Full Report - BBTN

Diunggah oleh

FrederikRasaliJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Full Report - BBTN

Diunggah oleh

FrederikRasaliHak Cipta:

Format Tersedia

PT MINNA PADI INVESTAMA

Member of Indonesia Stock Exchange

EQUITY RESEARCH

FULL REPORT

PT Bank Tabungan Negara (Persero), Tbk.

Mortgage Champion

11 March 2016

Initiate Coverage

BUY

Last Price (11 March 2016)

1,650

Target Price

1,845

52-Week Range

935-1,720

PBV 2016F

1.16x

Market Cap (Bio IDR)

17,550

Issued Shares (Mio Shares) 10,573.17

Shareholders List

Government

60.04%

Maryono

0%

Irman A. Zahiruddin

0.05%

Mansyur S. Nasution

0.00%

Sis Apik Wijayanto

0%

Public

39.91%

HIGHLIGHTS

Its All about Collection. BTN has increasing

loan quality due to their effort to control the

assets. BTN managed to reduce to 2.11% Net

NPL in 2015 by start selling non-performing

assets before the collectability categorized as

loss

Interesting Interest Rate. As the portfolio

of BTN mostly are on mortgage loan, we

expect that lower interest rate will give the

Bank more mortgage loan. BTN has around

5% net interest margin and still have room to

cut around 50 Bps to improve more

mortgage loan growth around 20% in 2016

which is in line with the BI Rate outlook.

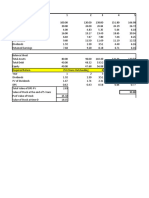

FINANCIAL SUMMARY

Initiate BUY. With current price at Rp. 1,650

per share, PBV ratio stands at 1.4x P/BV16.

We set our target price at Rp.1,845 which

translates to 0.96x PBV16 as well as 12% of

upside potential from the latest price.

2013A 2014A 2015A

2016F

2017F

2018F

CASA Ratio

25.12%

24.31%

23.76%

23.95%

24.02%

22.45%

Coverage Ratio

28.13%

14.84%

22.21%

25.19%

21.42%

21.43%

PPOP Margin

24.71%

18.70%

23.71%

25.29%

23.17%

23.18%

Provision to PPOP

16.83%

33.30%

26.08%

24.51%

26.75%

26.75%

6.24%

5.30%

5.50%

5.26%

4.93%

4.54%

17.84%

16.31%

19.65%

18.23%

16.67%

15.78%

Net Interest Income

Capital Adequacy Ratio

Gross NPL

Frederik Rasali

+62 21 525 5555

fred@minnapadi.com

Unconventional Expansion. With more

portfolio weight on mortgage loan, the risk

would be high if in the case consumer buying

power for housing is deteriorating. BTN has

taken precaution to mitigate the risk by using

new business such as life insurance firm,

Mortgage Backed Security, and multi finance

subsidiary to reduce NPL and increase

income at the same time.

4.82%

4.88%

4.15%

3.96%

3.66%

3.59%

Return on Equity (ROE)

13.52%

8.81%

12.87%

13.62%

12.51%

11.67%

Return on Assets (ROA)

1.19%

0.77%

1.08%

1.13%

1.02%

0.96%

0.793

1.007

1.194

1.160

1.365

2.100

Price-to-Book Value (P/BV)

Source: BBTN, MPI Research

PT MINNA PADI INVESTAMA

Member of Indonesia Stock Exchange

EQUITY RESEARCH

INDUSTRY OUTLOOK

When we are talking about countrys growth, we would be thinking about the capital

needed for firms to grow with and we know that banks are the most common solution

for firms to look for capitals. Based on an IMF survey on Indonesia, economic outlook is

seen growing around 5.4% this year. This means banking growth on average will also be

around 5%, just slightly below the GDP due to not all of Indonesian firms use 100% bank

loans to fund their businesses.

Performance Indicator

Capital Adequacy Ratio (%)

Core Capital Ratio to ATMR (%)

Return on Assets Ratio (%)

Operating Expenses / Operating Income (%)

Net Interest Margin Ratio (%)

Loan to Deposit Ratio (%)

Liquid Assets Ratio (%)

Jan

21.01

18.75

2.82

82.15

4.24

88.48

16.88

Feb

21.26

18.99

2.51

81.59

4.06

88.26

17.35

Mar

20.98

18.40

2.69

79.49

5.30

87.58

18.74

Apr

20.79

18.19

2.53

79.94

5.30

87.94

18.16

Exhibit 1: Indonesian Banking Performance

May

20.51

17.98

2.45

80.42

5.33

88.72

17.26

Jun

20.28

17.75

2.29

81.40

5.32

88.46

17.35

Jul

20.78

18.21

2.27

81.39

5.32

88.50

17.03

Aug

20.73

18.19

2.30

81.46

5.32

88.81

16.87

Sep

20.62

18.14

2.31

81.82

5.32

88.54

17.56

Oct

21.05

18.54

2.30

81.11

5.34

89.74

16.69

Nov

21.33

18.85

2.33

81.62

5.35

90.47

16.44

Dec

21.39

19.00

2.32

81.49

5.39

92.11

16.70

Source: Otoritas Jasa Keuangan

Banking sector in 2015 was quite robust in terms of average Net Interest Margin (NIM)

although consumption was slowing down in Q4 2015. The average Net Interest Margin in

December stood at 5.39%, increasing gradually after four months of being stagnant at

5.32% (June 2015-September 2015).

Capital Adequacy Ratio (CAR) also improved from 21.01% to 21.39% from January 2015 to

December 2015, which means rising capital has offset Risk-Based Balanced Asset (ATMR)

where banks have more durability against risks. Average Loan-to-Deposit ratio reportedly

stood at 92.11% at the end of 2015, suggesting that loan activities were picking up beyond

Bank Indonesias upper band of 92% set for banks with NPL above 5%. Third-party fund

growth has slowed down however, as lower BI rate has pushed investors to pick riskier

investment to gain better yield.

