Chapter 6

Diunggah oleh

dj_han85Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Chapter 6

Diunggah oleh

dj_han85Hak Cipta:

Format Tersedia

Worksheets List

Chapter 6, Page100

Chapter 6, Page101

Chapter 6, Page102

Chapter 6, Page103

Chapter 6, Page104

Chapter 6, Page105

Chapter 6, Page106

11-General Details

14- Months Lists

13-Parametrs and Calculations

15 - BS, P&L Level

16-Notes Lists

21-Trial Balance Data

Financial Ratio

Notes

Cash from Operating Activities

Net Income

Adjusted by:

Depreciation

Net cash provided by operating activities

Changes in Working Capital:

(Increase) Decrease in Current Assets:

Accounts receivable

Inventories

Prepaid expenses

Increase (Decrease) in Current Liabilities:

Line of Credit

Current Portion of Long-Term Debt

Accounts Payable

Accrued Expenses

Other Payables

Net changes in Working Capital

Net cash provided before investments & financing activities

Long Term Assets

(Increase) Decrease in fixed assets

(Increase) Decrease in other assets

Cash used (from) Long Term Assets

Long Term Liablilities

Increase (Decrease) in long term debts

Increase (Decrease) in capital

Cash from (used) liablilities and capiatal

Net Increase (Decrease) in Cash

Cash at the beginning of the year

Cash at the end of the year

Audit

The Formulas in row 48

Cash Flow Report

For the year ended December, 31 2003

XYZ Corporation Inc.

2003 2002

229,168 147,430

59,312 50,221

288,480 197,651

-115,064 -210,824

-26,040 -39,010

10,107 -1,774

-24,051 37,563

746 2,963

71,971 35,646

13,006 16,597

-7,687 2,020

-77,012 -156,819

211,468 40,832

-68,419 -78,836

-63,811 -26,457

-132,231 -105,293

-96,085 76,917

-726 11,447

-96,810 88,364

-17,573 23,903

318,697 294,795

301,124 318,697

301,124 318,697

=Cash =OFFSET(Cash,0,1)

Cash Flow Report

For the year ended December, 31 2003

XYZ Corporation Inc.

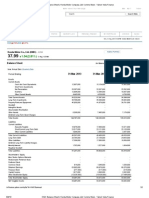

ASSETS Notes 2003 2002

Current Assets

Cash 5 301,124 318,697

Accounts Receivable 7 1,653,558 1,538,494

Inventories 8 546,173 520,133

Prepaid Expenses 9 13,552 23,659

Total Current Assets 2,514,407 2,400,983

Property and Equipment (at Cost) 10

Land & Building 674,019 677,191

Machinery and Equipment 386,140 326,052

Furniture and Fixtures 59,410 47,906

Total Property and Equipment 1,119,569 1,051,150

Less: Accumulated Depreciation (478,852) (419,540)

Net Book Value 640,717 631,610

Other Assets

Investment in Revenue Bond 11 364,321 300,260

Patents, Trademarks and Goodwill 12 52,250 52,500

Total Other Assets 416,571 352,760

TOTAL ASSETS 3,571,695 3,385,352

LIABILITIES AND STOCKHOLDER'S EQUITY

Current Liabilities

Line of Credit 476,783 500,834

Current Portion of Long-Term Debt 0 0

Accounts Payable 547,255 475,284

Accrued Expenses 234,296 221,291

Other Payables 19,250 26,937

Total Current Liabilities 1,277,585 1,224,345

Long-Term Liabilities

Note Payable 784,273 840,105

Equipment Leases Payable 185,459 224,965

Less: Current Portion Shown Above (40,252) (39,506)

Total Long-Term Liabilities 929,480 1,025,564

TOTAL LIABILITIES 2,207,064 2,249,909

Stockholder's Equity

Capital Stock 151,897 152,623

Retained Earnings 1,172,482 943,314

Total Stockholder's Equity 1,324,379 1,095,937

TOTAL LIABILITIES AND STOCKHOLDER'S EQUITY 3,531,443 3,345,846

December 31

XYZ Corporation Inc.

Balance Sheet

Notes 2003

Revenue 20

Sales 2,920,093

Services 955,214

Total Revenue 3,875,307

Cost of Goods Sold

Materials 854,521

Labor & Subcontractors Costs 602,125

Other Cost of goods sold 384,521

Increase / Decrease in Inventories 21 -26,040

Total Cost of Goods Sold 1,815,127

Gross Income 2,060,180

Operating Expenses

Selling 480,161

General & Administrative 22 758,542

Other Operating Expense 23 275,541

Depreciation 59,312

Total Operating Expenses 1,573,556

Net Income before Operations 486,624

Operating Income (Loss)

Other income (expense) 24 32,512

Interest expense 75,421

Total Operating Income 107,933

Income (Loss) Before Income Taxes 378,691

Provision (benefit) for income taxes 25 149,523

Net Income (Loss) for the year 229,168

Retained Earnings beginning of the year 26 943,314

Retained Earnings 1,172,482

XYZ Corporation Inc.

Income Statement

For the year ended December, 31 2003

2002

2,633,626

725,458

3,359,084

733,352

536,645

350,241

-30,254

1,589,984

1,769,100

441,256

675,992

260,887

50,221

1,428,356

340,744

-2,521

62,584

60,063

280,681

133,251

147,430

795,884

943,314

XYZ Corporation Inc.

