CG From The Islamic Perspective PDF

Diunggah oleh

Asep Kurniawan0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

11 tayangan12 halamanJudul Asli

CG from the islamic perspective.pdf

Hak Cipta

© © All Rights Reserved

Format Tersedia

PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

11 tayangan12 halamanCG From The Islamic Perspective PDF

Diunggah oleh

Asep KurniawanHak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 12

Critical Perspectives on Accounting 20 (2009) 556567

Corporate governance from the Islamic perspective:

A comparative analysis with OECD principles

Abdussalam Mahmoud Abu-Tapanjeh

Chairman of Accounting Department, Business Administration College, Faculty of

Business Administration, Mutah University, Karak, Jordan

Received 11 June 2007; received in revised form 9 October 2007; accepted 6 December 2007

Abstract

There is a growing concern emerged with a great prole regarding the Islamic principles of corporate

governance. Amajor ethical component of any economic activity in Islamis to provide justice, honest

and fairness and to ensure all parties their rights and dues. Islamic economy has progressed a great

deal during these last two decades with impetus as an important concern in developing an Islamic

corporate system. This paper is anattempt todiscuss the nature, applications andcomparisonof Islamic

principles of corporate governance (IPCG) with conventional principles of corporate governance

considering special reference to Organization of Economic Co-operation and Development (OECD).

After the discussion, it can be concluded that the dimension of Islamic perspectives of corporate

governance has broader horizon and cannot compartmentalize the roles and responsibilities in which

all actions and obligations fall under the jurisdiction of the divine law of Islam whereas, the OECD

principles implements a rm with six different issue and obligations. Furthermore, this paper can

provide some insight view in fettering mechanism to controlled, direct and organized economic

activity from the Islamic point of view.

2008 Elsevier Ltd. All rights reserved.

1. Introduction

The debate of corporate governance emerged as a great prole and of critical interest

since the mid-1980s attracting a great deal of attention for the practitioners, communities

Tel.: +962 795 287171.

E-mail address: tapanjeh@yahoo.com.

1045-2354/$ see front matter 2008 Elsevier Ltd. All rights reserved.

doi:10.1016/j.cpa.2007.12.004

A.M. Abu-Tapanjeh / Critical Perspectives on Accounting 20 (2009) 556567 557

as the managers, shareholders, investors, regulatory agencies, as well as in the academic

research (Abu-Tapanjeh, 2006). The corporate governance is not only one of the main prin-

ciple in running a rmsuccessfully but also it ensures security condence by monitoring and

controls the operation of the rm. In this present business environment with diverse cultural

background, the principles of corporate governance cannot be applied for all propositions.

Thus need rigorously to adopt purposefully and implement new corporate rules and regu-

lations that are more robust in the face of rapid nancial innovation. This implies that good

corporate governance is not just comply with hard and fast rules but also seen as guidelines

for a supervisory framework of different environmental structures. Corporate governance

need to become principle based, rather than being based on rules and regulations (OECD,

2004). This issue is well addressed by different committees around the world and has been

repeated and renovated again and again by business committees and business leaders. These

core concerns triggered in forming global reports on Corporate Governance. Hence, the

Organization for Economic Co-operation and Development (OECD) principles endorsed by

(OECD) ministers was bornin1999andsince thenwithits soundnancial systembecame an

international benchmark for policy makers, investors, corporations and other stakeholders.

The call for principles of corporate governance is not something new and alien to Islam.

The Islamic nancial system has thrived for centuries during the heyday of the Muslim

civilization, but with the inltration of modern conventional economy leads to misplace

the Islamic civilization. And such a way Islamic economic developed as a social discipline

in response to this environment. Although Islamic economy do perform mostly the same

functions as conventional economy, there is always a distinct unique form of differences

between both the principles implement. In fact, the primary feature of Islamic economy is to

give just, honest, fair and balanced society as envisioned to Islamic ethical values and rules.

(Ahmad, 2000; Mirakhor, 2000; Warde, 2000), expressed that Islamic business is always

characterized by ethical norms and social commitments, grounded on ethical and moral

framework of the Shariah. (Asyraf, 2006) herewith underpinned nicely that these Shariah

injunctions interweave Islamic nancial transactions with genuine concern for ethically

and socially responsible activities at the same time as prohibiting involvement in illegal

activities or those which are detrimental to social and environmental well-being. Khalifa

(2003) also describes Islamic economics as it is Godly, ethical, humanly, and moderate and

balanced. Therefore, all forms of exploitation are prohibited in Islamic business system and

should underpin with the ethical rules of Shariah.

The main objectives of this study are to briey discuss the current state of corporate

governance practices at the conventional economy and to establish the measurement of

good corporate governance at the functional level and how far this approach can ensure

the relativity with the Islamic corporate governance. This study describes a radically differ-

ent approach focusing the similarities and differences of conventional corporate governance

fromthe Islamic perspective. The researcher referred the principles of corporate governance

(OCED)2004, for the purpose of this study. It is done so, since these principles were so

sound that it was immediately adopted by many well profounded companies and organiza-

tions and soon became a benchmark for identication of good elements all over the world.

Therefore, this paper is an attempt to bring a comparative position and to analyze the

similarities and differentiations of the revised OECD principles and its annotations to the

Islamic perspective.

558 A.M. Abu-Tapanjeh / Critical Perspectives on Accounting 20 (2009) 556567

The remainder of the paper presents into six divided sections, the following section

discusses the identication of corporate governance. The OECD principles are further ana-

lyzed in section three. Section 4 discusses the Islamic perspective of corporate governance

and its comparison with OECD principles and the last section gives the conclusion of the

study.

2. Corporate governance

Corporate governance characteristics albeit playing different roles in ensuring compa-

nies success are ultimately the only responsible role affecting the business economy. (Van

Den Berghe, 2001), state that performance is nally the outcome of many interlinking fac-

tors where corporate governance is the only one possible element within the whole set of

performance drivers.

