Analisis COC PT. Astra Internasional TBK

Diunggah oleh

HariantoPratamaPuteraJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Analisis COC PT. Astra Internasional TBK

Diunggah oleh

HariantoPratamaPuteraHak Cipta:

Format Tersedia

Analysis By : Ahmad Sulaemi_0221.12.

349

Check By : Dede Sofyan_0221.12.348

DATA MANAJEMEN KEUANGAN LANJUTAN UNTUK UAS

A. Perhitungan Beta PT. Astra International Tbk Tahun 2014

Tanggal

IHSG

02/12/2013

02/01/2014

03/02/2014

03/03/2014

01/04/2014

02/05/2014

02/06/2014

01/07/2014

04/08/2014

01/09/2014

01/10/2014

03/11/2014

01/12/2014

(Sumber : Yahoo Finance )

4.274.176.758

4.418.756.836

462.021.582

4.768.276.855

4.840.145.996

4.893.908.203

4.878.582.031

5.088.801.758

5.136.862.793

5.137.579.102

5.089.546.875

5.149.888.184

5.226.946.777

Return Maket Harga Saham Return Saham

6800

0,0338

6425

-0,0551

-0,8954

6950

0,0817

9,3205

7375

0,0612

0,0151

7425

0,0068

0,0111

7075

-0,0471

-0,0031

7275

0,0283

0,0431

7725

0,0619

0,0094

7575

-0,0194

0,0001

7050

-0,0693

-0,0093

6775

-0,039

0,0119

7125

0,0517

0,015

7425

0,0421

SUMMARY OUTPUT

Regression Statistics

Multiple R

R Square

Adjusted R Square

Standard Error

Observations

0,268983943

0,072352361

-0,020412402

0,0532792

12

ANOVA

Regression

Residual

Total

df

1

10

11

SS

0,002214038

0,028386732

0,03060077

MS

0,002214038

0,002838673

F

Significance F

0,779955216

0,397888753

Intercept

X Variable 1

Coefficients

Standard Error

0,00493729 0,015944566

0,005209481 0,005898744

t Stat

0,309653462

0,883150732

P-value

0,763180749

0,397888753

Beta Saham adalah

0,0052

Lower 95% Upper 95% Lower 95,0% Upper 95,0%

-0,030589417 0,040464 -0,030589417 0,040463997

-0,007933741 0,018353 -0,007933741 0,018352702

Analysis By : Ahmad Sulaemi_0221.12.349

Check By : Dede Sofyan_0221.12.348

DATA MANAJEMEN KEUANGAN LANJUTAN UNTUK UAS

B. Perhitungan Presentasi Pajak

Laba Sebelum Pajak

27.352.000.000.000

Beban Pajak

5.227.000.000.000

Presentase Pajak

19,11% <= (Beban Pajak / Laba Sebelum Pajak) X 100 %

(Sumber Laporan Keuangan PT. Astra International Tbk Tahun 2014)

C. Perhitungan Bunga Bebas Resiko (BI Rate) & LIBOR Rate

Tanggal

09/01/2014

13/02/2014

13/03/2014

08/04/2014

08/05/2014

12/06/2014

10/07/2014

14/08/2014

11/09/2014

07/10/2014

13/11/2014

18/11/2014

11/12/2014

Rata-rata Tahun 2014

(Sumber : www.bi.go.id)

BI Rate

7,50

7,50

7,50

7,50

7,50

7,50

7,50

7,50

7,50

7,50

7,50

7,75

7,75

7,54

Bulan

Januari

Februari

Maret

April

Mei

Juni

Juli

Agustus

September

Oktober

Nopember

Desember

Rata-rata

LIBOR Rate

0,09

0,09

0,09

0,09

0,09

0,09

0,09

0,09

0,09

0,09

0,10

0,11

0,09

Analysis By : Ahmad Sulaemi_0221.12.349

Check By : Dede Sofyan_0221.12.348

D. Risk Free Rate Indonesia

Desember 2014

(Sumber : www.market-risk-primea.com)

