Chris Haig 2011 Award Top 100 Usa

Diunggah oleh

api-267124068Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Chris Haig 2011 Award Top 100 Usa

Diunggah oleh

api-267124068Hak Cipta:

Format Tersedia

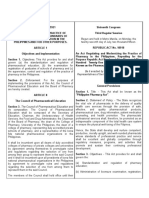

Most Loans Closed

Top Originators List - maximum of 50 people / per full page

Online rankings: scotsmanguide.com/Top2011

2010

Closing Closed

Ratio Loans

Broker/

Banker

Apps.

Taken

Staff

Yrs.

in

Biz

896

Both

95%

10

95%

827

Both

75%

14

99%

590

Both

100%

12

677

Both

100%

14

Both

90%

10

Banker

100%

13

Yinan Nancy Sun

Both

95%

10

Austin First Mortgage

403

Banker

100%

15

99%

513

Banker

100%

15

82%

500

Both

100%

19

19

State

Closed

Loans

Purchases

Vs. Refis

Volume

TX

680

21%/79%

$142,066,029

NOVA Home Loans

AZ

664

52%/48%

$137,735,768

WeFit2U Inc.

CA

653

75%/25%

$253,709,948

4 Kevin Lyons

Anchor Funding Inc.

CA

651

5%/95%

$210,983,919

92%

5 Shimmy Braun

Guaranteed Rate

IL

643

26%/74%

$196,659,161

90%

722

6 Harinder Johar

Guaranteed Rate

IL

637

11%/89%

$203,987,953

90%

592

7 Joe Caltabiano

Guaranteed Rate

IL

521

39%/61%

$183,378,309

100%

447

8 Brian Minkow

Prospect Mortgage

CA

507

57%/43%

$187,628,451

70%

Capital Bank

MD

495

26%/74%

$199,666,343

Mortgage Master Inc.

MA

480

15%/85%

$181,089,652

# Name

Company

1 Yinan Nancy Sun

Austin First Mortgage

2 Paul Volpe

3 Christopher Vincent Hussain

9 Brad Cohen

10 Tom Digan

82%

10 Dave Gibbs

Mortgage Master Inc.

MA

480

15%/85%

$147,467,865

74%

477

Both

100%

12 Gerald McCarthy

Mortgage Master Inc.

MA

478

10%/90%

$168,783,797

77%

413

Both

100%

15

13 Shawn Huss

First Place Bank

OH

467

47%/53%

$89,023,043

85%

431

Banker

100%

19

14 Brian Blonder

EagleBank

MD

466

7%/93%

$171,566,418

90%

353

Banker

100%

12

11

15 Kevin Zhu

MLD Mortgage Inc.

NJ

464

12%/88%

$150,040,590

95%

522

Banker

100%

16 Brian Scott Cohen

Wells Fargo Home Mortgage

NY

460

54%/46%

$194,520,504

75%

409

Banker

100%

17 Michael Meena

Augusta Financial Inc.

CA

443

55%/45%

$143,047,252

97%

423

Both

100%

21

18 John Vlogianitis

Wells Fargo Home Mortgage

NY

441

46%/54%

$187,168,000

70%

463

Banker

100%

11

19 Eric Almquist

First National Bank

NE

438

34%/66%

$83,072,170

87%

490

Banker

80%

15

20 John Rodgers

Prime Mortgage Lending

NC

434

43%/57%

$94,540,588

40%

351

Banker

50%

13

21 Brad Sarvak

Emery Financial

CA

433

14%/86%

$182,967,683

94%

428

Broker

50%

31

22 Alison Freed

Mortgage Master Inc.

MA

425

8%/92%

$145,922,305

76%

350

Both

100%

27

22 Chris Haig

Wells Fargo Home Mortgage

CA

425

2%/98%

$87,909,000

85%

361

Banker

100%

10

24 Suren Sampat

1st Advantage Mortgage, a Draper and Kramer Company

IL

424

11%/89%

$113,034,372

98%

876

Both

100%

21

25 Norman Calvo

Universal Mortgage Inc.

NY

420

60%/40%

$186,491,045

95%

382

Broker

50%

29

26 Jacob Deegan

Flagship Financial Group

UT

413

1%/99%

$76,792,977

75%

343

Broker

25%

11

27 David Jaffe

On Q Financial

CA

412

33%/67%

$154,169,282

90%

493

Both

70%

21

28 Michael Mundy

Pinnacle Mortgage Inc.

