Harsh

Diunggah oleh

Michel EricHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Harsh

Diunggah oleh

Michel EricHak Cipta:

Format Tersedia

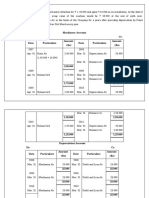

On 1

st

January 2001, X Ltd. purchased a machine for Rs.58,000 and

spent Rs.2,000 on its erection. On 1

st

July 2001, an additional

machinery costing Rs.20,000 was purchased. On 1

st

July 2003, the

machine purchased on 1.1.2001 was sold for Rs.28,600 and on the

same date a new machine was purchased at a cost of Rs.40,000.

Depreciation was provided for annually on 31

st

December, at the

rate of 10% p.a. on the written down value of the machinery.

Prepare the Machinery Account for the first three calendar years.

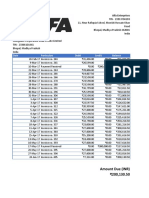

Date Particulars Rs. Date Particulars Rs.

2001

Jan.1

July 1

To Bank A/c

To Bank A/c

To Bank A/c

58,000

2,000

20,000

80,000

2001

Dec.31

By Depreciation A/c

By Balance c/d

7,000

73,000

80,000

2002

Jan 1

To Balance b/d 73,000

73,000

2002

Dec.31

By Depreciation A/c

By Balance c/d

7,300

65,700

73,000

2003

Jan.1

July 1

To Balance b/d

To Bank A/c

65,700

40,000

1,05,700

2003

July 1

July 1

July 1

Dec. 31

Dec. 31

By Bank A/c

By Depreciation A/c

By P & L A/c

By Depreciation A/c

By Balance c/d

28,600

2,430

17,570

3,710

53,390

1,05,700

Solution :

Dr. Machinery A/c Cr.

Anda mungkin juga menyukai

- How Better Regulation Can Shape the Future of Indonesia's Electricity SectorDari EverandHow Better Regulation Can Shape the Future of Indonesia's Electricity SectorBelum ada peringkat

- Chapter 5 DepreciationDokumen20 halamanChapter 5 DepreciationanuradhaBelum ada peringkat

- Viet Nam: Energy Sector Assessment, Strategy, and Road MapDari EverandViet Nam: Energy Sector Assessment, Strategy, and Road MapBelum ada peringkat

- Additional Illustrations-15Dokumen15 halamanAdditional Illustrations-15Gulneer LambaBelum ada peringkat

- Economics of Climate Change Mitigation in Central and West AsiaDari EverandEconomics of Climate Change Mitigation in Central and West AsiaBelum ada peringkat

- Depreciation AccountingDokumen12 halamanDepreciation Accountingshreyu14796Belum ada peringkat

- Depreciation: For 11 CommerceDokumen12 halamanDepreciation: For 11 CommerceAaditya Agrawal100% (1)

- Indonesia: Energy Sector Assessment, Strategy, and Road MapDari EverandIndonesia: Energy Sector Assessment, Strategy, and Road MapBelum ada peringkat

- FAC1502 Tutorial Letter 102 UNISADokumen45 halamanFAC1502 Tutorial Letter 102 UNISAdanBelum ada peringkat

- Nepal Energy Sector Assessment, Strategy, and Road MapDari EverandNepal Energy Sector Assessment, Strategy, and Road MapBelum ada peringkat

- CCP302Dokumen10 halamanCCP302api-3849444Belum ada peringkat

- Depriciation Methods 1Dokumen26 halamanDepriciation Methods 1wasif ahmedBelum ada peringkat

- RTP Group IDokumen202 halamanRTP Group Iravi_bansal85Belum ada peringkat

- DepreciationDokumen9 halamanDepreciationPriyank JainBelum ada peringkat

- U8 - DCM1103 - Fundamentals of Accounting IDokumen4 halamanU8 - DCM1103 - Fundamentals of Accounting IowaisBelum ada peringkat

- Reveiw For MondayDokumen8 halamanReveiw For MondayRehab ElsamnyBelum ada peringkat

- Final Accounts QuestionDokumen12 halamanFinal Accounts QuestionIndu Gupta33% (3)

