Syllabus (BUS 536)

Diunggah oleh

pheeyonaHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Syllabus (BUS 536)

Diunggah oleh

pheeyonaHak Cipta:

Format Tersedia

1

CORPORATE FINANCIAL MANAGEMENT BUS 536 FALL 2014 MW 5:00- 6:15PM (VH216)

Dr. Orkunt Dalgic

Office: VH 339

Phone: (845) 257-2939

Email: dalgico@newpaltz.edu

Office Hours

Mon 11am-12pm & 3:30pm-4:30pm

Thu 11am-1pm

Course Description

The role of financial management in business decisions, the relationship between finance and other corporate

functions, and quantitative techniques used for analysis. Topics include financial analysis, planning and control,

valuation, and investing and financing decisions.

Student Learning Objectives

At the end of this course, the student will be able to:

1. Understand how financial markets work

2. Interpret and apply information contained in financial statements using appropriate analytical tools

3. Apply financial forecasting techniques

4. Analyze the relationship between risk and return

5. Solve problems related to discounted cash flow analysis

6. Value the firm as well as stocks and bonds

7. Evaluate long-term investing and financing decisions

Attainment of the course objective is measured primarily by students performance in examination. The

course also introduces computer applications in financial analysis and develops "real-world" computer

skills for the student as well as developing the written communications skills required to present the

results of the analyses performed. The knowledge and understanding gained in this course will serve the

students in their future business and professional careers.

Program Goals Supported

MBA

goals

Globalization Analytical Skills Communication Ethics Leadership

Major V

Minor V

Prerequisites

BUS507 and BUS520

Required Text & Other Materials

Corporate Finance: Core Principles and Applications, Ross, Westerfield, Jaffe and Jordan, McGraw-Hill

Irwin Publishing, 4

th

ed. (3

rd

ed. also acceptable).

McGraw-Hill Connect (Required): Connect is a web-based assignment and assessment solution

required for this course, and is designed to assist you with your coursework, based on your needs.

2

o Connect access codes may be packaged with a new textbook in the bookstore. Connect can also be

purchased online at our class sections Connect website (see Blackboard for the link).

o You can also register in Connect and have free access (without a code) to Connect for a limited trial

period (typically three weeks). You can then purchase the code within the three-week trial period.

o REGISTRATION: To register in Connect, please visit the Connect website (see link on Blackboard)

and click Register Now.

o SUPPORT & TIPS: If you have any issues while registering or using Connect, please contact

McGraw-Hills Customer Experience team through http://www.mhhe.com/support or at 800-331-

5094. To avoid problems related to unexpected technical issues, you are advised not to wait until

the last moment to complete assignments. Please see the document: http://highered.mcgraw-

hill.com/olc2/dl/866234/Connect_Student_Quick_Tips.pdf for further support.

A financial calculator is required for all class sessions and exams. I will demonstrate the use of the

Texas Instruments BA II Plus Professional calculator in class, and I highly recommend that you buy this

calculator. The manual that comes with this calculator provides you with very good examples and

detailed step-by-step explanation of how to use all of the functions of the calculator. It is your

responsibility to learn how to use your financial calculator. I advise you to do it AS SOON AS POSSIBLE!

Harvard Online Simulation: M&A in Wine Country, V2 (Required): Must be purchased by each student

via the following link (Cost is $15). https://cb.hbsp.harvard.edu/cbmp/access/28481573

PowerPoint lecture notes will be distributed via Blackboard.

Homework quizzes will be posted regularly on McGraw-Hill Connect, and must be completed online by

the deadlines given (see Connect for exact deadlines).

Grading

Homework Assignments (Connect): 15% of grade

Article/Section Presentation: 5% of grade

Team Case Study: 10% of grade

Team Research Project (Total): 15% of grade (7.5% presentation, 7.5% report)

Harvard Online Simulation: 10% of your grade (In order for your course grade not to be adversely

affected, you must make a solid attempt at completing all phases of

the simulation. An extra course grade bonus of 1%, 2% and 3% will

also be awarded to the top three students based on simulation score.)

Mid-term Exam: 20% of your grade (see schedule for date)

Final Exam: 20% of your grade (see schedule for date)

Class participation: 5% of your grade (appropriate and relevant participation during class

discussions and in-class presentations of other students).

Homework Assignments (Connect)

Homework assignments must be completed for each chapter via McGraw-Hill Connect, and will require

calculations, and knowledge of concepts and definitions. You are expected to work individually on the

assignments, and not as part of a team.

3

Homework assignments related to the chapters that are covered fully in a given week are typically (not always)

due at 11:59pm on the following Sunday. For example, if one chapter is covered in Mondays class, and

another chapter in Wednesdays class, then the online homework assignment for both chapters will typically be

due the following Sunday at no later than 11:59pm. If you are not sure, please ask in class or consult the

Connect system for the assignment due dates. You will be able to check each of your answers (using online

link) exactly one time, prior to submitting the assignment on Connect.

Article/Section Presentation(s)

You will be required to present a mini-article or Textbook section as part of a student team (see below for a

list). In the first class session, each student will choose a team for the presentations. Lots will then be drawn to

assign presentations. Grading will consider professionalism, content, and presentation style equally.

Mini-Articles (called Real World in 3

rd

ed. & Finance Matters in 4

th

ed.) and Textbook Sections to be presented

All items to be presented are available in required RWJJ textbook (3

rd

ed. or 4

th

ed.)

