Form No. 27A

Diunggah oleh

katuri3689Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Form No. 27A

Diunggah oleh

katuri3689Hak Cipta:

Format Tersedia

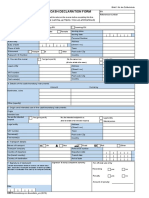

Form No.

27A

Form for furnishing information with the statement of deduction / collection of tax at source ( tick whichever is applicable ) filed on computer media for the period

(From _ _ / _ _ / _ _ to _ _ / _ _ / _ _ (dd/mm/yy)#

1 (a) Tax Deduction Account No. ( d ) Financial Year

(b) Permanent Account No. ( e ) Assessment year

(c) Form No. (f) Previous receipt number

(In case return / statement has been filed earlier)

2 Particulars of the deductor / collector 3 Name of the person responsible for deduction / collection of tax

(a) Name (a) Name

(b) Type of deductor* (b) Address

(c) Branch / division (if any) Flat No.

(d) Address Name of the premises / building

Flat No. Road / street / lane

Name of the premises / building Area / location

Road / street / lane Town / City / District

Area / location State

Town / City / District Pin code

State Telephone No.

Pin code E-mail

Telephone No.

E-mail

4 Control totals

Sr. No. No. of deductee / Amount Tax deducted Tax deposited

party paid Rs. / collection (Total challan amount)

records Rs. Rs.

Total

5 Total Number of Annexures enclosed

6 Other Information

VERIFICATION

I, , hereby certify that all the particulars furnished above are correct and complete.

Place : Signature of person responsible for deducting / collecting tax at source

Date : Name and designation of person responsible for deducting / collecting tax at source

* Mention type of deductor - Government or Others

# dd/mm/yy :- date/month/year

Anda mungkin juga menyukai

- Income Taxation Solution Manual 2019 Ed PDFDokumen40 halamanIncome Taxation Solution Manual 2019 Ed PDFCah Cords100% (12)

- Bir Form 1905 New VersionDokumen4 halamanBir Form 1905 New Versionchato law office100% (1)

- Please Write in Capital Letters and Tick Where ApplicableDokumen3 halamanPlease Write in Capital Letters and Tick Where ApplicableYusri JumatBelum ada peringkat

- Final Exam Tax2 With AnswersDokumen6 halamanFinal Exam Tax2 With AnswersNikki Estores GonzalesBelum ada peringkat

- Dangerous Drugs Board Regulation No. 3Dokumen9 halamanDangerous Drugs Board Regulation No. 3Junyvil TumbagaBelum ada peringkat

- CLN4U Legal GlossaryDokumen12 halamanCLN4U Legal GlossaryJulian HeidtBelum ada peringkat

- Interview With A Certified Nut, Mercenary Leader Sydney Burnett-AlleyneDokumen5 halamanInterview With A Certified Nut, Mercenary Leader Sydney Burnett-AlleyneChris WalkerBelum ada peringkat

- 1010EZ FillableDokumen5 halaman1010EZ FillableFilozófus ÖnjelöltBelum ada peringkat

- American ExceptionalismDokumen14 halamanAmerican ExceptionalismSara Škrobo100% (2)

- Form No. 27B: (In Case Return Has Been Filed Earleer)Dokumen1 halamanForm No. 27B: (In Case Return Has Been Filed Earleer)anon-418665100% (1)

- Form No. 27A: (In Case Return / Statement Has Been Filed Earlier)Dokumen1 halamanForm No. 27A: (In Case Return / Statement Has Been Filed Earlier)Rishi SrivastavaBelum ada peringkat

- Form No. 27Q ( (See Section 194E, 194LB, 194LBA, 194LBB, 194LBC, 194LC, 194N, 195, 196A, 196B, 196C, 196D, 197A, 206AA, 206AB and Rule 31A) )Dokumen6 halamanForm No. 27Q ( (See Section 194E, 194LB, 194LBA, 194LBB, 194LBC, 194LC, 194N, 195, 196A, 196B, 196C, 196D, 197A, 206AA, 206AB and Rule 31A) )Sophia RoseBelum ada peringkat

