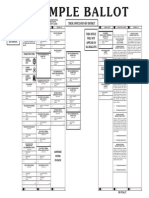

2014 Larimer County Sample Ballot

Diunggah oleh

ColoradoanJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

2014 Larimer County Sample Ballot

Diunggah oleh

ColoradoanHak Cipta:

Format Tersedia

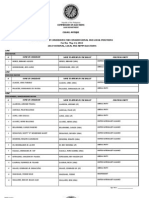

Official Ballot

General Election

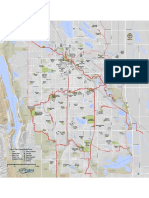

Larimer County, Colorado

Tuesday, November 4, 2014

Angela Myers

Clerk and Recorder

SAMPLE BALLOT

Instructions to Voters

To vote, fill in the oval completely. Please

use black ink.

Correct

If you mark in any of the incorrect ways

shown below it may be difficult to

determine your intent. If you make a

mistake please ask for a new ballot.

Incorrect

Your ballot may be continued on the back.

Federal Offices

Mark Udall

Democratic

Cory Gardner

Republican

Gaylon Kent

Libertarian

Raul Acosta

Unaffiliated

(Signed declaration to limit service to no more than 2 terms)

Bill Hammons

Unity

Steve Shogan

Unaffiliated

United States Senator

(Vote for One)

Jared Polis

Democratic

George Leing

Republican

Representative To The 114th United States

Congress - District 2

(Vote for One)

State Offices

Bob Beauprez / Jill Repella

Republican

John Hickenlooper / Joe Garcia

Democratic

Harry Hempy / Scott Olson

Green

Matthew Hess / Brandon Young

Libertarian

Mike Dunafon / Robin J. Roberts

Unaffiliated

Paul Noel Fiorino / Charles George Whitley

Unaffiliated

Governor/Lieutenant Governor

(Vote for One Pair)

Joe Neguse

Democratic

Wayne W. Williams

Republican

Amanda Campbell

American Constitution

Dave Schambach

Libertarian

Secretary of State

(Vote for One)

Walker Stapleton

Republican

Betsy Markey

Democratic

David Jurist

Libertarian

State Treasurer

(Vote for One)

Don Quick

Democratic

Cynthia Coffman

Republican

David K. Williams

Libertarian

Attorney General

(Vote for One)

James A. Wilkerson

Republican

Coroner

(Vote for One)

Justin Smith

Republican

Sheriff

(Vote for One)

Donna Walter

Republican

Joann Ginal

Democratic

State Representative - District 52

(Vote for One)

Brian DelGrosso

Republican

State Representative - District 51

(Vote for One)

Perry L. Buck

Republican

State Representative - District 49

(Vote for One)

State Offices

Kevin Lundberg

Republican

State Senate - District 15

(Vote for One)

County Offices

Lew Gaiter III

Republican

Kathy Gilliland

Democratic

Eric Sutherland

Unaffiliated

Commissioner - District 1

(Vote for One)

Angela Myers

Republican

Clerk and Recorder

(Vote for One)

Irene Josey

Republican

Treasurer

(Vote for One)

Steve Miller

Republican

Assessor

(Vote for One)

Jeni Arndt

Democratic

Tim Bessler

Republican

State Representative - District 53

(Vote for One)

Continued

Chad Washburn

Republican

Surveyor

(Vote for One)

Kim McGahey

Republican

Linda Shoemaker

Democratic

Daniel Ong

Libertarian

Regent Of The University Of Colorado -

Congressional District 2

(Vote for One)

FRONT Card 1 RptPct 101-1000 "NOUSE" FOR PROOF ONLY 09/22/14 12:51:56

Red Feather Lakes

Fire Protection District

Fredrick M. Sandal

Nancy Kay

Terrance Von Ferebee

Directors

Four-year term

(Vote for not more than Three (3))

Bruce Finger

Directors

Two-year term

(Vote for not more than Two (2))

Judicial

YES

NO

Justice Of The Colorado Supreme Court

(Vote Yes or No)

Shall Justice Brian D. Boatright of the Colorado

Supreme Court be retained in office?

YES

NO

Justice Of The Colorado Supreme Court

(Vote Yes or No)

Shall Justice Monica M. Marquez of the Colorado

Supreme Court be retained in office?

YES

NO

Court Of Appeals

(Vote Yes or No)

Shall Judge Terry Fox of the Colorado Court of

Appeals be retained in office?

YES

NO

Court Of Appeals

(Vote Yes or No)

Shall Judge Alan M. Loeb of the Colorado Court of

Appeals be retained in office?

YES

NO

District Judge - 8th Judicial District

(Vote Yes or No)

Shall Judge Julie Kunce Field of the 8th Judicial

District be retained in office?

YES

NO

District Judge - 8th Judicial District

(Vote Yes or No)

Shall Judge Thomas R. French of the 8th Judicial

District be retained in office?

YES

NO

District Judge - 8th Judicial District

(Vote Yes or No)

Shall Judge Stephen E. Howard of the 8th Judicial

District be retained in office?

Larimer County

YES/FOR

NO/AGAINST

Ballot Issue 1A

CONTINUE PROTECTING OUR NATURAL AREAS, OPEN

SPACE, RIVERS AND WILDLIFE HABITAT

WITHOUT INCREASING TAXES, SHALL THE EXISTING ONE-

QUARTER OF ONE PERCENT LARIMER COUNTY SALES

AND USE TAX, OR 25 CENTS FOR EVERY 100 DOLLARS

(WHICH WILL NOT BE COLLECTED ON SALES OF FOOD OR

PRESCRIPTION DRUGS), BE EXTENDED FOR 25 YEARS

FOR THE SAME PURPOSES OF:

CONSERVING NATURAL AREAS, OPEN SPACES,

RIVERS AND WILDLIFE HABITAT,

PROTECTING LANDS THAT PRESERVE WATER

QUALITY AND RIVERS, LAKES AND STREAMS,

OPERATING, MAINTAINING AND IMPROVING

NATURAL AREAS, PARKS AND TRAILS, AND

PROTECTING WORKING FARMS AND RANCHES

SUBJECT TO RECOMMENDATIONS OF A CITIZENS'

ADVISORY COMMITTEE AND INDEPENDENT AUDIT, AND

CONTINUING THESE FUNDS INCLUDING EARNINGS

THEREFROM AS A VOTER-APPROVED REVENUE CHANGE

WITHOUT REGARD TO ANY SPENDING, REVENUE, OR

OTHER LIMITATION CONTAINED WITHIN ARTICLE X,

SECTION 20 OF THE COLORADO CONSTITUTION OR ANY

OTHER LAW, AND WITH NO CHANGES TO THE HELP

PRESERVE OPEN SPACES PROGRAM EXCEPT CHANGING

THE COUNTYS PORTION TO 50%, AND ALLOWING AT

LEAST 35% OF THE COUNTY FUNDS TO BE USED FOR

LAND ACQUISITION AND CONSERVATION; AT LEAST 50%

FOR IMPROVEMENT, MANAGEMENT, MAINTENANCE AND

ADMINISTRATION OF OPEN SPACE, NATURAL AREAS,

WILDLIFE HABITATS, PARKS AND TRAILS; AND AT MOST

15% TO BE USED FOR EITHER OF THESE COUNTY OPEN

SPACE PROGRAM PURPOSES?