Chap./Item # Title of Article/ Section Page 3

rd

ed. Page 4

th

ed.

Ch4: Jackpot! (Article) 100 97

Ch5: Beauty is in the Eye of the Bondholder (Article) 150 146

Ch6: How Fast is Too Fast (Article) 176 172

Ch7: The Practice of Capital Budgeting (Section 7.8 in both editions) 222-224 217-218

Ch10: The U.S. Equity Risk Premium (Section 10.8 in 3

rd

, 10.6 in 4

th

) 308-311 302-305

Ch11: Beta, Beta, Whos Got the Beta? (Article) 348 343

Ch12: The Cost of Capital, Texas Style (Article) 382 378

Ch15: Fin. Management and Bankruptcy Process (Sub. of 15.9 or 15.8) 483-484 475

Helpful Suggestions Regarding the Article/Section Presentations:

- Read the article/section from start to finish at least twice, preferably three times.

- Remember that you are not required to present all of the material in the article or section. Concentrate on

the major points and on some of the real-world examples used.

- You can include some charts and/or supplementary materials from outside sources (e.g. Internet) if you

like, but only if they are specifically related to the main points. Also remember to indicate clearly during

the presentation (i.e. reference) any outside sources you use.

- I will question the presenting team or make (clarifying) comments to class during and/or after the

presentation. Other students are also encouraged to ask questions during or after the presentations.

- Not including questions/comments, your presentation should last no more than 10 minutes. However, it

may take up to 15 minutes including comments/questions. You will be stopped promptly at the 15-minute

mark, so prepare accordingly.

- If you decide to use PowerPoint slides:

o Please give a copy of these as handouts (6 per page) to each student. Black & white copies are

acceptable.

o Make sure there are no more than 5-6 slides in the presentation (plan to spend about two minutes

on each slide). Therefore, if two people are presenting, each person should use about 2-3 slides,

and if three are presenting, each person should use 1-2 slides, etc.

And finally:

- Try to make the presentation interesting by using the real world examples in the article/section and

optionally, outside sources.

- Please practice your presentation skills (e.g. clear voice, confident posture, etc.) prior to presenting!

4

Team Case Study

You will be expected to work in a team of your choosing (no more than two people per team), or individually,

to complete the following case study from the textbook:

Chapter 6: Stock Valuation at Ragan Industries (page 197 in 3

rd

ed., 194 in 4

th

ed.)

The case study carries 10% of the grade. Student reports of the answers/solution to the case will be due in

class at the start of the week (i.e. Monday) after the associated chapter is fully covered in class. Reports will be

graded competitively, i.e. relative to other teams in the class, and will be judged on the quality of the contents

as well as appearance. Therefore, please make sure your report is written neatly and legibly (if handwritten),

or typed (preferably); and does not contain spelling or grammar mistakes. In order not to lose points for your

(correct) answer, you must identify all of the major steps in your calculations. I also expect you to explain your

reasoning/thinking behind the calculation steps involved (if this is not clear in the calculations).

Research Project (Presentation & Report)

During the semester, you will be expected to work on a research project, either by yourself or with other

students. Projects will be graded competitively, i.e. relative to other projects in the class. The project can be

about any topic in corporate financial management that is covered in this our course, but you must clear your

topic with me first.

Presentation: The in-class presentation should concentrate on presenting and discussing your research and

findings within 20-25 minutes. Only one person from the team is expected to present, but I, and people from

other teams may ask any person on your team questions during the presentation regarding your topic. You are

expected to answer these as clearly and thoroughly as possible, but not necessarily during the presentation

itself. There will be a five to ten-minute time period after each presentation allotted for such questions.

Report: The project report should look professional, and include an executive summary, an introduction, a

middle section, and a conclusion. It should be about 8-10 pages (single-spaced), not including any appendices.

You are also encouraged to use figures, graphs or tables (not more than 5 or 6 altogether) to illustrate, support

and clarify your main points. In order to justify the inclusion of a particular table, figure or graph, your report

must refer to the data contained in this table, figure, or graph. You can place figures, graphs or tables, either at

the end or within the write-up itself. You must include a table of contents at the beginning of the report, and a

complete table of references (i.e. bibliography) at the end of the report that includes all of the sources referred

to in your report.

Important Note: You must be thorough in your analysis and persuasive in your arguments, in both the project

report and the in-class presentation. Use as much quantitative and other specific information (details) as

necessary to support your conclusions and/or arguments, but no more. Note that you are required to

synthesize the information you have gathered and to use this information to facilitate your numerical analyses

and to support your arguments. The research project is NOT supposed to be merely a collection of unrelated

facts, figures and/or dates of certain events. You must be able to make convincing connections between

events, companies, concepts, etc. In other words, I am just as interested in your thought process, as I am in

what you know, or have learned.

(Suggested) List of Topics for Project:

1. A study of a large corporation (it can be a Dow Jones or a Fortune 500 firm, or another well-known US

corporation) that involves a thorough analysis of the corporations financial situation in the past few years,

its current situation, as well as its future outlook. The analysis can include, but not be limited to cash flows,

financial ratios, stock price, and a thorough analysis of key events that drove changes in measures of

financial performance. Based strictly on your analysis, specific recommendations should also be made to

potential investors regarding whether they should buy or sell the stock.

