COST BEHAVIOR ANALYSIS & USE

Diunggah oleh

Joshua HinesJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

COST BEHAVIOR ANALYSIS & USE

Diunggah oleh

Joshua HinesHak Cipta:

Format Tersedia

COST BEHAVIOR: ANALYSIS

AND USE

Types of Cost Behavior Patterns

An activity base (also called a cost driver) is a measure of what causes the incurrence of

variable costs. As the level of the activity base increases, the total variable cost increases

proportionally.

Units produced (or sold) is not the only activity base within companies. A cost can be

considered variable if it varies with activity bases such as miles driven, machine hours, or

labor hours.

As an example of an activity base, consider overage charges on a cell phone bill. The activity

base is the number of minutes used above the allowed minutes in the calling plan.

A variable cost remains constant if expressed on a per unit basis. Referring to the cell phone

example, the cost per overage minute is constant, for example 45 cents per overage minute.

Some examples of variable costs that are likely present in many types of businesses are:

Merchandising companies cost of goods sold.

Manufacturing companies direct materials, direct labor, and variable overhead.

Merchandising and manufacturing companies commissions, shipping costs, and

clerical costs such as invoicing.

Service companies supplies, travel, and clerical.

True Variable Cost vs. Step-Variable Cost

The amount of a true variable cost used during the period varies in direct proportion to

the activity level.

The overage charge on a cell phone bill was one example of a true variable cost.

Direct material is an example of a cost that behaves in a true variable pattern. Direct

materials purchased but not used can be stored and carried forward to the next period of

inventory.

A step-variable cost is a resource that is obtainable only in large chucks and whose costs

change only in response to fairly wide changes in activity. For example, maintenance

workers are often considered to be a variable cost, but this labor cost does not behave as a

true variable cost.

The Linearity Assumption and the Relevant Range

Economists correctly point out that many costs which accountants classify as variable costs

actually behave in a curvilinear fashion.

COST BEHAVIOR: ANALYSIS

AND USE

Nonetheless, within a narrow band of activity known as the relevant range, a curvilinear cost

can be satisfactorily approximated by a straight line.

The relevant range is that range of activity within which the assumptions made about cost

behavior are valid.

For example, your cell phone bill probably includes a fixed amount related to the total

minutes allowed in your calling plan. The amount does not change when you use more or

less allowed minutes.

For example, the fixed cost per minute used decreases as more allowed minutes are used.

As you make more and more allowed calls, the basic rate cost per call decreases. If your

basic rate is $39 per month and you make one allowed call per month, the average basic

rate is $39 per call. However, if you make 100 allowed calls per month, the average basic

rate per call drops to 39 cents per call.

Fixed Costs

The relevant range of activity for a fixed cost is the range of activity over which the graph of

the cost is flat.

Mixed Cost

The mixed cost line can be expressed with the equation Y = a + bX. This equation should

look familiar, from your algebra and statistics classes.

In the equation, Y is the total mixed cost; a is the total fixed cost (or the vertical intercept of

the line); b is the variable cost per unit of activity (or the slope of the line), and X is the

actual level of activity.

In our utility example, Y is the total mixed cost; a is the total fixed monthly utility charge; b

is the cost per kilowatt hour consumed, and X is the number of kilowatt hours consumed.

Analyzing Mixed Costs

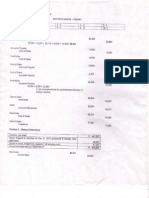

High-Low Method

To analyze mixed costs with the high-low method, the first step is to choose the data points

pertaining to the highest and lowest activity levels. In the example above, the high level of

activity was in June at 850 hours of maintenance and the low level of activity is in February

COST BEHAVIOR: ANALYSIS

AND USE

with 450 hours of maintenance. Notice that this method relies upon two data points to

estimate the fixed and variable portions of a mixed cost.

The second step is to determine the total costs associated with the two chosen points. We

incurred costs of $9,800 at the high level of activity and $7,400 at the low level of activity.

The third step is to calculate the change in cost between the two data points. The change in

maintenance hours was 400 hours and the change in maintenance dollars was $2,400.

Notice, this method relies upon two data points to estimate the fixed and variable portions of

a mixed costs, as opposed to one data point with the scattergraph method.

For this example, we divide $2,400 by 400 and determine that the variable cost per hour of

maintenance is $6.00.

The fourth step is to take the total cost at either activity level (in this case, $9,800).

Deduct the variable cost component ($6 per hour times 850 hours) for the total cost of

$9,800.

The difference represents the estimate of total fixed costs ($4,700).