YES/FOR

NO/AGAINST

Ballot Issue 1B

CONTINUE LARIMER COUNTY JAIL COUNTYWIDE SALES

AND USE TAX

WITHOUT INCREASING TAXES, SHALL THE FIFTEEN ONE-

HUNDREDTHS OF ONE PERCENT LARIMER COUNTY SALES

AND USE TAX PREVIOUSLY APPROVED FOR OPERATING

THE ADDITION TO THE LARIMER COUNTY JAIL BE

EXTENDED TWENTY-FIVE YEARS TO AND INCLUDING

DECEMBER 31, 2039, AND CONTINUING THESE FUNDS AS A

VOTER-APPROVED REVENUE CHANGE WITHOUT REGARD

TO ANY SPENDING, REVENUE, OR OTHER LIMITATION

CONTAINED WITHIN ARTICLE X, SECTION 20 OF THE

COLORADO CONSTITUTION OR ANY OTHER LAW, AND

ALLOWING THE REVENUES TO BE USED FOR OPERATING

THE LARIMER COUNTY JAIL, WHICH SERVES FORT

COLLINS, LOVELAND, BERTHOUD, ESTES PARK,

JOHNSTOWN, TIMNATH, WELLINGTON, WINDSOR AND THE

UNINCORPORATED AREAS OF LARIMER COUNTY?

YES/FOR

NO/AGAINST

Proposition 105 (STATUTORY)

Shall there be a change to the Colorado Revised Statutes concerning

labeling of genetically modified food; and, in connection therewith,

requiring food that has been genetically modified or treated with

genetically modified material to be labeled, "Produced With Genetic

Engineering" starting on July 1, 2016; exempting some foods including

but not limited to food from animals that are not genetically modified but

have been fed or injected with genetically modified food or drugs,

certain food that is not packaged for retail sale and is intended for

immediate human consumption, alcoholic beverages, food for animals,

and medically prescribed food; requiring the Colorado department of

public health and environment to regulate the labeling of genetically

modified food; and specifying that no private right of action is created

for failure to conform to the labeling requirements?

YES/FOR

NO/AGAINST

Proposition 104 (STATUTORY)

Shall there be a change to the Colorado Revised Statutes requiring any

meeting of a board of education, or any meeting between any

representative of a school district and any representative of employees,

at which a collective bargaining agreement is discussed to be open to

the public?

YES/FOR

NO/AGAINST

Amendment 68 (CONSTITUTIONAL)

SHALL STATE TAXES BE INCREASED $114,500,000 ANNUALLY IN

THE FIRST FULL FISCAL YEAR, AND BY SUCH AMOUNTS THAT

ARE RAISED THEREAFTER, BY IMPOSING A NEW TAX ON

AUTHORIZED HORSE RACETRACKS' ADJUSTED GROSS

PROCEEDS FROM LIMITED GAMING TO INCREASE STATEWIDE

FUNDING FOR K-12 EDUCATION, AND, IN CONNECTION

THEREWITH, AMENDING THE COLORADO CONSTITUTION TO

PERMIT LIMITED GAMING IN ADDITION TO PRE-EXISTING PARI-

MUTUEL WAGERING AT ONE QUALIFIED HORSE RACETRACK IN

EACH OF THE COUNTIES OF ARAPAHOE, MESA, AND PUEBLO;

AUTHORIZING HOST COMMUNITIES TO IMPOSE IMPACT FEES ON

HORSE RACETRACKS AUTHORIZED TO CONDUCT LIMITED

GAMING; ALLOWING ALL RESULTING REVENUE TO BE

COLLECTED AND SPENT NOTWITHSTANDING ANY LIMITATIONS

PROVIDED BY LAW; AND ALLOCATING THE RESULTING TAX

REVENUES TO A FUND TO BE DISTRIBUTED TO SCHOOL

DISTRICTS AND THE CHARTER SCHOOL INSTITUTE FOR K-12

EDUCATION?

YES/FOR

NO/AGAINST

Amendment 67 (CONSTITUTIONAL)

Shall there be an amendment to the Colorado constitution protecting

pregnant women and unborn children by defining "person" and "child"

in the Colorado criminal code and the Colorado wrongful death act to

include unborn human beings?

State of Colorado

Ballot questions referred by the general assembly or

any political subdivision are listed by letter, and

ballot questions initiated by the people are listed

numerically. A ballot question listed as an

"amendment" proposes a change to the Colorado

constitution, and a ballot question listed as a

"proposition" proposes a change to the Colorado

Revised Statutes. A "yes/for" vote on any ballot

question is a vote in favor of changing current law or

existing circumstances, and a "no/against" vote on

any ballot question is a vote against changing

current law or existing circumstances.

YES

NO

County Judge, Larimer

(Vote Yes or No)

Shall Judge Peter E. Schoon Jr. of the Larimer

County Court be retained in office?

Judicial

YES

NO

County Judge, Larimer

(Vote Yes or No)

Shall Judge Thomas L. Lynch of the Larimer County

Court be retained in office?

Continued

BACK Card 1 RptPct 101-1000 "NOUSE" FOR PROOF ONLY 09/22/14 12:51:56

Larimer County

YES/FOR

NO/AGAINST

Ballot Issue 200

ANIMAL CARE AND CONTROL FACILITY SALES AND USE TAX AND

DEBT QUESTION

SHALL LARIMER COUNTY TAXES BE INCREASED $5,500,000

ANNUALLY, (ESTIMATED FIRST YEAR DOLLAR INCREASE), AND

BY WHATEVER ADDITIONAL AMOUNT IS RAISED ANNUALLY

THEREAFTER, BY THE IMPOSITION OF AN ADDITIONAL

COUNTYWIDE SALES AND USE TAX AT THE RATE OF ONE TENTH

OF ONE PERCENT (0.1%) AND SHALL LARIMER COUNTY DEBT BE

INCREASED BY AN AMOUNT NOT EXCEEDING $14,900,000 WITH A

REPAYMENT COST OF UP TO $16,400,000 WITH SUCH TAXES

AND DEBT TO BE SUBJECT TO THE FOLLOWING:

THE COLLECTION OF THE TAX SHALL BEGIN ON JANUARY

1, 2015 AND CONTINUE THROUGH AND INCLUDING THE

EARLIER OF DECEMBER 31, 2020 OR THE EARLIEST DATE

POSSIBLE TO TERMINATE THE TAX AFTER THE COUNTY

HAS PAID THE DEBT;

THE REVENUES OF SUCH SALES AND USE TAX SHALL BE

DEPOSITED INTO THE LARIMER COUNTY ANIMAL CARE

AND CONTROL FACILITY CAPITAL IMPROVEMENT FUND TO

BE PLEDGED FOR THE PAYMENT OF THE DEBT AND TO BE

USED FOR THE FINANCING, DESIGN, CONSTRUCTION

(INCLUDING RELOCATION COSTS), AND OPERATION AND

MAINTENANCE COSTS OF AN ANIMAL CARE AND CONTROL

FACILITY ON LAND OWNED BY LARIMER HUMANE SOCIETY

PURSUANT TO AN AGREEMENT BETWEEN THE COUNTY

AND THE SOCIETY;