DATA MANAJEMEN KEUANGAN LANJUTAN UNTUK UAS

7,85%

Analysis By : Ahmad Sulaemi_0221.12.349

Check By : Dede Sofyan_0221.12.348

DATA MANAJEMEN KEUANGAN LANJUTAN UNTUK UAS

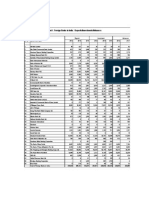

PERHITUNGAN COST OF CAPITAL PT. ASTRA INTERNATIONAL Tbk

BERDASARKAN LAPORAN KEUANGAN TAHUN 2014

(Dalam jutaan Rupiah)

AKUN

Nilai

Comp. Int. Rate Cost of Debt WACC Keterangan Suku Bunga

UTANG JANGKA PENDEK

Rupiah

PT. Bank Central Asia Tbk

980.000

0,61%

9,50%

7,68% 0,05%

8,00% - 11,00%

PT. Bank Sumitiomo Mitsui Indonesia

489.000

0,31% 10,80%

8,74% 0,03%

LIBOR + 1,80%

PT. Bank Pan Indonesia Tbk

421.000

0,26% 11,45%

9,26% 0,02%

11,25% - 11,65%

PT. Bank Mizuho Indonesia Tbk

245.000

0,15% 10,98%

8,88% 0,01%

10,70% - 11,25%

PT. Bank CIMB Niaga TBk

200.000

0,13%

7,50%

6,07% 0,01%

5,75% - 9,25%

PT. Bank ANZ Indonesia

200.000

0,13%

2,10%

1,70% 0,00%

LIBOR + 2,10%

The Bank of Tokyo-Mitsubishi UFJ Ltd

150.000

0,09% 10,70%

8,66% 0,01%

LIBOR + 1,70%

The Hongkong & Shanghai Banking Corp Ltd

50.000

0,03%

8,63%

6,98% 0,00%

6,90% - 10,35%

Lain-lain

24.000

0,02%

9,50%

7,68% 0,00%

8,00% - 11,00%

USD

Mizuho Bank Ltd

1.864.000

1,17% 10,45%

8,45% 0,10%

LIBOR + 1,20%

Oversea-Chinese Banking Corp Ltd

1.422.000

0,89% 10,48%

8,47% 0,08%

LIBOR + 1,25%

PT. Bank Sumitomo Mitsui Indonesia

311.000

0,20% 10,80%

8,74% 0,02%

LIBOR +

1,80%

The Bank of Tokyo-Mitsubisih UFJ Ltd

124.000

0,08% 10,70%

8,66% 0,01%

LIBOR + 1,70%

Sumitomo Mitsui Banking Corporation

122.000

0,08% 10,70%

8,66% 0,01%

LIBOR + 1,70%

Lain-lain

78.000

0,05% 10,63%

8,59% 0,00%

Pinjaman Sindikasi

Mizuho Bank Ltd

3.110.000

1,95% 10,25%

8,29% 0,16%

LIBOR + 1,25%

The Bank of Tokyo-Mitsubisih UFJ Ltd

622.000

0,39% 10,20%

8,25% 0,03%

LIBOR + 1,20%

TOTAL UTANG JANGKA PENDEK

10.412.000

6,53%

0,54%

UTANG JANGKA PANJANG

Rupiah

PT. Bank Mandiri (Persero) Tbk

2.108.000

1,32%

9,13%

7,38% 0,10%

8,25% - 10,00%

PT. Bank Centra Asia Tbk

1.796.000

1,13%

9,63%

7,79% 0,09%

8,00% - 11,25%

PT. Bank Pan Indonesia Tbk

1.336.000

0,84% 10,00%

8,09% 0,07%

8,75% - 11,25%

PT. Bank DKI

474.000

0,30% 10,13%

8,19% 0,02%

9,25% - 11,00%

PT. Bank Negara Indonesia (Persero) Tbk

345.000

0,22% 11,45%

9,26% 0,02%

9,90% - 13,00%

PT. BPD Jawa Barat & Banten Tbk

200.000

0,13%

9,40%

7,60% 0,01%

9,40%

PT. Bank ICBC Indonesia

99.000

0,06%

9,65%

7,81% 0,00%

9,40% - 9,90%

PT. UOB

54.000

0,03%

