EPF Calender

Diunggah oleh

Amitav TalukdarJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

EPF Calender

Diunggah oleh

Amitav TalukdarHak Cipta:

Format Tersedia

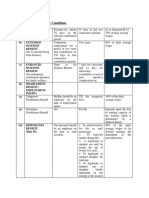

Provident Fund Process Calendar

Act Requirement Applicability

-Minimum wages (Basic) INR 6500/=p.m. -Number of Employees Minimum 20

Records to be Maintained

-Attendance Register -Eligibility Register -Inspection Register -Contribution Register -Salary Register -Form 11 (Revised)

Returns to be filed

Monthly Return Before 25th of Every Month -Form 12 A (Revised) -PF Contribution challan -Form 2 (Revised) -Form 5 (New Joinees) -Form 10(Resigned Emp)

Due dates Monthly Contribution (15th of Every Month) Grace Period of 5 Days if Salary paid on 07th in place of 01st Monthly Return (25th of Every Month) Annual Return (30th April )

Contribution

-Employee Contribution -Employer Contribution 12% on Basic 12% on Basic

PF Withdrawal

-Form 10 C -Form 19 -Form 3 A (Revised)

Annual Return Before 30th April -Form 3 A (Revised) -Form 6 A -PF Deposit Challan (All Twelve months)

Admin & EDLI Chg

-1.10% Admin Chg on Net Basic -0.50% EDLI Chg on 6,500/= -0.01% Admin Chg on EDLI

PF Transfer

-Form 13 (Revised) -Form 3 A (Revised)

New Joinees Info . (25th of Every month)

Resigned Emp info (25th of Every month)

PF withdrawal (Completion of 60 day from the DOJ) PF Transfer (Completion of 60 day from the DOJ)

In the event of death For Advance

-Form - 31 -Form 20 (PF) -Form 5(IF) (EDLI) -Form 10-D (Pension)

One Time submission

-Form -9 (Revised)

Anda mungkin juga menyukai

- Provident Fund Full DetailsDokumen5 halamanProvident Fund Full DetailsGaurav VijayBelum ada peringkat

- Vendor Statutory Compliance Checklist-KarnatakaDokumen1 halamanVendor Statutory Compliance Checklist-Karnatakamanishdg50% (6)

- Employee Provident Fund ComplianceDokumen3 halamanEmployee Provident Fund ComplianceAswanth GokaBelum ada peringkat

- Calculate income tax liability under old and new tax regimesDokumen6 halamanCalculate income tax liability under old and new tax regimesJigeesha BhargaviBelum ada peringkat

- Statutory ComplianceDokumen2 halamanStatutory Compliancemax997Belum ada peringkat

- RegistrationDokumen15 halamanRegistrationpratikdhond100% (3)

- Compliance Manual F.Y. 2020 21 A.Y.2021 22 PDFDokumen52 halamanCompliance Manual F.Y. 2020 21 A.Y.2021 22 PDFTHERMAL TECH ENGINEERINGBelum ada peringkat

- Esic ChallanDokumen7 halamanEsic Challanrgsr2008Belum ada peringkat

- Kar Shops Commercial Forms FormatDokumen16 halamanKar Shops Commercial Forms FormatbelvaisudheerBelum ada peringkat

- Contract Labour RegisterDokumen34 halamanContract Labour Registerravinder.singh19853857Belum ada peringkat

- Relevant Dates: 15-Apr QuarterlyDokumen6 halamanRelevant Dates: 15-Apr Quarterlysanyu1208Belum ada peringkat

- Cheklist For Employers: Statutory Deposits & ReturnsDokumen4 halamanCheklist For Employers: Statutory Deposits & ReturnsVas VasakulaBelum ada peringkat

- INCOME UNDER SALARIESDokumen44 halamanINCOME UNDER SALARIEShny0910Belum ada peringkat

- PF Pension Settlement Form-TCSDokumen4 halamanPF Pension Settlement Form-TCSSridhara Krishna BodavulaBelum ada peringkat

- Overtime Allowance Eligibility and RatesDokumen3 halamanOvertime Allowance Eligibility and RatesKumudha Devi100% (1)

- Salary AdministrationDokumen17 halamanSalary AdministrationMae Ann GonzalesBelum ada peringkat

- USSP User Manual v1.0Dokumen18 halamanUSSP User Manual v1.0Siva ChBelum ada peringkat

- Online Registration of Establishment With DSC: User ManualDokumen39 halamanOnline Registration of Establishment With DSC: User ManualroseBelum ada peringkat

- Karnataka Shops and Commercial Establishments Act, 1961Dokumen44 halamanKarnataka Shops and Commercial Establishments Act, 1961Latest Laws TeamBelum ada peringkat

- Higher Pension As Per SC Decision With Calculation - Synopsis1Dokumen13 halamanHigher Pension As Per SC Decision With Calculation - Synopsis1hariveerBelum ada peringkat

- Income Tax DepartmentDokumen19 halamanIncome Tax DepartmentSharathBelum ada peringkat