THE DEBT SHALL CONSIST OF SALES AND USE TAX

REVENUE BONDS OR OTHER FINANCIAL OBLIGATIONS TO

BE ISSUED FOR THE PURPOSE OF FINANCING THE DESIGN

AND CONSTRUCTION (INCLUDING RELOCATION COSTS)

OF THE ANIMAL CARE AND CONTROL FACILITY, BEARING

INTEREST AT A NET EFFECTIVE INTEREST RATE NOT TO

EXCEED 3.95%, AND OTHERWISE TO BE ISSUED IN ONE

OR MORE SERIES IN SUCH MANNER AND UPON SUCH

TERMS AND PROVISIONS WHICH MAY INCLUDE

REDEMPTION PRIOR TO MATURITY WITH OR WITHOUT

PREMIUM, ALL AS THE COUNTY MAY DETERMINE;

THE COUNTY IS AUTHORIZED TO ISSUE DEBT TO REFUND

THE DEBT AUTHORIZED IN THIS QUESTION, PROVIDED

THAT AFTER THE ISSUANCE OF SUCH REFUNDING DEBT

THE TOTAL OUTSTANDING PRINCIPAL AMOUNT OF ALL

DEBT ISSUED PURSUANT TO THIS QUESTION DOES NOT

EXCEED THE MAXIMUM PRINCIPAL AMOUNT SET FORTH

ABOVE, AND PROVIDED FURTHER THAT ALL DEBT ISSUED

BY THE COUNTY PURSUANT TO THIS QUESTION IS ISSUED

ON TERMS THAT DO NOT EXCEED THE REPAYMENT

COSTS AUTHORIZED IN THIS QUESTION;

AND SHALL THE REVENUES OF SUCH SALES AND USE TAX

REVENUES, THE PROCEEDS OF THE BONDS, AND

INVESTMENT INCOME ON ALL SUCH REVENUES AND

PROCEEDS BE COLLECTED, RETAINED AND SPENT AS A

VOTER-APPROVED REVENUE CHANGE AND EXCEPTION

TO THE LIMITS WHICH WOULD OTHERWISE APPLY

PURSUANT TO ARTICLE X, SECTION 20 OF THE COLORADO

CONSTITUTION;

ALL PURSUANT TO AND AS FURTHER PROVIDED IN THE

PETITION FILED WITH THE COUNTY PURSUANT TO 29-2-104(4),

COLORADO REVISED STATUTES, AS AMENDED, REQUIRING THIS

QUESTION TO BE SUBMITTED TO THE ELECTORS OF THE

COUNTY?

Town of Windsor

YES/FOR

NO/AGAINST

Ballot Issue 2A

SHALL THE TOWN OF WINDSOR DEBT BE INCREASED BY AN

AMOUNT NOT TO EXCEED SIXTEEN-MILLION ONE-HUNDRED

THOUSAND DOLLARS ($16,100,000) WITH A MAXIMUM

REPAYMENT COST NOT TO EXCEED TWENTY-EIGHT MILLION

FOUR-HUNDRED FIFTY THOUSAND DOLLARS ($28,450,000) AND

SHALL THE TOWN OF WINDSOR TAXES BE INCREASED BY NOT

MORE THAN ONE-MILLION NINE-HUNDRED TWENTY-FIVE

THOUSAND DOLLARS ($1,925,000) IN THE FIRST FULL FISCAL

YEAR AND BY SUCH AMOUNT AS IS GENERATED ANNUALLY

THEREAFTER BY THE TAX INCREASE DESCRIBED BELOW

SUBJECT TO THE FOLLOWING:

(1) SUCH DEBT SHALL CONSIST OF SALES AND USE TAX

REVENUE BONDS TO BE PAYABLE FROM ALL OR ANY

PORTION OF THE TOWN'S SALES AND USE TAX AND ISSUED

SOLELY FOR THE PURPOSE OF CONSTRUCTING AND

EQUIPPING AN EXPANSION OF THE WINDSOR COMMUNITY

RECREATION CENTER, FUNDING A RESERVE FUND AND

PAYING COSTS OF ISSUANCE OF THE BONDS;

(2) SUCH BONDS SHALL BE DATED AND SOLD AT SUCH TIME,

AND AT SUCH PRICES (AT, ABOVE OR BELOW PAR) AND

CONTAINING SUCH TERMS, NOT INCONSISTENT HEREWITH,

AS THE TOWN MAY DETERMINE;

(3) SUCH TAX SHALL CONSIST OF A RATE INCREASE IN THE

TOWN-WIDE SALES AND USE TAX OF .75% (SEVENTY-FIVE

ONE HUNDREDTHS OF ONE PERCENT), WHICH

REPRESENTS THREE-QUARTERS OF ONE CENT ON EACH

ONE DOLLAR PURCHASE COMMENCING JANUARY 1, 2015;

(4) THE PROCEEDS OF THE INCREASE IN THE TOWN SALES

AND USE TAX SHALL BE DEPOSITED INTO THE WINDSOR

COMMUNITY RECREATION CENTER EXPANSION FUND TO

BE USED SOLELY FOR CONSTRUCTING AND EQUIPPING

THE WINDSOR COMMUNITY RECREATION CENTER

EXPANSION, INCLUDING, AMONG OTHER THINGS:

A LEISURE POOL,

A WALK/JOG TRACK,

LAP LANES,

A FITNESS/WELLNESS STUDIO,

AN AEROBICS/DANCE/YOGA STUDIO,

AND AN AUXILIARY GYM;

(5) THE PROCEEDS DEPOSITED INTO THE WINDSOR

COMMUNITY RECREATION CENTER EXPANSION FUND

SHALL ALSO BE USED FOR PAYING THE COSTS OF

DEPRECIATION, OPERATING AND MAINTAINING THE

WINDSOR COMMUNITY RECREATION CENTER, OR PAYING

THE DEBT SERVICE ON REVENUE BONDS OR REFUNDING

BONDS ISSUED FOR SAID PURPOSES (INCLUDING

ESTABLISHING RESERVES TO PAY DEBT SERVICE);

(6) THE INCREASED RATE OF SALES AND USE TAX SHALL BE

REDUCED TO A LEVEL SUFFICIENT TO FUND EQUIPMENT,

OPERATIONS, MAINTENANCE AND DEPRECIATION OF THE

WINDSOR COMMUNITY CENTER AT SUCH TIME AS ALL DEBT

SERVICE ON REVENUE BONDS OR REFUNDING BONDS FOR

SAID PURPOSES ARE PAID IN FULL; AND

(7) SHALL ALL PROCEEDS OF THE BONDS AND MONEYS

DEPOSITED IN THE WINDSOR COMMUNITY RECREATION

CENTER EXPANSION FUND (REGARDLESS OF AMOUNT) AND

ANY INVESTMENT INCOME ON THE PROCEEDS OR THE

DEPOSIT CONSTITUTE A VOTER - APPROVED REVENUE

CHANGE, AND AN EXCEPTION TO THE REVENUE AND

SPENDING LIMITS OF ARTICLE X, SECTION 20 OF THE

COLORADO CONSTITUTION?

