Lecture 5

Diunggah oleh

Mystiquemashal0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

28 tayangan12 halamanACCOUNTANTS DIVIDE the ECONOMIC LIFE OF a BUSINESS INTO ARTIFICIAL TIME PERIODS (TIME period ASSUMPTION) REVENUE RECOGNITION PRINCIPLE ACCOUNITNG CYCLE Match expenses with revenues in the period when the company makes efforts to generate those revenues.

Deskripsi Asli:

Judul Asli

LECTURE-5

Hak Cipta

© © All Rights Reserved

Format Tersedia

PPTX, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniACCOUNTANTS DIVIDE the ECONOMIC LIFE OF a BUSINESS INTO ARTIFICIAL TIME PERIODS (TIME period ASSUMPTION) REVENUE RECOGNITION PRINCIPLE ACCOUNITNG CYCLE Match expenses with revenues in the period when the company makes efforts to generate those revenues.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PPTX, PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

28 tayangan12 halamanLecture 5

Diunggah oleh

MystiquemashalACCOUNTANTS DIVIDE the ECONOMIC LIFE OF a BUSINESS INTO ARTIFICIAL TIME PERIODS (TIME period ASSUMPTION) REVENUE RECOGNITION PRINCIPLE ACCOUNITNG CYCLE Match expenses with revenues in the period when the company makes efforts to generate those revenues.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PPTX, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 12

ACCOUNITNG CYCLE

4. SUMMARIZING PREPARATION OF REPORTS

a. ADJUSTING ENTRIES

b. ADJUSTED TRIAL BALANCE

c. FINANCIAL STATEMENTS

d. CLOSING

e. POST CLOSING TRIAL BALANCE

STEPS

ACCOUNITNG CYCLE

4a.ADJUSTING ENTRIES

TIME PERIOD CONCEPT

REVENUE RECOGNITION

PRINCIPLE

EXPENSE RECOGNITION PRINCIPLE

(MATCHING PRINCIPLE)

ACCRUAL AND CASH SYSTEM OF

ACCOUNTING

CONCEPTS

TIME PERIOD CONCEPT

ACCOUNITNG CYCLE

ACCOUNTANTS DIVIDE THE ECONOMIC LIFE OF A BUSINESS INTO

ARTIFICIAL TIME PERIODS (TIME PERIOD ASSUMPTION).

GENERALLY A MONTH, A QUARTER, OR A YEAR.

ALSO KNOWN AS THE PERIODICITY ASSUMPTION

MONTHLY AND QUARTERLY TIME PERIODS ARE CALLED INTERIM

PERIODS.

FISCAL YEAR = ACCOUNTING TIME PERIOD THAT IS ONE YEAR IN

LENGTH.

CALENDAR YEAR = JANUARY 1 TO DECEMBER 31.

Jan. Feb. Mar. Apr. Dec.

. . . . .

REVENUE RECOGNITION

PRINCIPLE

ACCOUNITNG CYCLE

RECOGNIZE REVENUE IN THE ACCOUNTING PERIOD IN WHICH IT IS

EARNED.(WHEN EARNING PROCESS IS COMPLETED)

SALE HAS BEEN MADE OR SERVICES HAVE BEEN PERFORMED

CASH EITHER BEEN COLLECTED OR COLLECTIBILTY IS REASONABLY

ASSURED

EXPENSE RECOGNITION

PRINCIPLE

ACCOUNITNG CYCLE

Match expenses with

revenues in the period

when the company makes

efforts to generate those

revenues.

Let the expenses follow

the revenues.

