Iconix Note 20151229 PDF

Diunggah oleh

moonflye8222Deskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Iconix Note 20151229 PDF

Diunggah oleh

moonflye8222Hak Cipta:

Format Tersedia

CRT Research | Credit Intensive and

Special Situations

Kevin Starke

(203) 569-6421 kstarke@crtllc.com

Managing Director

Patrick Marshall

(203) 569-4373 pmarshall@crtllc.com

Research Associate

Iconix Brand Group Inc

(ICON, NR, PT: None, Close: $5.67)

Company Note

NR - PT: None

ICON: Another Blow to Confidence Before Exiting 2015

December

December

29,29,

2015

2015

The announcement of a formal SEC investigation increases the steepness and slipperiness of the slope on

which ICON has been treading since it announced the comment letter process in early August.

Bankruptcy risk has been introduced into the equation, and longer-dated bonds trading in the 50s are the

market's verification of this point.

Yes it may still be able to get a refinancing done, but the cost of that financing could singlehandedly crush

free cash flow yield, by at least one conservative measure.

This could undermine the speculative attraction of the stock unless it breaches the key $5 trading level, at

which stocks typically lose a lot of institutional investor support.

In this note, we provide context on ICON against other stocks under SEC investigation, as well as context on

its other legal distractions, including two disputes with trade partners that may be indicative of a house in

disarray.

Iconix Brand Group Inc. (ICON, or the Company) yesterday dropped the third in a series of 2015 bombshells on

the market in the waning days of the year, announcing that it was under formal investigation by the Securities and

Exchange Commission (SEC). The full text of the announcement is as follows, with emphasis added:

Iconix Brand Group, Inc. (Nasdaq: ICON) announced that the Company received a formal order of investigation

from the Staff of the SEC. The Company intends to fully cooperate with the SEC.

As previously disclosed, the Company is currently in a comment letter process with the Staff of the SEC related

to the accounting treatment for the formation of certain joint ventures. Additionally, the Company formed a

Special Committee of the Board of Directors to conduct a review of the accounting treatment related to certain

of the Company's transactions.

As announced in a Form 8-K filed on November 5, 2015, the Company's current management team determined,

based in part on the Special Committee's review, that ICON would restate its historical financial statements in

respect of (i) the 2013 fiscal year and the fourth quarter thereof, (ii) the 2014 fiscal year and each quarterly

period thereof and (iii) the first and second quarters of 2015, to correct certain errors in accounting. The Company

completed these restatements, which were filed at the end of November 2015.

Iconix will continue to focus on building its brand management platform across the globe and is committed to

driving the long-term success of the Company. The Company is currently in active discussions with potential

lenders and continues to expect to be in a position to refinance its 2016 convertible notes.

The amount of detail in this release is dissatisfying, to say the least. What dissatisfies is the lack of disclosure about

what information the SEC is seeking. And bear in mind that the SEC makes no public statement at the outset of a

formal investigation, so all we have to rely upon is the Companys telling of it.

Please find important disclosures on page 8 of this report.

CRT Research | Credit Intensive and Special Situations

Iconix Brand Group Inc

December 29, 2015

Iconix Brand Group Inc (ICON, NA, PT:NA)

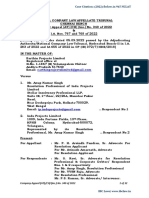

Exhibit 1. Iconix Capital Structure

LTM Figures as of

LTM EBITDA

Settlement Date

($ in millions)

Restricted cash

Unrestricted cash

Secured

$100MM Variable Funding Facility due 2043

2012-1 Sr. Secured Notes due 2043

2013-1 Sr. Secured Notes due 2043

9/30/2015

184.8

Cap.

Face

12/31/2015

Cum.

Cap.

Face

Balance

64.9

117.9

182.8

LTM

EBITDA

184.8

Mult. (x)

Net

Cum.

Cap.

Face

Net Cap.

Market

LTM

EBITDA

184.8

Mult. (x)

828.2

4.5x

645.4

3.5x

300.0

400.0

277.8

LTM

EBITDA

184.8

Mult. (x)

100.0

494.5

233.7

828.2

645.4

1,528.2

8.3x

1,345.4

1,806.0

9.8x

1,623.2

Price

-100.0

YTM

(%)

Interest Exp.

Analysis

Mat.

Rate/

Coup.

(%)

Est.

Int. Exp.

7.3x

491.0

8.8x

277.8

1,345.4

1,623.2

100.00

100.00

100.00

4.14% 01/25/43

4.23% 01/25/43

4.35% 01/25/43

4.14%

4.23%

4.35%

4.1

20.9

10.2

89.00

56.00

32.18% 06/01/16

30.26% 03/15/18

2.50%

1.50%

7.5

6.0

Int Exp

48.7

3.5x

267.0

224.0

Equity

Common Stock (ICON)

Net

Cum.

Cap.

Mkt

Price / YTM

Analysis

(182.8)

100.0

494.5

233.7

700.0

Cap.

Mkt

(182.8)

828.2

Senior Unsecured

2.5% Convertible Sr. Sub. Note due 2016

1.5% Convertible Sr. Sub. Note due 2018

Net Cap.

Face

7.3x

8.8x

5.74

48.4 MM Shrs

Source: Company reports; Bloomberg; CRT Capital Group LLC estimates.

The press release as worded creates doubt as to whether there might be something that the special committee did not

find and publish in the November 5 8-K, or did its prior review root out all of the restatements that needed to be done?

This question is of more than academic importance, because it gives clues as to whether the SECs interests go beyond

the transactions reclassified in the November 5 8-K or whether they are limited thereto.

And that matters, in turn, because it partly determines how plausible the last statement in the press release is, namely

that the Company is in a position to refinance its 2016 convertible notes. If theres a truism that the ICON situation

proves, it is that one thing leads to another. And yet we, like other investors, have continually taken the view that the

Companys situation vis--vis the SEC was not likely to degrade further. Such a stance has led to burned fingers. The

comment letter process was followed by the restatement. The restatement has been followed by a formal investigation.

What next? A civil settlement? A Wells notice? Nothing can be ruled out.