Lyons Regional Library District

YES/FOR

NO/AGAINST

Ballot Issue 4C

SHALL THE LYONS REGIONAL LIBRARY DISTRICT TAXES BE

INCREASED BY $357,000 AND BY WHATEVER ADDITIONAL

AMOUNTS ARE RAISED ANNUALLY THEREAFTER, BY A MILL LEVY

OF NOT MORE THAN 5.85 MILLS, COMMENCING IN TAX YEAR

2014 FOR COLLECTION IN FISCAL YEAR 2015, AND CONTINUING

THEREAFTER AS PROVIDED BY LAW, SUCH PROCEEDS TO BE

USED FOR ANY LAWFUL PURPOSE FOR WHICH LIBRARY

DISTRICT FUNDS MAY BE USED UNDER THE COLORADO

LIBRARY LAW (SECTION 24-90-101 ET SEQ., C.R.S.) AND SHALL

SUCH TAX PROCEEDS BE COLLECTED AND SPENT BY THE

DISTRICT AS VOTER APPROVED REVENUE CHANGES IN EACH

YEAR, WITHOUT REGARD TO ANY SPENDING OR REVENUE

LIMITATION CONTAINED IN ARTICLE X, SECTION 20 OF THE

COLORADO CONSTITUTION OR SECTION 29-1-301, C.R.S.?

Larimer County

Local Improvement District

YES/FOR

NO/AGAINST

Western Mini Ranches #2014-1

Ballot Issue 5A

SHALL LARIMER COUNTY DEBT BE INCREASED BY THE

AMOUNT OF $1,720,000, WITH A REPAYMENT COST OF

$3,497,333 AND SHALL LARIMER COUNTY TAXES BE

INCREASED $3,497,333 ANNUALLY OR BY SUCH LESSER

ANNUAL AMOUNT AS MAY BE NECESSARY TO PAY THE

AFOREMENTIONED DEBT, BY IMPOSING SPECIAL

ASSESSMENTS UPON PROPERTY IN THE COUNTYS LOCAL

IMPROVEMENT DISTRICT NO. 2014-1 (WESTERN MINI

RANCHES), WHICH ASSESSMENTS ARE SUBJECT TO

PREPAYMENT AT THE OPTION OF THE PROPERTY OWNER:

SUCH DEBT TO CONSIST OF SPECIAL ASSESSMENT

BONDS OR OTHER FINANCIAL OBLIGATIONS BEARING

INTEREST AT A NET EFFECTIVE INTEREST RATE NOT TO

EXCEED 5%; SUCH SPECIAL ASSESSMENT BONDS OR

OTHER FINANCIAL OBLIGATIONS SHALL BE ISSUED TO

PAY THE COSTS OF PROVIDING CERTAIN LOCAL

IMPROVEMENTS IN SUCH DISTRICT, TO BE REPAID FROM

THE PROCEEDS OF SPECIAL ASSESSMENTS TO BE

IMPOSED UPON THE PROPERTY INCLUDED WITHIN SUCH

DISTRICT; SUCH TAXES TO CONSIST OF THE

AFOREMENTIONED SPECIAL ASSESSMENTS IMPOSED

UPON THE PROPERTY IN THE DISTRICT BENEFITED BY

THE LOCAL IMPROVEMENTS; AND SHALL THE PROCEEDS

OF SUCH BONDS OR OTHER FINANCIAL OBLIGATIONS AND

THE PROCEEDS OF SUCH ASSESSMENTS, AND

INVESTMENT INCOME THEREON CONSTITUTE VOTER-

APPROVED REVENUE CHANGES AND BE COLLECTED AND

SPENT BY THE COUNTY WITHOUT REGARD TO ANY

EXPENDITURE, REVENUE-RAISING, OR OTHER LIMITATION

CONTAINED WITHIN ARTICLE X, SECTION 20 OF THE

COLORADO CONSTITUTION OR ANY OTHER LAW, AND

WITHOUT LIMITING IN ANY YEAR THE AMOUNT OF OTHER

REVENUES THAT MAY BE COLLECTED AND SPENT BY THE

COUNTY?

Larimer County

General Improvement District

YES/FOR

NO/AGAINST

Pinewood Springs #2

Ballot Issue 5B

SHALL LARIMER COUNTY PINEWOOD SPRINGS GENERAL

IMPROVEMENT DISTRICT #2 TAXES BE INCREASED $35,851

(FROM $35,851 TO $71,702) ANNUALLY (IN THE FIRST

YEAR) OR SUCH GREATER AMOUNT AS IS RAISED IN

SUBSEQUENT YEARS BY THE IMPOSITION OF AN

ADDITIONAL 5.000 MILL LEVY TO THE EXISTING DISTRICT

MILL LEVY OF 5.000 MILL LEVY UPON AD VALOREM

PROPERTY TAXES AT A MILL LEVY RATE NOT TO EXCEED

10.000 MILLS, THE REVENUES OF WHICH WILL BE

COLLECTED BEGINNING JANUARY 1, 2015 AND EACH YEAR

THEREAFTER, SUCH REVENUES TO BE USED FOR THE

IMPROVEMENT AND MAINTENANCE OF ROADS IN THE

DISTRICT AND FOR THE GENERAL OPERATING EXPENSES

OF THE DISTRICT, AND SHALL THE PROCEEDS OF SUCH

TAX, THE SPECIFIC OWNERSHIP TAXES RECEIVED BY THE

DISTRICT AND INVESTMENT EARNINGS ON BOTH

CONSTITUTE VOTER APPROVED REVENUE AND/OR

SPENDING CHANGES AND BE COLLECTED AND SPENT BY

THE DISTRICT WITHOUT REGARD TO ANY SPENDING,

REVENUE RAISING OR OTHER LIMITATION CONTAINED

WITHIN ARTICLE X, SECTION 20 OF THE COLORADO

CONSTITUTION; AND SHALL THE DISTRICT BE

AUTHORIZED TO COLLECT AND EXPEND FROM ITS MILL

LEVY ANY SUCH AMOUNT WHICH IS MORE THAN THE

AMOUNT WHICH WOULD OTHERWISE BE PERMITTED

UNDER THE 5.5% LIMIT IMPOSED BY SECTION 29-1-301,

COLORADO REVISED STATUTES IN 2014 AND EACH YEAR

THEREAFTER?