The lowering of BI rate early in 2016 from 7.25% to 7.00% has pushed the banking sector

to decrease their loan and deposit interest rates as well. While this will put pressure on

NIM in the future, lower interest rate is expected to lead to more consumption. More

consumption means more consumer credit in which in this case will directly affect banks

focusing on credit cards, mortgage and vehicle loans (Kredit Kendaraan Bermotor). Banks

indirectly affected will be those who channel credit to the retail sector. NIM is seen around

4.9% to 5.1% but we would say that the total frequency of credit will increase by 10% on

average as big banks may give more credits and this is seen offsetting the downside of

the decline in NIM.

Indonesian banking assets are mostly have no significant differences, in fact the portion

of total third party funds is now channeled by banks to more credits assets (92.16% of

total third party funds on December 2015 versus 88.29% on average from January 2015

November 2015) rather than focusing on non-credit assets such as treasury gains from

foreign exchange trades or gains from securities available for trade (see Exhibit 2)

PT MINNA PADI INVESTAMA

Member of Indonesia Stock Exchange

EQUITY RESEARCH

The composition of third party funds portion also saw a significant change in December

2015 where the total current saving has increased from 28% on average from January to

November 2015 to 31% in December 2015 while demand deposit fell from 18% on

average from January 2015 to November 2015 to 16% in December 2015. Time deposit

remained constant at 42% in December 2015. The increase in savings means that more

customers are expecting to spend more rather than put their money in demand deposit

and time deposit accounts.

Rp7,000,000

Rp6,000,000

Rp5,000,000

Rp4,000,000

Rp3,000,000

Rp2,000,000

Rp1,000,000

Rp0

Jan

Feb

Mar

Apr

Mei

Jun

Jul

Aug

Sep

Oct

Nov

Dec

2015

Asset

Credit

Third Party Funds

Exhibit 2: Indonesian Banking Asset Growth

Source: Otoritas Jasa Keuangan

Exhibit 3: Indonesian Bank Funding Portion

Source: Otoritas Jasa Keuangan

Total credit channeled in November 2015 reached 2,952 trillion rupiah, an increase of 106

trillion rupiah from November 2015. Commercial banks are focusing on retail credit as

much as 27% of total credit while processing industry took as much as 25.75%. It is

forecast that the retail credit will grow larger in line with consumption as BI rate

decreased by 50 basis points. The credit for construction will also increase as the

government launched its housing project called 1 Juta Rumah Jokowi and a lot of other

infrastructure projects such as toll road and power plant. We may also need to pay a

closer look on banks that channel credit to retail, construction, household and financials.

PT MINNA PADI INVESTAMA

Member of Indonesia Stock Exchange

EQUITY RESEARCH

1.96% 0.09% 0.00%

0.41%

0.30%

8.64%

4.58%

6.26%

0.73%

0.28%

0.44%

Agriculture

Fishery

Mining

5.58%

Processing Industry

6.01%

Electricity, Gas and Water

Construction

2.91%

25.75%

Retail

Food Provision

Logistic and Communication

26.84%

Financials

5.86%

Business Services and Ownership

3.37%

Exhibit 4: Credit Channeling as of December 2015

Government

Source: Otoritas Jasa Keuangan

This year, total credit to be channeled is predicted to grow by 14%, which will give us

3,244.4 trillion rupiah by 2016. The breakdown can be seen on Exhibit 5.

Exhibit 5: Predicted Credit Channeling for 2016

Source: Otoritas Jasa Keuangan

Based on the various government stimulus packages and Bank Indonesias recent rate

decision, we expect that the retail business will get a boost due to lower deposit rate

(down from 7.5% to 7%). More people may also put more of their savings to riskier

investments and spending as investing in time deposit seems to become less attractive.

In turn, this will lead to more consumption.

PT MINNA PADI INVESTAMA

Member of Indonesia Stock Exchange

EQUITY RESEARCH

ECONOMIC OUTLOOK

Economic Growth

5.10%

5.00%

5.04%

4.90%

4.80%

4.70%

4.74%

4.72%

4.67%

4.60%

4.50%

4.40%

Q1 2015

Q2 2015

Exhibit 6: Indonesia GDP Growth (Y/Y)

Q3 2015

Q4 2015

Source: Bank Indonesia

Indonesia GDP managed to beat the market expectation in the final quarter of 2015,

rising by 5.04% vs. 4.74% in prior quarter. Government spending played its part in terms

of infrastructure construction and also investment from foreign direct investment. What

actually pushed the economy were the consumption and the balance of trade at the end

of the day. Consumer confidence index was also getting better in January 2016 when it

reached 112.6 according to a survey conducted by Bank Indonesia. On exhibit 7 the

Consumer Confidence Index is displayed in blue line and it has been in an uptrend since

October 2015 and in January 2016 the robust confidence level was influenced by further

fuel price cut and electricity tariff.

PT MINNA PADI INVESTAMA

EQUITY RESEARCH

Member of Indonesia Stock Exchange

The consumer confidence index shows an increase on December 2015 when it reached

112.6, up from 100 at September 2015 according to BI data, which gives us the idea that

retail business will have more activities and will need loans to grow their businesses

further. Total loan growth is seen to be around 17% this year while the portion of loans

for the retail sector is expected to stand at 30.8%.

Exhibit 7: Consumer Confidence Index as of January 2016

Source: Bank Indonesia

PT MINNA PADI INVESTAMA

EQUITY RESEARCH

Member of Indonesia Stock Exchange

COMPANY OVERVIEW

Brief Company Profile

Bank Tabungan Negara which is famous with the abbreviation BTN has been operational

from 1950. BTN focuses on mortgage loan channeling with the largest market share

around 30% compared to other banks that mainly channels mortgage loan. BTN was

publicly listed back in 2009. Prior going public in the same year, BTN managed to create

Asset backed security as mortgage bond securitization namely KIK-EBA which is the first

mortgage security in Indonesia, since then BTN upgrade the banking business into more

non-conventional way. In 2012 BTN has released right issue and managed to get 2.12

Trillion Rupiah with the goal to maintain capital quality and increase credit capacity. In

2013 BTN has fully integrated to focus on securing their market share by increasing loan

quality, reducing non-performing loan and focus more on the transaction process.

BTNs efforts to become global bank with three transformational steps that can be

categorized as:

1. Survival Period

Transformation 1 called Survival Period (2013 2015) where BTN maintain current

condition by protecting current market condition, create a predictable change,

financial capital driven and dominance the market by size.