We nonetheless still think it more likely than not that the restatement captures the full extent of ICONs accounting

issues, and that the SEC is investigating to see whether there was fraudulent intent behind them. It may seek to levy

fines or prosecute individuals accordingly, but the accounting statements as they now stand may be accurate. If this

scenario does unfold, the Company likely can issue its 10-K, helping to provide a basis for lenders to help the Company

refinance the $300 million in 2.5% convertible notes that come due in June 2016. Those notes were thinly traded

yesterday, but quotes did seem to drop by only about three points, to 88-90, while the longer-dated 1.5% notes were off

more markedly by about five points, to 55-57. The Company apparently said at the annual meeting that it can reduce the

amount needed to borrow by $100-$150 million, such that any replacement debt could be in the amount of $150-$200

million. Given the elevated risks, and credit market volatility generally, ICON is likely being driven into distressed lender

hands, and coupon expectations in the sub-10% range should probably now be pinned in the 10-15% range. Lenders on

the new deal will probably not want to be temporally junior to the $400 million in 1.5% convertible notes due 2018, so

we could see step-coupons, springing maturities or other mechanisms that motivate the Company to deal with the 2018

maturity in a proactive fashion.

The problem is that the confidence one can have in this relatively favorable scenario is less than it was a week ago. ICON

was already on a slippery slope. That slope just got steeper and icier. Ways that one thing can lead to another include

announcement of potential further restatements, outright fraud allegations, the aforementioned Wells notices,

Page 2

CRT Research | Credit Intensive and Special Situations

Iconix Brand Group Inc

December 29, 2015

Iconix Brand Group Inc (ICON, NA, PT:NA)

customer defections and, finally, lender unwillingness to refinance the 2016 maturity. We do bankruptcies as an asset

class, and while we cant say that ICON has started the backward slide down the slope into Ch 11, it has elevated the risk

of such an outcome. Bear in mind, of course, that the SEC doesnt typically try to drive companies into bankruptcy. Its

enforcement activities are not generally undertaken at the expense of a companys creditors, and any fine the SEC might

levy is arguably subject to subordination under the Bankruptcy Code in any case. Anyone interested to read more on SEC

fine magnitudes and trends should see the Wall Street Journals July 13, 2015 edition.

The impact of formal SEC investigations on stock prices has been the subject of only very modest academic attention. A

paper entitled Market Efficiency and Investor Reactions to SEC Fraud Investigations in the Journal of Forensic &

Investigative Accounting (Vol. 2, Issue 3, Special Issue, 2010) by Theodore E. Christensen, Daniel Gyung H. Paik, and

Christopher D. Williams is probably the most instructive on the topic (a couple of other student papers that get

circulated seemed less rigorous to us). Differentiating between informal and formal investigations, the authors found

that the biggest impact of SEC scrutiny is usually found at the onset of the informal investigation. In the three-day

window (day -1 to day +1) surrounding the announcement of an informal investigation, fraud firms experienced a 29%

decline. At the onset of the formal investigation, the impact is more muted, with a negative 7.6% return in the three-day

window surrounding its announcement. How has ICON stacked up? We can liken its announcement of the comment

letter process to an informal investigation, and note that between August 6 and August 10 (day -1 and day +1, spanning

a weekend) the stock dropped to $14.57 from $19.60, or 26%, relatively in line with the results of Christensen et al.

The three-day window we are now in surrounding of a formal SEC investigation is obviously not complete, but the stock

is down 24% from its Friday close of $7.45 to $5.67. We should also note that the stock had a leg down when it

announced the restatement, dropping 56% to $7.05 on November 9 from $16.14 on November 5. It had risen notably in

the interim between August 10 and November 5. Thus, from August 6 to today, the stock is down a cumulative 72%.

Christensen et al did not study the performance of stocks over an entire period like this, so it is difficult to say if ICON

has been penalized too harshly, other than to say that the markets reaction today is well above average for fraud

firms when a formal investigation is announced. The study showed little significant abnormal return in the +2 to +5 day

windows and did not go beyond that. The situation in ICON is exacerbated by a looming debt maturity and management

turnover, to be sure. But these factors may be hallmarks in other fraud firms as well, so there is some chance that

ICON stock could move toward the historical mean, i.e., outperform.

When we raise bankruptcy risk, we are not speaking idly. Christensen et al found that among the various firm

characteristics that fraud firms demonstrated were notably worse Altman-Z scores and increasing leverage ratios

(both measures of bankruptcy risk) in the years leading up to the run-in with the SEC. Unfortunately the study did not go

on to say how many members of the sample did eventually go bankrupt. The study found evidence consistent with prior

studies that fraud firms have incentives to manage earnings to attract external financing at a lower cost, but may

experience significant increases in the cost of capital when such manipulations are made. Our assessment that the new

coupon is likely to exceed 10% has some empirical basis. Another prior study cited in Christensens literature review

found that as failing firms approach bankruptcy, they are more likely to overstate earnings, and their financial

statements reflect significantly greater income-increasing accrual magnitudes than do control firms. (See Earnings

Manipulation in Failing Firms, by R.L. Rosner, in Contemporary Accounting Research, 20, (2): 361-408, 2003.) One key

potential standout factor for ICON is, of course, that it does appear to generate very significant amounts of free cash

flow (depending on the measure used), and it is very difficult to see how this can be undercut by potential fraud

allegations.

Page 3

CRT Research | Credit Intensive and Special Situations

Iconix Brand Group Inc

December 29, 2015

Iconix Brand Group Inc (ICON, NA, PT:NA)

Fraud firm, it should be noted, is just a shorthand. Some companies, including many in the study, are (were) ultimately

exonerated. So could ICON. The study we have been citing does not encompass the results of SEC investigation. Into this

void comes a 2012 student paper entitled Market Reaction to the SEC Enforcement Action, by Haicha Sha of Tilburg

University. In this paper, Sha finds that wrongly judged firms see their stock appreciate by an average of 2.8%, while

fraudulent firms whose fraud is confirmed see a positive 1% increase in the -1 day to +1 day window surrounding

conclusion of an SEC action. This may not be a reward worth waiting around for. And Shas other contribution to the

literature is to tell us just how long that wait may be. The study found that:

A significant period of time generally elapses between the markets discovery of a firms fraudulent conduct and

the completion of the SEC investigation of the case as well as the issuance of an AAER [Accounting and Auditing

Enforcement Releases] report. In the sample of Fraud Group, the average lag time is 36 months with a standard

deviation of 20 months. However, this period varies widely for each individual case from a minimum of 3 months

to a maximum of 87 months.

