Internal - Retained Earnings External - Debt (Short-Term vs. Long-Term), Equity and Hybrids (Preferred

Diunggah oleh

dskrishnaJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Internal - Retained Earnings External - Debt (Short-Term vs. Long-Term), Equity and Hybrids (Preferred

Diunggah oleh

dskrishnaHak Cipta:

Format Tersedia

Sources of Capital: Internal retained earnings External - Debt (short-term vs.

. long-term), Equity and Hybrids (preferred stock, convertible bonds, etc.) 2. Which source of capital (internal or external) is used more? Why? External if the company can leverage well. This will work out well if the current interest rate on external debt is less than the current dividend pay out percentage and if there is continued opportunity available to the company to make more money with this external debt Internal if the company can convince the shareholders to retain the earnings instead of distributing as dividends and if there is plenty of opportunity available for using such internal funds for profitable deployment. Virtually these retained earnings would be available to the company at nil cost. 3. Which source of external capital (debt or equity) is used more? Why? Almost all the companies use both the forms of external capital debt and equity. The equity is available at nil cost. If the company can leverage well, it can raise debt capital as well and if such debt carries lower interest rate when compared with the percentage earnings. 4. Are there any trends in corporate financing? Capital structure in practice debt capital and equity capital is an evolving subject. Many of the successful companies have one form of financing pattern either wholly using internal funds, or external equity. In case debt capital is sought for, the creditors would insist on adequate margin from the company itself by way of shareholder funds. Thus, depending upon the evolving situation, the modern companies meet their financing requirements either through retained earnings, or equity capital and if debt capital is sought for, with required equity capital arrangements. 5. If a firm issues new debt, what will happen to the firms stock price? And if a firm issues new equity, what will happen to the firms stock price?

151

Anda mungkin juga menyukai

- NHPC 3Dokumen49 halamanNHPC 3shyamagniBelum ada peringkat

- NHPC 3Dokumen49 halamanNHPC 3Hitesh Mittal100% (1)

- CF 3rd AssignmentDokumen6 halamanCF 3rd AssignmentAnjum SamiraBelum ada peringkat

- Chapter 1 FM IIDokumen16 halamanChapter 1 FM IImelat felekeBelum ada peringkat

- Factors Determining Capital StructureDokumen2 halamanFactors Determining Capital StructureMostafizul HaqueBelum ada peringkat

- Financing Decisions Capital Structure: M. Pavan KumarDokumen26 halamanFinancing Decisions Capital Structure: M. Pavan KumarPavan Kumar MylavaramBelum ada peringkat

- Factors Determining Capital Structure EssayDokumen2 halamanFactors Determining Capital Structure Essayrakesh kumarBelum ada peringkat

- MB20202 Corporate Finance Unit IV Study MaterialsDokumen21 halamanMB20202 Corporate Finance Unit IV Study MaterialsSarath kumar CBelum ada peringkat

- Unit 3 FMDokumen8 halamanUnit 3 FMpurvang selaniBelum ada peringkat

- Financial Management: Investment, Financing and Dividend DecisionsDokumen7 halamanFinancial Management: Investment, Financing and Dividend Decisionssonal2901Belum ada peringkat

- Capital StructureDokumen8 halamanCapital Structureibnebatuta103Belum ada peringkat

- Source of Finance 1Dokumen35 halamanSource of Finance 1Niraj GuptaBelum ada peringkat

- 12 Business Studies CH 09 Financial ManagementDokumen6 halaman12 Business Studies CH 09 Financial ManagementMeera TalrejaBelum ada peringkat

- Chapter 7 - Sources of FinanceDokumen12 halamanChapter 7 - Sources of FinanceSai SantoshBelum ada peringkat

- 14, 15 & 16. Capital StructureDokumen5 halaman14, 15 & 16. Capital StructureSatyam RahateBelum ada peringkat

- Long Term FinancingDokumen5 halamanLong Term Financingjayaditya joshiBelum ada peringkat

- Unit Iii-1Dokumen13 halamanUnit Iii-1Archi VarshneyBelum ada peringkat

- Arrangement of Funds LPSDokumen57 halamanArrangement of Funds LPSRohan SinglaBelum ada peringkat

- Corporate FinanceDokumen5 halamanCorporate FinanceAvi AggarwalBelum ada peringkat

- Assignment 1 FMDokumen8 halamanAssignment 1 FMSopnobaz FakirBelum ada peringkat

- Capital StructureDokumen9 halamanCapital StructureManish XiiBelum ada peringkat

- Investments An Introduction 11Th Edition Mayo Solutions Manual Full Chapter PDFDokumen38 halamanInvestments An Introduction 11Th Edition Mayo Solutions Manual Full Chapter PDFninhletitiaqt3100% (8)