NJ

410

56%/44%

$142,766,009

93%

405

Both

100%

11

29 Tim Roach

Trident Mortgage Co.

PA

408

49%/51%

$150,622,880

95%

485

Banker

100%

17

30 Mark Lewin

MetLife Home Loans

IN

397

56%/44%

$57,872,938

90%

362

Banker

100%

15

31 Diane T. Clark

PrimeLending

TX

385

84%/16%

$116,204,382

95%

316

Banker

99%

28

32 Shelly Logemann

Emery Financial

CA

381

19%/81%

$205,856,857

94%

406

Broker

65%

11

33 Kathy Shaw

First Place Bank

OH

375

26%/74%

$103,784,426

85%

421

Banker

100%

19

34 Al Hensling

United American Mortgage Corp.

CA

372

32%/68%

$177,391,888

90%

365

Both

5%

29

35 Michael Shane

Sammamish Mortgage

WA

367

17%/83%

$107,199,318

92%

480

Broker

100%

10

36 Courtney Walker

NOVA Home Loans

AZ

366

52%/48%

$62,154,570

90%

362

Both

65%

12

37 Jerry Sundt

VIP Mortgage

AZ

365

56%/44%

$71,480,513

65%

410

Both

95%

10

38 Steven Siwinski

Guaranteed Rate

IL

362

25%/75%

$77,795,514

70%

358

Both

100%

10

39 John Willis

Mortgage Master Inc.

MA

359

14%/86%

$116,751,515

78%

435

Both

100%

16

39 Kelly Malatesta

Affiliated Mortgage Co.

TX

359

28%/72%

$87,422,175

82%

421

Banker

100%

20

41 Franco Tamburrino

Coast 2 Coast Funding Group Inc.

CA

357

57%/43%

$92,845,200

81%

347

Both

33%

13

42 Louise Thaxton

Fairway Independent Mortgage Corp.

LA

356

74%/26%

$64,453,474

90%

312

Banker

50%

14

43 Jason Griesser

Trident Mortgage Co.

PA

354

67%/33%

$94,519,531

95%

394

Banker

100%

44 Craig Miller

FirsTrust Mortgage Inc.

MO

352

16%/84%

$63,252,938

80%

643

Banker

100%

11

45 Joe Smith

Guaranteed Rate

MA

348

22%/78%

$121,511,948

82%

466

Both

78%

19

46 Gregg Harris

LenderCity

MO

337

4%/96%

$77,577,450

90%

366

Broker

100%

15

46 John Abraham

Associated Bank

IL

337

50%/50%

$74,958,054

90%

43

Banker

100%

22

48 Max Leaman

PrimeLending

TX

335

80%/20%

$68,041,841

92%

257

Banker

98%

10

49 Kelly Novotny

Union Bank & Trust Co.

NE

332

26%/74%

$57,180,442

95%

455

Banker

100%

16

50 Allyson Kreycik

Guaranteed Rate

IL

328

43%/57%

$118,425,395

90%

410

Both

98%

50 Billy Winfree

Pinnacle National Bank

TN

328

53%/47%

$77,861,527

75%

331

Banker

100%

11

52 Ricardo Brasil

Guaranteed Rate

IL

327

20%/80%

$110,347,392

95%

354

Both

75%

10

53 Christopher Hutchens

Alpha Mortgage Corp.

NC

325

71%/29%

$69,776,785

86%

404

Banker

100%

17

54 Anthony Musante

Bank of America Home Loans

CA

322

25%/75%

$170,197,990

80%

315

Banker

70%

22

55 Christopher Cox

Acacia Federal Savings Bank

DC

321

74%/26%

$112,617,421

97%

366

Banker

100%

22

55 John Kalin

Mortgage Master Inc.

MA

321

12%/88%

$98,447,973

81%

287

Both

100%

18

57 Valerie Gothard

Gateway Mortgage Group

TX

320

43%/57%

$27,584,825

85%

301

Banker

70%

15

58 Jon Tobias

NOVA Home Loans

AZ

319

94%/6%

$50,231,809

99%

307

Both

40%

59 Joshua Sigman

Legacy Mutual Mortgage

TX

316

73%/27%

$66,245,561

99%

250

Banker

100%

59 Jim Bane

Starkey Mortgage

TX

316

66%/34%

$64,164,962

99%

439

Banker

50%

20

61 Deborah ORourke

Mortgage Master Inc.

