FFR-1 and FFR-2

Diunggah oleh

శ్రీనివాసకిరణ్కుమార్చతుర్వేదులHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

FFR-1 and FFR-2

Diunggah oleh

శ్రీనివాసకిరణ్కుమార్చతుర్వేదులHak Cipta:

Format Tersedia

Posted 5 years ago

11

Posted 5 years ago

Posted 4 years ago

Discussion > Accounts > Cost Accounts > FFR-1 and FFR-2

Pages : 1 2

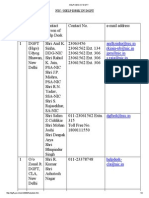

Tarun Malakia

manager -finance

[ Scorecard : 69]

Dear All can anybody upload FFR-1 and FFR-2 for submittion to the banks Financial

follow up reports Tarun Malakia

Online classes for CA CS CMA

N.Sivaraj

Manager _ F&A

[ Scorecard : 83]

Originally posted by :Tarun Malakia

"

Dear All

can anybody upload FFR-1 and FFR-2 for submittion to the banks

Financial follow up reports

Tarun Malakia

"

Attached File : 3 sbi ffr i & ii format.xls downloaded 4505 times

Message Thanked by (Total thanks : 1)

kintu

hi Tarun,

thanks for uploading FFR-1 & 2. It would be kind of you if you help me out in solving

some of my doubts.

There are 12 Replies

to this message

srinivasa kirankumar Logout

Member Strength 13,16,405 and growing..

Need

Payment

Gateway?

zaakpay.com

Contact Zaakpay for

Zero Setup Fee Cards,

Netbanking & Mobile

Payments

CCI ONLINE COACHING NEWS EXPERTS ARTICLES FILES FORUM JOBS E-MAIL EVENTS STUDENTS JUDICIARY MORE

FFR-1 and FFR-2 http://www.caclubindia.com/forum/ffr-1-and-ffr-2-34347.asp

1 of 7 24-07-2014 11:49 AM

Posted 4 years ago

Posted 4 years ago

Posted 4 years ago

Posted 4 years ago

Posted 2 years ago

Dilen

Self Employed

[ Scorecard : 57]

1-in FFR-1, what comes in the column "change during the current year" - should we

also incorporate figures for same quarter of previous year, and then compare the

current year's quarter with the previous year's quarter?

2-am i correct in understanding that the last column of FFR-1 "estimates at the end

of current year" includes the whole year figures for the current year?

Vikesh Kumar

Service

[ Scorecard : 24]

hkh

Vikesh Kumar

Service

[ Scorecard : 24]

Please send file with all formula.

Pradeep

Manager- Finance

[ Scorecard : 21]

Please help

Sarawanan

Manager / Finance

[ Scorecard : 31]

sir

with formula i require this file

sarwanan

Umesh V Naig

Manager

[ Scorecard : 58]

Is it mandatory for filing FFR 1/ FFR to the bank , if we are SME/ SSI sector

what is the condition of working capital sanctions and pl also send the format

Related Files

how to take .doc

72 downloads

ass.zip

1336 downloads

as 2 ed.pdf

68 downloads

as 1.pdf

1118 downloads

as 2.pdf

389 downloads

a s.pdf

63 downloads

More >>

FFR-1 and FFR-2 http://www.caclubindia.com/forum/ffr-1-and-ffr-2-34347.asp

2 of 7 24-07-2014 11:49 AM

Posted 2 years ago

Posted 2 years ago

sangappa inamati

Chief Accountant

[ Scorecard : 29]

Hi can anybody provide me FFR 01 and FFR 02 for submission to Bank

Umesh V Naig

Manager

[ Scorecard : 58]

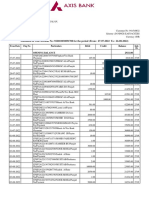

FINANCIAL FOLLOW UP REPORT (FFR - I)

Report for the I_ (I/II/III/IV) Quarter ended .............

