Study On Prospect and Market Opportunity of OIL & NATURAL GAS in Indonesia, 2015 - 2019

Diunggah oleh

Central Data MediatamaJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Study On Prospect and Market Opportunity of OIL & NATURAL GAS in Indonesia, 2015 - 2019

Diunggah oleh

Central Data MediatamaHak Cipta:

Format Tersedia

HubungiKami:

021 31930 108

021 31930 109

021 31930 070

marketing@cdmione.com

he glory period of Indonesian oil industry occurred in

1977 1992 with average production of 1.5 million

barrels per day. The condition made Indonesia as a

respectful oil producing

country in OPEC

(Organization of the Petroleum Exporting Countries) of

which the establishment was initiated by Indonesia.

However, in line with the rising consumption and declining

production of oil in the country, Indonesia has become an

oil importing country since 2003.

Indonesian oil production at present reaches 800 thousand

barrel per day so it is not able to meet the domestic oil

need and Indonesia shall import a great deal of oil. The

government through Special Task Force for Upstream Oil

and Gas Business Activities (SKK Migas) has encouraged to

increase oil production. To realize production target of 820

thousand barrels per day in 2015, some 7 units of new oil

and gas projects have been in operation including Bayan

field performed by Manhattan Kalimantan Investment Pte

Ltd, Kerendan Gas Plant (Salamander Energy Ltd), South

East Sumatra Development (CNOOC SES), Beringin Field

(Pertamina EP), Kepodang Field (Petronas Carigali Muriah)

and Full Development of South Belut (Conoco Philips

Indonesia Inc).

Based on a research of CDMI that fossil fuel reserves in

Indonesia are getting thin and only 3.61 billion barrels or

0.21% of world reserves left. With average oil production

of 300 million barrels per annum and if new proven

reserves are not discovered, Indonesian oil will be used up

in upcoming 12 years. Similarly, the proven natural gas

reserve in Indonesia is only 102 TSCF/Trillion Square Cubic

Feet, or 1.6% of world gas reserves. By viewing the

production rate of 3 TSCF per annum, it is estimated that

Indonesian natural gas reserve will run out in upcoming 34

years.

Oil and gas sector has great contribution to state income which

is obtained from the export. In 2000 2014, the export value

of oil and gas had increased with average growth rate of

7.95% per annum from US$ 14.37 billion in 2000 to US$ 30.33

billion in 2014. In this period, the contribution of oil and gas

export value towards total Indonesian export value was

20.27% per annum on the average.

The potential of Indonesian oil and gas is still great enough.

From Indonesian hydrocarbon basins, it is estimated to produce

more than 9 billion barrels. Most of the basins have already

discovered in Western Indonesian regions. If the potential of oil

and gas resources in Eastern Indonesian regions can be

realized, the number of oil and gas will be greater. From 60

sediment basins which is estimated to contain hydrocarbon,

some 22 basins have yet to be explored.

Viewing the great potential, P.T. Central Data Mediatama

Indonesia (CDMI), an independent consultant company in

Jakarta, is interested in performing a deep research and finally

succeeded to publish a study book with the title of Study on

Prospect and Market Opportunity of OIL & NATURAL GAS in

Indonesia, 2015 - 2019.

This study book is only available at CDMI and directly ordered

to our marketing division Mrs. Tina by phones (021) 3193

0108, 3193 0109, 3193 0070 or Fax (021) 3193 0102 or email: marketing@cdmione.com at a price of US$ 700.- for

Indonesian Edition and US$ 750.- for English Edition.

Having submitted this offer, we thank you for your cooperation

and look forward to hearing your response promptly.

Cordially yours,

P.T. CDMI

Muslim M. Amin

...........................................................................................................................................

our creative data for your partners

Phone:(021)31930108 9

Fax:(021)31930102

Email:marketing@cdmione.com

Website:www.cdmione.com

P.T.CENTRALDATAMEDIATAMAINDONESIA

AGPBuilding,2ndFloor

Jl.PegangsaanTimurNo.1Cikini

Jakarta10320,Indonesia

Pleasesendus

Name(Mr/Mrs/Ms)

NameofCompany

Address

Telephone/Fax

Please,tick

copy(ies)

StudyonProspectandMarketOpportunityofOIL&NATURALGAS

inIndonesia,20152019

Position :

Date

//

Signature:

Price :

US$700(IndonesianEdition);

US$750(EnglishEdition)

Check/BankDraft

Note:Overseasisaddeddeliverycost

Invoiceus

Indonesianedition

Englishedition

CDMI

OIL&NATURALGAS,20152019

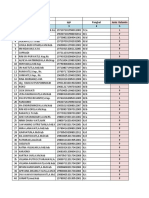

LIST OF CONTENTS .................................................................................. i

LIST OF TABLES ....................................................................................... v

1.

