Financial Analysis P&G

Diunggah oleh

sayko88Deskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Financial Analysis P&G

Diunggah oleh

sayko88Hak Cipta:

Format Tersedia

Financial analysis:

Anna Boy Juan R. Nogueira Yuan Zhao

Horizontal & trend analysis

In this section, we are going to analyze the behavior of the company during the last 5 years and compare the gap between each year. For this purpose, we have selected some of the most representative figures of the different financial sheets:

Income statement Net sales COGS Net earnings Balance sheet Total assets: current & non current Total liabilities: current & non current Total liabilities + equity

1. Income statement analysis In the figure below we can see the different figures represented. Regarding sales revenues we can highlight some facts and comments: 2010/11: Sales increase in almost 3% while the net earnings reduce in -7.37%. 2012/13: Sales only increase in 0.58% while the net earnings increase in 5.17%. We are in our maximum level of sales revenues of the whole period and the company has experienced a significant rise in net earnings. The sales revenues are increasing during the whole period, with an average of 2.35%. It's a positive result, the trend is stable and keep growing.

In terms of COGS, we can see the evolution of the direct cost associate to production of the goods of P&G, some ideas are explained: COGS experiment an increase of more than 5% during 2011 and 2012 that have a direct consequence in the reduction of net earnings even if sales increase around 3%. During the 5 years, COGS is increasing around 2.39% per year. The minimum COGS was in 2010, since that year its in continuous progression helped also by increase in sales.

Last, we will analyze the behavior of the net income: The net revenues, in general, are decreasing -4.06% per year. Since 2010 the net earnings are always lower, although in 2013 we can see a change in the negative trend. Facts like Venezuela inflation and impairment charges, incremental restructuring charges and an increase in income taxes had a big impact on it.

Broadly, P&G has a good health and the net revenues are consolidated over 10 billion . In any case, P& G should continue increasing the sales revenues and improve their efficiency to reduce costs because the net revenues are coming down, although we see a recovery in 2013. Some strategies had been followed by P&G to recover net earnings, e.g.: Divestiture of the snacks business.

100000

Earnings evolution

2,93% -1,99% 13436 -5,21% 2010 NET EARNINGS 2011 2,74%

3,18%

0,58%

50000

5,12%

-7,37%

6,35% -8,82% 2012

0,09% 5,17% 2013

0 NET SALES 2009 COGS

2. Balance sheet analysis In this section we can find to different main groups: assets & liabilities-equity of the firm, the charts below represent those figures.

In terms of current assets, they are stable around 20000 m rising to maximum levels in last year increasing in 10% to 23990m. The biggest part of this current assets, around 60%, belongs to inventory and account receivables, which slightly are increasing during the period. In the other hand, cash presented it lowest values in 2010 and 2011 and since that, has grown at a tremendous rate increasing from 2879 to 5947 in the last four years. This general increase in current assets is governed by the sales increase in the period. In singular cases like the spectacular increase in cash while the net revenues are decreasing during the period should be explained by the capacity of the company to negotiate, e.g.: account receivables and payables.

Assets evolution

150000 100000 50000 0 2009 2010 2011 TOTAL NON CURRENT ASSETS 2012 2013 TOTAL ASSETS -14,26% -3,13% -4,94% 7,94% 6,39% -4,42% -5,20% -0,27% 5,31% 4,48% 9,49%

16,97%

TOTAL CURRENT ASSETS

In the other hand, the non-current assets are mainly based on goodwill and intangible assets, cost and growth synergies of acquisitions and joint-ventures have an important weight on the balance sheet of P&G. In relation with liabilities, the biggest figure is represented by long-term debt that represents around 30% of the total liabilities. If we compare the situation of liabilities over the assets of the firm. In 2013 for example, the current liabilities exceeded current assets by $6.0 billion, largely due to short-term borrowings, P&G should be able to support the short-term liquidity and operating needs through cash generated from operations. In any case, P&G short and long term credit situations were rating with high grades by agencies like Moodys or Standard & Poors, and along with the fact that P&G is a main actor in the fast-moving consumer goods sector, they should not have problems to finance their business.

150000

Liabilities + Equity 7,94%

-4,94% -3,07% -6,60 10,68% 5,42%

-4,42% -5,83% -3,05%

5,31%

100000

50000 0

7,30% 3,44%

TOTAL CURRENT LIABILITIES TOTAL LIABILITIES TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY

2009

2010

2011

TOTAL NON CURRENT LIABILITIES TOTAL SHAREHOLDERS' EQUITY

2012

2013

Vertical analysis

1. Income Statement There is an increase of the gross margin between 2013 and 2012 even it does not reach the same level as the previous year. It can be explain mainly by manufacturing cost savings and higher pricing. However it has been negatively impacted by higher commodity costs due to negative geographic and product mix because of lower gross margin than the average in growing countries and also reduced by capacity investments and to a lesser extent by foreign exchange impacts and higher commodity costs.