MATCHING PRINCIPLE

CASH AND ACCRUAL SYSTEM

OF ACCOUNITNG

ACCOUNITNG CYCLE

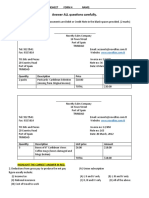

CASH ACCRUAL

TRANSACTION RECORDED IN THE

PERIOD WHEN SETTELED

RECORDED IN THE

PERIOD WHEN INCURRED

REVENUE

EXPENSES

RECOGNIZED WHEN

RECEIVED

RECOGNIZED WHEN

EARNED

RECOGNIZED WHEN

PAID

RECOGNIZED WHEN

DUE/INCURRED

GAAP

NOT AS PER GAAP AS PER GAAP

ACCOUNITNG CYCLE

WHY THERE IS A NEED OF ADJUSTMENTS

TO RECORD/ADJUST

UNRECORDED /UNADJUSTED

LIABILITIES

REVENUE

EXPENSES

ASSETS

ACCOUNITNG CYCLE

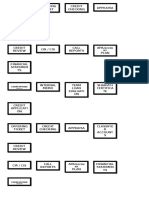

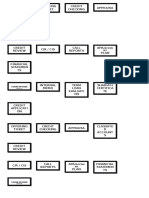

TYPES OF ADJUSTING ENTRIES

DEFERRALS

TRANSACTIONS

ACCRUALS

TRANSACTIONS

RECOREDED BUT

UNADJUSTED

UN RECORDED

PREPAID

EXPENSES

UNEARNED

REVENUES

ACCRUED

REVENUES

ACCRUED

EXPENSES

Revenue received

in advance

ACCOUNITNG CYCLE

PREPAIDS

EXPENSES

Expenses paid in advance

Example: Insurance,supplies,advertising,

rent, equipment, buildings

PREPAID /SUPPLIES/BUILDING..DR

CASH. CR

RENT/INSURANCE

/SUPPLIES

EXPENSEDR

PREPAID/SUPPLIES..CR

BUILDING

/EQUIPMENT

DEPRECIATION EXPENSEDR

ACCUMULATED DEPRECIATIONCR

ADJUSTMENT

DEFERRALS

REASON:ASSET HAVE BEEN USED

ACCOUNITNG CYCLE

UNEARNED

REVENUES

Revenue has received in advance

Example: Magazine subscriptions, Customer

deposits,Rent, Airline tickets

CASH..DR

UNEARNED REVENUE..CR

ADJUSTMENT

UNEARNED REVENUEDR

EARNED REVENUE..CR

DEFERRALS

REASON:REVENUE HAS BEEN EARNED

ACCOUNITNG CYCLE

ACCRUALS

ACCRUED

REVENUE

REVENUE EARNED BUT NOT RECEIVED

EXAMPLES :RENT , SERVICES PERFORMED

ADJUSTMENT

REASON:NOT RECORDED

ACC/RECV..DR

REVENUE..CR

ACCRUED

EXPENSES

EXPENSES DUE BUT NOT PAID

EXAMPLES :RENT ,SALARIES, INTEREST,

ADJUSTMENT

REASON:NOT RECORDED

EXPENSE..DR

PAYABLES..CR

ACCOUNITNG CYCLE ADJUSTMENT SUMMARY

EXPENSE

DUE BUT

NOT PAID

PAID IN

ADVANCE

EXPENSEDR

PAYABLESCR

EXPENSEDR

PREPAID/SUPPLIES..CR

REVENUE

EARNED

BUT NOT

RECEIVED

ALREADY

RECEIVED IN

ADVANCE

ACC/RECVDR

REVENUECR

UNEARNED REVENUEDR

EARNED REVENUE..CR

Anda mungkin juga menyukai

- Fap Chapter 3 Solution ManualDokumen66 halamanFap Chapter 3 Solution Manualummara_javed69% (16)

- Usda FORM 3560-07Dokumen16 halamanUsda FORM 3560-07Jeff Thomas0% (1)

- Form DB-450 Claim For Disability BenefitsDokumen2 halamanForm DB-450 Claim For Disability BenefitsWilliam Mattar100% (3)

- Digital Marketing Case StudyDokumen12 halamanDigital Marketing Case StudyMystiquemashal100% (1)

- Funderburk Accounting Accruals and Deferrals For AttendeesDokumen50 halamanFunderburk Accounting Accruals and Deferrals For AttendeesMechileBelum ada peringkat

- HWChap003 ANSDokumen68 halamanHWChap003 ANShelloocean100% (1)

- Ansoff MatrixDokumen14 halamanAnsoff MatrixHemant PatilBelum ada peringkat

- "In This "Age of Accounts" Some Literacy IN Accounting Has Become A Prime Necessity "Dokumen35 halaman"In This "Age of Accounts" Some Literacy IN Accounting Has Become A Prime Necessity "sanjaydubey3Belum ada peringkat