In fact, the term corporate governance has gained prominence only during the last

two decades (Zingales, 1997). This terminology clearly had its origin from a Greek word

kyberman which means to steer, guide or govern. This passed on from Greek to Latin

word as gubernare and the old French governer, but this word has been dened in dif-

ferent ways by different organizations or committees, according to their own ideological

concerns. The OECD has dened it as the set of relationships between a companys man-

agement, its board, its stakeholders and other stakeholders (OECD, 1999). Mr. Wolfensohn

(Wolfensohn, 2001), World Bank President, has gone a step further by explaining that cor-

porate governance needs to be fairness, transparency and accountability. Dyck (2000)

also describe in adding this argument that corporate governance is broadly the complex

set of socially dened constraints that effect the willingness to make investments in cor-

porations in exchange for promises. Furthermore, Dalton et al. (2003) argued that agency

theory is the theoretical basis of most of the research on corporate governance, they suggest

the need to consider other theoretical ways of examining the relationship and propose a

substitution theory approach which considers a range of governance mechanisms. Here it

would be worth noting to quote Hakim (2002); he explains corporate governance as, In

the practical sense, corporate governance involves the nuts and bolts of how corporations

should fulll their responsibilities to their shareholders and other stakeholders. Corpo-

rate governance is the mechanism by which agency problems of corporation stakeholders,

including the shareholders, creditors, management, employees, consumers and the public

at large are framed and sought to be resolved. Transparency, accountability and adequate

disclosure are three essential ingredients in corporate governance. Hence, therefore, it can

be concluded here that corporate governance is a set of mechanism that helps in conrm-

ing, with fair and just dealing to all the stakeholders and to strengthening transparency and

accounting.

Good corporate governance has long been considered a crucial role for stakeholders in

the business environment. Though the goal of corporate governance differs from one rm

to another, or from one country to another, the main important concern is to impetus a good

code of mechanisms to uplift and govern the organization. But with the current business

pressure, corporate governance structure changes very fast. The nancial innovation and

globalization forcing the executives to adopt rigorous re-evaluation of corporate governance

A.M. Abu-Tapanjeh / Critical Perspectives on Accounting 20 (2009) 556567 559

principles. Meyer (2004) says that a systematic governance means adjusting the signals

with an organization such that staff automatically do the right things, without the need

for oversight. Sound corporate governance practices have become critical to worldwide

efforts to stabilize and strengthen good capital markets and protect investors (Darman,

2005).

Many studies exist linking good corporate governance with better performance. There is

empirical evidence to suggest that countries that have implemented good corporate gover-

nance measures have generally experienced robust growth of corporate sectors and higher

ability to attract capital than those that have not (SECP, 2005). Fianna and Grant (2005)

explains that good corporate governance helps to bridge the gap between the interests of

those that a company, by increasing investor condence and lowering the cost of capital

for the company. Furthermore, they also add that it also helps in ensuring company hon-

ors, its legal commitments and forms value-creating relations with stakeholders. Coles et

al. (2001) and Durnev and Han (2002), also found that companies with better corporate

governance enjoy higher valuation. However, there is a growing argument that corporate

governance still needs to be renovated and revised. Hence, it can be concluded that issue of

good corporate governance is still open for discussion.

3. OECD principles of corporate governance

Supranational authorities like the world bank developed their own sets of standard princi-

ples and recommendations. Likewise, OECDprinciples, a notable global report on corporate

governance set its own principles consulting with governments and stakeholders from dif-

ferent countries and committees worldwide. It is considered one of the principles of the

twelve key standards for sound nancial systems adopted by the Financial Stability Forum

(FSF).

The OECD Principles of corporate governance originally adopted by the 30 member

countries of the OECD in 1999 have became a reference tool for policy makers, cor-

porations, institutional and regulatory frameworks and others. It also provides practical

guidance and suggestions for stock exchange, investors, corporations and other profound

organizations of the world other than OECD member countries. Daniel (2003) states the

reasons why one should care about the quality of corporate governance, as rstly, it leads

to increased economic efciency and growth, it improves the use of capital, and encour-

ages foreign direct investment. Secondly, it lowers the risk of crisis and in the case of

an external shock it improves the robustness of the economy. Thirdly, it is crucial for the

legitimacy of a market economy. Henceforth, to ensure consideration of these standards,

the OECD has oriented discussions including some main categories of the principles. The

OECD began a review of the principles in 2003 considering the recent changes and devel-

opments and after an extensive review the process led to adopt revised and reviewed OECD

principles of corporate governance in April, 2004. The revision principles not only reect

the experience of OECD countries but also the emerging and developing economics. The

revised principles are non-binding in nature and it lays up to the governments and mar-

ket participants to decide for their own framework. It also conrmed the adaptability of

the principles as a reference in varying legal, economic and cultural contexts. Corpo-

560 A.M. Abu-Tapanjeh / Critical Perspectives on Accounting 20 (2009) 556567

rate governance is the system by which business corporations are directed and controlled.

The corporate governance species the distribution of rights and responsibilities among

different participants in the corporation, such as the board, managers, shareholders and

other stakeholders, and spell out the rules and procedures for making decisions on cor-

porate affairs. By doing this, it also provides the structures through which the company

objectives are set, and the means of attaining those objectives and monitoring perfor-

mance (OECD, 2004). The following are the main areas of the OECD principles and its

annotation:

Principle 1: Ensuring the basis for an effective corporate governance framework.

Annotation: The corporate governance framework should promote transparent and efcient

markets, be consistent with the rule of law and clearly articulate the division

of responsibilities among different supervisory, regulatory and enforcement

authorities.

Principle 2: The right of shareholders and key ownership functions.

Annotation: The corporate governance framework should protect and facilitate the exercise

of shareholders rights.

Principle 3: The equitable treatment of shareholders.

Annotation: The corporate governance framework should ensure the equitable treatment of

all shareholders, including minority and foreign shareholders. All shareholders

should have the opportunities to obtain effective redress for violation of their

rights.

Principle 4: The role of stakeholders in corporate governance.

Annotation: The corporate governance framework should recognize the rights of stake-

holders established by lawor through mutual agreements and encourage active

co-operation between corporations and stakeholders in creating wealth, jobs,

and the sustainability of nancially sound enterprises.

Principle 5: Disclosure and transparency.

Annotation: The corporate governance framework should ensure that timely and accurate

disclosure is made on all material matters regarding the corporation, includ-

ing the nancial situation, performance, ownership, and governance of the

company.

Principle 6: The responsibilities of the board.

Annotation: The corporate governance framework should ensure the strategic guidance

of the company, the effective monitoring of management by the board, and

boards accountability to the company and the shareholders.

The main theme of the above principle lies in four basic principles. Firstly, the mechanismof

business ethics, secondly the mechanism of decision making, thirdly in adequate disclosure

and transparency and lastly the mechanismof book keeping and nal accounts.These OECD

principles are so sound that even the non-members of OECDare implementing and adopting.

As Morck (2005) states that the soundness of these principles has been proved by its adoption

all over the world the next section will discuss the Islamic view of corporate government

from the Islamic perspective.

