Topic 4 Central Bank (BNM)

Diunggah oleh

Ing HongHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Topic 4 Central Bank (BNM)

Diunggah oleh

Ing HongHak Cipta:

Format Tersedia

CENTRAL

BANK

1

STRUCTURE OF CENTRAL BANKS:

MALAYSIA

2

BANK NEGARA MALAYSIA

Established on 26 January 1959, under the Central

Bank of Malaya Ordinance, 1958

The CBA 1958 has been repealed by the Central

Bank of Malaysia Act 2009 which became effective

on 25 November 2009.

It is a statutory body wholly owned by the

Government of Malaysia with the paid-up capital

progressively increased, currently at RM100 million.

The Bank reports to the Minister of Finance,

Malaysia and keeps the Minister informed of matters

pertaining to monetary and financial sector policies.

3

The Need for Central Bank

Maintaining generally low and stable inflation for decades

Thereby, preserving the purchasing power of the ringgit.

Prudent conduct of

monetary policy

Fostering a sound and progressive financial sector. Financial system stability

Developing financial system infrastructure with major emphasis

placed on building the nation's efficient and secured payment

systems

Developing the necessary institutions (including Securities

Commission, Bursa Malaysia and Credit Guarantee

Corporation)

Developmental role

Improving access to financial services for all economic sectors

and segments of society,

Promotes financial

inclusion

Advising on macroeconomic policies and managing the public debt.

Issuing currency

Managing the country's international reserves.

Banker and adviser to the

Government

4

OBJECTIVES

Stable economic

growth

High level of

employment

Stability in the

Ringgits purchasing

power

Eradication of

poverty

Restructuring of

society

Rising living

standard

Reasonable position

in the countrys

balance of

payments

5

FUNCTIONAL AREAS

Economics &

Monetary

Policy

Investment and

operations

Regulation

Payment

System

Supervision

Organizational

Development

Communication

6

FUNCTIONAL AREAS

Economics & Monetary Policy

Primarily provides good technical and research support on growth-related issues to enhance

formulation of monetary and credit policies in promoting monetary stability and ensuring the

availability of adequate credit to finance economic growth.

Investment and operations

Manage domestic liquidity and exchange rates to ensure that monetary policy targets are

achieved as well as managing external reserves to safeguard its value and optimise its returns. It

also has the responsibility of providing advice and assistance to the Government in the area of

debt and fund management and contributing to domestic financial market development.

Regulation

Promote financial sector stability through the progressive development of sustainable, robust and

sound financial institutions and financial infrastructure, thus enabling a competitive local financial

industry to be resilient against the changing future environment as well as leads initiatives to

enhance access to financing. It also formulates and implements policies and strategies towards

building and positioning Malaysia as a premier integrated Islamic Financial Centre and enhance

the financial capability of consumers.

7

FUNCTIONAL AREAS

Payment systems

Develop policies and strategies to promote reliable, secure and efficient clearing, settlement and

payment systems in the country.

Supervision

Develop, enhance and implement an effective surveillance framework to ensure safety and

soundness of financial institutions and to enforce sound practices in them.

Organisational development

Spearhead the Bank's strategic management, organisational-performance management and

programme management functions to drive its performance-improvement processes and

strengthening the capacity building of the Bank. It also leads and drives human resources

initiatives and other strategic activities to ensure that the overall Human Capital Management

framework is implemented effectively.

Communications

The communications function has assumed increasing importance in response to the heightened

demands of the various stakeholders, seeking greater transparency and disclosure.

8

FUNCTIONS OF BNM

Banker for

Currency Issues

Keeper of

International

Reserves

Government

Banker and

Financial Advisor

Monetary Policy Banker to Banks

9

FUNCTIONS OF THE BNM

Bank for Currency Issue

Authority under Part III of Central Bank of Malaysia Ordinance

(CBO)1958

Under the Malaysian Currency (Ringgit) Act 1978, the Malaysian

currency is renamed as Ringgit and Sen respectively

The par value of Malaysian Ringgit was defined as equivalent to

0.290299 grams of fine gold

Under Part IV of the CBO, the currency is required to have a

minimum cover of 80.59% in gold and foreign exchange

In practice, BNM maintains an external asset cover well above

100% of its current liabilities

10

Functions of the BNM

Keeper of International Reserves

BNMs international reserves comprise of gold, foreign exchange, reserve

position with the International Monetary Fund (IMF) and holdings of

Special Drawing Rights (SDR)

