Insurance Notes

Diunggah oleh

api-252378600Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Insurance Notes

Diunggah oleh

api-252378600Hak Cipta:

Format Tersedia

7.10.1.

L1 Note taking guide

Types of Insurance Essentials Note-Taking Guide

Lauren Erb Name__________________

39 Total Points Earned Total Points Possible Percentage

INSURANCE Policyholder:

4/10/14 Date__________________

2nd period Class _________________

Risk:

Insurance:

Arrangement between an individual (consumer) and an insurer (insurance company) to protect the individual against risk.

Policy:

contract between the individual and the insurer specifying the terms of the insurance arrangements.

The consumer who purchased the policy.

Premium:

The fee paid to the insurer to be covered under the specified terms.

Uncertainty about a situation's outcome. Can be unpredictable events which lead to loss or damage.

Deductible:

the amount paid out of pocket by the policy holder for the initial portion of a loss before the insurance coverage begins.

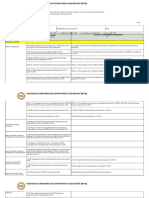

AUTOMOBILE INSURANCE Liability Medical payment Uninsured/under insured Physical damage

Covers damages caused to the vehicle. Two optional forms of coverage are available.

Types

Covers the insured if injuries or damages are caused to other people or their property.

Covers injuries sustained by the driver of the insured vehicle or any passenger regardless of fault.

Covers injury or damage to the driver, passengers, or the vehicle caused by a driver with insufficient insurance.

Yes

The driver, passengers, and vehicle cause by a driver with insufficient insurance.

Collision

Covers a collision with another object, car, or from a rollover.

Comprehensive

Covers all physical damage losses except collision and other specified losses.

Required by law Who/ what is covered

Yes

The person insured and damages cause to other people and property.

Yes

The driver, insured vehicle, and passengers.

Yes

another object, car, physical damage except collisions and other specified losses.

Family Economics & Financial Education October 2010 The Essentials to Take Charge of Your Finances Types of Insurance Page 10 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences Take Charge America Institute at The University of Arizona

7.10.1.L1 Note taking guide

HEALTH INSURANCE Why is it important to purchase health insurance? Provides protection against:

It provides protection against financial losses resulting from injury, illness, and disability. The purpose is to provide coverage for emergency or routine medical expenses

May cover:

How may health insurance be purchased?

The purpose is to provide coverage for emergency or routine medical expenses

It may cover hospital, surgical, dental, vision, long-term care, prescription, and other major expenditures.

By an individual or through their employer.

Children may stay on their parents health insurance until:

They are 19 or while they are in college.

LIFE INSURANCE Life insurance:

A contract between an insurer and policyholder specifying a sum to be paid to a beneficiary upon the insureds death.

Beneficiary:

Dependent:

The recipient of any policy proceeds if the insured person dies.

A person who relies on someone else financially.

Who should purchase life insurance?

People who have a dependent spouse, dependent children, an aging or disabled dependent relative, or are business owners.

DISABILITY INSURANCE Disability insurance:

Replaces a portion of ones income if they become unable to work due to illness or injury.

If needed, how much does disability insurance pay an individual?

Typically pays between 60% 70% of ones full time wage.

HOMEOWNERS AND R ENTERS INSURANCE Peril:

An event which can cause a financial loss like fire, falling trees, lightning, and others.

Renters insurance:

Protects the insured from loss to the contents of the dwelling rather than the dwelling itself.

Homeowners insurance:

Combines property and liability insurance into one policy to protect a home from damage costs due to perils.

Property insurance:

Protects the insured from financial losses due to destruction or damage to property or possessions.

Why is it important for a renter to purchase renters insurance?

Because the landlords insurance policy on the dwelling does not cover the renters personal possessions.

Liability insurance:

Protects the insured party from being held liable for others financial losses.

Covers:

Major perils, provides liability protection, and provides for additional living expenses if the dwelling is rendered uninhabitable by one of the covered perils.