A.M. Abu-Tapanjeh / Critical Perspectives on Accounting 20 (2009) 556567 561

4. Corporate principles from Islamic perspective

4.1. Islamic business principles

The Islamic religion relates directly to all spheres of life, including how to conduct the

trade and commerce. Shariah covers not only religious ritual, but also many aspects of

day-to-day life, politics, economics, banking, business or contract law, and social issues

(Wikipedia, 2005).

Muslims are directed to conduct their business in accordance with the Shariah rules, i.e.,

to be fair, honest and just toward others. Accumulating wealth of oneself is allowed under the

constraint restrictions of Islamic ethics. Saeed (1996) explains that, wealth is considered a

trust and a test, where failure to use it wisely, especially to alleviate the hardship of the poor

is detrimental to the person who holds that wealth. And above all, the main virtue is of

prohibition of riba. Haqqi (1999) states that one of the most important prohibitions against

misuse, of wealth is prohibition against riba, which is generally translated to mean usury

or interest. This statement impetes that the virtue of Islamic business is fair, and honest

dealing, where all kinds of exploitations are prohibited. Lewis (2005) rightly points out

here that, Islam always encouraged trade and commerce as long as it is conducted within

the framework of Holy Quran, and the word of Allah as revealed to his prophet Muhammad

(PBUH).

Business transactions had long been in practice since the early days of Islam, but with

the colonization of the western countries, the social environmental discipline gets inicted

(infected) with the western ideology. Sequently, Islamic economics developed as a social

disciples in response to this environment, with the aim of establishing or restoring Islamic

authority in areas where Muslims increasingly were falling under the sway of western ideas

(Ahmad, 1984; Kuran, 1995; Nasr, 1984). Business needs to be arranged and organized in

order to contest the outcome. Lewis (2005) explains that, how rms are organized, directed

and controlled, in short what is now called corporate governance, is one aspect of this

broader agenda. Yet, despite a considerable interest in the topic of corporate governance

recently by organizations such as the Islamic Development Bank (Ahmad, 2000; AAOIFI,

2003; Chapra, 1992), little is written on corporate governance structures and there is not

even as yet a unied expression in Arabic to represent the meaning of corporate governance

(Sourial, 2004). Albeit this statement, corporate governance in Islamic law provides and

embodies a more larger and vast guidelines with encompassing duties and practices as on

how to deal with economic transactions up to the moral conduct of a Muslim without even

dening the modern world corporate governance as such Islamic laws impetus corporate

governance in every individual actions of Muslim up to the social environment. Hence, the

following is a discussion as how the OECD principle of corporate governance can be seen

in Islamic business activities by taking these following principles and how it governs the

conduct of business.

4.1.1. Business ethics

In Islam, the absolute and eternal owner of everything on earth and on the heaven, belongs

to Allah (S.W.T.), the almighty, and we human beings are just vice regent of it. Muslims are

entitled to conduct their business activity as guided by the Shariah code of conduct, which

562 A.M. Abu-Tapanjeh / Critical Perspectives on Accounting 20 (2009) 556567

encourage to be just, fair and honest to all the people involved in the business. Therefore, a

Muslim business people are hence taught to possess a high moral conduct, so not to betray,

deceive or exploit his fellowships. Muslim should also not therefore overcome with there

business activity with a consequent results in prot making only. At the same time, Muslims

require to work and produce and being not to be lazy and unproductive. Thus, Ali (2005)

explains the Islamic work ethic, as work is a virtue in light of a persons needs, and is

a necessity for establishing equilibrium in ones individual and social life (Nasr, 1984).

This is mentioned in the Holy Quran (6.132): To all are degrees (or ranks) according

to their deeds. This clearly shows that any system without an appropriate ethical and

moral climate, will not inuence a proper system of governance. Therefore, like OECD, the

above discussion clearly emphasized that Islamic business ethics promotes transparency,

consistent of and equal rule of law.

4.1.2. Decision-making

The holy Quran clearly mandates the principles, which govern the Muslims lives. These

principles were implied and compiled to Muslim since the early days of the Islamic state.

The ethical notion of corporate governance assumes a more broader and holistic signicance

in Islam. The dimension of governance in all manifestations is essentially about decision-

making. Islamic ethics of decision making not only comply in the hands of superior ofcials

but also extends the responsibility to fulll with obligations beyond shareholders, clients,

nanciers, suppliers, customers, employees, embracing within spiritual religious bounty.

An employee would be expected to contribute his or her knowledge to the formulation

and implementation of the organizational vision and consultative procedures should be

applied to all affected, i.e., shareholders, suppliers, customers, workers and the community

(Baydoun et al., 1999).

Islam mandates human beings as trustees of Allah in all situations and the ultimate trust

is to keep in Allah, the ultimate owner of everything in this world. Muslims are taught to

maintain and strengthen good relationship with superiors, clients and the management con-

forming with the divine norms and rules, hence inspired the whole community with values

of truthfulness, fairness, tolerance and justice, etc., this shows that the Islamic institutions

imply decision-making in a different and more broader ways than conventional institutions

do. This is written in many verses of the Holy Quran and Hadith.

And consult them on affairs (of moment). Then, when thou has taken a decision, put

thy trust in Allah (Al-Imran 3.159).

Those who respond to their Lord and establish regular prayer; who conduct their affairs

by mutual consultation; who spend out of what we bestow on them for sustenance (Ash-

Shura, 42.38).

Abu-Hamzah Anas bin Malik (RA) reported that the prophet believers (in Allah and in

his religion) until he loves for his brother what he loves for himself (Al-Bukhari &Muslims).

Islam introduced improvements in accordance with the moral principles enunciated by the

Holy Quran (Stork, 1999).

These above verses clearly emphasize on consultation and whom to consult. The best

beneted ways to whom to consult are those good men who respond to God and fear God,

and who can conduct fair mutual justice with equal importance to all. Thus, this conveys

the Muslims to live true in mutual consultation and forbearance, and rely on Allah. Islam

A.M. Abu-Tapanjeh / Critical Perspectives on Accounting 20 (2009) 556567 563

encourages the participants to work together freely and frankly when arriving at decisions

(Shaikh, 1988). Islam also demands the whole group to participate in decision-making.

Another Islamic principles that represent a core element of corporate governance is that

of an institution called Hisbah established under the Abbasides (750 a.d. onwards) which

ensures compliance with the Shariah requirements, particularly in the business affairs.

Duties like correcting weight and measures, fair trading rules, checking business, frauds,

auditing illegal contracts, keeping the market free, and preventing hoarding of necessities

were carried out by this ofce as stated by (Abdul Rahman, 1998).