2. Digital Banking Period

Transformation 2 called Digital Banking Period (2015- - 2019) in which BTN focuses

more on dominance by speed in transaction and process through technology and will

focus more on human capital driven.

3. Global-playership Period

Transformation 3 called Global Playership Periods (2020 2025) focuses more on

size and speed through network to face global free trade while BTN will continuously

change to fulfill global demand. In this level focuses more on human and financial

capital driven.

Exhibit 8: BBTN Transitional Plan

Source: BBTN

PT MINNA PADI INVESTAMA

EQUITY RESEARCH

Member of Indonesia Stock Exchange

Nowadays, BTN focuses on the transaction service by improving the IT quality such as EBanking, EDC payment, E-Cash, Mobile Banking, Vending Machine and digital offices.

These efforts are in line with BTNs transformation plan number 2 to improve speed,

technology and human capital driven.

Human Capital

Talking about the focus of BTN in human capital, the management team in BTN are

experienced in Banking with astounding achievement and have solid team that can

support the business. BTN has setup robust organizational structure where the retail and

commercial banking are separated to focus more on each business. All of the position

are monitored by independent audit committee to ensure all of the management and

staff are comply with the company goal.

Exhibit 9: Organization Chart

Source: BBTN

PT MINNA PADI INVESTAMA

Member of Indonesia Stock Exchange

EQUITY RESEARCH

Board of Commissioners

Board of Commissioners

Name

Chandra M Hazah

Kamaruddin Sjam

Catherinawati Hadiman

Arie Coerniadi

Experience

Position

President

Commissioner

Independent

Commissioner

Independent

Commissioner

Independent

Commissioner

Sumiyati

Commissioner

Fajar Harry Sampurno

Commissioner

Lucky Fathul Aziz H

Commissioner

Also president commissioner in PT. PLN (Perusahaan Listrik Negara), former President of KPK (Anti Corruption

Commissioner)

Former member of DPR Commissioner XI. President Commissioner of PT. Lanang Bersatu, and Director of BPKP

(Financial Oversight Agencies and Development)

President Director of PT. Diaspora Saraswati Gemilang. Former Deputy Director of CIMB Niaga and Director of

Corporate Banking at Bank Niaga

CFO in PT. Sarana Global Indonesia. Former Vice President in NISP securities, Group Head Vice President of

National Restructuring Bank

Current Commissioner in PT. Jiwasraya and Head of Financial Education and Training Agency (BPPK), Indonesia

Finance Ministry. Former Head of Financial Planing Bureau, Secretary General Ministry of Finance

Deputy of Mining , Strategic Industry and Media in Indonesia Ministry of State Owned Enterprise. Former

President Director of PT. Dahana and PT. Industri Kapal Indonesia

Deputy Commissioner Strategic Management 1B OJK. Former Head of Repesentative Bank Indonesia Region VI

West Java and Head of Bank Indonesia Representative New York

Exhibit 10: Board of Commissioners

Source: BBTN

Board of Directors

Board of Directors

Name

Position

Maryono

President Director

Managing Director

Irman A Zahidruddin

for Funding and

Distribution

Experience

Former President Director at Bank Mutiara, Head of Network Group Bank Mandiri Jakarta, Head Regional 1 of

Bank Mandiri Medan

7 years in BTN. Formerly as Consumer Group Director of Bank Permata, Director at GE Capital, Director GE Astra

Fiannce, Director Card Area Citibank NA - Indonesia Timur

Managing Director

Mansyur S Nasution

for Mortgage &

Consumer

Former Executive Vice President - Coordinator Consumer Finance Bank Mandiri and Head of Corporate

Secretary Group Bank Mandiri

Lending

Iman Nugroho Soeko

Director

Previously as Chief Executive and Head of Bank Mandiri Europe Limited

Oni Febriarto R

Director

Previously as Head of Small and Micro Lending Division and Branch Manager for branch office BTN Ciputat

Sis Apik Wijayanto

Director

Previously as Regional II Head for Bank BRI and as Branch Manager for Bank BRI Yogyakarta

Sulis Osdoko

Director

Adi Setianto

Director

Previously as Head of Retail Funding & Service Division, Head of Consumer Funding & Service Division and Head

of Information and Communication Technology in BTN

Previously as Network and Service Director and Treasury and Financial Institution Director of Bank BNI

Exhibit 11: Board of Directors

Source: BBTN

Exhibit 12: Ownership Structure

Source: BBTN

PT MINNA PADI INVESTAMA

Member of Indonesia Stock Exchange

EQUITY RESEARCH

Company Highlights

Superb Loan Management

BBTN is actively engage to reduce their gross Non-performing loan (NPL) from an average

of 4.03% from December 2012 to December 2014 into 3.42% in December 2015 where in

the December 2014 gross NPL reached 4.01% through focusing on collection. For the Net

NPL which mean only count the credit loss can be reduced from 2.76% at December 2014

to 2.11% at December 2015. And we found out the spread between gross and net NPL

are increasing every year from 0.52% in December 2011 to 1.25% in December 2014 and

1.31% in 2015 which mean that the portion of credit loss decreases more in each year.

Gross Vs. Net NPL

4.00%

4.05%

4.09%

4.01%

3.50%

3.42%

3.12%

3.04%

3.00%

2.76%

2.75%

2.50%

2.23%

2.11%

2.00%

Dec - 11

Dec - 12

Dec - 13

Gross NPL

Exhibit 13: BBTNs Gross NPL vs. Net NPL

Dec - 14

Dec - 15

Net NPL

Source: BBTN

Pre-emptive Strike

Talking about BTN loan quality, BTN has great policy regarding to loan collectability. Every

time BTN found a doubtful account, BTN will try to push the borrower from higher

collectability level to become one level lower within 3 months this will reduce the credit

risk acquired by BTN regarding to the borrower. To make sure the lead time between

assets acquired by BTN that expected to become collectability 5 or loss, BTN started to

offer the collateral when the loan turns into collectability 3 in which by the time if the loan

reached collectability 5. With collateral sold, BTN can write off the doubtful account with

minimum bad debt expense which later on will save provision by 1% of total credit at

least. The coverage ratio of BTN now stand at 43.14% in December 2015 as the provision

increased from 33.77% in December 2014 where provision on earning asset increased by

30.55% to 2,064 Billion Rupiah in December 2015 and 1,581 Billion Rupiah in 2014 and

NPL is falling as shown in exhibit 13.