Family Economics & Financial Education October 2010 The Essentials to Take Charge of Your Finances Types of Insurance Page 11 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences Take Charge America Institute at The University of Arizona

Anda mungkin juga menyukai

- Property, Liability and Auto Insurance: A Handbook and Guide for Insurance Concepts and Coverage!Dari EverandProperty, Liability and Auto Insurance: A Handbook and Guide for Insurance Concepts and Coverage!Penilaian: 5 dari 5 bintang5/5 (1)

- Insurance Note Taking GuideDokumen2 halamanInsurance Note Taking Guideapi-2523918430% (1)

- Insurance Note Taking GuideDokumen2 halamanInsurance Note Taking Guideapi-252377919Belum ada peringkat

- Insurance Note Taking GuideDokumen2 halamanInsurance Note Taking Guideapi-252460708Belum ada peringkat

- Insurance Note Taking GuideDokumen2 halamanInsurance Note Taking Guideapi-252988764Belum ada peringkat

- Insurance Note Taking GuideDokumen2 halamanInsurance Note Taking Guideapi-252384953Belum ada peringkat

- Insurance Note Taking GuideDokumen2 halamanInsurance Note Taking Guideapi-252384641Belum ada peringkat

- Insurance Note Taking GuideDokumen2 halamanInsurance Note Taking Guideapi-252392987Belum ada peringkat

- Insurance SheetDokumen2 halamanInsurance Sheetapi-252377967Belum ada peringkat

- InsuranceDokumen2 halamanInsuranceapi-252391740Belum ada peringkat

- Insurance Note Taking GuideDokumen2 halamanInsurance Note Taking Guideapi-252387344100% (1)

- Insurance Note Taking GuideDokumen2 halamanInsurance Note Taking Guideapi-252391503Belum ada peringkat

- Types of Insurance Lesson PlanDokumen8 halamanTypes of Insurance Lesson PlanpcsgdnwuBelum ada peringkat

- Insurance BasicsDokumen24 halamanInsurance BasicsKomal LalwaniBelum ada peringkat

- 9-6-16 InsuranceDokumen52 halaman9-6-16 Insuranceapi-327394992Belum ada peringkat

- Insuranc 1Dokumen10 halamanInsuranc 1zunaira sarfrazBelum ada peringkat

- Insurance and Risk ManagementDokumen6 halamanInsurance and Risk ManagementSolve AssignmentBelum ada peringkat

- 5-Insurance Planning (Insurance Planning)Dokumen35 halaman5-Insurance Planning (Insurance Planning)Farahliza RosediBelum ada peringkat

- Unit FourDokumen35 halamanUnit FourBI SH ALBelum ada peringkat

- COMM 229 Notes Chapter 6Dokumen5 halamanCOMM 229 Notes Chapter 6Cody ClinkardBelum ada peringkat

- Insurance – Definition and Meaning 2Dokumen4 halamanInsurance – Definition and Meaning 2ЕкатеринаBelum ada peringkat

- Family Risk ManagementDokumen12 halamanFamily Risk ManagementAakash ReddyBelum ada peringkat

- Daniel AyoolaDokumen10 halamanDaniel AyoolaSalim SulaimanBelum ada peringkat

- Introduction of Mediclaim InsuranceDokumen17 halamanIntroduction of Mediclaim InsuranceKunal KaduBelum ada peringkat

- Insurance BasicsDokumen23 halamanInsurance BasicsChamandeep SinghBelum ada peringkat

- Insurance and Pension FundDokumen44 halamanInsurance and Pension FundFiaz Ul HassanBelum ada peringkat

- Finance ReportDokumen4 halamanFinance ReportKatrina FregillanaBelum ada peringkat

- Law of Insurance AnswersheetDokumen55 halamanLaw of Insurance Answersheetkhatriparas71Belum ada peringkat

- Frauds in Insurance SectorDokumen74 halamanFrauds in Insurance Sectoranilmourya5100% (1)

- Lesson 7Dokumen3 halamanLesson 7shadowlord468Belum ada peringkat

- InsuranceDokumen6 halamanInsuranceHarsh SadavartiaBelum ada peringkat

- Aid To Trade Insurance: Aditva SharmaDokumen20 halamanAid To Trade Insurance: Aditva Sharmaaditva SharmaBelum ada peringkat

- RMIN 4000 Exam Study Guide Ch 2 & 9Dokumen13 halamanRMIN 4000 Exam Study Guide Ch 2 & 9Brittany Danielle ThompsonBelum ada peringkat

- NotesDokumen6 halamanNotesGoodataka ZackamanBelum ada peringkat

- Accidental Insurance: Accident Al PoliciesDokumen8 halamanAccidental Insurance: Accident Al PoliciesannieangeloBelum ada peringkat

- Everything You Need to Know About Life InsuranceDokumen11 halamanEverything You Need to Know About Life InsurancePooja TripathiBelum ada peringkat