- Practice Question DepreciationDokumen100 halamanPractice Question DepreciationTinu Burmi AnandBelum ada peringkat

- DepreciationDokumen84 halamanDepreciationDubai SheikhBelum ada peringkat

- CCP302Dokumen13 halamanCCP302api-3849444Belum ada peringkat

- Accounting Assignment PDFDokumen58 halamanAccounting Assignment PDFIsha_12Belum ada peringkat

- Kts g11 - Principles of Accounts Final AdjustmentsDokumen16 halamanKts g11 - Principles of Accounts Final AdjustmentsBupe Banda100% (1)

- Lecture No.3Dokumen3 halamanLecture No.3Assi JammiBelum ada peringkat

- Trail BlanceDokumen9 halamanTrail Blanceujjwalkumar02090Belum ada peringkat

- Financial Accounting and Reporting II-FS2021 Assignment 1 (Ranib Bhakta Sainju)Dokumen6 halamanFinancial Accounting and Reporting II-FS2021 Assignment 1 (Ranib Bhakta Sainju)Ranib Bhakta SainjuBelum ada peringkat

- Bank Reconciliation PerdiscoDokumen8 halamanBank Reconciliation Perdiscoabhii10238% (24)

- BudgetingDokumen51 halamanBudgetingVignesh KivickyBelum ada peringkat

- June Accounting QuestionsDokumen6 halamanJune Accounting QuestionsallhomeworktutorsBelum ada peringkat

- Ledger: by Christy Biju ClassDokumen31 halamanLedger: by Christy Biju ClassCHRISTY BIJUBelum ada peringkat

- ACC201 Examination July Semester 2007Dokumen7 halamanACC201 Examination July Semester 2007reflectooBelum ada peringkat

- Solutions OfChapter10Dokumen5 halamanSolutions OfChapter10Vijey RamalingamBelum ada peringkat

- Accounting For Managers 1Dokumen43 halamanAccounting For Managers 1nivedita_h424040% (1)

- All VouchersDokumen23 halamanAll VouchersSunandaBelum ada peringkat

- 6 Disposal of Fixed AssetsDokumen6 halaman6 Disposal of Fixed Assetsశ్రీనివాసకిరణ్కుమార్చతుర్వేదులBelum ada peringkat

- Lab Assisst InstructionsDokumen7 halamanLab Assisst InstructionsOlumideBelum ada peringkat

- Accounts Preliminary Paper No 8Dokumen6 halamanAccounts Preliminary Paper No 8AMIN BUHARI ABDUL KHADERBelum ada peringkat

- Depreciation WorksheetDokumen17 halamanDepreciation WorksheetMayank VermaBelum ada peringkat

- DepreciationDokumen21 halamanDepreciationDark XYBelum ada peringkat

- 11 Accountancy Notes ch05 Depreciation Provision and Reserves 02 PDFDokumen18 halaman11 Accountancy Notes ch05 Depreciation Provision and Reserves 02 PDFVigneshBelum ada peringkat

- 01 Lectures Notes Final PDFDokumen16 halaman01 Lectures Notes Final PDFMuhammad Arslan100% (3)

- Book-Keeping and Accounts/Series-2-2004 (Code2006)Dokumen16 halamanBook-Keeping and Accounts/Series-2-2004 (Code2006)Hein Linn Kyaw100% (4)

- Depreciation: Submitted By: Abhilasha Lovepreet Parul Sunira TarrunnumDokumen31 halamanDepreciation: Submitted By: Abhilasha Lovepreet Parul Sunira TarrunnumnimrandBelum ada peringkat

- Financial Accounting 1: Class: K53Dd Team 3 Chapter 4: Property, Plan and EquipmentDokumen15 halamanFinancial Accounting 1: Class: K53Dd Team 3 Chapter 4: Property, Plan and EquipmentChitta LeeBelum ada peringkat

- Depreciation WorksheetDokumen1 halamanDepreciation WorksheetbnbcafejaipurBelum ada peringkat

- Kunda LTD Liq QnsDokumen1 halamanKunda LTD Liq QnsMkaroBelum ada peringkat

- AccountingDokumen8 halamanAccountingBasil Babym50% (2)