10

PT MINNA PADI INVESTAMA

Member of Indonesia Stock Exchange

EQUITY RESEARCH

Focus Made Easy

BTN loan portfolio will overweigh the non-subsidized mortgage loans as the mortgage

loan rate from BTN is seen lower from the average since BI rate cut from 7.5% to 7% in

early 2016. With upward property sales outlook in 2016 after BI cut the rate, it is expected

that housing loan in BTN will grow around 27% from 2015, giving nominal total loan of

Rp.158.2 trillion Rupiah in 2016, increasing from Rp.124.9 trillion Rupiah in 2015. By

focusing more on housing loan, BTN can get a certain business model that cannot be

done by other banks that has spread out loan portfolio among all sectors. BTN has

worked with developers and property agencies to improve the credit channeling. We can

see that the growth of housing loan portfolio is much higher than the non-housing loans

and this was resulted by business sector focus.

Mostly BTNs mortgage valued at Rp200 300 million per unit. This customer segment

mostly earns Rp 72 360 Million per year and mostly are first time home buyers. In

addition, this segment is forecasted to grow from 74 Million people in 2012 to 141 million

people in 2020.

Jokowis One Million Housing is aiming at providing housing for the low income segment

through BTNs mortgage business. The project will give boost to BTN in 2017.

BTN Loan Composition (in Billion Rupiah)

Loan Type

31-12-13 A

31-12-14 A

31-12-15 A

31-12-16 F

31-12-17 F

31-12-18 F

Rp.

Rp.

Rp.

Rp.

Rp.

Rp.

Housing Loans

87,005

87

102,614

89

124,927

90

158,168

91

191,383

93

214,349

94

Subsidized Mortgages

28,429

28

34,347

30

43,527

31

52,232

30

49,759

24

45,013

20

Non-Subsidized Mortgages

39,548

39

45,601

39

53,567

39

73,092

42

95,691

46

109,318

48

7,198

8,179

8,934

10,542

17,224

27,865

12

Construction Loan

11,829

12

14,486

13

18,900

14

22,302

13

28,707

14

32,152

14

Non-Housing Loans

13,463

13

13,302

11

14,029

10

14,871

15,316

13,785

2,597

2,916

3,839

4,858

9,190

4,824

10,865

11

10,386

10,190

10,013

6,126

8,960

Other Housing Loans

Consumer Loan

Commercial Loan

Exhibit 14: BBTN Loan Portfolio

Source: BBTN, MPI Research

Interest Rate Sensitive

BTN to focus more on providing cheap mortgage for medium to low market segment.

This market segment is very sensitive towards their cash flow, therefore interest rate level

will influence the market segment decision whether to get mortgage loan or not. It is a

good news for the bank as BTN is one of the leading mortgage loan providers. With

decision from BI to cut rate by 50 basis points from 7.5% to 7.0% in 2016, this means that

BTN can give cheaper mortgage rate. Currently BTN also provides mortgage loan at 6.6%

for non-subsidized mortgage loan and 5% for subsidized mortgage loan in early 2016 to

boost the mortgage loan. Right now, BTN normal mortgage rate stays at 9.6% - 10.6%

which varies across different fixed rate period. If BTN to cut another 0.5% interest rate,

we expect total mortgage loan growth will reach around 20%. BTN focuses more on

improving CASA as the demand for deposit will be the main source of the banks low cost

of fund, while time deposit will be reduced by portion in the future as lower BI rate will

11

PT MINNA PADI INVESTAMA

Member of Indonesia Stock Exchange

EQUITY RESEARCH

eventually decrease the demand for time deposit. CASA in FY 2015 has reached 47.56%

increases from FY 2014 45.81%.

Deposits

Current Account

Savings Account

Time Deposits

Total

BTN deposit mix In Tillion

FY2011

FY2012 FY2013 FY2014 FY2015 y.o.y

13.15

13.27

19.12

23.23

30.88 32.93%

14.82

21.54

24.24

25.55

29.87 16.93%

34.01

45.88

52.86

57.7

66.99 16.10%

61.97

80.69

96.21

106.48

127.75 19.97%

Exhibit 15: BBTN Deposit Mix

Source: BBTN

Competitive Interest Rate

What makes us believe that BTN can hold the biggest market share at 30% for mortgage

loan is that BTN mortgage rate is very competitive compared to other banks. BTN has the

lowest 1 year fix rate period and BTN can serve 25 years of mortgage while other banks

are mostly only 20 years. Although banking service is still hold by BCA, but BTN now has

increased their investment to create more convenient transaction by improving IT system

and create strategic outlet location. Customers in middle to low income segment are the

most price sensitive segment in which they are looking for the lowest total monthly

payment and transaction cost with benefits for additional value of the loan.

Normal Mortgage Rate Comparison

Bank Name

BTN

Rate

Additional Service

9.60% 25 years mortgage period, 1 year fixed rate, life insurance and fire insurance

BCA

10.25% Fastest process, lowest floating rate, can withdraw mortgage

BRI

10.25% lowest downpayment

BNI

10.75% longest fixed rate for 5 years compared to other banks

CIMB Niaga

9.75% No fee for late payment (terms and condition apply)

Exhibit 16: Non-Promotional Mortgage List

Source: BBTN, BBCA, BBRI, BBNI, BNGA

Expansionary business model

As a bank that focuses on long term mortgage loan, using conventional banking business

model would give a very high risk because longer loan age with uncertain economic

condition. BTN has the longest mortgage loan at 25 years compared to other banks. With

long term bonds issued by BTN have an average maturity of 7 to 10 years, this creates

maturity mismatch, however BTN has increased the fee based income since 2014 where

BTN manage to create 496 Billion IDR versus FY 2013 only 31 Billion IDR. It turns out the

fee based income is pretty successful to cover up borrowing cost as fund borrowing

interest in FY 2015 reached 516 Billion IDR, Fee based income in FY 2015 has reached 596

Billion IDR (+20.2% YoY).

BTN was the first bank to create a mortgage backed security (MBS) in Indonesia

back in February 2009 named as kontrak investasi kolektif efek beragun aset (KIK EBA).