As at May 2005, the net international resources stood at RM284.5 billion,

sufficient to finance 8.2 months of retained imports of the country

Since 21 June 1973, government adopt currency arrangement to allow

Ringgit to float upwards to ensure the basic strength of Malaysian Ringgit

to be reflected in the international exchanges, and the gold regime was

abolished

From 27 September 1975, the external value of RM has been determined

in terms of a composite basket comprising of the currencies of major

trading partner of Malaysia, and the principal currencies used in external

settlements

11

FUNCTIONS OF THE BNM

Government Banker and Financial Advisor

Act as banker, fiscal agent and financial advisor

Manage liquidity at source and ensure governments

expenditure patterns is in line with BNMs action to manage

liquidity in the banking system

Additional measure to ensure that government does not opt

for deficit financing

As fiscal agent, BNM acts on behalf of government for its

public loan program, including raising the internal and

external loans and debt management

12

FUNCTIONS OF THE BNM

Responsibility for Monetary Policy

Promoting monetary stability and sound

financial structure and influencing the credit

situation to help achieving the nations overall

economic objectives

Management of banking system to avoid

systemic failure

13

FUNCTIONS OF THE BNM

Banker to the Banks

Promote sound financial structure

Licensing of banks and non banks

Banking relationship

Currency distribution

Inspection and investigation of banks and non

banks

Lender of last resort

14

Financial Services Act 2013 (FSA) and

Islamic Financial Services Act 2013 (IFSA)

Gazette March 2013 and to be in-force in mid-

2013

When?

To replace IBA 1983, BAFIA 1989, Exchange

Control Act 1953, Takaful Act 1984, Insurance

Act 1996 and Payment Systems Act 2003

Why?

Facilitate and catalyze Malaysias transition

towards becoming a high value-added, high

income economy

How?

15

Purposes:

Firstly, the legislation better supports effective regulation and supervision in

anticipation of a more sophisticated and expanding financial system.

Secondly, it maintains a clear focus on risk and fair conduct towards consumers,

while allowing for differentiation between financial institutions. This in turn

supports healthy competition and productive innovation in the financial sector.

Thirdly, as the financial sector becomes more open and inter-connected with the

regional and global financial systems, it ensures that the financial sector activities

continues to support and positively contribute to the Malaysian economy

16

Financial Services Act 2013 (FSA) and

Islamic Financial Services Act 2013 (IFSA)

Source: http://www.themalaysianinsider.com/litee/business/article/bank-negara-forges-ahead-with-initiative-to-strengthen-financial-sector/

ADMINISTERED LEGISLATIONS

Central Bank of

Malaysia Act 2009

BAFIA 1989

Islamic Banking

Act 1983

Insurance Act 1996

Exchange Control

Act 1953

Takaful Act 1984

Development

Financial

Institution Act

2002

AMLA 2001

Payment System

Act 2003

Money Changing

Act 1998

17

ADMINISTERED LEGISLATION

Central Bank of Malaysia Act 2009

An Act to provide for the continued existence of the Central Bank of

Malaysia and for the administration, objects, functions and powers of

the Bank, for consequential or incidental matters.

Banking and Financial Institutions Act 1989 (BAFIA)

An Act to provide new laws for the licensing and regulation of

institutions carrying on banking, finance company, merchant banking,

discount house and money-broking businesses, for the regulation of

institutions carrying on certain other financial businesses, and for

matters incidental thereto or connected therewith. Incorporating Latest

Amendments up to Act A1256/2005 - cif : 1 Apr. 2006

18

ADMINISTERED LEGISLATION

Exchange Control Act 1953

An Act to confer powers, and impose duties and restrictions in relation to gold,

currency, payments, securities, debts, and the import, export, transfer and settlement

of property, and for purposes connected with the matters aforesaid. Incorporating

Latest Amendments up to Act A1241/2005 - cif : 1 Jan. 2007

Islamic Banking Act 1983

An Act to provide for the licensing and regulation of Islamic banking business.

Incorporating Latest Amendments up to Act A1307/2007 - cif : 31 July 2007

Insurance Act 1996

An Act to provide new laws for the licensing and regulation of insurance business,

insurance broking business, adjusting business and financial advisory business and for

other related purposes. Incorporating Latest Amendments up to Act A1247/2005 - cif :

1 Jan. 1997

19

ADMINISTERED LEGISLATION

Takaful Act 1984

An Act to provide for the regulation of takaful business in Malaysia and for other

purposes relating to or connected with takaful. Incorporating Latest Amendments

up to Act A1306/2007 - cif : 31 July 2007

Development Financial Institutions Act 2002 (Act 618)

The DFIA which came into force on 15 February 2002 focuses on promoting the

development of effective and efficient development financial institutions (DFIs) to

ensure that the roles, objectives and activities of the DFIs are consistent with the

Government policies and that the mandated roles are effectively and efficiently

implemented. DFIA also emphasises on efficient management and effective

corporate governance, provides a comprehensive supervision mechanism and

mechanism to strengthen the financial position of DFIs through the specification

of prudential requirements. Incorporating Latest Amendments up to

PU(A)285/2007 - cif : 31 August 2007

20

ADMINISTERED LEGISLATION

Anti-Money Laundering and Anti-Terrorism Financing Act 2001 (Act 613)

This renamed and revised Act which came into force on 15 January 2002, is to provide for the

offence of money laundering, the measures to be taken for the prevention of money laundering

and terrorism financing offences and to provide for the forfeiture of terrorist property and property

involved in, or derived from, money laundering and terrorism financing offences, and for matters

incidental thereto and connected therewith. Incorporating Latest Amendments up to

PU(A) 400/2009 cif : 13 November 2009

Payment Systems Act 2003 (Act 627)

An Act to make provisions for the regulation and supervision of payment systems and payment

instruments and for matters connected therewith. Came into force on 1 Nov 2003.

