" IN YEAR 2013

Old law LD 1495

Total Tax Average Tax Percent Individual Tax Individual Tax Families Tax Average Families Tax Average Families with

Tax Increase Increase Tax Liability Percentage Liability Percentage with Tax Decrease Tax with Tax Increase Tax Tax Increase

Expanded Income Families (Decrease) (Decrease) Change ($ MIL) Distribution ($ MIL) Distribution Decrease ($ MIL) Decrease Increase ($ MIL) Increase (percent)

LESS THAN $ 35,970 346,616 ($13,379,000) ($39) -5.73% $233.656 10.4% $214.277 9.7% ### 307,964 -$14.360 -$46.63 38,652 $0.98 $25.38 11.2%

$ 35,970 - $ 62,853 138,647 ($1,397,000) ($10) -0.43% $321.183 14.3% $319.785 14.5% ### 92,367 -$6.417 -$69.47 46,279 $5.02 $108.47 33.4%

$ 62,853 - $ 83,757 69,324 $1,319,000 $19 0.53% $248.543 11.1% $249.862 11.3% 42,661 -$3.850 -$90.2 26,663 $5.169 $193.9 38.5%

$ 83,757 - $119,293 69,322 $1,872,000 $27 0.49% $383.902 17.1% $385.774 17.5% 45,010 -$6.674 -$148.3 24,312 $8.547 $351.5 35.1%

$119,293 - $159,211 34,662 $2,894,000 $83 1.00% $288.771 12.9% $291.665 13.2% 21,134 -$4.969 -$235.1 13,527 $7.863 $581.3 39.0%

$159,211 - $350,810 27,730 $2,846,000 $103 0.73% $388.767 17.3% $391.613 17.8% 15,883 -$9.964 -$627.3 11,847 $12.810 $1,081.3 42.7%

---------------- --------------------- -------------------- ------------------- ------------------------------------- --------------------------------------- ------------------ ------------------- ------------------- ------------------- ---------------------------------------------------------

SUBTOTAL 686,301 ($5,845,000) ($9) -0.31% $1,864.822 83.18% $1,852.976 84.05% 525,020 -$46.234 -$88.06 161,281 $40.390 $250.43 23.5%

MORE THAN $350,810 6,931 ($25,508,000) ($3,680) -6.80% $377.028 16.8% $351.520 15.9% 4,638 -$34.831 -$7,509.2 2,293 $9.323 $4,065.8 33.1%

--------------- -------------------- -------------------- ------------------ ------------------ ------------------ -------------------- ------------------ ------------------ ------------------ ------------------ ------------------ ------------------ ------------------ ------------------

Total 693,232 ($31,353,000) ($45) -1.40% $2,241.850 100.0% $2,204.496 100.0% 529,658 -$81.065 -$153.05 163,574 $49.713 $303.92 23.6%

NOTE: THE NUMBERS ABOVE INCLUDE THE MAINE REVENUE SERVICES ESTIMATE THAT ABOUT $6 MILLION IN TAX REFUNDS

ALLOWED FOR ABOUT 120,000 LOW INCOME TAXPAYERS WILL NOT BE COLLECTED DUE TO FAILURE TO FILE INCOME TAX RETURN.

Combined Incidence (Sales and income Tax) in 2013, Old Law and LD 1495

Incidence analysis combines FY 2013 sales tax proposal and calendar year 2013 income tax proposal

Old law LD 1495

Individual Tax Individual Tax Change in Tax Percent Families Tax Average Families Tax Average Families with

Tax Liability Percentage Liability Percentage Liability Tax with Tax Decrease Tax with Tax Increase Tax Tax Increase

Expanded Income Families ($ MIL) Distribution ($ MIL) Distribution ($ MIL) Change Decrease ($ MIL) Decrease Increase ($ MIL) Increase (percent)

-$ Infinity <= 14594 138,657 $48.289 2.2% $38.497 1.7% -$9.793 -20.3% 137,917 -$9.812 -$71.1 740 $0.019 $25.6 0.5%

14594 <= 20835 69,314 $37.054 1.7% $32.950 1.5% -$4.104 -11.1% 65,989 -$4.167 -$63.1 3,325 $0.063 $18.9 4.8%

