CH 07 SM

Diunggah oleh

api-267019092Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

CH 07 SM

Diunggah oleh

api-267019092Hak Cipta:

Format Tersedia

CHAPTER 7

DISCUSSION QUESTIONS

Q7-1. Quality costs may be grouped into the following three classifications:

1. Prevention costs are the costs incurred to

prevent product failure. They include the

cost of designing high quality products

and production systems, including the

costs of implementing and maintaining

such systems.

2. Appraisal costs are the costs incurred to

detect product failure. They include the

cost of inspecting and testing materials,

inspecting products during production,

and the cost of obtaining information from

customers about product satisfaction.

3. Failure costs are the costs incurred when a

product fails, and may occur internally or

externally. Internal failure costs are those

that occur during the manufacturing or production process (e.g., scrap, spoilage, and

rework), and external failure costs are

those that occur after the product has

been sold (e.g., warranty repairs and

replacements, sales refunds, handling

customer complaints, and lost sales

resulting from poor product quality).

Q7-2. TQM stands for total quality management,

which is a company-wide approach to quality

improvement in all processes and activities.

TQM is a pervasive philosophy of doing business that applies to all functional areas of the

company and to all personnel.

Q7-3. Five characteristics of TQM systems are:

1. The companys objective for all business

activity is to serve its customers. The term

product is extended to include services

as well as goods, and customer includes

internal users as well as those outside of

the company who purchase the companys

products. Each employees activity is oriented to providing service to the customer.

2. Top management provides an active

leadership role in the quality improvement

movement.

3. All employees are actively involved in

quality improvement. Employees are not

only asked to contribute ideas, but also to

Q7-4.

Q7-5.

Q7-6.

Q7-7.

7-1

find better ways of doing things.

Involvement can be successful only when

there is encouragement and an open and

honest environment of trust.

4. The company has a system of identifying

quality problems, developing solutions,

and setting quality improvement objectives. This typically involves organizing

employees from all ranks and from different organizational units along with managers who have authority to take the

necessary action to solve problems.

5. The company places a high value on its

employees and provides continuous training, as well as recognition for achievement. Employees perform best when they

are well trained, and they have the greatest capacity to contribute when they are

highly educated.

The concept of continuous quality improvement

differs from the concept of quality optimization

in that continuous quality improvement is a

dynamic process of change under the assumption that the ideal is not an absolute known

value; whereas quality optimization is a static

approach to finding the best solution to a

given set of fixed and known constraints.

The first problem with trying to inspect quality

into the product is that it detects internal failures only after considerable cost has been

incurred. The second problem is that the magnitude of the cost of the internal failures,

detected by inspection, is rarely measured

and typically ignored.

Companies should concentrate their efforts

on preventing poor quality rather than on trying to inspect it into the process, because it

will result in less total quality cost. The

approach is founded on the belief that by

increasing prevention costs, the cost of internal failuressuch as scrap, spoilage, rework,

and downtimewill decline by a larger

amount than the increase in prevention costs.

Quality costs should be measured and

reported to management in order to provide

incentive and direction for improving quality.

7-2

Large quality costs indicate large opportunities for improvement. Also, measurements

provide a basis for monitoring the cost of

quality and evaluating improvements.

Q7-8. Scrap includes (1) the filings and trimmings

remaining after processing materials, (2)

defective materials that cannot be used or

returned to the vendor, and (3) broken parts

resulting from employee errors or machine

failures. Spoiled goods differ from scrap in

that they are partially or fully completed units

that are in some way defective and are not

economically or physically correctable.

Spoiled goods may be units of the product or

component parts, and they may or may not

have a salvage value. Rework is the process

of correcting defective manufactured goods.

Q7-9. The cost of scrap, spoilage, and rework

should not be ignored, because such costs

Chapter 7

are often quite high and often result from

internal failures that can be eliminated.

Ignoring the cost of these internal failures

sends a signal to managers that such costs

are acceptable. Reporting such costs provides incentive for improvement, particularly if

the costs are large.

Q7-10. In order to know what to do with the cost, the

accountant must know whether the spoilage or

rework is caused by the customer or by an

internal failure. If spoilage or rework is the

result of a customer requirement, the unrecoverable cost should be charged to the job. On

the other hand, if the spoilage or rework is the

consequence of an internal failure, the unrecoverable cost should be removed from the job

(i.e., charged to Factory Overhead Control)

and reported to responsible management.

Chapter 7

7-3

EXERCISES

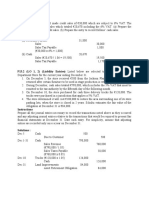

E7-1

(1)

(2)

(3)

(4)

E7-2

E7-3

E7-4

E7-5

Accounts Receivable ...................................................

Scrap Sales (or Other Income)...........................

1,650

Accounts Receivable ...................................................

Cost of Goods Sold.............................................

1,650

Accounts Receivable ...................................................

Factory Overhead Control .................................

1,650

Accounts Receivable ...................................................

Work in Process .................................................

1,650

Spoiled Goods Inventory .............................................

Factory Overhead Control ...........................................

Work in Process .................................................

120

112

1,650

1,650

1,650

1,650

232

$27,000 total job cost/1,000 chairs = $27 cost per chair

Spoiled Goods Inventory ($10 100 chairs)..............

Factory Overhead Control (($27 $10) 100)...........

Finished Goods Inventory ($27 900 chairs)............

Work in Process .................................................

1,000

1,700

24,300

Spoiled goods inventory ($100 100 units) ..............

Cost of Goods Sold......................................................

Work in Process .................................................

10,000

94,000

Factory Overhead Control ...........................................

Materials (100 units $1.50)...............................

Payroll (100 units 1/4 hour $10 per hour) ...

Applied Factory Overhead

(100 1/4 hr $12 rate) .............................

700

Finished Goods Inventory ...........................................

Work in Process .................................................

6,600

27,000

104,000

150

250

300

6,600

7-4

E7-6

Chapter 7

Work in Process............................................................

Materials (1,000 units $1).................................

Payroll (1,000 units 1/6 hour $15) ................

Applied Factory Overhead (1,000 1/6 $30)..

8,500

Cost of Goods Sold......................................................

Work in Process ($65,000 + $8,500)...................

73,500

Accounts Receivable ($73,500 150%) .....................

Sales .....................................................................

110,250

1,000

2,500

5,000

73,500

110,250

Chapter 7

7-5

E7-7

(1)

Island Company

Forming Department

Cost of Production Report

For August

Quantity Schedule

Beginning inventory ...............................