8,78%

7,10% 0,00%

8,65% - 8,90%

Lain-lain

38.000

0,02%

9,77%

7,90% 0,00%

Mata Uang Asing

Oversea-Chinese Banking Corp Ltd

1.361.000

0,85% 10,88%

8,80% 0,08%

LIBOR + 1,70%

Mizuho Bank Ltd

918.000

0,58% 10,78%

8,72% 0,05%

LIBOR + 1,70%

Sumitomo Mitsui Banking Corporation

821.000

0,51% 10,75%

8,70% 0,04%

LIBOR + 1,70%

PT. Bank ANZ Indonesia

351.000

0,22% 10,85%

8,78% 0,02%

LIBOR + 1,85%

The Hongkong & Shanghai Banking Corp Ltd

228.000

0,14% 10,85%

8,78% 0,01%

LIBOR + 1,85%

PT. Bank CIMB Niaga TBk

149.000

0,09%

9,42%

7,62% 0,01%

9,42%

The Japan Bank For Internatonal Corp

56.000

0,04%

4,40%

3,56% 0,00%

4,40%

Lain-lain

37.000

0,02% 10,82%

8,75% 0,00%

Pinjaman Sindikasi

Sumitomo Mitsui Banking Corporation

7.782.000

4,88% 10,63%

8,59% 0,42%

LIBOR + 1,55%

Mizuho Bank Ltd

4.964.000

3,11% 10,73%

8,68% 0,27%

LIBOR + 1,35%

Oversea-Chinese Banking Corp Ltd

4.113.000

2,58% 11,20%

9,06% 0,23%

LIBOR + 1,80%

PT. Bank OCPC NISP Tbk

3.839.000

2,41% 10,90%

8,82% 0,21%

LIBOR + 1,80%

The Hongkong & Shanghai Banking Corp Ltd

1.944.000

1,22% 10,54%

8,53% 0,10%

LIBOR + 1,28%

The Japan Bank For Internatonal Corp

1.888.000

1,18% 10,57%

8,55% 0,10%

LIBOR + 1,13%

Standard Chatered Bank

825.000

0,52% 11,03%

8,92% 0,05%

LIBOR + 1,95%

The Bank of Tokyo-Mitsubisih UFJ Ltd

723.000

0,45% 11,10%

8,98% 0,04%

LIBOR + 2,00%

CTBC Bank Co Ltd

414.000

0,26% 11,00%

8,90% 0,02%

LIBOR + 2,00%

Netherland Development Finance Co

307.000

0,19% 11,00%

8,90% 0,02%

LIBOR + 1,85%

CIMB Bank Berhad

52.000

0,03% 10,65%

8,61% 0,00%

LIBOR + 1,65%

Pinjaman Pihak Selain Bank

Lembaga Pembiayaan Ekspor Indonesia

87.000

0,05%

9,00%

7,28% 0,00%

9,00%

JA Mitsui

166.000

0,10% 11,37%

9,19% 0,01%

LIBOR + 1,85%

MG Leasing Corporation

10.000

0,01% 10,25%

8,29% 0,00%

LIBOR + 2,50%

1,70%

1,70%

2,05%

1,85%

1,80%

1,70%

2,10%

2,60%

2,00%

1,80%

2,00%

2,10%

2,20%

2,15%

2,88%

Analysis By : Ahmad Sulaemi_0221.12.349

Check By : Dede Sofyan_0221.12.348

UTANG OBLIGASI

Obligasi ASF XII

Obligasi Berkelanj. I-1 ASF th. 2012

Obligasi Berkelanj. I-3 ASF th. 2013

Obligasi Berkelanj. II -1 ASF th. 2013

Obligasi Berkelanj. II-2 ASF th. 2013

Obligasi Berkelanj. II-3 ASF th. 2014

Obligasi Berkelanj. II-4 ASF th. 2014

ASF Singapore Dollar Guaranteed Bond

Obligasi Berkelanj. I-1 FIF th. 2012

Obligasi Berkelanj. I-2 FIF th. 2013

Obligasi Berkelanj. I-3 FIF th. 2014

Obligasi SAN th. 2012

