E-Banking MCQ'S

Diunggah oleh

GuruKPOJudul Asli

Hak Cipta

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniE-Banking MCQ'S

Diunggah oleh

GuruKPOSet-1

Q. If you have an ATM Card of SBI and a balance of Rs. 1200 you

want to get money from the ATM of HDFC, you can get money:

(a) Equal to your balance

(b) Less than you balance

(c) You cannot get money

(d) None of the above

Q. Board and management oversight does not include:

(a) Cost benefit and risk assessment

(b) Customers expectation ignores

(c) Customers expectation ignores

(d) Monitoring and accountability

Q. Poor e-banking planning is connected with:

(a) Strategic Risk

(b) Legal Risk

(c) Market Risk

(d) None of the above

Q. License to issue digital signature certificates are issued by:

(a) Finance Minister

(b) Banks

(c) Controller

(d) None of the above

Q. Key used to create digital signature is:

(a) Public key

(b) Private key

(c) Linear key

(d) None of the above

Q. For which card one has to made advance payment?

(a) Smart card

(b) Gold Card

(c) Debit Card

(d) Credit Card

Q. Smart Cards are based in...........standards:

(a) SET

(b) MIME

(c) HTTP

(d) TULIP

Q. Digital signature certificated are issued by:

(a) Central Government

(b) State Government

(c) Certifying Authority

(d) None of the above

Q. Payment gateways are used for:

(a) Interbank

(b) Delivery process

(c) Purchase

(d) None of the above

Q. VAN stands for:

(a) Varied Area Network

(b) Virtual Area Network

(c) Value Added Network

(d) None of the above

Q. A computer which converts data transmission protocol between

network is:

(a) Gateway

(b) Switch

(c) Hub

(d) None of the above

Q. The customer access E-banking services using:

(a) PC

(b) PDA

(c) ATM

(d) All of the above

Q. Who can pass the law for e-banking?

(a) SBI

(b) Parliament

(c) RBI

(d) Merchant Association

Q. In credit card what is the grace period of payment?

(a) 10-15 days

(b) 5-20 days

(c) 15-45 days

(d) 1-2 days

Q. The most common payment especially for low value puchase, is

made by:

(a) Debit card

(b) Credit card

(c) Cash

(d) ATM

Q. Transactional E-Banking is typically a front end system. That

realises on a programming like called:

(a) Inter phase

(b) Interlink

(c) Inter join

(d) None of the above

Q. The primary type of website used for E-banking

(a) Information

(b) Transaction

(c) Both a and b

(d) None of the above

Q. For which card one has to made advance payment:

(a) Credit Card

(b) Debit Card

(c) Smart Card

(d) Gold Card

Q. The liability of the credit card holder on loss of the credit card

is:

(a) Unlimited

(b) Up to credit limit

(c) Up to the time, matter is reported to the issuing bank

(d) Till two days after the matter reported to the bank

Q. What is true about electronic money:

(a) Both bank and customers would have public key encryption keys

(b) Only bank has public key encryption keys

(c) Only customers have public key encryption keys

(d) No one has public encrypting keys

Q. You have a credit limit of Rs.50,000 on your credit card, you

have purchased readymade garments of Rs. 40,000 in the current

month. How much more money can you use for purchasing from

your credit card:

(a) Rs. 10,000

(b) Rs. 5,000

(c) Rs. 50,000

(d) None

Q. PIN in ATM card id of:

(a) 4 alphabets

(b) 2 alphabets and 2 digits

(c) 4 digits

(d) None of the above

Q. Which transaction cannot be done by ATM card:

(a) Cash withdrawal of 500

(b) Cash withdrawal of 350

(c) Cash withdrawal of 1000

(d) Cash withdrawal of 4000

Q. Knowing someone else password by certain illegal means is.

(a) Hacking

(b) Plagiarism

(c) Log on script

(d) Password policy

Q. The card by which you cannot buy a product is:

(a) Credit card

(b) ATM card

(c) Debit card

(d) Smart card

Q. Loss of trust due to unauthorized activity on customer account

is concerned with:

(a) Reputational risk

(b) Liquidity risk

(c) Market risk

(d) None of the above

Q. Which one of the following is a safety measure in banking

network?

