Perkembangan NPL Kredit Mikro, Kecil, Dan Menengah (MKM) Perbankan

Diunggah oleh

Kang WarnoJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Perkembangan NPL Kredit Mikro, Kecil, Dan Menengah (MKM) Perbankan

Diunggah oleh

Kang WarnoHak Cipta:

Format Tersedia

PERKEMBANGAN NPL KREDIT MIKRO, KECIL, DAN MENENGAH (MKM) PERBANKAN1

NPL OF MICRO, SMALL, AND MEDIUM (MSM) CREDITS 1

(Miliar Rp/Billions of IDR )

III. PERKEMBANGAN NPL KREDIT MKM

2006

Total

Kredit Mikro (Rp0-Rp50

jt)

Kredit Kecil (>Rp 50 jtRp500jt)

Kredit Menengah

(>Rp500 jt-Rp5M)

NPL-gross Kredit

MKM **)

Kredit Modal Kerja

Kredit Investasi

Kredit Konsumsi

NPL-gross Kredit

MKM

Pertanian, perburuan

dan sarana pertanian

Pertambangan

Perindustrian

Listrik, Gas dan Air

Konstruksi

Perdagangan, restoran

dan hotel

Pengangkutan,

pergudangan dan

komunikasi

Jasa Dunia Usaha

Jasa Sosial

Lain-lain

NPL-gross Kredit

MKM

Bank Persero

Bank Swasta Nasional

Devisa

Bank Swasta Nasional

Non Devisa

BPD

Bank Campuran

Bank Asing

BPR/BPRS

NPL-gross Kredit

MKM

NPL-gross Kredit Non

MKM

NPL OF MSM CREDITS .III

2007

Total

2008

%

Total

Total

Jan

%

Total

Feb

%

Total

Mar

%

Total

Apr

Total

Mei

Total

Jun

Total

Jul

%

Total

Agt

Total

Sep

%

Total

Okt

Total

Nov

Total

Des

Total

%

Micro Credits (up to

3.13% IDR50 million)

Small Credits

(>IDR50million 1.99% IDR500 million)

