Technical Analysis 19 January 2010 JPY: Comment: Strategy: Chart Levels

Diunggah oleh

Miir ViirJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Technical Analysis 19 January 2010 JPY: Comment: Strategy: Chart Levels

Diunggah oleh

Miir ViirHak Cipta:

Format Tersedia

Mizuho Corporate Bank

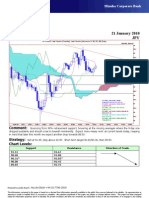

Technical Analysis 19 January 2010

JPY

JPY=EBS, Last Quote [Candle], Last Quote [Ichimoku 9, 26, 52, 26] Daily

17Oct09 - 25Feb10

Pr

93.5

93

92.5

92

91.5

91

90.5

90

89.5

89

88.5

88

87.5

JPY=EBS , Last Quote, Candle

19Jan10 90.79 90.79 90.34 90.45

JPY=EBS , Last Quote, Tenkan Sen 9 87

19Jan10 92.06

JPY=EBS , Last Quote, Kijun Sen 26 86.5

19Jan10 91.19

JPY=EBS , Last Quote, Senkou Span(a) 52

23Feb10 91.62 86

JPY=EBS , Last Quote, Senkou Span(b) 52

23Feb10 89.30 85.5

JPY=EBS , Last Quote, Chikou Span 26

15Dec09 90.45 85

20Oct09 27Oct 03Nov 10Nov 17Nov 24Nov 01Dec 08Dec 15Dec 22Dec 29Dec 05Jan 12Jan 19Jan 26Jan 02Feb 09Feb 16Feb 23Feb

Comment: Retracing 38% of December’s rally so allow for a little hesitation around here today. Note also that

the Lagging Span may also find support from the thin ‘cloud’ of 26 days ago. Futures positions are being re-built but

note these are running at about one-third of the 2007 peak.

Strategy: Sell at 90.45, adding to 91.00; stop above 92.05. Short term target 90.00, then 89.50.

Chart Levels:

Support Resistance Direction of Trade

90.34 90.79

90.00 91.07

89.85 91.33

89.50 91.66

89.30* 92.05*

Produced by London Branch - Nicole Elliott +44-20-7786-2509

The information contained in this paper is based on or derived from information generally available to the public from sources believed to be reliable. No representation or

warranty is made or implied that it is accurate or complete. Any opinions expressed in this paper are subject to change without notice. This paper has been prepared

solely for information purposes and if so decided, for private circulation and does not constitute any solicitation to buy or sell any instrument, or to engage in any trading

strategy.

Charts provided by Reuters.

Anda mungkin juga menyukai

- Appendix 1 SNC Annual Report Re-Issue Format AmendmentsDokumen18 halamanAppendix 1 SNC Annual Report Re-Issue Format AmendmentsMaureen del RosarioBelum ada peringkat

- Nomura QuantDokumen120 halamanNomura QuantArtur Silva100% (1)

- Your Marketing Genius To FCDokumen6 halamanYour Marketing Genius To FCreev_mtra50% (2)

- LPJ NSB: Toko: Kebonpolo MGL (O103)Dokumen12 halamanLPJ NSB: Toko: Kebonpolo MGL (O103)power renjer100% (1)

- Whistle BlowingDokumen17 halamanWhistle BlowingJieYee Tay100% (1)

- IBC May 19 Arpita MamDokumen58 halamanIBC May 19 Arpita Mamvishnuverma100% (8)

- Xerox Management Failed To See The Opportunities Afforded by Many of The Innovations at ParcDokumen2 halamanXerox Management Failed To See The Opportunities Afforded by Many of The Innovations at Parcambrosialnectar50% (2)

- Arch Act - Ar Intan PDFDokumen89 halamanArch Act - Ar Intan PDFIhsan Rahim100% (1)

- 1/7 (Row1 Col1)Dokumen7 halaman1/7 (Row1 Col1)renato_aleman_1Belum ada peringkat

- Sale Purchase Agreement TemplateDokumen3 halamanSale Purchase Agreement TemplateMay&Ben100% (1)