- Accident Insurance: An Overview of Coverage, Benefits and ConsiderationsDokumen9 halamanAccident Insurance: An Overview of Coverage, Benefits and Considerationsbhavika_08_1680844570% (1)

- Insurance Fraud DetectionDokumen74 halamanInsurance Fraud DetectionJai GaneshBelum ada peringkat

- Insurance HandbookDokumen28 halamanInsurance HandbookGreat VivekanandaBelum ada peringkat

- Insurance and Risk ManagementDokumen10 halamanInsurance and Risk Managementhitesh gargBelum ada peringkat

- Insurance MGT NotesDokumen36 halamanInsurance MGT NotesHONEY AGRAWALBelum ada peringkat

- What Is Insurance by VISHALDokumen6 halamanWhat Is Insurance by VISHALVishalBelum ada peringkat

- Insurance Company ProfileDokumen12 halamanInsurance Company ProfileKai MK4Belum ada peringkat

- Understanding InsuranceDokumen64 halamanUnderstanding InsuranceMikant Fernando63% (8)

- New Microsoft Word DocumentDokumen3 halamanNew Microsoft Word DocumentShantam GulatiBelum ada peringkat

- 5-RISK MANAGEMENT AND LIFE INSURANCE (Insurance Planning)Dokumen45 halaman5-RISK MANAGEMENT AND LIFE INSURANCE (Insurance Planning)Haliyana HamidBelum ada peringkat

- Insurance and Risk ManagementDokumen6 halamanInsurance and Risk Managementbhupendra mehraBelum ada peringkat

- Insurance Assignmnt Merits and DemeritsDokumen8 halamanInsurance Assignmnt Merits and DemeritsDjay SlyBelum ada peringkat

- Definition of InsuranceDokumen11 halamanDefinition of InsurancePuru SharmaBelum ada peringkat

- Insurance PDFDokumen16 halamanInsurance PDFNANDHINI MBelum ada peringkat

- Definition of Insurance Code and TypesDokumen2 halamanDefinition of Insurance Code and TypesKoko LaineBelum ada peringkat

- Law Economics Risk Management Hedge Risk Uncertain: Types of InsuranceDokumen3 halamanLaw Economics Risk Management Hedge Risk Uncertain: Types of InsuranceEdvergMae VergaraBelum ada peringkat

- Insurance "101" Terminology: Presented For Wisconsin 4-H Youth Development StaffDokumen31 halamanInsurance "101" Terminology: Presented For Wisconsin 4-H Youth Development StaffBounna PhoumalavongBelum ada peringkat

- Classification of InsuranceDokumen10 halamanClassification of InsuranceKhalid MehmoodBelum ada peringkat

- Finance PPT 2Dokumen11 halamanFinance PPT 2sanhithBelum ada peringkat

- INSURANCE MANAGEMENT GUIDEDokumen25 halamanINSURANCE MANAGEMENT GUIDEDeepak ParidaBelum ada peringkat

- What Is Insurance - Meaning, Types, Importance & BenefitsDokumen7 halamanWhat Is Insurance - Meaning, Types, Importance & BenefitsAyush VermaBelum ada peringkat

- Insurance & Risk Management JUNE 2022Dokumen11 halamanInsurance & Risk Management JUNE 2022Rajni KumariBelum ada peringkat

- Walmart Cover LetterDokumen1 halamanWalmart Cover Letterapi-252390333Belum ada peringkat

- M&Ms Color Number Brown 5 Red 8 Yellow 10 Green 11 Blue 15 Orange 9Dokumen2 halamanM&Ms Color Number Brown 5 Red 8 Yellow 10 Green 11 Blue 15 Orange 9api-252390333Belum ada peringkat

- BudgetDokumen2 halamanBudgetapi-252390333Belum ada peringkat

- Job ApplicationDokumen3 halamanJob Applicationapi-252390333Belum ada peringkat

- Dylan Smith: EducationDokumen1 halamanDylan Smith: Educationapi-252390333Belum ada peringkat

- W 2Dokumen1 halamanW 2api-252390333Belum ada peringkat

- Relevant CostingDokumen5 halamanRelevant CostingBeatriz Basa DimainBelum ada peringkat

- Fintech and TechfinDokumen13 halamanFintech and TechfinMaryam IraniBelum ada peringkat