Medium Credits

3.33% (>IDR500 million - IDR5

NPL-gross of MSM's

2.72% Credits

7,646.3

4.20%

7,823.0

3.86%

9,409.1

4.02% 11,027.8

4.32% 10,890.3

5.41% 11,313.6

5.45% 12,276.0

4.66%

9,523.0 3.64%

9,772.9

3.64%

9,343.6

3.41%

9,678.9

3.46% 10,024.8

3.58% 10,522.0

3.73% 10,103.2

3.57%

9,273.1

3.33%

8,864.1

4,652.3

4.00%

5,105.9

3.30%

4,802.6

2.17%

5,810.3

2.05%

6,540.3

2.20%

6,919.0

2.26%

7,003.3

2.23%

7,238.0 2.24%

7,745.0

2.33%

7,345.5

2.14%

7,607.0

2.16%

7,913.6

2.18%

7,999.3

2.17%

8,324.7

2.20%

8,758.9

2.26%

7,883.6

6,468.3

4.98%

6,366.2

3.81%

7,032.9

3.43%

7,906.3

3.47%

8,416.6

3.81%

8,721.3

3.87%

8,663.2

3.70%

8,912.2 3.75%

9,526.5

3.93%

9,023.2

3.58%

9,214.5

3.64%

9,412.8

3.60%

9,291.7

3.52%

9,672.8

3.62% 10,867.9

3.96%

9,396.9

18,766.9

4.38%

19,295.0

3.68% 21,244.7

3.22% 24,744.4

3.23% 25,847.1

3.59% 26,954.0

3.65% 27,942.5

3.44% 25,673.2 3.12% 27,044.4

3.21% 25,712.3

2.96% 26,500.4

3.00% 27,351.3

3.02% 27,813.0

3.04% 28,100.7

3.03% 28,899.9

3.07%

26,144.7

10,735.0

2,855.3

5,176.6

5.93%

7.49%

2.48%

10,624.1

2,682.1

5,988.8

4.92% 11,967.4

5.82%

2,768.4

2.28%

6,508.9

4.59% 14,029.6

4.93% 2,946.7

1.90% 7,768.1

4.77% 12,194.3

4.50%

2,920.5

1.91% 10,732.2

4.66% 12,715.6

4.32% 3,072.2

2.75% 11,166.2

4.68% 13,365.6

4.34% 3,037.0

2.82% 11,540.0

4.35% 13,780.1 4.46% 14,397.7

4.26% 3,123.7 4.35% 3,242.0

2.66% 8,769.3 1.99% 9,404.8

4.58% 13,825.0

4.53% 2,944.7

2.06% 8,942.6

4.19% 14,239.4

3.47% 3,215.9

1.97% 9,045.1

4.26% 14,901.8

3.71% 3,171.0

1.95% 9,278.5

4.15% 15,070.2

3.88% 2,920.5

2.00% 9,822.2

4.24% 15,371.2

3.57% 3,082.4

2.06% 9,647.1

4.29% 16,818.1

3.66% 3,104.5

1.98% 8,977.4

4.64%

3.65%

1.82%

15,419.8

2,779.9

7,945.1

18,766.9

4.38%

19,295.0

3.68% 21,244.7

3.22% 24,744.4

3.23% 25,847.1

3.59% 26,954.0

3.65% 27,942.5

3.44% 25,673.2 3.12% 27,044.4

3.21% 25,712.3

2.96% 26,500.4

3.00% 27,351.3

3.02% 27,813.0

3.04% 28,100.7

3.03% 28,899.9

3.07%

26,144.7

1,237.2

122.8

2,226.7

21.5

570.8

8.25%

9.37%

6.03%

1.45%

5.64%

1,252.0

102.5

2,082.9

13.9

602.4

7.16%

6.71%

5.46%

4.84%

4.54%

1,177.8

96.5

3,495.8

7.6

807.3

5.55%

5.29%

7.52%

1.35%

4.71%

1,586.9

93.0

2,646.7

17.9

1,186.3

6.44%

2.18%

5.93%

2.54%

6.13%

789.4

90.2

2,516.9

12.3

1,113.2

5.36%

4.09%

5.20%

2.03%

6.67%

767.6

82.3

2,564.4

15.5

1,161.9

5.19%

2.11%

5.13%

2.50%

6.96%

937.9

94.9

2,523.1

17.3

1,078.3

5.51%

1.78%

5.00%

2.69%

6.13%

961.4

128.3

2,485.5

14.9

1,176.2

5.57%

2.30%

4.97%

2.13%

6.52%

891.6

157.5

2,631.1

19.9

1,444.6

5.17%

2.53%

5.16%

2.93%

7.14%

770.3

286.0

2,457.7

20.0

1,286.0

4.21%

4.15%

4.68%

2.71%

6.27%

999.1

119.3

2,627.3

20.3

1,270.3

4.67%

1.66%

5.01%

2.31%

6.10%

1,035.1

125.4