Period covered by the Report : 3(3/6/9/12) months

Name of the Borrower:_

A. Performance during the year:

Activity

Annual

Plan

(current

year)

Actuals, cumulative up to

quarter ended

__.__.__

Percentage of

achievement

(i) Production (Quantity)

(ii) Net sales (Rs. in

lacs)

(a)

Domestic

(b) Exports

B. Status of working capital funds : (Rs. in

lacs)

At the end of

last year

(31.3.2011 )

At the quarter

ending

( 30/06/2011)

Change during

the current

year

{(2)-(1)}

(+) or (-)

Estimates at the end

of current year

(31.3.2012)

(1) (2) (3) (4)

Current Assets (CA)

a. Inventory

b. Receivables

c. Other CA

d. Total CA

(a+b+c)

Current Liabilities (CL)

e. Bank

Borrowings

for WC

f. Sundry

Creditors

g. Other

CL

h. Total

CL

(e+f+g)

i. NWC (d - h)

j. Current Ratio

(d/h)

How current assets have been financed

k. e/d in % XXX

l. f/d in % XXX

11

FFR-1 and FFR-2 http://www.caclubindia.com/forum/ffr-1-and-ffr-2-34347.asp

3 of 7 24-07-2014 11:49 AM

m. g/d in % XXX

n. i/d in % XXX

TOTAL

(k+l+m+n)

100

C. Levels of inventory, receivables and sundry

creditors.

(In number of days)

At the end of last year

(31.3. 2011 )

At the quarter

ended

(30 / 06 /

2011 )

Estimates at the end of current

year (31.3. 2012 )

Inventory

Receivables

Sundry

creditors

See notes on the next page.

NOTES :

(i) This report should be submitted by the borrower within 6 weeks

from close of each quarter.

(ii) Classification of Current Assets and Current Liabilities should be

the same as in assessment of working capital limits. (Deposits/ instalments

of TLs/DPG/ debentures etc. due within 12 months from the end of the

quarter should be included in the OCL).

(iii) The information should be furnished for each line of activity/

division/unit separately as also for the company, as a whole.

(iv) In Section C, levels in days should be computed for each column

as follows:

For Inventory : (Value x 365)/ Net Sales

For Receivables : (Value x 365)/ Gross Sales

For Sundry Creditors : (Value x 365)/ Purchases

(For the above, sales and purchases for part of the year are to

be annualised)

(v) This format is also applicable to traders and merchant exporters.

FINANCIAL FOLLOW-UP REPORT (FFR II)

PART-A

Name of the borrower :_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

A. Half-Yearly Operating Statement (Rs. in

lacs)

Last year

(Actuals)

Current year

(estimates)

Half year

ended

_ _._ _ . 20_

_ (Actuals)

1. Gross Sales (*1)

a. Domestic

b. Exports

2. Less Excise duty

3. Net sales (1-2)

4. Cost of goods sold

(a) Raw materials

consumption (*2)

(b) Other spares

(c) Power & fuel

(d) Direct labour

(factory wages &

salaries)

(e) Other manufacturing

expenses including

depreciation

11

FFR-1 and FFR-2 http://www.caclubindia.com/forum/ffr-1-and-ffr-2-34347.asp

4 of 7 24-07-2014 11:49 AM

(f) Sub-total (4(a) to 4(e))

Add : Opening stocks-in-

process & finished goods

Deduct : Closing stocks-

in-process & finished goods

Total Cost of goods sold

5.Selling, general &

administrative expenses

6.Interest

7.Sub-total (4+5+6)

8.Operating Profit/ Loss

(3-7)

9.Other non-operating

income/ expenses - Net

(+/-)

10. Profit before tax/ Loss

(8+9)

Notes: (*1) Gross sales would be sales after adjustment for rejections

and returns of goods.

(*2) Raw material includes stores & spares used in the process of

manufacture.

(Continued part B)

PART-B

B. Half yearly funds flow statement

(Rs. in lacs)

Last year (Actuals)

(audited

/provisional)

Current

year

(estimates)

Half year

ended

_ _._ _._

_

(Actuals)

1 2 3

1. SOURCES

a) Profit before tax

b) Depreciation

c) Increase in Capital

d) Increase in term liabilities

e) Decrease in

i) Fixed assets

ii) Other non-current assets

f) Others

g) TOTAL (1(a) to 1(f))