Started in process this period ..............

Materials

Transferred to Finishing Department ....

Ending inventory .....................................

Spoiled in process ..................................

100%

100%

Labor

60%

100%

Cost Charged to Department

Beginning inventory:

Materials ....................................................................................

Labor...........................................................................................

Factory overhead ......................................................................

Total cost in beginning inventory......................................

Cost added during current period:

Materials ....................................................................................

Labor...........................................................................................

Factory overhead.......................................................................

Total cost added during current period............................

Total cost charged to department ..................................................

Cost Accounted for as Follows

Transferred to Finishing Department ....

Charge to Factory Overhead for spoilage:

Materials ............................................

Labor ..................................................

Factory overhead ..............................

Work in Process, ending inventory:

Materials ............................................

Labor ..................................................

Factory overhead ..............................

Total cost accounted for ........................

Units

8,000

Overhead

50%

100%

Quantity

1,000

9,000

10,000

8,000

1,500

500

10,000

Total

Cost

$ 1,260

770

1,400

$ 3,430

Equivalent

Units*

Unit

Cost**

$36,240

10,510

21,725

$68,475

$71,905

10,000

9,400

9,250

$3.75

1.20

2.50

$7.45

% Complete Unit Cost

100%

$7.45

Total Cost

$59,600

500

500

500

100%

100%

100%

$3.75

1.20

2.50

$1,875

600

1,250

1,500

1,500

1,500

100%

60%

50%

$3.75

1.20

2.50

$5,625

1,080

1,875

3,725

8,580

$71,905

7-6

Chapter 7

E7-7 (Concluded)

*Total number of equivalent units required in the cost accounted for section determined as follows:

Equivalent units transferred out.........................

Equivalent units in ending inventory .................

Equivalent units of spoilage ...............................

Total equivalent units...........................................

Materials

8,000

1,500

500

10,000

Labor

8,000

900

500

9,400

Overhead

8,000

750

500

9,250

** Total cost (i.e., the cost in beginning inventory plus the cost added during the current period)

divided by the total number of equivalent units required in the cost accounted for section

(2)

Work in ProcessFinishing Department...................

Factory Overhead Control ...........................................

Work in ProcessForming Department ..

59,600

3,725

63,325

Chapter 7

7-7

E7-8

(1)

Juniper Company

Finishing Department

Cost of Production Report

For July

Quantity Schedule

Beginning inventory................................

Received from Cutting Department.......

Materials

Labor

Overhead

40%

100%

20%

100%

20%

100%

Transferred to Finished Goods ..............

Ending inventory .....................................

Spoiled in process ..................................

Cost Charged to Department

Beginning inventory:

Cost from preceding department.............................................

Materials .....................................................................................

Labor...........................................................................................

Factory overhead.......................................................................

Total cost in beginning inventory ....................................

Cost added during current period:

Cost from preceding department.............................................

Materials ....................................................................................

Labor...........................................................................................

Factory overhead ......................................................................

Total cost added during current period ...........................

Total cost charged to department ..................................................

Cost Accounted for as Follows

Transferred to Finished Goods ..............

Transferred to Spoiled Goods inventory

at salvage value ................................

Charge to Factory Overhead for spoilage:

Cost of completed spoiled units .....

Less salvage value of spoiled units

Work in Process, ending inventory:

Cost from preceding department ....

Materials ............................................

Labor ..................................................

Factory overhead ..............................

Total cost accounted for ........................

Units

3,800

Quantity

500

4,500

5,000

3,800

800

400

5,000

Total

Cost

$ 5,500

1,950

1,180

1,770

$ 10,400

Equivalent

Units*

Unit

Cost**

$ 54,500

20,650

16,260

24,390

$115,800

$126,200

5,000

4,520

4,360

4,360

$12.00

5.00

4.00

6.00

$27.00

% Complete Unit Cost

100%

$27.00

400

Total Cost

$102,600

$10.00

400

400

100%

800

800

800

800

100%

40%

20%

20%

4,000

$27.00

10.00

$10,800

4,000

$12.00

5.00

4.00

6.00

$ 9,600

1,600

640

960

6,800

12,800

$126,200

7-8

Chapter 7

E7-8 (Concluded)

*Total number of equivalent units required in the cost accounted for section determined as follows:

Equivalent units transferred out ............

Equivalent units in ending inventory ....

Equivalent units of spoilage ..................

Total equivalent units .............................

Prior

Dept. Cost Materials

3,800

3,800

800

320

400

400

5,000

4,520

Labor

3,800

160

400

4,360

Overhead

3,800

160

400

4,360

** Total cost (i.e., the cost in beginning inventory plus the cost added during the current period)

divided by the total number of equivalent units required in the cost accounted for section

(2)

Finished Goods Inventory ...........................................

Spoiled Goods Inventory .............................................

Factory Overhead Control ...........................................

Work in ProcessFinishing Department..........

102,600

4,000

6,800

113,400

Chapter 7

E7-9

(1)

7-9

Carver Petroleum Inc.

Cracking Department

Cost of Production Report

For May

Quantity Schedule

Beginning inventory................................

Started in process this period ...............

Transferred to Refining Department......

Ending inventory .....................................

Lost in process .......................................

Materials

Conversion Cost

100%

70%

Cost Charged to Department

Beginning inventory:

Materials ....................................................................................

Conversion cost.........................................................................

Total cost in beginning inventory......................................

Cost added during current period:

Materials ....................................................................................

Conversion cost.........................................................................

Total cost added during current period............................

Total cost charged to department .................................................

Cost Accounted for as Follows

Transferred to Refining Department......

Work in Process, ending inventory:

Materials ............................................

Conversion cost ................................

Total cost accounted for ........................

Units

49,000

6,000

6,000

Quantity

5,000

55,000

60,000

49,000

6,000

5,000

60,000

Total

Cost

$ 1,900

240

$ 2,140

Equivalent

Units*

$20,100

5,080

$25,180

$27,320

55,000

53,200

.40

.10

$.40

.10

$

% Complete Unit Cost

100%

$.50

100%

70%

Unit

Cost**

.50

Total Cost

$24,500

$2,400

420

2,820

$27,320

*Total number of equivalent units required in the cost accounted for section determined as follows:

Equivalent units transferred out .....

Equivalent units in ending inventory

Total equivalent units .......................