20835 <= 27658 69,355 $54.815 2.4% $51.822 2.4% -$2.992 -5.5% 58,099 -$3.256 -$56.0 11,256 $0.264 $23.5 16.2%

27658 <= 35970 69,290 $93.498 4.2% $91.008 4.1% -$2.490 -2.7% 45,958 -$3.125 -$68.0 23,332 $0.635 $27.2 33.7%

35970 <= 47389 69,329 $131.922 5.9% $130.651 5.9% -$1.270 -1.0% 47,934 -$3.008 -$62.8 21,395 $1.738 $81.2 30.9%

47389 <= 62853 69,318 $189.261 8.4% $189.134 8.6% -$0.127 -0.1% 44,434 -$3.409 -$76.7 24,884 $3.282 $131.9 35.9%

62853 <= 83757 69,324 $248.543 11.1% $249.862 11.3% $1.319 0.5% 42,661 -$3.850 -$90.2 26,663 $5.169 $193.9 38.5%

83757 <= 119293 69,322 $383.902 17.1% $385.774 17.5% $1.872 0.5% 45,010 -$6.674 -$148.3 24,312 $8.547 $351.5 35.1%

119293 <= $ Infinity 69,323 $1,054.566 47.0% $1,034.798 46.9% -$19.768 -1.9% 41,656 -$49.764 -$1,194.6 27,667 $29.996 $1,084.2 39.9%

Totals 693,232 $2,241.849 100.0% $2,204.496 100.0% -$37.353 -1.7% 529,658 -$87.066 -$164.4 163,574 $49.713 $303.9 23.6%

Top Decile Decomposition: 90-95, 95-99, and 99+ :

119293 <= 159211 34,662 $288.771 12.9% $291.665 13.2% $2.894 1.0% 21,134 -$4.969 -$235.1 13,527 $7.863 $581.3 39.0%

159211 <= 350810 27,730 $388.767 17.3% $391.613 17.8% $2.846 0.7% 15,883 -$9.964 -$627.3 11,847 $12.810 $1,081.3 42.7%

350810 <= $ Infinity 6,931 $377.028 16.8% $351.520 15.9% -$25.508 -6.8% 4,638 -$34.831 -$7,509.2 2,293 $9.323 $4,065.8 33.1%

Maine Revenue Services

Economic Research Division

TOTAL TAX CUT FROM ABOVE -$37.353

ESTIMATE OF TAX REFUNDS THAT WILL NOT BE PAID OUT 6.000

---------------

ADJUSTED ACTUAL ESTIMATED NET TAX CUT TO MAINERS -$31.353

Anda mungkin juga menyukai

- LD1495 Incidence REPORTDokumen3 halamanLD1495 Incidence REPORTMelinda JoyceBelum ada peringkat

- Mrs Incidence Report 2011Dokumen2 halamanMrs Incidence Report 2011Melinda JoyceBelum ada peringkat

- Investimento: Dia Investimento Retorno Dia % Lucro Do DiaDokumen44 halamanInvestimento: Dia Investimento Retorno Dia % Lucro Do DiaDarcy LucateliBelum ada peringkat

- A4 - Color - Proudu 3 - G9Dokumen1 halamanA4 - Color - Proudu 3 - G9Franco ArquitecturaBelum ada peringkat

- Colombia BrasilDokumen3 halamanColombia BrasilBryanCamiloChiquizaBelum ada peringkat

- VCF June Improving Margin at Retail - Public VersionDokumen23 halamanVCF June Improving Margin at Retail - Public VersionLightship PartnersBelum ada peringkat

- NWMLS September ReportDokumen3 halamanNWMLS September ReportNeal McNamaraBelum ada peringkat

- Optional Problem (Retirement Planning)Dokumen1 halamanOptional Problem (Retirement Planning)Rushil SurapaneniBelum ada peringkat

- Book 1Dokumen3 halamanBook 1Reymark BaldoBelum ada peringkat

- Sales Funnel ANALYSIS EXAMPLE.Dokumen19 halamanSales Funnel ANALYSIS EXAMPLE.VINENBelum ada peringkat

- St. Louis Residential Real Estate Total Market Overview - May 9, 2011Dokumen1 halamanSt. Louis Residential Real Estate Total Market Overview - May 9, 2011Russell NoltingBelum ada peringkat