Selling, general and administrative expenses have been continuously increasing because of different factors: the devaluation of the devaluation of the official foreign exchange rate in Venezuela and an increase in marketing spending, partially offset by reduced overhead costs as a result of the productivity and cost savings plan. Goodwill and indefinite lived intangibles impairment charges appeared in 2012 and 2013 because of their Appliances and Salon Professional businesses and our Koleston Perfect and Wella indefinite-lived intangible assets, which are part of their Salon Professional business. Non-Operating Items Interest expense decreased continuously from 2009 due to lower interest rates on floating-rate debt. Interest income started to appear and slowly increase from 2011 due to an increase in cash, cash equivalents and debt securities. Other non- operating income, net reached its peak in 2013 primarily due to divestiture gains and investment income. - A holding gain of $631 million resulting from the purchase of the balance of P&G's Baby Care and Feminine Care joint venture in Iberia and a - Gain of approximately $250 million from the sale of the Italian bleach business, both in the current year, were partially offset by a $130 million divestiture gain from the PUR water filtration business in the prior year period.

Net Earnings Net earnings remained stable over the 5 years even if it suffered of a drop in 2012 of 3 points and a recovery in 2013. The increase by 2.4 point of percentage can be explain by the positive impact of the previous acquisition and divestiture gains as decline in impairment charges (-1.52 point of percentages). As the acquisition was the previous year, in 2013 the net earnings from discontinued operations dropped. The general outcome is an increase of the net earnings over net sales about 0.40 points of percentage, which is still at a lower level than 2009-2011. 2. Balance Sheet Liabilities/ On Total Shares and Liabilities Equity/Shares and Liabilities 2013 2012 2011 2010 2009 53% 52% 51% 52% 51% 47% 48% 49% 48% 49%

Over the years Liabilities and Equity were well balanced. An ideal situation would be that they get closer again to a 50%-50% situation. 2013 2012 2011 2010 2009 Stable $139.263 $132.244 $138.354 $128.172 $134.833 Total Assets $139.263 $132.244 $138.354 $128.172 $134.833 Business Equity and Liabilities 68.709 64.035 68.001 61.439 63.382 Equity 70.554 68.209 70.353 66.733 71.451 Liabilities The fact that the Assets and Equity+ Liabilities are equal is at the same time normal and expected as well as an indicator that the business is stable. Equity + Non-Current Liabilities Equity Non-current Liabilities Non-Current Asset 109.226 68.709 40.517 115.273 107.337 64.035 43.302 110.334 111.061 68.001 43.060 116.384 103.890 61.439 42.451 109.390 103.932 63.382 40.550 112.928

Equity + NCL > Liabilities

Non-current asset numbers are more that the Equity + non-current liabilities. That means that there is a funding gaps and that they will have to finance part of the Non Current asset with short term funding as the working capital liquidity is negative. That involved additional financial obligations and a higher financial risk because the non current asset generates cash at long term and they have to compensate short term debts.

2013 2012 2011 2010 2009 19364 17225 16422 14598 17497 ACCE 17605 16209 17312 15810 14581 PCCE -890 -1212 2916 ACCE-PCCE 1759 1016 ACCE: Current asset related with operating cycle PCCE: Current liabilities from operating cycle When the ACCE=PCCE means that the company is in an ideal situation where the operating cycle is auto funding. However when ACCE>PCCE (2013,2012,2009) means that there is an unbalance trade which leads to short term debt when the balance is temporary and long term debt when its remaining. When ACCE<PCCE (2010,2011) means that there is a trade surplus and the PCCE will help to finance the non current asset not related to the operating cycle. That also means that the company is making wait his providers and the clients pays directly which is the case of P&G.

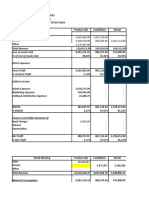

Ratio analysis

Profit margin Return on shareholders' equity Profitability Ratio Net Earnings per Common Share Earnings per share

Image 1.