- Chapter 4 Supplement Process Costing Using The FIFO Method: True/FalseDokumen38 halamanChapter 4 Supplement Process Costing Using The FIFO Method: True/FalseRashedul Islam PaponBelum ada peringkat

- Impact of Television Advertisement On ChildrenDokumen11 halamanImpact of Television Advertisement On ChildrenPrakash KhadkaBelum ada peringkat

- Great Pacific V CADokumen2 halamanGreat Pacific V CAWARLYN DUMOBelum ada peringkat

- Prospectus Sep2022Dokumen25 halamanProspectus Sep2022risa ridmaBelum ada peringkat

- Chapter 6 Instructor - Managing A Global BusinessDokumen22 halamanChapter 6 Instructor - Managing A Global BusinessYusuf ÇubukBelum ada peringkat

- Entrepreneurial Mindset: The Evolution of EntrepreneurshipDokumen26 halamanEntrepreneurial Mindset: The Evolution of EntrepreneurshipCzarina MichBelum ada peringkat

- Affidavit repair shop undertakingDokumen2 halamanAffidavit repair shop undertakingZeaBelum ada peringkat

- Weekly: Join in Our Telegram Channel - T.Me/Equity99Dokumen6 halamanWeekly: Join in Our Telegram Channel - T.Me/Equity99Hitendra PanchalBelum ada peringkat

- Portfolio Activity 7Dokumen5 halamanPortfolio Activity 7Aidah Bunoro0% (1)

- Curriculum Vitae: I. Personal InformationDokumen4 halamanCurriculum Vitae: I. Personal InformationHydraulic EngineeringBelum ada peringkat

- MGT201 Presentation by Mozammel AhmedDokumen19 halamanMGT201 Presentation by Mozammel AhmedIsrafil PannaBelum ada peringkat

- Comprof PT. Indo Kida PlatingDokumen16 halamanComprof PT. Indo Kida PlatingAreIf Cron BmxStreetBelum ada peringkat

- RFCL HDPE BagsDokumen9 halamanRFCL HDPE BagsSandeep Goud ChatlaBelum ada peringkat

- IPCR Performance ReviewDokumen32 halamanIPCR Performance ReviewDILG DipaculaoBelum ada peringkat

- The Waldorf Hilton Hotel Job Offered Contract LetterDokumen3 halamanThe Waldorf Hilton Hotel Job Offered Contract LetterHIsham Ali100% (2)

- Bam 241: Business Laws and Regulations Second Periodical ExaminationDokumen19 halamanBam 241: Business Laws and Regulations Second Periodical ExaminationGiner Mabale StevenBelum ada peringkat

- Inside the Black Box: Role of CEO Compensation Peer GroupsDokumen14 halamanInside the Black Box: Role of CEO Compensation Peer GroupsneckitoBelum ada peringkat

- SBI Life Insurance receipt for Rs. 100,000 premium paymentDokumen1 halamanSBI Life Insurance receipt for Rs. 100,000 premium paymentmanish sharmaBelum ada peringkat

- 30 Goal TemplatesDokumen32 halaman30 Goal TemplatesD RICEBelum ada peringkat

- HR Confidentiality FormDokumen2 halamanHR Confidentiality Formrekrutmen LSJ grupBelum ada peringkat

- 42-Electric Arc FurnacesDokumen11 halaman42-Electric Arc Furnacessureshkumar908Belum ada peringkat

- BiMedis - Your Own Online Store For Selling Medical EquipmentDokumen14 halamanBiMedis - Your Own Online Store For Selling Medical Equipmentxbiomed.frBelum ada peringkat

- Analysis of Pupil Performance: EconomicsDokumen32 halamanAnalysis of Pupil Performance: EconomicsT.K. MukhopadhyayBelum ada peringkat

- Marketing Plan Energypac FinalDokumen39 halamanMarketing Plan Energypac FinalMmr MishuBelum ada peringkat

- RP02 Porter HBR2001-Strategy and The InternetDokumen16 halamanRP02 Porter HBR2001-Strategy and The InternetJun ParkBelum ada peringkat

- 1-2 Math at Home Game TimeDokumen1 halaman1-2 Math at Home Game TimeKarla Panganiban TanBelum ada peringkat

- Auditing IDokumen58 halamanAuditing IBereket DesalegnBelum ada peringkat

- Prakas On Construction License - CambodiaDokumen4 halamanPrakas On Construction License - CambodiaVP SadokaBelum ada peringkat