Obligasi Berkelanj. I-1 SAN th. 2013

Obligasi Berkelanj. I-2 SAN th. 2014

Obigasi Serasi Auto Raya II th. 2011

Obigasi Serasi Auto Raya III th. 2011

TOTAL UTANG JANGKA PANJANG

TOTAL UTANG

EKUITAS

Modal Saham

Tambahan Modal disetor

Laba ditahan

Total Ekuitas

Total Modal

DATA MANAJEMEN KEUANGAN LANJUTAN UNTUK UAS

579.000

4.184.000

1.120.000

960.000

1.223.000

1.905.000

2.408.000

925.000

1.624.000

1.688.000

1.467.000

804.000

358.000

955.000

470.000

282.000

58.437.000

68.849.000

0,36%

2,62%

0,70%

0,60%

0,77%

1,19%

1,51%

0,58%

1,02%

1,06%

0,92%

0,50%

0,22%

0,60%

0,29%

0,18%

36,64%

43,17%

2.024.000

1.139.000

87.459.000

90.622.000

159.471.000

1,27%

0,71%

54,84%

56,83%

100%

10,00%

8,30%

7,75%

7,50%

9,63%

10,10%

10,05%

2,12%

7,65%

7,75%

10,05%

8,40%

9,75%

10,50%

10,20%

8,53%

8,09%

6,71%

6,27%

6,07%

7,79%

8,17%

8,13%

1,71%

6,19%

6,27%

8,13%

6,79%

7,89%

8,49%

8,25%

6,90%

0,03%

0,18%

0,04%

0,04%

0,06%

0,10%

0,12%

0,01%

0,06%

0,07%

0,07%

0,03%

0,02%

0,05%

0,02%

0,01%

2,93%

3,47%

0,07581

0,07581

0,07581

0,10%

0,05%

4,16%

4,31%

7,78%

TOTAL WACC ATAU COST OF CAPITAL PT. ASTRA INTERNATIONAL TBK :

KETERANGAN

Pajak

Beta

Bunga Bebas Resiko

Risk Free Rate

19,11%

0,0052

7,54%

7,85%

10,00%

8,00%

7,75%

7,25%

9,50%

9,60%

9,60%

2,12%

7,65%

7,75%

9,60%

8,40%

9,75%

10,50%

10,20%

8,30%

Suku Bunga LIBOR

Keterangan rumus yang digunakan

Cost of Debt

WACC Debt

= Suku Bunga X (1 - Pajak)

= Cost of Debt X Komposisi

Cost of Equity Modal Saham

WACC Equity

= Bunga Bebas Resiko + (Risk Free Rate X Beta Saham)

= Cost of Equity X Komposisi

9,00%

7,78

- 8,60%

-

7,75%

9,75%

10,60%

10,50%

- 10,50%

- 8,75%

Anda mungkin juga menyukai

- Manila Standard Today - Business Weekly Stock Review (September 3-7, 2012)Dokumen1 halamanManila Standard Today - Business Weekly Stock Review (September 3-7, 2012)Manila Standard TodayBelum ada peringkat

- Manila Standard Today - Weekly Business Stock Review (Aug 5-9, 2013) IssueDokumen1 halamanManila Standard Today - Weekly Business Stock Review (Aug 5-9, 2013) IssueManila Standard TodayBelum ada peringkat

- Banking Survey 2010Dokumen60 halamanBanking Survey 2010Fahad Paracha100% (1)

- Manila Standard Today - Business Weekly Stock Review (July 23-27, 2012)Dokumen1 halamanManila Standard Today - Business Weekly Stock Review (July 23-27, 2012)Manila Standard TodayBelum ada peringkat