2,650.7

21.5

1,313.7

5.05%

2.06%

4.86%

2.27%

6.11%

1,040.5

195.5

2,642.7

20.3

1,258.0

5.17%

3.09%

4.86%

2.10%

5.74%

1,062.0

106.0

2,680.7

22.4

1,445.8

5.39%

1.60%

4.97%

1.19%

6.25%

1,112.4

113.1

2,720.4

29.8

1,593.9

5.68%

1.70%

5.01%

2.17%

6.80%

878.7

126.5

2,487.6

31.1

1,285.4

4.45%

1.79%

4.45%

3.18%

5.87%

7,371.6

6.45%

7,316.2

5.13%

7,077.8

4.25%

8,840.7

4.46%

7,002.9

4.72%

7,497.8

4.88%

7,876.4

4.51%

8,114.8 4.62%

8,199.3

4.66%

7,682.9

4.16%

9,126.2

4.52%

9,409.5

4.57%

9,340.2

4.57%

9,361.2

4.64% 10,552.5

5.16%

9,699.1

4.71%

711.9

977.9

186.4

5,340.0

10.76%

3.86%

3.09%

2.53%

435.5

1,088.3

249.3

6,152.0

6.04%

3.33%

3.73%

2.33%

372.9

1,272.2

240.9

6,695.9

4.31%

2.92%

3.17%

1.93%

414.8

1,604.8

292.0

8,061.3

4.45%

595.7

3.39%

1,118.4

3.33%

574.3

1.97% 12,033.9

5.30%

561.5

2.49% 1,261.2

4.19%

686.3

2.87% 12,355.4

4.96%

577.0

2.62% 1,214.9

4.85%

728.6

2.90% 12,894.0

4.97%

595.3

2.35% 1,314.2

5.04%

758.3

2.75% 10,124.2

5.09%

596.8

2.50% 1,369.9

5.18%

805.5

2.13% 10,928.0

5.10%

588.3

2.57% 1,188.2

5.31%

986.9

2.22% 10,446.0

4.84%

2.31%

3.18%

2.13%

578.6

1,190.0

977.7

9,591.4

4.66%

2.37%

3.21%

1.97%

566.3

1,211.7

1,073.7

9,943.7

4.73%

587.7

2.38% 1,331.5

3.04%

996.6

2.00% 10,399.9

4.86%

624.8

2.34% 1,129.6

3.42% 1,364.3

2.05% 10,303.9

4.89%

2.10%

4.20%

1.97%

590.6

1,131.7

1,205.1

9,850.5

4.56%

2.10%

3.94%

1.85%

481.6

1,339.2

1,101.4

8,714.1

3.71%

2.36%

3.61%

1.59%

18,766.9

8,595.6

4.38%

5.93%

19,295.0

8,178.0

3.68% 21,244.7

4.63%

7,812.2

3.22% 24,744.4

3.39% 9,783.6

3.23% 25,847.1

3.43%

7,508.1

3.59% 26,954.0

3.39% 7,969.2

3.65% 27,942.5

3.52% 8,674.2

3.44% 25,673.2 3.12% 27,044.4

3.00% 8,996.3 3.05% 9,881.9

3.21% 25,712.3

3.29% 9,069.4

2.96% 26,500.4

2.96% 9,418.4

3.00% 27,351.3

3.02% 9,716.0

3.02% 27,813.0

3.05% 9,474.0

3.04% 28,100.7

2.95% 9,889.9

3.03% 28,899.9

3.04% 11,769.9

3.07%

3.52%

26,144.7

10,459.5

2.72%

3.04%

6,291.8

3.53%

6,520.9

3.00%

7,075.9

2.65%

7,943.3

2.78%

8,191.1

2.89%

8,423.1

2.90%

8,300.2

2.79%

8,560.6 2.83%

8,677.1

2.80%

8,299.0

2.59%

8,637.4

2.62%

2.59%

2.61%

2.55%

2.53%

8,595.3

560.3

3.30%

421.1

2.04%

364.6

1.55%

523.3

1.75%

573.3

1.94%

603.3

1.99%

637.4

2.02%

664.4 2.04%

730.4

2.13%

808.2

2.12%

810.8

2.20%

872.4

192.5

554.5

1.65%

3.86%

4.49%

1,130.0

171.9

1,159.4

1.67%

2.94%

8.15%

1,195.0

277.6

2,078.0

1.36%

3.26%

12.31%

1,660.7

540.6

2,268.6

1.54%

4.21%

13.87%

1,984.6

843.1

4,597.7

1.85%

4.22%

16.68%

2,122.7

760.2

4,869.9

1.94%

3.33%

16.59%

2,301.0

655.8

5,178.3

2.06%

2.95%

17.94%

2,325.3 2.04%

636.0 2.86%

2,244.6 9.17%

2,522.9

554.6

2,459.2

2.17%

2.42%

9.14%

2,497.2

641.0