Materials

49,000

6,000

55,000

Conversion Cost

49,000

4,200

53,200

** Total cost (i.e., the cost in beginning inventory plus the cost added during the current period)

divided by the total number of equivalent units required in the cost accounted for section

(2)

Work in ProcessRefining Department ....................

Work in ProcessCracking Department ..........

24,500

24,500

7-10

Chapter 7

E7-10 APPENDIX

(1)

Suarez Company

Tooling Department

Cost of Production Report

For March

Quantity Schedule

Beginning inventory................................

Started this period ..................................

Transferred to Finishing Department ....

Ending inventory .....................................

Spoiled in process ..................................

Materials

100%

Labor

70%

100%

100%

60%

90%

Overhead

60%

40%

90%

Quantity

2,000

13,000

15,000

7,000

3,000

5,000

15,000

Cost Charged to Department

Beginning inventory:

Materials .....................................................................................

Labor...........................................................................................

Factory overhead.......................................................................

Total cost in beginning inventory......................................

Cost added during current period:

Materials .....................................................................................

Labor...........................................................................................

Factory overhead ......................................................................

Total cost added during current period............................

Total cost charged to department ..................................................

Total

Cost

$ 1,600

290

950

$ 2,840

Equivalent

Units*

$ 9,750

2,380

9,200

$21,330

$24,170

13,000

11,900

11,500

Cost Accounted for as Follows

Transferred to Finishing Department:

From beginning inventory................

Cost to complete this period:

Materials ...............................

Labor .....................................

Factory overhead .................

Started and completed this period .

Total cost transferred to

Finishing Department ................

Charge to Factory Overhead for spoilage:

Materials ............................................

Labor ..................................................

Factory overhead ..............................

Work in Process, ending inventory:

Materials ............................................

Labor ..................................................

Factory overhead ..............................

Total cost accounted for ........................

Unit Cost

Units

Current %

Unit

Cost**

$.75

.20

.80

$1.75

Total Cost

$2,840

2,000

2,000

2,000

5,000

0%

30%

40%

100%

$ .75

.20

.80

$1.75

0

120

640

$ 3,600

8,750

$12,350

5,000

5,000

5,000

100%

90%

90%

$ .75

.20

.80

$3,750

900

3,600

3,000

3,000

3,000

100%

60%

40%

$ .75

.20

.80

$2,250

360

960

8,250

3,570

$24,170

Chapter 7

7-11

E7-10 APPENDIX (Concluded)

* Number of equivalent units of cost added during the current period determined as follows:

To complete beginning inventory ............................

Started and completed this period ...........................

Ending inventory.........................................................

Spoiled units ...............................................................

Total equivalent units .................................................

Materials

0

5,000

3,000

5,000

13,000

Labor

600

5,000

1,800

4,500

11,900

Overhead

800

5,000

1,200

4,500

11,500

** Cost added during the current period divided by the number of equivalent units of cost added during the current period

(2)

Work in ProcessFinishing Department...................

Factory Overhead Control ...........................................

Work in ProcessTooling Department .............

12,350

8,250

20,600

7-12

Chapter 7

E7-11 APPENDIX

(1)

Matrix Furniture Company

Finishing Department

Cost of Production Report

For September

Quantity Schedule

Beginning inventory................................

Received from Fabricating Department

Transferred to Finished Goods ..............

Ending inventory .....................................

Spoiled in process ..................................

Materials

80%

Labor

40%

Overhead

40%

100%

100%

60%

100%

60%

100%

Cost Charged to Department

Beginning inventory:

Cost from preceding department.............................................

Materials .....................................................................................

Labor...........................................................................................

Factory overhead.......................................................................

Total cost in beginning inventory......................................

Cost added during current period:

Cost from preceding department.............................................

Materials .....................................................................................

Labor...........................................................................................

Factory overhead.......................................................................

Total cost added during current period............................

Total cost charged to department .................................................

Quantity

1,200

6,000

7,200

5,000

1,500

700

7,200

Total

Cost

$ 14,160

1,210

1,300

3,250

$ 19,920

Equivalent

Units*

Unit

Cost**

$ 72,000

6,240

12,240

30,600

$121,080

$141,000

6,000

6,240

6,120

6,120

$12.00

1.00

2.00

5.00

$20.00

Chapter 7

7-13

E7-11 APPENDIX (Concluded)

Cost Accounted for as Follows

Transferred to Finished Goods:

From beginning inventory................

Cost to complete this period:

Materials ...............................

Labor .....................................

Factory overhead .................

Started and completed this period

Total cost transferred to

Finishing Department ................

Transferred to Spoiled Goods inventory

at salvage value ................................

Charge to Factory Overhead for spoilage:

Cost of completed spoiled units .....

Less salvage value of spoiled units

Work in Process, ending inventory:

Cost from preceding department ....

Materials ............................................

Labor ..................................................

Factory overhead ..............................

Total cost accounted for ........................

Units

Current %

Unit Cost

Total Cost

$19,920

1,200

1,200

1,200

3,800

20%

60%

60%

100%

$ 1.00

2.00

5.00

$20.00

240

1,440

3,600

$ 25,200

76,000

$101,200

700

$12.00

700

700

100%

1,500

1,500

1,500

1,500

100%

100%

60%

60%

8,400

$20.00

12.00

$14,000

8,400

$12.00

1.00

2.00

5.00

$18,000

1,500

1,800

4,500

5,600

25,800

$141,000

*Number of equivalent units of cost added during the current period determined as follows:

To complete beginning inventory ...

Started and completed this period .

Ending inventory...............................

Spoiled units .....................................

Total equivalent units .......................

Prior Dept.

Cost

0

3,800

1,500

700

6,000

Material

240

3,800

1,500

700

6,240

Labor

720

3,800

900

700

6,120

Overhead

720

3,800

900

700

6,120

** Cost added during the current period divided by the number of equivalent units of cost added during the current period

(2)

Finished Goods Inventory ...........................................

Spoiled Goods Inventory .............................................

Factory Overhead Control ...........................................

Work in ProcessFinishing Department..........

101,200

8,400

5,600

115,200

7-14

Chapter 7

E7-12 APPENDIX

(1)

Lanai Pop Inc.

Cooking Department

Cost of Production Report

For December

Quantity Schedule

Beginning inventory................................

Received from Mixing Department ........

Transferred to Bottling Department ......

Ending inventory .....................................

Lost in process........................................

Materials

75%

Labor

25%

100%

75%

Overhead

25%

75%

Quantity

10,000

40,000

50,000

37,000

8,000

5,000

50,000

Cost Charged to Department

Beginning inventory:

Cost from preceding department.............................................