Until 2015 BTN has created seven mortgage backed security with total Rp. 5.46 Trillion in

total value. With this kind of security, BTN expect to diversify the source of fund and also

12

PT MINNA PADI INVESTAMA

Member of Indonesia Stock Exchange

EQUITY RESEARCH

fee-based income. This product also enables BTN to mitigate risk and increase its credit

capacity. The first mortgage backed security gained idAA rating from Pefindo, AA (idn)

rating from Fitch Ratings and from Moodys with three different ratings from categories

Baa3 for bank deposits, D for bank financial strength, while Ba2 for baseline credit

assessment.

BTN Securitization

No.

Securitization

KIK EBA 1 / DSMF01

Nominal

Transaction date

Maturity

111,111,108,501

11-Feb-09

10-Jan-18

KIK EBA 2 / DSMF02

391,305,329,159

10-Nov-09

10-Dec-19

KIK EBA 3 / DBTN01

750,000,230,717

27-Dec-10

27-Sep-19

KIK EBA 4 / DBTN02

703,450,414,156

16-Nov-11

27-Feb-21

KIK EBA 5 / DBTN03

1,000,000,005,997

12-Dec-12

7-Jan-23

KIK EBA 6 / DBTN04

1,000,000,005,941

20-Dec-13

26-Feb-22

KIK EBA 7 / DBTN05

1,500,000,001,615

28-Nov-14

7-Sep-25

EBA SP 1 / SPBTN1

200,000,000,041

27-Nov-15

7-Mar-22

TOTAL

Exhibit 17: Mortgage-Backed Securities

5,655,867,096,127

Source: BBTN

Other than creating robust fee-based income, BTN in 2016 is planning to create two

subsidiaries that are focused in increasing profitability and reducing the default risk at

the same time. There will be a life insurance business where BBTN will be partnering with

JASINDO. The focus of this subsidiary will be on bundling life insurance sales with

property. The second subsidiary will be a multi finance company focusing more on

collection for BTN loan. The aim of this subsidiary is to reduce the NPL of BBTNs main

business. The multi finance business is also meant to enable credit loan for economic

segment that have fluctuative income such as peddler, food hawker, and others. Thus,

the subsidiaries that will be created by BTN will contribute profit by enabling the BTN to

provide more loans as well as reducing both risk and total NPL ratio.

Strong Banking Network

BTN has established robust network to give better service in both credit and funding

services. BTN has made one of the biggest mutual agreements with PT Pos Indonesia in

order to reach retail customers all around Indonesia. Post offices mainly help BTN to gain

more third-party funding from saving accounts. Services that Pos Indonesia provide

include opening of saving account, deposit, withdrawal, mortgage payment and school

tuition payment. There are 2,951 post offices around Indonesia with BTNs product

13

PT MINNA PADI INVESTAMA

Member of Indonesia Stock Exchange

EQUITY RESEARCH

eBataraPos for saving account. So far, the total number of accounts opened in

eBataraPos has reached 2,094,909 and its total value reached Rp2.09 Trillion as of

September 2015.

BTN Total Service Outlet

2009

Regional Office

2010

2011

2012

2013

2014

9m 2015

61

63

65

65

65

65

65

Subsidiary Branch

204

214

218

223

223

223

223

Cash Office

111

316

415

479

479

479

26

39

50

50

50

50

13

23

34

37

Branch Office

Syariah Outlet

21

Priority Outlet

Total Outlet

Pos Indonesia Office

286

416

647

769

843

854

857

2,045

2,661

2,738

2,922

2,922

2,951

2,951

528

745

1,181

1,404

1,504

1,830

1,830

4,340

5,312

6,337

7,142

8,011

8,582

8,814

ATM

Employees

Exhibit 18: BTN Total Service Outlet

Source: BBTN

14

PT MINNA PADI INVESTAMA

Member of Indonesia Stock Exchange

EQUITY RESEARCH

VALUATION

Key Ratios

Loan to Deposit Ratio (LDR)

Special Mention

CASA Ratio

Coverage Ratio

PPOP Margin

Provision to PPOP

Cost of Fund

Net Interest Income

Capital Adequacy Ratio

Gross NPL

Third Party Fund Growth

Dividend Pay Out Ratio

Return on Equity (ROE)

Return on Assets (ROA)

Book Value Per Share

P/BV

Latest Price

Exhibit 19: Key Ratios

2013 A

2014 A

2015 A

2016F

2017F

2018F

104.13%

107.68%

107.36%

105.22%

103.79%

102.62%

12.54%

14.87%

15.19%

13.22%

12.06%

10.95%

25.12%

24.31%

23.76%

23.95%

24.02%

22.45%

28.13%

14.84%

22.21%

25.19%

21.42%

21.43%

24.71%

18.70%

23.71%

25.29%

23.17%

23.18%

16.83%

33.30%

26.08%

24.51%

26.75%

26.75%

49.36%

59.24%

56.42%

55.44%

57.98%

57.96%

6.24%

5.30%

5.50%

5.26%

4.93%

4.54%

17.84%

16.31%

19.65%

18.23%

16.67%

15.78%

4.82%

4.88%

4.15%

3.96%

3.66%

3.59%

23.46%

11.57%

20.23%

21.50%

18.63%

14.63%

26.19%

42.05%

12.59%

15.00%

14.50%

17.20%

13.52%

8.81%

12.87%

13.62%

12.51%

11.67%

1.19%

0.77%

1.08%

1.13%

1.02%

0.96%

Rp1,097

Rp1,197

Rp1,361

Rp1,591

Rp1,818

Rp2,059

0.793

1.007

1.194

1.160

1.365

2.100

Rp870

Rp1,205

Rp1,625

Rp1,846

Rp2,482

Rp4,323

Source: BBTN, MPI Research

Asset quality

What makes BTN interesting is that coverage ratio will increase to 25.19% in 2016, while

the outlook for 2018 is that coverage ratio will decrease to 21.43%. Based on the current

information we expect that banking will have tighter competition in the future, leading to

higher cost of fund.

Gross NPL will decrease to 3.96% in 2016 and gradually getting lower to 3.59% in 2018 as

the subsidiary that predicted to start operating in this 2016 will help to control the NPL

and collection of credit loan.