- Manila Standard Today - Business Weekly Stock Review (Aug. 6-10 2012)Dokumen1 halamanManila Standard Today - Business Weekly Stock Review (Aug. 6-10 2012)Manila Standard TodayBelum ada peringkat

- Manila Standard Today - Business Weekly Stock Review (December 3-7, 2012)Dokumen1 halamanManila Standard Today - Business Weekly Stock Review (December 3-7, 2012)Manila Standard TodayBelum ada peringkat

- Manila Standard Today - Business Weekly Stocks Review (June 25, 2012)Dokumen1 halamanManila Standard Today - Business Weekly Stocks Review (June 25, 2012)Manila Standard TodayBelum ada peringkat

- Manila Standard Today - Business Weekly Stock Review (March 11 - 15, 2013)Dokumen1 halamanManila Standard Today - Business Weekly Stock Review (March 11 - 15, 2013)Manila Standard TodayBelum ada peringkat

- Syndicate Bank capital structure and financial performance from 1999-2010Dokumen6 halamanSyndicate Bank capital structure and financial performance from 1999-2010dsgoudBelum ada peringkat

- Manila Standard Today - Business Weekly Stock Review (November 19-23, 2012)Dokumen1 halamanManila Standard Today - Business Weekly Stock Review (November 19-23, 2012)Manila Standard TodayBelum ada peringkat

- Manila Standard Today - Business Weekly Stock Review (October 22-25, 2012)Dokumen1 halamanManila Standard Today - Business Weekly Stock Review (October 22-25, 2012)Manila Standard TodayBelum ada peringkat

- Market and Structural Review of a Stock Broking OrganizationDokumen43 halamanMarket and Structural Review of a Stock Broking Organizationrahulshah86Belum ada peringkat

- Manila Standard Today - Business Weekly Stock Review (November 5-9, 2012)Dokumen1 halamanManila Standard Today - Business Weekly Stock Review (November 5-9, 2012)Manila Standard TodayBelum ada peringkat

- Daily Trade Journal - 05.03Dokumen7 halamanDaily Trade Journal - 05.03ran2013Belum ada peringkat

- Crossings Boosted Turnover Adding 75% Amidst ASPI RallyDokumen6 halamanCrossings Boosted Turnover Adding 75% Amidst ASPI RallyRandora LkBelum ada peringkat

- Renewed Buying Interest On Bourse: Wednesday, April 03, 2013Dokumen7 halamanRenewed Buying Interest On Bourse: Wednesday, April 03, 2013Randora LkBelum ada peringkat

- Company: IDFC Project Cost Years 2003 2004 2005 2006 2007 2008 2009 2010 ProjectedDokumen68 halamanCompany: IDFC Project Cost Years 2003 2004 2005 2006 2007 2008 2009 2010 Projectedsumit_sagarBelum ada peringkat

- Financial Statement Analysis: Balance SheetDokumen3 halamanFinancial Statement Analysis: Balance SheetMohib Ullah YousafzaiBelum ada peringkat

- Soft 07Dokumen6 halamanSoft 07ishara-gamage-1523Belum ada peringkat

- Manila Standard Today - Business Weekly Stock Review (January 2-4, 2013) IssueDokumen1 halamanManila Standard Today - Business Weekly Stock Review (January 2-4, 2013) IssueManila Standard TodayBelum ada peringkat

- Daily Trade Journal - 07.08.2013Dokumen6 halamanDaily Trade Journal - 07.08.2013Randora LkBelum ada peringkat

- Manila Standard Today - Busines Weekly Stock Review (May 4-8, 2015)Dokumen1 halamanManila Standard Today - Busines Weekly Stock Review (May 4-8, 2015)Manila Standard TodayBelum ada peringkat

- BJBRDokumen3 halamanBJBRdavidwijaya1986Belum ada peringkat

- Daily Trade Journal - 11.03.2014Dokumen6 halamanDaily Trade Journal - 11.03.2014Randora LkBelum ada peringkat