Income Statement

For the year ended December, 31 2003

Notes

Cash from Operating Activities

Net Income

Adjusted by:

Depreciation

Net cash provided by operating activities

Changes in Working Capital:

(Increase) Decrease in Current Assets:

Accounts receivable

Inventories

Prepaid expenses

Increase (Decrease) in Current Liabilities:

Line of Credit

Current Portion of Long-Term Debt

Accounts Payable

Accrued Expenses

Other Payables

Net changes in Working Capital

Net cash provided before investments & financing activities

Long Term Assets

(Increase) Decrease in fixed assets

(Increase) Decrease in other assets

Cash used (from) Long Term Assets

Long Term Liablilities

Increase (Decrease) in long term debts

Increase (Decrease) in capital

Cash from (used) liablilities and capiatal

Net Increase (Decrease) in Cash

Cash at the beginning of the year

Cash at the end of the year

Audit

The Formulas in row 48

XYZ Corporation Inc.

Cash Flow Report

For the year ended December, 31 2003

2003 2002

229,168 147,430

59,312 50,221

288,480 197,651

-115,064 -210,824

-26,040 -39,010

10,107 -1,774

-24,051 37,563

746 2,963

71,971 35,646

13,006 16,597

-7,687 2,020

-77,012 -156,819

211,468 40,832

-68,419 -78,836

-63,811 -26,457

-132,231 -105,293

-96,085 76,917

-726 11,447

-96,810 88,364

-17,573 23,903

318,697 294,795

301,124 318,697

301,124 318,697

=Cash =OFFSET(Cash,0,1)

XYZ Corporation Inc.

Cash Flow Report

For the year ended December, 31 2003

Notes

Cash from Operating Activities

Net Income

Adjusted by:

Depreciation

Net cash provided by operating activities

Changes in Working Capital:

(Increase) Decrease in Current Assets:

Accounts receivable

Inventories

Prepaid expenses

Increase (Decrease) in Current Liabilities:

Line of Credit

Current Portion of Long-Term Debt

Accounts Payable

Accrued Expenses

Other Payables

Net changes in Working Capital

Net cash provided before investments & financing activities

Long Term Assets

(Increase) Decrease in fixed assets

(Increase) Decrease in other assets

Cash used (from) Long Term Assets

Long Term Liablilities

Increase (Decrease) in long term debts

Increase (Decrease) in capital

Cash from (used) liablilities and capiatal

Net Increase (Decrease) in Cash

Cash at the beginning of the year

Cash at the end of the year

Audit

The Formulas in row 48

XYZ Corporation Inc.

Cash Flow Report

For the year ended December, 31 2003

2003 2002

229,168 147,430

59,312 50,221

288,480 197,651

-115,064 -210,824

-26,040 -39,010

10,107 -1,774

-24,051 37,563

746 2,963

71,971 35,646

13,006 16,597

-7,687 2,020

-77,012 -156,819

211,468 40,832

-68,419 -78,836

-63,811 -26,457

-132,231 -105,293

-96,085 76,917

-726 11,447

-96,810 88,364

-17,573 23,903

318,697 294,795

301,124 318,697

301,124 318,697

=Cash =OFFSET(Cash,0,1)

XYZ Corporation Inc.

Cash Flow Report

For the year ended December, 31 2003

Notes

Cash from Operating Activities

Net Income

Adjusted by:

Depreciation

Net cash provided by operating activities

Changes in Working Capital:

(Increase) Decrease in Current Assets:

Accounts receivable

Inventories

Prepaid expenses

Increase (Decrease) in Current Liabilities:

Line of Credit

Current Portion of Long-Term Debt

Accounts Payable

Accrued Expenses

Other Payables

Net changes in Working Capital

Net cash provided before investments & financing activities

Long Term Assets

(Increase) Decrease in fixed assets

(Increase) Decrease in other assets

Cash used (from) Long Term Assets

Long Term Liablilities

Increase (Decrease) in long term debts

Increase (Decrease) in capital

Cash from (used) liablilities and capiatal

Net Increase (Decrease) in Cash

Cash at the beginning of the year

Cash at the end of the year

Audit

The Formulas in row 48

XYZ Corporation Inc.

Cash Flow Report

For the year ended December, 31 2003

2003 2002

229,168 147,430

59,312 50,221

288,480 197,651

-115,064 -210,824

-26,040 -39,010

10,107 -1,774

-24,051 37,563

746 2,963

71,971 35,646

13,006 16,597

-7,687 2,020

-77,012 -156,819

211,468 40,832

-68,419 -78,836

-63,811 -26,457

-132,231 -105,293

-96,085 76,917

-726 11,447

-96,810 88,364

-17,573 23,903

318,697 294,795

301,124 318,697

301,124 318,697

=Cash =OFFSET(Cash,0,1)

XYZ Corporation Inc.