Therefore, since the early days of Islam, corporate governance is embedded in an

appropriate ethical environment fullling the bounty of Shariah. The mode of corporate

governance is hence more vast and bigger in dealing with that of the OECD principles,

where BOD and the senior manger are entitled to implement the decision-making.

4.1.3. Disclosure and transparency

In Islamic economy, accountability is entitled to produce a true and fair disclosure and

transparency. Accountability is rst of all to Allah. The fundamental concept of Islamic

accountability is believed that all resources are made available to individuals in a form

of trust. Hence true disclosure of nancial facts, and accurate information should freely

available to the users. Another important point involved in disclosure is to provide the

users adequate information which needed for sound nancial decisions. This will lead in

paying accurate Zakah which is the third pillar of Islam. Accuracy in a sense, involves an

aspect of fairness and just system. This can help in making economic and business decisions

consistent. This fundamental is a powerful ethics in Islamic accounting system and helps

in promoting proper disclosure and transparency in any business dealing.

4.1.4. Book keeping and nal account

Islam encourages to deal business ensuring fair and just nancial transaction between

each other and the ultimate accountability to Allah. Al-Quran clearly shows us the moral

ethics of dealing this principle, as

O you who believe! when you deal with each other in transactions involving future

obligations in a xed period of time, reduce them to writing and let a scribe write down

faithfully as between the parties (Al-Quran, 2.282).

And if you are traveling and cannot nd a scribe, then there be a mortage taken. . .. . .. . .

And do not conceal any evidence for the whoever hides it, surely his heart is sinful, and

Allah is all knower of what you do (Al-Quran, 2.283).

We shall set up justice scales for the day of judgment, not a soul will be dealt unjustly

in the least and if there be (no more than) the weight of mustard seed, we will bring it (to

account), and enough are we to take account (Al-Quran, 21.47).

These verses clearly mandate that transactions in any business dealing should be written

down by a good man who possesses high moral conduct and can be just fair to each party.

Further, it also shows again that business should deal in a fair, honest and just manner.

Assets should not be usurped and should be earned in a lawful way where the economic

benets go to its owners. Therefore, any nancial transaction should be determined to the

balancedsheets andthus anyunlawful possessions of assets are prohibited. Acquiringwealth

in unlawful means will only lead to widespread inequalities and social waste. Islamic law

564 A.M. Abu-Tapanjeh / Critical Perspectives on Accounting 20 (2009) 556567

has very clear view on the basic principles as to how nancial reporting and accounting

practice should be undertaken in terms of objectives based on the spirit of Islam and its

teaching (Lewis, 2001a, 2001b).

Allah knows everything and whoever hides, has his own account on the day of judgment.

This shows that justice and balance has profound implication for the conduct of Islamic

business, and thus provide general approval and guidelines for lawful records of any business

transaction in a very well organized system.

From the above discussions, Islamic business policies and relevant business and com-

mercial affairs should conduct in a fair, just and honest manner. Khalifa (2003) states that

the distinctive characteristics of Islamic economics are that it is godly, ethical, humanly

and moderate and balanced. Islamic business since historical time requires an honest fulll-

ment. The institution of Hisba offers a framework of social ethics, relevant to monitor the

corporation, with the objective to obligate the correct ethical behavior in the wider social

context and empower individual Muslims to act as private prosecutors in the cause of better

governance by giving them a platform for social action (Lewis, 2006). Islamic moral ethics

also consider that those whoever cheats is not one of them and cheating is considered as a

moral problem, which needs greater internal fortitude to overcome it, while conventional

economy believes in deency of external law enforcement or of bad corporate governance.

Therefore, it clearly claries that accountability and responsibility are trusted to God, the

ultimate authority. In Islam, dealing with corporate governance is not only just the desig-

nation or his position and power but also his internal moral enthusiasm to fulll and carry

out the conduct of the job within the bounty of Islamic Shariah. It can be also seen that the

responsibility are not entitled to those only who encompass the business power but also to

all those stakeholders who are involved and related with the organization. Corporate gover-

nance in OECD entitled the power of decision making and participation of deeper internal

business dealings to those limited persons holding higher designation as BOD and senior

management authorities whereas, in Islam, those whoever related stakeholders of the orga-

nization are given full rights and responsibility to participate and conveys their thoughts and

ideas in reforming better corporate governance. And above all Islam was made accountable

not only to stakeholders, but also to God, the ultimate owner and authority. These powerful

moral ethics help in promoting fair, just and honest business dealing.

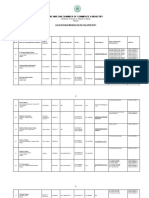

5. Comparison of Islamic Corporate Governance Principles with OECD

principles

An attempt is made to bring a comparative position of Islamic principles of corporate

governance with the revised principles of OECD.

Principle number OECD principles and annotation Islamic principles

1

Insuring the basis for an effective corporate governance framework

Promotion of transparent and

efcient markets with rule of law

and division of responsibilities

Promotion of business within ethical

framework of Shariah

Believes in prot and loss

Primacy of Justice and social welfare with

social and spiritual obligations

Prohibition of interest

A.M. Abu-Tapanjeh / Critical Perspectives on Accounting 20 (2009) 556567 565

Principle number OECD principles and annotation Islamic principles

2

The rights of shareholders and key ownership functions

Basic shareholder rights Property as trust from God

Participation in Decision-making at

the general meetings

Sole Authority is God

Structures and arrangements markets

for corporate control

Society as stakeholders

Ownership rights by all shareholders

including institutional shareholders

Accountability not only to stakeholders but

also to God, the ultimate owner

Consultative process between

shareholders and institutional

shareholders

3

The equitable treatment of shareholders

Protection to minority and foreign

shareholders

Just and fairness of value

Equitable distribution of wealth to all

stakeholders and disadvantages members

in the form of Zakat and Sadqa

Social and individual welfare with both

spiritual and moral obligation

Sensation of Equality

4

The role of stakeholders in corporate governance

In creating wealth, jobs and

sustainability of nancially sound

enterprises

Islamic accountability to Falah and social

welfare orientation

Haram/Halal dichotomy in transaction

Social & individual welfare from both

spiritual and material

Consideration to whole community.

