Hra Form

Diunggah oleh

pk2varmaDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Hra Form

Diunggah oleh

pk2varmaHak Cipta:

Format Tersedia

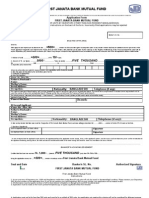

SAIL/BOKARO STEEL PLANT

FINANCE AND ACCOUNTS DEPART DECL NO.

PAY ACCOUNTS SECTION

(To be filled by Pay Acctts)

INCOME-TAX DECLARATION FORM FOR HOUSE PROPERTY

FOR THE FINANCIAL YEAR 200 -200

1.

NAME-

2.

DEPTT.

3.

ADDRESS OF THE HOUSE PROP4.

FOR INCOME TAX REBATE

RESIDENTIAL ADDRESS

5.

7.

STAFF NO:

6.

DATE OF WITHDRAWL OF LOA8.

PAN:

WHETHER LOAN FROM BSL/BANK

9.

DATE OF ACQUISITION /COMP10.

OF HOUSE:

YEARLY RE-PAYMENT:

Total:

a) PRINCIPAL : Rs.

a) INTEREST: Rs.

PLACE:

DATE:

SIGNATURE OF THE EMPLOYEE

VERIFICATION

I,

DO HEREBY DECLARE THAT THE HOUSE INDICATD AT SL. NO.3 OF THE ABOVE FORMAT IS

OCCUPIED BY ME FOR MY OWN PURPOSE AND THE INCOME FROM WHICH IS NIL. IN CASE THE PRESENT

STATUS IS CHANGED SUBSEQUENTLY, I SHALL DECLARE THE SAME IMMEDIATELY AND ALSO INTIMATE

THE INCOME, IF ANY, FAILING WHICH I SHALL BE HELD PERSONNALY RESPONSIBLE AND LIABLE AS AN

ASSESSEE BEFORE INCOME TAX AUTHORITIES. FURTHER THE STATEMENT GIVEN ABOVE IS TRUE TO THE

BEST OF MY KNOWLEDGE AND BELIEF.

PLACE:

DATE

SIGNATURE OF THE EMPLOYEE

NOTE:

1.

IF THE HOUSE HAS BEEN PURCHASED UNDER HOUSE LEASING SCHEME, A PHOTOCOPY OF THE OCCUPATION

REPORT UNDER HOUSE LEASING SCHEME SHOULD BE ATTACHED.

2.

IF THE HOUSE HAS BEEN CONSTRUCTED, THE PHOTOCOPY OF THE HOUSE COMPLETION CERTIFICATE ISSUED

BY THE COMPETENT AUTHORITY (MUNICIPALITY/CIRCLE OFFICER OR MUKHIYA AS THE CASE MAY BE) IS TO

BE ATTACHED.

3.

IF THE READYMADE HOUSE HAS BEEN PURCHASED , PHOTOCOPY OF THE HANDING OVER AND TAKING

OVER OF THE POSSESSION OF THE HOUSE ISSUED BY THE COMPETENT AUTHORITY IS TO BE ATTACHED.

4.

IN CASE, LOAN HAS BEEN TAKEN FROM THE BANK ETC.(OTHER THAN LOAN FROM SAIL/BSL), ORIGINAL

CERTIFICATE ISSUED BY THE CONCERNED BANK/AGENCY REGARDING REPAYMENT OF PRINCIPAL AND

INTEREST IS TO BE ATTACHED ALONGWITH THE DECLARATION FORM. IN CASE LOAN HAS BEEN TAKEN

FROM SAIL/BSL, DECLARATION IS TO BE SUBMITTED ALONGWITH COMPLETION/OCCUPATION CERTIFICATE.

5.

IN CASE AN EMPLOYEE IS HAVING MORE THAN ONE HOUSE IN HIS OWN NAME, HE SHOULD SUBMIT

DECLARATION IN PAY ACCOUNTS SECTION IN RESPECT OF ONE HOUSE ONLY WHICH IS OCCUPIED BY HIM.

THE MOMENT THE SAID HOUSE PROPERTY IS LET OUT, IT BECOMES THE ONUS OF THE EMPLOYEE TO DECLARE

THE INCOME IMMEDIATELY.

6.

THE LAST DATE FOR SUBMISSION OF THIS DECLARATION FORM IS 5TH OF EVERY MONTH. NO DECLARATION

SHALL BE ACCEPTED AFTER 5TH OF JAN'09.

7.

8.

APPLICATION WITHOUT VALID SUPPORTING DOCUMENTS WILL NOT BE COSIDERED.

THE ENTIRE RESPOSIBILITY REGARDING THE CORRECTNESS OF THIS DECLARATION FORM LIES WITH THE

EMPLOYEE CONCERNED.