This further calls to mind another factor here, namely variance. We all know that duration of investigation periods can

vary widely, as can the amount of fines ultimately imposed and the degree to which a stock reacts. ICON could be quite

idiosyncratic, for all we know. If one believes the refinancing of the 2016 notes is more likely than not, then a rebound in

the stock is also more likely than not, and this view is supported by the academic literature that suggests it is oversold.

The one thing wed be mindful of is the cost of the refinancing. Weve tended to think that it may be better to think of

the free cash flow (FCF) yield on ICON stock to contain both cash flows from operations and investing in the numerator,

not just operational cash flow. If we were to take this sum as averaged over the past four years, and divide by the

current market capitalization, ICON stock would have a 12% FCF yield. But if we assume that $200 million in debt is

refinanced at, say, a 12% rate, then the yield would drop to low single digits. Maybe we are being onerous versus

managements alternative calculation of FCF, but this is something to consider. To us stock might be more interesting at

penny-stock levels (i.e., sub-$5), and in the meantime, is probably best avoided.

ICONs Other Legal Distractions

While were on the subject of legal worries, we figured we would run through a couple of more minor ones that may not

be on everyones radar.

Anthony L&S LLC v US PONY Holdings LLC. On December 15, 2015, US PONY Holdings LLC, a unit of Iconix, was sued by

its business partner Anthony L&S LLC in the Supreme Court of New York, New York County. The case was docketed as

no. 654199/2015. The poor prose of the complaint undercuts its venom, but the accusations it makes are probably

worth noting, especially because they are supported by evidence of interactions between the business partners that

may not reflect well on ICON.

Our best interpretation of the fact pattern is that Anthony L&S (AL&S) was previously the sole licensee of the PONY

trademark in North America. Iconix seems to have approached AL&S, touting its experience in brand management, in a

bid for ICON to have AL&S contribute its rights to a JV of which the parties would own 75% and 25%, respectively. Under

the terms of the deal, ICON would market PONY and AL&S would pay an upfront $4 million royalty to ICON and $20

million in the first five years. The complaint provides no dates for these actions, but we know that ICON announced the

PONY acquisition on February 3, 2015.

Page 4

CRT Research | Credit Intensive and Special Situations

Iconix Brand Group Inc

December 29, 2015

Iconix Brand Group Inc (ICON, NA, PT:NA)

The complaint alleges that ICON knew that a substantial marketing effort would be needed to revive a brand so dormant

as PONY. It further alleges that ICON would attempt to recruit Derek Jeter and Kemba Walker as endorsers of the brand.

The complaint says that ICON was initially obligated to spend $1 million in 2015 on marketing efforts, but this was

amended to $800,000 and later to some unspecified amount as ICON kept delaying its efforts. AL&S for its part says it

spent $2 million on minimum royalty payments and untold millions on product development and production.

AL&S argues that the parties agreed to a go-to-market initiative set for June 1, 2015. It developed and produced new

footwear models between March and June to gear up for this initiative. The complaint lacks specificity as to what

promises ICON made in this interim from its side. The complaint contains excerpts of numerous emails from AL&S to

Iconix asking what progress had been made on the marketing front. No specific deadlines are mentioned in the replies

from Iconixs Alexander Cole. AL&S was on the verge of meeting with footwear retailers in late May and was seeking to

have a marketing deck from ICON ready for those meetings. The facts cited by the complaint do not strongly support an

inference that ICON was misleading AL&S but rather than the parties were simply on different pages as to the

appropriate timeline for the revival of the PONY brand. AL&S nonetheless made a $1 million royalty payment on May 30.

In June 2015, communications between AL&S and ICON shifted to Neil Cole for some unknown reason. The spring

initiatives having fallen flat, AL&S was moving on to fall 2015 opportunities. Again the parties seemed to be on different

pages. A reply from some unspecified person at ICON said, It is my understanding that Iconix is funding 2016 initiatives

not 2015. In a subsequent communication in July, ICON agreed to support fall and winter 20-15 marketing activities up

to 150K. For spring 2016, ICON committed to have a plan, a campaign, and athletes, because we want the SS16 launch

to be special. AL&S requested a meeting with Cole, but, per the complaint, it alleges that Cole declined to meet until

after August 6. Assuming this allegation is accurate, it raises questions as to why the August 6 date (when Cole resigned)

was seen to be important in early July.

No evidence of specific ICON deliverable deadlines is presented in the complaint, but an October 9 communication from

AL&S to ICON reads poorly for the latter:

Two weeks have passed since our last meeting. As it stands now, we still do not have firm marketing

commitments from Iconix in place. We have been out selling since June and we have been consistently shut

down from our retailers partners, due to not having firm brand marketing commitments in place. At this point, Q

1 & Q2 are now closed and it does not look like we will be making our Open Order sales projections for first

ha[lf] of 2016. We are now in an inventory situation with our financial partner Samsung, as we have 250,000 unsold units corning in for the Spring 2016 selling seasons. Units which we had planned to sell. We were promised

time and time again that we would be receiving marketing support for our initial market sell-in, but we still have

not. We have now lost the first half of 2016 selling opportunity and our business is in distress.

No specific reply to this communication from ICON is cited in the complaint.

The complaint finally alleges that ICON caused the PONY Holdings LLC entity to make a $1.2 million distribution to ICON

and a $400, 000 distribution to AL&S, despite the allegation that ICON had not lived up to its marketing obligations.

Without ICONs response to the complaint, we dont know if there is another side to the story. But the alleged fact

pattern fits conspicuously with what is in the public domain about ICON. Interim CEO Peter Cuneo said on the 3Q15

earnings call that the Company could do a better job on its marketing support of its brands. PONY does appear to be a

Page 5

CRT Research | Credit Intensive and Special Situations

Iconix Brand Group Inc

December 29, 2015

Iconix Brand Group Inc (ICON, NA, PT:NA)

recently acquired brand that is underperforming expectations. AL&S may have a legitimate grievance. The dispute is not

likely to have a major financial impact, but casts a deeper shadow on ICONs business practices.

IP Holdings Unltd LLC v Marcraft Clothes Inc. The plaintiff here is a unit of ICON that initiated the suit on April 22, 2015

to recover unpaid guaranteed minimum royalty payments totaling $4.6 million (case no. 651344/2015, also in New York

state court). Marcraft is a manufacturer licensed by ICON to sell Mark Ecko and Cut & Sew brands. Under the

agreement, Marcraft was selling the two brands primarily to Mens Wearhouse and Burlington Stores. The agreement

envisioned the following minimums:

Exhibit 2. Mark Ecko and Cut & Sew Contract Terms ($ in 000s)

Contract Year

2011

2012

2013

2014

Source: Court documents.