INTRODUCTION ..................................................................................... 1

1.1. Background........................................................................................ 1

1.2. Objective and Scope of Study .................................................................. 2

1.3. Methodology ...................................................................................... 2

1.3.1. Research Period ......................................................................... 2

1.3.2. Data Sources ............................................................................. 2

2.

OIL AND NATURAL GAS IN INDONESIA ................................................4

2.1. Formation of Oil and Natural Gas ............................................................. 4

2.2. Potential of Oil and Gas Resources in Indonesia ............................................ 6

2.3. Process of Natural Oil Processing ........................................................... 12

2.4. Government Program to Increase Production of Oil and Natural Gas................. 17

3.

STRATEGIC ROLE OF OIL AND GASINDUSTRY IN INDONESIA .......... 21

3.1. Oil and Gas Industry as Motor for Development ......................................... 21

3.2. Oil and Gas Industry as Main Contributor of State Income ............................. 23

3.3. Development and Contribution of Oil and Gas towards National GDP ............... 24

3.5. Oil and Gas Industry as Motor for Regional Growth..................................... 26

3.6. Oil and Gas Industry as Guarantor of the Nations future ............................... 27

3.7. Contribution of Oil and Gas Sector towards State Budget (APBN) .................... 28

4.

COMPREHENSIVENESS OF BUSINESS FACILITIES OF OIL AND GAS

INDUSTRIAL ACTIVITIES .................................................................... 30

4.1. Pertamina as Integrated Oil and Natural Gas Business ................................... 30

4.2. Transformation of Pertaminas Status into Persero ....................................... 31

4.3. Distribution of Oil and Natural Gas Refineries............................................ 40

4.4. Exploration and Production................................................................... 44

4.5. Marketing and Trade .......................................................................... 44

4.6. Comprehensiveness of Distribution Facilities of Oil and Natural Gas................. 46

4.7. Utilization of Oil and Natural Gas Resources ............................................. 48

ListofContents

i.

CDMI

OIL&NATURALGAS,20152019

5.

COOPERATION CONTRACT CONTRACTORS (KKKS) OF OIL AND NATURAL

GAS ....................................................................................................... 51

5.1. KKKS of Indonesian Oil and Natural Gas Exploration .................................. 51

5.2. KKKS of Indonesian Oil and Natural Gas Production ................................... 57

5.3. Development of Oil and Natural Gas Exploration Activities............................ 62

5.4. KKKS Having Already Been in Production ................................................ 66

5.5. Ending Contract of Oil and Gas Block ..................................................... 67

5.6. Appraisal of KKKS of Oil and Gas ......................................................... 68

6.

MAP OF OIL AND GAS MARKETS IN INDONESIA AND

IN THE WORLD .................................................................................... 72

6.1. Map of Oil and Gas Markets in the World ................................................. 72

6.1.1. Map of World Natural Oil Markets ................................................ 75

6.1.2. Development of Reserves of Oil Producing Countries .......................... 81

6.1.3. Development of Production of Oil Producing Countries ....................... 83

6.1.4. Development of Consumption of Oil Consuming Countries ................... 86

6.1.5. Development of World Natural Oil Price ......................................... 90

6.2. Map of World Natural Gas Markets ........................................................ 92

6.2.1. Development of Reserves of Natural Gas Producing Countries ............... 92

6.2.2. Development of Production of Natural Gas Producing Countries ............. 94

6.2.3. Development of Consumption of Natural Gas Consuming Countries ........ 96

6.2.4. Development of World Natural Gas Price ........................................ 98

6.2.5. Status of Natural Gas Industries in Several European and Asian Countries . 99

6.3. Production of Several World Oil and Gas Companies .................................. 101

6.4. Map of Indonesian Oil and Gas Markets .................................................. 104

6.4.1. Map of Indonesian Natural Oil Markets .......................................... 104

6.4.1.1. Development of Natural Oil and Condensate Production........... 104

6.4.1.2. Production of Oil and Condensate by Company ..................... 105

6.4.1.3. Development of Indonesian Natural Oil Export ...................... 107

6.4.1.4. Development of Indonesian Natural Oil Export by Destination

Country ..................................................................... 108

6.4.1.5. Development of Natural Oil Import .................................... 109

6.4.1.6. Development of Natural Oil Import by Country of Origin ......... 110

6.4.1.7. Development of Domestic Natural Oil Supply ....................... 112

6.4.1.8. Development of Indonesian Natural Oil Price ........................ 113

6.4.2. Map of Indonesian Natural Gas Markets ......................................... 114

6.4.2.1. Development of Natural Gas Production, 2000-2014 ............... 115

6.4.2.2. Average Natural Gas Production by Company ....................... 117

6.4.2.3. Development of Natural Gas Export ................................... 118

ListofContents

ii.