Money-Changing Act 1998 (Act 577)

An Act to provide for the licensing and regulation of money-changing business and for other

matters related thereto. Incorporating Latest Amendments up to PU(A) 237/2006 - cif : 21 Jul

2006

21

to regulate the operation and conducts of financial institutions,

including discount houses, and money and FOREX brokers

The Need for BAFIA

to monitor and control financial institutions more effectively with the aim

of ensuring a stronger and more stable financial system

Powers of Supervision

Non-adherence to the law could result in serious criminal violation of

law where prosecutors will seek criminal sanctions against the bank.

BAFIA provides for Scheduled Offences and Penalties as set out in the

Fourth Schedule. This includes jail term and fines

Consequences of

Breaches

22

Banking and Financial Institutions Act 1989

(Amendment 2010)

Salient Features

The licensing of banks and other

financial institutions [Part III];

Restrictions in respect to deposits

[Part IV];

Requirements for maintaining

reserve fund, capital funds, liquid

assets, and the furnishing of

financial information [Part VII];

Restrictions on business of

licensed institutions, such as the

prohibition of credit facilities to

directors or officers of the licensed

institutions as contained in Section

62 of BAFIA [Part IX];

Powers of supervision and control

over licensed institutions [Part X];

Licensed institutions duty of

secrecy as laid down in Section 97

of BAFIA and the circumstances in

which disclosure of confidential

information are required or

permitted under Section 99 of

BAFIA [Part XIII].

23

Institutions Under BAFIA

Licensed Institutions

Commercial banks, merchant banks, finance companies, discount houses, money

brokers and foreign exchange brokers

Scheduled Institutions

Major non bank sources of credit and finance, including issuers of charge/ credit cards

and travelers checks, operators of cash dispensing machines, development financial

institutions, building societies and housing credit institutions, factoring companies and

leasing companies

Others are representative offices of foreign banks or foreign institutions, with similar

activities of scheduled institutions

Non Scheduled Institutions

Other statutory bodies and institutions involved in the provisions of finance and credit

24

Major Provisions in BAFIA

Deposit taking

Powers and Duties

of Auditors

Shareholding

Powers of

Investigation,

Search and Seizure

Secrecy

Electronic Fund

Transfer

Penalties Local Incorporation

25

BASEL III

"Basel III" is a comprehensive set of reform measures, developed by the Basel

Committee on Banking Supervision, to strengthen the regulation, supervision and risk

management of the banking sector.

These measures aim to:

improve the banking sector's ability to absorb shocks arising from financial and economic stress, whatever the source

improve risk management and governance

strengthen banks' transparency and disclosures.

The reforms target:

bank-level, or microprudential, regulation, which will help raise the resilience of individual banking

institutions to periods of stress.

macroprudential, system wide risks that can build up across the banking sector as well as the

procyclical amplification of these risks over time.

These two approaches to supervision are complementary as greater resilience at the

individual bank level reduces the risk of system wide shocks.

26

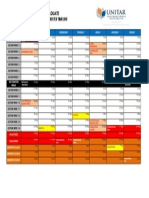

http://www.bis.org/bcbs/basel3/b3summarytable.pdf

27

IMPACT OF BASEL III REQUIREMENT

TO BANKS IN MALAYSIA

28

CAMEL Framework

CAMEL

C = Capital

Adequacy

Framework

A = Asset

Quality

M =

Management

E = Earning

Capacity

L = Liquidity

Framework

29

CAMEL Rating Frameworks

C

Capital

Adequacy

Support ups and

downs of

business to

finance the fixed

assets

Cushion on

unexpected

losses

Continuing

commitment of

shareholders

30

The Importance of Capital Adequacy

Framework

31

BNM: Capital Adequacy Framework

The Capital Adequacy Framework sets out the approach

for computing regulatory capital adequacy ratios, as well

as the levels of those ratios at which banking institutions

are required to operate.

The framework has been developed based on

internationally-agreed standards on capital adequacy

promulgated by the Basel Committee on Banking

Supervision (BCBS).

