Comparing Investments - An Example: D E A F B C

Diunggah oleh

kauti0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

10 tayangan1 halamanThis document compares the expected returns, risks, and utilities of six potential investments A-F. It shows the probability and return outcomes for each investment. Investment E has the highest expected return at 12.5% and investment B has the highest expected utility at 10.4881. The document also includes charts showing the utility and marginal utility curves for a $100 investment with a square root utility function.

Deskripsi Asli:

Utility Exam

Judul Asli

Utility Exam

Hak Cipta

© © All Rights Reserved

Format Tersedia

PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniThis document compares the expected returns, risks, and utilities of six potential investments A-F. It shows the probability and return outcomes for each investment. Investment E has the highest expected return at 12.5% and investment B has the highest expected utility at 10.4881. The document also includes charts showing the utility and marginal utility curves for a $100 investment with a square root utility function.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

10 tayangan1 halamanComparing Investments - An Example: D E A F B C

Diunggah oleh

kautiThis document compares the expected returns, risks, and utilities of six potential investments A-F. It shows the probability and return outcomes for each investment. Investment E has the highest expected return at 12.5% and investment B has the highest expected utility at 10.4881. The document also includes charts showing the utility and marginal utility curves for a $100 investment with a square root utility function.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 1

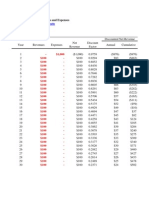

Comparing Investments - an example

Investment

Distribution

Return

Probability Return

Probability Return

Probability Return

Probability Return

Probability Return

Probability

8%

Expected return

Standard deviation of the return

10%

8.00%

8%

0.25

6%

0.5

10%

0.25

9%

0.25

10%

0.5

14%

0.5

12%

0.5

13%

0.5

12%

0.25

14%

0.25

15%

0.25

10.00%

10.00%

10.00%

12.00%

12.50%

0.00%

0.00%

1.414%

4.00%

1.414%

2.18%

Expected utility or the return*

10.3923

10.4881

10.4879

10.4864

10.5828

10.6061

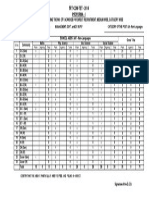

The dollar Return on $100

-25

W = Wo + Return = 100 + x

The Utility = U(W)

-20

-15

-10

-5

10

15

20

25

30

75

80

85

90

95

100

105

110

115

120

125

130

8.6603

8.9443

9.2195

9.4868

9.7468

10.0000

10.2470

10.4881

10.7238

10.9545

11.1803

11.4018

0.2840

0.2753

0.2673

0.2600

0.2532

0.2470

0.2411

0.2357

0.2306

0.2259

0.2214

The Marginal Utility

*Assumptions and Notation:

The initial wealth = Wo = $100

U(W) = W

11.50

The investment = $100

The dollar return = x

The final wealth = W = Wo + x

11.00

10.50

The utility function U(W) = W

10.00

9.50

9.00

8.50

70

75

80

85

90

95

100

105

110

115

120

125

130

135

W

Anda mungkin juga menyukai

- Capital X (Share of Gain) 10 Capital Y (Share of Gain) 5: Revaluation AccountDokumen2 halamanCapital X (Share of Gain) 10 Capital Y (Share of Gain) 5: Revaluation Accountzahid_mahmood3811Belum ada peringkat

- Assignment 2: Name: Saif Ali Momin Erp Id: 08003 Course: Business Finance IIDokumen39 halamanAssignment 2: Name: Saif Ali Momin Erp Id: 08003 Course: Business Finance IISaif Ali MominBelum ada peringkat

- Chapter 10: Uncertainty in Future EventsDokumen13 halamanChapter 10: Uncertainty in Future EventsKamBelum ada peringkat