2. USES

a) Net Loss

b) Dividend payments

c) Taxes paid

d) Decrease in term liabilities

(incl. public deposits)

e) Increase in :

i) Fixed assets

ii) ICDs placed

iii) Investments in associates/

subsidiaries

iv) Other non-current assets

f) Others

g) TOTAL (2(a) to 2(f))

3. Long term surplus (+) /

deficit (-) (1(g) 2(g))

4. Changes in current assets

Increase (+)/ Decrease (-)

5. Changes in other current

liabilities (other than bank

borrowings) ; Increase (+)/

Decrease (-)

6.Changes in WC gap; Increase (+)/

Decrease (-) [4 5]

11

FFR-1 and FFR-2 http://www.caclubindia.com/forum/ffr-1-and-ffr-2-34347.asp

5 of 7 24-07-2014 11:49 AM

7. Net surplus (+) / Deficit (-)

(3-6)

8.Changes in bank borrowings;

Increase (+) / Decrease (-)

See notes on the next page.

Notes :

(i) This report should be submitted by the borrower within 8 weeks

from the close of each half-year.

(ii) Information should be furnished for each line of activity/unit of the

Company separately as also for the Company as a whole.

(iii) Valuation of current assets or current liabilities and recording of

income and expenses should be on the same basis as adopted for the

statutory balance sheets, and it should be applied on a consistent basis.

(iv) Classification of current assets / current liabilities for the purpose

of funds flow should be the same as in assessment of working capital limits

and the relevant FFR I.

(v) In respect of traders and merchant exporters, a modified format

will be used.

THE ABOVE FORMATS SHALL GIVE A CLEAR IDEA OF THE PERFORMANCE BOTH

PROJECTION AND ACTUAL FOR ANALYSIS AND DECISION MAKING

Prev 1 2 Next

Related Threads

How to prepare icwai inter group - 1 exams

Project - AS 2 or AS 7?

Differences between Ind AS 1 and Existing AS 1

Differences between ind as 2 (inventories) and

existing as 2

As 1 to 36

Which accounting book 2 refer

Satyam scam: ca institute debars 2 audit

managers

Maintaining 2 different balance sheet

Need advise regarding group 1 accounts

What is the procedure 2 claim refund of profession

tax in mh

Post your reply for FFR-1 and FFR-2

Message

Attach File

Notify when someone replies (Email/Android)

11

FFR-1 and FFR-2 http://www.caclubindia.com/forum/ffr-1-and-ffr-2-34347.asp

6 of 7 24-07-2014 11:49 AM

Our Network Sites

2014 CAclubindia.com. Let us grow stronger by mutual exchange of knowledge.

Use thank button to convey your appreciation.

Maintain professionalism while posting and replying to topics.

Try to add value with your each post.

Forum Home | Forum Portal | Member Control Center | Who is Where | Popular Threads | Today's Topic | Recent Posts | Today's Posts |

Post New Topic | Thread With Files | Top Threads This Month | Forum Stats | Unreplied Threads

back to the top

Subscribe to the latest topics :

About We are Hiring Advertise Terms of Use

Disclaimer Privacy Policy Contact Us

11

FFR-1 and FFR-2 http://www.caclubindia.com/forum/ffr-1-and-ffr-2-34347.asp

7 of 7 24-07-2014 11:49 AM

Anda mungkin juga menyukai

- 16 Format of Financial Follow Up Report SbiDokumen4 halaman16 Format of Financial Follow Up Report SbiSandeep PahwaBelum ada peringkat

- External Code List 201003Dokumen315 halamanExternal Code List 201003Rabindra P.SinghBelum ada peringkat

- FleetLog PDFDokumen2 halamanFleetLog PDFboy telerBelum ada peringkat

- Service Manual JCB 8027Z, 8032Z Mini Excavator (Preview)Dokumen6 halamanService Manual JCB 8027Z, 8032Z Mini Excavator (Preview)Amip Folk0% (1)

- A - Plano Electrico 330clDokumen2 halamanA - Plano Electrico 330clgerardoBelum ada peringkat

- Edic Installation GuideDokumen54 halamanEdic Installation GuideJuan FernandezBelum ada peringkat

- Ecm (Engine Control Module) MT80Dokumen23 halamanEcm (Engine Control Module) MT80jorge luis guevara martinezBelum ada peringkat