MA

310

14%/86%

$93,203,614

77%

419

Both

100%

20

61 Sean Logue

Trident Mortgage Co.

PA

310

70%/30%

$89,149,729

95%

335

Banker

100%

63 Jim Rademann

R&R Mortgage

CA

308

46%/54%

$111,300,000

91%

302

Broker

100%

20

64 Linda Mister

SWBC Mortgage

TX

302

94%/6%

$46,764,378

99%

424

Banker

90%

30

65 Patrick Johns

Flagship Financial Group

UT

301

0%/100%

$58,788,432

60%

24

Broker

100%

66 Klaus Jensen

Mortgage Master Inc.

MA

300

16%/84%

$108,147,626

78%

328

Both

100%

67 Becky Sandiland

First National Bank of Omaha

NE

297

27%/73%

$44,266,544

83%

302

Both

100%

12

68 Don Stolan

Jayco Capital Mortgage

CA

296

22%/78%

$86,157,083

66%

104

Both

99%

10

68 Joseph Bigelman

John Adams Mortgage

MI

296

87%/12%

$49,652,160

90%

287

Both

85%

13

70 Matt Andre

FBC Mortgage LLC

FL

294

90%/10%

$46,493,350

95%

271

Banker

50%

71 Steve Grossman

NJ Lenders Corp.

NJ

293

45%/55%

$142,512,573

83%

334

Broker

65%

20

71 Debbie Foley

Fearon Financial LLC

OH

293

23%/77%

$78,777,774

71%

344

Banker

100%

73 Barry Schwartz

Perl Mortgage Inc.

IL

292

17%/83%

$100,511,557

81%

281

Banker

100%

13

74 Chris Nooney

PrimeLending

TX

291

88%/12%

$61,158,827

87%

326

Banker

80%

75 Heather Bomar

Cornerstone Home Lending

OK

289

67%/33%

$61,535,425

84%

268

Banker

100%

26

Scotsman Guide Residential Edition | scotsmanguide.com | April 2012

2011 Most

Loans Closed

Volume Rank: #26 | Refinance-Volume Rank: #16

Honesty is at the heart of Yinan Nancy Suns business

and, despite a tough market, business is as good as it

is prolific. With 680 loans closed in 2011, Sun is making her third straight appearance in the top five of

Scotsman Guides Most Loans Closed list.

Im very honest with people, Sun says. Whatever

I promise, I will honor. I wont charge [clients] anything more, so there are people coming back to me.

And thats certainly important for the Austin, Texasbased mortgage broker repeat and referral business plays a large part in Suns originations. Although

she closed more than $27 million in purchase volume,

she also closed nearly $115 million in refinances,

about 81 percent of her total volume. With that much

in refis, its inevitable to see some familiar faces.

I make [past clients] a priority, she says. If theyre

coming back to me for refinances, I take care of them

first. They already did one loan with me, so I think Im

obligated to help them out.

Still, when it comes to balancing purchase loans with

refis, Sun says that she likes to go with the flow of

the market. And this year, the makeup of that market

may be changing. In the first few months of the year,

Sun has been encountering more purchases.

Regardless of her markets composition, however,

closing a high number of loans always will be critical

to Suns business. With the volume I do, I get better

rates from the bank, she says. I dont need to do a

lot of money for each loan, so I can give customers a

very good price. (RF)

2011 Top

Purchase

Ratio

FHA-Volume Rank: #6 | Percent Purchase Loans: 100%

Jeffrey Blackey

First Mortgage Corp.

In a year when refinances seemed to rule the roost,

100 percent of Jeffrey Blackeys 2011 volume was

from purchase loans. I didnt do one refi last year,

he says.

Closing 151 purchase loans wasnt a fluke, either. A

mortgage banker based in California with First Mortgage Corp., Blackeys primary focus has been working

with builders for the past 15 years. Ive been able to

cultivate and maintain builder business throughout

the state of California, he says. The key to that is

good communication, on-time closings and having

good, niche products that help builders sell houses.

One of the main products he uses is Federal Housing

Administration (FHA) loans. The company I work for

is a traditional mortgage banker that is probably one

of the few that follows FHA guidelines with very few

overlays, Blackey says. Some of the products Im

able to offer are very unique, which helps us maintain the business we have, as well as develop new

business. Those products enabled Blackey to close

more than $29 million in FHA volume this past year,

earning him the No. 6 spot on the 2011 Top FHA Volume list.