- Finance - 1Dokumen7 halamanFinance - 1Corinne KellyBelum ada peringkat

- Excel 5Dokumen1 halamanExcel 5api-252707429Belum ada peringkat

- Sol5 13Dokumen28 halamanSol5 13Val Amiel MirandaBelum ada peringkat

- ENGR 301 - Assign4solnDokumen5 halamanENGR 301 - Assign4solnAP100% (1)

- Ce 11Dokumen8 halamanCe 11Christine AltamarinoBelum ada peringkat

- CFM4 Solns Chap 08Dokumen5 halamanCFM4 Solns Chap 08Sultan AlghamdiBelum ada peringkat

- Chapter 11Dokumen5 halamanChapter 11River Wu0% (1)

- DAYCODokumen4 halamanDAYCOAmarristas Puerto Blanco CalpeBelum ada peringkat

- CMCUni Chapter 13Dokumen78 halamanCMCUni Chapter 13Hiếu NguyễnBelum ada peringkat

- Coporate FinanceDokumen6 halamanCoporate Financeplayjake18Belum ada peringkat

- M1 - Risk & Return - Graded Quiz - Answer KeyDokumen4 halamanM1 - Risk & Return - Graded Quiz - Answer KeykhaledBelum ada peringkat

- MGRL ECON CHA 2Dokumen71 halamanMGRL ECON CHA 2Prasanna KumarBelum ada peringkat

- 01 DCF Valuation Exercises SolDokumen8 halaman01 DCF Valuation Exercises SolNeha JainBelum ada peringkat

- Tutorial 4 CHP 5 - SolutionDokumen6 halamanTutorial 4 CHP 5 - SolutionwilliamnyxBelum ada peringkat

- CA Final SFM Questions On Dividend Decision Prof Manish OW01JKS2Dokumen47 halamanCA Final SFM Questions On Dividend Decision Prof Manish OW01JKS2rahul100% (1)

- Risk Aversion and Capital AllocationDokumen5 halamanRisk Aversion and Capital AllocationPrince ShovonBelum ada peringkat

- Numerical Example:: Calculating Cost of CapitalDokumen5 halamanNumerical Example:: Calculating Cost of CapitalurdestinyBelum ada peringkat

- NPV and IRRDokumen7 halamanNPV and IRRWondim GenetBelum ada peringkat

- Analysis of Business Revenues and Expenses Over 30 YearsDokumen1 halamanAnalysis of Business Revenues and Expenses Over 30 YearsKneelBelum ada peringkat

- Business ValuationDokumen1 halamanBusiness Valuationdrs5542Belum ada peringkat

- Chapter 10Dokumen8 halamanChapter 10Natsu DragneelBelum ada peringkat

- Week 4 Application of AnnuitiesDokumen37 halamanWeek 4 Application of AnnuitiesDarkie DrakieBelum ada peringkat

- Corporate Finance Solution Chapter 6Dokumen9 halamanCorporate Finance Solution Chapter 6Kunal KumarBelum ada peringkat

- Practice Problems Ch12Dokumen57 halamanPractice Problems Ch12Kevin Baconga100% (2)

- WACC CalculatorDokumen11 halamanWACC CalculatorshountyBelum ada peringkat

- Financial ratios and bond valuation calculationsDokumen9 halamanFinancial ratios and bond valuation calculationsodie99Belum ada peringkat

- Capital Structure Changes and Duration AnalysisDokumen9 halamanCapital Structure Changes and Duration AnalysisKinBelum ada peringkat

- Time Value of MoneyDokumen20 halamanTime Value of MoneyAkashdeep SaxenaBelum ada peringkat

- Adding and Subtracting To 10 (A) : Calculate Each Sum or Difference. Score: /50Dokumen2 halamanAdding and Subtracting To 10 (A) : Calculate Each Sum or Difference. Score: /50Nur Maizatun AtmadiniBelum ada peringkat

- As Vertical 050 0110 0110 001Dokumen2 halamanAs Vertical 050 0110 0110 001Nur Maizatun AtmadiniBelum ada peringkat