Cash Flow Report

For the year ended December, 31 2003

Notes

Cash from Operating Activities

Net Income

Adjusted by:

Depreciation

Net cash provided by operating activities

Changes in Working Capital:

(Increase) Decrease in Current Assets:

Accounts receivable

Inventories

Prepaid expenses

Increase (Decrease) in Current Liabilities:

Line of Credit

Current Portion of Long-Term Debt

Accounts Payable

Accrued Expenses

Other Payables

Net changes in Working Capital

Net cash provided before investments & financing activities

Long Term Assets

(Increase) Decrease in fixed assets

(Increase) Decrease in other assets

Cash used (from) Long Term Assets

Long Term Liablilities

Increase (Decrease) in long term debts

Increase (Decrease) in capital

Cash from (used) liablilities and capiatal

Net Increase (Decrease) in Cash

Cash at the beginning of the year

Cash at the end of the year

Audit

The Formulas in row 48

XYZ Corporation Inc.

Cash Flow Report

For the year ended December, 31 2003

2003 2002

229,168 147,430

59,312 50,221

288,480 197,651

-115,064 -210,824

-26,040 -39,010

10,107 -1,774

-24,051 37,563

746 2,963

71,971 35,646

13,006 16,597

-7,687 2,020

-77,012 -156,819

211,468 40,832

-68,419 -78,836

-63,811 -26,457

-132,231 -105,293

-96,085 76,917

-726 11,447

-96,810 88,364

-17,573 23,903

318,697 294,795

301,124 318,697

301,124 318,697

=Cash =OFFSET(Cash,0,1)

XYZ Corporation Inc.

Cash Flow Report

For the year ended December, 31 2003

Company Name

Reports Date

Calander Year No Month Year End 5

XYZ Corporation Inc.