2,212.8

2.09%

2.51%

8.60%

2,626.5

628.4

2,114.6

2.17%

2.58%

7.88%

1,699.9

9.68%

1,713.8

8.02%

2,441.5

9.21%

2,024.2

6.86%

2,149.1

7.20%

2,205.5

7.23%

2,195.7

7.06%

2,246.0 7.05%

2,218.3

6.80%

2,184.8

6.56%

2,264.2

6.68%

18,766.9

4.38%

19,295.0

3.68% 21,244.7

3.22% 24,744.4

3.23% 25,847.1

3.59% 26,954.0

3.65% 27,942.5

3.44% 25,673.2 3.12% 27,044.4

3.21% 25,712.3

2.96% 26,500.4

3.00%

29,271.8

8.07%

20,346.3

4.28% 20,044.0

3.11% 20,939.6

3.15% 23,572.2

3.43% 24,114.8

3.49% 21,041.9

3.26% 21,474.4 3.23% 22,580.4

3.27% 21,952.2

3.04% 22,087.2

3.09%

49,705.9

6.14%

42,480.6

4.15% 44,493.5

3.33% 49,591.7

3.38% 50,974.0

3.55% 52,692.5

3.61% 51,021.0

3.43% 48,908.9 3.22% 51,411.6

3.29% 49,480.5

3.05% 50,434.9

3.09%

9,872.8

2.31%

8,853.4 1.69%

5,600.5

0.85% 10,319.2

1.35% 13,079.7

1.82% 12,182.2

1.65% 12,003.5

Sumber data: Bank Indonesia (Biro Pengembangan BPR dan UMKM - DKBU), diolah dari Laporan Bulanan Bank Umum (LBU) dan Laporan Bulanan BPR/BPRS.

1.48% 12,129.9 1.48% 12,996.4

1.54% 12,306.0

1.42% 12,587.8

1.42%

NPL-gross Perbankan

NPL-net Kredit MKM

2010 *)

2009

Kredit MKM tidak termasuk kartu kredit; total kredit perbankan dan kredit Non MKM termasuk kartu kredit.

Sudah termasuk pembiayaan oleh Bank Umum Syariah.

Untuk bulan Desember 2010, sudah termasuk baki debet BPR, belum termasuk BPRS.

*) Angka Sementara

NPL MKM Des 20103/2/2011

8,745.4

8,966.7

8,911.0

8,982.4

4.17% Working Capital Credits

3.21% Investment Credits

1.58% Consumer Credits

NPL-gross of MSM's

2.72% Credits

Agriculture,hunting and

agricultural facilities

Mining

Manufacturing Industry

Electricity, Gas & Water

Construction

Trade, restaurants and

hotels

Transportation, cargo

storage and

communication

Business Services

Social Services

Others

NPL-gross of MSM's

Credits

State Banks

Foreign Exchange

2.36% Private National Banks

Non Foreign Exchange

2.20% Private National Banks

Regional Development

2,666.4 2.16% 2,676.2

2.16% 2,863.1 2.27% 2,863.4 2.25%

2,362.1 1.87% Banks

580.2 2.43%

607.5

2.48%

563.2 2.35%

521.3 2.30%

560.9 2.25% Joint Banks

2,443.3 8.75% 2,845.1 10.23% 2,548.1 8.55% 1,547.8 5.80%

1,187.6 4.51% Foreign Banks

Rural/Islamic Rural

2,318.8 6.68% 2,369.6

6.82% 2,396.4 6.81% 2,276.8 6.79%

2,069.7 6.12% Banks

NPL-gross of MSM's

27,351.3 3.02% 27,813.0

3.04% 28,100.7 3.03% 28,899.9 3.07% 26,144.7 2.72% Credits

NPL-gross of Non

22,344.8 3.03% 21,500.4

2.88% 23,360.1 3.12% 24,153.5 3.14% 20,317.1 2.52% MSM's Credits

NPL-gross of

51,600.1 3.08% 51,531.4

3.04% 53,505.7 3.13% 54,522.4 3.13% 47,679.0 2.65% Banking's

NPL-net of MSM's

12,728.4 1.41% 13,711.7

1.50% 14,062.9 1.51% 14,339.4 1.53% 12,996.2 1.35% Credits

1

Data source: Bank Indonesia (Bureau of Rural Banks and MSMEs Development-Directorate of Credit,