Minimum Net Sales

$5,000

8,000

12,000

15,000

Actual Net Sales

$5,780

6,220

7,020

NA

Guaranteed Minimum

Royalties (8% of Min.

Net Sales)

$400

640

960

1,200

Guaranteed Minimum

Marketing Fees (3% of

Min. Net Sales)

$150

240

360

450

IP Holdings was only 51%-owned by ICON until May 2013, when it bought out the remaining 49% from companies

controlled by Seth Gerszberg. Prior to this acquisition, it had been the partners managing the licensing of the brands.

After the acquisition, wholly owned IP Holdings began promoting the Ecko brand in Dillards and JCPenney, among

others. Not long after, Mens Wearhouse acquired the Joseph Abboud brand, leading to a reduction in its orders of

similarly priced Mark Ecko product. These developments were part of what prompted Marcraft to seek a revision in

guaranteed minimums. The parties then agreed to set royalties at 8% and marketing fees at 1% of the greater of actual

net sales or $10 million from 2015 to 2018. For 2014 they agreed on a fixed $900,000 royalty payment against $10

million of sales.

The complaint alleges that Marcraft failed to make a modified payment of $225,000 for 1Q14. A notice of default was

sent on June 10, 2014 and the license agreement was terminated on June 25. The terms of the contract allegedly

provide that all future royalty and marketing payments are also due upon an event of default.

On August 26, 2015, Marcraft came back swinging with an answer and counterclaims of its own. It alleges that it was

duped by Iconix and Cole when it signed the amended agreement. It was deceived because Iconix employees

negotiating on Plaintiffs behalf at the direction of Cole purposefully concealed vital information in order to induce

Marcraft into the Letter Amendment. The information concealed, the counterclaims allege, included the looming Mark

Ecko Enterprises bankruptcy, the falling out between Cole and Gerszberg over the direction of the Ecko brand

(Gerszberg continued to license the brand after the sale of the 49% stake), Coles alleged direct attempt to bankrupt

Gerszberg, the fact that other retailers selling Ecko products were also failing to meet their guaranteed minimums, and

ICONs attempts to dilute the brand by pitching it to new direct-to-retail (DRM) accounts. In support of its counterclaims,

Marcraft cites a pattern of misbehavior allegedly evidenced by shareholder lawsuits against ICON and its need for

restatement of its financial information.

The counterclaims here admittedly sound like a Hail Mary pass into document discovery, in that the allegations dont

sound like much unless they can be backed up with documents that eventually get produced. ICONs grounds are a bit

firmer, since it can point to line and verse of the amended agreement and demonstrate both default and remedy. Still,

the fact pattern alleged by Marcraft may fit what the public knows about the apparent implosion of the Ecko brand, and

Page 6

CRT Research | Credit Intensive and Special Situations

Iconix Brand Group Inc

December 29, 2015

Iconix Brand Group Inc (ICON, NA, PT:NA)

thereby derive some credibility. In short, investors will want to know How did ICON let this happen? and the lawsuit

may provide some answers.

Page 7

CRT Research | Credit Intensive and Special Situations

Iconix Brand Group Inc

December 29, 2015

Iconix Brand Group Inc (ICON, NA, PT:NA)

REQUIRED DISCLOSURES

The recommendations and guidance expressed in this research report accurately reflect the personal recommendations and guidance of the research

analyst principally responsible for the preparation of this report

No part of the compensation received by the analyst principally responsible for the preparation of this report was, is or will be directly or indirectly

related to the specific recommendations and guidance expressed in this report. Direct or indirect analyst compensation may be based on performancerelated considerations associated with the recommendations and guidance expressed by the analyst in this report

The research analyst primarily responsible for the preparation of this report received compensation that is based upon CRT Capital Group LLCs total

business revenues, including revenues derived from CRTs investment banking business

Please Note

On April 20, 2015, CRT Capital Group LLC ("CRT") completed its acquisition of the Institutional Equity business of Sterne Agee Group, Inc. (the combined

Institutional Equity businesses, Sterne Agee CRT). As a result, research report publication previously produced separately has been merged into a single

production platform, including the Definitions of Investment Ratings, as of November 01, 2015.

Prior to November 01, 2015 the Legacy CRT Equity Analysts, listed below, assigned ratings based on the following definitions:

**Legacy CRT Platform (prior to November 01, 2015) - Investment Ratings Definitions:

Buy - Expected rate of return on investment at current prices levels is above that rate required, in CRT's view, to undertake the attendant risks perceivedpositive risk/reward investment balance.

Fair Value - Expected rate of return on investment at current prices levels is in line with that rate required, in CRT's view, to undertake the attendant risks

perceived- equitable/reward investment balance.

Sell - Expected rate of return on investment at current prices levels is below that rate required, in CRT's view, to undertake the attendant risks perceivednegative risk/reward investment balance

Legacy CRT Research Analysts:

Shagun Singh Chadha

Robert Coolbrith

Michael Derchin

David Epstein, CFA

Lee Giordano, CFA

Brett Levy

Kirk Ludtke

Kevin Starke, CFA

Amer Tiwana

Lance Vitanza, CFA

Rating and Price Target History

Regarding Research Reports authored by Legacy CRT Research Analysts ONLY:

For disclosure purposes; ratings noted within this reports Rating and Price Target History graph for dates prior to November 01, 2015, only, are reflective

of the **Legacy CRT Platform Investment Ratings Definitions, seen in these disclosures.

Rating

Meaning

Page 8

CRT Research | Credit Intensive and Special Situations

Iconix Brand Group Inc

December 29, 2015

Iconix Brand Group Inc (ICON, NA, PT:NA)

Buy (B)

Neutral (N)

Underperform (UP)

We expect this stock to outperform the industry over the next 12 months.

We expect this stock to perform in line with the industry over the next 12 months.

We expect this stock to underperform the industry over the next 12 months.