- Mizuho Corporate BankDokumen1 halamanMizuho Corporate BankMiir ViirBelum ada peringkat

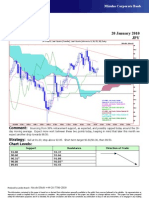

- Technical Analysis 21 January 2010 JPY: Comment: Strategy: Chart LevelsDokumen1 halamanTechnical Analysis 21 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirBelum ada peringkat

- Mizuho Corporate BankDokumen1 halamanMizuho Corporate BankMiir ViirBelum ada peringkat

- Technical Analysis 28 January 2010 JPY: Comment: Strategy: Chart LevelsDokumen1 halamanTechnical Analysis 28 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirBelum ada peringkat

- Mizuho Corporate BankDokumen1 halamanMizuho Corporate BankMiir ViirBelum ada peringkat

- Technical Analysis 20 January 2010 JPY: Comment: Strategy: Chart LevelsDokumen1 halamanTechnical Analysis 20 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirBelum ada peringkat

- Technical Analysis 12 January 2010 JPY: Comment: Strategy: Chart LevelsDokumen1 halamanTechnical Analysis 12 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirBelum ada peringkat

- Technical Analysis 15 January 2010 JPY: Comment: Strategy: Chart LevelsDokumen1 halamanTechnical Analysis 15 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirBelum ada peringkat

- Mizuho Corporate BankDokumen1 halamanMizuho Corporate BankMiir ViirBelum ada peringkat

- Mizuho Corporate BankDokumen1 halamanMizuho Corporate BankMiir ViirBelum ada peringkat

- Technical Analysis 29 January 2010 JPY: Comment: Strategy: Chart LevelsDokumen1 halamanTechnical Analysis 29 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirBelum ada peringkat

- Technical Analysis 11 January 2010 JPY: Comment: Strategy: Chart LevelsDokumen1 halamanTechnical Analysis 11 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirBelum ada peringkat

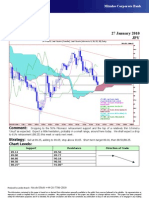

- Technical Analysis 27 January 2010 JPY: Comment: Strategy: Chart LevelsDokumen1 halamanTechnical Analysis 27 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirBelum ada peringkat

- Technical Analysis 05 January 2010 JPY: Comment: Strategy: Chart LevelsDokumen1 halamanTechnical Analysis 05 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirBelum ada peringkat

- Technical Analysis 15 September 2010 JPY: CommentDokumen1 halamanTechnical Analysis 15 September 2010 JPY: CommentPlan B EconomicsBelum ada peringkat

- Technical Analysis 04 January 2010 JPY: Comment: Strategy: Chart LevelsDokumen1 halamanTechnical Analysis 04 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirBelum ada peringkat

- My LATESTFXForecastsfor JUNE30Dokumen3 halamanMy LATESTFXForecastsfor JUNE30api-26441337Belum ada peringkat

- PCPL: Lito Pumicpic: Effectivity Date: February 2020Dokumen1 halamanPCPL: Lito Pumicpic: Effectivity Date: February 2020Jieza May MarquezBelum ada peringkat

- A B C E F G H C D D: AzoteaDokumen1 halamanA B C E F G H C D D: AzoteaGustavo Róssiter VargasBelum ada peringkat

- Power Point Cakupan PHBSDokumen3 halamanPower Point Cakupan PHBSnovita sariBelum ada peringkat

- Kontur FixDokumen1 halamanKontur FixIpan YopaniBelum ada peringkat

- Residential Area: 10 M Wide RoadDokumen1 halamanResidential Area: 10 M Wide RoadharishBelum ada peringkat

- Kurva S PT - Etsa Hari Ke 30Dokumen5 halamanKurva S PT - Etsa Hari Ke 30Ariwibowo SuparnadiBelum ada peringkat

- Cake - I Will SurviveDokumen6 halamanCake - I Will SurviveJazz QuevedoBelum ada peringkat

- Ground Floor Living Room and DiningDokumen1 halamanGround Floor Living Room and DiningDesign TeamBelum ada peringkat