32

Source: Bank Negara Malaysia

33

CET1

Fully paid up and

permanently viable

Freely available

and not earmarked

a particular asset

of banking

activities

Ability to absorb

losses occurring in

the course of

ongoing business

Represents no

fixed charge on

the earnings of an

institutions

34

BNM: Capital Adequacy Framework

Risk Weighted Capital Adequacy Framework (RWCR)

35

CAMEL Rating Frameworks

A

Asset

Quality

Poor credit

evaluation

Connected

lending to

directors or

staff

Criminal

breach of trust

Risk

diversification

36

CAMEL Rating Frameworks

M

Management

Integrity

Professional

competence

Qualities of Service

37

Earning Capacity

Interest

Income

Interest

Expenses

Non Interest

Income/ Off

Balance

Sheet

Activities

38

CAMEL Rating Frameworks

39

CAMEL Rating Frameworks

L: LIQUIDITY FRAMEWORK

40

CAMEL Rating Frameworks

L: LIQUIDITY FRAMEWORK

Two-Tier Regulatory System

Shareholders funds (Net investment in subsidiaries) of

RM500 million by end-1995

Shareholders funds (Net investment in subsidiaries) of

RM500 million by end-1998

Paid up capital of RM1 billion by end 2000

Tier-I Status:

Commercial

Banks

Minimum capital requirement for Tier-I merchant bank is

RM250 million, and finance companies of RM300 million

By end of 1998, Tier-I merchant banks and finance

companies are required to have shareholders funds of

RM500 millions and RM600 millions respectively

Tier-I Status:

Merchant Banks

and Finance

Companies

41

THE BNM BALANCE SHEET

Referred to as monetary liability, are currency in circulation

and reserves.

Important part in money supply as increases in both or either

will lead to increase in the money supply (everything else

being constant).

Monetary Base is the sum of BNMs Monetary Liabilities

(currency in circulation, reserves, coins).

Liabilities

Comprised of government securities and discount loans.

Important component because of:

Changes in asset items leads to changes in reserves and

consequently changes in the money supply.

The assets earn interest while the liabilities do not.

Assets

42

MONETARY POLICY AND THE

ECONOMY

Principle objectives of monetary policy is to promote monetary

stability and sound financial system

The BNM plays a key role of overall macroeconomic policy and

the final objectives, primarily to regulate money supply in

circulation and the credit supply in the economy

Monetary policy tools are categorized into two:

general instruments

selective instruments

43

Monetary Instruments

General Instruments: Influence the level of bank reserves or

high powered money

Variations in the statutory reserve requirements (SRR)

Adjustment in the liquidity ratio

Money Market Operations

Selective Instruments: Influence credit to a particular sub-sector

or type of lending

Priority sector lending guidelines, e.g. SME

Hire purchase guidelines on motor vehicles

Credit cards operations guidelines

Credit limit for financing specific types of property

44

MONETARY POLICYS TOOLS

Interbank

Rate

Reserve

Requirement:

SRR and Liquidity

Open

Market

Operations

45

STATUTORY RESERVE REQUIREMENTS

(SRR)

Defined in terms of a banks eligible liabilities (EL), comprises of deposits

(including NCDs and REPOs) and net interbank borrowings.

Purpose

Instrument to control volume of deposits and loans that a bank support given a size of its reserves

Monetary management tool

Discussion:

Bank Negara Malaysia (BNM) yesterday maintained the Overnight Policy Rate (OPR) at 3.00% at its

fifth Monetary Policy Committee (MPC) meeting of the year. The Statutory Reserve Requirement (SRR)

was also left at 4%. We see no change in the OPR at the final MPC meetings of the year on 8 Nov, and

expect this level to stay for most of 2013. What is your expectation of the prevailing interest rates in

the market? Discuss.

46

STATUTORY RESERVE REQUIREMENTS

(SRR)

Implications

Cost of funds to banking institutions

Inequality issues among FIs

Disruption in forward planning

Announcement effect of SRR adjustment has a very

powerful effect in influencing the psychology of economic

agents and market participants

47

LIQUIDITY REQUIREMENTS

Expressed as Eligible Liability (EL) base of the banking

institutions

Reasons for imposition

Ensure that banking institutions are liquid

Selective credit policy to encourage direct credit to desired areas

Ensure continuous and ready financing of governments development

project

Monetary instrument to influence liquidity situation in the banking system

48

Components of Liquid Assets

Cash

Clearing Balances with BNM

Money at Call

Cash and Cash

Equivalence

Treasury Bills

Bank Negara Bills

Bills Discounted or Purchased

Bank Negara Certificates

Government Investment Certificates

State Government Certificates

Short-term Bills

Government Securities

Cagamas Bonds

Medium Term

49

Forces that Affect Flow of Money and Credit in the Economy

Central Bank Business Plans

Flow of international

trade

Distribution of

income and

allocation of income

Government

Budgetary Policies

50

MONETARY POLICY STRATEGY

Monetary

targeting

Inflation

targeting

51

MONETARY TARGETING

The Central Bank (CB) announces that it will achieve a certain value

(the target) of the annual growth of a monetary aggregate, such as

5% growth for M1, and CB is accountable to achieve the target

Types of targets:

Intermediate targets, such as monetary aggregates and interest rates, which will

have direct effect on the goals chosen.

Operating targets are another set of variables such as reserve aggregates, which

are more responsive to the tools chosen will then be aimed at.