Continued

YES/FOR

NO/AGAINST

Little Valley #14

Ballot Issue 5C

SHALL LARIMER COUNTY LITTLE VALLEY GENERAL

IMPROVEMENT DISTRICT #14 TAXES BE INCREASED

$27,809 (FROM $55,617 TO $83,426) ANNUALLY (IN THE

FIRST YEAR) OR SUCH GREATER AMOUNT AS IS RAISED IN

SUBSEQUENT YEARS BY THE IMPOSITION OF AN

ADDITIONAL 5.000 MILL LEVY TO THE EXISTING DISTRICT

MILL LEVY OF 10.000 MILL LEVY UPON AD VALOREM

PROPERTY TAXES AT A MILL LEVY RATE NOT TO EXCEED

15.000 MILLS, THE REVENUES OF WHICH WILL BE

COLLECTED BEGINNING JANUARY 1, 2015 AND EACH YEAR

THEREAFTER, SUCH REVENUES TO BE USED FOR THE

IMPROVEMENT AND MAINTENANCE OF ROADS IN THE

DISTRICT AND FOR THE GENERAL OPERATING EXPENSES

OF THE DISTRICT, AND SHALL THE PROCEEDS OF SUCH

TAX, THE SPECIFIC OWNERSHIP TAXES RECEIVED BY THE

DISTRICT AND INVESTMENT EARNINGS ON BOTH

CONSTITUTE VOTER APPROVED REVENUE AND/OR

SPENDING CHANGES AND BE COLLECTED AND SPENT BY

THE DISTRICT WITHOUT REGARD TO ANY SPENDING,

REVENUE RAISING OR OTHER LIMITATION CONTAINED

WITHIN ARTICLE X, SECTION 20 OF THE COLORADO

CONSTITUTION; AND SHALL THE DISTRICT BE

AUTHORIZED TO COLLECT AND EXPEND FROM ITS MILL

LEVY ANY SUCH AMOUNT WHICH IS MORE THAN THE

AMOUNT WHICH WOULD OTHERWISE BE PERMITTED

UNDER THE 5.5% LIMIT IMPOSED BY SECTION 29-1-301,

COLORADO REVISED STATUTES IN 2014 AND EACH YEAR

THEREAFTER?

FRONT Card 2 RptPct 101-1000 "NOUSE" FOR PROOF ONLY 09/22/14 12:51:56

Larimer County

Public Improvement District

YES/FOR

NO/AGAINST

Cobblestone Farms #57

Ballot Issue 5D

SHALL TAXES BE INCREASED $10,200 ANNUALLY (IN THE FIRST

YEAR) OR SUCH GREATER AMOUNT AS IS RAISED IN

SUBSEQUENT YEARS WITHIN THE BOUNDARIES OF THE

PROPOSED COBBLESTONE FARMS PUBLIC IMPROVEMENT

DISTRICT NO. 57 BY THE IMPOSITION OF AD VALOREM

PROPERTY TAXES AT A MILL LEVY RATE NOT TO EXCEED 25.564

MILLS, THE REVENUES OF WHICH WILL BE COLLECTED

BEGINNING JANUARY 1, 2015 AND EACH YEAR THEREAFTER,

SUCH REVENUES TO BE USED FOR THE IMPROVEMENT AND

MAINTENANCE OF ROADS AS REQUESTED IN THE PETITION FOR

CREATION OF THE DISTRICT AND FOR THE GENERAL

OPERATING EXPENSES; SHALL COBBLESTONE FARMS PUBLIC

IMPROVEMENT DISTRICT NO. 57 BE CREATED; AND SHALL THE

PROCEEDS OF SUCH TAXES, THE SPECIFIC OWNERSHIP TAXES

RECEIVED BY THE DISTRICT AND INVESTMENT EARNINGS ON

BOTH CONSTITUTE VOTER APPROVED REVENUE AND/OR

SPENDING CHANGES AND BE COLLECTED AND SPENT BY THE

DISTRICT WITHOUT REGARD TO ANY SPENDING, REVENUE

RAISING OR OTHER LIMITATION CONTAINED WITHIN ARTICLE X,

SECTION 20 OF THE COLORADO CONSTITUTION; AND SHALL

THE DISTRICT BE AUTHORIZED TO COLLECT AND EXPEND FROM

ITS MILL LEVY ANY SUCH AMOUNT WHICH IS MORE THAN THE

AMOUNT WHICH WOULD OTHERWISE BE PERMITTED UNDER

THE 5% LIMIT IMPOSED BY SECTION 29-1-301, COLORADO

REVISED STATUTES IN 2014 AND EACH YEAR THEREAFTER?

YES/FOR

NO/AGAINST

Misty Creek #58

Ballot Issue 5E

SHALL TAXES BE INCREASED $8,100 ANNUALLY (IN THE FIRST

YEAR) OR SUCH GREATER AMOUNT AS IS RAISED IN

SUBSEQUENT YEARS WITHIN THE BOUNDARIES OF THE

PROPOSED MISTY CREEK PUBLIC IMPROVEMENT DISTRICT NO.

58 BY THE IMPOSITION OF AD VALOREM PROPERTY TAXES AT A

MILL LEVY RATE NOT TO EXCEED 19.854 MILLS, THE REVENUES

OF WHICH WILL BE COLLECTED BEGINNING JANUARY 1, 2015

AND EACH YEAR THEREAFTER, SUCH REVENUES TO BE USED

FOR THE IMPROVEMENT AND MAINTENANCE OF ROADS AS

REQUESTED IN THE PETITION FOR CREATION OF THE DISTRICT

AND FOR THE GENERAL OPERATING EXPENSES; SHALL MISTY

CREEK PUBLIC IMPROVEMENT DISTRICT NO. 58 BE CREATED;

AND SHALL THE PROCEEDS OF SUCH TAXES, THE SPECIFIC

OWNERSHIP TAXES RECEIVED BY THE DISTRICT AND

INVESTMENT EARNINGS ON BOTH CONSTITUTE VOTER

APPROVED REVENUE AND/OR SPENDING CHANGES AND BE

COLLECTED AND SPENT BY THE DISTRICT WITHOUT REGARD

TO ANY SPENDING, REVENUE RAISING OR OTHER LIMITATION

CONTAINED WITHIN ARTICLE X, SECTION 20 OF THE COLORADO

CONSTITUTION; AND SHALL THE DISTRICT BE AUTHORIZED TO

COLLECT AND EXPEND FROM ITS MILL LEVY ANY SUCH AMOUNT

WHICH IS MORE THAN THE AMOUNT WHICH WOULD OTHERWISE

BE PERMITTED UNDER THE 5% LIMIT IMPOSED BY SECTION 29-

1-301, COLORADO REVISED STATUTES IN 2014 AND EACH YEAR

THEREAFTER?

YES/FOR

NO/AGAINST

Grasslands #59

Ballot Issue 5F

SHALL TAXES BE INCREASED $66,500 ANNUALLY (IN THE FIRST

YEAR) OR SUCH GREATER AMOUNT AS IS RAISED IN

SUBSEQUENT YEARS WITHIN THE BOUNDARIES OF THE

PROPOSED GRASSLANDS PUBLIC IMPROVEMENT DISTRICT NO.