Anda mungkin juga menyukai

- Document ChecklistDokumen2 halamanDocument ChecklistSuresh IndhumathiBelum ada peringkat

- Assets Liabilities Statments - F - 349 For GuarantorDokumen8 halamanAssets Liabilities Statments - F - 349 For GuarantorSubbu75% (4)

- (See para 9) : (Form A)Dokumen6 halaman(See para 9) : (Form A)RixinayBelum ada peringkat

- AFCL Other FormDokumen3 halamanAFCL Other FormihshourovBelum ada peringkat

- Basic Requirements and Procedure in Registering A CorporationDokumen3 halamanBasic Requirements and Procedure in Registering A CorporationAnnie Lara BarzagaBelum ada peringkat

- Commoditites Account Opening FormDokumen22 halamanCommoditites Account Opening Formabdulrehman akhtarBelum ada peringkat

- Customer Relationship Form: Securities LimitedDokumen24 halamanCustomer Relationship Form: Securities Limitedsyed kamalBelum ada peringkat

- Name Change Request Form: Folio NoDokumen2 halamanName Change Request Form: Folio NoMohan PvdvrBelum ada peringkat

- Isr Guidance and Forms TPLDokumen11 halamanIsr Guidance and Forms TPLParag SaxenaBelum ada peringkat

- Notice To Shareholders To Update KYC DetailsDokumen229 halamanNotice To Shareholders To Update KYC Detailskanianbalayam1983Belum ada peringkat

- Appication For Authority To Print Receipts and Invoices: Jeth Printing Press - Ubando, Ernesto IDokumen1 halamanAppication For Authority To Print Receipts and Invoices: Jeth Printing Press - Ubando, Ernesto IKristina Lourdes TaguraBelum ada peringkat

- Documents Required For Registration Under Service TaxDokumen7 halamanDocuments Required For Registration Under Service TaxVinay SinghBelum ada peringkat

- SaharaRefundFormEnglish PDFDokumen2 halamanSaharaRefundFormEnglish PDFPrashantUpadhyayBelum ada peringkat

- Form CDokumen2 halamanForm CnthyagarajBelum ada peringkat

- Checklist - Purchase of Flat or ConstructionDokumen4 halamanChecklist - Purchase of Flat or ConstructionUdhasu PatkarBelum ada peringkat

- Chinabank Home Loan Updated List of Requirements - 2023Dokumen2 halamanChinabank Home Loan Updated List of Requirements - 2023ANDI CastroBelum ada peringkat

- Opinion - Setting-Up of Holding CorporationDokumen6 halamanOpinion - Setting-Up of Holding CorporationJustin LoredoBelum ada peringkat

- Placer County Fictitious Business NameDokumen2 halamanPlacer County Fictitious Business NameSierra Nevada Media Group100% (1)

- Form 10 ADokumen2 halamanForm 10 ABabu Jamal KhanBelum ada peringkat

- Part A: Application Form For Issue / Modification in Importer Exporter Code Number (IEC)Dokumen8 halamanPart A: Application Form For Issue / Modification in Importer Exporter Code Number (IEC)sivapathasekaranBelum ada peringkat

- ZPPF Closer ApplicationDokumen6 halamanZPPF Closer ApplicationgsreddyBelum ada peringkat

- Indian Overseas Bank ..BranchDokumen6 halamanIndian Overseas Bank ..Branchanwarali1975Belum ada peringkat

- CBZDokumen6 halamanCBZPatrick MukoyiBelum ada peringkat

- But With Annotation of Mortgage in Favor of Sps. Santos Not Acceptable If Seller's Property Is STILL Mortgaged To 3rd Party (Sps. Santos)Dokumen2 halamanBut With Annotation of Mortgage in Favor of Sps. Santos Not Acceptable If Seller's Property Is STILL Mortgaged To 3rd Party (Sps. Santos)Larry Calata AlicumanBelum ada peringkat

- List of Requirements Prior Turn inDokumen1 halamanList of Requirements Prior Turn indavid durianBelum ada peringkat

- 1 MPB-501 - Application For Pension 2 MPC - 60Dokumen10 halaman1 MPB-501 - Application For Pension 2 MPC - 60Anitha Mary DambaleBelum ada peringkat

- PartialwithdrawalformDokumen5 halamanPartialwithdrawalformchavalisaikamesh6Belum ada peringkat

- Form-A: - Joint Photograph of Both The Depositor & Spouse in Case of A Joint AccountDokumen13 halamanForm-A: - Joint Photograph of Both The Depositor & Spouse in Case of A Joint AccountVenkateshBelum ada peringkat

- Form 19Dokumen4 halamanForm 19Jagadeesan100% (1)

- Particulars Required For NOCDokumen3 halamanParticulars Required For NOCSathish JayaprakashBelum ada peringkat

- Form of Application For Final Payment of Genmeral Provident Fund BalanceDokumen7 halamanForm of Application For Final Payment of Genmeral Provident Fund Balancegggsss57Belum ada peringkat

- Housing Loand Persmission FormDokumen8 halamanHousing Loand Persmission FormK.SuganyaBelum ada peringkat

- UTI Change of Bank Revised FormDokumen2 halamanUTI Change of Bank Revised FormParul KumarBelum ada peringkat

- CertificateDokumen829 halamanCertificatemarcopqBelum ada peringkat

- House Building AdvanceDokumen17 halamanHouse Building AdvanceavratnamBelum ada peringkat