By using intermediate and operating targets, CB can judge more

quickly whether its policies are on the right track, rather than waiting

until it sees final outcome.

52

INFLATION TARGETING

Countries

are

adopting

inflation

targeting

as

monetary

policy

strategy

to

achieve

price

stability

Elements:

Public

announcement

of medium

term numerical

targets for

inflation

Institutional

commitment to

price stability

as the primary,

long run goal

of monetary

policy and a

commitment to

achieve the

inflation goal

An information

inclusive

approach to

include many

variables aside

from monetary

aggregate in

deciding for

monetary

policy

Increased

transparency

of the

monetary

policy strategy

through

communication

with the public

and the

markets about

the plans and

the objectives

of monetary

policymakers

Increased

accountability

of the CB for

attaining its

inflation

objectives

53

INFLATION TARGETING

Advantages Disadvantages

Transparency and highly understood by the public

on regular communication

Delayed signaling outcomes are revealed after a

long lag

Increases accountability of the CB reduce

likelihood of CB of pushing for overly expansionary

monetary policy of expanding output and

employment in the short run

Too much rigidity imposes rigid rule on monetary

policymakers, and limit their abilities to respond to

unforeseen circumstances

Reduce political pressure on CB by pointing out that

CB can control inflation in the long run but not

increase growth and number of jobs

Potential for increased output fluctuations target

level should be 2% or higher

Low economic growth low growth in output and

employment

54

CHANGING FINANCIAL LANDSCAPE

Rapid development

of deeper and

broader securities

market

Consolidation of

financial

institutions

Broader range of

financial products

and services

Growth of Islamic

banking and

Islamic bond

market

Increasing global

integration

55

Issues in Financial Markets and Institutions

BNMs Perspective

Interest Rates

and Regulation

Increase/

Decrease in

Reserves

BLR, BFR,

OPR

BAFIA

1989,

BASEL II

Securities Exchange Act 1996

Risk

Default Risk

Liquidity

Risk

Operational

Risk

Others

Transaction

Costs

Asymmetric of Information Peach vs.

Lemon

Adverse Selection

Moral Hazard

Conflict of Interest/ Agency Theory

56

Anda mungkin juga menyukai

- Bank Negara Malaysia & Financial SystemDokumen27 halamanBank Negara Malaysia & Financial SystemNatashaHaziqahBelum ada peringkat

- Monetary Policy: Aira Mae Nueva Jhessanie PinedaDokumen43 halamanMonetary Policy: Aira Mae Nueva Jhessanie PinedaMAWIIIBelum ada peringkat

- HUM 2107: Engineering Economics: Fiscal and Monetary PolicyDokumen10 halamanHUM 2107: Engineering Economics: Fiscal and Monetary PolicyAshrafi ChistyBelum ada peringkat

- The International Financial Environment: Multinational Corporation (MNC)Dokumen30 halamanThe International Financial Environment: Multinational Corporation (MNC)FarhanAwaisiBelum ada peringkat

- Non Banking Financial InstitutionDokumen23 halamanNon Banking Financial InstitutionAnonymous oH0BGYqBelum ada peringkat

- Insider Trading: Laws and CasesDokumen24 halamanInsider Trading: Laws and CasesharshitBelum ada peringkat

- Lecture 5Dokumen49 halamanLecture 5premsuwaatiiBelum ada peringkat

- Banker and Customer Relationship PDFDokumen25 halamanBanker and Customer Relationship PDFaaditya01Belum ada peringkat

- Venture Capital FinalDokumen26 halamanVenture Capital Finalaarzoo dadwalBelum ada peringkat

- Pricing Decisions - MCQsDokumen26 halamanPricing Decisions - MCQsMaxwell;Belum ada peringkat

- An Introduction To Asset Pricing Models: Questions To Be AnsweredDokumen45 halamanAn Introduction To Asset Pricing Models: Questions To Be AnsweredEka Maisa YudistiraBelum ada peringkat

- Chapter 2 - Statement of Cash FlowsDokumen23 halamanChapter 2 - Statement of Cash FlowsCholophrex SamilinBelum ada peringkat

- EBT Market: Bonds-Types and CharacteristicsDokumen25 halamanEBT Market: Bonds-Types and CharacteristicsKristen HicksBelum ada peringkat

- CHAPTER 3 Investment Information and Security TransactionDokumen22 halamanCHAPTER 3 Investment Information and Security TransactionTika TimilsinaBelum ada peringkat

- International Financial PPT PpresentationDokumen41 halamanInternational Financial PPT PpresentationSambeet ParidaBelum ada peringkat

- 426 Chap Suggested AnswersDokumen16 halaman426 Chap Suggested AnswersMohommed AyazBelum ada peringkat

- Chapter 1Dokumen213 halamanChapter 1Annur SofeaBelum ada peringkat

- CH12 Mish11 EMBFMDokumen40 halamanCH12 Mish11 EMBFMBradley Ray100% (1)