Date: The accounting cycle of P&G begins 1st July each year and ends 30 June next year. Source: Annual reports 2009-2013 of P&G. The ten ratios we used are current ratio, acid-test ratio, accounts receivable turnover, number of days sales in accounts receivable, inventory turnover, equity ratio, profit margin, ROE, earnings per share and price-earnings ratio. These ten ratios can be classified into four issues. The structure of the categories of these ten issues is like the Image 1. These ten ratios can reflect the financial performance of the company. Thus, to evaluate the financial performance of P&G, we calculate the ten ratios of P&G. The results are shown in Table 1 below.

Categories of Ratios

Market Tests

Price-earnings ratio

Quick ratio

Current Ratio Accounts receivable turnover Number of days sales in accounts receivable Inventory Turnover

Liquidity Ratio

Equity Ratios

Equity ratio

Table 1.

1. Liquidity Ratios

P&G Financial Ratios

1,00 0,71 0,77 0,50 0,00 2009 2010 2011 2012 Current Ratio Table 1.1 2013 0,80 0,88 0,80

1.1 Current Ratio In the case of P&G, the current ratio is between 0.71 and 0.88 from 2009 to 2013 (in Table 1.1). Since 2009, the current ratio increased steadily and continually. In 2012, the current ratio of P&G got the top point, 0.88. Then it decreased a little in 2013, to 0.80. The main reason for that is the sudden decreasing of current liabilities in 2012 and then an increasing in 2013.

0,50

P&G Financial Ratios

0,34 0,34 0,33 0,44 0,40

1.2 Acid-Test (Quick) Ratio In the case of P&G, the quick assets include cash and accounts receivable. Also, because the concussion of the current liabilities in 2012 and 2013. The quick ratio has an increasing in 2012, to 0.44, and a decreasing in 2013 to 0.40. In other years, it stays around 0.34.

0,00 2009 2010 2011 2012 Quick ratio 2013

P&G Financial Ratios

14,00 13,00 12,00 11,00 2009 2010 2011 2012 Accounts receivable 2013 12,18

1.3 Accounts Receivable Turnover The amount of 2009 is the average number of the acc. receivables of 2008 and 2009, and the same procedure for the other years. For accounts receivable turnover, the performance in 2011 is the best one with 13.66 times, the one in 2009 is the worst one, about 12.18 times. The reason for that is the account receivable in 2008 is relative high and in 2010 low. In general, the sales are increasing so they will do it too.

13,57 13,66

13,33 13,64

P&G Financial Ratios

30,00 29,98

1.4 Number of Days Sales in Accounts Receivable

28,00

The number of days sales in accounts receivable is opposite as the accounts receivable turnover. In P&G, the highest 26,90 26,73 27,38 26,00 26,77 accounts receivable is 29.98 days in 2009, the lowest is 26.73 days in 2011. That means it takes 29.98 days to collect an 24,00 account receivable in 2009, 26.73 days in 2011. In 2011, P&G 2009 2010 2011 2012 receives account receivable quicker. In general, we see a 2013 decrease on the trend, which is positive for the company. Number of days sales in accounts

10,00 5,00 0,00

P&G Financial Ratios

5,06 5,40

1.5 Inventory Turnover

8,30

5,66

7,38

2009 2010 2011 2012 Inventory Turnover (times)

2013

The way to calculate the average inventory is same as the measure to calculate the average acc. receivable. The inventory turnover of P&G increases yearly, from 5.06 to 8.30. The reason is that the COGS increases continually, while the inventory decreases from 2008 to 2013.

2. Equity (Long-Tern Solvency) Ratio: Equity Ratio

0,60

The equity indicates relationship between debt and equity financing in a company. The equity ratio of P&G has a strong shift since 2009. In 2010, the equity ratio reaches the top, 0.53, 0,53 0,50 0,47 then it decreases to the lowest point, 0.44. However, the equity 0,48 0,50 0,44 ratio increases again since 2011, to 0.50 in 2013. It is directly 0,40 affected by the fluctuations of total assets and shareholders 2009 2010 2011 2012 equity. In 2010 and 2013, the shareholders equity is very high, 2013 Equity (stockholders equity) ratio while the total assets are relative low in 2010 and 2013.

Equity ratio

3. Profitability Tests

0,40 0,20 0,00

Profit Margin

0,20 0,20 0,19

3.1 Profit Margin The profit margin of P&G is around 0.18. It decreases from 0.20 in 2009 and 2010 to 0.16 in 2012. Then it increase a little in 0,16 0,17 2013, 0.17. In general, its around 0.20 but with a negative trend, mainly because COGS sold has increase more than sales revenues, but we see a slight recover in the last year.