- SCSS ApplicationDokumen3 halamanSCSS ApplicationSravya MeghanaBelum ada peringkat

- Change of Bank Without Existing Bank Proof FormDokumen2 halamanChange of Bank Without Existing Bank Proof FormAmit GokhaleBelum ada peringkat

- FormjDokumen1 halamanFormjDimple ChawlaBelum ada peringkat

- GPF Nra FormDokumen5 halamanGPF Nra Formsatee7596Belum ada peringkat

- Document Checklist For NRI Car Loan PDFDokumen1 halamanDocument Checklist For NRI Car Loan PDFarunkumarBelum ada peringkat

- Circular Ay 2010 11Dokumen4 halamanCircular Ay 2010 11shaitankhopriBelum ada peringkat

- Accommodation FormDokumen2 halamanAccommodation Formsunny09vinaykumarBelum ada peringkat

- The South Indian Bank LTD.: Head Office: ThrissurDokumen4 halamanThe South Indian Bank LTD.: Head Office: Thrissursurya managementBelum ada peringkat

- BDO PersonalLoanAKAppliFormDokumen4 halamanBDO PersonalLoanAKAppliFormAirMan ManiagoBelum ada peringkat

- JB 1st M.F - RBDokumen3 halamanJB 1st M.F - RBsalmanaeyshaBelum ada peringkat

- INE 366I01010: VRL Logistics LimitedDokumen2 halamanINE 366I01010: VRL Logistics LimitednavaremandarBelum ada peringkat

- Boi Mutual FundDokumen12 halamanBoi Mutual FundSwapnil RahaneBelum ada peringkat

- Checklistchange DOBDokumen2 halamanChecklistchange DOBGodwin JumboBelum ada peringkat

- Premier Cement Mills Limited: Application FormDokumen1 halamanPremier Cement Mills Limited: Application FormFaruque AhmedBelum ada peringkat

- Procedure For Issueof Duplicate Share CertificateDokumen5 halamanProcedure For Issueof Duplicate Share CertificateKrunalBelum ada peringkat

- Guidelines For RemisiersDokumen15 halamanGuidelines For Remisierssantosh.pw4230Belum ada peringkat

- Response To ClaimDokumen8 halamanResponse To ClaimwinnieBelum ada peringkat

- Expression of Interest - ImperiaDokumen3 halamanExpression of Interest - ImperiacubadesignstudBelum ada peringkat

- Form ISR - 1: Request For Registering Pan, Kyc Details or Changes / Updation ThereofDokumen4 halamanForm ISR - 1: Request For Registering Pan, Kyc Details or Changes / Updation ThereofSreejith SasidharanBelum ada peringkat

- Employee's Provident Fund Scheme 1952: Form 31Dokumen5 halamanEmployee's Provident Fund Scheme 1952: Form 31penusilaBelum ada peringkat

- IEPF Refund Procedure PDFDokumen6 halamanIEPF Refund Procedure PDFChandan GuptaBelum ada peringkat

- Action To Be Taken by The spouse/NOK On Demise of PensionerDokumen9 halamanAction To Be Taken by The spouse/NOK On Demise of PensionerHeena RamachandranBelum ada peringkat

- Drafting Applications Under CPC and CrPC: An Essential Guide for Young Lawyers and Law StudentsDari EverandDrafting Applications Under CPC and CrPC: An Essential Guide for Young Lawyers and Law StudentsPenilaian: 5 dari 5 bintang5/5 (4)

- Drafting Written Statements: An Essential Guide under Indian LawDari EverandDrafting Written Statements: An Essential Guide under Indian LawBelum ada peringkat

- Heep 103Dokumen5 halamanHeep 103pk2varmaBelum ada peringkat

- Questions - Metals & Non - MetalsDokumen6 halamanQuestions - Metals & Non - MetalsJohn RajeshBelum ada peringkat

- Heep 113Dokumen4 halamanHeep 113pk2varmaBelum ada peringkat

- Heep 111Dokumen7 halamanHeep 111pk2varma0% (1)

- Heep 109Dokumen6 halamanHeep 109pk2varmaBelum ada peringkat

- Heep 116Dokumen7 halamanHeep 116pk2varmaBelum ada peringkat

- Heep 118Dokumen6 halamanHeep 118pk2varmaBelum ada peringkat

- Heep 102Dokumen6 halamanHeep 102pk2varmaBelum ada peringkat

- Heep 106Dokumen7 halamanHeep 106pk2varmaBelum ada peringkat

- Heep 107Dokumen3 halamanHeep 107pk2varmaBelum ada peringkat

- CoilerDokumen2 halamanCoilerpk2varmaBelum ada peringkat

- Friction: Ultiple Hoice UestionsDokumen5 halamanFriction: Ultiple Hoice Uestionspk2varmaBelum ada peringkat

- Reaching The Age of Adolescence: Ultiple Hoice UestionsDokumen8 halamanReaching The Age of Adolescence: Ultiple Hoice Uestionspk2varmaBelum ada peringkat