Blackey closed more than $45 million in overall volume this past year. Still, every loan is a challenge

in todays market, he says. That volume couldnt

be achieved without the support of the talented

processors and underwriters with whom he works,

Blackey says, and this year is shaping up to be even

better than 2011. 2012 has actually started out with

a bang, and our projections indicate that our volume

will be increasing again, he says. (JEG)

Anda mungkin juga menyukai

- All You Need to Know About Payday LoansDari EverandAll You Need to Know About Payday LoansPenilaian: 5 dari 5 bintang5/5 (1)

- Local Market Trends: The Real Estate ReportDokumen4 halamanLocal Market Trends: The Real Estate Reportsusan5458Belum ada peringkat

- Repair and Boost Your Credit Score in 30 Days: How Anyone Can Fix, Repair, and Boost Their Credit Ratings in Less Than 30 DaysDari EverandRepair and Boost Your Credit Score in 30 Days: How Anyone Can Fix, Repair, and Boost Their Credit Ratings in Less Than 30 DaysBelum ada peringkat

- The Pensford Letter - 3.26.12Dokumen4 halamanThe Pensford Letter - 3.26.12Pensford FinancialBelum ada peringkat

- The Everything Improve Your Credit Book: Boost Your Score, Lower Your Interest Rates, and Save MoneyDari EverandThe Everything Improve Your Credit Book: Boost Your Score, Lower Your Interest Rates, and Save MoneyBelum ada peringkat

- Top 200 Mortgage Loan OriginatorsDokumen6 halamanTop 200 Mortgage Loan OriginatorsNikitas Kouimanis100% (1)

- The Credit Score Blueprint: Strategies and Secrets to Raising Your Credit Score: Strategies and Secrets to Raising Your Credit ScoreDari EverandThe Credit Score Blueprint: Strategies and Secrets to Raising Your Credit Score: Strategies and Secrets to Raising Your Credit ScoreBelum ada peringkat

- Local Market Trends: The Real Estate ReportDokumen4 halamanLocal Market Trends: The Real Estate ReportSusan StrouseBelum ada peringkat

- The Best Credit Repair Manual Ever WrittenDari EverandThe Best Credit Repair Manual Ever WrittenPenilaian: 5 dari 5 bintang5/5 (30)

- SLIDES: Chelsea Groton Bank and Chelsea Groton Foundation Annual Meeting (4/17/14)Dokumen52 halamanSLIDES: Chelsea Groton Bank and Chelsea Groton Foundation Annual Meeting (4/17/14)The BulletinBelum ada peringkat

- The Debt-Free Millionaire: Winning Strategies to Creating Great Credit and Retiring RichDari EverandThe Debt-Free Millionaire: Winning Strategies to Creating Great Credit and Retiring RichBelum ada peringkat

- Central Banker - Winter 2013Dokumen12 halamanCentral Banker - Winter 2013Federal Reserve Bank of St. LouisBelum ada peringkat

- How to Increase or Build Your Credit Score in One Month: Add Over 100 Points Without The Need of Credit Repair ServicesDari EverandHow to Increase or Build Your Credit Score in One Month: Add Over 100 Points Without The Need of Credit Repair ServicesPenilaian: 3 dari 5 bintang3/5 (1)

- Elmgrove Street FinancingDokumen1 halamanElmgrove Street FinancingLandGuyBelum ada peringkat

- Credit and CollectionDokumen17 halamanCredit and CollectionDia Cessianne VillarolaBelum ada peringkat

- Finally A Home Improvement Special: The Middlefield Banking CompanyDokumen1 halamanFinally A Home Improvement Special: The Middlefield Banking CompanyatewarigrBelum ada peringkat

- How to Reverse World Recession in Matter of Days: Win 10 Million Dollar to Prove It WrongDari EverandHow to Reverse World Recession in Matter of Days: Win 10 Million Dollar to Prove It WrongBelum ada peringkat

- The Credit Squeeze Is Intensifying On Main StreetDokumen4 halamanThe Credit Squeeze Is Intensifying On Main StreetValuEngine.comBelum ada peringkat

- The Pensford Letter - 11.19.12Dokumen4 halamanThe Pensford Letter - 11.19.12Pensford FinancialBelum ada peringkat

- Jones Electrical Faces Cash Shortfall Despite ProfitsDokumen5 halamanJones Electrical Faces Cash Shortfall Despite ProfitsAsif AliBelum ada peringkat

