Answer

Diunggah oleh

Nitesh Agrawal0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

8 tayangan1 halamansacvvvdva

Hak Cipta

© © All Rights Reserved

Format Tersedia

DOCX, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen Inisacvvvdva

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

8 tayangan1 halamanAnswer

Diunggah oleh

Nitesh Agrawalsacvvvdva

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 1

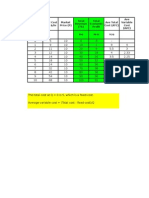

a)weighted-average shares outstanding for 2015.

= (670000*2)*(2/12) = (602,800*2)*(3/12) + 1,205,600*(5/12) + 1,433,600*(2/12)

= 1266000

b)Basic EPS for 2015 = Net Income-preferred dividend/ weighted-average shares

outstanding

= (2800000-84000)/1266000

= 2.15 per share

c)

Incremental EPS in Case of Preference Share Conversion = (1050000*8%)/210000

= 0.40 per share --------------2nd Rank

.

Note:-Assuming Conversion ratio = 1:1

..

..

Incremental EPS in Case of Options Conversion = 0/Free no. of Shares

= 0/15000

= 0 per share --------- 1st rank

.

Note:Free no.of shares in Options =90000 - (90000*25)/30

= 15000 shares

Dilution Test:After adjusting options:EPS = (2800000+0)/(1266000+15000)

= 2.19 per share

..

After Adjusting preference shares:EPS = (2800000+84000)/(1266000+15000+210000)

= 1.93 per share

..

Both the Instruments are dilutive.

,,

Therefore, Diluted EPS = 1.93 per share

..

Anda mungkin juga menyukai

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- 13 MBS Direct - International Accounting, 7 - eDokumen1 halaman13 MBS Direct - International Accounting, 7 - eNitesh AgrawalBelum ada peringkat

- 1 2Dokumen3 halaman1 2Nitesh AgrawalBelum ada peringkat

- Total Hourly Output & Sales of Pizzas: This Is Where I'm at With It Please Help! Thank YouDokumen2 halamanTotal Hourly Output & Sales of Pizzas: This Is Where I'm at With It Please Help! Thank YouNitesh AgrawalBelum ada peringkat

- SolutionsDokumen30 halamanSolutionsNitesh AgrawalBelum ada peringkat

- (Ch12) (ECON203) (ReviewQuestions) With AnswersDokumen3 halaman(Ch12) (ECON203) (ReviewQuestions) With AnswersNitesh AgrawalBelum ada peringkat

- Innovative HR PracticesDokumen6 halamanInnovative HR PracticesRukmini GottumukkalaBelum ada peringkat

- FIN 534 Week 2 Chapter 3 SolutionDokumen3 halamanFIN 534 Week 2 Chapter 3 SolutionNitesh AgrawalBelum ada peringkat

- Homework Week5Dokumen5 halamanHomework Week5Nitesh AgrawalBelum ada peringkat

- CH13 (5 Questions)Dokumen4 halamanCH13 (5 Questions)Nitesh Agrawal50% (2)

- Chap 014Dokumen67 halamanChap 014Nitesh Agrawal100% (2)

- Tax Return ProjectDokumen2 halamanTax Return ProjectNitesh AgrawalBelum ada peringkat

- Toyota Camry Honda Accord Salvage Value: Since Ford Fusion Has Better Benefit Cost Ratio. Hence It Should Be BoughtDokumen2 halamanToyota Camry Honda Accord Salvage Value: Since Ford Fusion Has Better Benefit Cost Ratio. Hence It Should Be BoughtNitesh AgrawalBelum ada peringkat

- Case6 AnswersDokumen7 halamanCase6 AnswersNitesh Agrawal100% (1)

- FirstlyDokumen1 halamanFirstlyNitesh AgrawalBelum ada peringkat

- Total Output & Sales Per Hour (Q) Total Cost (TC) $/HR Market Price (P) Total Revenue (TR) Total Economic Profit Ave Total Cost (ATC) Ave Variable Cost (AVC)Dokumen2 halamanTotal Output & Sales Per Hour (Q) Total Cost (TC) $/HR Market Price (P) Total Revenue (TR) Total Economic Profit Ave Total Cost (ATC) Ave Variable Cost (AVC)Nitesh AgrawalBelum ada peringkat

- In$ In$ 2011 DTA DTL DTA DTLDokumen3 halamanIn$ In$ 2011 DTA DTL DTA DTLNitesh AgrawalBelum ada peringkat

- C. If Selling Price in Year 1 Remains at $10 Per Unit, How Many Units Must Be Sold in Year 1 For The Operating Profit To Be $200,000?Dokumen1 halamanC. If Selling Price in Year 1 Remains at $10 Per Unit, How Many Units Must Be Sold in Year 1 For The Operating Profit To Be $200,000?Nitesh AgrawalBelum ada peringkat

- AssignmentDokumen8 halamanAssignmentNitesh AgrawalBelum ada peringkat

- 4,5,6Dokumen6 halaman4,5,6Nitesh AgrawalBelum ada peringkat

- 1Dokumen2 halaman1Nitesh AgrawalBelum ada peringkat

- Assignment Sem 2 2015Dokumen3 halamanAssignment Sem 2 2015Nitesh AgrawalBelum ada peringkat

- 1Dokumen2 halaman1Nitesh AgrawalBelum ada peringkat

- WK4 Acc WKDokumen57 halamanWK4 Acc WKNitesh AgrawalBelum ada peringkat

- Solution 5Dokumen10 halamanSolution 5Nitesh AgrawalBelum ada peringkat

- QuestionDokumen1 halamanQuestionNitesh AgrawalBelum ada peringkat

- 1 Practice-QDokumen1 halaman1 Practice-QNitesh AgrawalBelum ada peringkat

- AnswerDokumen1 halamanAnswerNitesh AgrawalBelum ada peringkat

- Che 330 Fall 2015 Hw5 Due: Oct 4: WWW - Hse.Gov - Uk/Research/Rrpdf/Rr615 PDFDokumen1 halamanChe 330 Fall 2015 Hw5 Due: Oct 4: WWW - Hse.Gov - Uk/Research/Rrpdf/Rr615 PDFNitesh AgrawalBelum ada peringkat

- Che 330 Fall 2015 Hw5 Due: Oct 4: WWW - Hse.Gov - Uk/Research/Rrpdf/Rr615 PDFDokumen1 halamanChe 330 Fall 2015 Hw5 Due: Oct 4: WWW - Hse.Gov - Uk/Research/Rrpdf/Rr615 PDFNitesh AgrawalBelum ada peringkat

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)