CDMI

OIL&NATURALGAS,20152019

6.4.2.4. Natural Gas Export by Destination Country .......................... 119

6.4.2.5. Development of Domestic Natural Gas Supply ...................... 120

6.4.2.6. Development of Natural Gas Price ..................................... 121

6.4.3. Comparative Ratio of Reserves and Production of Oil and Gas .............. 122

7.

PROJECTION OF OIL AND GAS MARKETS, 2015 - 2019 ...................... 124

7.1. Projection of Indonesian Oil and Gas Production ........................................ 124

7.1.1. Natural Oil ............................................................................ 124

7.1.2. Natural Gas ........................................................................... 127

7.2. Projection of Indonesian Oil and Gas Export ............................................ 129

7.2.1. Natural Oil ............................................................................ 129

7.2.2. Natural Gas............................................................................ 132

7.3. Projection of Indonesian Oil and Gas Import ............................................ 137

7.3.1. Natural Oil ............................................................................ 137

7.3.2. Natural Gas............................................................................ 137

7.4. Projection of Indonesian Oil and Gas Consumption .................................... 139

7.4.1. Natural Oil ............................................................................ 139

7.4.2. Natural Gas............................................................................ 140

8.

OPPORTUNITY OF OIL AND GAS INVESTMENT IN INDONESIA ........ 143

8.1. Oil and Gas Investment in Indonesia ....................................................... 144

8.2. Support of Law and Regulation ............................................................. 146

8.2.1. Promotion of Oil and Gas Investment ............................................ 149

8.2.2. Offer of Working Area .............................................................. 150

8.2.3. Oil and Gas Information Services ................................................. 153

8.2.4. Oil and Gas Recommendation and License Services ........................... 154

8.3. Coverage of Oil and Gas Commodity...................................................... 159

8.4. Scope of Oil and Gas Industry .............................................................. 160

8.5. Business Opportunity of Supporting Business ............................................ 161

9.

OIL & NATURAL GAS PROCESSING .................................................... 165

9.1. Natural Oil Processing ....................................................................... 165

9.1.1. Flow for Supplying National Oil Fuel (BBM) ................................... 167

9.1.2. Oil Fuel (BBM) Production ......................................................... 168

9.1.3. Oil Fuel (BBM) Import .............................................................. 171

9.1.4. Oil Fuel (BBM) Export.............................................................. 172

9.1.5. National Oil Fuel (BBM) Consumption........................................... 173

9.1.6. Projection of Oil Fuel (BBM) Consumption ..................................... 175

ListofContents

iii.

CDMI

OIL&NATURALGAS,20152019

9.2. Natural Gas Processing....................................................................... 176

9.2.1. LPG Production ...................................................................... 177

9.2.2. LPG Import ........................................................................... 177

9.2.3. Export of LPG and LNG ............................................................ 178

9.2.3.1. Development of LPG Export ............................................ 178

9.2.3.2. Development of LNG Export Volume ................................. 179

9.2.4. LPG Consumption ................................................................... 182

9.3. Distribution of Oil Fuel (BBM) and Natural Gas ........................................ 182

9.4. System for Forming Oil Fuel (BBM) Price in the Country ............................ 186

9.5. Development of Subsidized Oil Fuel (BBM) Price ...................................... 189

10. PROFILE OF INDONESIAN OIL AND NATURAL GAS COMPANY ........ 192

10.1. P.T. PERTAMINA (Persero) ............................................................... 192

10.2. P.T. PERUSAHAAN GAS NEGARA (PERSERO) Tbk. (PGN) .................... 194

10.3. P.T. MEDCO ENERGI INTERNATIONAL Tbk. (MEDC) .......................... 196

10.4. P.T. ELNUSA Tbk. (ELSA) ................................................................ 197

10.5. P.T. LEYAND INTERNATIONAL Tbk. (LAPD) ..................................... 198

ATTACHMENT .......................................................................................... 200

CDMI

ListofContents

iv.