- Trabajo Final de Ingeniería EconomicaDokumen30 halamanTrabajo Final de Ingeniería EconomicaSergio HernandezBelum ada peringkat

- Trabajo 2Dokumen2 halamanTrabajo 22021 Eco AHUATZIN ALCANTARA MIRANDABelum ada peringkat

- IndicesDokumen2 halamanIndicesSofia GrinbergBelum ada peringkat

- GERENCIAMENTODokumen15 halamanGERENCIAMENTOsued monteiroBelum ada peringkat

- St. Louis Residential Real Estate Statistics For The Week of April 12, 2011Dokumen1 halamanSt. Louis Residential Real Estate Statistics For The Week of April 12, 2011Russell NoltingBelum ada peringkat

- Gerenciamento Juros CompostosDokumen17 halamanGerenciamento Juros CompostosArthur AlexBelum ada peringkat

- Ej 2 HWDokumen2 halamanEj 2 HWSofia GrinbergBelum ada peringkat

- Taller Nivel LogisticoDokumen7 halamanTaller Nivel LogisticoJose BARRAGAN REYESBelum ada peringkat

- Taller Nivel LogisticoDokumen7 halamanTaller Nivel LogisticoJose BARRAGAN REYESBelum ada peringkat

- Gerenciamento de RiscoDokumen21 halamanGerenciamento de RiscoIgor PriscoBelum ada peringkat

- Common Size Income StatementDokumen7 halamanCommon Size Income StatementUSD 654Belum ada peringkat

- Iqoption PLANILHA 3%Dokumen8 halamanIqoption PLANILHA 3%Rafael Cabral RochaBelum ada peringkat

- Gerenciamento Juros CompostosDokumen17 halamanGerenciamento Juros Compostoslostatus1Belum ada peringkat

- Coin T2 Purchase Price T1 Stop LossDokumen6 halamanCoin T2 Purchase Price T1 Stop LossTai NguyenBelum ada peringkat

- Gerenciamento Juros CompostoDokumen8 halamanGerenciamento Juros CompostobrancopelisonkBelum ada peringkat

- MONEY ManagementDokumen9 halamanMONEY ManagementRavi KumarBelum ada peringkat

- Tata MotorsDokumen16 halamanTata Motorskelim34310Belum ada peringkat

- Tabla CobrosDokumen2 halamanTabla CobrosDiego De AlbaBelum ada peringkat

- Varun BeveragesDokumen16 halamanVarun BeveragesPuneet GirdharBelum ada peringkat

- UST Debt Policy Spreadsheet (Reduced)Dokumen9 halamanUST Debt Policy Spreadsheet (Reduced)Björn Auðunn ÓlafssonBelum ada peringkat

- Gerenciamento Completo Blaze Alunos Do MasterDokumen12 halamanGerenciamento Completo Blaze Alunos Do MasterMauzi 777Belum ada peringkat

- Investimento Retorno DiaDokumen9 halamanInvestimento Retorno DiaIsaque da Silva BarrosBelum ada peringkat

- Ubat CompoundingDokumen10 halamanUbat Compoundingmohd zaimBelum ada peringkat

- Planilha-Bruninho - 2Dokumen6 halamanPlanilha-Bruninho - 2palmeiras199920202021mdmBelum ada peringkat

- Revenues % Growth Operating Income Oper. Margin % Shares Outstanding Shares RepurchasedDokumen7 halamanRevenues % Growth Operating Income Oper. Margin % Shares Outstanding Shares RepurchasedAaron FosterBelum ada peringkat

- RegionFly - Case DataDokumen4 halamanRegionFly - Case DataLucas AalbersBelum ada peringkat

- Gerenciamento de Risco 2-3Dokumen16 halamanGerenciamento de Risco 2-3JOHN WALKERBelum ada peringkat

- Gerenciamento de RiscoDokumen11 halamanGerenciamento de RiscoKauã SilvaBelum ada peringkat

- Datos de Salida RiskDokumen6.669 halamanDatos de Salida RiskJhon ParraBelum ada peringkat

- Informatica ActividadesDokumen74 halamanInformatica ActividadesEmily AnguayaBelum ada peringkat

- REP 326 TABLERO INDICADORES TIENDA Reporte PDFDokumen2 halamanREP 326 TABLERO INDICADORES TIENDA Reporte PDFAlexis Martinez CazaresBelum ada peringkat