The fifth step is to construct an equation that can be used to estimate the total cost at any

activity level (Y = $4,700 + $6.00X). The basic equation of Y is equal to $4,700 (the total

fixed cost) plus $6 times the actual level of activity.

Anda mungkin juga menyukai

- Revision 1 ST TermDokumen33 halamanRevision 1 ST Term_dinashBelum ada peringkat

- Bolt OnsDokumen5 halamanBolt OnsSatyam AcharyaBelum ada peringkat

- Kings College of The PhilippinesDokumen6 halamanKings College of The PhilippinesIzza Mae Rivera KarimBelum ada peringkat

- Assignment On Mergers and AcquisitionDokumen15 halamanAssignment On Mergers and Acquisitionarchita0312Belum ada peringkat

- OLIGOPSONYDokumen3 halamanOLIGOPSONYBernard Okpe100% (1)

- Chapter Five Inventory Management - Chapter 4Dokumen10 halamanChapter Five Inventory Management - Chapter 4eferemBelum ada peringkat

- MATERIAL # 9 - (Code of Ethics) Code of EthicsDokumen6 halamanMATERIAL # 9 - (Code of Ethics) Code of EthicsGlessey Mae Baito LuvidicaBelum ada peringkat

- Stevenson 13e Chapter 1Dokumen30 halamanStevenson 13e Chapter 1zkBelum ada peringkat

- Assignment Week 1Dokumen6 halamanAssignment Week 1Naveen TahilaniBelum ada peringkat

- Chapter 9Dokumen10 halamanChapter 9Caleb John SenadosBelum ada peringkat

- Accounting ExamDokumen7 halamanAccounting Examjerrytanny100% (1)

- SDRM CaseDokumen3 halamanSDRM Casejawid tabeshBelum ada peringkat

- Bond Valuation PDF With ExamplesDokumen17 halamanBond Valuation PDF With ExamplesAmar RaoBelum ada peringkat

- Stevenson 13e Chapter 4Dokumen28 halamanStevenson 13e Chapter 4----Belum ada peringkat

- 1 ++Marginal+CostingDokumen71 halaman1 ++Marginal+CostingB GANAPATHYBelum ada peringkat

- Leverage Season 1 Episode 1 (The Nigerian Job) : A. List of Observed Non-Compliance To EthicsDokumen2 halamanLeverage Season 1 Episode 1 (The Nigerian Job) : A. List of Observed Non-Compliance To EthicsJamaica DavidBelum ada peringkat

- Module 2. Cost-Volume-Profit AnalysisDokumen10 halamanModule 2. Cost-Volume-Profit AnalysisAnnalyn ArnaldoBelum ada peringkat

- Dokumen PDFDokumen21 halamanDokumen PDFMark AlcazarBelum ada peringkat

- Working Capital and Current Assets ManagementDokumen66 halamanWorking Capital and Current Assets ManagementElmer KennethBelum ada peringkat

- Ho3 Cash and Marketable Securities ManagementDokumen3 halamanHo3 Cash and Marketable Securities ManagementMae ShoppBelum ada peringkat

- A Case Study On Hershey'S Erp Implementation FailureDokumen10 halamanA Case Study On Hershey'S Erp Implementation FailureRushi NaikBelum ada peringkat

- Chapte R: Short-Term Finance and PlanningDokumen57 halamanChapte R: Short-Term Finance and PlanningMohammad Salim HossainBelum ada peringkat

- Financial Statements and Ratio Analysis: All Rights ReservedDokumen68 halamanFinancial Statements and Ratio Analysis: All Rights ReservedAshis Ur RahmanBelum ada peringkat

- Question Bank - Management Accounting-1Dokumen5 halamanQuestion Bank - Management Accounting-1Neel Kapoor50% (2)

- 3 - Discussion - Joint Products and ByproductsDokumen2 halaman3 - Discussion - Joint Products and ByproductsCharles TuazonBelum ada peringkat

- M00340020220114128M0034-PT11-12-The Expenditure CycleDokumen25 halamanM00340020220114128M0034-PT11-12-The Expenditure CycleriznaldoBelum ada peringkat

- Gitman pmf13 ppt08Dokumen70 halamanGitman pmf13 ppt08Ali SamBelum ada peringkat

- Solved ExercisesDokumen9 halamanSolved ExercisesKyle BroflovskiBelum ada peringkat

- The U.S Postal Service Case Study Q1Dokumen2 halamanThe U.S Postal Service Case Study Q1NagarajanRK100% (1)