Materials .....................................................................................

Labor...........................................................................................

Factory overhead.......................................................................

Total cost in beginning inventory......................................

Cost added during current period:

Cost from preceding department.............................................

Materials ....................................................................................

Labor...........................................................................................

Factory overhead.......................................................................

Total

Cost

$ 2,920

305

140

210

$ 3,575

Equivalent

Units*

$10,850

1,500

2,430

3,645

35,000

37,500

40,500

40,500

Total cost added during current period............................

Total cost charged to department ..................................................

$18,425

$22,000

Cost Accounted for as Follows

Transferred to Bottling Department:

From beginning inventory................

Cost to complete this period:

Materials ...............................

Labor .....................................

Factory overhead ................

Started and completed this period .

Total cost transferred to

Finishing Department ................

Work in Process, ending inventory:

Cost from preceding department ....

Materials ............................................

Labor ..................................................

Factory overhead ..............................

Total cost accounted for.........................

Unit Cost

Units

Current %

Unit

Cost**

$.31

.04

.06

.09

$.50

Total Cost

$3,575

10,000

10,000

10,000

27,000

25%

75%

75%

100%

$.04

.06

.09

$.50

100

450

675

$ 4,800

13,500

$18,300

8,000

8,000

8,000

8,000

100%

100%

75%

75%

$.31

.04

.06

.09

$2,480

320

360

540

3,700

$22,000

Chapter 7

7-15

E7-12 APPENDIX (Concluded)

*Number of equivalent units of cost added during the current period determined as follows:

To complete beginning inventory ...

Started and completed this period .

Ending inventory...............................

Total equivalent units .......................

Prior

Dept. Cost Materials

0

2,500

27,000

27,000

8,000

8,000

35,000

37,500

Labor

7,500

27,000

6,000

40,500

Overhead

7,500

27,000

6,000

40,500

** Cost added during the current period divided by the number of equivalent units of cost added during the current period

(2)

Work in ProcessBottling Department .....................

Work in ProcessCooking Department ..........

18,300

18,300

7-16

Chapter 7

PROBLEMS

P7-1

(1)

(2)

Spoiled Goods Inventory (200 units $1.75).............

Factory Overhead Control ...........................................

Work in Process .................................................

350

1,450

Accounts Receivable ($550 + $350)............................

Scrap Sales .........................................................

Spoiled Goods Inventory ...................................

900

1,800

550

350

P7-2

(1)

(2)

$90,000 total job cost = $18 per unit

5,000 units on job

Spoiled Goods Inventory (200 units $15 salvage) .

Factory Overhead Control ...........................................

Work in Process (200 units $18 cost).............

3,000

600

Cost of Goods Sold......................................................

Work in Process ($90,000 $3,600) ..................

86,400

Accounts Receivable ($86,400 140%) .....................

Sales .....................................................................

120,960

Spoiled Goods Inventory (200 units $15 salvage)

Work in Process .................................................

3,000

Cost of Goods Sold......................................................

Work in Process ($90,000 $3,000) ...................

87,000

Accounts Receivable ($87,000 140%) .....................

Sales .....................................................................

121,800

3,600

86,400

120,960

3,000

87,000

121,800

Chapter 7

7-17

P7-3

(1)

(2)

Factory Overhead Control ...........................................

Materials (100 units $2)....................................

Payroll (100 units 1/2 hr $12 rate) ...............

Applied Factory Overhead

(100 1/2 hr $24 rate) .............................

2,000

Cost of Goods Sold......................................................

Work in Process .................................................

200,000

Accounts Receivable ($200,000 150%) ...................

Sales .....................................................................

300,000

Work in Process............................................................

Materials (100 units $2)....................................

Payroll (100 units 1/2 hour $12 rate) ..........

Applied Factory Overhead

(100 1/2 hr $24 rate) .............................

2,000

Cost of Goods Sold......................................................

Work in Process ($200,000 + $2,000).................

202,000

Accounts Receivable ($202,000 150%) ...................

Sales .....................................................................

303,000

200

600

1,200

200,000

300,000

200

600

1,200

202,000

303,000

7-18

P7-4 (1)

Chapter 7

Billingsley Company

Cutting Department

Cost of Production Report

For April

Quantity Schedule

Beginning inventory................................

Started in process this period ...............

Transferred to Assembling Department

Ending inventory .....................................

Spoiled in process ..................................

Materials

100%

100%

Labor

60%

90%

Cost Charged to Department

Beginning inventory:

Materials .....................................................................................

Labor ..........................................................................................

Factory overhead.......................................................................

Total cost in beginning inventory ....................................

Cost added during current period:

Materials .....................................................................................

Labor...........................................................................................

Factory overhead ......................................................................

Total cost added during current period............................

Total cost charged to department .................................................

Cost Accounted for as Follows

Transferred to Assembling Department

Charge to Factory Overhead for spoilage:

Materials ............................................

Labor ..................................................

Factory overhead ..............................

Work in Process, ending inventory:

Materials ............................................

Labor .................................................

Factory overhead ..............................

Total cost accounted for ........................

Units

18,000

Overhead

60%

90%

Quantity

5,000

20,000

25,000

18,000

4,000

3,000

25,000

Total

Cost

$ 1,260

789

1,789

$ 3,838

Equivalent

Units*

Unit

Cost**

$36,240

10,761

21,311

$68,312

$72,150

25,000

23,100

23,100

$1.50

.50

1.00

$3.00

% Complete Unit Cost

100%

$3.00

Total Cost

$54,000

3,000

3,000

3,000

100%

90%

90%

$1.50

.50

1.00

$4,500

1,350

2,700

4,000

4,000

4,000

100%

60%

60%

$1.50

.50

1.00

$6,000

1,200

2,400

8,550

9,600

$72,150

*Total number of equivalent units required in the cost accounted for section determined as follows:

Equivalent units transferred out.........................

Equivalent units in ending inventory .................

Equivalent units of ...............................................

Total equivalent units .........................................

Materials

18,000

4,000

3,000

25,000

Labor

18,000

2,400

2,700

23,100

Overhead

18,000

2,400

2,700

23,100

** Total cost (i.e., the cost in beginning inventory plus the cost added during the current period)

divided by the total number of equivalent units required in the cost accounted for section

Chapter 7

7-19

P7-4 (Continued)

Billingsley Company

Assembling Department

Cost of Production Report

For April

Quantity Schedule

Beginning inventory................................