5

2. A review of the latest changes or trends in corporate finance (e.g. executive compensation, the manager-

shareholder conflict, corporate governance, cost of capital, capital investment decisions, capital structure,

etc.) Use specific numerical examples and data (including tables and charts) if possible to illustrate any

important key points/sections in your report. Also, relate your arguments to what we learned in the course

whenever possible.

3. A thorough estimation of the weighted average cost of capital (WACC) for a large US corporation, including

the estimation of unlevered betas, target capital (debt) structure, the risk-free rate, estimation of the

market risk premium, etc. Use the methods learned in the course as well as other methods (if applicable).

In addition, your report must include a comparison of your WACC estimate to that of other firms in the

same industry, and an analysis of the discrepancies/similarities. Remember, you will need lots of specific

details about the corporation, and to use what you have learned in the course (and possibly go beyond it).

4. Case study of a large corporation (must be a non-financial corporation, i.e. not a bank or investment firm)

that has experienced major financial troubles in its recent history (i.e. huge financial losses, stock price

declines, etc.), and the aftermath of its financial troubles. How did the firms managers respond to the

crisis? Was the response adequate and appropriate? Was it unexpected? What precautions could or

should the firms have taken to ensure the financial crisis did not reoccur? How has the financial health of

the firm actually changed since its financial troubles? If it changed for the better, was it due to unexpected

(fortunate) events (i.e. competitors suffered a loss, a highly successful product, etc.), or did specific

decisions of the CEO, shareholders, play a significant role? If the situation did not improve, why not?

Discuss in detail with lots of specific details (dates, names, etc.) and numerical data.

5. Other possible research ideas are also welcome, but you must clear the topic with me first.

Harvard Online Simulation (M&A in Wine Country V2)

In this multi-player simulation, students will play the role of a CEO at 1 of 3 publicly traded wine producers: Bel

Vino, Starshine, or International Beverage. Bel Vino and Starshine consider a merger-of-equals transaction

while International Beverage considers acquiring either Bel Vino or Starshine. Students review confidential

information to determine value and set reservation prices (Round 1) before negotiating deal terms (Round 2).

Stock prices rise and fall in reaction to the formal bidding process and help create a dynamic and competitive

negotiation environment. Subjects Covered: Financial negotiations; Mergers & acquisitions; Valuation; Value

creation

The simulation is entirely web-based and a built-in chat feature allows students to negotiate privately online.

Simulation Schedule:

Wed, Nov 5: In-class Session 1: Discussion of upcoming simulation.

o Debrief subjects: Rationale for Business combinations; Setting reservation prices; value creation

opportunities; Financial structure synergies; Next steps

o Students will be assigned to groups of two, and instructions will be given for upcoming play

Wed, Nov 5 (right after class): Round 1 (reservation price phase) begins: Students use financial analysis

and valuation methods to calculate & submit their reservation price. This takes place outside the

classroom.

Wed, Nov 12: (right before class): Round 1 ends: All reservation prices must be entered no later than

4:30pm on this day No exceptions!

Wed, Nov 12 (right after class): Round 2 (negotiation phase) begins: This is where the actual simulation of

the bidding process happens and where merger/acquisition deals are made. This takes place outside the

classroom.

Wed, Nov 19: In-class Session 2: Discussion & debriefing of the simulation: Discussing actual negotiations,

outcomes and lessons learned.

6

Exams

There will be two exams, i.e. a mid-term and a final. The final is not cumulative. The mid-term exam will be

given in class during regular class time. I will tell you more about each exam as we get closer to the exam

dates. For each exam and assignment you are required to use a financial calculator, and optionally, four single-

sided (or two double sided) 8 11 sheets of notes and formulas. After your exams are graded, your grade

point score as well as your raw exam score will be posted on Blackboard.

Class Participation

For this class to be a success I need active and meaningful participation by students, and strongly encourage

such participation. Students who make frequent and meaningful contributions will earn the maximum number

of class participation points.

Office Hours, Appointments and Email Correspondence

My office hours (during regular semesters) and office location are listed on the first page of this syllabus. While

I am unable to meet outside of my office hours, I can answer any questions you have via email. To make sure

your email receives timely attention, please write Student BUS 536 in the subject field of your email.

Important Dates to keep in mind

First class: Aug 25; Last class: Dec 8

Last date to withdraw from this class: Wed, June 11

No class on: Sep 1 (Labor Day); Oct 13 (Fall Break), Nov 26 (Thanksgiving)

Electronic end of semester SEIs: Dec 1 10

Final exam: Dec 15, 5:00-7:00pm

Policies

Attendance and Absences: While I do not take attendance, I do ask that students attend every class and every

in-class presentation. Please note that you are responsible for obtaining any class materials and notes you did

not receive due to your absence. Students are personally responsible for obtaining any class materials and

notes they did not receive due to absences. Although attendance rarely affects your grade, missing a lot of

classes without a valid excuse (more than four), could adversely affect your overall grade.

Missed Exams, Quizzes, or Assignments, and Grade Changes: Make-up exams will not be given for missed

exams. If you miss the deadline for an online quiz, you will lose points for the quiz. Without a valid written

excuse, you will not receive credit for missed exams. If you have a valid written excuse for any missed exam,

the average of your other exams will be used to determine your missed exam score. Without a valid excuse, a

missed exam will receive a score of zero.