Rural Banks and MSMEs), processed from Banks' Monthly Reports and Rural Banks/Rural Islamic Banks' Monthly Report.

MSM Credits not includes credits to credit card holders; banking credit and non MSM credits includes credit card.

Includes financing of Islamic Banks.

Outstanding of Conventional Rural Banks were included in December 2010, Islamic Rural Banks were not included.

881.0

2.31%

873.8

2.26%

929.1

2.35%

938.3

2.33%

909.5

*) Preliminary Figures

Anda mungkin juga menyukai

- Emerging FinTech: Understanding and Maximizing Their BenefitsDari EverandEmerging FinTech: Understanding and Maximizing Their BenefitsBelum ada peringkat

- Net Ekspansi Kredit Usaha Mikro, Kecil, Dan Menengah (Umkm) PerbankanDokumen6 halamanNet Ekspansi Kredit Usaha Mikro, Kecil, Dan Menengah (Umkm) Perbankanmuhammad_nursyamsuBelum ada peringkat

- Financial Soundness Indicators for Financial Sector Stability in Viet NamDari EverandFinancial Soundness Indicators for Financial Sector Stability in Viet NamBelum ada peringkat

- SME Financing Through Credit Guarantee Scheme Indonesia ExperienceDokumen40 halamanSME Financing Through Credit Guarantee Scheme Indonesia ExperienceADBI EventsBelum ada peringkat

- COVID-19 and the Finance Sector in Asia and the Pacific: Guidance NotesDari EverandCOVID-19 and the Finance Sector in Asia and the Pacific: Guidance NotesBelum ada peringkat

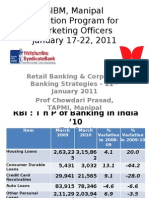

- Retail Banking in IndiaDokumen21 halamanRetail Banking in IndiaAnilSGBelum ada peringkat

- Metamorphosis of Modern Management - Financial ServicesDokumen12 halamanMetamorphosis of Modern Management - Financial ServicesSiva BalajiBelum ada peringkat

- Agribusiness Event Presentation - Access To FinanceDokumen37 halamanAgribusiness Event Presentation - Access To FinanceHamdBelum ada peringkat

- Sapm Final DeckDokumen45 halamanSapm Final DeckShasank JalanBelum ada peringkat

- Prime MinisterDokumen11 halamanPrime Ministervishalr245Belum ada peringkat

- Pillars of Financial Inclusion-V1-ScotchDokumen18 halamanPillars of Financial Inclusion-V1-ScotchKamzalian Tomging100% (3)

- Sibm, RBCBDokumen20 halamanSibm, RBCBProf Dr Chowdari PrasadBelum ada peringkat

- Final IA ReportDokumen20 halamanFinal IA Reportpriyanka atmaramBelum ada peringkat

- Session 6 Financial Inclusion and MSMEs Access To Finance in NepalDokumen26 halamanSession 6 Financial Inclusion and MSMEs Access To Finance in NepalPrem YadavBelum ada peringkat

- ADB - Myanmar - Fact Sheet - As of 31 December 2012Dokumen4 halamanADB - Myanmar - Fact Sheet - As of 31 December 2012Mdy BoyBelum ada peringkat

- Microfinance in Bangladesh: General BackgroundDokumen6 halamanMicrofinance in Bangladesh: General BackgroundFotoClippingBelum ada peringkat