- Bosch Edc17cp15 Xrom Tc1796 Mitsubishi 1033Dokumen3 halamanBosch Edc17cp15 Xrom Tc1796 Mitsubishi 1033ddf_dedoBelum ada peringkat

- En Us t2 2005Dokumen462 halamanEn Us t2 2005Rafael Canizares ChiarandiBelum ada peringkat

- Additions, Revisions, or Updates: Subject DateDokumen7 halamanAdditions, Revisions, or Updates: Subject DateGeoff AndrewBelum ada peringkat

- CGDI BMW Change FEM BDC 0318Dokumen18 halamanCGDI BMW Change FEM BDC 0318gsmhelpeveshamBelum ada peringkat

- Manual Provision ISRDokumen121 halamanManual Provision ISRacadropBelum ada peringkat

- Intake Air Control System: Parts LocationDokumen6 halamanIntake Air Control System: Parts LocationМухамметBelum ada peringkat

- Service Advisor CF and AG 5.2.201911Dokumen1 halamanService Advisor CF and AG 5.2.201911Dio FubyBelum ada peringkat

- Chassis Module Output PinsDokumen3 halamanChassis Module Output PinsEdwin Alfonso Hernandez MontesBelum ada peringkat

- Manual OTCDokumen2 halamanManual OTCJunior CarmonaBelum ada peringkat

- Re95201 2012-2Dokumen16 halamanRe95201 2012-2Vinod HegdeBelum ada peringkat

- 2019 Gran I10 G 1.2 Mpi-DiagramDokumen1 halaman2019 Gran I10 G 1.2 Mpi-DiagramDarwin MosqueraBelum ada peringkat

- Operator Training ManualDokumen195 halamanOperator Training ManualIgnacio MuñozBelum ada peringkat

- 3 - Sbi FFR I & II FormatDokumen3 halaman3 - Sbi FFR I & II FormatArti BalujaBelum ada peringkat

- 42 FFR 1 2 FormatDokumen3 halaman42 FFR 1 2 FormatpraveenBelum ada peringkat

- 3 - Sbi FFR I & II FormatDokumen3 halaman3 - Sbi FFR I & II FormatArti BalujaBelum ada peringkat

- Financial Follow Up Report (FFR-II)Dokumen3 halamanFinancial Follow Up Report (FFR-II)Kiran ThakkerBelum ada peringkat

- 3 - Sbi FFR I & II FormatDokumen3 halaman3 - Sbi FFR I & II FormatCA Shailendra Singh78% (9)

- Last Years Actuals As Per The Audited Accounts Current Years Estimates Following Years ProjectionsDokumen22 halamanLast Years Actuals As Per The Audited Accounts Current Years Estimates Following Years ProjectionsAnupam BaliBelum ada peringkat

- Assessment of Working Capital Requirements Form Ii - Operating StatementDokumen12 halamanAssessment of Working Capital Requirements Form Ii - Operating Statementsluniya88Belum ada peringkat

- Assessment of Working Capital Requirements: Form - I Particulars of Existing / Proposed Limits From The Banking SystemDokumen12 halamanAssessment of Working Capital Requirements: Form - I Particulars of Existing / Proposed Limits From The Banking SystemsubbupisipatiBelum ada peringkat

- Accounting & Finance (SMB108)Dokumen25 halamanAccounting & Finance (SMB108)lravi4uBelum ada peringkat

- Cma DataDokumen13 halamanCma DataJoseph LunaBelum ada peringkat

- Financial Statements and Disclosure of InformationDokumen7 halamanFinancial Statements and Disclosure of InformationAjit PatilBelum ada peringkat

- IE Chapter 3 - ProjectDokumen56 halamanIE Chapter 3 - Project10-12A1- Nguyễn Chí HiếuBelum ada peringkat

- Form 23ACDokumen6 halamanForm 23ACNikkhil GuptaaBelum ada peringkat

- 30 Credit Management AnalysisDokumen13 halaman30 Credit Management AnalysisYogesh R LahotiBelum ada peringkat

- CSR Proposal For ConstructionDokumen16 halamanCSR Proposal For Constructionkppandeykaran078Belum ada peringkat