Received from Cutting Department.......

Materials

Labor

Overhead

80%

100%

20%

100%

20%

100%

Transferred to Finished Goods Inventory

Ending inventory .....................................

Spoiled in process ..................................

Cost Charged to Department

Beginning inventory:

Cost from preceding department ...........................................

Materials .....................................................................................

Labor...........................................................................................

Factory overhead.......................................................................

Total cost in beginning inventory......................................

Cost added during current period:

Cost from preceding department ...........................................

Materials .....................................................................................

Labor...........................................................................................

Factory overhead.......................................................................

Total cost added during current period ...........................

Total cost charged to department ..................................................

Cost Accounted for as Follows

Transferred to Finished Goods ..............

Transferred to Spoiled Goods Inventory

at salvage value ................................

Charge to Factory Overhead for spoilage:

Cost of completed spoiled units .....

Less salvage value of spoiled units

Work in Process, ending inventory:

Cost from preceding department ....

Materials ............................................

Labor ..................................................

Factory overhead ..............................

Total cost accounted for.........................

Units

17,000

Quantity

4,000

18,000

22,000

17,000

4,000

1,000

22,000

Total

Cost

$ 12,000

38,028

3,356

5,034

$ 58,418

Equivalent

Units*

Unit

Cost**

54,000

163,372

15,444

23,166

$255,982

$314,400

22,000

21,200

18,800

18,800

$ 3.00

9.50

1.00

1.50

$15.00

% Complete Unit Cost

100%

$15.00

1,000

Total Cost

$255,000

$ 3.00

1,000

1,000

100%

4,000

4,000

4,000

4,000

100%

80%

20%

20%

3,000

$15.00

3.00

$15,000

3,000

$3.00

9.50

1.00

1.50

$12,000

30,400

800

1,200

12,000

44,400

$314,400

7-20

Chapter 7

P7-4 (Concluded)

* Total number of equivalent units required in the cost accounted for section determined as follows:

Equivalent units transferred out .....

Equivalent units in ending inventory

Equivalent units of spoilage ............

Total equivalent units .......................

Prior

Dept. Cost Materials

17,000

17,000

4,000

3,200

1,000

1,000

22,000

21,200

Labor

17,000

800

1,000

18,800

Overhead

17,000

800

1,000

18,800

** Total cost (i.e., the cost in beginning inventory plus the cost added during the current period)

divided by the total number of equivalent units required in the cost accounted for section

(2)

Work in ProcessAssembling Department ..............

Factory Overhead Control ...........................................

Work in ProcessCutting Department .............

54,000

8,550

Finished Goods Inventory ...........................................

Spoiled Goods Inventory .............................................

Factory Overhead Control ...........................................

Work in ProcessAssembling Department .....

255,000

3,000

12,000

62,550

270,000

Chapter 7

7-21

P7-5

(1)

Hulvey Brewery Company

Mixing and Brewing Department

Cost of Production Report

For January

Quantity Schedule

Beginning inventory................................

Started in process this period ...............

Transferred to Canning Department......

Ending inventory .....................................

Lost in process .......................................

Materials

100%

Labor

40%

Cost Charged to Department

Beginning inventory:

Materials .....................................................................................

Labor.........................................................................................

Factory overhead.......................................................................

Total cost in beginning inventory......................................

Cost added during current period:

Materials .....................................................................................

Labor...........................................................................................

Factory overhead.......................................................................

Total cost added during current period............................

Total cost charged to department ..................................................

Cost Accounted for as Follows

Transferred to Canning Department......

Work in Process, ending inventory:

Materials ............................................

Labor ..................................................

Factory overhead ..............................

Total cost accounted for ........................

Units

28,000

%

Complete

100%

6,000

6,000

6,000

100%

40%

40%

Overhead

40%

Quantity

4,000

36,000

40,000

28,000

6,000

6,000

40,000

Total

Cost

$ 600

88

128

$ 816

Equivalent

Units*

$4,840

824

1,088

$6,752

$7,568

34,000

30,400

30,400

$.16

.03

.04

$.23

Unit Cost

$.23

$.16

.03

.04

Unit

Cost**

Total Cost

$6,440

$960

72

96

1,128

$7,568

*Total number of equivalent units required in the cost accounted for section determined as follows:

Equivalent units transferred out................................

Equivalent units in ending inventory ........................

Total equivalent units .................................................

Materials

28,000

6,000

34,000

Labor

28,000

2,400

30,400

Overhead

28,000

2,400

30,400

** Total cost (i.e., the cost in beginning inventory plus the cost added during the current period)

divided by the total number of equivalent units required in the cost accounted for section

7-22

Chapter 7

P7-5 (Continued)

Hulvey Brewery Company

Canning Department

Cost of Production Report

For January

Quantity Schedule

Beginning inventory................................

Received from Mixing and

Brewing Department ........................

Transferred to Finished Goods Inventory

Ending inventory .....................................

Spoiled in process .................................

Materials

Labor

Quantity

2,000

28,000

30,000

100%

100%

60%

80%

Cost Charged to Department

Beginning inventory:

Cost from preceding department.............................................

Materials ....................................................................................

Labor...........................................................................................

Factory overhead.......................................................................

Total cost in beginning inventory ....................................

Cost added during current period:

Cost from preceding department ...........................................

Materials ....................................................................................

Labor ..........................................................................................

Factory overhead ......................................................................

Total cost added during current period............................

Total cost charged to department ..................................................

Cost Accounted for as Follows

Transferred to Finished Goods Inventory

Charge to Factory Overhead for spoilage:

Cost from preceding department ...

Materials ...........................................

Labor .................................................

Factory overhead .............................

Work in Process, ending inventory:

Cost from preceding department ...

Materials ...........................................

Labor .................................................

Factory overhead ..............................

Total cost accounted for.........................

Overhead

60%

80%

25,000

1,000

4,000

30,000

Total

Cost

$ 550

190

75

150

$ 965

Equivalent

Units*

Unit

Cost**

$ 6,440

1,520

789

1,578

$10,327

$11,292

30,000

30,000

28,800

28,800

$.233

.057

.030

.060

$.380

Units

25,000

%

Complete

100%

Unit Cost

$.380

4,000

4,000

4,000

4,000

100%

100%

80%

80%

$.233

.057

.030

.060

$932

228

96

192

1,000

1,000

1,000

1,000

100%

100%

60%

60%

$.233

.057

.030

.060

$233

57

18

36

Total Cost

$ 9,500

1,448

344

$11,292

Chapter 7

7-23

P7-5 (Concluded)

*Total number of equivalent units required in the cost accounted for section determined as follows:

Prior

Dept. Cost Materials

Equivalent units transferred out .....