5

Disclosure and transparency

Matters regarding corporation Accountability with Shariah compliance

Financial situation Socio-economic objectives related to

rms control and accountability to all its

stakeholders

Performance, ownership and

governance

Justice, equality, truthfulness transparency

Wider accountability with written as well

as oral disclosure

6

The responsibilities of the board

Strategic guidance Accountability not only to company or

board or stakeholders but also to Allah the

ultimate authority who leads to welfare

and success

Monitoring of management Holistic and integrative guidance

Accountability to company and

stakeholders

Negotiation and co-operation

Consultation and consensus seeking for

each decision with related stakeholders

566 A.M. Abu-Tapanjeh / Critical Perspectives on Accounting 20 (2009) 556567

6. Conclusion

This study has aimed to analyze the possible need of corporate governance from Islamic

perspective with the world notable principles reviewed by OECD. It discusses above the

current state of corporate governance practices at the conventional economy and established

the measurement of good corporate governance at the functional level, compared from

Islamic perspectives. Like any other civilization and religion, Islamic culture also embedded

a good corporate governance since the early days of Islamization. Islamic society had its own

different views and values compared with the outer non-Islamic world. The strong belief of

accountability in this world and thereafter had strong implication in every Muslim life and

governs a wider scope and extended obligations of corporate governance with that compared

to conventional principles. Hence success and welfare is measured with moral and ethical

spiritual obligations with a strong trust in accountability with Allah, the ultimate authority.

Therefore, the recommended set of principles of OECD had long been existing since the

early stage of Islamic civilization. But, with the globalization tendency and in ltering with

the cultural, religious and social, business and political factors, lead to misplace the true

ethos of Islamic civilization. Hence, in this present situation, the OECDprinciples have been

successfully implemented and considered a very effective tool of corporate governance as

compared to Islamic principles of corporate governance.

References

AAOIFI. Accounting, auditing and governance standards for islamic nancial institutions. 4th edition Bahrain:

Accounting and Auditing Organization for Islamic Financial Institutions; 2003.

Abdul Rahman AR. Issues in corporate accountability and governance: an Islamic perspective. American Journal

of Islamic Social Sciences 1998;15(1).

Abu-Tapanjeh. Good corporate governance mechanism and rms operating and nancial performance: insight

from the perspective of jordanian industrial companies. Journal of King Saud University (Administrative

Science) 2006;19(2):10121.

Ahmad E. Islamand politics. In: HaddamT, Haines B, Findley E, editors. The Islamic impact. NewYork: Syracuse

University Press; 1984.

Ahmad K. Islamic nance and banking: the challenge and prospects. Review of Islamic Economic 2000;9:5782.

Ali AJ. Islamic perspectives on management and organization. Cheltenham: Edwar Elgar; 2005. p. 52.

Asyraf WD. Stakeholders expectation toward corporate social responsibility of Islamic Banks. In: IIUM Interna-

tional Accounting Conference (INTAC) III; 2006.

Baydoun N, Mamman A, Mahmaud A. The religious context of management practices: the case of the Islamic

religion, accounting, commerce & nance. The Islamic Perspective Journal 1999;3(1/2):5279.

Chapra UM. Islam and the economic challenge. Leicester (UK): The Islamic Foundation; 1992.

Coles JW, Mcwilliams VB, Sen N. An examination of the relationship of governance mechanisms to performance.

Journal of Management 2001;29(1):2350.

Dalton DR, Daily CM, Certo SJ, Roengpitya R. Meta-analysis of nancial performance and equity: fusion or

confusion. Academy of Management Journal 2003;46(1):26990.

Daniel B. Experiences withthe OECDcorporate governance principles. In: Middle East andNorthAfrica Corporate

Governance Workshop; 2003.

Darman MG. Corporate governance worldwide. International Chamber Of Commerce; 2005.

Durnev A, Han KE. The interplay of rm-specic factors and legal regimes in corporate governance and rm

valuation. In: Paper Presented at Dartmouths Center for Corporate Governance Conference: Contemporate

Governance; 2002. p. 123.

A.M. Abu-Tapanjeh / Critical Perspectives on Accounting 20 (2009) 556567 567

Dyck IJA. Ownership structure, legal protections and corporate governance; 2000. p. 7.

Fianna J, Grant K. The revised OECD principles of corporate governance and their relevance to non-OECD

countries, vol. 13. Blackwell Publishing Ltd; 2005. p. 2.

Hakim Sam R. Islamic banking, challenges and corporate governance, LARIBA; 2002.

Haqqi ARA. The philosophy of Islamic law of transactions. Kuala Lumpur: Univision Press; 1999.

Khalifa AS. The multidimensional nature and purpose of business in Islam, accounting, commerce & nance. The

Islamic Perspective Journal 2003;7(1/2):125.

KuranT. Islamic economic andthe Islamic sub-economy. The Journal of Economic Perspectives 1995;9(4):15573.

Lewis MK. Islam and accounting. Accounting Forum 2001a;25(2):10327.

Lewis MK. Islam and accounting. Accounting Forum 2001b;9(1):529.

Lewis MK. Islamic corporate governance. Review of Islamic Economics 2005;9(1):529.

Lewis MK. Accountability and Islam. In: Presented at Fourth International Conference on Accounting and Finance

in Transition; 2006. p. 8.

Meyer ND. The internal economy. Ridge Field: CT Ndma Publishing; 2004.

Mirakhor A. General characteristics of an Islamic economic system. In: Siddiqi A, editor. Anthology of Islamic

banking. London: Institute of Islamic Banking and Insurance; 2000. p. 1131.

Morck R. A history of corporate governance around the world. The University of Chicago Press; 2005.

Nasr SH. Islamic work ethics. Hamdard Islamicus 1984;7(4):2535.

OECD. OECD Principles of Corporate Governance (www.oecd.org/daf/governance/principles/html); 2004. p. 2.

OECD. OECD Principles of Corporate Governance; 2004.

Saeed A. Islamic banking and interest: a study of the prohibition of Riba and its contemporary interpretation. In:

Studies law and society. Leiden: E.J. Brill; 1996.

SECP. Manual of corporate governance. Securities and Exchange Commission of Pakistan; 2005.

Shaikh MA. Ethics of decision making in Islamic and western environments. American Journal of Islamic Social

Sciences 1988;5(1):11528.

Sourial MS. Corporate governance in the Middle East and North Africa: an overview. In: Mimeo. Cairo: Ministry

of Foreign Trade; 2004.

Stork M. Guide to the Quran. Singapore: Times Book International; 1999.

Van Den Berghe. Beyond corporate governance. European Business Forum, 5. Spring; 2001.

Warde I. Islamic nance in the global economy. Edinburgh: Edinburgh University Press; 2000.

Wikipedia. The true encyclopedia. http:/www.en.wikipedia.org/wiki/syariah; 2005.

Wolfensohn. Financial Times, 21 June (1999). Cited by the Encyclopedias of Corporate Governance in the Article

on What is Corporate Governance. (www.encycogov.com); 11 July 2001. p. 1.