- Gitman Pmf13 Ppt07 GEDokumen55 halamanGitman Pmf13 Ppt07 GEM Farhan Bhatti100% (1)

- Materials Inventory Cost Flow Using Moving Average MethodDokumen1 halamanMaterials Inventory Cost Flow Using Moving Average MethodEi HmmmBelum ada peringkat

- IAS 17 SummaryDokumen13 halamanIAS 17 SummaryAABelum ada peringkat

- Analyze Capital Structure Using EBIT-EPS AnalysisDokumen3 halamanAnalyze Capital Structure Using EBIT-EPS AnalysisJann KerkyBelum ada peringkat

- 2011-02-03 230149 ClarkupholsteryDokumen5 halaman2011-02-03 230149 ClarkupholsteryJesus Cardenas100% (1)

- Standard Cost and Components and Variance AnalysisDokumen7 halamanStandard Cost and Components and Variance AnalysisNaveen RajputBelum ada peringkat

- Business CombinationDokumen18 halamanBusiness CombinationJoynul AbedinBelum ada peringkat

- Overview of Financial MarketsDokumen15 halamanOverview of Financial MarketsDavidBelum ada peringkat

- Regal Marine Operations StrategyDokumen3 halamanRegal Marine Operations StrategyMichael HamerBelum ada peringkat

- Enterprise Resource Planning SystemsDokumen33 halamanEnterprise Resource Planning SystemsCarmina PanganBelum ada peringkat

- Variance Analysis 2 Way To 4 Way With NotesDokumen3 halamanVariance Analysis 2 Way To 4 Way With NotesAceeBelum ada peringkat

- Chapter 1 AuditingDokumen17 halamanChapter 1 AuditingMohamed DiabBelum ada peringkat

- ACC701Sem - Mid Exam RevisionDokumen4 halamanACC701Sem - Mid Exam RevisionUshra KhanBelum ada peringkat

- Distributions To Shareholders: Dividends and Share RepurchasesDokumen33 halamanDistributions To Shareholders: Dividends and Share RepurchasesPrincess EngresoBelum ada peringkat

- What Should Be The Fate of The Current Provisions Governing Joint Venture in The Forthcoming Revised Commercial Code of Ethiopia? Retention or Exclusion?Dokumen18 halamanWhat Should Be The Fate of The Current Provisions Governing Joint Venture in The Forthcoming Revised Commercial Code of Ethiopia? Retention or Exclusion?melewon2Belum ada peringkat

- Ifrs 15 Solutions Retail Consumer Industry PWCDokumen58 halamanIfrs 15 Solutions Retail Consumer Industry PWCjuna madeBelum ada peringkat

- Strategic Management Assessment Task 8: Market ResearchDokumen4 halamanStrategic Management Assessment Task 8: Market ResearchJes Reel100% (1)

- CA IPCC Cost Accounting Theory Notes On All Chapters by 4EG3XQ31Dokumen50 halamanCA IPCC Cost Accounting Theory Notes On All Chapters by 4EG3XQ31Bala RanganathBelum ada peringkat

- Managerial Accounting Absorption and Variable Costing 081712Dokumen14 halamanManagerial Accounting Absorption and Variable Costing 081712Mary Ann Jacolbe BaguioBelum ada peringkat

- CHAPTER I and IIDokumen13 halamanCHAPTER I and IIPritz Marc Bautista MorataBelum ada peringkat

- Quiz SIA - SolvedDokumen5 halamanQuiz SIA - SolvedShinta AyuBelum ada peringkat

- Financial Management: Week 10Dokumen10 halamanFinancial Management: Week 10sanjeev parajuliBelum ada peringkat

- Seatwork For BA202.SaturdayDokumen2 halamanSeatwork For BA202.SaturdayMelcanie Tiala YatBelum ada peringkat

- Cost Estimation Methods for ManagersDokumen41 halamanCost Estimation Methods for ManagersTuhin SamirBelum ada peringkat

- Ch04 Cost Volume Profit AnalysisDokumen21 halamanCh04 Cost Volume Profit Analysiszoe regina castroBelum ada peringkat

- Managerial AccountingDokumen10 halamanManagerial AccountingM HABIBULLAHBelum ada peringkat

- Ch04 Cost Volume Profit AnalysisDokumen21 halamanCh04 Cost Volume Profit AnalysisYee Sook Ying0% (1)

- Chapter 1 Cma IiDokumen23 halamanChapter 1 Cma IifirewBelum ada peringkat

- Lesson 1-3 Cost Behavior: Analysis and UseDokumen15 halamanLesson 1-3 Cost Behavior: Analysis and UseClaire BarbaBelum ada peringkat