- CH 15 SolDokumen4 halamanCH 15 SolSilviu TrebuianBelum ada peringkat

- Revenue Cost ProfitDokumen15 halamanRevenue Cost ProfitXelaBelum ada peringkat

- Engineering EconomyDokumen7 halamanEngineering EconomyBurn-Man Hiruma Villanueva100% (1)

- Capacity Planning InsightsDokumen13 halamanCapacity Planning InsightsSarsal6067Belum ada peringkat

- Vertical Analysis of A Balance SheetDokumen4 halamanVertical Analysis of A Balance SheetMary80% (5)

- TVM Problems Solved for NPV, PV, FV, Interest RatesDokumen19 halamanTVM Problems Solved for NPV, PV, FV, Interest RatesĐào Quốc AnhBelum ada peringkat

- Adding and Subtracting To 10 (C) : Calculate Each Sum or Difference. Score: /50Dokumen2 halamanAdding and Subtracting To 10 (C) : Calculate Each Sum or Difference. Score: /50Nur Maizatun AtmadiniBelum ada peringkat

- Corporate Valuation: Group - 2Dokumen6 halamanCorporate Valuation: Group - 2RiturajPaulBelum ada peringkat

- Robustness of The EOQ ModelDokumen1 halamanRobustness of The EOQ ModelPraf47100% (2)

- HW WK6Dokumen5 halamanHW WK6Kyle KanaBelum ada peringkat

- Cost-Volume-Profit Analysis and Planning: Mini ExercisesDokumen5 halamanCost-Volume-Profit Analysis and Planning: Mini ExercisespoollookBelum ada peringkat

- IE 343 Section 1 Engineering Economy Exam 1 Review Problems - SolutionDokumen6 halamanIE 343 Section 1 Engineering Economy Exam 1 Review Problems - SolutionSeb TegBelum ada peringkat

- Distribution InventoriesDokumen46 halamanDistribution InventoriesRajib SarkarBelum ada peringkat

- Damodaran On Valuation Lect5Dokumen7 halamanDamodaran On Valuation Lect5Keshav KhannaBelum ada peringkat

- Activity 6 Formula and Functions in Excel PDFDokumen3 halamanActivity 6 Formula and Functions in Excel PDFArklon N. PerezBelum ada peringkat

- Chapter 25: International Diversification: Problem SetsDokumen7 halamanChapter 25: International Diversification: Problem SetsMehrab Jami Aumit 1812818630Belum ada peringkat

- Chapter 07Dokumen10 halamanChapter 07Sadaf ZiaBelum ada peringkat

- Chapter 02 - How To Calculate Present ValuesDokumen15 halamanChapter 02 - How To Calculate Present ValuesShoaibTahirBelum ada peringkat

- Mini Case - Chapter 3Dokumen5 halamanMini Case - Chapter 3shivam1992Belum ada peringkat

- Solutions Manual to accompany Introduction to Linear Regression AnalysisDari EverandSolutions Manual to accompany Introduction to Linear Regression AnalysisPenilaian: 1 dari 5 bintang1/5 (1)

- Universities as Complex Enterprises: How Academia Works, Why It Works These Ways, and Where the University Enterprise Is HeadedDari EverandUniversities as Complex Enterprises: How Academia Works, Why It Works These Ways, and Where the University Enterprise Is HeadedBelum ada peringkat

- The xVA Challenge: Counterparty Credit Risk, Funding, Collateral and CapitalDari EverandThe xVA Challenge: Counterparty Credit Risk, Funding, Collateral and CapitalBelum ada peringkat

- Faster Disaster Recovery: The Business Owner's Guide to Developing a Business Continuity PlanDari EverandFaster Disaster Recovery: The Business Owner's Guide to Developing a Business Continuity PlanBelum ada peringkat

- J.K. Lasser's Guide to Self-Employment: Taxes, Strategies, and Money-Saving Tips for Schedule C FilersDari EverandJ.K. Lasser's Guide to Self-Employment: Taxes, Strategies, and Money-Saving Tips for Schedule C FilersBelum ada peringkat