- 2022 08 18 05 16 46 Loan Appl Form 1Dokumen5 halaman2022 08 18 05 16 46 Loan Appl Form 1Jasmin GriffithBelum ada peringkat

- Accounting and Finance BankersDokumen68 halamanAccounting and Finance BankersNamita SharmaBelum ada peringkat

- Prime Double EntriesDokumen18 halamanPrime Double EntriesfarhanmammadovupsystemsBelum ada peringkat

- Tally Prime Course Account and IntroDokumen15 halamanTally Prime Course Account and IntroAnkit Singh100% (1)

- Accounting and Finance Bankers: by Ravi Ullal ConsultantDokumen68 halamanAccounting and Finance Bankers: by Ravi Ullal ConsultantHlic NotesBelum ada peringkat

- Chapter 3 - Brief Exercises - SolutionsDokumen4 halamanChapter 3 - Brief Exercises - SolutionsHa Dang Huynh NhuBelum ada peringkat

- Igcse Accounting Prepayments Accruals Questions AnswersDokumen16 halamanIgcse Accounting Prepayments Accruals Questions AnswersInnocent GwangwaraBelum ada peringkat

- Final ChecklistDokumen10 halamanFinal ChecklistWatzi TooyaBelum ada peringkat

- Afis Manual: Ar-Cash Receipts: ADOA - General Accounting OfficeDokumen50 halamanAfis Manual: Ar-Cash Receipts: ADOA - General Accounting Officecristel jane FullonesBelum ada peringkat

- Format Lembar Kerja AkuntansiDokumen29 halamanFormat Lembar Kerja AkuntansiBudi SusantoBelum ada peringkat

- Adjusting Accounts and Preparing Financial Statements: QuestionsDokumen74 halamanAdjusting Accounts and Preparing Financial Statements: QuestionsChaituBelum ada peringkat

- 157 28395 EY111 2013 4 2 1 Chap003Dokumen74 halaman157 28395 EY111 2013 4 2 1 Chap003JasonBelum ada peringkat

- Dipendra Giri B2 (Smile Please) : Cash A/c....... Dr. To Bad Debts Recovered A/cDokumen1 halamanDipendra Giri B2 (Smile Please) : Cash A/c....... Dr. To Bad Debts Recovered A/cDipendra GiriBelum ada peringkat

- Trial Balance and BRSDokumen19 halamanTrial Balance and BRSAdarshBelum ada peringkat

- IPSASB IPSAS 33 First Time Adoption of Accrual Basis IPSASsDokumen114 halamanIPSASB IPSAS 33 First Time Adoption of Accrual Basis IPSASskajaleBelum ada peringkat

- Accounting CommunityDokumen20 halamanAccounting Communitywhyme_bBelum ada peringkat

- AbrahamDokumen38 halamanAbrahamfayeraleta2024Belum ada peringkat

- Adjusting Accounts and Preparing Financial StatementsDokumen54 halamanAdjusting Accounts and Preparing Financial StatementsAmna TahirBelum ada peringkat

- Entries and Adjustments in Different Books of AccountsDokumen34 halamanEntries and Adjustments in Different Books of AccountsSHEKHAR SUMITBelum ada peringkat

- Change in PSR Full Solution With ConceptsDokumen15 halamanChange in PSR Full Solution With ConceptsANTECBelum ada peringkat

- Financial Accounting Course WorkDokumen17 halamanFinancial Accounting Course Workelvis page kamunanwireBelum ada peringkat

- LSS DisbursementsDokumen34 halamanLSS DisbursementsG. Mac AoidhBelum ada peringkat

- 00 Tapovan Advanced Accounting Free Fasttrack Batch Summary PlusDokumen57 halaman00 Tapovan Advanced Accounting Free Fasttrack Batch Summary PlusDhiraj JaiswalBelum ada peringkat

- Budgetexecution 140703195626 Phpapp02Dokumen9 halamanBudgetexecution 140703195626 Phpapp02jemroseBelum ada peringkat

- Accounting Entires For Oracle Apps R12 PDFDokumen14 halamanAccounting Entires For Oracle Apps R12 PDFRamesh GarikapatiBelum ada peringkat