59 BY THE IMPOSITION OF AD VALOREM PROPERTY TAXES AT A

MILL LEVY RATE NOT TO EXCEED 34.310 MILLS, THE REVENUES

OF WHICH WILL BE COLLECTED BEGINNING JANUARY 1, 2015

AND EACH YEAR THEREAFTER, SUCH REVENUES TO BE USED

FOR THE IMPROVEMENT AND MAINTENANCE OF ROADS AS

REQUESTED IN THE PETITION FOR CREATION OF THE DISTRICT

AND FOR THE GENERAL OPERATING EXPENSES; SHALL

GRASSLANDS PUBLIC IMPROVEMENT DISTRICT NO. 59 BE

CREATED; AND SHALL THE PROCEEDS OF SUCH TAXES, THE

SPECIFIC OWNERSHIP TAXES RECEIVED BY THE DISTRICT AND

INVESTMENT EARNINGS ON BOTH CONSTITUTE VOTER

APPROVED REVENUE AND/OR SPENDING CHANGES AND BE

COLLECTED AND SPENT BY THE DISTRICT WITHOUT REGARD

TO ANY SPENDING, REVENUE RAISING OR OTHER LIMITATION

CONTAINED WITHIN ARTICLE X, SECTION 20 OF THE COLORADO

CONSTITUTION; AND SHALL THE DISTRICT BE AUTHORIZED TO

COLLECT AND EXPEND FROM ITS MILL LEVY ANY SUCH AMOUNT

WHICH IS MORE THAN THE AMOUNT WHICH WOULD OTHERWISE

BE PERMITTED UNDER THE 5% LIMIT IMPOSED BY SECTION 29-

1-301, COLORADO REVISED STATUTES IN 2014 AND EACH YEAR

THEREAFTER?

Red Feather Lakes

Fire Protection District

YES/FOR

NO/AGAINST

Ballot Issue 5G

WITHOUT RAISING ADDITIONAL TAXES, SHALL THE EXISTING

TAX OF 1.900 MILLS, THAT WAS APPROVED BY THE VOTERS ON

MAY 4, 2004, BE EXTENDED BEYOND ITS CURRENT EXPIRATION

DATE OF DECEMBER 31, 2015, THE TAX REVENUES FROM WHICH

ARE TO BE UTILIZED FOR GENERAL OPERATING EXPENSES AND

CAPITAL ACQUISITIONS, INCLUDING NEW FIRE FIGHTING

EQUIPMENT AND VEHICLES, AT THE DISCRETION OF THE

ELECTED BOARD OF DIRECTORS AND IN ACCORDANCE WITH

THE DISTRICTS LONG RANGE PLAN, AND SHALL SUCH TAX

CONTINUE THEREAFTER AS PROVIDED BY LAW, AND THE

PROCEEDS FROM WHICH CONTINUE TO BE COLLECTED AND

SPENT BY THE DISTRICT AS VOTER APPROVED REVENUE AND

SPENDING CHANGES IN EACH YEAR, WITHOUT REGARD TO ANY

SPENDING OR REVENUE LIMITATION CONTAINED IN ARTICLE X,

SECTION 20 OF THE COLORADO CONSTITUTION OR SECTION 29-

1-301, COLORADO REVISED STATUTES?

YES/FOR

NO/AGAINST

Ballot Question 5H

Shall the limitations on terms of office contained in Article XVIII, Section

11, of the Colorado Constitution be eliminated as applied to the Red

Feather Lakes Fire Protection District?

End of Ballot

"WARNING:

Any person who, by use of force or other means, unduly influences an eligible elector to vote in any particular manner or to refrain from voting, or who falsely makes, alters, forges, or counterfeits

any mail ballot before or after it has been cast, or who destroys, defaces, mutilates, or tampers with a ballot is subject, upon conviction, to imprisonment, or to a fine, or both."

BACK Card 2 RptPct 101-1000 "NOUSE" FOR PROOF ONLY 09/22/14 12:51:56

Anda mungkin juga menyukai

- Law, Race and the Constitution in the Obama-ContextDari EverandLaw, Race and the Constitution in the Obama-ContextBelum ada peringkat

- Flagler 2012 Sample BallotDokumen2 halamanFlagler 2012 Sample BallotFlagler County DECBelum ada peringkat

- Ballot 1Dokumen5 halamanBallot 1garivasBelum ada peringkat

- Elmore County Sample BallotDokumen1 halamanElmore County Sample BallotMontgomery AdvertiserBelum ada peringkat

- Official General Election Sample Ballot Lake County, Florida November 2, 2010Dokumen2 halamanOfficial General Election Sample Ballot Lake County, Florida November 2, 2010Alvin Patrick PeñafloridaBelum ada peringkat

- 2011 Publication BallotDokumen4 halaman2011 Publication BallotvaildailyBelum ada peringkat

- Jefferson 2016 SampleDokumen364 halamanJefferson 2016 SampleAnonymous NjRIfLbBelum ada peringkat

- CCRI 2009-2010 ScorecardDokumen8 halamanCCRI 2009-2010 ScorecardCommon Cause Rhode IslandBelum ada peringkat

- United States Court of Appeals, Fourth CircuitDokumen6 halamanUnited States Court of Appeals, Fourth CircuitScribd Government DocsBelum ada peringkat

- United States Court of Appeals, Tenth CircuitDokumen10 halamanUnited States Court of Appeals, Tenth CircuitScribd Government DocsBelum ada peringkat

- Republican Delegate Voter Guide 2016Dokumen2 halamanRepublican Delegate Voter Guide 2016Flint McColganBelum ada peringkat

- 2014 TX Primary LWV Voter GuideDokumen24 halaman2014 TX Primary LWV Voter GuideTea IceBelum ada peringkat

- Autauga County Sample BallotDokumen1 halamanAutauga County Sample BallotMontgomery AdvertiserBelum ada peringkat

- Jordan v. Silver, 381 U.S. 415 (1965)Dokumen6 halamanJordan v. Silver, 381 U.S. 415 (1965)Scribd Government DocsBelum ada peringkat

- Knox County, MODokumen2 halamanKnox County, MOKHQA NewsBelum ada peringkat

- SECOND NOTICE OPPORTUNITY CUREDokumen21 halamanSECOND NOTICE OPPORTUNITY CUREskunkyghost100% (2)

- Sample: The Commonwealth of MassachusettsDokumen2 halamanSample: The Commonwealth of MassachusettsMike CarraggiBelum ada peringkat

- Shelby County, MODokumen2 halamanShelby County, MOKHQA NewsBelum ada peringkat

- Jefferson 2012 SampleDokumen180 halamanJefferson 2012 SampleWalterLewellynBelum ada peringkat

- Sample Detroit BallotDokumen4 halamanSample Detroit BallotCharlesPughBelum ada peringkat

- Be It Enacted by The General Assembly of The State of ColoradoDokumen8 halamanBe It Enacted by The General Assembly of The State of ColoradoKennady NickellBelum ada peringkat

- November 6 BallotDokumen2 halamanNovember 6 BallotR L Hamilton EdmondsonBelum ada peringkat

- Saunders Thurston Letter To US Dept of JusticeDokumen2 halamanSaunders Thurston Letter To US Dept of JusticeMatt DixonBelum ada peringkat

- General Election Ballot: Judge's InitialsDokumen2 halamanGeneral Election Ballot: Judge's Initialsapi-166275322Belum ada peringkat

- 05 South Carolina MacroDokumen69 halaman05 South Carolina MacroJamie SandersonBelum ada peringkat

- United States v. Charleston County SC, 4th Cir. (2004)Dokumen18 halamanUnited States v. Charleston County SC, 4th Cir. (2004)Scribd Government DocsBelum ada peringkat

- South v. Peters, 339 U.S. 276 (1950)Dokumen5 halamanSouth v. Peters, 339 U.S. 276 (1950)Scribd Government DocsBelum ada peringkat