- Fincance ProjectDokumen3 halamanFincance Projectapi-302073423Belum ada peringkat

- San Mateo County Market Update - Septemebr 2011Dokumen4 halamanSan Mateo County Market Update - Septemebr 2011Gwen WangBelum ada peringkat

- Credit Card Webquest: Click On " Manage Your Money" Then "Understand Credit"Dokumen2 halamanCredit Card Webquest: Click On " Manage Your Money" Then "Understand Credit"api-300351917Belum ada peringkat

- Down Payments: Tighter Lending StandardsDokumen10 halamanDown Payments: Tighter Lending StandardsraqibappBelum ada peringkat

- Topic of Survey SWOT On Plastic MoneyDokumen9 halamanTopic of Survey SWOT On Plastic MoneyAshu SinghBelum ada peringkat

- Guide To Understanding Credit GuideDokumen11 halamanGuide To Understanding Credit GuideRobert Glen Murrell JrBelum ada peringkat

- Connections, September 2011 NewsletterDokumen2 halamanConnections, September 2011 NewsletterAlliant Credit UnionBelum ada peringkat

- Wakefield Reutlinger Realtors Newsletter 3rd Quarter 2013Dokumen4 halamanWakefield Reutlinger Realtors Newsletter 3rd Quarter 2013Wakefield Reutlinger RealtorsBelum ada peringkat

- Lc160808 PresentationDokumen28 halamanLc160808 PresentationCrowdfundInsiderBelum ada peringkat

- UntitledDokumen11 halamanUntitledJust Satisfying ThingsBelum ada peringkat

- CMBS 101 Slides (All Sessions)Dokumen41 halamanCMBS 101 Slides (All Sessions)Ken KimBelum ada peringkat

- Savings Products ToolkitDokumen86 halamanSavings Products ToolkitREAL SolutionsBelum ada peringkat

- Cost of Bad Loan - EditDokumen2 halamanCost of Bad Loan - EditLeslie WorkmanBelum ada peringkat

- MBA Mid-Year Mortgage Servicer RankingsDokumen20 halamanMBA Mid-Year Mortgage Servicer RankingsThe Partnership for a Secure Financial FutureBelum ada peringkat

- Case PresentationDokumen22 halamanCase PresentationMustafa MahmoodBelum ada peringkat

- Mortgage Settlement FundsDokumen3 halamanMortgage Settlement FundsThe Council of State GovernmentsBelum ada peringkat

- Do Small Businesses Get The Credit They Need?: Michaël Dewally, PH.DDokumen4 halamanDo Small Businesses Get The Credit They Need?: Michaël Dewally, PH.DAnonymous Feglbx5Belum ada peringkat

- Connections, June 2011 NewsletterDokumen2 halamanConnections, June 2011 NewsletterAlliant Credit UnionBelum ada peringkat

- Whitehall: Monitoring The Markets Vol. 4 Iss. 21 (June 10, 2014)Dokumen2 halamanWhitehall: Monitoring The Markets Vol. 4 Iss. 21 (June 10, 2014)Whitehall & CompanyBelum ada peringkat

- Budget Basics For Modular Home Buyers - How Much Home Can I Afford?Dokumen3 halamanBudget Basics For Modular Home Buyers - How Much Home Can I Afford?SEAN NBelum ada peringkat

- 14Dokumen3 halaman14api-597185067Belum ada peringkat

- Final Part BDokumen54 halamanFinal Part Bapi-315102376Belum ada peringkat

- Assignment of Personal FinancingDokumen11 halamanAssignment of Personal FinancingRimpy GeraBelum ada peringkat

- 2014 Finance TRENDSDokumen46 halaman2014 Finance TRENDSGreater Baton Rouge Association of REALTORS® Commercial Investment DivisionBelum ada peringkat

- Guerrilla Tactics That Will Give You A Good Credit RatingDokumen10 halamanGuerrilla Tactics That Will Give You A Good Credit Ratinglvn_reviewer55% (11)

- Credit Card Webquest: WWW - Aie.o RGDokumen3 halamanCredit Card Webquest: WWW - Aie.o RGapi-299234513Belum ada peringkat

- No Credit Check Loans - Fetch Easy Funds Without Unnecessary TroubleDokumen3 halamanNo Credit Check Loans - Fetch Easy Funds Without Unnecessary TroubleRobinson52Kristensen100% (1)