(a) Router

(b) Firewall

(c) Modem

(d) None of the above

Q. TSP helps financial institution of:

(a) Manage cost

(b) Improve service quality

(c) Obtain necessary expertise

(d) All of the above

Q. Legal risk arises because of:

(a) Violation of laws

(b) Non-confirmation with law

(c) Legal rights non established

(d) All of the above

Q. Which is the current revision & year of UCPDC?

(a) UCPDC 500, 1993

(b) UCODC 400, 1993

(c) UCPDC 300, 1973

(d) All of the above

Q. development financial institution in India that has got merged

with a bank is

(a) IDBI

(b) ICICI

(c) IDFC

(d) UTI

Set-2

Q. What is E-sign Act?

(a) Electronic Sign Act

(b) Electronic signatures in Global and National Commerce Act

(c) Electronic Signatures in National And Global Act

(d) None of the above

Q. For which card one has to make advance payment:

(a) Credit Card

(b) Debit Card

(c) Smart Card

(d) Gold Card

Q. Who can pass the law for E-banking?

(a) RBI

(b) Merchant Association

(c) Parliament

(d) None of the above

Q. Which type of transaction are not permitted on Credit Cards;

(a) Rail Booking

(b) Airline Booking

(c) Puchase of medicines

(d) Gambling transactions

Q. SSL is:

(a) Secret Sockets layers

(b) Securred Sockets layer

(c) Symmetric Sockets Layer

(d) None of the above

Q. Interim rules providing guidance on how the E-sing Act applies

to the customer financial services is issued by:

(a) Federal reserve board

(b) E sign authority

(c) The issuing bank

(d) RBI

Q. Loss of trust due to unauthorized activity on customer account

is concerned with:

(a) Reputation Risk

(b) Liquidity Risk

(c) Market Risk

(d) None of the above

Q. Intercepting and altering information relating to payment is:

(a) Impersonation

(b) Tampering

(c) Authenticating

(d) None of the abov

Set-3

Q. A Banker's cheque is:

(a) A local DD

(b) an outstation DD

(c) An outdated cheque

(d) A prredata Cheque

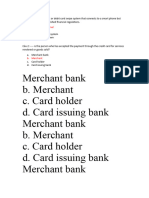

Q. Which one of the following is acquirer of a credit card

Transaction?

(a) ICICI Bank

(b) RBI

(c) VISA

(d) Bank of Rajasthan

Q. The card by which you can not by a product is :

(a) Credit card

(b) ATM card

(c) Debit card

(d) Smart card

Q. What is the full form of ATM ?

(a) Automated Teller Machine

(b) Automatic Transaction Machine

(c) Advanced Teller Machine

(d) Accurate teller money

Q. The potential hard for informational website E-banking is:

(a) Viewing Account by a customer

(b) Spreading Virus

(c) Checking balance by a customer

(d) Making online payment by a customer

Q. A Debit Card/ATM card is a.............digit number:

(a) 12

(b) 13

(c) 16

(d) 10

Q. What is E-sign Act?

(a) Electronic Sign Act

(b) Electronic signature in Global and National Commerce Act

(c) Electronic signature in National and Global Act

(d) None of the above

Q. If a customer service executive does not give proper

information after proper security checks, this is:

(a) Compliance

(b) Six sigma

(c) Effectiveness

(d) None of the above

Q. Intrusion detection system helps in:

(a) User enrolment

(b) Rapid intrusion detection and reaction

(c) Training

(d) Independent testing

Set-4

Q. Asymmetric key cryptography is also knows as:

(a) Public key technique

(b) Private key technique

(c) Solo key technique

(d) None of the above

Q. If a customer service executive does not give proper

information after proper secruity checks, this is:

(a) Compliance

(b) Six Sigma

(c) Effectiveness

(d) None of the above

Q. Smart cards are based on................standards:

(a) SET

(b) MIME

(c) HTTP

(d) TULIP

Q. Intrusion detection system helps in:

(a) User enrollment

(b) Rapid Intrusion detection and reaction

(c) Training

(d) Independent testing

Q. SET stands for:

(a) Selective Electronic Transfer

(b) Secure Electronic Transaction

(c) Safe Electronic Transaction

(d) None of the above

Q. IDS is:

(a) Intrusion Detection System

(b) Integrated Development System

(c) Integrated Detection Service

(d) Intrusion Development Service

Q. True about debit cards and ATM cards:

(a) Offline E-money

(b) Online E-money

(c) Cash Money

(d) light Money

Q. Securer electronic transaction is a :

(a) Protocol

(b) Transaction type

(c) Security agency

(d) JSP

Q. Which type of transaction are not permitted on credit card?

(a) Rail Booking

(b) Airline Booking

(c) Purchase of medicines

(d) Gambling transaction

Anda mungkin juga menyukai

- Management of Financial Services MCQ'SDokumen4 halamanManagement of Financial Services MCQ'SGuruKPO96% (23)