- All Forms Under Factories Act 1948Dokumen2 halamanAll Forms Under Factories Act 1948jagshishBelum ada peringkat

- YTD Statement-1326013854886Dokumen108 halamanYTD Statement-1326013854886deepson800Belum ada peringkat

- Benefits & Contributory Conditions: (I) (A) Sickness BenefitDokumen4 halamanBenefits & Contributory Conditions: (I) (A) Sickness BenefitKunwar Sa Amit SinghBelum ada peringkat

- Compliance PDFDokumen20 halamanCompliance PDFSUBHANKAR PALBelum ada peringkat

- ESIC e-Pehchan Card BenefitsDokumen3 halamanESIC e-Pehchan Card BenefitsGoutam HotaBelum ada peringkat

- Attendance Register FormatDokumen1 halamanAttendance Register Formatvishal_mtoBelum ada peringkat

- Labour Law Compliance Due DatesDokumen4 halamanLabour Law Compliance Due DatesAchuthan RamanBelum ada peringkat

- CCENT Notes Part-3Dokumen63 halamanCCENT Notes Part-3Anil JunagalBelum ada peringkat

- International J. Seed Spices Growth RatesDokumen4 halamanInternational J. Seed Spices Growth Ratesmohan rathoreBelum ada peringkat

- Pay SlipDokumen50 halamanPay SlipSushil Shrestha100% (1)

- Employees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of RegistrationDokumen2 halamanEmployees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of RegistrationTontadarya PolytechnicBelum ada peringkat

- EPF Provident Fund CalculatorDokumen6 halamanEPF Provident Fund CalculatorUtkal SolankiBelum ada peringkat

- What Is A Flexible Benefit Plan in A Salary Breakup? - QuoraDokumen8 halamanWhat Is A Flexible Benefit Plan in A Salary Breakup? - QuoraSiBelum ada peringkat

- Employee Pension SchemeDokumen6 halamanEmployee Pension SchemeAarthi PadmanabhanBelum ada peringkat

- MCSE PracticalsDokumen88 halamanMCSE PracticalsMayur UkandeBelum ada peringkat

- CCNA Cisco Routing Protocols and Concepts Final Exam-PracticeDokumen22 halamanCCNA Cisco Routing Protocols and Concepts Final Exam-Practicesabriel69100% (1)

- Major Spice State Wise Area Production Web 2015 PDFDokumen3 halamanMajor Spice State Wise Area Production Web 2015 PDFbharatheeeyuduBelum ada peringkat

- Form of Pension Proposals FormDokumen14 halamanForm of Pension Proposals Formlakshmi naryanaBelum ada peringkat

- Artifact 5 - Employee Pension Scheme Form 10 CDokumen4 halamanArtifact 5 - Employee Pension Scheme Form 10 CSiva chowdaryBelum ada peringkat

- Salary Taxation and Related Concepts: Malik Faisal Mehmood, ACADokumen25 halamanSalary Taxation and Related Concepts: Malik Faisal Mehmood, ACAMalik FaisalBelum ada peringkat

- Salary Structure: Please Put The Gross Salry in Red Column in Any Slab, U Will Find StructureDokumen6 halamanSalary Structure: Please Put The Gross Salry in Red Column in Any Slab, U Will Find StructureSagar ShindeBelum ada peringkat

- Anirudh Kumar JainDokumen4 halamanAnirudh Kumar JainAnirudh JainBelum ada peringkat

- Appointment Salary BreakupDokumen1 halamanAppointment Salary BreakupPhani KumarBelum ada peringkat

- Organisational Implications of Coaching: Jane StubberfieldDokumen13 halamanOrganisational Implications of Coaching: Jane Stubberfieldarjun.ec633Belum ada peringkat

- Family Pension SchemeDokumen15 halamanFamily Pension SchemeJitu Choudhary100% (1)

- PF & Gratuity ManagementDokumen7 halamanPF & Gratuity ManagementAkm Ashraf Uddin0% (1)

- PF TransferDokumen11 halamanPF TransfersinniBelum ada peringkat

- Esic Online ChallanDokumen26 halamanEsic Online ChallanahtradaBelum ada peringkat

- Acts RegisterDokumen3 halamanActs Registersheru006Belum ada peringkat

- Provident Fund (PF)Dokumen13 halamanProvident Fund (PF)chandub6Belum ada peringkat

- Template - Restructuring-Tax Computation-BER-Salary Tracker For FY 2015-16 - CKDokumen9 halamanTemplate - Restructuring-Tax Computation-BER-Salary Tracker For FY 2015-16 - CKajaykrsinghpintuBelum ada peringkat

- Salary, Net Salary, Gross Salary, Cost To Company Are They Same or Different. For Most People It IsDokumen6 halamanSalary, Net Salary, Gross Salary, Cost To Company Are They Same or Different. For Most People It IsAnonymous CwxsRiwBelum ada peringkat

- Sbi Service Rules 2015Dokumen25 halamanSbi Service Rules 2015Jeeban MishraBelum ada peringkat

- Statutory Compliance - PF and GratuityDokumen11 halamanStatutory Compliance - PF and GratuityHusna SadiyaBelum ada peringkat