Cheating and plagiarism: Students are expected to maintain the highest standards of honesty in their college

work. Cheating, forgery, and plagiarism are serious offenses, and students that engage in any form of academic

dishonesty will be subject to disciplinary action (see http://www.newpaltz.edu/advising/policies_integrity.html

for college academic integrity policy). The School of Business Ethics Statement and Policy Regarding Unethical

or Dishonest Behavior are appended, and can be viewed online at:

http://www.newpaltz.edu/schoolofbusiness/adminacad_integrity.html and

http://www.newpaltz.edu/schoolofbusiness/adminacad_behavior.html.

7

Information on electronic SEIs: students are responsible for completing the Student Evaluation of Instruction

(SEI) for this course and for all courses with an enrollment of three or more students. I value your feedback

and use it to improve my teaching and planning. Please complete the form online during the period shown

above, in the section: Important Dates to keep in mind.

Students with Disabilities: I make reasonable efforts to accommodate students with disabilities, including, but

not limited to, the scheduling of exams through the Disability Resource Center (DRC).

Course Schedule (continues on next page)

This schedule is tentative. Announcements will be posted on Blackboard if any changes occur.

Class Date Class Topics (in order) Source

1 Aug 25

Course Introduction and Assign teams

Basic Concepts (Chap 1, 2, 3): Please review on your own

(see Connect for practice and review material)

Connect

2 Aug 27 Discounted Cash Flow Valuation Ch 4

- Sep 1 Labor Day (no class)

3 Sep 3

Presentation: Ch4

Interest Rates and Bond Valuation (1)

Ch 5

4 Sep 8

Interest Rates and Bond Valuation (2)

Presentation: Ch5

5 Sep 10 Stock Valuation (1) Ch 6

6 Sep 15

Stock Valuation (2)

Presentation: Ch6

7 Sep 17 Net Present Value and Other Investment Rules (1) Ch 7

8 Sep 22

Chapter 6 Case Study Due (start of class)

Net Present Value and Other Investment Rules (2)

9 Sep 24

Presentation: Ch7

Making Capital Investment Decisions (1)

Ch 8

10 Sep 29 Making Capital Investment Decisions (2)

11 Oct 1 Making Capital Investment Decisions (3)

- Oct 6 Mid-Term Exam

12 Oct 8

Risk and Return Lessons from Market History (shortened)

Presentation: Ch10

Return and Risk: The Capital Asset Pricing Model (1)

Ch 10

Ch 11

- Oct 13 Fall Break (no class)

13 Oct 15 Return and Risk: The Capital Asset Pricing Model (2) Ch 11

14 Oct 20

Return and Risk: The Capital Asset Pricing Model (3)

Presentation: Ch 11

15 Oct 22 Risk, Cost of Capital, Capital Budgeting (1) Ch 12

16 Oct 27 Risk, Cost of Capital, Capital Budgeting (2)

17 Oct 29

Risk, Cost of Capital, Capital Budgeting (3)

Presentation: Ch12

8

Course Schedule (continued from previous page)

Class Date Class Topics (in order) Source

18 Nov 3 Mergers and Acquisitions (1) Ch 21

19 Nov 5

Mergers and Acquisitions (2)

HBS Simulation: Introduction & pre-simulation discussion

20 Nov 10 Capital Structure: Basic Concepts (1) Ch 14

21 Nov 12

All reservation prices for Simulation to be submitted by

4:30pm, i.e. before class

Capital Structure: Basic Concepts (2)

- Negotiation round of simulation begins right after class

22 Nov 17

Capital Structure: Limits to the Use of Debt (shortened)

Presentation: Ch15

Ch 15

23 Nov 19 HBS Simulation: Post-simulation debrief/discussion

24 Nov 24 Project Presentations

- Nov 26 Thanksgiving Break (no class)

25 Dec 1 Project Presentations

26 Dec 3 Project Presentations

27 Dec 8 Project Presentations

28 Dec 15

Final Exam (Dec 15, 5:00-7:00pm)

(Project Report due by 5:00pm via Blackboard link)

SUNY New Paltz School of Business Ethics Statement

School of Business students are expected to maintain the highest standards of honesty in their college work. Cheating,

forgery, and plagiarism are serious offenses, and students that engage in any form of academic dishonesty will be subject

to disciplinary action. While we prefer to adhere to a code of honor in the School of Business, due to national trends in

cheating, forgery, and plagiarism, we are instituting this policy within the school. Any student found cheating, committing

forgery, or plagiarizing may suffer serious consequences ranging from failing a specific piece of work to failing the course.

In some cases, a student may be expelled from the School of Business and the college.

Your business education includes learning ethics and values. We trust that you have the basic foundation upon which we

can build. You will be judged by your character as well as by your knowledge and skills since the business world

increasingly demands ethical behavior of its employees. Honesty remains an admirable quality.

The academic integrity policy of SUNY New Paltz (http://www.newpaltz.edu/advising/policies_integrity.html) defines

cheating, forgery, and plagiarism as follows.

Cheating is defined as giving or obtaining information by improper means in meeting any academic requirements or in

other aspects of your professional conducts. The use for academic credit of the same work in more than one course

without knowledge or consent of the instructor(s) is a form of cheating and is a serious violation of academic integrity.

Forgery is defined as the alteration of forms, documents, or records, or the signing of such forms or documents by

someone other than the proper designee.