- Retail BankingDokumen10 halamanRetail BankingPayal hazra100% (1)

- MCQ On IT 2Dokumen8 halamanMCQ On IT 2udai_chakraborty5511Belum ada peringkat

- Customer and Banker Relationship MCQDokumen13 halamanCustomer and Banker Relationship MCQsn n100% (3)

- MCQ On International BankingDokumen7 halamanMCQ On International Bankingparthasarathi_in100% (3)

- MCQ On ExportsDokumen13 halamanMCQ On ExportsAvlNarasimhaBelum ada peringkat

- Objective Type Questions in BankingDokumen27 halamanObjective Type Questions in Bankingmidhungbabu81% (31)

- Multiple Choice QuestionsDokumen33 halamanMultiple Choice QuestionsSunil Kumar Gadwal100% (1)

- MCQ Financial Regulatory FrameworkDokumen13 halamanMCQ Financial Regulatory Frameworkthorat82Belum ada peringkat

- Msme MCQ-1Dokumen4 halamanMsme MCQ-1LrajBelum ada peringkat

- MCQ On International FinanceDokumen13 halamanMCQ On International Financesalaf100% (2)

- MCQ With Answers - CRMDokumen8 halamanMCQ With Answers - CRMdr bharath k0% (1)

- Personal Real Nominal McqsDokumen6 halamanPersonal Real Nominal Mcqsasfandiyar100% (2)

- Mobile Commerce GuideDokumen33 halamanMobile Commerce GuideRose Rhodah Marsh67% (6)

- Financial Management MCQs 35: Maximizing Firm ValueDokumen6 halamanFinancial Management MCQs 35: Maximizing Firm Valuekhan50% (2)

- MCQ Banking, Finance and Economy TestDokumen7 halamanMCQ Banking, Finance and Economy Testarun xornorBelum ada peringkat

- MIS MCQ Question BankDokumen14 halamanMIS MCQ Question BankMavani snehaBelum ada peringkat

- Banking Law MCQDokumen33 halamanBanking Law MCQShivansh Bansal100% (7)

- Digital Banking For Federal Bank MCQDokumen27 halamanDigital Banking For Federal Bank MCQsabs1234561080100% (5)

- Multiple Choice Questions On BANKINGDokumen12 halamanMultiple Choice Questions On BANKINGIndu GuptaBelum ada peringkat

- MCQ On Security Analysis and Portfolio ManagementDokumen4 halamanMCQ On Security Analysis and Portfolio ManagementKrithi SelvaBelum ada peringkat

- MCQs for Limited Insolvency ExamDokumen16 halamanMCQs for Limited Insolvency Examichchhit srivastavaBelum ada peringkat

- Multiple Choice Questions (MCQ) : Indian Financial SystemDokumen4 halamanMultiple Choice Questions (MCQ) : Indian Financial SystemPriyadarshini Mahakud100% (2)

- Important MCQDokumen37 halamanImportant MCQParminder Singh50% (10)

- MCQ MarketingDokumen22 halamanMCQ Marketingsonu80% (5)

- Finance Management MCQDokumen44 halamanFinance Management MCQLakshmi NarasaiahBelum ada peringkat

- International Finance MCQ With Answers PDFDokumen5 halamanInternational Finance MCQ With Answers PDFMijanur Rahman0% (1)

- Bank Reconciliation Statement MCQs Financial AccountingDokumen6 halamanBank Reconciliation Statement MCQs Financial AccountingPervaiz Shahid100% (1)

- NISM DP 1300 MCQS - by Vinay Kumar Gandi PDFDokumen175 halamanNISM DP 1300 MCQS - by Vinay Kumar Gandi PDFaditi100% (9)