- The Atlantic Beach PetitionDokumen2 halamanThe Atlantic Beach PetitionCSMP Florida100% (1)

- Large v. Fremont County, Wyo., 670 F.3d 1133, 10th Cir. (2012)Dokumen33 halamanLarge v. Fremont County, Wyo., 670 F.3d 1133, 10th Cir. (2012)Scribd Government DocsBelum ada peringkat

- Mock Election BallotDokumen6 halamanMock Election BallotStatesman JournalBelum ada peringkat

- Web App FormDokumen2 halamanWeb App FormDave RodriguezBelum ada peringkat

- 2011 League of Women Voters GuideDokumen101 halaman2011 League of Women Voters GuideBucksLocalNews.comBelum ada peringkat

- Judicial Disclosure Bill For California JudgesDokumen4 halamanJudicial Disclosure Bill For California JudgesKathleen DearingerBelum ada peringkat

- If They Can't Pay, Judge Says Florida Felons Can Still VoteDokumen125 halamanIf They Can't Pay, Judge Says Florida Felons Can Still Vote10News WTSPBelum ada peringkat

- Sample Democratic Primary Ballot 2014Dokumen2 halamanSample Democratic Primary Ballot 2014R L Hamilton EdmondsonBelum ada peringkat

- United States Court of Appeals, Second CircuitDokumen161 halamanUnited States Court of Appeals, Second CircuitScribd Government DocsBelum ada peringkat

- Nov. 3, Coulter First Amended ComplaintDokumen133 halamanNov. 3, Coulter First Amended ComplaintPeter CoulterBelum ada peringkat

- FL Ballot 2014Dokumen1 halamanFL Ballot 2014April BlackBelum ada peringkat

- United States Court of Appeals, Eleventh CircuitDokumen11 halamanUnited States Court of Appeals, Eleventh CircuitScribd Government DocsBelum ada peringkat

- Tom Cryer MemoDokumen109 halamanTom Cryer Memovgdiaz1970Belum ada peringkat

- Voting Law Changes 2012: Brennan Center ReportDokumen124 halamanVoting Law Changes 2012: Brennan Center ReportCREWBelum ada peringkat

- 93.121.11R - Move To Amend Campaign (Amended)Dokumen2 halaman93.121.11R - Move To Amend Campaign (Amended)lgolbyBelum ada peringkat

- Jabari Zakiya Opposition Testimony Bill 19-330Dokumen4 halamanJabari Zakiya Opposition Testimony Bill 19-330Jabari ZakiyaBelum ada peringkat

- Crowell v. State of North CarolinaDokumen11 halamanCrowell v. State of North CarolinaIVN.us EditorBelum ada peringkat

- Marijuana LawsuitDokumen44 halamanMarijuana LawsuitColoradoanBelum ada peringkat

- Sheriffs Sue Colorado Over Legal MarijuanaDokumen44 halamanSheriffs Sue Colorado Over Legal MarijuanaMarijuana MomentBelum ada peringkat

- Constitution of The United States of America: Historical DocumentDokumen14 halamanConstitution of The United States of America: Historical DocumentskillsoverstuffBelum ada peringkat

- Voting and Election Laws: An Official Website of The United States Government Here's How You KnowDokumen50 halamanVoting and Election Laws: An Official Website of The United States Government Here's How You KnowRUBY JAN CASASBelum ada peringkat

- Gordon v. Lance, 403 U.S. 1 (1971)Dokumen6 halamanGordon v. Lance, 403 U.S. 1 (1971)Scribd Government DocsBelum ada peringkat

- United States Court of Appeals, Fourth CircuitDokumen14 halamanUnited States Court of Appeals, Fourth CircuitScribd Government DocsBelum ada peringkat

- Texas Redistricting 23 Sept 2011Dokumen25 halamanTexas Redistricting 23 Sept 2011brian_d_fungBelum ada peringkat

- MotionDokumen28 halamanMotionMatt DixonBelum ada peringkat

- Swann v. Adams, 385 U.S. 440 (1967)Dokumen6 halamanSwann v. Adams, 385 U.S. 440 (1967)Scribd Government DocsBelum ada peringkat

- The Constitution: Major Cases and Conflicts, 4th EditionDari EverandThe Constitution: Major Cases and Conflicts, 4th EditionBelum ada peringkat

- The U.S. Constitution with The Declaration of Independence and The Articles of ConfederationDari EverandThe U.S. Constitution with The Declaration of Independence and The Articles of ConfederationPenilaian: 4.5 dari 5 bintang4.5/5 (6)

- Speeches at the Constitutional Convention: With the Right of Suffrage Passed by the Constitutional ConventionDari EverandSpeeches at the Constitutional Convention: With the Right of Suffrage Passed by the Constitutional ConventionBelum ada peringkat

- Lee, Jurich Civil Suit vs. PSD Dismissal RulingDokumen46 halamanLee, Jurich Civil Suit vs. PSD Dismissal RulingColoradoanBelum ada peringkat

- 23SA300Dokumen213 halaman23SA300Brandon Conradis100% (5)

- Schiller LawsuitDokumen20 halamanSchiller LawsuitColoradoanBelum ada peringkat

- CSU Racial Climate ReportDokumen18 halamanCSU Racial Climate ReportColoradoanBelum ada peringkat

- 2022-23 CHSAA Officials FeesDokumen2 halaman2022-23 CHSAA Officials FeesColoradoanBelum ada peringkat

- Cameron Park Fire Closure As of Aug. 20, 2020Dokumen1 halamanCameron Park Fire Closure As of Aug. 20, 2020ColoradoanBelum ada peringkat

- 2022 Larimer County General Election Sample BallotDokumen4 halaman2022 Larimer County General Election Sample BallotColoradoanBelum ada peringkat

- City of Fort Collins Trails MapDokumen1 halamanCity of Fort Collins Trails MapColoradoanBelum ada peringkat

- Larimer County Express (Coloradoan) From April 26, 1873Dokumen4 halamanLarimer County Express (Coloradoan) From April 26, 1873ColoradoanBelum ada peringkat

- Poudre School District Superintendent Evaluation, June 2022Dokumen8 halamanPoudre School District Superintendent Evaluation, June 2022ColoradoanBelum ada peringkat

- CSU Compliance With COVID-19 Final ReportDokumen16 halamanCSU Compliance With COVID-19 Final ReportColoradoanBelum ada peringkat

- Steve Pankey IndictmentDokumen7 halamanSteve Pankey IndictmentColoradoanBelum ada peringkat

- Cameron Peak Fire Map As of Aug. 20, 2020Dokumen1 halamanCameron Peak Fire Map As of Aug. 20, 2020ColoradoanBelum ada peringkat

- Appendix A CSU COVID ReportDokumen59 halamanAppendix A CSU COVID ReportColoradoanBelum ada peringkat

- B.A.S.E. Camp Closure Open LetterDokumen1 halamanB.A.S.E. Camp Closure Open LetterColoradoanBelum ada peringkat

- Colorado Mask Order 7-16-20Dokumen4 halamanColorado Mask Order 7-16-20CPR Digital67% (3)

- Susan Holmes Extreme Risk Protection Order PetitionDokumen6 halamanSusan Holmes Extreme Risk Protection Order PetitionColoradoan100% (1)