Plagiarism is the representation, intentional or unintentional, of anothers words or ideas as one's own. When using

another person's words in a paper, students must place them within quotation marks or clearly set them off in the text

with appropriate citation. When students use anothers ideas, they must clearly identify the source of the ideas.

Plagiarism is a violation of the rights of the plagiarized author and of the implied assurance by the students that when

9

they submit academic work it is their own work product. If students have any issues with respect to the definition of

plagiarism, it is their responsibility to clarify the matter by conferring with the instructor.

Cases requiring disciplinary and/or grade appeal action will be adjudicated in accordance with Procedures for Resolving

Academic Integrity Cases, a copy of which is available in the office of the Vice President for Students Affairs, the office of

the Provost for Academic Affairs, and in the academic Deans' offices.

We, the members of the SUNY New Paltz School of Business community, are committed to practicing the highest

standards of ethical behavior and demonstrating integrity in all we do. We practice these standards and expect them to

be demonstrated by others not only in our business dealings, but in all our relationships. Ours is a culture of integrity.

For us, ethical behavior means adhering to certain standards in both public and private.

School of Business Policy Regarding Unethical or Dishonest Behavior

The school maintains a system (including software and web-based resources), by which students are well informed,

educated and required to acknowledge by electronic signatures, the ethics, honesty and integrity standards of the School

of Business, and the consequences of violating those standards. Instructors who identify any violators should report the

incident to the Deans office for disciplinary action. The following procedure is followed by the deans office for handling

such incidents.

Penalties:

The involved students may request an appeal through Academic Appeal Committee (undergraduate) or Graduate Council

(graduate students). First time offenders receive a failing grade for the course, which can only be changed based on a

favorable outcome of the appeals process, if applicable. The deans office keeps a list of first time offenders. The

offenders are also required to recertify their understanding of our ethics, honesty and integrity standards. A second time

undergraduate offender will be referred for possible dismissal to the Office of Student Affairs. A second time graduate

student offender will be dismissed from the Master's degree program in which he/she is matriculated, subject to review

by the Graduate Council.

Note: Once a student completes the training program, he/she shall be treated equally regardless of their previous

educational experience and cultural norms. Instructors are encouraged to remind students of our ethics, honesty and

integrity standards at the beginning of each course.

Anda mungkin juga menyukai

- rsm427h1f 20129Dokumen8 halamanrsm427h1f 20129nnoumanBelum ada peringkat

- 11-601 Coding Bootcamp SyllabusDokumen11 halaman11-601 Coding Bootcamp Syllabuspak bosssBelum ada peringkat

- IT 115 Design Documentation Syllabus WED Spring 16Dokumen14 halamanIT 115 Design Documentation Syllabus WED Spring 16Rider TorqueBelum ada peringkat

- FINE 6200 F, Winter 2016, TuesdayDokumen9 halamanFINE 6200 F, Winter 2016, TuesdayAlex PoonBelum ada peringkat

- UT Dallas Syllabus For bps6310.0g1 06f Taught by Marilyn Kaplan (Mkaplan)Dokumen13 halamanUT Dallas Syllabus For bps6310.0g1 06f Taught by Marilyn Kaplan (Mkaplan)UT Dallas Provost's Technology GroupBelum ada peringkat

- Behavioral Economics & Decision Making (Webb) SP2017Dokumen11 halamanBehavioral Economics & Decision Making (Webb) SP2017darwin12Belum ada peringkat

- Analysis of Business StrategiesDokumen12 halamanAnalysis of Business StrategiesFawad Ahmed ArainBelum ada peringkat

- Queen's MBA Operations Management CourseDokumen9 halamanQueen's MBA Operations Management CourseNguyen Tran Tuan100% (1)

- GMGT 2010, A01-A02 (3CH) Business Communications September 8 - December 10, 2021 A01, 8:30 A.m.-9:45 A.M. A02, 11:30 A.m.-12:45 P.M. Mon/WedDokumen16 halamanGMGT 2010, A01-A02 (3CH) Business Communications September 8 - December 10, 2021 A01, 8:30 A.m.-9:45 A.M. A02, 11:30 A.m.-12:45 P.M. Mon/WedAhnafBelum ada peringkat

- Course Outline BUA602 - Fall 2023 Sec - FF (CRN 72892)Dokumen15 halamanCourse Outline BUA602 - Fall 2023 Sec - FF (CRN 72892)Pooja BadeBelum ada peringkat

- Syllabus HarvardDokumen8 halamanSyllabus HarvardAngelo KstllanosBelum ada peringkat

- Ais Auditing Adm4346aDokumen16 halamanAis Auditing Adm4346aArienBelum ada peringkat

- OPER3P92 Outline 2015Dokumen7 halamanOPER3P92 Outline 2015Samuel LiBelum ada peringkat

- SYLLABUS Fixed Income AnalysisDokumen5 halamanSYLLABUS Fixed Income AnalysisCloudSpireBelum ada peringkat

- BUSMHR 4490 3485 Syllabus FinalDokumen10 halamanBUSMHR 4490 3485 Syllabus FinalPhuong TranBelum ada peringkat

- W12 OMS311 SyllabusDokumen15 halamanW12 OMS311 SyllabusYoung H. ChoBelum ada peringkat