- ICICI Banking Corporation LTD.: Assessment of Working Capital Requirements Form Ii - Operating StatementDokumen16 halamanICICI Banking Corporation LTD.: Assessment of Working Capital Requirements Form Ii - Operating StatementPravin Namokar100% (1)

- Module - 4 Credit Risk - Financial Statement Analysis: Prof. R. KannanDokumen70 halamanModule - 4 Credit Risk - Financial Statement Analysis: Prof. R. Kannangopalswaminathan iyerBelum ada peringkat

- CMA Data in ExcelDokumen7 halamanCMA Data in ExcelVaishali MkBelum ada peringkat

- Quarterly Information System - Form II: Performance During The Quarter Ended:.................Dokumen2 halamanQuarterly Information System - Form II: Performance During The Quarter Ended:.................Ravindra ReddyBelum ada peringkat

- Class 12th QuestionBank EconomicsDokumen114 halamanClass 12th QuestionBank Economicsgamacode132Belum ada peringkat

- Financial Results, Auditors Report For December 31, 2015 (Result)Dokumen5 halamanFinancial Results, Auditors Report For December 31, 2015 (Result)Shyam SunderBelum ada peringkat

- Financial Results For Sept 30, 2015 (Standalone) (Result)Dokumen2 halamanFinancial Results For Sept 30, 2015 (Standalone) (Result)Shyam SunderBelum ada peringkat

- CH 4.7-Project Financial Analysis - CH 5Dokumen41 halamanCH 4.7-Project Financial Analysis - CH 5yemsrachhailu8Belum ada peringkat

- Project Implementation Reporting Format - 6Dokumen3 halamanProject Implementation Reporting Format - 6Ana Maria BorcanBelum ada peringkat

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Dokumen2 halamanFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderBelum ada peringkat

- Userfiles Financial 6fDokumen2 halamanUserfiles Financial 6fTejaswini SkumarBelum ada peringkat

- 01 s303 CmapaDokumen3 halaman01 s303 Cmapaimranelahi3430Belum ada peringkat

- Roll No Time Allowed: 3 Hours Maximum Marks: 100 Total Number of Questions: 8 Total Number of Printed Pages: 8Dokumen8 halamanRoll No Time Allowed: 3 Hours Maximum Marks: 100 Total Number of Questions: 8 Total Number of Printed Pages: 8Maninder BaggaBelum ada peringkat

- b1 Solving Set 2 May 2018 - OnlineDokumen4 halamanb1 Solving Set 2 May 2018 - OnlineGadafi FuadBelum ada peringkat

- IMT CDL Blue PDFDokumen7 halamanIMT CDL Blue PDFPranav SharmaBelum ada peringkat

- ICICI Banking Corporation LTD.: Assessment of Working Capital Requirements Form Ii - Operating StatementDokumen16 halamanICICI Banking Corporation LTD.: Assessment of Working Capital Requirements Form Ii - Operating StatementbalajeenarendraBelum ada peringkat

- Listing Exchange BSE FloorDokumen41 halamanListing Exchange BSE FloorSAROJBelum ada peringkat

- Financial Accounting and Reporting-IIDokumen7 halamanFinancial Accounting and Reporting-IIRochak ShresthaBelum ada peringkat

- Financial Anaylsis 1Dokumen27 halamanFinancial Anaylsis 1Nitika DhatwaliaBelum ada peringkat

- Mock Full Book 02 BookDokumen3 halamanMock Full Book 02 Bookgoharmahmood203Belum ada peringkat

- Audited Result 2010 11Dokumen2 halamanAudited Result 2010 11Priya SharmaBelum ada peringkat

- 12 - Advanced Corporate Reporting For Strategic BusinessDokumen3 halaman12 - Advanced Corporate Reporting For Strategic BusinessFatima FXBelum ada peringkat

- 7 Af 301 Fa - QPDokumen5 halaman7 Af 301 Fa - QPMuhammad BilalBelum ada peringkat

- (IE) Chapter 3 - Project Building and Management 2021Dokumen53 halaman(IE) Chapter 3 - Project Building and Management 2021Jane VickyBelum ada peringkat

- New Cma Without Password-Def Trax Treatedfinal-Interest For CC and TLDokumen90 halamanNew Cma Without Password-Def Trax Treatedfinal-Interest For CC and TLanon_599712233Belum ada peringkat