- Trainee Portfolio - Yahoo Finance PortfoliosDokumen1 halamanTrainee Portfolio - Yahoo Finance Portfoliosverve1977Belum ada peringkat

- Manila Standard Today - Business Weekly Stock Review (June 3-7, 2013) IssueDokumen1 halamanManila Standard Today - Business Weekly Stock Review (June 3-7, 2013) IssueManila Standard TodayBelum ada peringkat

- Part 2Dokumen31 halamanPart 2Prasad MoreBelum ada peringkat

- Daily Equity Newsletter by Market Magnify 09-03-2012Dokumen7 halamanDaily Equity Newsletter by Market Magnify 09-03-2012IntradayTips ProviderBelum ada peringkat

- Daily Equity Newsletter by Market Magnify 07-03-2012Dokumen7 halamanDaily Equity Newsletter by Market Magnify 07-03-2012IntradayTips ProviderBelum ada peringkat

- Daily Trade Journal - 01.07.2013Dokumen6 halamanDaily Trade Journal - 01.07.2013Randora LkBelum ada peringkat

- Daily Trade Journal - 10.01.2014Dokumen6 halamanDaily Trade Journal - 10.01.2014Randora LkBelum ada peringkat

- Daily Trade Journal - 06.08.2013Dokumen6 halamanDaily Trade Journal - 06.08.2013Randora LkBelum ada peringkat

- Statement I: Foreign Banks in India: Deposits/Investments/AdvancesDokumen8 halamanStatement I: Foreign Banks in India: Deposits/Investments/Advancespankajp100Belum ada peringkat

- Public Sec Banks 1Dokumen8 halamanPublic Sec Banks 1ajsharma8Belum ada peringkat

- Equity Analysis Equity Analysis - Daily DailyDokumen7 halamanEquity Analysis Equity Analysis - Daily Dailyapi-160037995Belum ada peringkat

- Econo Data CompleteDokumen10 halamanEcono Data Completeasad chBelum ada peringkat

- Tractic Loan 19.10.2022Dokumen2 halamanTractic Loan 19.10.2022narendar kumar kBelum ada peringkat

- Daily Trade Journal - 10.02.2014Dokumen6 halamanDaily Trade Journal - 10.02.2014Randora LkBelum ada peringkat

- Manila Standard Today - Business Weekly Stock Review (March 18 - 22, 2013)Dokumen1 halamanManila Standard Today - Business Weekly Stock Review (March 18 - 22, 2013)Manila Standard TodayBelum ada peringkat

- Market Share of Top 5 Banks in IndiaDokumen6 halamanMarket Share of Top 5 Banks in Indiamayank shridharBelum ada peringkat

- Equity Tips For 04-05Dokumen7 halamanEquity Tips For 04-05Theequicom AdvisoryBelum ada peringkat

- Kohat Textile Mills Shareholder CategoriesDokumen10 halamanKohat Textile Mills Shareholder CategoriesHashim AfzalBelum ada peringkat

- Market Analysis For The Day 13 AugDokumen7 halamanMarket Analysis For The Day 13 AugTheequicom AdvisoryBelum ada peringkat

- Indian Stock Market Outlook by Mansukh Investment & Trading Solutions 28/7/2010Dokumen5 halamanIndian Stock Market Outlook by Mansukh Investment & Trading Solutions 28/7/2010MansukhBelum ada peringkat

- Manila Standard Today - Business Weekly Stock Review (July 22-26, 2013)Dokumen1 halamanManila Standard Today - Business Weekly Stock Review (July 22-26, 2013)Manila Standard TodayBelum ada peringkat

- Manila Standard Today - Business Weekly Stock Review (December 17-21, 2012)Dokumen1 halamanManila Standard Today - Business Weekly Stock Review (December 17-21, 2012)Manila Standard TodayBelum ada peringkat

- HDFC Bank Loan Repayment ScheduleDokumen4 halamanHDFC Bank Loan Repayment ScheduleKota Mani KantaBelum ada peringkat