- Gerenciamento de Risco IqDokumen12 halamanGerenciamento de Risco IqMicael PereiraBelum ada peringkat

- Segue O Plano: InvestimentoDokumen12 halamanSegue O Plano: InvestimentoRicardo SouzaBelum ada peringkat

- 90 Day Trade - MASTERDokumen54 halaman90 Day Trade - MASTERLauren Gerlaine Reliford100% (1)

- Planilha de Gerenciamento Agressivo (10 - Ao Dia) God TraderDokumen2 halamanPlanilha de Gerenciamento Agressivo (10 - Ao Dia) God TraderTrader RonaldoBelum ada peringkat

- NetflixDokumen13 halamanNetflixRamesh SinghBelum ada peringkat

- Dórea - Gerenciamento de Risco IqDokumen172 halamanDórea - Gerenciamento de Risco IqFernanda CorreiaBelum ada peringkat

- Genzyme DCF PDFDokumen5 halamanGenzyme DCF PDFAbinashBelum ada peringkat

- Gerenciamento TraderDokumen11 halamanGerenciamento TraderLUMA OLIVEIRABelum ada peringkat

- Sales Manager Dashboard Template: Daily TrackerDokumen12 halamanSales Manager Dashboard Template: Daily TrackerAwais ZafarBelum ada peringkat

- Asian Paint FMVRDokumen20 halamanAsian Paint FMVRdeepaksg787Belum ada peringkat

- 03-Juros CompostosDokumen24 halaman03-Juros CompostosVENHAN PARA O MUNDO PES.Belum ada peringkat

- Sales Data Customer Percent Gross Profitgross Sales Gross Profit Industry Code Competitive RatingDokumen4 halamanSales Data Customer Percent Gross Profitgross Sales Gross Profit Industry Code Competitive RatingnorshaheeraBelum ada peringkat

- Nomina-Derecho Fiscal-Matutino 6 CuatriDokumen5 halamanNomina-Derecho Fiscal-Matutino 6 CuatriLibni VillalpandoBelum ada peringkat

- Cuota Facturacion Cuota: Seguimiento de DOMICILIOS Y ASISTIDADokumen4 halamanCuota Facturacion Cuota: Seguimiento de DOMICILIOS Y ASISTIDADiana Camargo MurciaBelum ada peringkat

- Salario Minimo Auxilio PDFDokumen1 halamanSalario Minimo Auxilio PDFpaulaBelum ada peringkat

- Salario Minimo Auxilio PDFDokumen1 halamanSalario Minimo Auxilio PDFDayanna BelloBelum ada peringkat

- Money ManagementDokumen13 halamanMoney ManagementMarchie VictorBelum ada peringkat

- United States Census Figures Back to 1630Dari EverandUnited States Census Figures Back to 1630Belum ada peringkat

- Governor Tax Plan 2-27-15 RDokumen11 halamanGovernor Tax Plan 2-27-15 RMelinda JoyceBelum ada peringkat

- NO On One - Website-ResponseDokumen6 halamanNO On One - Website-ResponseMelinda JoyceBelum ada peringkat

- LD 1495 "Tax Reform" The Real Facts: Albert A. Dimillo, Jr. Retired Corp Orate Tax Director & CpaDokumen30 halamanLD 1495 "Tax Reform" The Real Facts: Albert A. Dimillo, Jr. Retired Corp Orate Tax Director & CpaMelinda JoyceBelum ada peringkat

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Electronic Commerce 2012 Managerial and Social Networks Perspectives 7th Edition Turban Solutions ManualDokumen14 halamanElectronic Commerce 2012 Managerial and Social Networks Perspectives 7th Edition Turban Solutions Manualwillardnelsonmn5b61100% (25)

- Instagram-Social Media Image SizesDokumen34 halamanInstagram-Social Media Image Sizeswraeththu6Belum ada peringkat

- John LockeDokumen2 halamanJohn LockeCarl RollysonBelum ada peringkat

- Letter Re Iskolar Ni Juan Tech-Voc Certification ScholarshipDokumen4 halamanLetter Re Iskolar Ni Juan Tech-Voc Certification ScholarshipFlorinda GagasaBelum ada peringkat