- What Are The Main Advantages and Disadvantages of Fixed Exchange RatesDokumen4 halamanWhat Are The Main Advantages and Disadvantages of Fixed Exchange RatesGaurav Sikdar0% (1)

- Answer:: ch07: Dealing With Foreign ExchangeDokumen10 halamanAnswer:: ch07: Dealing With Foreign ExchangeTong Yuen ShunBelum ada peringkat

- Emerging trends in global marketsDokumen54 halamanEmerging trends in global marketsChandan AgarwalBelum ada peringkat

- Untitled 1Dokumen3 halamanUntitled 1cesar_mayonte_montaBelum ada peringkat

- Techniques For Managing ExposureDokumen26 halamanTechniques For Managing Exposureprasanthgeni22100% (1)

- Key Financial System RolesDokumen2 halamanKey Financial System RolesLinusChinBelum ada peringkat

- The Cost of Capital: All Rights ReservedDokumen56 halamanThe Cost of Capital: All Rights ReservedANISA RABANIABelum ada peringkat

- Macro Economic Policy, Monetary and Fiscal PolicyDokumen48 halamanMacro Economic Policy, Monetary and Fiscal Policysujata dawadiBelum ada peringkat

- Organization Structure and Design: OrganizingDokumen57 halamanOrganization Structure and Design: OrganizingKiệt HuỳnhBelum ada peringkat

- CH 1 - Scope of International FinanceDokumen7 halamanCH 1 - Scope of International Financepritesh_baidya269100% (3)

- FIN 420 Chapter 9 (Long Term Financing)Dokumen17 halamanFIN 420 Chapter 9 (Long Term Financing)Halim NordinBelum ada peringkat

- Risk and The Required Rate of ReturnDokumen31 halamanRisk and The Required Rate of Returngellie villarinBelum ada peringkat

- Introduction To Asset Pricing ModelDokumen8 halamanIntroduction To Asset Pricing ModelHannah NazirBelum ada peringkat

- Definition of Open Market OprationDokumen2 halamanDefinition of Open Market Oprationganeshkhale7052Belum ada peringkat

- Multiple Choice Questions & Answers: Banking LawDokumen2 halamanMultiple Choice Questions & Answers: Banking LawArun Kumar TripathyBelum ada peringkat

- Financial Insititutions and MarketsDokumen133 halamanFinancial Insititutions and MarketsVijay KumarBelum ada peringkat

- FX Risk Management Transaction Exposure: Slide 1Dokumen55 halamanFX Risk Management Transaction Exposure: Slide 1prakashputtuBelum ada peringkat

- FEMA REGULATION OF FOREIGN EXCHANGEDokumen31 halamanFEMA REGULATION OF FOREIGN EXCHANGEManpreet Kaur SekhonBelum ada peringkat

- Malaysian - Financial - System - Pdfmalaysian Financial SystemDokumen34 halamanMalaysian - Financial - System - Pdfmalaysian Financial Systemtrevorsum123100% (1)

- Ific BankDokumen95 halamanIfic BankAl AminBelum ada peringkat

- Foreign Exchange Risk ManagementDokumen12 halamanForeign Exchange Risk ManagementDinesh KumarBelum ada peringkat

- Compliance of AAOIFI Standards PDFDokumen13 halamanCompliance of AAOIFI Standards PDFHafij UllahBelum ada peringkat

- Inside JobDokumen5 halamanInside JobToobaZafar0% (1)

- Financial Services Act 2013 and Islamic Financial Services Act 2013 Come Into ForceDokumen3 halamanFinancial Services Act 2013 and Islamic Financial Services Act 2013 Come Into ForceDilawar AheerBelum ada peringkat

- Mortgage Backed SecuritiesDokumen3 halamanMortgage Backed SecuritiesLalit SapkaleBelum ada peringkat

- CHP 1 - Introduction To Merchant BankingDokumen44 halamanCHP 1 - Introduction To Merchant BankingFalguni MathewsBelum ada peringkat

- Lecture Notes2231 SCMDokumen57 halamanLecture Notes2231 SCMhappynandaBelum ada peringkat

- Break Even AnalysisDokumen28 halamanBreak Even Analysisrupa vidwajaBelum ada peringkat

- Conduct of Monetary Policy Goal and TargetsDokumen12 halamanConduct of Monetary Policy Goal and TargetsSumra KhanBelum ada peringkat

- The Service Quality ModelDokumen2 halamanThe Service Quality Modelvishalsharma127100% (1)

- FMTD - RIsk Management in BanksDokumen6 halamanFMTD - RIsk Management in Banksajay_chitreBelum ada peringkat

- Financial System and Financial MarketDokumen10 halamanFinancial System and Financial MarketPulkit PareekBelum ada peringkat

- The Structure of Financial System of BangladeshDokumen9 halamanThe Structure of Financial System of BangladeshHn SamiBelum ada peringkat