2009 2010 2011 2012 2013 Profit

0,40 0,20 0,00

Return on shareholders' equity

0,24

3.2 Return on Average Common Stockholders Equity (ROE)

Since 2009, ROE (in Table 3.2) increases from 0.24 to 0.26 in 0,26 2011. Then it decreases to 0.21 in 2013. We can see the direct 0,24 0,21 0,21 correlation with the profit margin.

Table 3.2 Return on shareholders' equity

3.3 Earnings per Share The earnings per share in 2009 is 4.45. Then it increases to the top point, 4.86, in 2011. In 2012, it drops dramatically to 4.11 in 4,00 4,11 2012. In 2013, it increases again to 4.55. The reason for the 3,00 changing is that the earning available for common stocks got the 2009 2010 highest number in 2011 and lowest number in 2012. And the 2011 2012 2013 weighted-Average number of common stock increases from Earnings per share 2009 to 2013 continually. This figure can be explained by behavior of P&G in net income and profit margin, in general, the firm didnt perform as well as before in 2012 but in 2013 we see a change in the trend.

4,45 4,55 5,00 4,76 4,86

4. Market Tests: Price- Earnings Ratio

20,00 10,00 0,00 2009 2010 2011 2012 Price-earnings ratio 2013

P&G Financial Ratios

11,47 12,61 13,08 14,89 17,13

The Price-earnings ratio of P&G increases steadily and continually from 11.4 in 2009 to 17.14 in 2013. That means the performance of the stocks of P&G in the marketplace became better and better since 2009. The main reason for the continual increasing of the price is the continual growth of the market price per share.

Appendix:

Amounts in millions except per share amounts; Years ended June 30 NET SALES Cost of products sold/NET SALES Gross Margin Selling, general and administrative expense/NET SALES Goodwill and indefinite lived intangibles impairment charges/NET SALES OPERATING INCOME /NET SALES Interest expense/NET SALES Interest Income/NET SALES Other non-operating income/(expense), net/NET SALES EBIT /NET SALES Income taxes on continuing operations/NET SALES NET EARNINGS FROM CONTINUING OPERATIONS/NET SALES NET EARNINGS FROM DISCONTINUED OPERATIONS/NET SALES NET EARNINGS/NET SALES

2009

2010

2011

2012

2013

2010

2011

2012

2013

100,00% 100,00% 100,00% 100,00% 100,00% 50,45% 49,6% 29,51% 48,04% 52,0% 31,67% 49,15% 50,9% 31,75% 50,66% 49,3% 31,57% 50,41% 49,6% 32,02% -5% 4,9% 7%

Based on 2009 -3% 0% 2,6% 8% -0,4% 7%

0% 0,1% 9% -81%

0,00% 20,05% 1,77% 0,00% 0,52% 18,79% 4,87%

0,00% 20,30% 1,20% 0,00% -0,04% 19,06% 5,20%

0,00% 19,11% 1,02% 0,08% 0,33% 18,49% 4,07%

1,88% 15,88% 0,92% 0,09% 0,22% 15,28% 4,14%

0,37% 17,21% 0,79% 0,10% 1,12% 17,64% 4,09%

Based on 2012 1% -5% -21% -32% -42% -48% 20% -57% -19% -15% -20% Based on 2011 -107% 1% 7% 0% -35% -2% -16% 4%

-14% -55% 35% 116% -6% -16% -3%

13,93% 3,59% 17,52% 2009

13,87% 2,27% 16,13% 2010 15,33% 28,40% 9,01% 3,22% 21,77% 33,99% 5,27% 17,01% 14,65% 15,01% 66,82% 0,00% 3,51% 85,35%

14,42% 0,28% 14,71% 2011 12,60% 28,56% 9,80% 3,26% 20,52% 33,59% 5,19% 20,06% 15,88% 15,39% 41,60% 23,58% 3,55% 84,12%

11,13% 1,90% 13,03% 2012 20,25% 27,70% 7,94% 3,13% 19,61% 30,68% 4,57% 16,81% 16,57% 15,41% 40,66% 23,43% 3,93% 83,43%

13,55% 0,00% 13,55% 2013 24,79% 27,13% 7,10% 3,01% 18,69% 28,80% 3,95% 15,33% 17,23% 15,56% 39,63% 22,67% 4,92% 82,77% -37% -8% 2010 -30% 7% 27% 5% 3% 8% -4% 16% -10% 4% 1% -92% -16% 2011 -42% 7% 38% 6% -3% 7% -6% 37% -2% 7% -37% -47% -26% 2012 -7% 4% 12% 2% -8% -2% -17% 15% 2% 7% -38% -1% 22% 0% -100% -23% 2013 14% 2% 0% -2% -12% -8% -28% 5% 6% 8% -40% -4% 52% -1%