Ratings Percentages

As of December 29, 2015

Percentage of Banking Clients Within Each Rating Category

As of December 29, 2015

Buy 56.55%

6.18%

Neutral* 41.95%

4.17%

Underperform 1.50%

0.00%

*FINRA Rule 2711 (H)(5)(A)- Regardless of the rating system that a member employs, a member must disclose in each research report the

percentage of all securities rated by the member to which the member would assign a "buy,""hold/neutral," or "sell" rating. For purposes of

this Rule, Fair Value would be assigned as "hold/neutral".

Valuations are based on estimates using traditional industry methods including, inter alia, analysis of earnings multiples, discounted cash flow calculations

and net asset value assessments. Price targets should be considered in the context of all prior CRT research published in connection with the subject

issuer, which may or may not have included price targets, as well as developments relating to the company, its industry and financial markets. Risks that

may impede achievement of the stated price target, if any, include, but are not limited to, broad market and macroeconomic fluctuations and unforeseen

changes in the subject companys fundamentals or business trends.

OTHER DISCLOSURES

This communication is directed at, and for use by, institutional investors only and is not intended for use by retail investors.

This report has no regard to the specific investment objectives, financial situation or particular needs of any specific recipient. This report is published

solely for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. The

securities described herein may not be eligible for sale in all jurisdictions or to certain categories of investors. This report is based on information obtained

from sources believed to be reliable but is neither guaranteed to be accurate nor intended to be a complete statement or summary of the securities,

markets or developments referred to in the report. Recipients should not use this report as a substitute for the prudent exercise of their own judgment.

Any opinions expressed in this report are subject to change without notice and CRT is under no obligation to update or keep current the information

contained herein. CRT and/or its directors, officers and employees may have or may have had interests or long or short positions in, and may at any time

make purchases and/or sales as principal or agent, or may have acted or may act in the future as market maker in the relevant securities or related financial

instruments discussed in this report. CRT may rely on informational barriers such as Chinese Walls to control the flow of information situated in one or

more areas within CRT into other units, divisions or groups within CRT.

Past performance is not necessarily indicative of future results. Options, derivative products and futures are not suitable for all investors due to the high

degree of risk associated with trading these instruments. Foreign currency rates of exchange may adversely effect the value, price or income of any security

or related instrument described in this report.

CRT accepts no liability whatsoever for any loss or damage of any kind arising out of the use of all or any part of this report. CRT specifically prohibits the

re-distribution of this report by third parties, via the internet or otherwise, and accepts no liability whatsoever for the actions of such third parties in this

respect. Additional information is available upon request. Clients who wish to effect transactions should contact their sales representative.

For UK Professional Clients:

This research report is disseminated in the UK by CRT Capital (UK) Limited which is authorized and regulated by the Financial Conduct Authority. This

research report is intended for distribution in the UK only to, and should be relied upon only by, persons who or may be classified as eligible counterparties

or professional clients pursuant to the FCA's rules or who are investment professionals as defined in Article 19 of the Financial Services and Markets Act

2000 (Financial Promotion) Order 2005.

2015 CRT Capital Group LLC. All rights Reserved. The Copyright Act of 1976 prohibits the reproduction by photocopy machine or any other means of all

or any portion of this issue except with permission of the publisher. 262 Harbor Drive, Stamford, CT 06902

Page 9

CRT Research | Credit Intensive and Special Situations

Iconix Brand Group Inc

December 29, 2015

Iconix Brand Group Inc (ICON, NA, PT:NA)