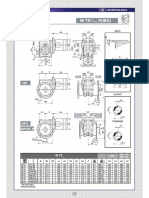

- W 75 ... P (IEC) : BonfiglioliDokumen1 halamanW 75 ... P (IEC) : BonfiglioliAtox BlackBelum ada peringkat

- Site Pt. Duta Alam Sumatera Kecamatan Merapi Barat, Kabupaten Lahat, Provinsi Sumatera SelatanDokumen1 halamanSite Pt. Duta Alam Sumatera Kecamatan Merapi Barat, Kabupaten Lahat, Provinsi Sumatera SelatandejomarlubBelum ada peringkat

- Site Plan S6 - 4-1-2020Dokumen1 halamanSite Plan S6 - 4-1-2020harishBelum ada peringkat

- Merry Christmas Mr. LawrenceDokumen1 halamanMerry Christmas Mr. Lawrenceckun kit yipBelum ada peringkat

- Group Leader Development 14-7-2022Dokumen10 halamanGroup Leader Development 14-7-2022Lancar Jaya PrintingBelum ada peringkat

- Indian Railways: Trends, Issues, Opportunities and Outlook: G Raghuram Indian Institute of Management, AhmedabadDokumen33 halamanIndian Railways: Trends, Issues, Opportunities and Outlook: G Raghuram Indian Institute of Management, AhmedabadmakbimhrdBelum ada peringkat

- Diseño de Alcantarillado Sanitario Municipio de Los CordobasDokumen1 halamanDiseño de Alcantarillado Sanitario Municipio de Los CordobasJose Alfredo Petro NavarroBelum ada peringkat

- Trombone IIDokumen8 halamanTrombone IIKirs YoshikageBelum ada peringkat

- 1-Cluster 03 Sewer Drawings 11-04-2018Dokumen1 halaman1-Cluster 03 Sewer Drawings 11-04-2018Bernie QuepBelum ada peringkat

- UntitledDokumen18 halamanUntitledImri TalgamBelum ada peringkat

- CNN Features Off-The-shelf: An Astounding Baseline For RecognitionDokumen8 halamanCNN Features Off-The-shelf: An Astounding Baseline For RecognitionAkash GuptaBelum ada peringkat

- FIFA 22 Team of The Year FUT TOTY FifaRosters 6Dokumen1 halamanFIFA 22 Team of The Year FUT TOTY FifaRosters 6Alvaro CoqueBelum ada peringkat

- 4DDokumen1 halaman4DFitri WahyuniBelum ada peringkat

- PP-001 Universal2 Pump Seal Reference ChartDokumen1 halamanPP-001 Universal2 Pump Seal Reference Chartandres roblezBelum ada peringkat

- Khadi Chowk To Bridge Part - 2Dokumen1 halamanKhadi Chowk To Bridge Part - 2naman jainBelum ada peringkat

- 55m - 36mps - Cat. II-C-3-40PA 13m2Dokumen1 halaman55m - 36mps - Cat. II-C-3-40PA 13m2MaryBelum ada peringkat

- Pemodelan EksitingDokumen1 halamanPemodelan EksitingAyah AlealanaBelum ada peringkat

- Kurva S PT - Etsa Hari Ke 25Dokumen1 halamanKurva S PT - Etsa Hari Ke 25Ariwibowo SuparnadiBelum ada peringkat

- 12 Plan Invelitoare Propus PDFDokumen1 halaman12 Plan Invelitoare Propus PDFkatika01Belum ada peringkat

- Mika C - ADokumen2 halamanMika C - AJean-Claude BourletBelum ada peringkat

- Eis Me Aqui TromboneDokumen2 halamanEis Me Aqui TromboneIury AugustoBelum ada peringkat

- Sewer Line Profile - Line Mh7-Mh19: RevisionsDokumen1 halamanSewer Line Profile - Line Mh7-Mh19: RevisionsBernie QuepBelum ada peringkat

- Electrical Motor Efficiency Ratings PDFDokumen3 halamanElectrical Motor Efficiency Ratings PDFGustavo CuatzoBelum ada peringkat

- F&O ROLLOVER Jun - 2019 PDFDokumen7 halamanF&O ROLLOVER Jun - 2019 PDFcdranuragBelum ada peringkat