- (See Sections 192A, 193, 194, 194A, 194B, 194BB, 194C, 194D, 194DA, 194EE, 194F, 194G, 194H, 194-I, 194J, 194K, 194LA, 194LBA, 194LBB, 194LBC, 194NDokumen6 halaman(See Sections 192A, 193, 194, 194A, 194B, 194BB, 194C, 194D, 194DA, 194EE, 194F, 194G, 194H, 194-I, 194J, 194K, 194LA, 194LBA, 194LBB, 194LBC, 194NRavi PrakashBelum ada peringkat

- Form No. 27Q (Dokumen7 halamanForm No. 27Q (11co249lovemylifeBelum ada peringkat

- Form ADokumen1 halamanForm APankaj PandeyBelum ada peringkat

- As Approved by Income Tax DepartmentDokumen5 halamanAs Approved by Income Tax DepartmentRicha JoshiBelum ada peringkat

- Printed From Taxmann's Income Tax Rules On CD Page 1 of 3Dokumen3 halamanPrinted From Taxmann's Income Tax Rules On CD Page 1 of 3Akshay SinghBelum ada peringkat

- Form No. 27A (See Rule 37B) Form For Furnishing Information With The Return or Statement of Deduction of Tax at Source Filed On Computer MediaDokumen2 halamanForm No. 27A (See Rule 37B) Form For Furnishing Information With The Return or Statement of Deduction of Tax at Source Filed On Computer Mediabestperson86Belum ada peringkat

- 27a PTNS15179D 24Q Q2 202324Dokumen1 halaman27a PTNS15179D 24Q Q2 202324Santosh ĶBelum ada peringkat

- Form No. 27A: VerificationDokumen1 halamanForm No. 27A: VerificationHIMANSHU VARSHNEYBelum ada peringkat

- 27a Hyda09790e 26Q Q3 201819 PDFDokumen1 halaman27a Hyda09790e 26Q Q3 201819 PDFkukatpally ialaBelum ada peringkat

- Sr. No. No. of Deductee / Party Amount Paid Tax Deducted / Collection Tax Deposited (RS.) (RS.) (RS.) Total Challan AmountDokumen4 halamanSr. No. No. of Deductee / Party Amount Paid Tax Deducted / Collection Tax Deposited (RS.) (RS.) (RS.) Total Challan Amountcool_naviBelum ada peringkat

- 27a Hydm08437c 24Q Q4 201920Dokumen1 halaman27a Hydm08437c 24Q Q4 201920Chadda Bhimsingh KondepudiBelum ada peringkat

- Cash Declaration Form: Y Y Y M Y M D DDokumen2 halamanCash Declaration Form: Y Y Y M Y M D DluisBelum ada peringkat

- Application For A Permit To Construct or Demolish: For Use by Principal AuthorityDokumen2 halamanApplication For A Permit To Construct or Demolish: For Use by Principal AuthorityjcBelum ada peringkat

- Form 27 QDokumen4 halamanForm 27 QPradeep JainBelum ada peringkat

- Application For Registration Information Update/Correction/CancellationDokumen3 halamanApplication For Registration Information Update/Correction/CancellationMarina M. DuqueBelum ada peringkat

- 27a BPLM14677F 27Q Q4 202021Dokumen1 halaman27a BPLM14677F 27Q Q4 202021ManuBelum ada peringkat

- Sw-1621406230-Form 14b - 230710 - 094646Dokumen4 halamanSw-1621406230-Form 14b - 230710 - 094646protaz christopherBelum ada peringkat

- Sample: Application Form Appointment of Distributors Information About YouDokumen4 halamanSample: Application Form Appointment of Distributors Information About YouVenkateshBelum ada peringkat

- DT-1001 Ind RegDokumen4 halamanDT-1001 Ind RegMugabi EltonbenBelum ada peringkat

- 1 Taxpayer Identification Number (TIN) 2 RDO Code 3 Contact Number - 4 Registered NameDokumen3 halaman1 Taxpayer Identification Number (TIN) 2 RDO Code 3 Contact Number - 4 Registered NameRose O. DiscalzoBelum ada peringkat

- Govt Central Registry Rules Form IDokumen9 halamanGovt Central Registry Rules Form ISonam VijBelum ada peringkat

- Pan Card FormDokumen6 halamanPan Card FormAniruddha SamantaBelum ada peringkat

- Taxi and Private Hire Booking Office Licence Renewal Application ChecklistDokumen8 halamanTaxi and Private Hire Booking Office Licence Renewal Application ChecklistAr. RajaBelum ada peringkat