- Supplemental Course Outline, COMM 212 - Fall 2014 Revised Prof Wendy KellerDokumen10 halamanSupplemental Course Outline, COMM 212 - Fall 2014 Revised Prof Wendy KellerboomclapslapBelum ada peringkat

- His Is A Full Class Attendance at The First Day of Class Is MandatoryDokumen11 halamanHis Is A Full Class Attendance at The First Day of Class Is MandatoryChaucer19100% (1)

- Course Outline Mgnt4670 Winter 2008 Section 02Dokumen7 halamanCourse Outline Mgnt4670 Winter 2008 Section 02hatanoloveBelum ada peringkat

- 111061Dokumen9 halaman111061chamaarBelum ada peringkat

- IIMB - Tech Ops Strat - PGP T4 - 2019-20 - Syllabus - June 12 2019Dokumen7 halamanIIMB - Tech Ops Strat - PGP T4 - 2019-20 - Syllabus - June 12 2019Sai RamBelum ada peringkat

- MGMT 5320.001 Spring 2013 SyllabusDokumen16 halamanMGMT 5320.001 Spring 2013 SyllabusKiều Thảo AnhBelum ada peringkat

- MADMSyllabus 2009Dokumen13 halamanMADMSyllabus 2009api-7002006Belum ada peringkat

- COMM 401 Course Outline - 2021 Summer - ADDokumen8 halamanCOMM 401 Course Outline - 2021 Summer - ADJiedan HuangBelum ada peringkat

- W24 Section K - Course OutlineDokumen7 halamanW24 Section K - Course Outlinemariannee.santoroBelum ada peringkat

- Behavioral Economics & Decision Making (Webb) SP2016Dokumen14 halamanBehavioral Economics & Decision Making (Webb) SP2016darwin12Belum ada peringkat

- Prices ADokumen13 halamanPrices AKumar KisBelum ada peringkat

- SMU Cox Financial ModelingDokumen5 halamanSMU Cox Financial Modelingobliv11Belum ada peringkat

- Project Outline Rooms DivisionDokumen8 halamanProject Outline Rooms DivisionLiza RodVilBelum ada peringkat

- SDSU BA360 SyllabusDokumen7 halamanSDSU BA360 SyllabusChristina LiuBelum ada peringkat

- BUAD 425 SyllabusDokumen7 halamanBUAD 425 SyllabussocalsurfyBelum ada peringkat

- IDS 406 Spring 2008Dokumen8 halamanIDS 406 Spring 2008Maggie Phillips HammondBelum ada peringkat

- Comm 401 My Course Outline Summer 2019Dokumen9 halamanComm 401 My Course Outline Summer 2019hakawrBelum ada peringkat

- STAT 512: Applied Regression Analysis: Fall 2018Dokumen7 halamanSTAT 512: Applied Regression Analysis: Fall 2018Gurkreet SodhiBelum ada peringkat

- Iom 581 TTH Syllabus: Sosic@Marshall - Usc.EduDokumen11 halamanIom 581 TTH Syllabus: Sosic@Marshall - Usc.Edusocalsurfy0% (1)

- Management SyllabusDokumen10 halamanManagement SyllabusTom QiBelum ada peringkat

- MGT3412Fall - 2016 Course OutlineDokumen8 halamanMGT3412Fall - 2016 Course OutlineJBelum ada peringkat

- MAR6157 International Marketing All Xie, JDokumen9 halamanMAR6157 International Marketing All Xie, JMithilesh SinghBelum ada peringkat

- Tech Ops Strat - 2022-23 - PGP - 25may2022Dokumen8 halamanTech Ops Strat - 2022-23 - PGP - 25may2022Rashesh S VBelum ada peringkat

- Syllabus Fall2015Dokumen6 halamanSyllabus Fall2015Vemuri RajaBelum ada peringkat

- CS4443 XTIA - TSU Web-Based Software Development (Xiaoli Huan)Dokumen7 halamanCS4443 XTIA - TSU Web-Based Software Development (Xiaoli Huan)canadaspiritBelum ada peringkat

- UT Dallas Syllabus For Ba4305.002.10s Taught by (h1562)Dokumen12 halamanUT Dallas Syllabus For Ba4305.002.10s Taught by (h1562)UT Dallas Provost's Technology GroupBelum ada peringkat

- Achieving Effective Operations SyllabusDokumen6 halamanAchieving Effective Operations SyllabusKyleHudginsBelum ada peringkat

- HRDV 3308 Syllabus Spring 2016 ZaragozaDokumen12 halamanHRDV 3308 Syllabus Spring 2016 ZaragozaJosylynnBelum ada peringkat

- Updated FIN812 Capital Budgeting - 2015 - SpringDokumen6 halamanUpdated FIN812 Capital Budgeting - 2015 - Springnguyen_tridung2Belum ada peringkat

- MGM101 Introduction to Management FunctionsDokumen11 halamanMGM101 Introduction to Management FunctionsBookAddict721Belum ada peringkat

- Math 5760 /6890: Introduction To Mathematical Finance I Fall 2020 SyllabusDokumen4 halamanMath 5760 /6890: Introduction To Mathematical Finance I Fall 2020 Syllabussaruji_sanBelum ada peringkat

- 5133 Syllabus 2016F DallasDokumen6 halaman5133 Syllabus 2016F DallasHousi WongBelum ada peringkat