- Weight and Length - Boys - 0 2 YearsDokumen1 halamanWeight and Length - Boys - 0 2 YearsSirawit KaewchaiyaBelum ada peringkat

- Laboratorio-Primera Pla3ntaDokumen1 halamanLaboratorio-Primera Pla3ntaValeria VicenteBelum ada peringkat

- Datasheet-Igbt 6-Pack-Cm75tu-24fDokumen4 halamanDatasheet-Igbt 6-Pack-Cm75tu-24fMohammad kazem DehghaniBelum ada peringkat

- Plan Parter-ModelDokumen1 halamanPlan Parter-ModelAndrei CrismariuBelum ada peringkat

- LC 1Dokumen1 halamanLC 1Jeryy AvenaimBelum ada peringkat

- TREAD-0.30 M Rise - 0.15 M Hand Rails .H-1.20M: Parking Area (54.72X27.2) MDokumen1 halamanTREAD-0.30 M Rise - 0.15 M Hand Rails .H-1.20M: Parking Area (54.72X27.2) MVigneshBelum ada peringkat

- Merry Christmas Mr. Lawrence-FluteDokumen2 halamanMerry Christmas Mr. Lawrence-FluteBruno Del BenBelum ada peringkat

- Site:-Plot No. 192, Darbar Nagar at Unn at Choryashi at SuratDokumen1 halamanSite:-Plot No. 192, Darbar Nagar at Unn at Choryashi at SuratHRPANSURIYABelum ada peringkat

- AUG 11 UOB Global MarketsDokumen3 halamanAUG 11 UOB Global MarketsMiir ViirBelum ada peringkat

- Westpack AUG 11 Mornng ReportDokumen1 halamanWestpack AUG 11 Mornng ReportMiir ViirBelum ada peringkat

- AUG 11 DBS Daily Breakfast SpreadDokumen6 halamanAUG 11 DBS Daily Breakfast SpreadMiir ViirBelum ada peringkat

- AUG 10 UOB Global MarketsDokumen3 halamanAUG 10 UOB Global MarketsMiir ViirBelum ada peringkat

- AUG-10 Mizuho Technical Analysis EUR JPYDokumen1 halamanAUG-10 Mizuho Technical Analysis EUR JPYMiir ViirBelum ada peringkat

- AUG 10 UOB Asian MarketsDokumen2 halamanAUG 10 UOB Asian MarketsMiir ViirBelum ada peringkat

- AUG-10 Mizuho Technical Analysis GBP USDDokumen1 halamanAUG-10 Mizuho Technical Analysis GBP USDMiir ViirBelum ada peringkat

- Danske Daily: Key NewsDokumen4 halamanDanske Daily: Key NewsMiir ViirBelum ada peringkat

- JYSKE Bank AUG 10 Corp Orates DailyDokumen2 halamanJYSKE Bank AUG 10 Corp Orates DailyMiir ViirBelum ada peringkat

- AUG 10 DBS Daily Breakfast SpreadDokumen8 halamanAUG 10 DBS Daily Breakfast SpreadMiir ViirBelum ada peringkat

- Market Drivers - Currencies: Today's Comment Today's Chart - EUR/USDDokumen5 halamanMarket Drivers - Currencies: Today's Comment Today's Chart - EUR/USDMiir ViirBelum ada peringkat

- AUG 10 Danske EMEADailyDokumen3 halamanAUG 10 Danske EMEADailyMiir ViirBelum ada peringkat

- JYSKE Bank AUG 09 Corp Orates DailyDokumen2 halamanJYSKE Bank AUG 09 Corp Orates DailyMiir ViirBelum ada peringkat

- AUG-09-DJ European Forex TechnicalsDokumen3 halamanAUG-09-DJ European Forex TechnicalsMiir ViirBelum ada peringkat

- AUG 10 Danske FlashCommentFOMC PreviewDokumen7 halamanAUG 10 Danske FlashCommentFOMC PreviewMiir ViirBelum ada peringkat

- Westpack AUG 10 Mornng ReportDokumen1 halamanWestpack AUG 10 Mornng ReportMiir ViirBelum ada peringkat