Zingales L. Corporate governance. The new Palgrave dictionary of economic and the law; 1997. p. 1.

Anda mungkin juga menyukai

- Corporate Governance From The Islamic Perspective: A Comparative Analysis With OECD PrinciplesDokumen25 halamanCorporate Governance From The Islamic Perspective: A Comparative Analysis With OECD PrinciplesYusar SagaraBelum ada peringkat

- Corporate Governance Practices and Performance of Financial Institutions: From Islamic Critical Theory ViewDokumen10 halamanCorporate Governance Practices and Performance of Financial Institutions: From Islamic Critical Theory ViewaijbmBelum ada peringkat

- An Overview of Corporate Governance Some EssentialDokumen7 halamanAn Overview of Corporate Governance Some EssentialNaufal Surya MahardikaBelum ada peringkat

- A Review of Corporate Governance in Africa: Literature, Issues and ChallengesDokumen35 halamanA Review of Corporate Governance in Africa: Literature, Issues and Challengestinashe chavundukatBelum ada peringkat

- MSC Administrative Science 5017 2nd Research Assignment Aut-22Dokumen22 halamanMSC Administrative Science 5017 2nd Research Assignment Aut-22hafeezBelum ada peringkat

- Jurnal 8Dokumen10 halamanJurnal 8Anjar FadhliaBelum ada peringkat

- A Literature Review of Corporate GovernanceDokumen6 halamanA Literature Review of Corporate GovernanceDewi Asri Rosalina0% (1)

- Role of Audit in Corporate GovernanceDokumen22 halamanRole of Audit in Corporate GovernancelikepopularBelum ada peringkat

- Corporate Governance and Leadership:Is There A Nexus?: Nwosu M. Eze, Eze-Nwosu P. ChiamakaDokumen8 halamanCorporate Governance and Leadership:Is There A Nexus?: Nwosu M. Eze, Eze-Nwosu P. Chiamakamanishaamba7547Belum ada peringkat

- Jurnal InternasionalDokumen7 halamanJurnal InternasionalDyn JambiBelum ada peringkat

- Corporate Governance and Firms' Financial Performance: Cite This PaperDokumen12 halamanCorporate Governance and Firms' Financial Performance: Cite This PaperRahmat KaswarBelum ada peringkat

- Najeeb Haider, Nabila Khan, Nadeem IqbalDokumen7 halamanNajeeb Haider, Nabila Khan, Nadeem IqbaldecentyBelum ada peringkat

- Corporate Governance in InsuranceDokumen95 halamanCorporate Governance in Insurancemohyeb50% (4)

- Carine FYP From GoogleDokumen42 halamanCarine FYP From GoogleCarine TeeBelum ada peringkat

- CGP in NGODokumen5 halamanCGP in NGOHashir bariBelum ada peringkat

- Morality of Corporate GovernanceDokumen19 halamanMorality of Corporate GovernanceSimbahang Lingkod Ng Bayan100% (1)

- Corporate Governance and SustainabilityDokumen8 halamanCorporate Governance and SustainabilitysailendrBelum ada peringkat

- Corporate Governance Practices of Listed Companies in India.Dokumen11 halamanCorporate Governance Practices of Listed Companies in India.Om Pratik MishraBelum ada peringkat

- Corporate Governance - Quantity Versus Quality - Middle Eastern PerspectiveDari EverandCorporate Governance - Quantity Versus Quality - Middle Eastern PerspectiveBelum ada peringkat

- (2010 Rev Jan 19 Teehankee) Corporate GovernanceDokumen19 halaman(2010 Rev Jan 19 Teehankee) Corporate GovernanceRaymond Pacaldo100% (2)

- Assist. Ph.D. Student Bocean Claudiu University of Craiova Faculty of Economics and Business Administration Craiova, RomaniaDokumen6 halamanAssist. Ph.D. Student Bocean Claudiu University of Craiova Faculty of Economics and Business Administration Craiova, RomaniaDana MoraruBelum ada peringkat

- IE2001Dokumen8 halamanIE2001eyaacobBelum ada peringkat

- CORPORATE GovernanceDokumen62 halamanCORPORATE Governanceaurorashiva1Belum ada peringkat

- Role of Ethics in Corporate GovernanceDokumen11 halamanRole of Ethics in Corporate GovernancepranjalBelum ada peringkat

- Guven AlpayDokumen20 halamanGuven Alpayfisayobabs11Belum ada peringkat

- Research Online Research OnlineDokumen11 halamanResearch Online Research OnlineMunib HussainBelum ada peringkat

- CGBEDokumen28 halamanCGBEmaddymatBelum ada peringkat

- Businss Ethics Assignment 1Dokumen16 halamanBusinss Ethics Assignment 1woldeamanuelBelum ada peringkat

- Corporate GovernanceDokumen19 halamanCorporate GovernanceShubham Dhimaan100% (1)

- Two Tier CG ModelDokumen10 halamanTwo Tier CG Modelsafdar_tahir6548Belum ada peringkat

- Introduction: An Overview of Telecommunication CompaniesDokumen27 halamanIntroduction: An Overview of Telecommunication CompaniesSri VarshiniBelum ada peringkat

- Chapter #1: INTRODUCTION BackgroundDokumen21 halamanChapter #1: INTRODUCTION Backgroundعباس ناناBelum ada peringkat

- 10 Corporate Social ResponsibilityDokumen15 halaman10 Corporate Social ResponsibilityopislotoBelum ada peringkat

- Corporate Governance and Firm Performance: Assistant PHD Claudiu G. Bocean Lecturer PHD Cătălin M. BarbuDokumen7 halamanCorporate Governance and Firm Performance: Assistant PHD Claudiu G. Bocean Lecturer PHD Cătălin M. Barbuaaditya01Belum ada peringkat

- Determinant Factors For Success of Corporate Governance in An OrganizationDokumen7 halamanDeterminant Factors For Success of Corporate Governance in An OrganizationMuhammadarslan73Belum ada peringkat

- Sample Thesis On Corporate GovernanceDokumen7 halamanSample Thesis On Corporate GovernanceWriteMyMathPaperSingapore100% (2)

- Corporate Governanc1. AbstractDokumen15 halamanCorporate Governanc1. AbstractKamala BalakrishnanBelum ada peringkat

- A Comparison Between Corporate Governance and Corporate Governance in Islamic PerspectiveDokumen10 halamanA Comparison Between Corporate Governance and Corporate Governance in Islamic Perspectiverasyid37Belum ada peringkat

- CG in Islamic FinanceDokumen4 halamanCG in Islamic FinancehanyfotouhBelum ada peringkat