- Managerial Accounting and Cost Concept Continuation Lesson Proper: The Analysis of Mixed CostsDokumen5 halamanManagerial Accounting and Cost Concept Continuation Lesson Proper: The Analysis of Mixed CostsStephanie AndalBelum ada peringkat

- Cost Behavior - Analysis and Use-1Dokumen83 halamanCost Behavior - Analysis and Use-1Sabbir ZisBelum ada peringkat

- Job Interview QuestionsDokumen5 halamanJob Interview QuestionsJoshua HinesBelum ada peringkat

- Divorce UnconstitutionalDokumen27 halamanDivorce UnconstitutionalJoshua HinesBelum ada peringkat

- The One That Got Away ChordsDokumen9 halamanThe One That Got Away ChordsJoshua HinesBelum ada peringkat

- Faber Drive When Im With You ChordsDokumen3 halamanFaber Drive When Im With You ChordsJoshua HinesBelum ada peringkat

- Managerial Accounting Chapter 4Dokumen3 halamanManagerial Accounting Chapter 4Joshua HinesBelum ada peringkat

- Case Study I PencilDokumen4 halamanCase Study I PencilJoshua HinesBelum ada peringkat

- Case 8 Philips in ChinaDokumen1 halamanCase 8 Philips in ChinaJoshua Hines0% (2)

- Leadership ModulesDokumen42 halamanLeadership ModulesJoshua HinesBelum ada peringkat

- The Man Who Cant Be Moved LyricsDokumen1 halamanThe Man Who Cant Be Moved LyricsJoshua HinesBelum ada peringkat

- Optimal Capital Structure for Campus DeliDokumen17 halamanOptimal Capital Structure for Campus DeliJoshua Hines100% (1)

- MA Course Requirement Chapter 1Dokumen4 halamanMA Course Requirement Chapter 1Joshua HinesBelum ada peringkat

- Managerial Accounting by Garrison Appendix 12B34 MASDokumen29 halamanManagerial Accounting by Garrison Appendix 12B34 MASJoshua Hines0% (1)

- Auditing Standards and Practices Council: Philippine Auditing Practice Statement 1000 Inter-Bank Confirmation ProceduresDokumen11 halamanAuditing Standards and Practices Council: Philippine Auditing Practice Statement 1000 Inter-Bank Confirmation ProceduresAbigael EsmenaBelum ada peringkat

- Managerial Accounting Chapter 5 by GarrisonDokumen4 halamanManagerial Accounting Chapter 5 by GarrisonJoshua Hines100% (1)

- Examples of Management ActivitiesDokumen1 halamanExamples of Management ActivitiesJoshua HinesBelum ada peringkat

- Examples of Management ActivitiesDokumen1 halamanExamples of Management ActivitiesJoshua HinesBelum ada peringkat

- Intro To Media LiteracyDokumen16 halamanIntro To Media LiteracyJeff CalaunanBelum ada peringkat

- Optimal Capital Structure for Campus DeliDokumen17 halamanOptimal Capital Structure for Campus DeliJoshua Hines100% (1)

- Republic Act No 7079Dokumen2 halamanRepublic Act No 7079Ronald QuilesteBelum ada peringkat

- activities.pdf თამაშები, ენერჯაიზერებიDokumen16 halamanactivities.pdf თამაშები, ენერჯაიზერებიPaata Alaverdashvili100% (1)

- New Government Accounting SystemDokumen15 halamanNew Government Accounting SystemJoshua HinesBelum ada peringkat

- How the SBA Budget Process WorksDokumen8 halamanHow the SBA Budget Process WorksJoshua HinesBelum ada peringkat

- Optimal Capital Structure for Campus DeliDokumen17 halamanOptimal Capital Structure for Campus DeliJoshua Hines100% (1)

- Leadership Manual 2011Dokumen67 halamanLeadership Manual 2011Joshua HinesBelum ada peringkat

- Sample EssaysDokumen16 halamanSample EssaysJoshua HinesBelum ada peringkat

- Optimal Capital Structure for Campus DeliDokumen17 halamanOptimal Capital Structure for Campus DeliJoshua Hines100% (1)

- Chapter 5 - Inventories and Related ExpensesDokumen13 halamanChapter 5 - Inventories and Related ExpensesJoshua HinesBelum ada peringkat

- ASEAN ArticleDokumen1 halamanASEAN ArticleJoshua HinesBelum ada peringkat

- Easy As ABC (Study Guide and Tips)Dokumen6 halamanEasy As ABC (Study Guide and Tips)Joshua HinesBelum ada peringkat