- Financial Accounting MCQs on Amalgamation, Absorption and External Reconstruction (B.ComDokumen12 halamanFinancial Accounting MCQs on Amalgamation, Absorption and External Reconstruction (B.ComsameerBelum ada peringkat

- MCQ On Letter of CreditDokumen25 halamanMCQ On Letter of CreditLakshman Singh75% (8)

- BASEL Norms MCQDokumen15 halamanBASEL Norms MCQBiswajit Das100% (1)

- Financial Management MCQDokumen2 halamanFinancial Management MCQRajendra Pansare88% (8)

- MCQ For MBFS PDFDokumen19 halamanMCQ For MBFS PDFNaziya TamboliBelum ada peringkat

- Financial Management MCQsDokumen11 halamanFinancial Management MCQsmadihaadnan150% (2)

- Retail MCQ ModuleDokumen19 halamanRetail MCQ ModuleBattina AbhisekBelum ada peringkat

- Marketing Management MCQ Pune UniDokumen32 halamanMarketing Management MCQ Pune UniABHIJIT S. SARKAR80% (5)

- Company Law-MCQDokumen40 halamanCompany Law-MCQAkshit Singh100% (1)

- E-Crm MCQDokumen2 halamanE-Crm MCQakyadav123100% (4)

- MCQ in Bba-Business EthicsDokumen25 halamanMCQ in Bba-Business EthicsMidhin S Nair100% (2)

- 300+ TOP Financial Accounting MCQs and Answers PDF 2021Dokumen17 halaman300+ TOP Financial Accounting MCQs and Answers PDF 2021Bhagat DeepakBelum ada peringkat

- IMPS, NUUP, QSAM and UPI banking services explainedDokumen200 halamanIMPS, NUUP, QSAM and UPI banking services explainedLakshmi Narasaiah100% (1)

- Fire Chapter 1 MCQ PDFDokumen7 halamanFire Chapter 1 MCQ PDFjds0% (1)

- MCQS ON FOREIGN EXCHANGE CONCEPTSDokumen37 halamanMCQS ON FOREIGN EXCHANGE CONCEPTSPadyala Sriram67% (6)

- B.Com III Semester Company Accounts MCQsDokumen190 halamanB.Com III Semester Company Accounts MCQsRam IyerBelum ada peringkat

- Important MCQs of Financial DerivativesDokumen22 halamanImportant MCQs of Financial Derivativespk100% (4)

- FM MCQsDokumen58 halamanFM MCQsPervaiz ShahidBelum ada peringkat

- 142 Mcqs Good - Financial ManagementDokumen26 halaman142 Mcqs Good - Financial ManagementMuhammad Arslan Usman71% (7)

- Joint Venture MCQDokumen3 halamanJoint Venture MCQSonu SagarBelum ada peringkat

- Corporate Account MCQDokumen25 halamanCorporate Account MCQArul Dass67% (12)

- Consumer Protection Act McqsDokumen2 halamanConsumer Protection Act McqsDeeparsh SinghalBelum ada peringkat

- Isssue of Shares and Debentures MCQDokumen42 halamanIsssue of Shares and Debentures MCQlolBelum ada peringkat

- MCQSDokumen19 halamanMCQSpankaj singhBelum ada peringkat

- Security Analysis & Portfolio Management (MCQ, S & Short Answers)Dokumen54 halamanSecurity Analysis & Portfolio Management (MCQ, S & Short Answers)Hamid Ilyas80% (10)

- Prof. Parikh's Time Value of Money MCQsDokumen4 halamanProf. Parikh's Time Value of Money MCQsAmrita kumariBelum ada peringkat

- L1 QuestionsDokumen16 halamanL1 QuestionsAnimesh SrivastavaBelum ada peringkat

- EpaymentDokumen6 halamanEpaymentvyknk21Belum ada peringkat

- Mid TermDokumen9 halamanMid Termhyd.hus54646Belum ada peringkat

- Quiz Plastic MoneyDokumen2 halamanQuiz Plastic MoneyJesicaBelum ada peringkat

- E Commerce MCQ'SDokumen17 halamanE Commerce MCQ'SGuruKPO88% (33)

- Applied ElectronicsDokumen40 halamanApplied ElectronicsGuruKPO75% (4)

- Applied ElectronicsDokumen37 halamanApplied ElectronicsGuruKPO100% (2)

- OptimizationDokumen96 halamanOptimizationGuruKPO67% (3)