William Jump

Jon Schenk

Dir Equity Sales, Trading & Res

Dir of Equity Sales & Sales Trading

470.419.6651

646.205.4952

CONSUMER

Automotive Aftermarket

Ali Faghri

| afaghri@sterneageecrt.com

George Kasiaras

| gkasiaras@sterneageecrt.com

646.293.6744

646.293.6752

Broadlines & Hardlines Retail

Charles Grom, CFA

| cgrom@sterneageecrt.com

Renato Basanta, CFA

| rbasanta@sterneageecrt.com

John Parke

| jparke@sterneageecrt.com

646.293.6726

646.293.6740

646.293.6738

Consumer Packaged Goods

April Scee

| ascee@sterneageecrt.com

Mark Salama, CFA

| msalama@sterneageecrt.com

Theo Brito

| tbrito@sterneageecrt.com

Footwear & Apparel

Sam Poser

Ben Shamsian

Elizabeth Bean

Gaming & Lodging

David Bain

Sherry Yin

Leisure & Lifestyle Products

Lee J. Giordano, CFA

| lgiordano@sterneageecrt.com

Media

Lance Vitanza, CFA

Brian Denes

| lvitanza@crtllc.com

| bdenes@crtllc.com

Restaurants

Lynne Collier

Philip May

| lcollier@sterneageecrt.com

| pmay@sterneageecrt.com

Dir of Equity Research

Dir of Credit Research

646.293.6701

203.569.4361

HEALTHCARE

646.293.6760

646.293-6724

646.293-6762

| sposer@sterneageecrt.com

646.293.6748

| bshamsian@sterneageecrt.com 646.293.6747

| ebean@sterneageecrt.com

646.293.6746

| dbain@sterneageecrt.com

| syin@sterneageecrt.com

Stuart Linde

Kirk Ludtke

949.721.6651

949.721-6651

212.915.3163

Healthcare Services

Brian Wright

Ryan Amberger

| bwright@sterneageecrt.com

646.293.6737

| ramberger@sterneageecrt.com 646.293.6736

Medical Technology

Gregory P. Chodaczek

Caitlin Howard

| gchodaczek@sterneageecrt.com 484.532.5406

| choward@sterneageecrt.com

646.293.6706

Shagun Singh Chadha

Angel Krustev

| ssingh@crtllc.com

| akrustev@crtllc.com

203.569.4345

203.569.4305

INDUSTRIALS

Aerospace & Defense

Peter Arment

Josh W. Sullivan

Asher Carey

John Ayling

|

|

|

|

parment@sterneageecrt.com

jsullivan@sterneageecrt.com

acarey@sterneageecrt.com

jayling@sterneageecrt.com

646.293-6732

646.293.6730

646.293.6741

646.293.6743

Auto, Auto Parts and Auto Retailers

Michael P. Ward, CFA

| mward@sterneageecrt.com

646.293-6731

Tim Vecchione

| tvecchionei@sterneageecrt.com 646.293.6743

Automotive

Kirk Ludtke

| kludtke@crtllc.com

203.569.4361

203.569.4337

203.569.4376

Coal, Metals & Mining, Engineering & Construction

Michael S. Dudas, CFA | mdudas@sterneageecrt.com

Satyadeep Jain, CFA

| sjain@sterneageecrt.com

Patrick Uotila, CPA

| puotila@sterneageecrt.com

646.293.6749

646.293.6742

646.293.6720

469.899.3306

469.899.3307

Construction Materials & Diversified Industrials

Todd Vencil, CFA

| tvencil@sterneageecrt.com

Teresa Nguyen, CFA

| tnguyen@sterneageecrt.com

804.729.8025

804.729.8026

CREDIT/DISTRESSED & SPECIAL SITUATIONS

David Epstein, CFA

| depstein@crtllc.com

203.569.4328

Jack Chan

| jchan@crtllc.com

203.569.4351

Brett M. Levy

| blevy@crtllc.com

203.569.4336

Kevin Starke, CFA

| kstarke@crtllc.com

203.569.6421

Patrick Marshall, CFA

| pmarshall@crtllc.com

203.569.4373

Amer Tiwana

| atiwana@crtllc.com

203.569.4318

Homebuilding

Jay McCanless

Warner Watkins

Water and Flow Control

Kevin Bennett, CFA

| kbennett@sterneageecrt.com

Ed Riley

| eriley@sterneageecrt.com

804.729.8024

804.729.8027

ENERGY

Exploration & Production

Tim Rezvan, CFA

| trezvan@sterneageecrt.com

James Lizzul

| jlizzul@sterneageecrt.com

646.293.6729

646.293.6722

TECHNOLOGY

Data Networking and Storage

Alex Kurtz

| akurtz@sterneageecrt.com

Amelia Harris

| aharris@sterneageecrt.com

415.762.4881

415.762.4880

Oilfield Services & Equipment

Stephen D. Gengaro

| sgengaro@sterneageecrt.com

Ivan Suleiman

| isuleiman@sterneageecrt.com

646.293.6728

646.293.6727

Interactive Entertainment / Internet

Arvind Bhatia, CFA

| abhatia@sterneageecrt.com

Brett Strauser

| bstrauser@sterneageecrt.com

469.899.3304

469.899.3305

Internet

Robert Coolbrith

| rcoolbrith@crtllc.com

415.762.4890

IT Services

Moshe Katri

| mkatri@sterneageecrt.com

646.293.6751

646.293.6733

212.915.3172

FINANCIAL SERVICES

Banks

Peter J. Winter

Amir Jairazbhoy

| pwinter@sterneageecrt.com

646.293.6761

| ajairazbhoy@sterneageecrt.com 646.293.6725

| jmccanless@sterneageecrt.com 615.645.7325

| wwatkins@sterneageecrt.com 615.645.7327

Property / Casualty Insurance

Vinay Misquith

| vmisquith@sterneageecrt.com

Vignesh Murali

| vmurali@sterneageecrt.com

212.915.3169

646.293.6735

Mobile and Consumer Computing

Rob Cihra

| rcihra@sterneageecrt.com

Edison Yu

| xyu@sterneageecrt.com

Specialty/Real Estate Finance

Henry J. Coffey, Jr., CFA | hcoffey@sterneageecrt.com

Jason P. Weaver, CFA

| jweaver@sterneageecrt.com

Yi Fu Lee, CFA, CPA

| ylee@crtllc.com

Pedro Saboia

| psaboia@sterneageecrt.com

615.645.7322

615.645.7320

212.915.3168

203.569.4324

Semiconductors

Douglas Freedman

Kevin Chen

| dfreedman@sterneageecrt.com 415.762.4887

| kchen@sterneageecrt.com

415.762.4886

TRANSPORTATION, SERVICES & EQUIPMENT

Airlines

Michael Derchin

| mderchin@crtllc.com

203.569.4354

Adam Hackel

| ahackel@crtllc.com

203.569.4378

Page 10

Anda mungkin juga menyukai

- BUS 1102 - Week 7 - Statement of The Cash FlowDokumen6 halamanBUS 1102 - Week 7 - Statement of The Cash FlowEmad AldenBelum ada peringkat

- Third Point Q1'09 Investor LetterDokumen4 halamanThird Point Q1'09 Investor LetterDealBook100% (2)

- Third Point Q109 LetterDokumen4 halamanThird Point Q109 LetterZerohedgeBelum ada peringkat

- Audit II AssignmentDokumen10 halamanAudit II AssignmentEric Wong Jun JieBelum ada peringkat

- Corsair Capital Q3 2010Dokumen5 halamanCorsair Capital Q3 2010tigerjcBelum ada peringkat

- Gruber Corporate Profits and SavingDokumen60 halamanGruber Corporate Profits and SavingeconstudentBelum ada peringkat

- Third Point Q3 Investor LetterDokumen8 halamanThird Point Q3 Investor Lettersuperinvestorbulleti100% (1)

- Patient Capital Management IncDokumen6 halamanPatient Capital Management IncyuvalysBelum ada peringkat

- White Brook Capital Q2 2020Dokumen8 halamanWhite Brook Capital Q2 2020Paul AsselinBelum ada peringkat

- Blackbird 3rd Q 2002Dokumen3 halamanBlackbird 3rd Q 2002Don HeymannBelum ada peringkat

- Mayo - CitibankDokumen23 halamanMayo - CitibankHolsk Nyberg100% (1)

- Group discussion report analysisDokumen11 halamanGroup discussion report analysisMuhammad FaisalBelum ada peringkat

- Broyhill Letter (Q2-08)Dokumen3 halamanBroyhill Letter (Q2-08)Broyhill Asset ManagementBelum ada peringkat

- Third Point Q4 Investor Letter FinalDokumen12 halamanThird Point Q4 Investor Letter FinalZerohedge100% (3)

- Investing Myths DebunkedDokumen18 halamanInvesting Myths DebunkedVicente Manuel Angulo GutiérrezBelum ada peringkat

- Chartered Professional Accountants of Canada, Cpa Canada, Cpa. © 2015, Chartered Professional Accountants of Canada. All Rights ReservedDokumen19 halamanChartered Professional Accountants of Canada, Cpa Canada, Cpa. © 2015, Chartered Professional Accountants of Canada. All Rights ReservedHassleBustBelum ada peringkat

- Citigroup Inc: Stock Report - May 7, 2016 - NYS Symbol: C - C Is in The S&P 500Dokumen11 halamanCitigroup Inc: Stock Report - May 7, 2016 - NYS Symbol: C - C Is in The S&P 500Luis Fernando EscobarBelum ada peringkat

