Rolling Loaded Dice

Diunggah oleh

api-253727194Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Rolling Loaded Dice

Diunggah oleh

api-253727194Hak Cipta:

Format Tersedia

Tyler Gross

Prof. Suetorsak

FIN 1380-001

17 November 2014

Gross 1

Rolling Loaded Dice: The Potential Cost of Walking into High-Interest Loans

Too often, people walk into investments without looking beyond the price. I was lucky to

be able to take out an interest-free loan at my work. I borrowed 600 dollars and paid off $150 off

every bi-weekly check for 2 months. In typical financing, this is unheard of. When youre

signing a contract, having knowledge of interest becomes your bargaining power- your ability to

roll the dice, if you will. Therefore, it may be of some value to you to understand why this

happens. The first thing you need to know is that there is a difference between simple interest

and compounded interest, and then we can talk about the benefits of paying loans off quickly.

First off, simple interest is an easy concept. You can calculate it using this easy-to-use

formula: I=PRT or Interest equals Principal times Rate times how long the investment has been

gaining interest (i.e., Time). Time begins when you invest a Principal. Whether it be a savings

account or a loan, the more time the principal is left untouched the greater the interest. Time is

always based annually because the rate is always annual.

The difference between simple interest and compounded interest is the number of times

interest is charged by the lender per year. All simple interest investments are compounded once a

year, but compounding an interest rate means you will have to pay semiannually, quarterly or

even daily depending on how often the interest is compounded. The Rate in simple interest

formula is divided to form the compounded Rate, and Periods takes over the amount of time

based on how many times the principal is compounded in a year.

Lets put it into simpler terms. Lets say my boss had decided to give me a loan with an

8% interest rate compounded annually. In this scenario, I decide to pay it off in 6 months. Well

plug in the values now: P= $600, R= 8% and Time = .5 (for half a year). This gives me 24

dollars in interest and therefore the $24 more that Ill have to pay off this year on top of my

principal. . Simple interest payments base the payment schedule off of the aforementioned

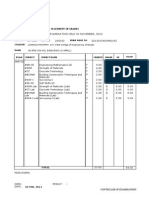

formula. So the payment schedule would look like this: (Notice that the amount paid to interest

stays the same per month.)

Payment (NOT BASED ON

COMPOUND)

00

104

104

104

104

104

104

Interest

New Principal

00

4

4

4

4

4

4

600

500

400

300

200

100

100

Gross 2

Lets make sure everything looks correct. The number of periods that interest compounds is 1,

for one year. Im paying my loan in less than the time allotted, so there is no need to configure

for periods or adjusted rates. Based on this, Ive decided to pay off my debt in months at 104

payments. Easily do-able.

Many times when you take out a loan, your payment schedule will already be worked out

for you. And not only that- the lender will compound your interest. Heres what my loan interest

schedule would have looked like compounded semiannually, paid off in a year:

Principal

Rate= 8/2=4

P*R= Interest

Beginning of Period

End of Period

1st half of year

600

0.04

24

600

624

2nd half of year

624

0.04

24.96

624

648.96

Whoa. How did my interest more than double? The key to understanding Compounded Interest

is to know that the odds are working in the lenders favor. In this scenario, not by much. (By a

factor of 96 cents, in comparison to simple interest terms.) But how about some of the other

scenarios in which this loan could be paid off (Interest bolded):

1 year, compounded semiannually

2 years, compounded semiannually

2 years, compounded quarterly

5 years, compounded monthly (highly unlikely)

648.96-P=

701.94-P=

703.02-P=

893.91-P=

48.96

101.94

103.02

293.91

To be a wise consumer, take into consideration how many periods will occur in a year (to

find adjusted rate) and the number of periods in a loan (Number or Period). You may be asking

yourself why dont we all just pay off our loans quickly to avoid paying high amounts of

interest? There are two reasons: 1.) People suck at making payments. Period. (no pun intended)

And 2.) Most contracts have restrictions against it. Lenders make money when people pay

interest, and if lenders dont make money (in the event that you pay off your loan quickly) then

lenders go out of business and nobody benefits.

The fact of the matter is this: youre playing a tough game if you take out a loan.. Just

know that you always pay on top of what youre borrowing. Be sure to look out for high interest

rates, heavily compounded interest, long term investments (every year costs more than the last)

and fixed, rigid schedules; if you make a deal with all of these elements plus adjustable interest

rates, you might as well be rolling someone elses loaded dice.

Anda mungkin juga menyukai

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Part IDokumen4 halamanPart Iapi-253727194Belum ada peringkat

- ThetrumanshowadecentmovieDokumen5 halamanThetrumanshowadecentmovieapi-253727194Belum ada peringkat

- Part I CoverDokumen1 halamanPart I Coverapi-253727194Belum ada peringkat

- Geothermal Energy Group Eporfolio PaperDokumen21 halamanGeothermal Energy Group Eporfolio Paperapi-253727194Belum ada peringkat

- The Organizational Structure of A RestaurantDokumen8 halamanThe Organizational Structure of A Restaurantapi-253727194Belum ada peringkat

- Tyler Gross Resume Apr 2014-2Dokumen2 halamanTyler Gross Resume Apr 2014-2api-253727194Belum ada peringkat