- OMSA6740 Summer2023 Xie SyllabusDokumen6 halamanOMSA6740 Summer2023 Xie Syllabuslauren.barthenheierBelum ada peringkat

- TC576Dokumen7 halamanTC576galileaaddisonBelum ada peringkat

- BRIEF POSTER CWB (23jan) PMMDokumen12 halamanBRIEF POSTER CWB (23jan) PMMaishariaz342Belum ada peringkat

- BUS 331 01 Syllabus Wynter Spring 2023Dokumen6 halamanBUS 331 01 Syllabus Wynter Spring 2023Javan OdephBelum ada peringkat

- COMM401 Syllabus Fall15 DKerDokumen6 halamanCOMM401 Syllabus Fall15 DKerAnthony WhiteBelum ada peringkat

- EML 4501 SyllabusDokumen4 halamanEML 4501 SyllabusShyam Ramanath ThillainathanBelum ada peringkat

- MKT 460: Marketing Information and Analysis: 1. Course OverviewDokumen9 halamanMKT 460: Marketing Information and Analysis: 1. Course OverviewNghĩa Nguyễn TrọngBelum ada peringkat

- Coursework 1 - Brief and Guidance 2018-19 FinalDokumen12 halamanCoursework 1 - Brief and Guidance 2018-19 FinalHans HoBelum ada peringkat

- CSCI 335 Software Design and Analysis III SyllabusDokumen7 halamanCSCI 335 Software Design and Analysis III Syllabushicu0Belum ada peringkat

- TOGAF® 9.2 Level 2 Scenario Strategies Wonder Guide Volume 1 – 2023 Enhanced Edition: TOGAF® 9.2 Wonder Guide Series, #4Dari EverandTOGAF® 9.2 Level 2 Scenario Strategies Wonder Guide Volume 1 – 2023 Enhanced Edition: TOGAF® 9.2 Wonder Guide Series, #4Belum ada peringkat

- Teaching Primary Programming with Scratch Pupil Book Year 6Dari EverandTeaching Primary Programming with Scratch Pupil Book Year 6Belum ada peringkat

- Green Tea Crème Brûlée 抹茶クレームブリュレDokumen1 halamanGreen Tea Crème Brûlée 抹茶クレームブリュレpheeyonaBelum ada peringkat

- Case - Euro Disney Disucssion QuestionsDokumen1 halamanCase - Euro Disney Disucssion QuestionspheeyonaBelum ada peringkat

- MBA507Dokumen10 halamanMBA507pheeyonaBelum ada peringkat

- Analyzing Blockbuster's Strategic Challenges in a Disrupted MarketDokumen2 halamanAnalyzing Blockbuster's Strategic Challenges in a Disrupted MarketpheeyonaBelum ada peringkat

- Analyzing Blockbuster's Strategic Challenges in a Disrupted MarketDokumen2 halamanAnalyzing Blockbuster's Strategic Challenges in a Disrupted MarketpheeyonaBelum ada peringkat

- Case 1 ToyotaDokumen5 halamanCase 1 Toyotapheeyona0% (1)

- Examplary QuestionsDokumen2 halamanExamplary QuestionspheeyonaBelum ada peringkat

- CafeDokumen4 halamanCafepheeyonaBelum ada peringkat

- Website For Asian Movie, HK Movie, Korean Movie, Indian Movie, JapaneseDokumen2 halamanWebsite For Asian Movie, HK Movie, Korean Movie, Indian Movie, JapanesepheeyonaBelum ada peringkat

- Capital Budgeting Decisions ChapterDokumen24 halamanCapital Budgeting Decisions Chapterpheeyona100% (1)

- CASE05 BlockbusterDokumen18 halamanCASE05 BlockbusterpheeyonaBelum ada peringkat

- Country DataDokumen1 halamanCountry DatapheeyonaBelum ada peringkat

- MBA 504 Ch8 SolutionsDokumen11 halamanMBA 504 Ch8 SolutionspheeyonaBelum ada peringkat

- MBA 504 Ch8 SolutionsDokumen11 halamanMBA 504 Ch8 SolutionspheeyonaBelum ada peringkat

- MBA 504 Ch5 SolutionsDokumen12 halamanMBA 504 Ch5 SolutionspheeyonaBelum ada peringkat

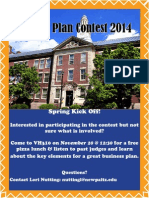

- Business Plan Kickoff ContestDokumen1 halamanBusiness Plan Kickoff ContestpheeyonaBelum ada peringkat

- Business Plan Kickoff ContestDokumen1 halamanBusiness Plan Kickoff ContestpheeyonaBelum ada peringkat

- Marketing Analytics PresentationDokumen40 halamanMarketing Analytics PresentationpheeyonaBelum ada peringkat

- Barclay CaseDokumen7 halamanBarclay CasepheeyonaBelum ada peringkat

- Case SolutionDokumen7 halamanCase SolutionpheeyonaBelum ada peringkat

- Gamma Gamma FinaDokumen11 halamanGamma Gamma FinapheeyonaBelum ada peringkat

- BBCaseDokumen10 halamanBBCasepheeyonaBelum ada peringkat

- Action Plan Template GuidanceDokumen4 halamanAction Plan Template GuidanceJanith DushyanthaBelum ada peringkat