25,000

25,000

Equivalent units in ending inventory

1,000

1,000

Equivalent units of spoilage ............

4,000

4,000

Total equivalent units .......................

30,000

30,000

Labor

25,000

600

3,200

28,800

Overhead

25,000

600

3,200

28,800

** Total cost (i.e., the cost in beginning inventory plus the cost added during the current period)

divided by the total number of equivalent units required in the cost accounted for section

(2)

Work in ProcessCanning Department ....................

Work in ProcessMixing and

Brewing Department .................................

6,440

Finished Goods Inventory ...........................................

Factory Overhead Control ...........................................

Work in ProcessCanning Department ..........

9,500

1,448

6,440

10,948

7-24

Chapter 7

P7-6 APPENDIX

(1)

Hadenville Tool Company

Fabricating Department

Cost of Production Report

For April

Quantity Schedule

Beginning inventory................................

Started this period ..................................

Transferred to Finishing Department ....

Ending inventory .....................................

Spoiled in process ..................................

Materials

100%

Labor

70%

100%

100%

40%

60%

Cost Charged to Department

Beginning inventory:

Materials .....................................................................................

Labor...........................................................................................

Factory overhead.......................................................................

Total cost in beginning inventory......................................

Cost added during current period:

Materials .....................................................................................

Labor ..........................................................................................

Factory overhead ......................................................................

Total cost added during current period............................

Total cost charged to department .................................................

Overhead

70%

40%

60%

Quantity

2,000

9,000

11,000

9,000

1,500

500

11,000

Total

Cost

$ 1,900

340

1,020

$ 3,260

Equivalent

Units*

Unit

Cost**

$ 9,180

2,125

6,375

$17,680

$20,940

9,000

8,500

8,500

$1.02

.25

.75

$2.02

Chapter 7

7-25

P7-6 APPENDIX (Continued)

Cost Accounted for as Follows

Transferred to Finishing Department:

From beginning inventory ..............

Cost to complete this period:

Labor .....................................

Factory overhead .................

Started and completed this period .

Total cost transferred to Finishing

Department ................................

Charge to Factory Overhead for spoilage:

Materials ............................................

Labor ..................................................

Factory overhead .............................

Work in Process, ending inventory:

Materials ...........................................

Labor ..................................................

Factory overhead ..............................

Total cost accounted for ........................

Units

Current %

Unit Cost

Total Cost

$3,260

2,000

2,000

7,000

30%

30%

100%

$ .25

.75

$2.02

150

450

$ 3,860

14,140

$18,000

500

500

500

100%

60%

60%

$1.02

.25

.75

$ 510

75

225

1,500

1,500

1,500

100%

40%

40%

$1.02

.25

.75

$1,530

150

450

810

2,130

$20,940

*Number of equivalent units of cost added during the current period determined as follows:

To complete beginning inventory .......................

Started and completed this period.....................

Ending inventory ..................................................

Spoiled units ........................................................

Total equivalent units .........................................

Materials

0

7,000

1,500

500

9,000

Labor

600

7,000

600

300

8,500

Overhead

600

7,000

600

300

8,500

** Cost added during the current period divided by the number of equivalent units of cost added during the current period

7-26

Chapter 7

P7-6 APPENDIX (Continued)

Hadenville Tool Company

Finishing Department

Cost of Production Report

For April

Quantity Schedule

Beginning inventory................................

Received from Fabricating Department

Transferred to Finished Goods ..............

Ending inventory .....................................

Spoiled in process ..................................

Materials

100%

Labor

40%

Overhead

40%

100%

100%

60%

100%

60%

100%

Cost Charged to Department

Beginning inventory:

Cost from preceding department.............................................

Materials .....................................................................................

Labor ..........................................................................................

Factory overhead.......................................................................

Total cost in beginning inventory......................................

Cost added during current period:

Cost from preceding department.............................................

Materials .....................................................................................

Labor ..........................................................................................

Factory overhead.......................................................................

Total cost added during current period............................

Total cost charged to department .................................................

Quantity

3,000

9,000

12,000

9,900

2,000

100

12,000

Total

Cost

$ 6,100

3,500

520

780

$10,900

Equivalent

Units*

Unit

Cost**

$18,000

10,800

4,000

6,000

$38,800

$49,700

9,000

9,000

10,000

10,000

$2.00

1.20

.40

.60

$4.20

Chapter 7

7-27

P7-6 APPENDIX (Concluded)

Cost Accounted for as Follows

Transferred to Finished Goods:

From beginning inventory ..............

Cost to complete this period:

Labor .....................................

Factory overhead .................

Started and completed this period .

Total cost transferred to Finished Goods

Transferred to Spoiled Goods Inventory

at salvage value ...............................

Charge to Factory Overhead for spoilage:

Cost of completed spoiled units .....

Less salvage value of spoiled units

Work in Process, ending inventory

Cost from preceding department ....

Materials ............................................

Labor ..................................................

Factory overhead ..............................

Total cost accounted for ........................

Units

Current %

Unit Cost

Total Cost

$10,900

3,000

3,000

6,900

60%

60%

100%

100

$ .40

.60

$4.20

720

1,080

$1.00

100

100

100%

2,000

2,000

2,000

2,000

100%

100%

60%

60%

$12,700

28,980

$41,680

100

$4.20

1.00

420

100

$2.00

1.20

.40

.60

$ 4,000

2,400

480

720

320

7,600

$49,700

* Number of equivalent units of cost added during the current period determined as follows:

To complete beginning inventory ...

Started and completed this period .

Ending inventory...............................

Spoiled units .....................................

Total equivalent units .......................

Prior

Dept. Cost Materials

0

0

6,900

6,900

2,000

2,000

100

100

9,000

9,000

Labor

1,800

6,900

1,200

100

10,000

Overhead

1,800

6,900

1,200

100

10,000

** Cost added during the current period divided by the number of equivalent units of cost added during the current period

(2)

Work in ProcessFinishing Department...................

Factory Overhead Control ...........................................

Work in ProcessFabricating Department ......

18,000

810

Finished Goods Inventory ...........................................

Spoiled Goods Inventory .............................................

Factory Overhead Control ...........................................

Work in ProcessFinishing Department..........