- 2012 q3 Letter DdicDokumen5 halaman2012 q3 Letter DdicDistressedDebtInvestBelum ada peringkat

- Midyear Outlook: Five Distinct Macro Disconnects: InsightsDokumen28 halamanMidyear Outlook: Five Distinct Macro Disconnects: Insightsastefan1Belum ada peringkat

- Coco Bonds ThesisDokumen6 halamanCoco Bonds Thesispuzinasymyf3100% (2)

- Accounting Textbook Solutions - 67Dokumen19 halamanAccounting Textbook Solutions - 67acc-expertBelum ada peringkat

- 2022 Fef Semi Annual LetterDokumen8 halaman2022 Fef Semi Annual LetterDavidBelum ada peringkat

- Kerr Is Dale Quarterly Letter 12-31-11Dokumen3 halamanKerr Is Dale Quarterly Letter 12-31-11VALUEWALK LLCBelum ada peringkat

- ULTI Aug 16 Short ReportDokumen16 halamanULTI Aug 16 Short ReportAnonymous Ecd8rCBelum ada peringkat

- Q1 2020 ThirdPoint-InvestorLetterDokumen11 halamanQ1 2020 ThirdPoint-InvestorLetterlopaz777Belum ada peringkat

- Bond Investment AnalysisDokumen15 halamanBond Investment AnalysisNicole PTBelum ada peringkat

- Intel Financial Statement Analysis PaperDokumen36 halamanIntel Financial Statement Analysis Paperapi-246945443100% (2)

- Third Point Q3 2013 TPOI LetterDokumen5 halamanThird Point Q3 2013 TPOI LettermistervigilanteBelum ada peringkat

- Pefindo Default StudyDokumen16 halamanPefindo Default StudyAgathos KurapaqBelum ada peringkat

- Third Point Q1 LetterDokumen10 halamanThird Point Q1 LetterZerohedge100% (1)

- Einhorn Letter Q1 2021Dokumen7 halamanEinhorn Letter Q1 2021Zerohedge100% (4)

- IPO Paper Week5 Scott BarnesDokumen7 halamanIPO Paper Week5 Scott BarnessdbarnesBelum ada peringkat

- Citigroup Research PaperDokumen4 halamanCitigroup Research Paperzqbyvtukg100% (1)

- Corsair Capital Q4 2011Dokumen3 halamanCorsair Capital Q4 2011angadsawhneyBelum ada peringkat

- Emp Capital Partners - 4Q12 Investor LetterDokumen7 halamanEmp Capital Partners - 4Q12 Investor LetterLuis AhumadaBelum ada peringkat

- JPMorgan Global Investment Banks 2010-09-08Dokumen176 halamanJPMorgan Global Investment Banks 2010-09-08francoib991905Belum ada peringkat

- Bank Loans Poised to Deliver Attractive Risk-Adjusted ReturnsDokumen6 halamanBank Loans Poised to Deliver Attractive Risk-Adjusted ReturnsSabin NiculaeBelum ada peringkat

- Case 1 - Financial Analysis and Planning Fall 2010Dokumen9 halamanCase 1 - Financial Analysis and Planning Fall 2010AmnaMohamedBelum ada peringkat

- 13-Cash Flow StatementDokumen66 halaman13-Cash Flow Statementtibip12345100% (6)

- Question and Answer - 31Dokumen31 halamanQuestion and Answer - 31acc-expertBelum ada peringkat

- Selector September 2008 Quarterly NewsletterDokumen23 halamanSelector September 2008 Quarterly Newsletterapi-237451731Belum ada peringkat

- Investment Commentary: Market and Performance SummaryDokumen12 halamanInvestment Commentary: Market and Performance SummaryCanadianValue100% (1)

- Counting On Cash: An Active Approach To Sustainable Equity ReturnsDokumen8 halamanCounting On Cash: An Active Approach To Sustainable Equity ReturnsdpbasicBelum ada peringkat

- Assessing Business and Audit Risks at Toy MakerDokumen6 halamanAssessing Business and Audit Risks at Toy Makerramandipk51161100% (1)

- Tyco Plans To Split Into Four Companies Amid Accounting Questions, Stock SlideDokumen6 halamanTyco Plans To Split Into Four Companies Amid Accounting Questions, Stock SlideYamil PerezBelum ada peringkat

- Loewen Group CaseDokumen2 halamanLoewen Group CaseSu_NeilBelum ada peringkat

- Alejandro Escalante Homework Chapter 3Dokumen5 halamanAlejandro Escalante Homework Chapter 3Alejandro Escalante100% (1)

- Semper Vic Partners Letter 2020-Q1 PDFDokumen14 halamanSemper Vic Partners Letter 2020-Q1 PDFlauchihinBelum ada peringkat

- Citi Third Quarter 2013 Earnings Review: October 15, 2013Dokumen26 halamanCiti Third Quarter 2013 Earnings Review: October 15, 2013Mark ReinhardtBelum ada peringkat

- AC3103 Seminar 3 AnswersDokumen5 halamanAC3103 Seminar 3 AnswersKrithika NaiduBelum ada peringkat

- Christopher C. Davis and Kenneth C. Feinberg Portfolio ManagersDokumen11 halamanChristopher C. Davis and Kenneth C. Feinberg Portfolio ManagersfwallstreetBelum ada peringkat

- 1) Assess The Current Financial Health and Recent Financial Performance of The Firm. Identify Any Strengths or WeaknessesDokumen2 halaman1) Assess The Current Financial Health and Recent Financial Performance of The Firm. Identify Any Strengths or WeaknessesJane SmithBelum ada peringkat

- Why Do Companies Issue Debt When They Don't Seem To Need The MoneyDokumen3 halamanWhy Do Companies Issue Debt When They Don't Seem To Need The MoneythebigpicturecoilBelum ada peringkat

- Pefindo'S Corporate Default and Rating Transition Study (1996 - 2010)Dokumen21 halamanPefindo'S Corporate Default and Rating Transition Study (1996 - 2010)Theo VladimirBelum ada peringkat

- MSC Industrial Direct (MSM) Q4 2020 Earnings Call: OperatorDokumen24 halamanMSC Industrial Direct (MSM) Q4 2020 Earnings Call: OperatorMobarockHosainBelum ada peringkat