LDR in the other hand will stay high as the bank has a long term credit period at 20 25

years on average, compared to other banks which only 5 15 years loan period which

cause BTN loan to deposit ratio (LDR) remains above 100%. This LDR may worry the

investor in the case the loan will not getting paid, then the deposit cant cover up the loan

loss. In this case, we would clarify that BTN has substantial fee-based income and good

asset handling as the customer get into collectability category of 3, the asset will be taken

and started to be offered by BTN to other potential buyer. In conclusion the recoverability

of the asset and liquidity is expected to remain manageable.

Capital adequacy ratio predicted to decrease to 18.23% in 2016 as the bank gives more

credit, so the risk weighted asset will increase and predicted to be 15.78% in 2018. As long

as the CAR stays above 8%, the bank is considered to have enough capital to support the

main banking activity towards the risk.

15

PT MINNA PADI INVESTAMA

EQUITY RESEARCH

Member of Indonesia Stock Exchange

Current account and saving account ratio (CASA) predicted to grow to 23.95% in 2016 and

peaked at 24.02% in 2017 while decreasing to 22.45% in 2018 as we assume the

competition is getting harder, pushing BTN to offer higher deposit rate before they can

give more credit for profitability.

Profitability

What makes a firm interesting to invest is the ability to give profitability to the

shareholders. In the case of banking, we would use net interest income as the indicator

of profitability. Net interest income predicted to be at 5.26%, while the outlook of the NIM

will gradually decrease over three years period to 4.73%.

The pre-provision operation profit predicted around 25% in 2016 while in the long run

the pre-provision operating profit will be around 27% as the cost can be lowered but

result in higher provision at the same time. High pre-provision operating profit means

that the bank is actually making profit from operation despite the provision.

Although both ROA and ROE are expected to fall, we would like to highlight that the total

asset and equity growth in 2016 will be significantly higher. The challenge towards these

metrics will be related to net interest margin outlook that is seen to be tighter as BI rate

outlook is still seen going downward. What makes the bank gives more profit is in terms

of nominal return and we assume that in 2018 the banking environment may not be the

same. ROA and ROE in 2016 predicted to be 1.13% and 13.62%, respectively, increasing

from 2015 and later in 2018 will decline to 0.96% for ROA and 11.67% for ROE.

Cost of fund is the direct cost of lending which must be the focus on determining bank

profitability. Cost of fund seen to be rising as competition in banking will rise in 2016 and

onward. The calculation is using assumption that the banking condition in Indonesia until

2018 will be the same as current condition and taking MEA into account is expected to

make cost of fund in 2016 is 55.44% and up further to 57.96% in 2018.

RISKS TO OUR VIEW

Since BTN has more than 70% of their loan portfolio on mortgage, we should focus more

on mortgage growth in Indonesia. As the mortgage loan slows down, the bank will greatly

suffer in terms of total loan can be given to the market. Loan payment for mortgage can

be influenced by the housing price outlook. As the price is going up and interest rate of

BI outlook going up, borrower will find the loan payment more expensive which

eventually will raise concern over credit default.

BTN has more than just traditional banking strategy. BTN actively engages in bond

securitization and creates new business units to support the core activity of the bank

which has the risk of failure in the investment of new business or bond securitization

which will burden the core activity of BTN

Government and BI regulation may influence the profitability and cost structure of the

banking industry in Indonesia, including that of BTN.

16

PT MINNA PADI INVESTAMA

EQUITY RESEARCH

Member of Indonesia Stock Exchange

Head Office

Equity Tower 11th Floor, SCBD Lot 9

Jl. Jend. Sudirman Kav. 52-53

Jakarta Selatan Indonesia

Tel. +62 21 525 5555

Fax. +62 21 527 1527

Branches

Jakarta

Ruko Plaza Intercon,

Taman Kebon Jeruk Blok A 15-16,

Lantai 2,

Intercon

Jakarta Barat 11630

Tel. +62-21-8257-5555

Fax. +62-21-584-1839

Surabaya

Spazio Office Tower 2nd Floor

Kompleks Graha Festival Kav. 3

Graha Famili

Jl Mayjen Yono Sewoyo

Surabaya 60225

Tel. +62-31-9900-1000

Fax. +62-31-9900-1001

Solo

Jl. Monginsidi No. 27 A/B Solo

Tel. +62-271-635470

Fax. +62-271-663935

Semarang

Jl. Sriwijaya No.8A

Semarang 50257

Tel. +62-24-8411555

Fax. +62-24-8313032

Bandung

Jl. Veteran 42 Bandung 40112

Tel. +62-22-4216-555

Fax. +62-22-4203-100

DISCLAIMER

This research report is prepared by PT MINNA PADI INVESTAMA Tbk. for information purposes

only and is not to be used or considered as an offer or the solicitation of an offer to sell or to

buy or subscribe for securities or other financial instruments. The report has been prepared

without regard to individual financial circumstance, need or objective of person to receive it.

The securities discussed in this report may not be suitable for all investors. The appropriateness

of any particular investment or strategy whether opined on or referred to in this report or

otherwise will depend on an investors individual circumstance and objective and should be

independently evaluated and confirmed by such investor, and, if appropriate, with his

professional advisers independently before adoption or implementation (either as is or varied).

17

Anda mungkin juga menyukai

- Bank and NBFC - MehalDokumen38 halamanBank and NBFC - Mehalsushrut pawaskarBelum ada peringkat

- Bank and NBFC Mehal PDFDokumen38 halamanBank and NBFC Mehal PDFPrasun AgarwalBelum ada peringkat

- CASA Accretion: Key Points Supply DemandDokumen11 halamanCASA Accretion: Key Points Supply DemandDarshan RavalBelum ada peringkat

- Equity Research: (Series IV) 10th August 2012Dokumen18 halamanEquity Research: (Series IV) 10th August 2012kgsbppBelum ada peringkat

- Indian Financials: Tryst With DestinyDokumen28 halamanIndian Financials: Tryst With DestinyJohnny HarlowBelum ada peringkat

- Factors Impacting Syariah Bank Asset Growth in West JavaDokumen11 halamanFactors Impacting Syariah Bank Asset Growth in West JavaDeZti RinaBelum ada peringkat