- Corporate Governance Capital Structure and Firm Perfromance Eacse PDFDokumen30 halamanCorporate Governance Capital Structure and Firm Perfromance Eacse PDFCharles AkaraBelum ada peringkat

- Corporate Governance From A Global Perspective: SSRN Electronic Journal April 2011Dokumen18 halamanCorporate Governance From A Global Perspective: SSRN Electronic Journal April 2011Tehsemut AntBelum ada peringkat

- Corporate GovernanceDokumen11 halamanCorporate GovernanceiResearchers OnlineBelum ada peringkat

- Corporate Governance Notes Unit IDokumen19 halamanCorporate Governance Notes Unit IShantanu Chaudhary75% (4)

- Corporate GovernanceDokumen162 halamanCorporate GovernancegauravmarotiBelum ada peringkat

- CORPORATE GOVERNANCE CHDokumen39 halamanCORPORATE GOVERNANCE CHabid hussainBelum ada peringkat

- UNIT 4 Part 1Dokumen3 halamanUNIT 4 Part 1Astik TripathiBelum ada peringkat

- Corporate Governance, AnalysesDokumen15 halamanCorporate Governance, AnalysesPavithra GopalakrishnanBelum ada peringkat

- How The Corporate Governance Affects Organizational Strategy: Lessons From Jordan Environment.Dokumen15 halamanHow The Corporate Governance Affects Organizational Strategy: Lessons From Jordan Environment.IOSRjournalBelum ada peringkat

- Corporate Governance - Practices and Challenges in AfricaDokumen9 halamanCorporate Governance - Practices and Challenges in AfricaLionel Itai MuzondoBelum ada peringkat

- Abbreviations: Chief Executive OfficerDokumen22 halamanAbbreviations: Chief Executive Officerعباس ناناBelum ada peringkat

- Proposed Research Work For Major Research Project On: "A Study On Indian Corporate Governance Practices"Dokumen11 halamanProposed Research Work For Major Research Project On: "A Study On Indian Corporate Governance Practices"Yepuru ChaithanyaBelum ada peringkat

- Corporate Governance From A Global PerspectiveDokumen18 halamanCorporate Governance From A Global PerspectiveAsham SharmaBelum ada peringkat

- Theises 2Dokumen66 halamanTheises 2Sadia NBelum ada peringkat

- CG International PerspectiveDokumen6 halamanCG International PerspectiveAayushiBelum ada peringkat

- Bank Research TopicsDokumen13 halamanBank Research TopicsnobleconsultantsBelum ada peringkat

- Corporate Governance NotesDokumen18 halamanCorporate Governance NotesChisala MwemboBelum ada peringkat

- Corporate Governance and Firm Performance - A Study of Bse 100 CompaniesDokumen11 halamanCorporate Governance and Firm Performance - A Study of Bse 100 CompaniesAbhishek GagnejaBelum ada peringkat

- Integrated Model for Sound Internal Functioning and Sustainable Value Creat: A Solution for Corporate Environments: Post Covid-19 PandemicDari EverandIntegrated Model for Sound Internal Functioning and Sustainable Value Creat: A Solution for Corporate Environments: Post Covid-19 PandemicBelum ada peringkat

- Typical Floor Plan Proposed Apartment Scheme at Ahmedabad: 6.00 Mt. Wide RoadDokumen7 halamanTypical Floor Plan Proposed Apartment Scheme at Ahmedabad: 6.00 Mt. Wide RoadrasheshpatelBelum ada peringkat

- KP Shivranjani All Floor Plans 1Dokumen9 halamanKP Shivranjani All Floor Plans 1rasheshpatelBelum ada peringkat

- Class1 English Unit09 NCERT TextBook EnglishEdition PDFDokumen12 halamanClass1 English Unit09 NCERT TextBook EnglishEdition PDFAnubhav Kumar JainBelum ada peringkat

- Ratna Turquoise A Gas I ADokumen2 halamanRatna Turquoise A Gas I ArasheshpatelBelum ada peringkat

- "Retrenchment in Organizations": A Project ONDokumen19 halaman"Retrenchment in Organizations": A Project ONrasheshpatel50% (2)

- Almanac 2018 19Dokumen212 halamanAlmanac 2018 19rasheshpatelBelum ada peringkat

- Institute Invitation - NDC20Dokumen4 halamanInstitute Invitation - NDC20rasheshpatelBelum ada peringkat

- IELTS Listening Answer SheetDokumen1 halamanIELTS Listening Answer SheetFazle RabbyBelum ada peringkat

- NISM Series V A Mutual Fund Distributors Workbook August 2014 Feb 2015Dokumen246 halamanNISM Series V A Mutual Fund Distributors Workbook August 2014 Feb 2015bhishmaBelum ada peringkat

- Internatinal Conference - TracksDokumen1 halamanInternatinal Conference - TracksrasheshpatelBelum ada peringkat

- Practice Letter A PDFDokumen1 halamanPractice Letter A PDFrasheshpatelBelum ada peringkat

- Biff and Chip PDFDokumen1 halamanBiff and Chip PDFrasheshpatelBelum ada peringkat

- H©Rù - U SLP¡ DPV¡ LP¡B Kudpap¡ - L) : A¡Da¡ - Ku A XDokumen4 halamanH©Rù - U SLP¡ DPV¡ LP¡B Kudpap¡ - L) : A¡Da¡ - Ku A XrasheshpatelBelum ada peringkat

- Reading All About Letter KDokumen1 halamanReading All About Letter Ktwenty19 lawBelum ada peringkat

- Reading All About Letter LDokumen1 halamanReading All About Letter LrasheshpatelBelum ada peringkat

- New Doc 2018-11-24 17.17.07Dokumen1 halamanNew Doc 2018-11-24 17.17.07rasheshpatelBelum ada peringkat

- New Doc 2018-11-24 17.18.18Dokumen11 halamanNew Doc 2018-11-24 17.18.18rasheshpatelBelum ada peringkat

- BookDokumen3 halamanBookrasheshpatel60% (5)

- Key Words With Peter JaneDokumen1 halamanKey Words With Peter JanerasheshpatelBelum ada peringkat

- Article 19 of Constitution of India and Right To FreedomDokumen3 halamanArticle 19 of Constitution of India and Right To FreedomrasheshpatelBelum ada peringkat

- NISM AMFI (Mutual Fund) Exam ModuleDokumen208 halamanNISM AMFI (Mutual Fund) Exam ModulerasheshpatelBelum ada peringkat