Yes

No

month

Number Months List

Quarter Number

Calander year

Quarter Number

Fiscal year

Quarter # -

Calander or

Fiscal Year

Fiscal Year

Number

1 January 31, 1998 1 3 3

2 February 28, 1998 1 3 3

3 March 31, 1998 1 4 4

4 April 30, 1998 2 4 4

5 May 31, 1998 2 4 4

6 June 30, 1998 2 1 1

7 July 31, 1998 3 1 1

8 August 31, 1998 3 1 1

9 September 30, 1998 3 2 2

10 October 31, 1998 4 2 2

11 November 30, 1998 4 2 2

12 December 31, 1998 4 3 3

13 January 31, 1999 1 3 3

14 February 28, 1999 1 3 3

15 March 31, 1999 1 4 4

16 April 30, 1999 2 4 4

17 May 31, 1999 2 4 4

18 June 30, 1999 2 1 1

19 July 31, 1999 3 1 1

20 August 31, 1999 3 1 1

21 September 30, 1999 3 2 2

22 October 31, 1999 4 2 2

23 November 30, 1999 4 2 2

24 December 31, 1999 4 3 3

25 January 31, 2000 1 3 3

26 February 29, 2000 1 3 3

27 March 31, 2000 1 4 4

28 April 30, 2000 2 4 4

29 May 31, 2000 2 4 4

30 June 30, 2000 2 1 1

31 July 31, 2000 3 1 1

32 August 31, 2000 3 1 1

33 September 30, 2000 3 2 2

34 October 31, 2000 4 2 2

35 November 30, 2000 4 2 2

36 December 31, 2000 4 3 3

37 January 31, 2001 1 3 3

38 February 28, 2001 1 3 3

39 March 31, 2001 1 4 4

40 April 30, 2001 2 4 4

41 May 31, 2001 2 4 4

42 June 30, 2001 2 1 1

43 July 31, 2001 3 1 1

44 August 31, 2001 3 1 1

45 September 30, 2001 3 2 2

46 October 31, 2001 4 2 2

47 November 30, 2001 4 2 2

48 December 31, 2001 4 3 3

49 January 31, 2002 1 3 3

50 February 28, 2002 1 3 3

51 March 31, 2002 1 4 4

52 April 30, 2002 2 4 4

53 May 31, 2002 2 4 4

54 June 30, 2002 2 1 1

55 July 31, 2002 3 1 1

56 August 31, 2002 3 1 1

57 September 30, 2002 3 2 2

58 October 31, 2002 4 2 2

59 November 30, 2002 4 2 2

60 December 31, 2002 4 3 3

61 January 31, 2003 1 3 3

62 February 28, 2003 1 3 3

63 March 31, 2003 1 4 4

64 April 30, 2003 2 4 4

65 May 31, 2003 2 4 4

66 June 30, 2003 2 1 1

67 July 31, 2003 3 1 1

68 August 31, 2003 3 1 1

69 September 30, 2003 3 2 2

70 October 31, 2003 4 2 2

71 November 30, 2003 4 2 2

72 December 31, 2003 4 3 3

73 January 31, 2004 1 3 3

74 February 29, 2004 1 3 3

75 March 31, 2004 1 4 4

76 April 30, 2004 2 4 4

77 May 31, 2004 2 4 4

78 June 30, 2004 2 1 1

79 July 31, 2004 3 1 1

80 August 31, 2004 3 1 1

81 September 30, 2004 3 2 2

82 October 31, 2004 4 2 2

83 November 30, 2004 4 2 2

84 December 31, 2004 4 3 3

85 January 31, 2005 1 3 3

86 February 28, 2005 1 3 3

87 March 31, 2005 1 4 4

88 April 30, 2005 2 4 4

89 May 31, 2005 2 4 4

90 June 30, 2005 2 1 1

91 July 31, 2005 3 1 1

92 August 31, 2005 3 1 1

93 September 30, 2005 3 2 2

94 October 31, 2005 4 2 2

95 November 30, 2005 4 2 2

96 December 31, 2005 4 3 3

97 January 31, 2006 1 3 3

98 February 28, 2006 1 3 3

99 March 31, 2006 1 4 4

100 April 30, 2006 2 4 4

101 May 31, 2006 2 4 4

102 June 30, 2006 2 1 1

103 July 31, 2006 3 1 1

104 August 31, 2006 3 1 1

105 September 30, 2006 3 2 2

106 October 31, 2006 4 2 2

107 November 30, 2006 4 2 2

108 December 31, 2006 4 3 3

MonthSelectionNumber 72

Calander Year No

Fiscal Year - month ending # 5

Datails

ComboBox Link &

Formulas

Cell Name Defined in

Column B

ComboBox month selection Number 72 MonthSelectionNumber

Reports Date December 31, 2003 ReportsDate

Reports Month Number 12 ReportsMonthNumber

Reports Year Number 2003 ReportsYearNumber

Fiscal Year No

Fiscal Year End month Number 5

Calander / Fiscal month list number 65 LastYearMonthListNumber

last Annual Year end report May 31, 2003 LastYearYearEnd

ComboBox MonthSelectionNumber

BS VS Annual 60 CompareMonthNumberBS

Reports Date December 31, 2002 ReportsDate

For the year ended For the year ended December, 31 2003

Quarters

Formula in Column B

ComboBox Cell Link

=INDEX(MonthsList,MonthSelectionNumber)

=MONTH(ReportsDate)

=YEAR(ReportsDate)

=CalanderYear

=FiscalYearMonthNumber

=IF(CalanderYear="yes",MonthSelectionNumber-

ReportsMonthNumber,MonthSelectionNumber-

IF(ReportsMonthNumber<B7,(ReportsMonthNumber+B7),

ReportsMonthNumber-B7))

=INDEX(MonthsList,LastYearMonthListNumber)

ComboBox Cell Link

=INDEX(MonthsList,CompareMonthNumberBS)

Level1 Level2 Level3

Assets Current Assets Cash

Assets Current Assets Accounts Receivable

Assets Current Assets Inventories

Assets Current Assets Other Current Assets

Assets Current Assets Prepaid Expenses

Assets Investments and other Assets Investment in Revenue Bond

Assets Investments and other Assets Patents, Trademarks and Goodwill

Assets Fixed Assets Land & Building

Assets Fixed Assets Machinery and Equipment

Assets Fixed Assets Furniture and Fixtures

Assets Fixed Assets Less: Accumulated Depreciation

Assets Fixed Assets Leasehold Improvements

Equity & Liabilities Current liabilities Current portion of long-term debt

Equity & Liabilities Current liabilities Accounts payable

Equity & Liabilities Current liabilities Accrued expenses - payroll

Equity & Liabilities Current liabilities Other accrued liabilities

Equity & Liabilities Current liabilities Income taxes payable

Equity & Liabilities Current liabilities Other current liabilities

Equity & Liabilities Long-term Liabilities Loans from financial institutions

Equity & Liabilities Long-term Liabilities Current Portion of Long-Term Debt

Equity & Liabilities Long-term Liabilities Equipment Leases Payable

Equity & Liabilities Long-term Liabilities Other long-term liabilities

Equity & Liabilities Long-term Liabilities Deferred tax liabilities

Equity & Liabilities Long-term Liabilities Pension fund loans

Equity & Liabilities Shareholders' Equity Capital Stock

Equity & Liabilities Shareholders' Equity Paid in Capital

Equity & Liabilities Shareholders' Equity Share Premium

Equity & Liabilities Shareholders' Equity Retained earnings

Equity & Liabilities Shareholders' Equity Net profit for the period

Profit & Loss Net Sales Sales

Profit & Loss Cost of Sales Cost of goods sold

Profit & Loss Expenses Research & Development

Profit & Loss Expenses Marketing

Profit & Loss Expenses General & Administration

Profit & Loss Expenses Amortization

Profit & Loss Non Operating Income Non Operating Income

Profit & Loss Non Operating Expenses Non Operating Expenses

Profit & Loss Special Gain ( Loss ) Special Gain ( Loss )

Profit & Loss Income Taxes Income Taxes

Notes # Notes Description

Notes # Notes Title

1 Summary of Sugnificant Accounting Policies

2 Structure of Balance Sheet and Income Statements

3 Transactions with Affiliated and othe Related Parties

4 Currency Translation

5

6

7 Notes & Account Recivable

8 Inventories

9 Prepaid Expenses

10 Property, Plant and equipment

11 Securities

12 Intangible Assets

13

14

15

16

17

18 Stockholder's Equity

19 Earnings Reserves and Retained Profits

20 Sales revenue

21

22

23

24

25

26 Income Taxes

27 Employee Benefit Plan

28

29

30

31

32

33

34

35

36

37

Notes Title Balance Sheet, P&L

Note 1 - Summary of Sugnificant Accounting Policies

Note 2 - Structure of Balance Sheet and Income Statements

Note 3 - Transactions with Affiliated and othe Related Parties

Note 4 - Currency Translation

Note 5 - Cash

Note 6 - Line of Credit

Note 7 - Notes & Account Recivable Accounts Receivable

Note 8 - Inventories Inventories

Note 9 - Prepaid Expenses Prepaid Expenses

Note 10 - Property, Plant and equipment Property and Equipment (at Cost)