- Equity Tips and Market Outlook For 19 OCtDokumen7 halamanEquity Tips and Market Outlook For 19 OCtRani RaiBelum ada peringkat

- Daily News Letter 27dec2012Dokumen7 halamanDaily News Letter 27dec2012Theequicom AdvisoryBelum ada peringkat

- Manila Standard Today - Business Weekly Stock Review (October 27 - 31, 2014)Dokumen1 halamanManila Standard Today - Business Weekly Stock Review (October 27 - 31, 2014)Manila Standard TodayBelum ada peringkat

- Equity Analysis Equity Analysis - Daily DailyDokumen7 halamanEquity Analysis Equity Analysis - Daily Dailyapi-160037995Belum ada peringkat

- Daily Trade Journal - 08.10.2013Dokumen6 halamanDaily Trade Journal - 08.10.2013Randora LkBelum ada peringkat

- Manila Standard Today - Business Weekly Stock Review (September 15-18, 2014)Dokumen1 halamanManila Standard Today - Business Weekly Stock Review (September 15-18, 2014)Manila Standard TodayBelum ada peringkat

- Daily Market Update: Indices Closed With Gains Foreign Sales Account For 51.9% of TurnoverDokumen2 halamanDaily Market Update: Indices Closed With Gains Foreign Sales Account For 51.9% of TurnoverRandora LkBelum ada peringkat

- NDTV Profit: NDTV Profit Khabar Movies Cricket Doctor Good Times Social Register Sign-InDokumen30 halamanNDTV Profit: NDTV Profit Khabar Movies Cricket Doctor Good Times Social Register Sign-Inpriyamvada_tBelum ada peringkat

- Daily Trade Journal - 22.01.2014Dokumen6 halamanDaily Trade Journal - 22.01.2014Randora LkBelum ada peringkat

- Daily Equtiy News Letter 11jan 2013Dokumen7 halamanDaily Equtiy News Letter 11jan 2013Theequicom AdvisoryBelum ada peringkat

- Market Snapshot ADokumen5 halamanMarket Snapshot Abi11yBelum ada peringkat

- SR Company Last Price Change % CHGDokumen44 halamanSR Company Last Price Change % CHGRahul ReinBelum ada peringkat

- Ingles Semana 5Dokumen5 halamanIngles Semana 5marlon choquehuancaBelum ada peringkat

- Draft Observations For Tax Audit ReportDokumen5 halamanDraft Observations For Tax Audit Reportravirockz128Belum ada peringkat

- Full Download Understanding Human Sexuality 13th Edition Hyde Test BankDokumen13 halamanFull Download Understanding Human Sexuality 13th Edition Hyde Test Bankjosiah78vcra100% (29)

- Notes Labor RevDokumen4 halamanNotes Labor RevCharmagneBelum ada peringkat

- CAGAYAN STATE UNIVERSITY TECHNOLOGY LIVELIHOOD EDUCATION CLUB CONSTITUTIONDokumen7 halamanCAGAYAN STATE UNIVERSITY TECHNOLOGY LIVELIHOOD EDUCATION CLUB CONSTITUTIONjohnlloyd delarosaBelum ada peringkat

- SC Upholds BIR Levy of Marcos Properties to Cover Tax DelinquenciesDokumen7 halamanSC Upholds BIR Levy of Marcos Properties to Cover Tax DelinquenciesGuiller C. MagsumbolBelum ada peringkat

- PT Indomobil Sukses Internasional TBK.: Annual ReportDokumen397 halamanPT Indomobil Sukses Internasional TBK.: Annual ReportSUSANBelum ada peringkat

- Stress Analysis and Evaluation of A Rectangular Pressure VesselDokumen10 halamanStress Analysis and Evaluation of A Rectangular Pressure Vesselmatodelanus100% (1)

- Legal Standoff Over Fine LiabilityDokumen1 halamanLegal Standoff Over Fine Liabilityrmaq100% (1)