- CMA DataDokumen35 halamanCMA Dataashishy99Belum ada peringkat

- Form E.R.-8 Original/DuplicateDokumen4 halamanForm E.R.-8 Original/Duplicateశ్రీనివాసకిరణ్కుమార్చతుర్వేదులBelum ada peringkat

- Before The Customs and Central Excise Settlement Commission - Bench at - Form of Application For Settlement of A Case Under Section 32EDokumen3 halamanBefore The Customs and Central Excise Settlement Commission - Bench at - Form of Application For Settlement of A Case Under Section 32Eశ్రీనివాసకిరణ్కుమార్చతుర్వేదులBelum ada peringkat

- Invoice: Original Duplicate Triplicate QuadruplicateDokumen2 halamanInvoice: Original Duplicate Triplicate Quadruplicateశ్రీనివాసకిరణ్కుమార్చతుర్వేదులBelum ada peringkat

- Formats & Procedures: Import of Capital GoodsDokumen16 halamanFormats & Procedures: Import of Capital Goodsశ్రీనివాసకిరణ్కుమార్చతుర్వేదులBelum ada peringkat

- Cenvat Credit: V S DateyDokumen44 halamanCenvat Credit: V S Dateyశ్రీనివాసకిరణ్కుమార్చతుర్వేదులBelum ada peringkat

- Materials ManagementDokumen3 halamanMaterials Managementశ్రీనివాసకిరణ్కుమార్చతుర్వేదులBelum ada peringkat

- Registration Form: Dr. Radha RaghuramapatruniDokumen2 halamanRegistration Form: Dr. Radha Raghuramapatruniశ్రీనివాసకిరణ్కుమార్చతుర్వేదులBelum ada peringkat

- Electronic Fund Transfer HelpDokumen11 halamanElectronic Fund Transfer Helpశ్రీనివాసకిరణ్కుమార్చతుర్వేదులBelum ada peringkat

- CLM-Logistics at LargeDokumen21 halamanCLM-Logistics at Largeశ్రీనివాసకిరణ్కుమార్చతుర్వేదులBelum ada peringkat

- Cold ChainDokumen7 halamanCold Chainశ్రీనివాసకిరణ్కుమార్చతుర్వేదులBelum ada peringkat

- Ebrc'-Faqs: S Questions GuidelinesDokumen7 halamanEbrc'-Faqs: S Questions Guidelinesశ్రీనివాసకిరణ్కుమార్చతుర్వేదులBelum ada peringkat

- Explanation of CBEC and Non-CBEC Currency CalculationsDokumen28 halamanExplanation of CBEC and Non-CBEC Currency Calculationsశ్రీనివాసకిరణ్కుమార్చతుర్వేదులBelum ada peringkat

- Anilksinha@nic - in Rkjain-Ub@nic - in Jpm@nic - in S.raja@nic - in Rnyadav@nic - inDokumen2 halamanAnilksinha@nic - in Rkjain-Ub@nic - in Jpm@nic - in S.raja@nic - in Rnyadav@nic - inశ్రీనివాసకిరణ్కుమార్చతుర్వేదులBelum ada peringkat

- Export Procedures in India - Export Documents Required, Documents Required For ExportDokumen2 halamanExport Procedures in India - Export Documents Required, Documents Required For Exportశ్రీనివాసకిరణ్కుమార్చతుర్వేదులBelum ada peringkat

- Modified TufsDokumen114 halamanModified Tufsశ్రీనివాసకిరణ్కుమార్చతుర్వేదులBelum ada peringkat

- Tufsbookletsection4 Annex1Dokumen38 halamanTufsbookletsection4 Annex1శ్రీనివాసకిరణ్కుమార్చతుర్వేదులBelum ada peringkat

- CPALE Syllabi 2018 PDFDokumen32 halamanCPALE Syllabi 2018 PDFLorraine TomasBelum ada peringkat

- Case Study WilkersonDokumen2 halamanCase Study WilkersonHIMANSHU AGRAWALBelum ada peringkat

- AAO Promotion Exam NewSyllabus ItDokumen35 halamanAAO Promotion Exam NewSyllabus ItSRanizaiBelum ada peringkat