- Key Words With Peter Jane PDFDokumen3 halamanKey Words With Peter Jane PDFrasheshpatel0% (2)

- The Banking Regulation (Co-Operative Societies) Rules, 1966Dokumen4 halamanThe Banking Regulation (Co-Operative Societies) Rules, 1966rasheshpatel100% (2)

- Growing Shopping Malls and Behaviour of Urban ShoppersDokumen20 halamanGrowing Shopping Malls and Behaviour of Urban ShoppersrasheshpatelBelum ada peringkat

- A Structured Equation Modelling Approach PDFDokumen21 halamanA Structured Equation Modelling Approach PDFrasheshpatelBelum ada peringkat

- HWM Rules 2016Dokumen68 halamanHWM Rules 2016Raja Rao KamarsuBelum ada peringkat

- Case Analysis - M.C. Mehta v. Union of IndiaDokumen3 halamanCase Analysis - M.C. Mehta v. Union of IndiarasheshpatelBelum ada peringkat

- Consumer Behavior - The Psychology of MarketingDokumen10 halamanConsumer Behavior - The Psychology of MarketingrasheshpatelBelum ada peringkat

- Center Advisory Counciland Development CouncilsDokumen3 halamanCenter Advisory Counciland Development CouncilsrasheshpatelBelum ada peringkat

- GCSR Hand Book 2014-15Dokumen33 halamanGCSR Hand Book 2014-15ARVIND YADAVBelum ada peringkat

- DuaDokumen9 halamanDuaIrufaBelum ada peringkat

- Class - X X Social Science: Time: 3 Hours Maximum Marks: 80 Total No. of Pages: 15Dokumen15 halamanClass - X X Social Science: Time: 3 Hours Maximum Marks: 80 Total No. of Pages: 15vidyapostBelum ada peringkat

- List of Addl - District and Sessions JudgeDokumen32 halamanList of Addl - District and Sessions JudgeCourt Sdk0% (1)

- Dua Before Starting HomeworkDokumen9 halamanDua Before Starting Homeworkafeuhwbpa100% (1)

- Moroccan Female Religious AgentsDokumen179 halamanMoroccan Female Religious AgentsCmcf TiceBelum ada peringkat

- Mattimoosa - Obituary 2Dokumen1 halamanMattimoosa - Obituary 2HansH.MoosaBelum ada peringkat

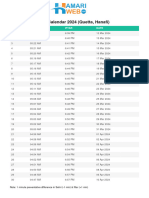

- Quetta Ramadan Calendar 2024 HamariwebDokumen1 halamanQuetta Ramadan Calendar 2024 HamariweblangoverehmatullahBelum ada peringkat

- PAK 301 VU Lecture 1Dokumen5 halamanPAK 301 VU Lecture 1Muhamamd Khan MuneerBelum ada peringkat

- ANATAPURDokumen67 halamanANATAPURVenkataraman Balayogi100% (1)

- Tawassur ContemplationDokumen16 halamanTawassur ContemplationHilario NobreBelum ada peringkat

- Shariah - The Threat To America (Team B Report)Dokumen372 halamanShariah - The Threat To America (Team B Report)jack007xrayBelum ada peringkat

- NEC Merit List 2019Dokumen20 halamanNEC Merit List 2019Usama Bin Iqbal100% (3)

- Explanation of Hadeeth 12 in Forty Hadeeth of An NawaweeDokumen7 halamanExplanation of Hadeeth 12 in Forty Hadeeth of An NawaweeHassan Basarally50% (2)

- Viva SlidesDokumen18 halamanViva Slidesauni hazirahBelum ada peringkat

- Daily List For Monday, 20 April, 2020 Mr. Justice Waqar Ahmad Seth, Chief Justice Court No: 1Dokumen90 halamanDaily List For Monday, 20 April, 2020 Mr. Justice Waqar Ahmad Seth, Chief Justice Court No: 1Kublai KhanBelum ada peringkat

- Monthly Ubqari Magazine September English2015Dokumen117 halamanMonthly Ubqari Magazine September English2015amirmushtaq260% (1)

- Political Era of Benazir Bhutto 1988-1990 & 1993-1996: Miss Sania SajjadDokumen13 halamanPolitical Era of Benazir Bhutto 1988-1990 & 1993-1996: Miss Sania SajjadZayn AliBelum ada peringkat

- Nibiru Anunnaki 2018Dokumen421 halamanNibiru Anunnaki 2018BlueCloud, The Real100% (8)

- 7 NafiDokumen20 halaman7 NafiAbdellatif El BekkariBelum ada peringkat

- Topic 01 - Concept of Q NewDokumen38 halamanTopic 01 - Concept of Q NewAqilah RuslanBelum ada peringkat

- WUS Mayang 2019 FINALDokumen767 halamanWUS Mayang 2019 FINALAskana SakhiBelum ada peringkat

- Thousands Mark Somali Youth DayDokumen4 halamanThousands Mark Somali Youth DayUNSOM (The United Nations Assistance Mission in Somalia)Belum ada peringkat

- Associate CalassDokumen151 halamanAssociate CalassMuhammad Naveed AnjumBelum ada peringkat

- Suhrawardi: First Published Wed Dec 26, 2007 Substantive Revision Wed Apr 4, 2012Dokumen23 halamanSuhrawardi: First Published Wed Dec 26, 2007 Substantive Revision Wed Apr 4, 2012bruno4vilela4da4silv100% (2)

- A Glimpse of The Deviated SectsDokumen0 halamanA Glimpse of The Deviated SectsJamal DookhyBelum ada peringkat

- Islamic History TimelineDokumen1 halamanIslamic History TimelineNoshki NewBelum ada peringkat

- Daftar Siswa SD NEGERI RAGATUNJUNG 03 KELAS 1, 2 Dan 5Dokumen6 halamanDaftar Siswa SD NEGERI RAGATUNJUNG 03 KELAS 1, 2 Dan 5Atha FairuzBelum ada peringkat

- Jadwal Imam Rawatib Masjid Al-WaqarDokumen1 halamanJadwal Imam Rawatib Masjid Al-WaqarFahmi Arief HidayatBelum ada peringkat

- The Life and Times O Shaikh Ahmad Sirhindi: ©ottor of (JiloisopfipDokumen375 halamanThe Life and Times O Shaikh Ahmad Sirhindi: ©ottor of (JiloisopfipAli Asghar ShahBelum ada peringkat

- The Virtue of Fasting of Ramadan and Standing in Its Night PrayerDokumen3 halamanThe Virtue of Fasting of Ramadan and Standing in Its Night PrayerDede RahmatBelum ada peringkat