- 27a Cala01174f 26Q Q3 201516Dokumen1 halaman27a Cala01174f 26Q Q3 201516ravibhartia1978Belum ada peringkat

- Area Code AO Type Range Code AO No.: Signature of The DeclarantDokumen2 halamanArea Code AO Type Range Code AO No.: Signature of The Declarantyraju88Belum ada peringkat

- 27a RTKQ00058C 27Q Q4 202122Dokumen1 halaman27a RTKQ00058C 27Q Q4 202122suneet bansalBelum ada peringkat

- Form No. 27A: VerificationDokumen1 halamanForm No. 27A: VerificationAbhinaya JoBelum ada peringkat

- 5LI For Non Surrender of BLDokumen2 halaman5LI For Non Surrender of BLBAHRAT A/L MURALITHARAN MoeBelum ada peringkat

- Itr 62 Form 68Dokumen1 halamanItr 62 Form 68Suresh KumarBelum ada peringkat

- Quick Guide To Using This Utility For Echeckpost: Color CodesDokumen32 halamanQuick Guide To Using This Utility For Echeckpost: Color CodesNagaBelum ada peringkat

- Booking Office 3124Dokumen8 halamanBooking Office 3124m227765hBelum ada peringkat

- Application For Installation of Solar PV On Grid Rooftop SystemsDokumen2 halamanApplication For Installation of Solar PV On Grid Rooftop SystemsElectron ProtonBelum ada peringkat

- Schedule D Withholding On Payment TaxDokumen3 halamanSchedule D Withholding On Payment Taxgirma1299Belum ada peringkat

- Market Operators 4514525Dokumen8 halamanMarket Operators 4514525m227765hBelum ada peringkat

- RGD Revised Form A 002Dokumen8 halamanRGD Revised Form A 002Brew-sam ABBelum ada peringkat

- GMC Registration Application FormDokumen8 halamanGMC Registration Application FormRabiul IslamBelum ada peringkat

- Form No. 27A: VerificationDokumen1 halamanForm No. 27A: VerificationtdsbolluBelum ada peringkat

- Form 68 PDFDokumen1 halamanForm 68 PDFNihanth KandimallaBelum ada peringkat

- Income-Tax Rules, 1962: "FORM No.68 Form of Application Under Section 270AA (2) of The Income-Tax Act, 1961Dokumen1 halamanIncome-Tax Rules, 1962: "FORM No.68 Form of Application Under Section 270AA (2) of The Income-Tax Act, 1961Anonymous 2evaoXKKdBelum ada peringkat

- 1905 January 2018 ENCS - CorrectedDokumen14 halaman1905 January 2018 ENCS - CorrectedKimberly MayBelum ada peringkat

- Application For Shipping Guarantee (SG) / Endorsement of Transport Document (Etd)Dokumen2 halamanApplication For Shipping Guarantee (SG) / Endorsement of Transport Document (Etd)BAHRAT A/L MURALITHARAN MoeBelum ada peringkat

- AARTO 25 - Application For Refunding of MoniesDokumen1 halamanAARTO 25 - Application For Refunding of MoniesMochakaBelum ada peringkat

- 15g and H AutofillDokumen15 halaman15g and H AutofillAnonymous 6z7noS4fBelum ada peringkat

- 27a Amrv10705c 26Q Q4 201819Dokumen1 halaman27a Amrv10705c 26Q Q4 201819Amrit PaulBelum ada peringkat

- 27a Hydi07527c 2Dokumen1 halaman27a Hydi07527c 2efilesgr1Belum ada peringkat

- 27eq 06062016Dokumen4 halaman27eq 06062016Manishtha SharmaBelum ada peringkat

- Cash Declaration Form: Use Capital Letters / Tick As AppropriateDokumen4 halamanCash Declaration Form: Use Capital Letters / Tick As Appropriateamirmohammad KhaliliBelum ada peringkat

- Form No. 15G: Part - IDokumen2 halamanForm No. 15G: Part - Ibalaji stationersBelum ada peringkat

- U.S. Customs Form: CBP Form 823S - SENTRI ApplicationDokumen4 halamanU.S. Customs Form: CBP Form 823S - SENTRI ApplicationCustoms Forms100% (1)

- SSS Calamity Loan Application FormDokumen3 halamanSSS Calamity Loan Application FormVeronica LagoBelum ada peringkat