- Gilaninia and MousavianDokumen9 halamanGilaninia and Mousavianpradeep110Belum ada peringkat

- Mergers and Acquisition and Treatments To IPR Project (8th Semester)Dokumen15 halamanMergers and Acquisition and Treatments To IPR Project (8th Semester)raj vardhan agarwalBelum ada peringkat

- A Critic Le Analysis of AppleDokumen14 halamanA Critic Le Analysis of Applesabishi2312Belum ada peringkat

- Managerial Economics Presentation On Gulf AirlinesDokumen16 halamanManagerial Economics Presentation On Gulf AirlinesSaquib SiddiqBelum ada peringkat

- CN WWF 20191021Dokumen14 halamanCN WWF 20191021Maria Fernanda ZuluagaBelum ada peringkat

- Module 6 SDMDokumen34 halamanModule 6 SDMdharm287Belum ada peringkat

- Acct Statement XX1708 26082022Dokumen4 halamanAcct Statement XX1708 26082022Firoz KhanBelum ada peringkat

- I. Questions and AnswersDokumen5 halamanI. Questions and AnswersMinh MinhBelum ada peringkat

- Leadership Whitepaper Darden ExecutiveDokumen20 halamanLeadership Whitepaper Darden ExecutiveZaidBelum ada peringkat

- Banking Law Honors PaperDokumen4 halamanBanking Law Honors PaperDudheshwar SinghBelum ada peringkat

- IBP Journal Nov 2017Dokumen48 halamanIBP Journal Nov 2017qasimBelum ada peringkat

- Supply Chain Management of BanglalinkDokumen20 halamanSupply Chain Management of BanglalinkSindhu Nath ChowdhuryBelum ada peringkat

- Agnes Hanson's ResumeDokumen1 halamanAgnes Hanson's ResumeAgnes HansonBelum ada peringkat

- Client / Brand Analysis: 1.1. About GraingerDokumen11 halamanClient / Brand Analysis: 1.1. About GraingerMiguel Angel RuizBelum ada peringkat

- BCOM PM Unit 3Dokumen11 halamanBCOM PM Unit 3Anujyadav MonuyadavBelum ada peringkat

- MBA Finance, HR, Marketing ProjectsDokumen7 halamanMBA Finance, HR, Marketing ProjectsSagar Paul'gBelum ada peringkat

- Mumbai Mint 07-07-2023Dokumen18 halamanMumbai Mint 07-07-2023satishdokeBelum ada peringkat

- 2W Multi Brand Repair StudioDokumen26 halaman2W Multi Brand Repair StudioShubham BishtBelum ada peringkat

- Expand/Collapsesd Expand/Collapse SD-BF Sd-Bf-AcDokumen18 halamanExpand/Collapsesd Expand/Collapse SD-BF Sd-Bf-AcserradajaviBelum ada peringkat

- Adaptive Selling BehaviorDokumen18 halamanAdaptive Selling BehaviorArkaprabha RoyBelum ada peringkat

- Tourist Attraction and The Uniqueness of Resources On Tourist Destination in West Java, IndonesiaDokumen17 halamanTourist Attraction and The Uniqueness of Resources On Tourist Destination in West Java, IndonesiaAina ZainuddinBelum ada peringkat

- Clyde Springs Resume 2015 UpdateDokumen3 halamanClyde Springs Resume 2015 UpdatesnehaBelum ada peringkat

- Risk Quantification - ERMDokumen20 halamanRisk Quantification - ERMSeth ValdezBelum ada peringkat

- Chapter 2 Tax 2Dokumen7 halamanChapter 2 Tax 2Hazel Jane EsclamadaBelum ada peringkat

- ICUMSA 45 Specifications and Proceduers - 230124 - 134605Dokumen3 halamanICUMSA 45 Specifications and Proceduers - 230124 - 134605Alexandre de Melo0% (1)

- Resume Juan Pablo Garc°a de Presno HRBP DirectorDokumen3 halamanResume Juan Pablo Garc°a de Presno HRBP DirectorLuis Fernando QuiroaBelum ada peringkat

- Econ PBLDokumen14 halamanEcon PBLapi-262407343Belum ada peringkat