- Mid-Term Examination: University of Economics and Law - Vietnam National University - HCMCDokumen7 halamanMid-Term Examination: University of Economics and Law - Vietnam National University - HCMCNgân Võ Trần TuyếtBelum ada peringkat

- $1,000,000 Mortgage Total Cost Analysis Jumbo Report Peter BoyleDokumen2 halaman$1,000,000 Mortgage Total Cost Analysis Jumbo Report Peter BoylePeter BoyleBelum ada peringkat

- Carr Place $525Dokumen1 halamanCarr Place $525LandGuyBelum ada peringkat

- Week 7 Revision Exercise (Quest)Dokumen4 halamanWeek 7 Revision Exercise (Quest)Eleanor ChengBelum ada peringkat

- 2015 - s1 - PF - Web - Week 13 - Borrowing Day 3Dokumen25 halaman2015 - s1 - PF - Web - Week 13 - Borrowing Day 3api-263127781Belum ada peringkat

- BancFirst (BANF) Initiation ReportDokumen5 halamanBancFirst (BANF) Initiation ReportGeoffrey HortonBelum ada peringkat

- Fast No Credit Check LoansDokumen3 halamanFast No Credit Check LoansRobinson52KristensenBelum ada peringkat

- Market Structure and Regulation in The U.S. Banking IndustryDokumen67 halamanMarket Structure and Regulation in The U.S. Banking Industryshashi_patelBelum ada peringkat

- Local Market Trends: The Real Estate ReportDokumen4 halamanLocal Market Trends: The Real Estate ReportSusan StrouseBelum ada peringkat

- Firsttechedrates LoansDokumen2 halamanFirsttechedrates LoansSrinivas ReddyBelum ada peringkat

- Local Market Trends: The Real Estate ReportDokumen4 halamanLocal Market Trends: The Real Estate Reportsusan5458Belum ada peringkat

- Occupant Load CalculationsDokumen60 halamanOccupant Load CalculationsKAIVALYA TIWATNEBelum ada peringkat

- Ce125-2500 Open FrameDokumen48 halamanCe125-2500 Open FrameRomão OliveiraBelum ada peringkat

- De Thi HK 2 Tieng Anh 9 de 2Dokumen17 halamanDe Thi HK 2 Tieng Anh 9 de 2Lê Thu HiềnBelum ada peringkat

- History shapes Philippine societyDokumen4 halamanHistory shapes Philippine societyMarvin GwapoBelum ada peringkat

- Vonovia 9M2021 Presentation 20211118Dokumen76 halamanVonovia 9M2021 Presentation 20211118LorenzoBelum ada peringkat

- Oxy AcetyleneDokumen43 halamanOxy Acetyleneregupathi100% (1)

- S 212 Pre Course WorkDokumen5 halamanS 212 Pre Course Workafiwierot100% (2)

- Chapter 7 - The Political SelfDokumen6 halamanChapter 7 - The Political SelfJohn Rey A. TubieronBelum ada peringkat

- RA 5921 and RA 10918Dokumen32 halamanRA 5921 and RA 10918Hani Loveres100% (1)

- Assignment 2Dokumen4 halamanAssignment 2maxamed0% (1)

- Gantt Chart Engr110 - Gantt Chart Template 3Dokumen1 halamanGantt Chart Engr110 - Gantt Chart Template 3api-375485735Belum ada peringkat

- GSMA Moile Money Philippines Case Study V X21 21Dokumen23 halamanGSMA Moile Money Philippines Case Study V X21 21davidcloud99Belum ada peringkat

- Dental System SoftwareDokumen4 halamanDental System SoftwareHahaBelum ada peringkat

- 02 - Order Quantities When Demand Is Approximately LevelDokumen2 halaman02 - Order Quantities When Demand Is Approximately Levelrahma.samyBelum ada peringkat

- Leks Concise Guide To Trademark Law in IndonesiaDokumen16 halamanLeks Concise Guide To Trademark Law in IndonesiaRahmadhini RialiBelum ada peringkat

- Writing A Formal Letter To The PresidentDokumen1 halamanWriting A Formal Letter To The PresidentPiaAnaisBelum ada peringkat

- OS9000 AOS 6.1.5 R01 Network Configuration GuideDokumen846 halamanOS9000 AOS 6.1.5 R01 Network Configuration GuideclaupasinaBelum ada peringkat