- Accounts Notes Grade 11Dokumen47 halamanAccounts Notes Grade 11Jordan Mulenga100% (1)

- DepreciationDokumen21 halamanDepreciationxvfidxwmgBelum ada peringkat

- Attention C.A. PCC & Ipcc Students: (No.1 Institute of Jharkhand)Dokumen17 halamanAttention C.A. PCC & Ipcc Students: (No.1 Institute of Jharkhand)Mahalaxmi RamasubramanianBelum ada peringkat

- Class 12 Accountancy Solved Sample Paper 2 - 2012Dokumen37 halamanClass 12 Accountancy Solved Sample Paper 2 - 2012cbsestudymaterialsBelum ada peringkat

- 6 Following Are The: (A) Sales (B) Sundry Debtors (C) Closing Stock (D) Sundry Creditors (E) Fixed AssetsDokumen5 halaman6 Following Are The: (A) Sales (B) Sundry Debtors (C) Closing Stock (D) Sundry Creditors (E) Fixed Assetsvaibhav_kapoor_6Belum ada peringkat

- Beearr EngineersDokumen1 halamanBeearr Engineerskk5860232Belum ada peringkat

- (RSS) Financial Accounting - I: Debit CreditDokumen8 halaman(RSS) Financial Accounting - I: Debit CreditNiteeshaBelum ada peringkat

- Accounts Compiler by Rahul Malkan Sir-73-98Dokumen26 halamanAccounts Compiler by Rahul Malkan Sir-73-98sanketBelum ada peringkat

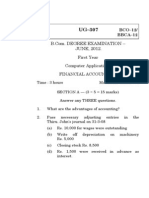

- UG307 BCO12-bbca12Dokumen6 halamanUG307 BCO12-bbca12Vignesh KumarBelum ada peringkat

- Example 1: Pass-Book: Date Particulars Withdrawals Deposits Dr. or Cr. BalanceDokumen5 halamanExample 1: Pass-Book: Date Particulars Withdrawals Deposits Dr. or Cr. Balancecharu bishtBelum ada peringkat

- Rka Bok 2018 Final Update 1 - 2Dokumen233 halamanRka Bok 2018 Final Update 1 - 2asmiyatunBelum ada peringkat

- Class 11 Accountancy Project 2 Comprehensive ProblemDokumen9 halamanClass 11 Accountancy Project 2 Comprehensive ProblemANTELOPE CVBelum ada peringkat

- Accounting Project (CompletedDokumen20 halamanAccounting Project (CompletedRajesh KumarBelum ada peringkat

- More Power T o You: Company NameDokumen1 halamanMore Power T o You: Company NameMichel EricBelum ada peringkat

- Active Dealer ListDokumen6 halamanActive Dealer ListMichel EricBelum ada peringkat

- How To Plant Aloe VeraDokumen31 halamanHow To Plant Aloe VeraMichel Eric67% (3)

- Account Statement For The Period 01/02/2016 To 29/02/2016Dokumen2 halamanAccount Statement For The Period 01/02/2016 To 29/02/2016Michel EricBelum ada peringkat

- Statement For ManglamDokumen1 halamanStatement For ManglamMichel EricBelum ada peringkat

- IT ProjectDokumen13 halamanIT ProjectMichel EricBelum ada peringkat

- Impact of Smart Phones On Youth by Namita SainiDokumen74 halamanImpact of Smart Phones On Youth by Namita SainiMichel EricBelum ada peringkat

- DB Corporation ProspectusDokumen657 halamanDB Corporation Prospectusvishalsharma8522Belum ada peringkat

- For Research Report: QuestionnaireDokumen6 halamanFor Research Report: QuestionnaireMichel EricBelum ada peringkat

- The Study of Consumer Preference Amp Consumer Perception Towards Various Brands of CarsDokumen76 halamanThe Study of Consumer Preference Amp Consumer Perception Towards Various Brands of CarsMichel EricBelum ada peringkat

- EconomicsDokumen3 halamanEconomicsMichel EricBelum ada peringkat