- 12 Chapter 4Dokumen53 halaman12 Chapter 4Hota bBelum ada peringkat

- Project On HDFC BankDokumen28 halamanProject On HDFC BankVijay KusmalBelum ada peringkat

- Investor PresentationDokumen23 halamanInvestor PresentationRabekanadarBelum ada peringkat

- Promotion Reading Material PDFDokumen72 halamanPromotion Reading Material PDFkandasamy004Belum ada peringkat

- Small and Medium EnterprisesDokumen9 halamanSmall and Medium EnterprisesGaurav KumarBelum ada peringkat

- Final Status Paper 2020-21Dokumen181 halamanFinal Status Paper 2020-21BhupeshBelum ada peringkat

- MSME Committee Report Feb 2015Dokumen83 halamanMSME Committee Report Feb 2015jay.kumBelum ada peringkat

- Trends in Microfinance 2010 - 2015Dokumen10 halamanTrends in Microfinance 2010 - 2015Ram KumarBelum ada peringkat

- Investor Presentation PDFDokumen28 halamanInvestor Presentation PDFTeluguKingdom NetBelum ada peringkat

- Table B7: Bank-Wise and Bank Group-Wise Gross Non-Performing Assets, Gross Advances, and Gross NPA Ratio of Scheduled Commercial Banks - 2012Dokumen5 halamanTable B7: Bank-Wise and Bank Group-Wise Gross Non-Performing Assets, Gross Advances, and Gross NPA Ratio of Scheduled Commercial Banks - 2012shipra1305Belum ada peringkat

- Basics of Securities Markets Nepalese Perspective 12.12.2022Dokumen51 halamanBasics of Securities Markets Nepalese Perspective 12.12.2022As a beekeeperBelum ada peringkat

- Overview of MFOs in India - NABARD - Sep 2009Dokumen41 halamanOverview of MFOs in India - NABARD - Sep 2009srivastBelum ada peringkat

- Banking Sector in CambodiaDokumen9 halamanBanking Sector in Cambodiaសួន សុខាBelum ada peringkat

- 2013 OverviewDokumen26 halaman2013 OverviewSheikh KaiserBelum ada peringkat

- DAIBB SME SolutionsDokumen29 halamanDAIBB SME SolutionsShafiul Azam100% (3)

- Materi Ka Ojk Tpakd GabunganDokumen16 halamanMateri Ka Ojk Tpakd GabunganRendi ArcanggiBelum ada peringkat

- Credit Gap For Small Scale IndustriesDokumen52 halamanCredit Gap For Small Scale IndustriesGaurav KumarBelum ada peringkat

- Asia SME Finance Monitor 2014 PDFDokumen9 halamanAsia SME Finance Monitor 2014 PDFSan SéngBelum ada peringkat

- Abhishek BFSIDokumen11 halamanAbhishek BFSIabhishekBelum ada peringkat

- Introduction: Financial Inclusion and PMJDYDokumen4 halamanIntroduction: Financial Inclusion and PMJDYNakshtra DasBelum ada peringkat

- Financial Management A Project On Financial Inclusion and PMJDYDokumen9 halamanFinancial Management A Project On Financial Inclusion and PMJDYNakshtra DasBelum ada peringkat

- Development of Small and Medium Enterprise Sector in The Republic of MoldovaDokumen8 halamanDevelopment of Small and Medium Enterprise Sector in The Republic of MoldovaElena RobuBelum ada peringkat

- RRBsDokumen2 halamanRRBssindhuja singhBelum ada peringkat

- Togo Full PDF Country NoteDokumen12 halamanTogo Full PDF Country NoteNathaniel JakesBelum ada peringkat

- Macroeconomic Impact of DemonetisationDokumen59 halamanMacroeconomic Impact of DemonetisationrdandapsBelum ada peringkat

- Promotion Study Material I To II and II To III-1Dokumen131 halamanPromotion Study Material I To II and II To III-1Shuvajoy ChakrabortyBelum ada peringkat