- 2839 Financial Globalization Chapter May30Dokumen45 halaman2839 Financial Globalization Chapter May30indiaholicBelum ada peringkat

- Evolution of Financial SystemDokumen12 halamanEvolution of Financial SystemGautam JayasuryaBelum ada peringkat

- Ch. 3 (Interest Rates) FMI (Mishkin Et Al) (8th Ed.) PDFDokumen43 halamanCh. 3 (Interest Rates) FMI (Mishkin Et Al) (8th Ed.) PDFRahul NagrajBelum ada peringkat

- Group 3 Financial MarketsDokumen17 halamanGroup 3 Financial MarketsLady Lou Ignacio LepasanaBelum ada peringkat

- Banking Sector Stability, Efficiency, and Outreach in Kenya: This Draft: August 2009 Executive SummaryDokumen36 halamanBanking Sector Stability, Efficiency, and Outreach in Kenya: This Draft: August 2009 Executive SummaryrajrudrapaaBelum ada peringkat

- Chapter 2Dokumen26 halamanChapter 2trevorsum123Belum ada peringkat

- Roles and Functions: Central Bank of Malaysia Act 2009Dokumen3 halamanRoles and Functions: Central Bank of Malaysia Act 2009Khairy IsmailBelum ada peringkat

- Country Dial CodesDokumen2 halamanCountry Dial CodesSandeshGiriBelum ada peringkat

- Convo Clearance Form-UNITAR 2015 PDFDokumen1 halamanConvo Clearance Form-UNITAR 2015 PDFIng HongBelum ada peringkat

- Proview Customer User Guide enDokumen31 halamanProview Customer User Guide enIng HongBelum ada peringkat

- Course Plan - BFB4123n BAFB4123InvAnalysisSept14 (Con)Dokumen5 halamanCourse Plan - BFB4123n BAFB4123InvAnalysisSept14 (Con)Ing HongBelum ada peringkat

- The Following Factors Must Be AddressedDokumen2 halamanThe Following Factors Must Be AddressedIng HongBelum ada peringkat

- Project Sept 2014Dokumen2 halamanProject Sept 2014Ing HongBelum ada peringkat

- Refund FormDokumen1 halamanRefund FormIng HongBelum ada peringkat

- The Disaster at Syarikat Zumaju Sdn. BHDDokumen1 halamanThe Disaster at Syarikat Zumaju Sdn. BHDIng HongBelum ada peringkat

- BWB3013 - Course Assignment Sep2013Dokumen6 halamanBWB3013 - Course Assignment Sep2013Ing HongBelum ada peringkat

- Course Plan - BAFB4103June14Dokumen3 halamanCourse Plan - BAFB4103June14Ing HongBelum ada peringkat

- Employee Engagement 2007 Report - ReviewDokumen34 halamanEmployee Engagement 2007 Report - ReviewPrity GiBelum ada peringkat

- Setting Up A Business in MalaysiaDokumen30 halamanSetting Up A Business in MalaysiaIng HongBelum ada peringkat

- UGQB 3163 Assignment Cover PYDokumen1 halamanUGQB 3163 Assignment Cover PYIng HongBelum ada peringkat

- Risk and Return Note 1Dokumen12 halamanRisk and Return Note 1Bikram MaharjanBelum ada peringkat

- Introduction To Research Feb2013Dokumen4 halamanIntroduction To Research Feb2013Ing HongBelum ada peringkat

- British CV ExampleDokumen1 halamanBritish CV ExamplehdbarazyBelum ada peringkat

- Evaluation RubricDokumen2 halamanEvaluation RubricIng HongBelum ada peringkat

- Problem Set Capital StructureQADokumen15 halamanProblem Set Capital StructureQAIng Hong100% (1)

- International Success Factors of Hollywood MoviesDokumen5 halamanInternational Success Factors of Hollywood MoviesIng HongBelum ada peringkat

- Marketing You "Learning by Doing" Is The Principle Upon Which 4-H Is FoundedDokumen10 halamanMarketing You "Learning by Doing" Is The Principle Upon Which 4-H Is FoundedrockeygreatBelum ada peringkat

- Dean List UNITAR-170214 - 062016Dokumen12 halamanDean List UNITAR-170214 - 062016Ing HongBelum ada peringkat

- BWB 3013 / BAWB 3013: Class Exercise Two: Constitutions of CompanyDokumen1 halamanBWB 3013 / BAWB 3013: Class Exercise Two: Constitutions of CompanyIng HongBelum ada peringkat

- Bachelor Local FeeDokumen1 halamanBachelor Local FeeIng HongBelum ada peringkat

- ReportDokumen2 halamanReportIng HongBelum ada peringkat

- British CV ExampleDokumen1 halamanBritish CV ExamplehdbarazyBelum ada peringkat

- UNITAR Undergraduate FEB 2014 Semester Timeline-020114 061352Dokumen1 halamanUNITAR Undergraduate FEB 2014 Semester Timeline-020114 061352Ing HongBelum ada peringkat