Note 11 - Securities Investment in Revenue Bond

Note 12 - Intangible Assets Patents, Trademarks and Goodwill

Note 13 - Accounts Payable

Note 14 - Accrued Expenses

Note 15 - Other Payables

Note 16 - Note Payable

Note 17 - Equipment Leases Payable

Note 18 - Stockholder's Equity Total Stockholder's Equity

Note 19 - Earnings Reserves and Retained Profits Retained Earnings

Note 20 - Sales revenue Sales

Note 21 - Labor And Materials

Note 22 - Selling

Note 23 - General & Administrative

Note 24 - Other Operating Expense

Note 25 - Other income (expense) - net

Note 26 - Income Taxes Provision (benefit) for income taxes

Note 27 - Employee Benefit Plan

Note 28 -

Note 29 -

Note 30 -

Note 31 -

Note 32 -

Financial Assets

Trade and Other Receivables

Issued Capital

Special item with an Equity Portion

Special item for investment Allowances for Fixed Assets

Provosions

Liabilities

Contingent Liabilities

Other Financial Obligations

Derivative Financial Instruments

Decrease / Increas in Inventories of finished Goods and Work in Progress

Work Performed by the Enterprise and Capitalized

Other Operating Income

Raw-Material and Consumables Used

Staff Costs

Depreciation

Other Operatiing Expenses

Income From other investments

Amortization of Financial Assets and Investments Classified as Current Assets

Interest

Income Taxes

Other Information

Account

Number Accout Name BS, P&L Level 3

1011 Checking Account #1 Cash

1012 Checking Account #2 Cash

1021 Payroll Checking Account Cash

1051 Savings Account #1 Cash

1061 Money Market Account #1 Cash

1071 Short Term CD's Cash

1091 Petty Cash Cash

1111 Accounts Receivable Accounts Receivable

1121 Allowance for doubtful accounts Accounts Receivable

1201 Inventories for sale Inventories

1211 Inventories for use Inventories

1301 Prepaid expenses Prepaid Expenses

1560 Patents Patents, Trademarks and Goodwill

1571 Marketable Stocks Investment in Revenue Bond

1811 Land Land & Building

1821 Buildings Land & Building

1831 Tools & Equipment Machinery and Equipment

1841 Office Furninshings & Equip Furniture and Fixtures

1921 Accumulated Depreciated BuildingsLess: Accumulated Depreciation

1931 Accumulated Depreciated Tools/Equipment Less: Accumulated Depreciation

1941 AccumulatedDepreciated Office Equipment Less: Accumulated Depreciation

1991 Depreciated Lease Improvements Less: Accumulated Depreciation

2011 Accounts Payable Accounts Payable

2111 Payroll Liabilities Line of Credit

2113 Employee Soc. Sec. Withholdings Accrued expenses

2118 Company Medicare Liability other Payables

2401 Short Term Loans Current portion of long-term debt

2401 Short Term Loans Less: Current Portion Shown Above

2501 Mortgage Loan Note Payable

2601 Fed deffered income taxes Equipment Leases Payable

2701 Employee Pension Current portion of long-term debt

3001 Capital Stock Capital Stock

3101 Paid in capital Retained earnings

3501 Retained Earnings Retained earnings

4001 Sales Sales

4501 Services Services

4701 Interest Income Other income (expense)

4801 Gain/Loss Sale of Assets Other income (expense)

4901 Other Income Other income (expense)

5001 Materials Materials

5101 Subcontracted Costs Labor & Subcontractors Costs

5201 Labor Labor & Subcontractors Costs

5301 Rental Other Cost of goods sold

5311 Maintenance & Repairs Other Cost of goods sold

5321 Cleaning Other Cost of goods sold

5331 Insurance Other Cost of goods sold

5341 Utilities Other Cost of goods sold

5351 Property Taxes Other Cost of goods sold

5501 Increase / Decrease in Inventories Increase / Decrease in Inventories

6501 Salary & Wages Selling

6511 Commissions Selling

6521 Advertising Selling

6531 Preliminary Designs Selling

6532 Promotional Events Selling

6533 Promotional Literature Selling

6534 Displays/Product Samples Selling

6535 Project Management Personnel Selling

6541 Sales & Marketing Expense-Other Selling

7001 Salary & Wages General & Administrative

7101 Employee Bonuses General & Administrative

7102 Employee Sick Pay General & Administrative

7103 Employee Vacation Pay General & Administrative

7104 Company Paid Medicare (FICA) General & Administrative

7105 Company Paid Soc. Sec. (FICA) General & Administrative

7106 Federal Unemployment Tax (FUTA)General & Administrative