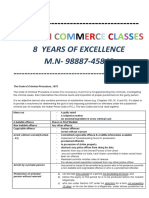

- Complete Basic of PF&ESIDokumen5 halamanComplete Basic of PF&ESIDevendradangeBelum ada peringkat

- Compliance Due Date Event Name: Compliance Calender For The Month of November 2012Dokumen6 halamanCompliance Due Date Event Name: Compliance Calender For The Month of November 2012kumar_anil666Belum ada peringkat

- PF & ESI Compliance GuideDokumen15 halamanPF & ESI Compliance GuideAbdul KhadhirBelum ada peringkat

- Notes On Provident Fund & E.S.IDokumen2 halamanNotes On Provident Fund & E.S.IBhumika Pithadiya100% (2)

- Monthly PayslipDokumen42 halamanMonthly PayslipVenkatesh ChowdaryBelum ada peringkat

- Handout - Company Law - Lecture Notes WS 14-15Dokumen84 halamanHandout - Company Law - Lecture Notes WS 14-15Amitav Talukdar100% (1)

- Taxation NotesDokumen63 halamanTaxation Notesthushara234465087% (31)

- The Payment of Bonus Act 188Dokumen32 halamanThe Payment of Bonus Act 188Devendra K ChoudharyBelum ada peringkat

- 2013Dokumen40 halaman2013PrabhanshuKumarBelum ada peringkat

- SBI PO Exam 28-06-2014 Question Paper PDFDokumen3 halamanSBI PO Exam 28-06-2014 Question Paper PDFAmitav TalukdarBelum ada peringkat

- CIT vs Sitaldas Tirathdas: Deduction of maintenance allowance from total incomeDokumen74 halamanCIT vs Sitaldas Tirathdas: Deduction of maintenance allowance from total incomeNidaFatimaBelum ada peringkat

- Trials Before Court of Session To Be Conducted by Public ProsecutionsDokumen2 halamanTrials Before Court of Session To Be Conducted by Public ProsecutionsAmitav TalukdarBelum ada peringkat

- CIT vs Sitaldas Tirathdas: Deduction of maintenance allowance from total incomeDokumen74 halamanCIT vs Sitaldas Tirathdas: Deduction of maintenance allowance from total incomeNidaFatimaBelum ada peringkat

- CRPC Summary NotesDokumen5 halamanCRPC Summary NotesAmitav Talukdar89% (18)

- The Payment of Bonus Act, 1966Dokumen25 halamanThe Payment of Bonus Act, 1966Amitav Talukdar67% (3)

- 2013Dokumen40 halaman2013PrabhanshuKumarBelum ada peringkat

- 2013Dokumen40 halaman2013PrabhanshuKumarBelum ada peringkat

- Tandoor CaseDokumen2 halamanTandoor CaseAmitav TalukdarBelum ada peringkat

- Law of CrimeDokumen51 halamanLaw of CrimeAmitav TalukdarBelum ada peringkat

- StatisticDokumen1 halamanStatisticAmitav TalukdarBelum ada peringkat

- Freemarkets Online Inc: An Example of Global Supply Chain ManagementDokumen9 halamanFreemarkets Online Inc: An Example of Global Supply Chain ManagementAmitav TalukdarBelum ada peringkat

- Complexity Is The Integration of SimplicityDokumen5 halamanComplexity Is The Integration of SimplicityAmitav TalukdarBelum ada peringkat

- Interpretation of StatutesDokumen33 halamanInterpretation of StatutesChaitu Chaitu100% (4)

- English Verb Tense ReviewDokumen46 halamanEnglish Verb Tense ReviewVishwas SinghBelum ada peringkat

- The Minimum Wage Act 1948Dokumen27 halamanThe Minimum Wage Act 1948Amitav TalukdarBelum ada peringkat

- The Payment of Bonus Act 188Dokumen32 halamanThe Payment of Bonus Act 188Devendra K ChoudharyBelum ada peringkat

- The Maternity Benefits Act, 1961: KalpanaDokumen5 halamanThe Maternity Benefits Act, 1961: KalpanaAmitav TalukdarBelum ada peringkat

- The Maternity Benefits Act, 1961: KalpanaDokumen5 halamanThe Maternity Benefits Act, 1961: KalpanaAmitav TalukdarBelum ada peringkat

- Social Security - Presentation1Dokumen18 halamanSocial Security - Presentation1Amitav Talukdar100% (1)

- GratuityDokumen14 halamanGratuityAmitav TalukdarBelum ada peringkat

- 720 Degree AppraisalDokumen15 halaman720 Degree AppraisalAmitav TalukdarBelum ada peringkat

- Social Security in India: Status, Issues and Ways ForwardDokumen24 halamanSocial Security in India: Status, Issues and Ways ForwardAmitav TalukdarBelum ada peringkat

- Facotries Act, 1948Dokumen90 halamanFacotries Act, 1948Ravi KumarBelum ada peringkat

- BIMAROUDokumen37 halamanBIMAROUAmitav TalukdarBelum ada peringkat