Cash and Cash equivalents/On Total Current Asset Accounts receivable/Total Current Assets Material and supplies/On Total Inventory Work in process/On Total Inventory Finished goods/On Total Inventory Total Inventories/ On Total Current Asset Deferred income taxes/On Total Current Asset Prepaid expenses and other current assets/ On Total Current Asset Total Current Assets/Total Assets NET PROPERTY, PLANT AND EQUIPMENT/On Total Assets GOODWILL/On Total Assets TRADEMARKS AND OTHER INTANGIBLE ASSETS, NET/ On Total Assets OTHER NONCURRENT ASSETS/On Total Assets Total Non Current Assets/Total Assets

21,83% 26,64% 7,11% 3,07% 21,23% 31,41% 5,52% 14,60% 16,25% 14,43% 66,10% 0,00% 3,22% 83,75%

Based on 2011 9% 2% 10% 0%

2009 Accounts payable/ TOTAL Current Liabilities Accrued and other liabilities/ TOTAL Current Liabilities Debt Due within one year/ TOTAL Current Liabilities TOTAL Current Liabilities/TOTAL 19,35% 27,83% 52,81% 43,25%

2010 29,86% 35,25% 34,89% 36,39%

2011 29,39% 34,04% 36,57% 38,79%

2012 31,80% 33,28% 34,92% 36,52%

2013 29,22% 29,39% 41,39% 42,57%

2010 54,31% 26,64% -33,94%

2011 51,88% 22,29%

2012 64,31% 19,57%

2013 50,99% 5,59%

-33,88% -21,63% 30,76% -15,86% -15,57% -1,56%

Liabilities LT Debt/ Total Liabilities Deferred Income Taxes/ Total Liabilities Other noncurrent Liabilities/ Total Liabilities Non current Liabilities/ Total liabilities TOTAL Current Liabilities/On Total Shares and Liabilities Non current Liabilities/On Total Shares and Liabilities Total liabilities/ On Total Shares and Liabilities Convertible Class A preferred stock, stated value $1 per share (600 shares authorized)/ Total shareholders equity Common stock, stated value $1 per share (10,000 shares authorized; shares issued: 2013 4,009.2, 2012- 4,008.4))/ Total shareholders equity Additional paid-in capital)/ Total shareholders equity Reserve for ESOP debt retirement)/ Total shareholders equity Accumulated other comprehensive income (loss))/ Total shareholders equity Treasury stock, at cost (shares held: 2013 - 1,266.9, 2012 1,260.4))/ Total shareholders equity Retained earnings)/ Total shareholders equity Noncontrolling interest)/ Total shareholders equity Total shareholders equity/TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY) 28,90% 15,05% 12,80% 56,75% 22,92% 30,07% 52,99% 32,01% 16,34% 15,27% 63,61% 18,94% 33,12% 52,07% 31,32% 15,73% 14,15% 61,21% 19,73% 31,12% 50,85% 30,91% 14,85% 17,72% 63,48% 18,83% 32,74% 51,58% 27,09% 15,35% 14,99% 57,43% 21,57% 29,09% 50,66% 10,74% 8,56% 19,28% 12,09% -17,34% 10,13% -1,75%

10,30% 8,35% 4,56% 10,57% 7,85% 6,92% -1,29% 38,47% 11,86% -6,29% 1,98% 17,14% 1,19% -5,89% -3,26% -4,40%

-17,82% 13,92% 3,49% -4,04% 8,88% -2,67%

2,09%

2,08%

1,81%

1,87%

1,65%

-0,50%

-10,66% -20,78% 13,13%

6,32%

6,52%

5,89%

6,26%

5,83%

3,19%

-6,77%

-1,00%

-7,71%

96,43% 100,42% -2,11% -2,20%

91,77% -2,00%

98,67% -2,12%

92,47% -1,97%

4,14% 3,93%

-4,83% -5,61%

2,32% 0,24%

-4,10% -6,93%

-5,30%

-12,73%

-3,02%

-14,57%

-10,91%

140,30%

175,10% 106,00% 42,99%

-88,29%

-99,79%

-98,94%

108,70% 104,74%

13,02%

12,06%

23,11%

18,63%

90,42% 105,17% 103,94% 117,67% 116,72% 0,45% 47,01% 0,53% 47,93% 0,53% 49,15% 0,93% 48,42% 0,94% 49,34%