7107 Workers Comp Insurance General & Administrative

7201 Employment Advertising General & Administrative

7202 Recruiting & Hiring General & Administrative

7203 Training & Education General & Administrative

7204 Employee Entertainment General & Administrative

7205 Payroll Service Fees General & Administrative

7301 Accounting Fees General & Administrative

7302 Attorney Fees General & Administrative

7351 Telephone-Answering Service General & Administrative

7352 Telephone-Cellular Service General & Administrative

7353 Telephone-ISDN Line General & Administrative

7354 Telephone-Local Service General & Administrative

7355 Telephone-Long Dist Service General & Administrative

7356 Tolls & Parking General & Administrative

7357 Tool Maintenance & Repairs General & Administrative

7381 Travel General & Administrative

7382 Travel-Airfare General & Administrative

7383 Travel-Car Rental General & Administrative

7384 Travel-Food & Entertainment General & Administrative

7385 Travel-Hotel General & Administrative

7401 Charitable Contributions Other Operating Expense

7501 Computer Software General & Administrative

7502 Consultant-Business General & Administrative

7503 Consultant-Computer General & Administrative

7511 Corporation Fees & Costs General & Administrative

7521 Equipment Lease-Copier General & Administrative

7522 Equipment Lease-Office General & Administrative

7631 Building Maintenance Other Operating Expense

7632 Cleaning Service Other Operating Expense

7633 Equip Maint. & Repairs Other Operating Expense

7634 Misc. Expenses Other Operating Expense

7635 Security Monitoring Other Operating Expense

7636 Utilities Other Operating Expense

7701 Taxes-Business License Other Operating Expense

7702 Taxes-Business Property Other Operating Expense

7901 Depreciation-Buildings Depreciation

8001 Bank Account Finance Charges Interest expense

8002 Bank Account Service Fees Interest expense

9001 Taxes-Corporate Income Provision (benefit) for income taxes

Retained Earnings beginning of the year

Retained Earnings beginning year

BS, P&L Level 2 BS, P&L Level 1 December 2002 December 2003

Current Assets ASSETS 318,697 301,124

Current Assets ASSETS

Current Assets ASSETS

Current Assets ASSETS

Current Assets ASSETS

Current Assets ASSETS

Current Assets ASSETS

Current Assets ASSETS 1,538,494 1,653,558

Current Assets ASSETS

Current Assets ASSETS 520,133 546,173

Current Assets ASSETS

Current Assets ASSETS 23,659 13,552

Other Assets ASSETS 52,500 52,250

Other Assets ASSETS 300,260 364,321

Property and Equipment (at Cost) ASSETS 677,191 674,019

Property and Equipment (at Cost) ASSETS

Property and Equipment (at Cost) ASSETS 326,052 386,140

Property and Equipment (at Cost) ASSETS 47,906 59,410

Property and Equipment (at Cost) ASSETS -419540.1 -478852.44

Property and Equipment (at Cost) ASSETS

Property and Equipment (at Cost) ASSETS

Property and Equipment (at Cost) ASSETS

Current Liabilities LIABILITIES AND STOCKHOLDER'S EQUITY 475,284 547,255

Current Liabilities LIABILITIES AND STOCKHOLDER'S EQUITY 500,834 476,783

Current Liabilities LIABILITIES AND STOCKHOLDER'S EQUITY 221,291 234,296

Current Liabilities LIABILITIES AND STOCKHOLDER'S EQUITY 26,937 19,250

Current Liabilities LIABILITIES AND STOCKHOLDER'S EQUITY 39,506 40,252

Long-Term Liabilities LIABILITIES AND STOCKHOLDER'S EQUITY -39506 -40252

Long-Term Liabilities LIABILITIES AND STOCKHOLDER'S EQUITY 840,105 784,273

Long-Term Liabilities LIABILITIES AND STOCKHOLDER'S EQUITY 224,965 185,459

Long-Term Liabilities LIABILITIES AND STOCKHOLDER'S EQUITY

Stockholder's Equity LIABILITIES AND STOCKHOLDER'S EQUITY 152,623 151,897

Stockholder's Equity LIABILITIES AND STOCKHOLDER'S EQUITY 943,314 1,172,482

Stockholder's Equity LIABILITIES AND STOCKHOLDER'S EQUITY

Revenue Profit & Loss 2,633,626 2,920,093

Revenue Profit & Loss 725,458 955,214

Operating Income (Loss) Profit & Loss 2,521 -32,512

Operating Income (Loss) Profit & Loss

Non Operating Income Profit & Loss

Cost of goods sold Profit & Loss -733,352 -854,521

Cost of goods sold Profit & Loss -536,645 -602,125

Cost of goods sold Profit & Loss 0 0

Cost of goods sold Profit & Loss -350,241 -384,521

Cost of goods sold Profit & Loss 0 0

Cost of goods sold Profit & Loss 0 0

Cost of goods sold Profit & Loss 0 0