- Computer Graphics & Image ProcessingDokumen117 halamanComputer Graphics & Image ProcessingGuruKPOBelum ada peringkat

- Biyani Group of Colleges, Jaipur Merit List of Kalpana Chawala Essay Competition - 2014Dokumen1 halamanBiyani Group of Colleges, Jaipur Merit List of Kalpana Chawala Essay Competition - 2014GuruKPOBelum ada peringkat

- Abstract AlgebraDokumen111 halamanAbstract AlgebraGuruKPO100% (5)

- Advertising and Sales PromotionDokumen75 halamanAdvertising and Sales PromotionGuruKPO100% (3)

- Biyani's Think Tank: Concept Based NotesDokumen49 halamanBiyani's Think Tank: Concept Based NotesGuruKPO71% (7)

- Think Tank - Advertising & Sales PromotionDokumen75 halamanThink Tank - Advertising & Sales PromotionGuruKPO67% (3)

- Production and Material ManagementDokumen50 halamanProduction and Material ManagementGuruKPOBelum ada peringkat

- Algorithms and Application ProgrammingDokumen114 halamanAlgorithms and Application ProgrammingGuruKPOBelum ada peringkat

- Data Communication & NetworkingDokumen138 halamanData Communication & NetworkingGuruKPO75% (4)

- Community Health Nursing I Nov 2013Dokumen1 halamanCommunity Health Nursing I Nov 2013GuruKPOBelum ada peringkat

- Phychology & Sociology Jan 2013Dokumen1 halamanPhychology & Sociology Jan 2013GuruKPOBelum ada peringkat

- Algorithms and Application ProgrammingDokumen114 halamanAlgorithms and Application ProgrammingGuruKPOBelum ada peringkat

- Banking Services OperationsDokumen134 halamanBanking Services OperationsGuruKPOBelum ada peringkat

- Phychology & Sociology Jan 2013Dokumen1 halamanPhychology & Sociology Jan 2013GuruKPOBelum ada peringkat

- Paediatric Nursing Sep 2013 PDFDokumen1 halamanPaediatric Nursing Sep 2013 PDFGuruKPOBelum ada peringkat

- Business LawDokumen112 halamanBusiness LawDewanFoysalHaqueBelum ada peringkat

- Community Health Nursing Jan 2013Dokumen1 halamanCommunity Health Nursing Jan 2013GuruKPOBelum ada peringkat

- Community Health Nursing I July 2013Dokumen1 halamanCommunity Health Nursing I July 2013GuruKPOBelum ada peringkat

- Fundamental of Nursing Nov 2013Dokumen1 halamanFundamental of Nursing Nov 2013GuruKPOBelum ada peringkat

- Biological Science Paper I July 2013Dokumen1 halamanBiological Science Paper I July 2013GuruKPOBelum ada peringkat

- Business Ethics and EthosDokumen36 halamanBusiness Ethics and EthosGuruKPO100% (3)

- Biological Science Paper 1 Nov 2013Dokumen1 halamanBiological Science Paper 1 Nov 2013GuruKPOBelum ada peringkat

- BA II English (Paper II)Dokumen45 halamanBA II English (Paper II)GuruKPOBelum ada peringkat

- Biological Science Paper 1 Jan 2013Dokumen1 halamanBiological Science Paper 1 Jan 2013GuruKPOBelum ada peringkat

- Software Project ManagementDokumen41 halamanSoftware Project ManagementGuruKPO100% (1)

- Service MarketingDokumen60 halamanService MarketingGuruKPOBelum ada peringkat

- Product and Brand ManagementDokumen129 halamanProduct and Brand ManagementGuruKPOBelum ada peringkat

- "This Ain't Avatar" Suit: LFP Vs John Does 1-1,106Dokumen6 halaman"This Ain't Avatar" Suit: LFP Vs John Does 1-1,106DallasObserverBelum ada peringkat

- NetBackup 7.0 Server RequirementsDokumen4 halamanNetBackup 7.0 Server RequirementsgynaxBelum ada peringkat

- KYC VERIFICATION USING BLOCKCHAIN TECHNOLOGYDokumen5 halamanKYC VERIFICATION USING BLOCKCHAIN TECHNOLOGYPrashant A UBelum ada peringkat