- ScotiaBank AUG 09 Daily FX UpdateDokumen3 halamanScotiaBank AUG 09 Daily FX UpdateMiir ViirBelum ada peringkat

- AUG-09 Mizuho Technical Analysis EUR JPYDokumen1 halamanAUG-09 Mizuho Technical Analysis EUR JPYMiir ViirBelum ada peringkat

- JYSKE Bank AUG 09 Market Drivers CurrenciesDokumen5 halamanJYSKE Bank AUG 09 Market Drivers CurrenciesMiir ViirBelum ada peringkat

- Jyske Bank Aug 09 em DailyDokumen5 halamanJyske Bank Aug 09 em DailyMiir ViirBelum ada peringkat

- Plus Size Clothing IsDokumen27 halamanPlus Size Clothing Iskomal katyalBelum ada peringkat

- SBUX - 4M 2019-05-15 (KDR) - RevisedDokumen87 halamanSBUX - 4M 2019-05-15 (KDR) - RevisedKhuert Jirioz CooperBelum ada peringkat

- NFIFWI - Circular Details - Print PreviewDokumen2 halamanNFIFWI - Circular Details - Print PreviewVijay KumarBelum ada peringkat

- FT Lauderdale-Q3 2010 ReportDokumen11 halamanFT Lauderdale-Q3 2010 ReportKen RudominerBelum ada peringkat

- 3935 A722-43007 - Rev00 - 01Dokumen55 halaman3935 A722-43007 - Rev00 - 01Elena CucerBelum ada peringkat

- Coarse Seminar NSTPDokumen9 halamanCoarse Seminar NSTPLorenz HernandezBelum ada peringkat

- Basic Facts of Sox LawDokumen2 halamanBasic Facts of Sox LawnamuBelum ada peringkat

- Business Standard 9th Nov 18Dokumen14 halamanBusiness Standard 9th Nov 18Kalai ArasiBelum ada peringkat

- Answer of The Case Questions: 1. Answer: Summary of The CaseDokumen10 halamanAnswer of The Case Questions: 1. Answer: Summary of The Caseনিশীথিনী কুহুরানীBelum ada peringkat

- Single BG Format - RCLDokumen2 halamanSingle BG Format - RCLMuhammad SalmanBelum ada peringkat

- Analyzing Investing Activities:: Special TopicsDokumen40 halamanAnalyzing Investing Activities:: Special TopicsAbhishek PandaBelum ada peringkat

- List of Pregnant Women Without Philhealth:: Brgy. TaguinDokumen6 halamanList of Pregnant Women Without Philhealth:: Brgy. Taguincristal1on1Belum ada peringkat

- 2017 Agm MinutesDokumen6 halaman2017 Agm Minutesapi-248973401Belum ada peringkat

- Mir Kamal PashaDokumen3 halamanMir Kamal PashakamalBelum ada peringkat

- Acct 410 - Government and Not-for-ProfitDokumen7 halamanAcct 410 - Government and Not-for-Profitllutz7Belum ada peringkat

- Labor Cases ListDokumen2 halamanLabor Cases ListAubrey AquinoBelum ada peringkat

- Executive Summary: Organization StudyDokumen61 halamanExecutive Summary: Organization StudyImamjafar SiddiqBelum ada peringkat

- Cost Accounting de Leon Chapter 3 SolutionsDokumen9 halamanCost Accounting de Leon Chapter 3 SolutionsRichelle SangatananBelum ada peringkat

- Certificate of Contribution: Optum Global Solutions (Philippines), Inc. Under Unitedhealth Group ("Company")Dokumen1 halamanCertificate of Contribution: Optum Global Solutions (Philippines), Inc. Under Unitedhealth Group ("Company")Grey Del PilarBelum ada peringkat

- Sears Store Closing ListDokumen2 halamanSears Store Closing List13WMAZBelum ada peringkat

- Steven Meldahl Bankruptcy Claims Register 2Dokumen40 halamanSteven Meldahl Bankruptcy Claims Register 2CamdenCanaryBelum ada peringkat