Soal Mid Resiko

Diunggah oleh

Ginanjar AgungHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Soal Mid Resiko

Diunggah oleh

Ginanjar AgungHak Cipta:

Format Tersedia

MID TEST FOR BILINGUAL CLASS

1. Assume that you are considering selecting assets from among the following

four candidates:

Market

Condition

Good

Average

Poor

Market

Condition

Good

Average

Poor

Assume that

Asset 1

Return

16

12

8

Asset 3

Return

Probability

0.25

0.5

0.25

Market

Condition

Good

Average

Poor

Assets 2

Return

Probability

4

6

8

0.25

0.5

0.25

Assets 4

Market

Return

Condition

20

0.25

Good

16

14

0.5

Average

12

8

0.25

Poor

8

there is no relationship for each investment (Assets)

Probability

Probability

1/3

1/3

1/3

a. Solve for the expected return and standard deviation of return for each

separated investment.

b. Make 6 portfolios for 2 combination assets with the same portions invested in

each asset (50%) and solve for expected return portfolio and variance of each

of the portfolios

2. Assume that you are considering selecting investment for 2 projects A and B

with the same economic years (3 years) and Initial outlay (2000). Interest

rate for each project is 20%. Probability distribution and cash flows for both

project are:

Year

1

A Project

Cash flow

800

900

1200

1400

900

1000

1300

1500

1000

1200

1500

1600

Probability

0.20

0.30

0.40

0.10

0.15

0.25

0.30

0.30

0.20

0.25

0.30

0.25

year

1

B Project

Cash flow

1000

1200

1300

1400

1100

1300

1400

1500

1200

1300

1500

1600

Probability

0.1

0.3

0.2

0.4

0.1

0.25

0.4

0.25

0.2

0.2

0.35

0.25

Question:

a. Solve for the Expected Net Present Value and standard deviation of each

project

b. Where is the more feasible value between A and B

Anda mungkin juga menyukai

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- TQM (Tourism)Dokumen16 halamanTQM (Tourism)Sean ChuaBelum ada peringkat

- Amena Akter Mim 1620741630 - SCM 320 Individual Assignment 1Dokumen10 halamanAmena Akter Mim 1620741630 - SCM 320 Individual Assignment 1amena aktar MimBelum ada peringkat

- Factors Affecting IHRMDokumen2 halamanFactors Affecting IHRMSamish ChoudharyBelum ada peringkat

- Subrata Sarkar ECLDokumen3 halamanSubrata Sarkar ECLRick RoyBelum ada peringkat

- How To Test Banking Domain Applications: A Complete BFSI Testing GuideDokumen52 halamanHow To Test Banking Domain Applications: A Complete BFSI Testing GuideMamatha K NBelum ada peringkat

- Plag 16-40 PDFDokumen18 halamanPlag 16-40 PDFSarthak BharsakaleBelum ada peringkat

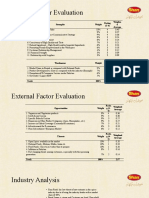

- Internal Factor Evaluation: Strengths Weight Rating (3-4) Weighte D AverageDokumen3 halamanInternal Factor Evaluation: Strengths Weight Rating (3-4) Weighte D AverageHira NazBelum ada peringkat

- Implementation Guide 1120: Standard 1120 - Individual ObjectivityDokumen5 halamanImplementation Guide 1120: Standard 1120 - Individual ObjectivityGemanta Furi BangunBelum ada peringkat

- Ms Thesis Last Final FinalDokumen54 halamanMs Thesis Last Final FinalgizaskenBelum ada peringkat

- CHAPTER 10. Corporation TaxDokumen55 halamanCHAPTER 10. Corporation TaxAmanda RuseirBelum ada peringkat

- Old Bazaar Kiosk Monthly Basis: Aeon Mall Kuching CentralDokumen5 halamanOld Bazaar Kiosk Monthly Basis: Aeon Mall Kuching CentralM Florence IstemBelum ada peringkat