- The Glenn Greenwald FallacyDokumen5 halamanThe Glenn Greenwald Fallacyapi-253727194Belum ada peringkat

- Abraham Cover PageDokumen2 halamanAbraham Cover Pageapi-253727194Belum ada peringkat

- Abrahmic Religions2Dokumen7 halamanAbrahmic Religions2api-253727194Belum ada peringkat

- Document2 PDFDokumen2 halamanDocument2 PDFapi-253727194Belum ada peringkat

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (120)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Espn NFL 2k5Dokumen41 halamanEspn NFL 2k5jojojojo231Belum ada peringkat

- Psychology and Your Life With Power Learning 3Rd Edition Feldman Test Bank Full Chapter PDFDokumen56 halamanPsychology and Your Life With Power Learning 3Rd Edition Feldman Test Bank Full Chapter PDFdiemdac39kgkw100% (9)

- Test 1Dokumen9 halamanTest 1thu trầnBelum ada peringkat

- IBM Unit 3 - The Entrepreneur by Kulbhushan (Krazy Kaksha & KK World)Dokumen4 halamanIBM Unit 3 - The Entrepreneur by Kulbhushan (Krazy Kaksha & KK World)Sunny VarshneyBelum ada peringkat

- Logic of English - Spelling Rules PDFDokumen3 halamanLogic of English - Spelling Rules PDFRavinder Kumar80% (15)

- Mathematics Into TypeDokumen114 halamanMathematics Into TypeSimosBeikosBelum ada peringkat

- Deseret First Credit Union Statement.Dokumen6 halamanDeseret First Credit Union Statement.cathy clarkBelum ada peringkat

- Seminar On DirectingDokumen22 halamanSeminar On DirectingChinchu MohanBelum ada peringkat

- Roman Roads in Southeast Wales Year 3Dokumen81 halamanRoman Roads in Southeast Wales Year 3The Glamorgan-Gwent Archaeological Trust LtdBelum ada peringkat

- Alice (Alice's Adventures in Wonderland)Dokumen11 halamanAlice (Alice's Adventures in Wonderland)Oğuz KarayemişBelum ada peringkat

- IndianJPsychiatry632179-396519 110051Dokumen5 halamanIndianJPsychiatry632179-396519 110051gion.nandBelum ada peringkat

- Jurnal UlkusDokumen6 halamanJurnal UlkusIndri AnggraeniBelum ada peringkat

- Oral Communication in ContextDokumen31 halamanOral Communication in ContextPrecious Anne Prudenciano100% (1)

- Curriculum Vitae: Personal InformationDokumen3 halamanCurriculum Vitae: Personal InformationMira ChenBelum ada peringkat

- People Vs Felipe Santiago - FCDokumen2 halamanPeople Vs Felipe Santiago - FCBryle DrioBelum ada peringkat

- Project Proposal On The Establishment of Plywood and MDF Medium Density Fiberboard (MDF) Production PlantDokumen40 halamanProject Proposal On The Establishment of Plywood and MDF Medium Density Fiberboard (MDF) Production PlantTefera AsefaBelum ada peringkat

- 40+ Cool Good Vibes MessagesDokumen10 halaman40+ Cool Good Vibes MessagesRomeo Dela CruzBelum ada peringkat

- FPSCDokumen15 halamanFPSCBABER SULTANBelum ada peringkat

- Employer'S Virtual Pag-Ibig Enrollment Form: Address and Contact DetailsDokumen2 halamanEmployer'S Virtual Pag-Ibig Enrollment Form: Address and Contact DetailstheffBelum ada peringkat

- " Thou Hast Made Me, and Shall Thy Work Decay?Dokumen2 halaman" Thou Hast Made Me, and Shall Thy Work Decay?Sbgacc SojitraBelum ada peringkat

- China Daily 20181031Dokumen24 halamanChina Daily 20181031JackZhangBelum ada peringkat

- Logo DesignDokumen4 halamanLogo Designdarshan kabraBelum ada peringkat

- Project Report On ICICI BankDokumen106 halamanProject Report On ICICI BankRohan MishraBelum ada peringkat

- W 26728Dokumen42 halamanW 26728Sebastián MoraBelum ada peringkat

- Veritas CloudPoint Administrator's GuideDokumen294 halamanVeritas CloudPoint Administrator's Guidebalamurali_aBelum ada peringkat

- 1 Introduction To PPSTDokumen52 halaman1 Introduction To PPSTpanabo central elem sch.Belum ada peringkat

- Polymeric Nanoparticles - Recent Development in Synthesis and Application-2016Dokumen19 halamanPolymeric Nanoparticles - Recent Development in Synthesis and Application-2016alex robayoBelum ada peringkat

- Syllabus Biomekanika Kerja 2012 1Dokumen2 halamanSyllabus Biomekanika Kerja 2012 1Lukman HakimBelum ada peringkat

- Vce Smart Task 1 (Project Finance)Dokumen7 halamanVce Smart Task 1 (Project Finance)Ronak Jain100% (5)

- Nandurbar District S.E. (CGPA) Nov 2013Dokumen336 halamanNandurbar District S.E. (CGPA) Nov 2013Digitaladda IndiaBelum ada peringkat