Anda mungkin juga menyukai

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Indonesian OIL PALM & REFINERY Directory, 2015"Dokumen3 halamanIndonesian OIL PALM & REFINERY Directory, 2015"Central Data MediatamaBelum ada peringkat

- Feasibility Study and Business Potential APARTMENT in DKI Jakarta, 2011 - 2014Dokumen4 halamanFeasibility Study and Business Potential APARTMENT in DKI Jakarta, 2011 - 2014Central Data MediatamaBelum ada peringkat

- Study On Potential and Business Opportunity of SUPERBLOCK in Jabodetabek, 2014 - 2018Dokumen6 halamanStudy On Potential and Business Opportunity of SUPERBLOCK in Jabodetabek, 2014 - 2018Central Data MediatamaBelum ada peringkat

- Feasibility Study On Development of Investment FIVE STAR HOTEL in Bali, 2011 - 2015Dokumen5 halamanFeasibility Study On Development of Investment FIVE STAR HOTEL in Bali, 2011 - 2015Central Data MediatamaBelum ada peringkat

- Profile of Indonesian CHEMICAL Manufacturers, 2011Dokumen2 halamanProfile of Indonesian CHEMICAL Manufacturers, 2011Central Data MediatamaBelum ada peringkat

- Study On Prospect and Opportunity of Wheat Flour (WHEAT) Industrial Market in Indonesia, 2013 - 2017Dokumen3 halamanStudy On Prospect and Opportunity of Wheat Flour (WHEAT) Industrial Market in Indonesia, 2013 - 2017Central Data MediatamaBelum ada peringkat

- Studi Potensi Bisnis Dan Pelaku Utama Industri GULA Di Indonesia, 2013Dokumen3 halamanStudi Potensi Bisnis Dan Pelaku Utama Industri GULA Di Indonesia, 2013Central Data MediatamaBelum ada peringkat

- Study On Business Potential and Major Players of OLEOCHEMICAL Industry in Indonesia, 2013 - 2016Dokumen3 halamanStudy On Business Potential and Major Players of OLEOCHEMICAL Industry in Indonesia, 2013 - 2016Central Data MediatamaBelum ada peringkat

- Study On Business Potential and Major Players of HEAVY EQUIPMENT Industry in Indonesia, 2013 - 2016Dokumen5 halamanStudy On Business Potential and Major Players of HEAVY EQUIPMENT Industry in Indonesia, 2013 - 2016Central Data MediatamaBelum ada peringkat

- Exclusive Indonesian COAL Directory, 2013 - 2014Dokumen2 halamanExclusive Indonesian COAL Directory, 2013 - 2014Central Data MediatamaBelum ada peringkat

- Copy (Ies) Name (MR/MRS/MS) Name of Company Please Send UsDokumen12 halamanCopy (Ies) Name (MR/MRS/MS) Name of Company Please Send UsCentral Data MediatamaBelum ada peringkat

- Kinerja 30 Group Perusahaan BATUBARA Di Indonesia, 2013/2014 Beserta Laporan KeuangannyaDokumen9 halamanKinerja 30 Group Perusahaan BATUBARA Di Indonesia, 2013/2014 Beserta Laporan KeuangannyaCentral Data MediatamaBelum ada peringkat

- Exclusive Indonesian AUTOMOTIVE Directory, 2013 - 2014Dokumen1 halamanExclusive Indonesian AUTOMOTIVE Directory, 2013 - 2014Central Data MediatamaBelum ada peringkat

- Indonesian OIL PALM & REFINERY Directory, 2012Dokumen5 halamanIndonesian OIL PALM & REFINERY Directory, 2012Central Data MediatamaBelum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5795)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1091)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Cyclic Issue 13 14Dokumen80 halamanCyclic Issue 13 14VerdeamorBelum ada peringkat

- Practical Report 4 A. Data Mahasiswa: Ingredients Pecel MadiunDokumen9 halamanPractical Report 4 A. Data Mahasiswa: Ingredients Pecel MadiunJihan AmiraBelum ada peringkat

- Nama SD Penilaian Tengah Semester TAHUN PELAJARAN 2020/2021Dokumen8 halamanNama SD Penilaian Tengah Semester TAHUN PELAJARAN 2020/2021NoviariBelum ada peringkat

- Summary of Oil and Gas in IndonesiaDokumen5 halamanSummary of Oil and Gas in IndonesiasynolaBelum ada peringkat

- Jurnal - L Suparto LM Hal 132-145Dokumen14 halamanJurnal - L Suparto LM Hal 132-145Dede BhubaraBelum ada peringkat

- Form Pip - Dinkes (3) Puskesmas Purwodadi IIDokumen9 halamanForm Pip - Dinkes (3) Puskesmas Purwodadi IIUptd Puskesmas Purwodadi IIBelum ada peringkat