- Banking Industry StructureDokumen10 halamanBanking Industry StructureRohit GuptaBelum ada peringkat

- Morning BulletinDokumen13 halamanMorning Bulletinharshilshah7676Belum ada peringkat

- Assignment On Fundamental Analysis of IdbiDokumen11 halamanAssignment On Fundamental Analysis of IdbifiiimpactBelum ada peringkat

- Swagat 2010 2011 Training BookletDokumen108 halamanSwagat 2010 2011 Training Bookletbitus92Belum ada peringkat

- Document of The World BankDokumen69 halamanDocument of The World BankOctadian PBelum ada peringkat

- Analisis RestoranDokumen28 halamanAnalisis RestoranSikathabis TaufanBelum ada peringkat

- A Project Report On Comparison Between HDFC Bank Amp ICICI BankDokumen45 halamanA Project Report On Comparison Between HDFC Bank Amp ICICI Bankillusionofsoul_51347Belum ada peringkat

- HDFC Bank Project ReportDokumen54 halamanHDFC Bank Project ReportAkash PatelBelum ada peringkat

- Liquidity Ratios:: (As of 31/12/2019, Growth Rate As Compared To End of Last Year) Unit: Billions VND, %Dokumen3 halamanLiquidity Ratios:: (As of 31/12/2019, Growth Rate As Compared To End of Last Year) Unit: Billions VND, %Quynh Ngoc Dang100% (1)

- Retail BankingDokumen49 halamanRetail Bankingrajunegi88Belum ada peringkat

- Challenges and Perspectives: The Malaysian Experience: Microtakaful & InsuranceDokumen10 halamanChallenges and Perspectives: The Malaysian Experience: Microtakaful & InsurancemohamedfisalBelum ada peringkat

- Economic Survey 2011 EnglishDokumen574 halamanEconomic Survey 2011 EnglishSujeet KumarBelum ada peringkat

- Size of The Sector NBFCDokumen14 halamanSize of The Sector NBFCniravthegreate999Belum ada peringkat

- Introduction To The CompanyDokumen28 halamanIntroduction To The CompanyMukesh ManwaniBelum ada peringkat

- B.B.A., L.L.B. (Hons.) / Third Semester-2021Dokumen17 halamanB.B.A., L.L.B. (Hons.) / Third Semester-2021Anoushka SudBelum ada peringkat

- Rwanda'S Financial Inclusion Success Story: Umurenge SaccosDokumen12 halamanRwanda'S Financial Inclusion Success Story: Umurenge SaccosBesufekad MamoBelum ada peringkat

- Financial Intervention and Changes of Livelihood Promotion Through Commercial Banks in Tirupur District of Tamilnadu-2019-03!27!12-02Dokumen8 halamanFinancial Intervention and Changes of Livelihood Promotion Through Commercial Banks in Tirupur District of Tamilnadu-2019-03!27!12-02Impact JournalsBelum ada peringkat

- Citibank - WikipediaDokumen10 halamanCitibank - Wikipediasharin kulalBelum ada peringkat

- SUBJECT: Claim Case No. 400264/16 SMT Pooja Kaur and Ors. Vs Ashok andDokumen4 halamanSUBJECT: Claim Case No. 400264/16 SMT Pooja Kaur and Ors. Vs Ashok andkunal jainBelum ada peringkat

- EFIN542 U09 T01 PowerPointDokumen26 halamanEFIN542 U09 T01 PowerPointcustomsgyanBelum ada peringkat

- Internship Report (Rida)Dokumen46 halamanInternship Report (Rida)Tania AliBelum ada peringkat

- AIF DataDokumen32 halamanAIF DataYASH CHAUDHARYBelum ada peringkat

- Deliverables: Professional ExperienceDokumen1 halamanDeliverables: Professional ExperienceArjav jainBelum ada peringkat

- Part 1 - Strategic Planning - Top Level Planning & Analysis - Sol 21 Aug 2021Dokumen67 halamanPart 1 - Strategic Planning - Top Level Planning & Analysis - Sol 21 Aug 2021Le BlancBelum ada peringkat