- Cameron Peak Fire Closures in U.S. Forest Service As of Aug. 20, 2020Dokumen1 halamanCameron Peak Fire Closures in U.S. Forest Service As of Aug. 20, 2020ColoradoanBelum ada peringkat

- Pardon Letter - Eric Edelstein - RedactedDokumen2 halamanPardon Letter - Eric Edelstein - RedactedColoradoanBelum ada peringkat

- Pardon Letter - Jamie Matthews - RedactedDokumen2 halamanPardon Letter - Jamie Matthews - RedactedColoradoanBelum ada peringkat

- Commutation Letter - William Hoover - RedactedDokumen2 halamanCommutation Letter - William Hoover - RedactedColoradoanBelum ada peringkat

- Pardon Letter - Brandon Burke - RedactedDokumen2 halamanPardon Letter - Brandon Burke - RedactedColoradoanBelum ada peringkat

- Commutation Letter - Abron Arrington - RedactedDokumen2 halamanCommutation Letter - Abron Arrington - RedactedColoradoanBelum ada peringkat

- Pardon Letter - Ingrid LaTorre - RedactedDokumen2 halamanPardon Letter - Ingrid LaTorre - RedactedColoradoanBelum ada peringkat

- Commutation Letter - Erik Jensen - RedactedDokumen2 halamanCommutation Letter - Erik Jensen - RedactedColoradoanBelum ada peringkat

- C 2019 004 John FurnissDokumen1 halamanC 2019 004 John FurnissColoradoanBelum ada peringkat

- Pardon Letter John Furniss - RedactedDokumen2 halamanPardon Letter John Furniss - RedactedColoradoanBelum ada peringkat

- C 2019 005 HooverDokumen1 halamanC 2019 005 HooverColoradoanBelum ada peringkat

- C 2019 001 Abron ArringtonDokumen1 halamanC 2019 001 Abron ArringtonColoradoanBelum ada peringkat

- C 2019 002 Brandon BurkeDokumen1 halamanC 2019 002 Brandon BurkeColoradoanBelum ada peringkat

- Through The Eye of A Needle by ANC 2001 PDFDokumen9 halamanThrough The Eye of A Needle by ANC 2001 PDFntesengl100% (1)

- McDaniel Election Challenge Madison County AffidavitDokumen27 halamanMcDaniel Election Challenge Madison County Affidavitthe kingfishBelum ada peringkat

- Culasi, AntiqueDokumen2 halamanCulasi, AntiqueSunStar Philippine NewsBelum ada peringkat

- Grammar I-3 InversionDokumen6 halamanGrammar I-3 InversionAndrei-AdrianDatcu100% (1)

- Case Digest On Veterans Federation Party v. COMELEC G.R. No. 1136781 (October 6, 2000)Dokumen105 halamanCase Digest On Veterans Federation Party v. COMELEC G.R. No. 1136781 (October 6, 2000)Teresa Marie NatavioBelum ada peringkat

- Election Law Doctrines ExplainedDokumen15 halamanElection Law Doctrines ExplainedLimberge Paul Corpuz100% (5)

- Andrei Marmor The Language of LawDokumen177 halamanAndrei Marmor The Language of LawDaniel De Vito0% (1)

- COMELEC Memo 201411 - 2014 General Elections ResultsDokumen18 halamanCOMELEC Memo 201411 - 2014 General Elections ResultsAteneo COMELECBelum ada peringkat

- Draft Bye LawsDokumen7 halamanDraft Bye LawsBalaji BiradarBelum ada peringkat

- Swensson V Obama, Reply Brief To Petitioner's Motion For Emergency Hearing, Fulton County Superior Court, 2-27-2012Dokumen8 halamanSwensson V Obama, Reply Brief To Petitioner's Motion For Emergency Hearing, Fulton County Superior Court, 2-27-2012Article II Super PACBelum ada peringkat

- Comarts ResearchDokumen63 halamanComarts ResearchKen ChiaBelum ada peringkat

- The Debate Bible: A Concise Guide to College Debate StrategyDokumen23 halamanThe Debate Bible: A Concise Guide to College Debate StrategyThomas FlanaganBelum ada peringkat

- ELECTION COMMITTEE-CIRCULAR NO.1 (From Page No. 1 To 6)Dokumen6 halamanELECTION COMMITTEE-CIRCULAR NO.1 (From Page No. 1 To 6)Anonymous YYNDnIGEBelum ada peringkat

- Bylaws of An Oklahoma CorporationDokumen31 halamanBylaws of An Oklahoma CorporationDiego AntoliniBelum ada peringkat

- Sema V. Comelec: ProvisionDokumen1 halamanSema V. Comelec: ProvisionWhere Did Macky GallegoBelum ada peringkat

- Padilla Vs Comelec (1992) : Political Unit or UnitsDokumen1 halamanPadilla Vs Comelec (1992) : Political Unit or UnitsAliw del RosarioBelum ada peringkat

- TAULE Vs Santos, 1991Dokumen13 halamanTAULE Vs Santos, 1991LucioJr AvergonzadoBelum ada peringkat

- Ky. Polling Location LawsuitDokumen39 halamanKy. Polling Location LawsuitCourier JournalBelum ada peringkat

- Transition Integrity Project: Background Concerns About The Legitimacy of The 2020 Presidential ElectionDokumen7 halamanTransition Integrity Project: Background Concerns About The Legitimacy of The 2020 Presidential ElectionFred JohnsonBelum ada peringkat

- Medwire April 2015Dokumen20 halamanMedwire April 2015Sarah BoastBelum ada peringkat

- LS-Elections ExplainedDokumen12 halamanLS-Elections ExplainedSirisha VarmaBelum ada peringkat

- Seriña Vs CFI DigestDokumen2 halamanSeriña Vs CFI DigestJhanelyn V. InopiaBelum ada peringkat

- PPG12 - Q2 - Mod10 - Elections and Political Parties in The PhilippinesDokumen14 halamanPPG12 - Q2 - Mod10 - Elections and Political Parties in The PhilippinesZENY NACUABelum ada peringkat

- Emerging Trends in Indian PoliticsDokumen5 halamanEmerging Trends in Indian PoliticsBrijeshBelum ada peringkat

- 2019 Water Rate Increase Letter To The City of OceansideDokumen9 halaman2019 Water Rate Increase Letter To The City of OceansideANNAMARIE760Belum ada peringkat

- NBCWSJ August Poll (8-4 Release)Dokumen13 halamanNBCWSJ August Poll (8-4 Release)Carrie DannBelum ada peringkat

- 38-Gaya (SC) : Lok Sabha Constituency ProfileDokumen1 halaman38-Gaya (SC) : Lok Sabha Constituency ProfileHaresh KHAIRNARBelum ada peringkat

- Final Election LawDokumen16 halamanFinal Election LawAlee GarciaBelum ada peringkat

- General AssemblyDokumen2 halamanGeneral AssemblyPopular Youtube VideosBelum ada peringkat

- Santiago vs COMELEC ruling on people's initiativeDokumen5 halamanSantiago vs COMELEC ruling on people's initiativePatrick TanBelum ada peringkat