- Tax RevDokumen763 halamanTax RevNeNe Dela LLanaBelum ada peringkat

- Petty Cash Policy-FNDokumen4 halamanPetty Cash Policy-FNengsaidjavidahmady001Belum ada peringkat

- Financial Statements: Prepared By: Ankit Singh Ray Mba 1 Semester Sec-ADokumen23 halamanFinancial Statements: Prepared By: Ankit Singh Ray Mba 1 Semester Sec-AAayush AggarwaklBelum ada peringkat

- Ch02-Solutions To Brief ExercisesDokumen5 halamanCh02-Solutions To Brief ExercisesAmanda_CChenBelum ada peringkat

- Modele de Plan D'Affaires: (Fonds D'appui Aux Acteurs Du Secteur Informel)Dokumen5 halamanModele de Plan D'Affaires: (Fonds D'appui Aux Acteurs Du Secteur Informel)paul vigneronBelum ada peringkat

- 1 Taking Into Account The Nomenclature of Accounts, Prepare A Chart of Accounts For A Service CompanyDokumen4 halaman1 Taking Into Account The Nomenclature of Accounts, Prepare A Chart of Accounts For A Service CompanyScribdTranslationsBelum ada peringkat

- Notice and Proof of Claim For Disability BenefitsDokumen4 halamanNotice and Proof of Claim For Disability BenefitsabramovrBelum ada peringkat

- Chapter 03 SMDokumen67 halamanChapter 03 SMAthena LauBelum ada peringkat

- Problems On DepreciationDokumen13 halamanProblems On DepreciationEkansh DwivediBelum ada peringkat

- Gam EntriesDokumen4 halamanGam EntriesjanineBelum ada peringkat

- AR AccountingDokumen6 halamanAR AccountingNestor BoscanBelum ada peringkat

- Self Auditing ProgramDokumen32 halamanSelf Auditing Programnita.singhBelum ada peringkat

- Accounting 4 Merchandising OperationsDokumen12 halamanAccounting 4 Merchandising OperationsISLAM KHALED ZSCBelum ada peringkat

- ملخص محاسبة - لِنَكُـن✨..Dokumen10 halamanملخص محاسبة - لِنَكُـن✨..ffpgy6c6cxBelum ada peringkat

- CH # 4 Financial StatementsDokumen4 halamanCH # 4 Financial StatementsAbubakar AliBelum ada peringkat

- TAG Credit FolderDokumen3 halamanTAG Credit FolderJo RylBelum ada peringkat

- Tag BCFDokumen3 halamanTag BCFJo RylBelum ada peringkat

- Atcl Saccos Development Topup Loan Application Contract or Form - New Version 2024Dokumen5 halamanAtcl Saccos Development Topup Loan Application Contract or Form - New Version 2024Ibaad AliBelum ada peringkat

- UntitledDokumen191 halamanUntitledVikas KumarBelum ada peringkat

- CH 03Dokumen32 halamanCH 03Rosmala DewiBelum ada peringkat

- 3900 Topper 21 101 503 550 8491 Depreciation Provisions and Reserves Up201608051529 1470391159 3522 PDFDokumen17 halaman3900 Topper 21 101 503 550 8491 Depreciation Provisions and Reserves Up201608051529 1470391159 3522 PDFManju BalajiBelum ada peringkat

- Panjab University, Chandigarh Bill For Medical Assistance ReimbursementDokumen2 halamanPanjab University, Chandigarh Bill For Medical Assistance ReimbursementPranav PuriBelum ada peringkat

- Payables: When We Receive The Goods in The Staging Area The Accounting Entry Would Be (MAS) / (GRN)Dokumen15 halamanPayables: When We Receive The Goods in The Staging Area The Accounting Entry Would Be (MAS) / (GRN)VK SHARMABelum ada peringkat

- Loan Application FormDokumen2 halamanLoan Application FormKaichou NeteroBelum ada peringkat

- Template AkuntansiDokumen15 halamanTemplate AkuntansiM Daiko S PBelum ada peringkat

- French Business Dictionary: The Business Terms of France and CanadaDari EverandFrench Business Dictionary: The Business Terms of France and CanadaBelum ada peringkat

- Party Rental Business Playbook Everything Needed To Start a Moonwalk Business!Dari EverandParty Rental Business Playbook Everything Needed To Start a Moonwalk Business!Belum ada peringkat