- Mainstreming Agro-Ecology in EthiopiaDokumen40 halamanMainstreming Agro-Ecology in EthiopiakiruskyBelum ada peringkat

- Chapter-3 PTD NewDokumen34 halamanChapter-3 PTD NewGODBelum ada peringkat

- Mastercam Mill-Turn Tutorial: June 2017Dokumen198 halamanMastercam Mill-Turn Tutorial: June 2017Joy G MosesBelum ada peringkat

- Price Elasticity of DemandDokumen3 halamanPrice Elasticity of Demandssharma21Belum ada peringkat

- Design of Gating and Feeding Systems-2Dokumen1 halamanDesign of Gating and Feeding Systems-2kaushikb26Belum ada peringkat

- DOJAC Accomplishment Report - UpdatedDokumen47 halamanDOJAC Accomplishment Report - UpdatedAllen GeronimoBelum ada peringkat

- Literature ReviewDokumen6 halamanLiterature Reviewapi-559288073Belum ada peringkat

- Modes of Discovery in GeneralDokumen16 halamanModes of Discovery in GeneralTrishBelum ada peringkat

- Apple Slices Recipe (Chicago Bakery Style Apple Sqares)Dokumen2 halamanApple Slices Recipe (Chicago Bakery Style Apple Sqares)Richard LundBelum ada peringkat

- AOCS Official Method Ja 9-87 Gardner ColorDokumen1 halamanAOCS Official Method Ja 9-87 Gardner ColorBruno DamiãoBelum ada peringkat

- Cisco Show CommandsDokumen20 halamanCisco Show CommandsNorbert OngBelum ada peringkat

- Bausa, Ampil, Suarez, Parades & Bausa For Petitioner. CV Law Office & Associates For Private RespondentsDokumen32 halamanBausa, Ampil, Suarez, Parades & Bausa For Petitioner. CV Law Office & Associates For Private RespondentsChesza MarieBelum ada peringkat

- The Family Code of The Philippines: Title Ix Parental AuthorityDokumen4 halamanThe Family Code of The Philippines: Title Ix Parental AuthorityMarc Eric Redondo100% (1)

- Lecture 1 - Part 1 - Introduction To ECE 105Dokumen12 halamanLecture 1 - Part 1 - Introduction To ECE 105homamhomarBelum ada peringkat

- Kali Hanuman Vani HanumanjiDokumen11 halamanKali Hanuman Vani HanumanjiDharmendrasinh AtaliaBelum ada peringkat

- The Treasury of Blessings A Meditation On Shakyamuni BuddhaDokumen3 halamanThe Treasury of Blessings A Meditation On Shakyamuni BuddhaMac DorjeBelum ada peringkat

- PDF DocumentDokumen5 halamanPDF DocumentMary Bea CantomayorBelum ada peringkat

- CONTOH Surat Lamaran Kerja Bhs EngDokumen10 halamanCONTOH Surat Lamaran Kerja Bhs Engboy5mil3Belum ada peringkat

- Ceiling Tiles PerforatedDokumen3 halamanCeiling Tiles PerforatedNooong NooongBelum ada peringkat

- Activity Sheet No. 1 THE HUMAN RESPIRATORY SYSTEMDokumen6 halamanActivity Sheet No. 1 THE HUMAN RESPIRATORY SYSTEMJenneriza DC Del RosarioBelum ada peringkat

- Buddhism Buddhist Conflict Resolution As Found in The Books of Discipline March 2011Dokumen24 halamanBuddhism Buddhist Conflict Resolution As Found in The Books of Discipline March 2011mycambodian100% (3)

- 5339 EHS Strategic ProblemDokumen29 halaman5339 EHS Strategic ProblemAnn Okafor83% (6)

- Woman and TaxDokumen7 halamanWoman and TaxMeita LarasatiBelum ada peringkat

- Patriot 2012 2.4LDokumen292 halamanPatriot 2012 2.4LJosé de JesúsBelum ada peringkat

- Studi Kasus Samsung Vs AppleDokumen6 halamanStudi Kasus Samsung Vs AppleAldo Arfiando As SambasiBelum ada peringkat

- BAFINAR - Midterm Draft (R) PDFDokumen11 halamanBAFINAR - Midterm Draft (R) PDFHazel Iris Caguingin100% (1)