41,680

100

320

18,810

42,100

7-28

Chapter 7

P7-7 APPENDIX

(1)

Carlton Chemical Company

Distillation Department

Cost of Production Report

For June

Quantity Schedule

Beginning inventory................................

Started this period ..................................

Transferred to Refining Department......

Ending inventory. ....................................

Lost in process........................................

Materials

100%

Labor

20%

100%

80%

Cost Charged to Department

Beginning inventory:

Materials ....................................................................................

Labor...........................................................................................

Factory overhead.....................................................................

Total cost in beginning inventory......................................

Coat added during current period:

Materials ....................................................................................

Labor ..........................................................................................

Factory overhead ......................................................................

Total cost added during current period............................

Total cost charged to department ..................................................

Overhead

20%

80%

Quantity

4,000

16,000

20,000

14,000

2,000

4,000

20,000

Total

Cost

$ 3,624

96

480

$ 4,200

Equivalent

Units*

Unit

Cost**

$10,800

1,480

7,400

$19,680

$23,880

12,000

14,800

14,800

$ .90

.10

.50

$1.50

Chapter 7

7-29

P7-7 APPENDIX (Continued)

Cost Accounted for as Follows

Transferred to Refining Department:

From beginning inventory ..............

Cost to complete this period:

Labor .....................................

Factory overhead .................

Started and completed this period .

Total cost transferred to

Refining Department ..................

Work in Process, ending inventory:

Materials ............................................

Labor ..................................................

Factory overhead ..............................

Total cost accounted for.........................

Units

Current %

Unit Cost

Total Cost

$4,200

4,000

4,000

10,000

80%

80%

100%

$ .10

.50

$1.50

320

1,600

$ 6,120

15,000

$21,120

2,000

2,000

2,000

100%

80%

80%

$ .90

.10

.50

$1,800

160

800

2,760

$23,880

* Number of equivalent units of cost added during the current period determined as follows:

To complete beginning inventory .......................

Started and completed this period.....................

Ending inventory ..................................................

Total equivalent units...........................................

Materials

0

10,000

2,000

12,000

Labor

3,200

10,000

1,600

14,800

Overhead

3,200

10,000

1,600

14,800

** Cost added during the current period divided by the number of equivalent units of cost added during the current period

7-30

Chapter 7

P7-7 APPENDIX (Continued)

Carlton Chemical Company

Refining Department

Cost of Production Report

For June

Quantity Schedule

Beginning inventory................................

Received from Distillation Department .

Transferred to Finished Goods Inventory

Ending inventory .....................................

Lost in process .......................................

Materials

100%

Labor

50%

100%

30%

Overhead

50%

30%

Quantity

2,000

14,000

16,000

12,000

2,000

2,000

16,000

Cost Charged to Department

Beginning inventory:

Cost from preceding department.............................................

Materials ....................................................................................

Labor ..........................................................................................

Factory overhead.......................................................................

Total cost in beginning inventory.......................................

Cost added during current period:

Cost from preceding department.............................................

Materials .....................................................................................

Labor...........................................................................................

Factory overhead.......................................................................

Total cost added during current period............................

Total cost charged to department ..................................................

Total

Cost

$ 3,500

240

160

900

$ 4,800

Equivalent

Units*

Unit

Cost**

$21,120

1,440

1,740

10,440

$34,740

$39,540

12,000

12,000

11,600

11,600

$1.76

.12

.15

.90

Cost Accounted for as Follows

Transferred to Finished Goods:.............

From beginning inventory................

Cost to complete this period:

Labor ....................................

Factory overhead .................

Started and completed this period .

Total cost transferred to Finished

Goods ..........................................

Work in Process, ending inventory:

Cost from preceding department ....

Materials ............................................

Labor ..................................................

Factory overhead ..............................

Total cost accounted for ........................

Unit Cost

Units

Current %

$2.93

Total Cost

$4,800

2,000

2,000

10,000

50%

50%

100%

$ .15

.90

$2.93

150

900

$ 5,850

29,300

$35,150

2,000

2,000

2,000

2,000

100%

100%

30%

30%

$1.76

.12

.15

.90

$3,520

240

90

540

4,390

$39,540

Chapter 7

7-31

P7-7 APPENDIX (Concluded)

*Number of equivalent units of cost added during the current period determined as follows:

To complete beginning inventory ...

Started and completed this period .

Ending inventory...............................

Total equivalent units .......................

Prior

Dept. Cost Materials

0

0

10,000

10,000

2,000

2,000

12,000

12,000

Labor

1,000

10,000

600

11,600

Overhead

1,000

10,000

600

11,600

** Cost added during the current period divided by the number of equivalent units of cost added during the current period

(2)

Work in ProcessRefining Department ....................

Work in ProcessDistillation Department .......

21,120

Finished Goods Inventory ...........................................

Work in ProcessRefining Department ...........

35,150

21,120

35,150

7-32

Chapter 7

CASES

C7-1

Although improvement in product quality was clearly a stated goal at Star Disk

Corporation, the companys reward structure suggests otherwise. Employees

cannot be expected to put quality first if rewards are dispensed for achieving

objectives that are often in conflict with quality improvement (i.e., short-run

production volume goals). The quality improvement effort seems to have been

focused solely on manufacturing activity, and the approach taken seems to

have been to improve quality by inspecting it into the product. Such an

approach is inadequate, because it waits too late in the process (i.e., after costs

have been incurred in manufacturing defective products, instead of before) and

focuses on only one piece of the problem rather than the whole problem.

In order to turn the problem around, top management must become

actively involved. The reward structure should be changed to ensure compatibility with quality goals. Quality teams that include employees from all business

functions (product design as well as manufacturing) and all levels (labor as well

as management) should be created to help identify quality problems and find

ways to solve the identified problems. Top management should actively participate in these teams in order to emphasize the importance of quality, coordinate

efforts between organization units, and provide direction. Employees are more

likely to become motivated when they understand the importance of quality,

and top management participation and leadership underscore that importance.

In addition, all employees must refocus their efforts on serving their respective

customers. The data presented in the case suggest that managers from the different departments put all their attention on meeting production volume goals

rather than on meeting the needs of their customers (i.e., the department

receiving their output).

Although product inspection should be continued, emphasis should be

shifted to preventing poor quality rather than detecting it. Prevention should

start with product design and extend throughout the entire manufacturing

process. Some things to be considered include:

(a) reducing the number of parts required in the product;

(b) using higher quality materials;

(c) using standardized parts;

(d) using well-known production technologies where possible;

(e) minimizing retoolings;

(f)

increasing employee training;

(g) reorganizing the manufacturing facility from production departments to

manufacturing cells to promote teamwork and decrease inventory costs;

(h) upgrading or modifying machinery;

(i)

installing a statistical process control system to monitor production quality and reduce production variability.