- Idm Internet DownloadDokumen1 halamanIdm Internet DownloadSyedi MolaBelum ada peringkat

- Catalyst 4500 Removing and ReplacingDokumen31 halamanCatalyst 4500 Removing and ReplacingTheodor Silva EspinozaBelum ada peringkat

- Subasish Junos Admin GuideDokumen130 halamanSubasish Junos Admin GuideSubhasish BiswalBelum ada peringkat

- SushmaArora-Cyber Crimes and LawsDokumen22 halamanSushmaArora-Cyber Crimes and LawsTharun Kvr0% (1)

- Happiestminds Corporate Brochure PDFDokumen4 halamanHappiestminds Corporate Brochure PDFmadhukiranBelum ada peringkat

- Installation Instructions: Model Number TDF-3A-120V TDF-10A-120V TDF-20A-120V TDF-3A-240V TDF-10A-240V TDF-20A-240VDokumen2 halamanInstallation Instructions: Model Number TDF-3A-120V TDF-10A-120V TDF-20A-120V TDF-3A-240V TDF-10A-240V TDF-20A-240Vhgdung12Belum ada peringkat

- Network Traffic Anomaly DetectionDokumen5 halamanNetwork Traffic Anomaly Detectionm1ndwerkBelum ada peringkat

- HostsDokumen7.045 halamanHostsMalikBelum ada peringkat

- Image To Text Encryption and Decryption Using Modified RSA AlgorithmDokumen5 halamanImage To Text Encryption and Decryption Using Modified RSA AlgorithmAbdul Rahman KhamisBelum ada peringkat

- 1 - Rewrite The Following Sentences in The Passive VoiceDokumen5 halaman1 - Rewrite The Following Sentences in The Passive VoicePaulo César GonçalvesBelum ada peringkat

- ISEC-655 Information Security Governance Assignment 2 GuidelinesDokumen3 halamanISEC-655 Information Security Governance Assignment 2 GuidelinesAyushi JainBelum ada peringkat

- Vendor Master Creation Request FormDokumen1 halamanVendor Master Creation Request FormVM RodrigoBelum ada peringkat

- Software Requirements SpecificationsDokumen7 halamanSoftware Requirements SpecificationsAbdullah BhattiBelum ada peringkat

- Secure SDLC Workshop - SelfPaced Online Training ProgramDokumen5 halamanSecure SDLC Workshop - SelfPaced Online Training Programagnes christeniaBelum ada peringkat

- Setting Up I2p For IRC+BrowsingDokumen3 halamanSetting Up I2p For IRC+BrowsingLeroypan100% (1)

- DeWalt DW720 RAS ManualDokumen16 halamanDeWalt DW720 RAS ManualAnders TärnbrantBelum ada peringkat

- Aadhaar Update Form: Aadhaar Enrolment Is Free & VoluntaryDokumen4 halamanAadhaar Update Form: Aadhaar Enrolment Is Free & VoluntarySushant YadavBelum ada peringkat

- Row Selection of ALV GridDokumen6 halamanRow Selection of ALV Gridhjheredias1Belum ada peringkat

- Digital Design of A Digital Combination LockDokumen6 halamanDigital Design of A Digital Combination LockIJERAS-International Journal of Engineering Research and Applied Science (ISSN: 2349-4522)Belum ada peringkat

- Online Voting System: An OverviewDokumen36 halamanOnline Voting System: An OverviewkapilBelum ada peringkat

- Amazon VPC NagDokumen136 halamanAmazon VPC NagnvlongjvcBelum ada peringkat

- MQ GuideDokumen129 halamanMQ GuidefuckyouSCBelum ada peringkat

- PacketFence 2017-Administration GuideDokumen166 halamanPacketFence 2017-Administration Guidescrib_nok0% (1)

- CVDokumen4 halamanCVShan AnwerBelum ada peringkat

- Concordance 10 User GuideDokumen244 halamanConcordance 10 User GuideJames TolbertBelum ada peringkat

- Andhra Pradesh Grama Sachivalayam Exam Hall TicketDokumen2 halamanAndhra Pradesh Grama Sachivalayam Exam Hall Ticketsuresh kumarBelum ada peringkat

- Cloud Security - An Overview: The OWASP FoundationDokumen30 halamanCloud Security - An Overview: The OWASP FoundationMostafaElBazBelum ada peringkat