- Ownership and Governance of State Owned Enterprises A Compendium of National Practices 2021Dokumen104 halamanOwnership and Governance of State Owned Enterprises A Compendium of National Practices 2021Ary Surya PurnamaBelum ada peringkat

- Surface water drainage infiltration testingDokumen8 halamanSurface water drainage infiltration testingRay CooperBelum ada peringkat

- ManuscriptDokumen2 halamanManuscriptVanya QuistoBelum ada peringkat

- RoutineHub - R Download - iOS 13, 14, 15, 2Dokumen1 halamanRoutineHub - R Download - iOS 13, 14, 15, 2Gabriell AnjosBelum ada peringkat

- Remembrance 23 Names PDFDokumen1 halamanRemembrance 23 Names PDFJennifer ThuncherBelum ada peringkat

- Reasons Why Coca Cola Has A Large Market Share in Kenya and The WorldDokumen9 halamanReasons Why Coca Cola Has A Large Market Share in Kenya and The WorldAludahBelum ada peringkat

- Intelligent Transportation System SolutionsDokumen38 halamanIntelligent Transportation System SolutionsWisnu AjiBelum ada peringkat

- Chapter 4. Quality Service and Standards TrainingDokumen40 halamanChapter 4. Quality Service and Standards TrainingJia Mae Sapico ApantiBelum ada peringkat

- The Case of Ataraxia and Apraxia in The Development of Skeptic THDokumen11 halamanThe Case of Ataraxia and Apraxia in The Development of Skeptic THeweBelum ada peringkat

- Samuel Vizcaino: Professional ProfileDokumen3 halamanSamuel Vizcaino: Professional ProfileVizcaíno SamuelBelum ada peringkat

- Process of Producting High Carbon Ferro ChromeDokumen5 halamanProcess of Producting High Carbon Ferro ChromeSantosh Kumar MahtoBelum ada peringkat

- Variolink Esthetic Brochure 673400Dokumen6 halamanVariolink Esthetic Brochure 673400wuhan lalalaBelum ada peringkat

- EDIBLE VACCINES: A COST-EFFECTIVE SOLUTIONDokumen21 halamanEDIBLE VACCINES: A COST-EFFECTIVE SOLUTIONPritish SareenBelum ada peringkat

- The Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeDari EverandThe Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimePenilaian: 4.5 dari 5 bintang4.5/5 (85)

- 12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurDari Everand12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurPenilaian: 4 dari 5 bintang4/5 (2)

- 24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldDari Everand24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldPenilaian: 5 dari 5 bintang5/5 (19)

- The Corporate Startup: How established companies can develop successful innovation ecosystemsDari EverandThe Corporate Startup: How established companies can develop successful innovation ecosystemsPenilaian: 4 dari 5 bintang4/5 (6)

- Summary of Zero to One: Notes on Startups, or How to Build the FutureDari EverandSummary of Zero to One: Notes on Startups, or How to Build the FuturePenilaian: 4.5 dari 5 bintang4.5/5 (100)

- Your Next Five Moves: Master the Art of Business StrategyDari EverandYour Next Five Moves: Master the Art of Business StrategyPenilaian: 5 dari 5 bintang5/5 (794)

- Creating Competitive Advantage: How to be Strategically Ahead in Changing MarketsDari EverandCreating Competitive Advantage: How to be Strategically Ahead in Changing MarketsPenilaian: 5 dari 5 bintang5/5 (2)

- ChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveDari EverandChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveBelum ada peringkat

- Summary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedDari EverandSummary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedPenilaian: 4.5 dari 5 bintang4.5/5 (38)

- Anything You Want: 40 lessons for a new kind of entrepreneurDari EverandAnything You Want: 40 lessons for a new kind of entrepreneurPenilaian: 5 dari 5 bintang5/5 (46)

- The Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelDari EverandThe Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelPenilaian: 5 dari 5 bintang5/5 (51)

- Summary: Who Not How: The Formula to Achieve Bigger Goals Through Accelerating Teamwork by Dan Sullivan & Dr. Benjamin Hardy:Dari EverandSummary: Who Not How: The Formula to Achieve Bigger Goals Through Accelerating Teamwork by Dan Sullivan & Dr. Benjamin Hardy:Penilaian: 5 dari 5 bintang5/5 (2)

- Without a Doubt: How to Go from Underrated to UnbeatableDari EverandWithout a Doubt: How to Go from Underrated to UnbeatablePenilaian: 4 dari 5 bintang4/5 (23)