- UNIEC-User Guide For StudentsDokumen13 halamanUNIEC-User Guide For StudentsIng HongBelum ada peringkat

- ProblemSet Cash Flow Estimation QA1Dokumen13 halamanProblemSet Cash Flow Estimation QA1Ing Hong0% (1)

- s4 Shaping The MKT OfferingsDokumen87 halamans4 Shaping The MKT OfferingsIng HongBelum ada peringkat

- Bank PresentationDokumen5 halamanBank Presentationujjawalapawar49Belum ada peringkat

- Classification of Financial Services IndustryDokumen4 halamanClassification of Financial Services IndustryRiteshHPatelBelum ada peringkat

- Master Circular KCCDokumen16 halamanMaster Circular KCCVaibhav PandeyBelum ada peringkat

- Consumer LendingDokumen51 halamanConsumer LendingAvi ThakurBelum ada peringkat

- Thomson Lear Ning1267Dokumen40 halamanThomson Lear Ning1267Sammy Ben MenahemBelum ada peringkat

- DT Pai ContentsDokumen136 halamanDT Pai ContentsAnjali SharmaBelum ada peringkat

- Results & Discussion: Table - 1 Gross Profit Ratio Year Gross Profit Net Sales 100 RatioDokumen9 halamanResults & Discussion: Table - 1 Gross Profit Ratio Year Gross Profit Net Sales 100 RatioeswariBelum ada peringkat

- Silabus Islamic Finance and Management - Durham UniversityDokumen2 halamanSilabus Islamic Finance and Management - Durham Universitymuhammad taufikBelum ada peringkat

- UK Money Creation GuideDokumen2 halamanUK Money Creation Guidematts292003574Belum ada peringkat

- Analysis and Interpretation of Financial StatementsDokumen23 halamanAnalysis and Interpretation of Financial StatementsJohn HolmesBelum ada peringkat

- Credit and Credit Risk Analysis of Rupali Bank LimitedDokumen103 halamanCredit and Credit Risk Analysis of Rupali Bank LimitedSharifMahmud50% (2)

- Eurotel at Vivaldi: Euro Towers International IncDokumen29 halamanEurotel at Vivaldi: Euro Towers International IncReegan MasarateBelum ada peringkat

- CNH New HollandDokumen268 halamanCNH New Hollandmanuchauhan0% (1)

- Buffett's Alpha - Frazzini, Kabiller and PedersenDokumen45 halamanBuffett's Alpha - Frazzini, Kabiller and PedersenkwongBelum ada peringkat

- FIN111 Tutorial 4QDokumen2 halamanFIN111 Tutorial 4QKai YinBelum ada peringkat

- Financial Services ClassificationDokumen8 halamanFinancial Services ClassificationPari SavlaBelum ada peringkat

- 1 Managing Yield Spreads and Credit Risks Michael SchmidDokumen37 halaman1 Managing Yield Spreads and Credit Risks Michael SchmidvferretBelum ada peringkat

- A Beautiful Mind With A Big MouthDokumen328 halamanA Beautiful Mind With A Big MouthAbdul ArifBelum ada peringkat

- Obligations of The Bailor (Art 1946 - Art 1952)Dokumen2 halamanObligations of The Bailor (Art 1946 - Art 1952)ChristineMedrianoBelum ada peringkat

- Ific BankDokumen95 halamanIfic BankAl AminBelum ada peringkat

- Working Capital Managment ProjectDokumen48 halamanWorking Capital Managment ProjectArun BhardwajBelum ada peringkat

- Rice Mill - Detailed Project Report - 9t Per Hour - For Finance, Subsidy & Project Related Support Contact - 9861458008Dokumen50 halamanRice Mill - Detailed Project Report - 9t Per Hour - For Finance, Subsidy & Project Related Support Contact - 9861458008Radha Krishna Sahoo100% (2)

- PROJECT REPORT HIGHLIGHTSDokumen47 halamanPROJECT REPORT HIGHLIGHTSAkshay RautBelum ada peringkat

- Underrating Procedures of Mortgage Loan in Real Estate SectorDokumen19 halamanUnderrating Procedures of Mortgage Loan in Real Estate Sectornahidul202Belum ada peringkat

- Co-operative Society Credit ReportDokumen68 halamanCo-operative Society Credit ReportPanav MohindraBelum ada peringkat

- CH 1Dokumen55 halamanCH 1kamkdgBelum ada peringkat

- Role and Significance of InsuranceDokumen10 halamanRole and Significance of InsuranceRohit PadalkarBelum ada peringkat

- Banking ConceptsDokumen383 halamanBanking Conceptspurinaresh85Belum ada peringkat

- Working Capital ProjectDokumen100 halamanWorking Capital ProjectJithesh RajinivasBelum ada peringkat

- J.hull RIsk Management and Financial InstitutionsDokumen31 halamanJ.hull RIsk Management and Financial InstitutionsEric Salim McLaren100% (1)