- N01799857@hawkmail Newpaltz EduDokumen4 halamanN01799857@hawkmail Newpaltz EdupheeyonaBelum ada peringkat

- Global Business TODAY GBVDokumen8 halamanGlobal Business TODAY GBVpheeyona33% (6)

- TNK BP RussiaDokumen16 halamanTNK BP RussiapheeyonaBelum ada peringkat

- MOIT Project 1Dokumen24 halamanMOIT Project 1pheeyonaBelum ada peringkat

- Beer in NYDokumen12 halamanBeer in NYpheeyonaBelum ada peringkat

- CASE05 BlockbusterDokumen18 halamanCASE05 BlockbusterpheeyonaBelum ada peringkat

- Factors That Influence Foreign Exchange RatesDokumen19 halamanFactors That Influence Foreign Exchange Ratesmdnabab100% (1)

- Asia Pacific Megatrends 2040: Outputs From The First Dialogue of The Asia Pacific Foresight GroupDokumen20 halamanAsia Pacific Megatrends 2040: Outputs From The First Dialogue of The Asia Pacific Foresight GroupEREBelum ada peringkat

- Total Station (Sokkia)Dokumen2 halamanTotal Station (Sokkia)amiruserBelum ada peringkat

- CNTX - Icmd 2009 (B03) PDFDokumen4 halamanCNTX - Icmd 2009 (B03) PDFIshidaUryuuBelum ada peringkat

- Zhichi Co WordDokumen1 halamanZhichi Co Wordsanjay gautamBelum ada peringkat

- Shriram Transport application formDokumen1 halamanShriram Transport application formPatel SumitBelum ada peringkat

- Kotler POM13e Instructor 10Dokumen35 halamanKotler POM13e Instructor 10Ahsan ButtBelum ada peringkat

- Ray Dalio Ted TalkDokumen2 halamanRay Dalio Ted Talkshashwath raoBelum ada peringkat

- BPSA Case Study - Assignment 2, ABID HUSSAIN, 1419MBA01Dokumen10 halamanBPSA Case Study - Assignment 2, ABID HUSSAIN, 1419MBA01abid hussainBelum ada peringkat

- BUSINESS PROCESS CHAPTERDokumen28 halamanBUSINESS PROCESS CHAPTERPham Thi Hoai PhuongBelum ada peringkat

- NSE NIFTY Correlation Sector IndexesDokumen11 halamanNSE NIFTY Correlation Sector IndexesSAI VAKABelum ada peringkat

- Valuing operating and financial synergies in mergers and acquisitionsDokumen18 halamanValuing operating and financial synergies in mergers and acquisitionsNITISH KUNJBIHARI SHAHBelum ada peringkat

- Interest Rate Parity (IRP) Theory: ExamplesDokumen3 halamanInterest Rate Parity (IRP) Theory: ExamplesMozam MushtaqBelum ada peringkat

- Departmental Stores: Fazil AbbasDokumen26 halamanDepartmental Stores: Fazil Abbassivakulanthay5195Belum ada peringkat

- Progress Report July, 2020 (OF)Dokumen40 halamanProgress Report July, 2020 (OF)Zewdu SimachewBelum ada peringkat

- Kotler Mm15e Inppt 01Dokumen42 halamanKotler Mm15e Inppt 01Prathamesh411100% (2)

- Term Paper of Markrting in Lux Face WashDokumen12 halamanTerm Paper of Markrting in Lux Face Washprashant0071988100% (1)

- WST PrattCapitalDokumen7 halamanWST PrattCapital4thfloorvalueBelum ada peringkat

- Marketing Chp9 L13-14Dokumen29 halamanMarketing Chp9 L13-14kEBAYBelum ada peringkat

- Invoice: Dummy 1 1-Apr-2007 HODDokumen2 halamanInvoice: Dummy 1 1-Apr-2007 HODharshaBelum ada peringkat

- Rental CriteriaDokumen6 halamanRental CriteriaHafiz Ahmad HassanBelum ada peringkat

- Group 15 F 405 Working Capital ManagementDokumen17 halamanGroup 15 F 405 Working Capital ManagementNowshad AyubBelum ada peringkat

- Chine FireworksDokumen4 halamanChine Fireworksأغيلا جيليانBelum ada peringkat

- MANSEK Equity Strategy - June 2023 MaterialDokumen58 halamanMANSEK Equity Strategy - June 2023 MaterialAnak CulunBelum ada peringkat

- ASSIGNMENT NO. 1 - Chapter 5 Final Income TaxationDokumen5 halamanASSIGNMENT NO. 1 - Chapter 5 Final Income TaxationElaiza Jayne PongaseBelum ada peringkat

- BMW Analysis: ST RDDokumen12 halamanBMW Analysis: ST RDJuewei ChenBelum ada peringkat

- Ia1 Assignment-CcmDokumen2 halamanIa1 Assignment-CcmNikhilBelum ada peringkat

- Competition, Cooperation and Conflict in Economy and BiologyDokumen7 halamanCompetition, Cooperation and Conflict in Economy and BiologyCarolina Riveros ArdilaBelum ada peringkat

- Kantar BrandZ Global Report 2023 v19Dokumen190 halamanKantar BrandZ Global Report 2023 v19RimRimRimBelum ada peringkat

- Tanker Full Report SMOO Q2 2023Dokumen8 halamanTanker Full Report SMOO Q2 2023danke22Belum ada peringkat