- Hasil Ujian Iho Sma 2023Dokumen81 halamanHasil Ujian Iho Sma 2023Afifah Aflah fara difaBelum ada peringkat

- CP 8 CatalogueDokumen9 halamanCP 8 CataloguebennyBelum ada peringkat

- 84-Article Text-281-1-10-20180312Dokumen14 halaman84-Article Text-281-1-10-20180312Dimas AdyBelum ada peringkat

- Assignment On The Relationship Between Culture Diversity and EntrepreneurshipDokumen69 halamanAssignment On The Relationship Between Culture Diversity and EntrepreneurshipAarya AustBelum ada peringkat

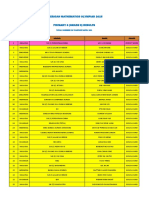

- American Mathematics Olympiad 2015 Primary 6 (Grade 6) ResultsDokumen10 halamanAmerican Mathematics Olympiad 2015 Primary 6 (Grade 6) ResultscheintBelum ada peringkat

- Education and Training: 2013 - 2017 - Semarang, IndonesiaDokumen3 halamanEducation and Training: 2013 - 2017 - Semarang, IndonesiaYudi ChandraBelum ada peringkat

- Strategi Pengembangan Bisnis Sapi Pedaging Kelompo PDFDokumen10 halamanStrategi Pengembangan Bisnis Sapi Pedaging Kelompo PDFexoucha ucihaBelum ada peringkat

- Biografi SoekarnoDokumen2 halamanBiografi SoekarnoGhinayah AmaliaBelum ada peringkat

- 201105151926340.nexant Industry Report 2011Dokumen40 halaman201105151926340.nexant Industry Report 2011yudhie_7Belum ada peringkat

- PPKM Jurangmangu TimurDokumen18 halamanPPKM Jurangmangu TimurAhmad SyarifuddinBelum ada peringkat

- Topik 4 Indonesian Political System During The Regime of Sukarno and SuhartoDokumen43 halamanTopik 4 Indonesian Political System During The Regime of Sukarno and SuhartoNEmy HatiniBelum ada peringkat

- Poster 1-2 WPSC APSA (A)Dokumen2 halamanPoster 1-2 WPSC APSA (A)samranBelum ada peringkat

- De Jure: (The Role of Corruption Eradication Commission (KPK) in Corruption Prevention and Eradication)Dokumen22 halamanDe Jure: (The Role of Corruption Eradication Commission (KPK) in Corruption Prevention and Eradication)Riduan Sapri PurbaBelum ada peringkat

- Syllabus For ArchitectureDokumen20 halamanSyllabus For ArchitecturexahidlalaBelum ada peringkat

- Know The Market and The PlayersDokumen5 halamanKnow The Market and The Playersvinka anggraeniBelum ada peringkat

- Indonesia Top 10 E-Commerce Sites by Monthly Traffic 2021 StatistaDokumen1 halamanIndonesia Top 10 E-Commerce Sites by Monthly Traffic 2021 StatistaRino Adi NugrohoBelum ada peringkat

- Implementasi Kebijakan Bantuan Langsung Tunai (BLT) Bagi Masyarakat Terdampak Covid-19 Di Kecamatan Cileunyi Kabupaten BandungDokumen13 halamanImplementasi Kebijakan Bantuan Langsung Tunai (BLT) Bagi Masyarakat Terdampak Covid-19 Di Kecamatan Cileunyi Kabupaten Bandungmahsusiyati sarasBelum ada peringkat

- Covid 19 - SeaDokumen70 halamanCovid 19 - SeaBaty NeBelum ada peringkat

- Form Test GroundingDokumen4 halamanForm Test GroundingSas Volta Sr.100% (5)

- Defense Offset Policy in IndonesiaDokumen5 halamanDefense Offset Policy in IndonesiaDickyHadiWijayaBelum ada peringkat

- History of Geothermal Exploration in Indonesia (1970-2010) : November 2014Dokumen9 halamanHistory of Geothermal Exploration in Indonesia (1970-2010) : November 2014Muhammad SatriyoBelum ada peringkat

- Assalamu'alaikum Wr. WB.: "The Important of English Language"Dokumen2 halamanAssalamu'alaikum Wr. WB.: "The Important of English Language"arditya mokoBelum ada peringkat

- Syllabus: Igcse Indonesia StudiesDokumen9 halamanSyllabus: Igcse Indonesia Studiesapi-243693409Belum ada peringkat

- Hortatory Exposition: Teacher: Dra. Sri HartatiDokumen9 halamanHortatory Exposition: Teacher: Dra. Sri HartatiTri Hapsari MPBelum ada peringkat