Chapter 7

7-33

C7-1 (Concluded)

A few of the biggest and most urgent problems should be identified and

tackled. In order to achieve results, effort should be concentrated on a few

costly problems that can be solved. Tackling too many problems results in dispersed efforts and little observable accomplishment. Improving quality takes

time and never ends. The company and its employees need some successes to

build confidence and create the momentum needed to turn the quality problem

around.

C7-2

Product cost may be increasing as a result of an increasing amount of scrap,

spoilage, and rework. Since the costs of these internal failures are not measured, management cannot evaluate the significance of the problem. In addition,

since these costs are not measured, employees have no incentive to reduce or

eliminate them. Treating scrap, spoilage, and rework as a normal production

cost encourages such waste. As a consequence, overall costs rise. The companys cost accountants should develop a system of determining the cost of

scrap, spoilage, and rework; implement the system (i.e., begin measuring such

costs); and report these costs to responsible managers. If the cost of scrap,

spoilage, and rework is high, management should initiate a quality improvement program that concentrates on preventing these internal failures. This may

involve organizing employee quality teams to identify problems and develop

solutions, locating new vendors to obtain higher quality materials, redesigning

products to improve quality, modifying or upgrading manufacturing machinery,

training or retraining employees, and/or reorganizing the production processes.

Anda mungkin juga menyukai

- Technical Proposal Template SampleDokumen12 halamanTechnical Proposal Template SampleWrite Bagga100% (1)

- Be16 P16 2aDokumen7 halamanBe16 P16 2aLisa Hammerle ClarkBelum ada peringkat

- CH 14Dokumen2 halamanCH 14tigger5191100% (1)

- CH 12 SMDokumen17 halamanCH 12 SMNafisah Mambuay100% (2)

- 20210213174013D3066 - Soal Cost System and Cost AccumulationDokumen6 halaman20210213174013D3066 - Soal Cost System and Cost AccumulationLydia limBelum ada peringkat

- TR 2 IndahDokumen3 halamanTR 2 IndahIndahyuliaputriBelum ada peringkat

- Working 3Dokumen6 halamanWorking 3Hà Lê DuyBelum ada peringkat

- Chapter 7. KeyDokumen8 halamanChapter 7. KeyHuy Hoàng PhanBelum ada peringkat

- Income statement and schedule of cost of goods manufacturedDokumen3 halamanIncome statement and schedule of cost of goods manufacturedMarjorie PalmaBelum ada peringkat

- CH 13 SMDokumen31 halamanCH 13 SMNafisah MambuayBelum ada peringkat

- Ex Ch.15Dokumen2 halamanEx Ch.15kenny 322016048Belum ada peringkat

- Rika Ristiani - Akuntansi Keuangan Menengah 2 - TM-02Dokumen5 halamanRika Ristiani - Akuntansi Keuangan Menengah 2 - TM-02MARCHO AGUSTABelum ada peringkat

- 9-25 Variable Versus Absorption Costing. The Zeta Company Manufactures Trendy, GoodDokumen3 halaman9-25 Variable Versus Absorption Costing. The Zeta Company Manufactures Trendy, GoodElliot Richard100% (1)

- Ch.16 Dilutive Securities and Earnings Per Share: Chapter Learning ObjectivesDokumen7 halamanCh.16 Dilutive Securities and Earnings Per Share: Chapter Learning ObjectivesFaishal Alghi FariBelum ada peringkat

- 3 Cash - Assignment PDFDokumen6 halaman3 Cash - Assignment PDFCatherine RiveraBelum ada peringkat

- Quality Costing - Cost AccountingDokumen20 halamanQuality Costing - Cost AccountingMd. Ruhul- AminBelum ada peringkat

- CH 13 SMDokumen31 halamanCH 13 SMNafisah MambuayBelum ada peringkat

- Sales Memory Aid San BedaDokumen37 halamanSales Memory Aid San BedaRufino Gerard Moreno93% (14)

- Radiography Examination Procedure For Asme Boiler, Pressure Vessel and PipingDokumen15 halamanRadiography Examination Procedure For Asme Boiler, Pressure Vessel and PipingEko Kurniawan100% (1)

- BOQ in GeneralDokumen9 halamanBOQ in Generalkmmansaf100% (1)

- Container BLDGS 1ST Edition PDFDokumen65 halamanContainer BLDGS 1ST Edition PDFfcjjcfBelum ada peringkat

- Nama Cornelius Cakra Adiwijaya NIM 041911333209Dokumen3 halamanNama Cornelius Cakra Adiwijaya NIM 041911333209Cornelius cakraBelum ada peringkat

- Melton Company Special Order AnalysisDokumen2 halamanMelton Company Special Order AnalysisclalalacBelum ada peringkat

- Tugas Ifrs Chapter 7.2Dokumen4 halamanTugas Ifrs Chapter 7.2Nabilla salsaBelum ada peringkat

- Exercises: Ex. 9-143-Lower-Of-Cost-Or-Net Realizable ValueDokumen9 halamanExercises: Ex. 9-143-Lower-Of-Cost-Or-Net Realizable ValueManuel Magadatu100% (1)

- Soal Cost System and Cost AccumulationDokumen5 halamanSoal Cost System and Cost AccumulationSugata S100% (1)

- Tugas CH 8 Dan 9Dokumen13 halamanTugas CH 8 Dan 9muhammad alfariziBelum ada peringkat

- TaufiqAlInsanSiahaan - Tugas Akuntansi Keuangan Menengah 1Dokumen6 halamanTaufiqAlInsanSiahaan - Tugas Akuntansi Keuangan Menengah 1taufiq al insanBelum ada peringkat

- Ananda Febrian P.S - 041911333118 - Tugas Akm 8Dokumen5 halamanAnanda Febrian P.S - 041911333118 - Tugas Akm 8sari ayuBelum ada peringkat

- IFA 2 - Group 5 - BE13.7&P13.2Dokumen1 halamanIFA 2 - Group 5 - BE13.7&P13.2AFIFAH KHAIRUNNISA SUBIYANTORO 1Belum ada peringkat

- Tutorial Laporan Arus KasDokumen17 halamanTutorial Laporan Arus KasRatna DwiBelum ada peringkat