Cost of goods sold Profit & Loss 0 0

Cost of goods sold Profit & Loss 0 0

Cost of goods sold Profit & Loss 30,254 26,040

Operating Expenses Profit & Loss -441,256 -480,161

Operating Expenses Profit & Loss 0 0

Operating Expenses Profit & Loss 0 0

Operating Expenses Profit & Loss 0 0

Operating Expenses Profit & Loss 0 0

Operating Expenses Profit & Loss 0 0

Operating Expenses Profit & Loss 0 0

Operating Expenses Profit & Loss 0 0

Operating Expenses Profit & Loss 0 0

Operating Expenses Profit & Loss -675,992 -758,542

Operating Expenses Profit & Loss 0 0

Operating Expenses Profit & Loss 0 0

Operating Expenses Profit & Loss 0 0

Operating Expenses Profit & Loss 0 0

Operating Expenses Profit & Loss 0 0

Operating Expenses Profit & Loss 0 0

Operating Expenses Profit & Loss 0 0

Operating Expenses Profit & Loss 0 0

Operating Expenses Profit & Loss 0 0

Operating Expenses Profit & Loss 0 0

Operating Expenses Profit & Loss 0 0

Operating Expenses Profit & Loss 0 0

Operating Expenses Profit & Loss 0 0

Operating Expenses Profit & Loss 0 0

Operating Expenses Profit & Loss 0 0

Operating Expenses Profit & Loss 0 0

Operating Expenses Profit & Loss 0 0

Operating Expenses Profit & Loss 0 0

Operating Expenses Profit & Loss 0 0

Operating Expenses Profit & Loss 0 0

Operating Expenses Profit & Loss 0 0

Operating Expenses Profit & Loss 0 0

Operating Expenses Profit & Loss 0 0

Operating Expenses Profit & Loss 0 0

Operating Expenses Profit & Loss 0 0

Operating Expenses Profit & Loss 0 0

Operating Expenses Profit & Loss 0 0

Operating Expenses Profit & Loss 0 0

Operating Expenses Profit & Loss 0 0

Operating Expenses Profit & Loss 0 0

Operating Expenses Profit & Loss 0 0

Operating Expenses Profit & Loss 0 0

Operating Expenses Profit & Loss 0 0

Operating Expenses Profit & Loss -260,887 -275,541

Operating Expenses Profit & Loss 0 0

Operating Expenses Profit & Loss 0 0

Operating Expenses Profit & Loss 0 0

Operating Expenses Profit & Loss 0 0

Operating Expenses Profit & Loss 0 0

Operating Expenses Profit & Loss 0 0

Operating Expenses Profit & Loss 0 0

Operating Expenses Profit & Loss -50,221 -59,312

Operating Income (Loss) Profit & Loss -62,584 -75,421

Operating Income (Loss) Profit & Loss 0 0

Income Taxes Profit & Loss -133,251 -149,523

Net Income (Loss) for the year Profit & Loss 795,884 943,314

Net Income (Loss) for the year Profit & Loss -795,884 -943,314

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

Financial Ratios 2003 2002

Liquidity Ratios

Current Ratio 1.91 1.90

Quick Ratio 1.48 1.47

Management Ratios

Inventory Turns 3.32 3.06

Asset Turn 1.09 0.99

Receivable Days 156 167

Profitability Ratios

Return on Assets 6.42% 4.35%

Earnings Per Share 1.51 0.97

Return on Equity 17.30% 13.45%

Return on sales 5.91% 4.39%

Gross Profit Margin 53.16% 52.67%

Leverage Ratios

Debt to Equity 169.69% 208.90%

Debt Ratio 89.38% 95.35%

ASSETS 2003 2002

Current Assets

Cash 301,124 318,697

Accounts Receivable 1,653,558 1,538,494

Inventories 546,173 520,133

Prepaid Expenses 13,552 23,659

Total Current Assets 2,514,407 2,400,983

Property and Equipment (at Cost)

Land & Building 674,019 677,191

Machinery and Equipment 386,140 326,052

Furniture and Fixtures 59,410 47,906

Total Property and Equipment 1,119,569 1,051,150

Less: Accumulated Depreciation (478,852) (419,540)

Net Book Value 640,717 631,610

Other Assets

Investment in Revenue Bond 364,321 300,260

Patents, Trademarks and Goodwill 52,250 52,500

Total Other Assets 416,571 352,760

TOTAL ASSETS 3,571,695 3,385,352

LIABILITIES AND STOCKHOLDER'S EQUITY

Current Liabilities

Line of Credit 476,783 500,834

Current portion of long-term debt 40,252 39,506

Accounts Payable 547,255 475,284

Accrued Expenses 234,296 221,291

Other Payables 19,250 26,937

Total Current Liabilities 1,317,837 1,263,851

Long-Term Liabilities

Note Payable 784,273 840,105

Equipment Leases Payable 185,459 224,965

Less: Current Portion Shown Above(40,252) (39,506)

Total Long-Term Liabilities 929,480 1,025,564

TOTAL LIABILITIES 2,247,316 2,289,415

Stockholder's Equity

Capital Stock 151,897 152,623

Retained Earnings 1,172,482 943,314

Total Stockholder's Equity 1,324,379 1,095,937

TOTAL LIABILITIES AND STOCKHOLDER'S EQUITY 3,571,695 3,385,352

December 31

XYZ Corporation Inc.