- Mega Project Assurance: Volume One - The Terminological DictionaryDari EverandMega Project Assurance: Volume One - The Terminological DictionaryBelum ada peringkat

- Pat Is TingtingDokumen2 halamanPat Is Tingtingyanzki606Belum ada peringkat

- Harvard GuideDokumen7 halamanHarvard GuideKidLeader93Belum ada peringkat

- APA Format Sample PDFDokumen9 halamanAPA Format Sample PDFMystiquemashalBelum ada peringkat

- Ijaiem 2013 11 27 084Dokumen9 halamanIjaiem 2013 11 27 084International Journal of Application or Innovation in Engineering & ManagementBelum ada peringkat

- Bibliography For Qualitative PapersDokumen5 halamanBibliography For Qualitative PapersMystiquemashalBelum ada peringkat

- APA Format Sample PDFDokumen9 halamanAPA Format Sample PDFMystiquemashalBelum ada peringkat

- Content Marketing IntroductionDokumen26 halamanContent Marketing IntroductionMystiquemashalBelum ada peringkat

- Unilever Sia Case StudyDokumen2 halamanUnilever Sia Case StudyAdeela SajjadBelum ada peringkat

- Nissan Case SMDokumen44 halamanNissan Case SMMystiquemashalBelum ada peringkat

- Strategic Computing and Communications Technolgy: - Course Web Page - RequirementsDokumen24 halamanStrategic Computing and Communications Technolgy: - Course Web Page - RequirementsVishal RastogiBelum ada peringkat

- Creating Your Mobile Marketing StrategyDokumen13 halamanCreating Your Mobile Marketing StrategyAgus AlvarezBelum ada peringkat

- Case Study PIADokumen5 halamanCase Study PIAMystiquemashalBelum ada peringkat

- Problems of Risk ManagementDokumen2 halamanProblems of Risk ManagementMystiquemashalBelum ada peringkat

- Accounitng Equation Some Basic Understanding: Assets Liabilities Equity +Dokumen5 halamanAccounitng Equation Some Basic Understanding: Assets Liabilities Equity +MystiquemashalBelum ada peringkat

- Assume You Are Having A Bank Account and Didn'T Maintain Any Record of The Transactions You Made What Will Happen ?Dokumen8 halamanAssume You Are Having A Bank Account and Didn'T Maintain Any Record of The Transactions You Made What Will Happen ?MystiquemashalBelum ada peringkat

- Accounting CycleDokumen12 halamanAccounting CycleMystiquemashalBelum ada peringkat

- Johnson & Jhonson Case StudyDokumen8 halamanJohnson & Jhonson Case StudyMystiquemashalBelum ada peringkat

- ECommerce Marketing Technologies and CommuncationsDokumen34 halamanECommerce Marketing Technologies and CommuncationsMystiquemashalBelum ada peringkat

- Branches of AccountingDokumen12 halamanBranches of AccountingMystiquemashalBelum ada peringkat

- Stats and MathsDokumen29 halamanStats and MathsMystiquemashalBelum ada peringkat

- LECTURE 1 LeadershipDokumen27 halamanLECTURE 1 LeadershipMystiquemashalBelum ada peringkat

- Chapter# 8 (Page# 300) Mathematics of FinanceDokumen8 halamanChapter# 8 (Page# 300) Mathematics of FinanceMystiquemashalBelum ada peringkat

- Dessler Hrm12ge PPT 11Dokumen53 halamanDessler Hrm12ge PPT 11Mystiquemashal100% (1)

- Chap 005Dokumen52 halamanChap 005MystiquemashalBelum ada peringkat

- Dessler Hrm12ge PPT 13Dokumen40 halamanDessler Hrm12ge PPT 13MystiquemashalBelum ada peringkat

- Dessler HRM PPT 09Dokumen45 halamanDessler HRM PPT 09Mystiquemashal100% (1)

- Chap 006 Managerial Accounting HiltonDokumen48 halamanChap 006 Managerial Accounting Hiltonkaseb0% (1)

- Basic Cost Management Concepts and Accounting For Mass Customization OperationsDokumen52 halamanBasic Cost Management Concepts and Accounting For Mass Customization Operationspalak32Belum ada peringkat