- Advanced Audit and Assurance (International) : Monday 11 June 2012Dokumen10 halamanAdvanced Audit and Assurance (International) : Monday 11 June 2012hiruspoonBelum ada peringkat

- The Signs Were There: The clues for investors that a company is heading for a fallDari EverandThe Signs Were There: The clues for investors that a company is heading for a fallPenilaian: 4.5 dari 5 bintang4.5/5 (2)

- Summary of Howard M. Schilit, Jeremy Perler & Yoni Engelhart's Financial Shenanigans, Fourth EditionDari EverandSummary of Howard M. Schilit, Jeremy Perler & Yoni Engelhart's Financial Shenanigans, Fourth EditionBelum ada peringkat

- Iconix Note 20151117 PDFDokumen7 halamanIconix Note 20151117 PDFmoonflye8222Belum ada peringkat

- Iconix Note 20151109 PDFDokumen14 halamanIconix Note 20151109 PDFmoonflye8222Belum ada peringkat

- Iconix Note 20151106 PDFDokumen6 halamanIconix Note 20151106 PDFmoonflye8222Belum ada peringkat

- Iconix Note 20150827 PDFDokumen19 halamanIconix Note 20150827 PDFmoonflye8222Belum ada peringkat

- KV V FDA-Alere AmicusDokumen146 halamanKV V FDA-Alere Amicusmoonflye8222Belum ada peringkat

- KV V FDA-Plaintiff Reply Motion To DismissDokumen52 halamanKV V FDA-Plaintiff Reply Motion To DismissKevin StarkeBelum ada peringkat

- Research Assignment 3 1Dokumen13 halamanResearch Assignment 3 1api-583942095Belum ada peringkat

- Newton's Second Law - RevisitedDokumen18 halamanNewton's Second Law - RevisitedRob DicksonBelum ada peringkat

- Bulk Sms Service Provider in India - Latest Updated System - Sending BULK SMS in IndiaDokumen4 halamanBulk Sms Service Provider in India - Latest Updated System - Sending BULK SMS in IndiaSsd IndiaBelum ada peringkat

- Look at The Pictures and Write Sentences Appropriate A Formal Business LetterDokumen2 halamanLook at The Pictures and Write Sentences Appropriate A Formal Business LetterMuhammad Talha Khan50% (2)

- KAPPA SIGMA BETA Fraternity: Checking and Auditing The Financial StatementsDokumen3 halamanKAPPA SIGMA BETA Fraternity: Checking and Auditing The Financial StatementsZean TanBelum ada peringkat

- Joseph Resler - Vice President - First American Bank - LinkedInDokumen5 halamanJoseph Resler - Vice President - First American Bank - LinkedInlarry-612445Belum ada peringkat

- Metric Hex Nuts, Style 2: ASME B18.2.4.2M-2005Dokumen14 halamanMetric Hex Nuts, Style 2: ASME B18.2.4.2M-2005vijay pawarBelum ada peringkat

- Test Drive AgreementDokumen5 halamanTest Drive AgreementRedcorp_MarketingBelum ada peringkat

- Format of Writ Petition To High Court Under Article 226Dokumen3 halamanFormat of Writ Petition To High Court Under Article 226Faiz MalhiBelum ada peringkat

- LandbankDokumen4 halamanLandbankJj JumalonBelum ada peringkat

- NFL Application Form 2019Dokumen5 halamanNFL Application Form 2019ranjitBelum ada peringkat

- Conditionals and Wish Clauses Advanced TestDokumen5 halamanConditionals and Wish Clauses Advanced TestVan Do100% (1)

- Voyage-Account CompressDokumen9 halamanVoyage-Account Compressmanisha GuptaBelum ada peringkat

- La Bugal-b'Laan Tribal Association Et - Al Vs Ramos Et - AlDokumen6 halamanLa Bugal-b'Laan Tribal Association Et - Al Vs Ramos Et - AlMarlouis U. PlanasBelum ada peringkat

- Despieve A4VG045Dokumen50 halamanDespieve A4VG045Zamuel Torres GarcíaBelum ada peringkat

- CoTeSCUP Vs Secretary of EducationDokumen12 halamanCoTeSCUP Vs Secretary of EducationsundaeicecreamBelum ada peringkat

- UCS-SCU22 BookDokumen36 halamanUCS-SCU22 BookRicardo Olmos MentadoBelum ada peringkat

- Mike Bobo Employment ContractDokumen15 halamanMike Bobo Employment ContractHKMBelum ada peringkat

- Agreement Road Right of WayDokumen3 halamanAgreement Road Right of WayRalna Dyan Florano100% (1)

- Direct Tax Computation and DeductionsDokumen21 halamanDirect Tax Computation and DeductionsVeena GowdaBelum ada peringkat

- CASE - 1 Luxor Writing Instruments Private LimitedDokumen6 halamanCASE - 1 Luxor Writing Instruments Private LimitedtubbychampBelum ada peringkat

- Barbaarinta Caruurta: Cabdifataax M. DucaaleDokumen18 halamanBarbaarinta Caruurta: Cabdifataax M. DucaaleMustafe AliBelum ada peringkat

- Pre SpanishDokumen2 halamanPre SpanishStephanie BolanosBelum ada peringkat

- Aarti Brochure 2009Dokumen4 halamanAarti Brochure 2009Sabari MarketingBelum ada peringkat

- FINANCIAL - MANAGEMENT Solution BookDokumen170 halamanFINANCIAL - MANAGEMENT Solution BookWajahat SadiqBelum ada peringkat

- NCLAT OrderDokumen32 halamanNCLAT OrderShiva Rama Krishna BeharaBelum ada peringkat

- Should B-Tel Lease or Buy Telecom TowersDokumen13 halamanShould B-Tel Lease or Buy Telecom TowersChristopher Anniban Salipio100% (1)

- Thailand 6N7D Phuket - Krabi 2 Adults Dec 23Dokumen4 halamanThailand 6N7D Phuket - Krabi 2 Adults Dec 23DenishaBelum ada peringkat

- STOCKL - Community After TotalitarianismDokumen178 halamanSTOCKL - Community After TotalitarianismMmarimmarBelum ada peringkat

- Solids, Kinetics, Coordination Compounds & Electrochemistry NotesDokumen3 halamanSolids, Kinetics, Coordination Compounds & Electrochemistry NotesudaysrinivasBelum ada peringkat