- Module Code: 19Mba509A Module Name: Strategic Management Programme: Mba Department: FMC Faculty: Management and CommerceDokumen29 halamanModule Code: 19Mba509A Module Name: Strategic Management Programme: Mba Department: FMC Faculty: Management and CommerceannetteBelum ada peringkat

- Program Conducted by Institute Related To IPR, Entrepreneurship / Start-Ups & InnovationDokumen26 halamanProgram Conducted by Institute Related To IPR, Entrepreneurship / Start-Ups & InnovationDaisy Arora KhuranaBelum ada peringkat

- B-UBP-MM7 - KFTD UAT Warehouse Management I UBP V1Dokumen16 halamanB-UBP-MM7 - KFTD UAT Warehouse Management I UBP V1alfauzanBelum ada peringkat

- Module 2 Lesson 1 Answer Sheet Tmelect1Dokumen6 halamanModule 2 Lesson 1 Answer Sheet Tmelect1John Ariel Labnao Gelbolingo67% (3)

- Fedex Masters ThesisDokumen7 halamanFedex Masters Thesiscrystalalvarezpasadena100% (1)

- Approaches To Measure Cost of Quality: C 0revention-Appraisal-Failure ,-+ "! & .& /01 2 && 3Dokumen6 halamanApproaches To Measure Cost of Quality: C 0revention-Appraisal-Failure ,-+ "! & .& /01 2 && 3sanyasamBelum ada peringkat

- PHL 318 Exam 2 Study Guide-1Dokumen2 halamanPHL 318 Exam 2 Study Guide-1Hunter FougnerBelum ada peringkat

- Sales of Goods ActDokumen56 halamanSales of Goods ActCharu ModiBelum ada peringkat

- 1.5.6 Resultados Del Test de Estilo de EmprendedorDokumen5 halaman1.5.6 Resultados Del Test de Estilo de EmprendedorGFranco BlancasBelum ada peringkat

- Full Operations Management 6Th Edition Test Bank Nigel Slack PDF Docx Full Chapter ChapterDokumen23 halamanFull Operations Management 6Th Edition Test Bank Nigel Slack PDF Docx Full Chapter Chaptersuavefiltermyr62100% (28)

- Day 3Dokumen34 halamanDay 3Adrianne Aldrin AlarcioBelum ada peringkat

- Hopfloor: Mandate Trade UnionDokumen36 halamanHopfloor: Mandate Trade UnionGugutza DoiBelum ada peringkat

- Manage Security Agency Within Legal Framework - Rev.1Dokumen44 halamanManage Security Agency Within Legal Framework - Rev.1Vksathiamoorthy KrishnanBelum ada peringkat

- Let's Create Local and Global Ads: Activity 2: Home Business! Lead inDokumen3 halamanLet's Create Local and Global Ads: Activity 2: Home Business! Lead inwendy barillasBelum ada peringkat

- Hesham Saafan - MSC - CPL - Othm: ContactDokumen3 halamanHesham Saafan - MSC - CPL - Othm: Contactnemoo80 nemoo90Belum ada peringkat

- mgt613 Mega Files of McqsssDokumen203 halamanmgt613 Mega Files of McqsssSalman SikandarBelum ada peringkat

- BI1001268978 - 1800792430MHC12023 - 06062023 - 1421 (1) MaxicareDokumen1 halamanBI1001268978 - 1800792430MHC12023 - 06062023 - 1421 (1) MaxicareJanet CafrancaBelum ada peringkat

- Tsedale & Asrat Wood & Metal Work Micro EnterpriseDokumen8 halamanTsedale & Asrat Wood & Metal Work Micro EnterpriseAbiot Asfiye GetanehBelum ada peringkat

- Problem #7: Recording Transactions in A Financial Transaction WorksheetDokumen17 halamanProblem #7: Recording Transactions in A Financial Transaction Worksheetfabyunaaa100% (1)