- Annd Rice MillDokumen54 halamanAnnd Rice MillGreatAkx100% (1)

- Procedures For International FundingDokumen2 halamanProcedures For International FundingHeart FrozenBelum ada peringkat

- Change Your Life PDF FreeDokumen51 halamanChange Your Life PDF FreeJochebed MukandaBelum ada peringkat

- GovAcc HO No. 2 - The Philippine Budget CycleDokumen9 halamanGovAcc HO No. 2 - The Philippine Budget Cyclebobo kaBelum ada peringkat

- Acc 411 Principles of AuditingDokumen95 halamanAcc 411 Principles of Auditingbenard kibet legotBelum ada peringkat

- 1 Villaroel v. EstradaDokumen2 halaman1 Villaroel v. EstradaNinaBelum ada peringkat

- Company Secretarial Practice - Part B - (E-Forms) PDFDokumen721 halamanCompany Secretarial Practice - Part B - (E-Forms) PDFAnonymous 5Hgrr4Q8JBelum ada peringkat

- Kausar AlamDokumen1 halamanKausar AlamVenu Gopal RaoBelum ada peringkat

- Kipley Pereles' Resume - ConcordiaDokumen2 halamanKipley Pereles' Resume - ConcordiaKipley_Pereles_5949Belum ada peringkat

- 2014-VII-1&2 NilimaDokumen13 halaman2014-VII-1&2 NilimaAPOORVA GUPTABelum ada peringkat

- Insurance Types Importance Objective Alternative Takaful Feature of Takaful, Re Insurance, Takaful WorldwideDokumen11 halamanInsurance Types Importance Objective Alternative Takaful Feature of Takaful, Re Insurance, Takaful WorldwideMD. ANWAR UL HAQUEBelum ada peringkat

- LCCI Level 3 - Advanced Business Calculations (Exam Kit)Dokumen332 halamanLCCI Level 3 - Advanced Business Calculations (Exam Kit)BethanyBelum ada peringkat

- NpaDokumen22 halamanNpaDeepika VermaBelum ada peringkat

- PDD Accounting For Bad Debts and Writeoffs (BDAR2160)Dokumen37 halamanPDD Accounting For Bad Debts and Writeoffs (BDAR2160)SRDBelum ada peringkat

- TVM Stocks and BondsDokumen40 halamanTVM Stocks and Bondseshkhan100% (1)

- Mike BarnsDokumen28 halamanMike BarnsSiraj KuvakkattayilBelum ada peringkat

- A Practical Guide To GST (Chapter 15 - Transition To GST)Dokumen43 halamanA Practical Guide To GST (Chapter 15 - Transition To GST)Sanjay DwivediBelum ada peringkat

- DP HCM (MATHS) Printable PDFDokumen81 halamanDP HCM (MATHS) Printable PDFAarzoo RatheeBelum ada peringkat

- Quiz 2Dokumen9 halamanQuiz 2yuvita prasadBelum ada peringkat

- DiversificationDokumen8 halamanDiversificationambulahbdugBelum ada peringkat

- Financial Analysis Statement Solution IncompleteDokumen9 halamanFinancial Analysis Statement Solution IncompleteJerome BaluseroBelum ada peringkat

- Internal Control Reviewer3Dokumen12 halamanInternal Control Reviewer3Lon DiazBelum ada peringkat

- Declaration by Salaried Persons To Be Submitted To The Employer by The EmployeeDokumen4 halamanDeclaration by Salaried Persons To Be Submitted To The Employer by The EmployeeM. AamirBelum ada peringkat

- TEST-24: VisionDokumen64 halamanTEST-24: VisionSanket Basu RoyBelum ada peringkat

- HSBC ProjectDokumen48 halamanHSBC ProjectPooja MishraBelum ada peringkat

- Example: Currency Forward ContractsDokumen23 halamanExample: Currency Forward ContractsRenjul ParavurBelum ada peringkat

- TaxationnnnDokumen12 halamanTaxationnnnRenji kleinBelum ada peringkat

- Yes Bank Annual Report 2011-12Dokumen204 halamanYes Bank Annual Report 2011-12shah1703Belum ada peringkat

- Hatch Final ReportDokumen47 halamanHatch Final ReportJennifer UrsuaBelum ada peringkat