- Capital Structure, Capitalisation and LeverageDokumen53 halamanCapital Structure, Capitalisation and LeverageCollins NyendwaBelum ada peringkat

- Assignment: Topic: Capital Structure DeterminantsDokumen9 halamanAssignment: Topic: Capital Structure DeterminantsBeenish AbdullahBelum ada peringkat

- ResearchDokumen5 halamanResearchCherry Amor Venzon OngsonBelum ada peringkat

- Dividend Discount ModelDokumen9 halamanDividend Discount ModelVatsal SinghBelum ada peringkat

- Chapter 3 PDFDokumen24 halamanChapter 3 PDFCarlos PadillaBelum ada peringkat

- Capital Structure Lecture SummaryDokumen8 halamanCapital Structure Lecture SummaryAmrit KaurBelum ada peringkat

- Corporate Finance BasicsDokumen27 halamanCorporate Finance BasicsAhimbisibwe BenyaBelum ada peringkat

- Capital Structure, The Determinants and FeaturesDokumen5 halamanCapital Structure, The Determinants and FeaturesRianto StgBelum ada peringkat

- Sources of FundDokumen16 halamanSources of FundRonak ShahBelum ada peringkat

- Factors Determining Optimal Capital StructureDokumen8 halamanFactors Determining Optimal Capital StructureArindam Mitra100% (8)

- Capital Structure and Dividend PolicyDokumen25 halamanCapital Structure and Dividend PolicySarah Mae SudayanBelum ada peringkat

- Financial Management II CH 1-5Dokumen270 halamanFinancial Management II CH 1-5Milion adereBelum ada peringkat

- Punjabi University Patiala: Assignment ONDokumen5 halamanPunjabi University Patiala: Assignment ONParamvir DhotBelum ada peringkat

- Financial ManagementDokumen8 halamanFinancial ManagementManjeet SinghBelum ada peringkat

- How Private Equity Makes MoneyDokumen53 halamanHow Private Equity Makes MoneyGeorge FinchBelum ada peringkat

- Investments An Introduction 10Th Edition Mayo Solutions Manual Full Chapter PDFDokumen39 halamanInvestments An Introduction 10Th Edition Mayo Solutions Manual Full Chapter PDFWilliamCartersafg100% (10)

- Topic 3 - Capital StructureDokumen17 halamanTopic 3 - Capital StructureSandeepa KaurBelum ada peringkat

- PMF Unit 5Dokumen10 halamanPMF Unit 5dummy manBelum ada peringkat

- 21MGH202T FM Unit IV Study MaterialsDokumen19 halaman21MGH202T FM Unit IV Study Materialslogashree175Belum ada peringkat

- Unit Iv: Financing DecisionsDokumen11 halamanUnit Iv: Financing DecisionsAR Ananth Rohith BhatBelum ada peringkat

- Sources of Industrial FinanceDokumen2 halamanSources of Industrial FinanceIsrar Ahmed ShaikhBelum ada peringkat

- Business Financing SourcesDokumen18 halamanBusiness Financing SourcesAYNETU TEREFEBelum ada peringkat

- Capital StructureDokumen8 halamanCapital StructureAnanthakrishnan KBelum ada peringkat

- MB20202 Corporate Finance Unit III Study MaterialsDokumen24 halamanMB20202 Corporate Finance Unit III Study MaterialsSarath kumar CBelum ada peringkat

- Ques:1 What Do We Understand by Finance? Why Do Business Need Finance? Describe Sources of Finance?Dokumen3 halamanQues:1 What Do We Understand by Finance? Why Do Business Need Finance? Describe Sources of Finance?Ravi MehraBelum ada peringkat

- Chapter Five: Financing Decision: Gedewon Gebre (MSC Accounting and Finance, Certified Authorized Accountant-Ethiopia)Dokumen12 halamanChapter Five: Financing Decision: Gedewon Gebre (MSC Accounting and Finance, Certified Authorized Accountant-Ethiopia)sosina eseyewBelum ada peringkat

- Sources of FinanceDokumen6 halamanSources of FinanceNeesha NazBelum ada peringkat

- Venture Capital-Group 6Dokumen31 halamanVenture Capital-Group 6Hemali PanchalBelum ada peringkat

- Chapter 3 LONG TERM SOURCES OF FINANCEDokumen7 halamanChapter 3 LONG TERM SOURCES OF FINANCERocket SinghBelum ada peringkat

- Financing DecisionsDokumen10 halamanFinancing DecisionsAahana GuptaBelum ada peringkat

- Financial Management IIDokumen78 halamanFinancial Management IIDawit NegashBelum ada peringkat