- What Is Defined As A Type of Living in Which Survival Is Based Directly or Indirectly On The Maintenance of Domesticated AnimalsDokumen26 halamanWhat Is Defined As A Type of Living in Which Survival Is Based Directly or Indirectly On The Maintenance of Domesticated AnimalsJen JenBelum ada peringkat

- Report on 5 Warehouses for LeaseDokumen6 halamanReport on 5 Warehouses for LeaseMirza MešanovićBelum ada peringkat

- Premiums and WarrantyDokumen8 halamanPremiums and WarrantyMarela Velasquez100% (2)

- Citizenship-Immigration Status 2016Dokumen1 halamanCitizenship-Immigration Status 2016rendaoBelum ada peringkat

- The Phantom Landlord - City Limits Magazine - March, April 2012Dokumen52 halamanThe Phantom Landlord - City Limits Magazine - March, April 2012City Limits (New York)Belum ada peringkat

- Industrial Security ConceptDokumen85 halamanIndustrial Security ConceptJonathanKelly Bitonga BargasoBelum ada peringkat

- Realvce: Free Vce Exam Simulator, Real Exam Dumps File DownloadDokumen16 halamanRealvce: Free Vce Exam Simulator, Real Exam Dumps File Downloadmario valenciaBelum ada peringkat

- Week.8-9.Fact and Opinion & Assessing EvidencesDokumen13 halamanWeek.8-9.Fact and Opinion & Assessing EvidencesRodel Delos ReyesBelum ada peringkat

- Grade 8 Unit 1 L.3: Actions Are Judged by IntentionsDokumen18 halamanGrade 8 Unit 1 L.3: Actions Are Judged by IntentionsAMNA MUJEEB tmsBelum ada peringkat

- Ethics of UtilitarianismDokumen26 halamanEthics of UtilitarianismAngelene MangubatBelum ada peringkat

- Teodoro M. Hernandez V The Honorable Commission On Audit FactsDokumen2 halamanTeodoro M. Hernandez V The Honorable Commission On Audit FactsAngela Louise SabaoanBelum ada peringkat

- Materi 5: Business Ethics and The Legal Environment of BusinessDokumen30 halamanMateri 5: Business Ethics and The Legal Environment of BusinessChikita DindaBelum ada peringkat

- The Statue of Liberty: Nonfiction Reading TestDokumen4 halamanThe Statue of Liberty: Nonfiction Reading TestMargarida RibeiroBelum ada peringkat

- Uy v. CADokumen6 halamanUy v. CAnakedfringeBelum ada peringkat

- COA DBM JOINT CIRCULAR NO 1 S, 2022Dokumen7 halamanCOA DBM JOINT CIRCULAR NO 1 S, 2022AnnBelum ada peringkat

- ST TuesDokumen34 halamanST Tuesdoug smitherBelum ada peringkat

- LabReport2 Group6Dokumen7 halamanLabReport2 Group6RusselBelum ada peringkat

- D.A.V. College Trust case analysisDokumen9 halamanD.A.V. College Trust case analysisBHAVYA GUPTABelum ada peringkat

- Court of Appeals Upholds Dismissal of Forcible Entry CaseDokumen6 halamanCourt of Appeals Upholds Dismissal of Forcible Entry CaseJoseph Dimalanta DajayBelum ada peringkat

- Petitioners: La Bugal-B'Laan Tribal Association Inc, Rep. Chariman F'Long Miguel Lumayong Etc Respondent: Secretary Victor O. Ramos, DENR EtcDokumen2 halamanPetitioners: La Bugal-B'Laan Tribal Association Inc, Rep. Chariman F'Long Miguel Lumayong Etc Respondent: Secretary Victor O. Ramos, DENR EtcApple Gee Libo-onBelum ada peringkat

- Why Discovery Garden Is The Right Choice For Residence and InvestmentsDokumen3 halamanWhy Discovery Garden Is The Right Choice For Residence and InvestmentsAleem Ahmad RindekharabatBelum ada peringkat