16,31% 18,11% 1,97%

14,96%

30,14%

29,09%

18,90% 108,45% 110,24% 4,56% 3,01% 4,96%

Anda mungkin juga menyukai

- Financial Statement Analysis Test Bank Part 1Dokumen14 halamanFinancial Statement Analysis Test Bank Part 1Judith67% (9)

- PG Valuation Analysis Project FinalDokumen20 halamanPG Valuation Analysis Project FinalKaushal Raj GoelBelum ada peringkat

- Macquarie Bank Case Study Session 5Dokumen4 halamanMacquarie Bank Case Study Session 5Vivek TripathyBelum ada peringkat

- Pas 1 - Presentation of Financial StatementsDokumen30 halamanPas 1 - Presentation of Financial StatementsLee Anne Gallema Camarao100% (3)

- Advanced Accounting Guerrero Peralta Volume 1 Solution Manual PDFDokumen189 halamanAdvanced Accounting Guerrero Peralta Volume 1 Solution Manual PDFRegina Fuertes Padilla100% (2)

- Financial Management 1Dokumen4 halamanFinancial Management 1Edith MartinBelum ada peringkat

- International Financial Management - An OverviewDokumen30 halamanInternational Financial Management - An Overviewutp100% (1)

- UntitledDokumen108 halamanUntitledapi-178888035Belum ada peringkat

- Savings andDokumen9 halamanSavings andRamiz JavedBelum ada peringkat

- The Impact of Inflation On Working CapitalDokumen16 halamanThe Impact of Inflation On Working CapitalVishal Mohanka0% (1)

- Advanced Financial Management Midterm Cheat SheetDokumen2 halamanAdvanced Financial Management Midterm Cheat SheetMaria de Figueiredo67% (3)

- BUSINESS COMBINATION - PTDokumen13 halamanBUSINESS COMBINATION - PTSchool FilesBelum ada peringkat

- Accounting TerminologiesDokumen16 halamanAccounting TerminologiesRidhanrhsnBelum ada peringkat

- Analysis of Annual Report - UnileverDokumen7 halamanAnalysis of Annual Report - UnileverUmair KhizarBelum ada peringkat

- Harmony of Accounting STDDokumen4 halamanHarmony of Accounting STDRavi Thakkar100% (1)

- Foreign ExchangeDokumen12 halamanForeign ExchangeMadhurGuptaBelum ada peringkat

- Red Flags of Enron's of Revenue and Key Financial MeasuresDokumen24 halamanRed Flags of Enron's of Revenue and Key Financial MeasuresJoshua BailonBelum ada peringkat

- Intrinsic Stock Value FCFF On JNJ StockDokumen6 halamanIntrinsic Stock Value FCFF On JNJ Stockviettuan91Belum ada peringkat

- Lecture in Finance 105 0n Investment Laws, Rules, and RegulationsDokumen30 halamanLecture in Finance 105 0n Investment Laws, Rules, and RegulationsJoy ZeeBelum ada peringkat

- Report US BHP BillitonDokumen1.361 halamanReport US BHP BillitonOpen Data 2019Belum ada peringkat

- Limitations of Ratio AnalysisDokumen9 halamanLimitations of Ratio AnalysisThomasaquinos Gerald Msigala Jr.Belum ada peringkat

- Short Essay 1: UnrestrictedDokumen8 halamanShort Essay 1: UnrestrictedSatesh KalimuthuBelum ada peringkat

- Residual Income ValuationDokumen21 halamanResidual Income ValuationqazxswBelum ada peringkat

- Amoun Company Analysis and Credit RatingDokumen9 halamanAmoun Company Analysis and Credit RatingHesham TabarBelum ada peringkat

- Capital StructureDokumen4 halamanCapital StructurenaveenngowdaBelum ada peringkat

- The Early Impact of Covid-19 Pandemic On The AviatDokumen7 halamanThe Early Impact of Covid-19 Pandemic On The Aviatali hassanBelum ada peringkat

- Case Study Ratio AnalysisDokumen6 halamanCase Study Ratio Analysisash867240% (1)

- Introduction To Consumer BehaviourDokumen28 halamanIntroduction To Consumer BehaviourShafqat MalikBelum ada peringkat

- Note 08Dokumen6 halamanNote 08Tharaka IndunilBelum ada peringkat

- DCF Excel FormatDokumen5 halamanDCF Excel FormatRaja EssakyBelum ada peringkat

- Global Finance Na PamatayDokumen193 halamanGlobal Finance Na PamatayMary Joy Villaflor HepanaBelum ada peringkat

- Financial RiskDokumen8 halamanFinancial RiskAnusha ButtBelum ada peringkat

- NPI Hotel OverviewDokumen6 halamanNPI Hotel OverviewxusorcimBelum ada peringkat