- Document From JayakumarDokumen20 halamanDocument From JayakumarBck SreedharBelum ada peringkat

- Dividend PolicyDokumen35 halamanDividend PolicyVic100% (3)

- Main ThesisDokumen46 halamanMain ThesisKalu bhaiBelum ada peringkat

- Sourcing Money May Be Done For A Variety of ReasonsDokumen24 halamanSourcing Money May Be Done For A Variety of ReasonsFelix Amirth RajBelum ada peringkat

- Dividend Investing for Beginners & DummiesDari EverandDividend Investing for Beginners & DummiesPenilaian: 5 dari 5 bintang5/5 (1)

- ESIC RD NotificationDokumen8 halamanESIC RD NotificationdskrishnaBelum ada peringkat

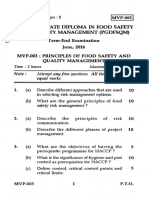

- MVP-003 June 2016Dokumen2 halamanMVP-003 June 2016dskrishnaBelum ada peringkat

- Page 3Dokumen1 halamanPage 3dskrishnaBelum ada peringkat

- Page 2Dokumen1 halamanPage 2dskrishnaBelum ada peringkat

- Ministry of Health and Family Welfare Notification: ART ECDokumen1 halamanMinistry of Health and Family Welfare Notification: ART ECdskrishnaBelum ada peringkat

- Print 1Dokumen1 halamanPrint 1dskrishnaBelum ada peringkat

- Tax ReturnDokumen2 halamanTax ReturndskrishnaBelum ada peringkat

- NPS ReturnsDokumen4 halamanNPS ReturnsdskrishnaBelum ada peringkat

- Bangaru KondaDokumen49 halamanBangaru KondadskrishnaBelum ada peringkat

- Job Description 4Dokumen4 halamanJob Description 4dskrishnaBelum ada peringkat

- Konkan Railway MapDokumen15 halamanKonkan Railway MapdskrishnaBelum ada peringkat

- FSSAI Minutes 82Dokumen1 halamanFSSAI Minutes 82dskrishnaBelum ada peringkat

- Konkan Railway Corporation Ltd. क कण रेलवे कॉप रेशन ल मटेडDokumen2 halamanKonkan Railway Corporation Ltd. क कण रेलवे कॉप रेशन ल मटेडdskrishnaBelum ada peringkat

- Checklist ITR 7 PDFDokumen4 halamanChecklist ITR 7 PDFshaik nayazBelum ada peringkat

- Ministry of Health and Family Welfare Notification: The Gazette of India: Extraordinary (P Ii-S - 3 (I) )Dokumen1 halamanMinistry of Health and Family Welfare Notification: The Gazette of India: Extraordinary (P Ii-S - 3 (I) )dskrishnaBelum ada peringkat

- Ignou Act OrdinanceDokumen1 halamanIgnou Act OrdinancedskrishnaBelum ada peringkat

- FSSAI Minutes 4Dokumen1 halamanFSSAI Minutes 4dskrishnaBelum ada peringkat

- Ignou NT AdvertisementDokumen10 halamanIgnou NT AdvertisementdskrishnaBelum ada peringkat

- FSSAI Minutes 5Dokumen1 halamanFSSAI Minutes 5dskrishnaBelum ada peringkat

- FSSAI Minutes 20Dokumen1 halamanFSSAI Minutes 20dskrishnaBelum ada peringkat

- FSSAI Minutes 78Dokumen1 halamanFSSAI Minutes 78dskrishnaBelum ada peringkat

- FSSAI Minutes 83Dokumen1 halamanFSSAI Minutes 83dskrishnaBelum ada peringkat

- FSSAI Minutes 17Dokumen1 halamanFSSAI Minutes 17dskrishnaBelum ada peringkat

- FSSAI Minutes 18Dokumen1 halamanFSSAI Minutes 18dskrishnaBelum ada peringkat

- FSSAI Minutes 13Dokumen1 halamanFSSAI Minutes 13dskrishnaBelum ada peringkat

- FSSAI Minutes 6Dokumen1 halamanFSSAI Minutes 6dskrishnaBelum ada peringkat

- FSSAI Minutes 19Dokumen1 halamanFSSAI Minutes 19dskrishnaBelum ada peringkat

- FSSAI Minutes 7Dokumen1 halamanFSSAI Minutes 7dskrishnaBelum ada peringkat

- FSSAI Minutes 8Dokumen1 halamanFSSAI Minutes 8dskrishnaBelum ada peringkat

- FSSAI Minutes 9Dokumen1 halamanFSSAI Minutes 9dskrishnaBelum ada peringkat