December 31

Anda mungkin juga menyukai

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Airbus Balancescorecard PPT 130923225913 Phpapp01Dokumen50 halamanAirbus Balancescorecard PPT 130923225913 Phpapp01dj_han85Belum ada peringkat

- The Wm. Wrigley Jr. Company: Capital Structure, Valuation and Cost of CapitalDokumen4 halamanThe Wm. Wrigley Jr. Company: Capital Structure, Valuation and Cost of CapitalAditya Mukherjee100% (1)

- Acctg1205 - Chapter 8Dokumen48 halamanAcctg1205 - Chapter 8Elj Grace BaronBelum ada peringkat

- MAS - CVP AnalysisDokumen18 halamanMAS - CVP AnalysisDane Enterna50% (2)

- AnswerDokumen21 halamanAnswerStephanie EspalabraBelum ada peringkat

- Responsibility Acctg Transfer Pricing GP AnalysisDokumen21 halamanResponsibility Acctg Transfer Pricing GP AnalysisstudentoneBelum ada peringkat

- Dtaa 2Dokumen18 halamanDtaa 2dj_han85Belum ada peringkat

- Capital BudgetingDokumen23 halamanCapital BudgetingNoelJr. Allanaraiz100% (4)

- Summary Comprehensive Response enDokumen5 halamanSummary Comprehensive Response endj_han85Belum ada peringkat

- April: Month Region 1 Region 2 Region 3Dokumen2 halamanApril: Month Region 1 Region 2 Region 3dj_han85Belum ada peringkat

- Environmental Accounting - A Tool Used by The Entity For Determining Environmental CostsDokumen11 halamanEnvironmental Accounting - A Tool Used by The Entity For Determining Environmental Costsdj_han85Belum ada peringkat

- Hukum Pasar Modal Dan Tanggung Jawab Sosial: Rochani Urip SalamiDokumen11 halamanHukum Pasar Modal Dan Tanggung Jawab Sosial: Rochani Urip Salamidj_han85Belum ada peringkat

- Standards (IFRSDokumen2 halamanStandards (IFRSSiddBelum ada peringkat

- TATA CONSULTANCY SERVICES ValautionDokumen3 halamanTATA CONSULTANCY SERVICES ValautionRohit Kumar 4170Belum ada peringkat

- Suggested December 2022 CAP III Group IDokumen67 halamanSuggested December 2022 CAP III Group Isubash pandeyBelum ada peringkat

- Chapter 14 - Managing InventoryDokumen13 halamanChapter 14 - Managing InventoryZinhle HlatshwayoBelum ada peringkat

- Im Acco 20213 Accounting Principles 3Dokumen107 halamanIm Acco 20213 Accounting Principles 3magua deceiBelum ada peringkat

- FIN202 - SU23 - Individual AssignmentDokumen8 halamanFIN202 - SU23 - Individual AssignmentÁnh Dương NguyễnBelum ada peringkat

- Acc 123 Week 45 1Dokumen47 halamanAcc 123 Week 45 1slow dancerBelum ada peringkat

- Difference Between Financial and Managerial AccountingDokumen10 halamanDifference Between Financial and Managerial AccountingRahman Sankai KaharuddinBelum ada peringkat

- Cfa Level 1 ExamDokumen9 halamanCfa Level 1 ExamEric D'SouzaBelum ada peringkat

- Financing Decisions - Practice Questions PDFDokumen3 halamanFinancing Decisions - Practice Questions PDFAbrar0% (1)

- Project: Packages LimitedDokumen10 halamanProject: Packages LimitedAleena IdreesBelum ada peringkat

- PREPARING, ANALYZING, AND FORECASTING FINANCIAL STATEMENT - qUANTIFYING THE BUSINESS PLANDokumen24 halamanPREPARING, ANALYZING, AND FORECASTING FINANCIAL STATEMENT - qUANTIFYING THE BUSINESS PLANNamy Lyn Gumamera0% (1)

- ACC101-Group Assignment-Spring19Dokumen2 halamanACC101-Group Assignment-Spring19Xuân HinhBelum ada peringkat

- Capital Budgeting Techniques: Prepared by Toran Lal VermaDokumen32 halamanCapital Budgeting Techniques: Prepared by Toran Lal VermaRishabh SharmaBelum ada peringkat

- Avantel LimitedDokumen17 halamanAvantel LimitedContra Value BetsBelum ada peringkat

- Managerial Accounting Braun 4th Edition Solutions ManualDokumen7 halamanManagerial Accounting Braun 4th Edition Solutions Manualbarrenlywale1ibn8Belum ada peringkat

- Financial Reporting Financial Statement Analysis and Valuation 9th Edition Wahlen Test BankDokumen25 halamanFinancial Reporting Financial Statement Analysis and Valuation 9th Edition Wahlen Test Bankcleopatramabelrnnuqf100% (29)

- What Is Financial AccountingDokumen3 halamanWhat Is Financial AccountingrcpascBelum ada peringkat

- JHM 1Qtr21 Financial Report (Amendment)Dokumen13 halamanJHM 1Qtr21 Financial Report (Amendment)Ooi Gim SengBelum ada peringkat

- HMC Balance Sheet - Honda Motor Company, LTD PDFDokumen2 halamanHMC Balance Sheet - Honda Motor Company, LTD PDFPoorvi JainBelum ada peringkat

- Found-ENG-L6-Basic - Financial - Plan - Template - With ExplanationDokumen5 halamanFound-ENG-L6-Basic - Financial - Plan - Template - With ExplanationNone TwoBelum ada peringkat

- Financial Accounting ProjectDokumen12 halamanFinancial Accounting ProjectRishabh ManawatBelum ada peringkat

- Aat Solution ManualDokumen15 halamanAat Solution ManualJustin ParsonsBelum ada peringkat

- Construction Accounting and FranchiseDokumen3 halamanConstruction Accounting and FranchiseAdam SmithBelum ada peringkat