- Application - To - Rent 2 PDFDokumen3 halamanApplication - To - Rent 2 PDFDimitrios LatsisBelum ada peringkat

- Inbound 1611108369526332790Dokumen5 halamanInbound 1611108369526332790Melvic PitorBelum ada peringkat

- 27a Hydg04225e 26Q Q3Dokumen1 halaman27a Hydg04225e 26Q Q3tdsbolluBelum ada peringkat

- 27a KLPS04342C 24Q Q4 202021Dokumen1 halaman27a KLPS04342C 24Q Q4 202021NIVRATTI CHAVANBelum ada peringkat

- PT - T V NLRCDokumen13 halamanPT - T V NLRCtheresagriggsBelum ada peringkat

- IMA 101-Chapter 1Dokumen3 halamanIMA 101-Chapter 1csaysalifuBelum ada peringkat

- Dan Meador's InstitutionalizedDokumen135 halamanDan Meador's InstitutionalizedleshawthorneBelum ada peringkat

- Agne vs. Director of Lands, 181 SCRA 793, February 06, 1990Dokumen2 halamanAgne vs. Director of Lands, 181 SCRA 793, February 06, 1990Axel FontanillaBelum ada peringkat

- Sexual HarassmentDokumen25 halamanSexual HarassmentDebasish Patra100% (2)

- El Chapo Court Decision/ Special Administrative Measure (SAM)Dokumen18 halamanEl Chapo Court Decision/ Special Administrative Measure (SAM)Chivis MartinezBelum ada peringkat

- Pernec Corp BHD V A & at Advanced Power Systems SDN BHD - 2Dokumen6 halamanPernec Corp BHD V A & at Advanced Power Systems SDN BHD - 2Charumathy NairBelum ada peringkat

- Malto Vs PeopleDokumen33 halamanMalto Vs PeopleTreb LemBelum ada peringkat

- Icc A 2009Dokumen3 halamanIcc A 2009Sana KhairiBelum ada peringkat

- ALTI Minutes of The Meeting 04Dokumen3 halamanALTI Minutes of The Meeting 04Dave Jasm MatusalemBelum ada peringkat

- Philippine Charity Sweepstakes Office vs. de Leon DigestDokumen2 halamanPhilippine Charity Sweepstakes Office vs. de Leon DigestEmir MendozaBelum ada peringkat

- SNY1019 CrosstabsDokumen8 halamanSNY1019 CrosstabsNick ReismanBelum ada peringkat

- Jurisprudence-II Project VIDokumen18 halamanJurisprudence-II Project VISoumya JhaBelum ada peringkat

- SALES: Capacity To BuyDokumen3 halamanSALES: Capacity To BuyMary Joy DomantayBelum ada peringkat

- Corpo Finals ReviewerDokumen3 halamanCorpo Finals ReviewerlawdiscipleBelum ada peringkat

- Republic of The Philippines Vs Hon. Antonio M. Eugenio, Jr. - DigestDokumen2 halamanRepublic of The Philippines Vs Hon. Antonio M. Eugenio, Jr. - DigestJan Michael Jay CuevasBelum ada peringkat

- Nypt - Your Guide To Parking Ticket Hearings - Got TicketsDokumen10 halamanNypt - Your Guide To Parking Ticket Hearings - Got TicketsLawrence BerezinBelum ada peringkat

- In Re Brooks, 1 Phil., 55, November 05, 1901Dokumen2 halamanIn Re Brooks, 1 Phil., 55, November 05, 1901Campbell HezekiahBelum ada peringkat

- Guide To Abolishing Affirmative Action For Women (Christoff's Dear Colleague Letter)Dokumen4 halamanGuide To Abolishing Affirmative Action For Women (Christoff's Dear Colleague Letter)Kursat Christoff Pekgoz100% (2)

- Metropolitan Bank V GonzalesDokumen1 halamanMetropolitan Bank V GonzalesYasuhiro Kei100% (1)

- Bicerra V TenezaDokumen2 halamanBicerra V TenezaClark LimBelum ada peringkat

- Younow Partner Amendment AgreementDokumen4 halamanYounow Partner Amendment AgreementAnonymous xlnmHO5GBelum ada peringkat

- Structural Violence and MilitarismDokumen2 halamanStructural Violence and MilitarismLeso KikwetuBelum ada peringkat