- Helping You Spot Opportunities: Investment Update - October, 2012Dokumen56 halamanHelping You Spot Opportunities: Investment Update - October, 2012Carla TateBelum ada peringkat

- INDEPTH - September 2011Dokumen17 halamanINDEPTH - September 2011Vivek BnBelum ada peringkat

- Bank of BarodaDokumen61 halamanBank of BarodaAnita VarmaBelum ada peringkat

- Can Fin Homes LTD (NSE Code: CANFINHOME) - Alpha/Alpha + Stock Recommendation For May'13Dokumen21 halamanCan Fin Homes LTD (NSE Code: CANFINHOME) - Alpha/Alpha + Stock Recommendation For May'13shahavBelum ada peringkat

- FINALYST!!Dokumen12 halamanFINALYST!!Anshul SoodBelum ada peringkat

- Ratio Analysis of HDFC FINALDokumen10 halamanRatio Analysis of HDFC FINALJAYKISHAN JOSHI100% (2)

- HDFC Securities Annual Report 11-12 FinalDokumen35 halamanHDFC Securities Annual Report 11-12 Finaljohn_muellorBelum ada peringkat

- Why You Should Track Macro DataDokumen3 halamanWhy You Should Track Macro DataTarun KumarBelum ada peringkat

- India's Financial Services IndustryDokumen6 halamanIndia's Financial Services IndustryRavi KumarBelum ada peringkat

- Financial Intermediation: ANK ReditDokumen25 halamanFinancial Intermediation: ANK ReditPraveen Reddy PenumalluBelum ada peringkat

- Initiating Coverage HDFC Bank - 170212Dokumen14 halamanInitiating Coverage HDFC Bank - 170212Sumit JatiaBelum ada peringkat

- Economic Report - 201603Dokumen4 halamanEconomic Report - 201603bajax_lawut9921Belum ada peringkat

- Industry Note Report On: Individual AssignmentDokumen6 halamanIndustry Note Report On: Individual AssignmentLaveenAdvaniBelum ada peringkat

- Monetary Policy Oct-12Dokumen5 halamanMonetary Policy Oct-12Piyush KhadgiBelum ada peringkat

- New Microsoft Office Word DocumentDokumen9 halamanNew Microsoft Office Word DocumentgauravgorkhaBelum ada peringkat

- Wholesale borrowing rates likely to fall in FY15Dokumen73 halamanWholesale borrowing rates likely to fall in FY15girishrajsBelum ada peringkat

- 5.1 Role of Commercial BanksDokumen5 halaman5.1 Role of Commercial Banksbabunaidu2006Belum ada peringkat

- Empower June 2012Dokumen68 halamanEmpower June 2012pravin963Belum ada peringkat

- EIIF Analysis of SBI Bank by Group 2Dokumen21 halamanEIIF Analysis of SBI Bank by Group 2Shweta GuptaBelum ada peringkat

- LG Zi 39285932Dokumen28 halamanLG Zi 39285932erlanggaherpBelum ada peringkat

- Assignment On Fundamental Analysis of IdbiDokumen11 halamanAssignment On Fundamental Analysis of IdbifiiimpactBelum ada peringkat

- Indian Banks Note (Revised)Dokumen19 halamanIndian Banks Note (Revised)zainab bharmalBelum ada peringkat

- Ndian Banking Sector OutlookDokumen3 halamanNdian Banking Sector OutlookvinaypandeychandBelum ada peringkat

- Finance Questions and AnswersDokumen35 halamanFinance Questions and AnswersRohitBelum ada peringkat

- 6 Banking and Financial ServicesDokumen5 halaman6 Banking and Financial ServicesSatish MehtaBelum ada peringkat

- Portfolio Development: Live Project - BANKING SectorDokumen61 halamanPortfolio Development: Live Project - BANKING SectorRicha AgarwalBelum ada peringkat

- Bank SizeDokumen10 halamanBank SizeSiti NurhalizaBelum ada peringkat

- Indian Banks Loan Growth RateDokumen4 halamanIndian Banks Loan Growth RateKabilanBelum ada peringkat

- The State Bank of IndiaDokumen4 halamanThe State Bank of IndiaHimanshu JainBelum ada peringkat

- 036 Sbi Contra FundDokumen19 halaman036 Sbi Contra Fundashwini shuklaBelum ada peringkat

- Why Common Man Prefers FDs Over Debt MFsDokumen5 halamanWhy Common Man Prefers FDs Over Debt MFsTEJINDER SINGHBelum ada peringkat

- Roadmap for ABC Bank's Growth as an NBFC-to-BankDokumen13 halamanRoadmap for ABC Bank's Growth as an NBFC-to-BankSohini BanerjeeBelum ada peringkat

- Crisil Sme Connect Dec09Dokumen32 halamanCrisil Sme Connect Dec09Rahul JainBelum ada peringkat

- Fin Sight Oct2012Dokumen3 halamanFin Sight Oct2012Sambit MishraBelum ada peringkat

- The Prospect of Indonesian Banking Industry in 2010Dokumen8 halamanThe Prospect of Indonesian Banking Industry in 2010DoxCak3Belum ada peringkat

- Q3 and 9M, FY2012 Performance Review and OutlookDokumen19 halamanQ3 and 9M, FY2012 Performance Review and OutlookpvinayakamBelum ada peringkat

- Crisil Yearbook On The Indian Debt Market 2015.unlockedDokumen114 halamanCrisil Yearbook On The Indian Debt Market 2015.unlockedPRATIK JAINBelum ada peringkat

- LinkDokumen24 halamanLinkDhileepan KumarasamyBelum ada peringkat

- Rates View - IndonesiaDokumen5 halamanRates View - IndonesiaEfi Yuliani H. SantosaBelum ada peringkat

- Banking Sector ReportDokumen21 halamanBanking Sector ReportsukeshBelum ada peringkat

- Assignment 3 BF-Efficiencies in Nep Capital MKTDokumen6 halamanAssignment 3 BF-Efficiencies in Nep Capital MKTDhiraj RaiBelum ada peringkat

- Financial Sevices in IndiaDokumen2 halamanFinancial Sevices in IndiaChidambaram PandiyanBelum ada peringkat