- Chennai Contact - 1Dokumen12 halamanChennai Contact - 1Jvr SubramaniaraajaaBelum ada peringkat

- The German Tradition of Psychology in Literature and Thought 1700-1840 PDFDokumen316 halamanThe German Tradition of Psychology in Literature and Thought 1700-1840 PDFerhan savasBelum ada peringkat

- Parameter ranges and attenuation values for RRH configurationsDokumen121 halamanParameter ranges and attenuation values for RRH configurationscharantejaBelum ada peringkat

- Metamorphic differentiation explainedDokumen2 halamanMetamorphic differentiation explainedDanis Khan100% (1)

- Study Guide For Kawabata's "Of Birds and Beasts"Dokumen3 halamanStudy Guide For Kawabata's "Of Birds and Beasts"BeholdmyswarthyfaceBelum ada peringkat

- Sensors & Accessories User ManualDokumen114 halamanSensors & Accessories User ManualAbrakain69Belum ada peringkat

- Digital Logic Technology: Engr. Muhammad Shan SaleemDokumen9 halamanDigital Logic Technology: Engr. Muhammad Shan SaleemAroma AamirBelum ada peringkat

- Schedule-of-rates-MI 2014-15Dokumen151 halamanSchedule-of-rates-MI 2014-15Vinisha RaoBelum ada peringkat

- Bushing Conductor TypesDokumen2 halamanBushing Conductor TypesSandeep BBelum ada peringkat

- CCTV Effectiveness in Reducing CrimeDokumen31 halamanCCTV Effectiveness in Reducing CrimeNeil Adonis UsaragaBelum ada peringkat

- MSS Command ReferenceDokumen7 halamanMSS Command Referencepaola tixeBelum ada peringkat

- Sally Su-Ac96e320a429130Dokumen5 halamanSally Su-Ac96e320a429130marlys justiceBelum ada peringkat

- Write EssayDokumen141 halamanWrite Essayamsyous100% (1)

- Nucor at A CrossroadsDokumen10 halamanNucor at A CrossroadsAlok C100% (2)

- Site Handover and Completion FormDokumen3 halamanSite Handover and Completion FormBaye SeyoumBelum ada peringkat

- Significance of Six SigmaDokumen2 halamanSignificance of Six SigmaShankar RajkumarBelum ada peringkat

- Work of Juan TamarizDokumen6 halamanWork of Juan Tamarizmrbookman3Belum ada peringkat

- Quarter 4 English 3 DLL Week 1Dokumen8 halamanQuarter 4 English 3 DLL Week 1Mary Rose P. RiveraBelum ada peringkat

- An Introduction To Software DevelopmentDokumen19 halamanAn Introduction To Software Developmentsanjeewani wimalarathneBelum ada peringkat

- Math 20-2 Unit Plan (Statistics)Dokumen4 halamanMath 20-2 Unit Plan (Statistics)api-290174387Belum ada peringkat

- Dealing in Doubt 2013 - Greenpeace Report On Climate Change Denial Machine PDFDokumen66 halamanDealing in Doubt 2013 - Greenpeace Report On Climate Change Denial Machine PDFŦee BartonBelum ada peringkat

- Amelia ResumeDokumen3 halamanAmelia Resumeapi-305722904Belum ada peringkat

- MNL036Dokumen22 halamanMNL036husni1031Belum ada peringkat

- No. of Periods UNIT - 1: Antenna FundamentalsDokumen8 halamanNo. of Periods UNIT - 1: Antenna Fundamentalsbotla yogiBelum ada peringkat

- W1 PPT ch01-ESNDokumen21 halamanW1 PPT ch01-ESNNadiyah ElmanBelum ada peringkat

- Parallel Merge Sort With MPIDokumen12 halamanParallel Merge Sort With MPIIrsa kanwallBelum ada peringkat

- FPGA Based Digital Electronic Education, Data Entry Organization For A CalculatorDokumen5 halamanFPGA Based Digital Electronic Education, Data Entry Organization For A CalculatorAkhilBelum ada peringkat

- MEM - Project Pump and TurbineDokumen22 halamanMEM - Project Pump and TurbineAbhi ChavanBelum ada peringkat

- Jene Sys 2016 ApplicationformDokumen4 halamanJene Sys 2016 ApplicationformReva WiratamaBelum ada peringkat

- Stages On The Empirical Program of RelativismDokumen9 halamanStages On The Empirical Program of RelativismJorge Castillo-SepúlvedaBelum ada peringkat