- Concept of Working Capital ManagementDokumen3 halamanConcept of Working Capital Managementmonish147852Belum ada peringkat

- Globetronics Technology Berhad: Joining The LED Lighting Revolution-12/10/2010Dokumen7 halamanGlobetronics Technology Berhad: Joining The LED Lighting Revolution-12/10/2010Rhb InvestBelum ada peringkat

- Financial Analysis of Coca Cola CompanyDokumen22 halamanFinancial Analysis of Coca Cola CompanyCedric AjodhiaBelum ada peringkat

- The History of Origin and Growth of Merchant Banking Throughout The WorldDokumen18 halamanThe History of Origin and Growth of Merchant Banking Throughout The WorldJeegar Shah0% (1)

- Analysis and Uses of Financial StatementsDokumen144 halamanAnalysis and Uses of Financial StatementsPepe ArriagaBelum ada peringkat

- Goldstar Example of Ratio AnalysisDokumen13 halamanGoldstar Example of Ratio AnalysisRoshan SomaruBelum ada peringkat

- Case StudyDokumen17 halamanCase StudyMarphz DausBelum ada peringkat

- Investment Appraisal Techniques 2Dokumen24 halamanInvestment Appraisal Techniques 2Jul 480wesh100% (1)

- The Role of Chief Financial Officers in Managing InnovationDokumen10 halamanThe Role of Chief Financial Officers in Managing InnovationNestaBelum ada peringkat

- Good HotelDokumen7 halamanGood HotelKhayHninsBelum ada peringkat

- Business Analytics Report (Hospitality Industry) 1Dokumen8 halamanBusiness Analytics Report (Hospitality Industry) 1anushaBelum ada peringkat

- Budgeting For Planning and ControlDokumen20 halamanBudgeting For Planning and ControlQdex Wirya KumaraBelum ada peringkat

- Functions of Treasury MGTDokumen5 halamanFunctions of Treasury MGTk-911Belum ada peringkat

- Assignment 3 - Financial Case StudyDokumen1 halamanAssignment 3 - Financial Case StudySenura SeneviratneBelum ada peringkat

- Work Values: A Formidable Domain Within The Context of People's LivesDokumen16 halamanWork Values: A Formidable Domain Within The Context of People's LivespancaBelum ada peringkat

- Swot Analysis - The Tool of Organizations Stability (KFC) As A Case StudyDokumen8 halamanSwot Analysis - The Tool of Organizations Stability (KFC) As A Case StudyRadeeshaBelum ada peringkat

- Emerging Market Carry Trade ChangedDokumen7 halamanEmerging Market Carry Trade ChangedYinghong chen100% (2)

- Sapphire Group 4Dokumen32 halamanSapphire Group 4Ahsan AnsariBelum ada peringkat

- Analysis of Financial StatementsDokumen12 halamanAnalysis of Financial StatementsMulia PutriBelum ada peringkat

- Financing Options For Small and Medium ScaleDokumen15 halamanFinancing Options For Small and Medium Scalepintu_brownyBelum ada peringkat

- Financial Analysis - Sonesta International Hotels CorporationDokumen11 halamanFinancial Analysis - Sonesta International Hotels CorporationAishaBelum ada peringkat

- Financial AnalysisDokumen8 halamanFinancial AnalysisNor Azliza Abd RazakBelum ada peringkat

- Chap-17-Lending Policies and ProceduresDokumen30 halamanChap-17-Lending Policies and ProceduresNazmul H. PalashBelum ada peringkat

- Engro Fertilizer - Financial AnalysisDokumen16 halamanEngro Fertilizer - Financial AnalysisHasan AshrafBelum ada peringkat

- Case 15 Savola GroupDokumen21 halamanCase 15 Savola GroupKad Saad50% (2)

- WhiteMonk HEG Equity Research ReportDokumen15 halamanWhiteMonk HEG Equity Research ReportGirish Ramachandra100% (1)

- 1 Introduction To Pricing StrategyDokumen9 halaman1 Introduction To Pricing Strategymayank_chowdharyBelum ada peringkat

- The Balance of Payments Accounts Ch. 15Dokumen21 halamanThe Balance of Payments Accounts Ch. 15Veljko Maric100% (1)

- RATIOS AnalysisDokumen61 halamanRATIOS AnalysisSamuel Dwumfour100% (1)

- Financial Statement AnalysisDokumen57 halamanFinancial Statement AnalysisYogesh PawarBelum ada peringkat