- Economic Value Added (EVA)Dokumen1 halamanEconomic Value Added (EVA)avinashbaBelum ada peringkat

- Valuation - Multiples and EV Value DriversDokumen27 halamanValuation - Multiples and EV Value DriversstrokemeBelum ada peringkat

- Daftar Pustaka: GOKMARIA SIMARMATA, Supriyadi, M.SC., PH.D., CMA., CA., AkDokumen3 halamanDaftar Pustaka: GOKMARIA SIMARMATA, Supriyadi, M.SC., PH.D., CMA., CA., AkMuhammad WildanBelum ada peringkat

- CBDCs and AMMDokumen19 halamanCBDCs and AMMGopal DubeyBelum ada peringkat

- Estate Tax-Handout 2Dokumen4 halamanEstate Tax-Handout 2Xerez SingsonBelum ada peringkat

- Profile PartnersDokumen20 halamanProfile PartnersSunita AgarwalBelum ada peringkat

- Methods of Project Financing: Project Finance Equity Finance The ProjectDokumen9 halamanMethods of Project Financing: Project Finance Equity Finance The ProjectA vyasBelum ada peringkat

- Kaiser Supplemental Savings and Retirement Plan Annual Report Form 5500Dokumen37 halamanKaiser Supplemental Savings and Retirement Plan Annual Report Form 5500James LindonBelum ada peringkat

- U.S. Individual Income Tax Return: (See Instructions.)Dokumen2 halamanU.S. Individual Income Tax Return: (See Instructions.)Daniel RamirezBelum ada peringkat

- Q No. 1 Assume That You Are Given Assignment To Evaluate The Capital Budgeting Projects of The CompanyDokumen3 halamanQ No. 1 Assume That You Are Given Assignment To Evaluate The Capital Budgeting Projects of The CompanyMuneeb Qureshi0% (1)

- Past Paper Inspector Inland Revenue FBR IIR Jobs in FPSCDokumen3 halamanPast Paper Inspector Inland Revenue FBR IIR Jobs in FPSCDedag DawoodBelum ada peringkat

- Financial Regulatory Bodies of IndiaDokumen6 halamanFinancial Regulatory Bodies of IndiaShivangi PandeyBelum ada peringkat

- Cash Book RevisionDokumen2 halamanCash Book RevisionSwati ChamariaBelum ada peringkat

- Gold Export GhanaDokumen3 halamanGold Export Ghanamusu35100% (4)

- Carmela Jia Ming A. Wong Section 20Dokumen2 halamanCarmela Jia Ming A. Wong Section 20Carmela WongBelum ada peringkat

- Neuvoo Cert CanDokumen4 halamanNeuvoo Cert CaniansyaBelum ada peringkat

- Sharpe Single Index ModelDokumen11 halamanSharpe Single Index ModelSai Mala100% (1)

- Lecture Note 03 - Bond Price VolatilityDokumen53 halamanLecture Note 03 - Bond Price Volatilityben tenBelum ada peringkat

- Chapter 2Dokumen25 halamanChapter 2heobenicerBelum ada peringkat

- P24139 Noria Commercial Paper Weekly 20211105Dokumen29 halamanP24139 Noria Commercial Paper Weekly 20211105NiltonBarbosaBelum ada peringkat

- Months 6 Year 5 - 0 18 - 0 5000 450 Pi I NDokumen4 halamanMonths 6 Year 5 - 0 18 - 0 5000 450 Pi I NDayLe Ferrer AbapoBelum ada peringkat

- Karvy Report On Comparative Study On Mutual FundsDokumen57 halamanKarvy Report On Comparative Study On Mutual FundsNishant GoldyBelum ada peringkat

- Ithrees's Whole Ion Finalyzed To PrintDokumen82 halamanIthrees's Whole Ion Finalyzed To PrintMohamed FayasBelum ada peringkat