- University of Hyderabad: General Category Reserved CategoriesDokumen1 halamanUniversity of Hyderabad: General Category Reserved CategorieskautiBelum ada peringkat

- Clearing and Settlement: Financial DerivativesDokumen24 halamanClearing and Settlement: Financial DerivativesAayush SharmaBelum ada peringkat

- Concession List NaturalDokumen7 halamanConcession List NaturalkautiBelum ada peringkat

- Hydrogen TwoDokumen6 halamanHydrogen TwokautiBelum ada peringkat

- Selected Thesis Topics 2014-2015Dokumen5 halamanSelected Thesis Topics 2014-2015Miguelo Malpartida BuenoBelum ada peringkat

- Accounting ConceptDokumen50 halamanAccounting Conceptrsal.284869430Belum ada peringkat

- Sri Venkateswara UniversityDokumen5 halamanSri Venkateswara UniversitykautiBelum ada peringkat

- Reve I W Questions Introduction To Economic UnderstandingDokumen2 halamanReve I W Questions Introduction To Economic UnderstandingkautiBelum ada peringkat

- How To Obtain A PHD in GermanyDokumen16 halamanHow To Obtain A PHD in GermanykautiBelum ada peringkat

- Business Sectors OverviewDokumen1 halamanBusiness Sectors OverviewkautiBelum ada peringkat

- Impact of Inflation IndianDokumen3 halamanImpact of Inflation IndiankautiBelum ada peringkat

- Glossary MonetraDokumen17 halamanGlossary MonetrakautiBelum ada peringkat

- June 2013 Final GCE Advanced Double Awards Including Applied SubjectsDokumen11 halamanJune 2013 Final GCE Advanced Double Awards Including Applied SubjectskautiBelum ada peringkat

- JFE10 Ugc NetDokumen49 halamanJFE10 Ugc NetkautiBelum ada peringkat

- School Assistant Non LanguagesDokumen1 halamanSchool Assistant Non LanguageskautiBelum ada peringkat

- S 17 13 III (Management)Dokumen32 halamanS 17 13 III (Management)kautiBelum ada peringkat

- Kadapa district SA Languages vacancies by medium, categoryDokumen1 halamanKadapa district SA Languages vacancies by medium, categorykautiBelum ada peringkat

- 01 - Basic UnixDokumen43 halaman01 - Basic UnixkautiBelum ada peringkat

- SAS Programming II: Manipulating Data With The DATA Step: Course DescriptionDokumen3 halamanSAS Programming II: Manipulating Data With The DATA Step: Course DescriptionkautiBelum ada peringkat

- Financial Institutions, Markets, and Money, 9 Edition: Power Point Slides ForDokumen23 halamanFinancial Institutions, Markets, and Money, 9 Edition: Power Point Slides ForkautiBelum ada peringkat

- British Council Entry Procedure January 2016Dokumen2 halamanBritish Council Entry Procedure January 2016kautiBelum ada peringkat

- General Securities Representative Qualification Examination (Series 7)Dokumen46 halamanGeneral Securities Representative Qualification Examination (Series 7)kautiBelum ada peringkat

- Rates Revision NotesDokumen1 halamanRates Revision NoteskautiBelum ada peringkat

- The Search For Persistence: Is Past Performance Related To Future Performance?Dokumen2 halamanThe Search For Persistence: Is Past Performance Related To Future Performance?kautiBelum ada peringkat

- Money Market ReformDokumen6 halamanMoney Market ReformkautiBelum ada peringkat

- Interview QuestionsDokumen1 halamanInterview QuestionskautiBelum ada peringkat

- International Exam FaqDokumen4 halamanInternational Exam FaqckrishnaBelum ada peringkat

- Grade 7 Solving Percent ProblemsDokumen9 halamanGrade 7 Solving Percent ProblemskautiBelum ada peringkat

- Biological KnowledgeDokumen1 halamanBiological KnowledgekautiBelum ada peringkat