- Transformed: Moving to the Product Operating ModelDari EverandTransformed: Moving to the Product Operating ModelPenilaian: 4 dari 5 bintang4/5 (1)

- What Self-Made Millionaires Do That Most People Don't: 52 Ways to Create Your Own SuccessDari EverandWhat Self-Made Millionaires Do That Most People Don't: 52 Ways to Create Your Own SuccessPenilaian: 4.5 dari 5 bintang4.5/5 (24)

- SYSTEMology: Create time, reduce errors and scale your profits with proven business systemsDari EverandSYSTEMology: Create time, reduce errors and scale your profits with proven business systemsPenilaian: 5 dari 5 bintang5/5 (48)

- Don't Start a Side Hustle!: Work Less, Earn More, and Live FreeDari EverandDon't Start a Side Hustle!: Work Less, Earn More, and Live FreePenilaian: 4.5 dari 5 bintang4.5/5 (30)

- Summary: Choose Your Enemies Wisely: Business Planning for the Audacious Few: Key Takeaways, Summary and AnalysisDari EverandSummary: Choose Your Enemies Wisely: Business Planning for the Audacious Few: Key Takeaways, Summary and AnalysisPenilaian: 4.5 dari 5 bintang4.5/5 (3)

- Creative Personal Branding: The Strategy To Answer What's Next?Dari EverandCreative Personal Branding: The Strategy To Answer What's Next?Penilaian: 4.5 dari 5 bintang4.5/5 (3)

- Crushing It!: How Great Entrepreneurs Build Their Business and Influence-and How You Can, TooDari EverandCrushing It!: How Great Entrepreneurs Build Their Business and Influence-and How You Can, TooPenilaian: 5 dari 5 bintang5/5 (887)

- Rich Dad's Before You Quit Your Job: 10 Real-Life Lessons Every Entrepreneur Should Know About Building a Multimillion-Dollar BusinessDari EverandRich Dad's Before You Quit Your Job: 10 Real-Life Lessons Every Entrepreneur Should Know About Building a Multimillion-Dollar BusinessPenilaian: 4.5 dari 5 bintang4.5/5 (407)

- AI Money Machine: Unlock the Secrets to Making Money Online with AIDari EverandAI Money Machine: Unlock the Secrets to Making Money Online with AIBelum ada peringkat

- Becoming Trader Joe: How I Did Business My Way and Still Beat the Big GuysDari EverandBecoming Trader Joe: How I Did Business My Way and Still Beat the Big GuysPenilaian: 4.5 dari 5 bintang4.5/5 (17)

- Built to Serve: Find Your Purpose and Become the Leader You Were Born to BeDari EverandBuilt to Serve: Find Your Purpose and Become the Leader You Were Born to BePenilaian: 5 dari 5 bintang5/5 (23)

- Summary of The Lean Startup: How Today's Entrepreneurs Use Continuous Innovation to Create Radically Successful Businesses by Eric RiesDari EverandSummary of The Lean Startup: How Today's Entrepreneurs Use Continuous Innovation to Create Radically Successful Businesses by Eric RiesPenilaian: 4.5 dari 5 bintang4.5/5 (99)

- Entrepreneurial Leap, Updated and Expanded Edition: A Real-World Guide to Discovering What It Takes to Be an Entrepreneur and How You Can Build the Business of Your DreamsDari EverandEntrepreneurial Leap, Updated and Expanded Edition: A Real-World Guide to Discovering What It Takes to Be an Entrepreneur and How You Can Build the Business of Your DreamsPenilaian: 5 dari 5 bintang5/5 (5)

- How to Prospect, Sell and Build Your Network Marketing Business with StoriesDari EverandHow to Prospect, Sell and Build Your Network Marketing Business with StoriesPenilaian: 5 dari 5 bintang5/5 (21)

- Level Up: How to Get Focused, Stop Procrastinating, and Upgrade Your LifeDari EverandLevel Up: How to Get Focused, Stop Procrastinating, and Upgrade Your LifePenilaian: 5 dari 5 bintang5/5 (22)

- Summary of The 33 Strategies of War by Robert GreeneDari EverandSummary of The 33 Strategies of War by Robert GreenePenilaian: 3.5 dari 5 bintang3.5/5 (20)

- Invention: A Life of Learning Through FailureDari EverandInvention: A Life of Learning Through FailurePenilaian: 4.5 dari 5 bintang4.5/5 (28)