- Micro Finance in EgyptDokumen40 halamanMicro Finance in EgyptdinamadkourBelum ada peringkat

- Investing in India: A Value Investor's Guide to the Biggest Untapped Opportunity in the WorldDari EverandInvesting in India: A Value Investor's Guide to the Biggest Untapped Opportunity in the WorldBelum ada peringkat

- Financial Statement Analysis ReportDokumen30 halamanFinancial Statement Analysis ReportMariyam LiaqatBelum ada peringkat

- Chapter # 17: Valuation of Accounts ReceivableDokumen24 halamanChapter # 17: Valuation of Accounts ReceivableHakim JanBelum ada peringkat

- Afar 2019Dokumen9 halamanAfar 2019TakuriBelum ada peringkat

- BA 123 Course Outline - 2014Dokumen9 halamanBA 123 Course Outline - 2014Margery BumagatBelum ada peringkat

- IPSAS in Your Pocket - January 2021Dokumen61 halamanIPSAS in Your Pocket - January 2021Megha AgarwalBelum ada peringkat

- Business Plan 1Dokumen39 halamanBusiness Plan 1RalucaAndreeaPopaBelum ada peringkat

- Financial Statement Analysis - IOCL 2023Dokumen78 halamanFinancial Statement Analysis - IOCL 2023onkarBelum ada peringkat

- Chapter 23 The Effects of Changes in Foreign Exchange Rates Afar Part 2Dokumen20 halamanChapter 23 The Effects of Changes in Foreign Exchange Rates Afar Part 2Kathrina RoxasBelum ada peringkat

- 2010-Principles of Accounting Main EQP and Commentaries 2010-Principles of Accounting Main EQP and CommentariesDokumen59 halaman2010-Principles of Accounting Main EQP and Commentaries 2010-Principles of Accounting Main EQP and Commentaries전민건Belum ada peringkat

- ACC117 - Chapter 1 - Introduction To Accounting PDFDokumen25 halamanACC117 - Chapter 1 - Introduction To Accounting PDFirfan ShahrilBelum ada peringkat

- Problem 2 12 AccountingDokumen4 halamanProblem 2 12 AccountingSofia Gwen VenturaBelum ada peringkat

- Accountancy Model Paper-2-1Dokumen9 halamanAccountancy Model Paper-2-1Hashim SethBelum ada peringkat

- FABM2 Module 1Dokumen14 halamanFABM2 Module 1Rea Mariz Jordan100% (1)

- Mock Exam FinalDokumen23 halamanMock Exam FinalKamaruslan MustaphaBelum ada peringkat

- Powerol - Monthly MIS FormatDokumen34 halamanPowerol - Monthly MIS Formatdharmender singhBelum ada peringkat

- Case Summary WalthamDokumen2 halamanCase Summary WalthamAnurag ChatarkarBelum ada peringkat

- ACC 226 Week 4 To 5 SIMDokumen33 halamanACC 226 Week 4 To 5 SIMMireya YueBelum ada peringkat

- AfarDokumen53 halamanAfarrodell pabloBelum ada peringkat

- ACCT504 Case Study 1 The Complete Accounting Cycle-13Dokumen12 halamanACCT504 Case Study 1 The Complete Accounting Cycle-13Mohammad Islam100% (1)

- Paper 5 - Financial Accounting: Answer To MTP - Intermediate - Syllabus 2008 - June 2015 - Set 2Dokumen16 halamanPaper 5 - Financial Accounting: Answer To MTP - Intermediate - Syllabus 2008 - June 2015 - Set 2Aleena Clare ThomasBelum ada peringkat

- Tutorial 6 Consolidated Statement of Financial Position (Csofp) - Part 2 - Question 1 (Q10.11)Dokumen8 halamanTutorial 6 Consolidated Statement of Financial Position (Csofp) - Part 2 - Question 1 (Q10.11)cynthiama7777Belum ada peringkat

- SMGR Ugrade - 4M17 Sales FinalDokumen4 halamanSMGR Ugrade - 4M17 Sales FinalInna Rahmania d'RstBelum ada peringkat

- Section A Group 2 PDFDokumen14 halamanSection A Group 2 PDFArpit BajajBelum ada peringkat

- Colegio de San Antonio de Padu1 Front PageDokumen9 halamanColegio de San Antonio de Padu1 Front PageRachel LawasBelum ada peringkat

- Consolidated Income Statement or Statement of Profit or Loss and Other Comprehensive IncomeDokumen4 halamanConsolidated Income Statement or Statement of Profit or Loss and Other Comprehensive IncomeOmolaja IbukunBelum ada peringkat