- Banking Finance and Insurance: A Report On Financial Analysis of IDBI BankDokumen8 halamanBanking Finance and Insurance: A Report On Financial Analysis of IDBI BankRaven FormourneBelum ada peringkat

- 103 Sbi Blue Chip FundDokumen21 halaman103 Sbi Blue Chip FundsagarBelum ada peringkat

- Red Jun 2014Dokumen38 halamanRed Jun 2014hrnanaBelum ada peringkat

- Balacesheet Analysis: Sbi Bank and Axis Bank: Vinay V. PatilDokumen16 halamanBalacesheet Analysis: Sbi Bank and Axis Bank: Vinay V. PatilVinay PatilBelum ada peringkat

- Investment Banking Industry Analysis Report PDFDokumen46 halamanInvestment Banking Industry Analysis Report PDFricky franklinBelum ada peringkat

- Banks: Anticipating A BottomDokumen6 halamanBanks: Anticipating A BottomerlanggaherpBelum ada peringkat

- Compare Their Profitability Ratios. Why Is There A Difference?Dokumen24 halamanCompare Their Profitability Ratios. Why Is There A Difference?Shruti MalpaniBelum ada peringkat

- Capital MarketDokumen11 halamanCapital MarketNiti KamdarBelum ada peringkat

- Financial Performance Analysis of Bandhan Bank and Federal BankDokumen11 halamanFinancial Performance Analysis of Bandhan Bank and Federal BankJyothish JbBelum ada peringkat

- Financial Markets Fundamentals: Why, how and what Products are traded on Financial Markets. Understand the Emotions that drive TradingDari EverandFinancial Markets Fundamentals: Why, how and what Products are traded on Financial Markets. Understand the Emotions that drive TradingBelum ada peringkat

- Badla MechanismDokumen27 halamanBadla Mechanismdivyapillai0201_Belum ada peringkat

- BiiiimplmoniwbDokumen34 halamanBiiiimplmoniwbShruti DubeyBelum ada peringkat

- TEST Paper 2Dokumen10 halamanTEST Paper 2Pools KingBelum ada peringkat

- YeahDokumen2 halamanYeahMoimen Dalinding UttoBelum ada peringkat

- July 2000 Issue PDFDokumen53 halamanJuly 2000 Issue PDFashlogicBelum ada peringkat

- Chapter 5 FMDokumen22 halamanChapter 5 FMHananBelum ada peringkat

- 06 09 22Dokumen248 halaman06 09 22md ziaullahBelum ada peringkat

- Strategy Papers and Cases QuestionsDokumen9 halamanStrategy Papers and Cases QuestionsMuhammad Ahmed0% (1)

- Week 1 - Asset Classes and Financial MarketsDokumen37 halamanWeek 1 - Asset Classes and Financial MarketsshanikaBelum ada peringkat

- Vault Guide To Private Equity and Hedge Fund PDFDokumen155 halamanVault Guide To Private Equity and Hedge Fund PDFHung Wen Go100% (2)

- Pacific ProjectDokumen40 halamanPacific Projectganesh0% (1)

- HI 5020 Corporate Accounting: Session 8b Intra-Group TransactionsDokumen16 halamanHI 5020 Corporate Accounting: Session 8b Intra-Group TransactionsFeku RamBelum ada peringkat

- Case StudyDokumen11 halamanCase StudyVinodh PaleriBelum ada peringkat

- SMChap 011Dokumen59 halamanSMChap 011testbank100% (2)

- Stock Market Investment Analysis and Portfolio AdjustmentDokumen9 halamanStock Market Investment Analysis and Portfolio AdjustmentsanaBelum ada peringkat

- Project Ivy Prospectus (CL) 003Dokumen108 halamanProject Ivy Prospectus (CL) 003nb22generalBelum ada peringkat

- PT Aqua Golden Mississippi Tbk. Financial SummaryDokumen2 halamanPT Aqua Golden Mississippi Tbk. Financial SummaryMila DiasBelum ada peringkat

- Meiditya Larasati - 01017190019 - PR Pertemuan 03Dokumen9 halamanMeiditya Larasati - 01017190019 - PR Pertemuan 03Haikal RafifBelum ada peringkat

- WWW Wallstreetmojo Com Financial Modeling in Excel Popmake 95356Dokumen20 halamanWWW Wallstreetmojo Com Financial Modeling in Excel Popmake 95356shashankBelum ada peringkat

- Accounting 3 & 4 - 07 Fundamentals of Acctg 2Dokumen10 halamanAccounting 3 & 4 - 07 Fundamentals of Acctg 2Kristine Salvador CayetanoBelum ada peringkat

- DBL Annual Report 2021 - Final PDFDokumen326 halamanDBL Annual Report 2021 - Final PDFShamim BaadshahBelum ada peringkat

- Hoshimo Ltd/Year 1 2 3 4 5 Income StatementDokumen6 halamanHoshimo Ltd/Year 1 2 3 4 5 Income StatementSeemaBelum ada peringkat

- Advanced Accounting Global 12th Edition Beams Test BankDokumen37 halamanAdvanced Accounting Global 12th Edition Beams Test Banksophieboniface4iw100% (34)

- Stocks and BondsDokumen40 halamanStocks and BondsFrances Dollero100% (1)

- The Tao of Warren BuffettDokumen27 halamanThe Tao of Warren BuffettSimon and Schuster52% (44)

- CANSLIM: A Guide to Picking Winning StocksDokumen6 halamanCANSLIM: A Guide to Picking Winning StocksMessi CakeBelum ada peringkat

- Lyceum-Northwestern University: L-NU AA-23-02-01-18Dokumen9 halamanLyceum-Northwestern University: L-NU AA-23-02-01-18Amie Jane MirandaBelum ada peringkat

- Software Requirement Specification (SRS) For Warehouse Management System (WMS)Dokumen10 halamanSoftware Requirement Specification (SRS) For Warehouse Management System (WMS)rishabhhackBelum ada peringkat

- Chapter 6 - Anchoring BiasDokumen18 halamanChapter 6 - Anchoring BiasNehal NabilBelum ada peringkat

- The Options Playbook - Brian Overby PDFDokumen343 halamanThe Options Playbook - Brian Overby PDFDinesh C100% (17)