Translation

Diunggah oleh

Kenneth Bryan Tegerero Tegio0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

198 tayangan3 halamanAccounting Translation

Hak Cipta

© © All Rights Reserved

Format Tersedia

DOC, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniAccounting Translation

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOC, PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

198 tayangan3 halamanTranslation

Diunggah oleh

Kenneth Bryan Tegerero TegioAccounting Translation

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOC, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 3

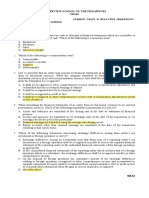

Problem 1. X Trading purchase goods from Y.

a company based in US for 1,200,000

dollar ($). The exchange rate at this time is P1 = $12.5. X pays 30 days later when the

Prevailing exchange rate is P1 = $16.

How much is the foreign currency gain/loss on the books of X and Y respective?

A. P21,000 gain; P21,000 loss

B. P21,000 gain; 0

C. P4,2000,000 loss; 0

D. P4,200,000 loss; 0

Problem 2. Manila company purchased merchandise for 300,000 pounds from a vendor in

London on November 30, 2022. Payment in British pounds was due on January 30, 2023.

The exchange rates for the British pounds were as follows:

Sports rate

30-day rate

60-day rate

November 30, 2022

$1.65

$1.62

1.64

1.59

1.63

1.56

December 31, 2022

In its December 31, 2022 income statement, what is the amount to be reported by Manila

Company as foreign exchange difference?

A. P9,000 gain

B. P3,367 loss

C. P3,367 gain

D. P9,000 loss

Problem 4. The following are taken from the records of Elite imports company, a foreign

subsidiary in New Zealand.

NZ dollar

Total Assets

12/31/15

146,000

Total Liabilities

12/31/15

45,000

Common Stock

12/31/15

60,000

Retained Earnings

01/01/15

29,000

Net Income

2015

15,000

Dividends Declared

12/31/15

3,000

Exchange rates:

Current rate

Historical rate

Weighted average rate

P10

11

12

The peso balance of retained earnings on December 31, 2014 is P325,000

What amount of cumulative translation adjustment is to be reported in the consolidated

Statement of Financial Position on December 31, 2015?

A. P122,000 debit

B. P166,000 credit

C. P125,000 debit

D. P125,000 credit

Problem 8. GWA Corporation of Makati paid P1,128,750 for a 35% interest in KYJ

Company of Taiwan on January 1, 2022, when KYJ net asset totaled 375,000 NT Dollar

and the exchange rate for NT Dollar was P8.60. A summary of change in KYJs net assets

during 2022 is as follows:

NT Dollar

Exchange Rates

Net assets, January 1

375,000

P8.60

Net income for 2022

75,000

8.55

Dividends paid for 2022

25,000

8.54

GWA Corporation anticipated a strengthening of the Philippines peso against the NT

Dollar during the last half of 2022, and it borrowed 150,000 NT Dollar from a Taiwanese

bank for one year at 10% interest on July !, 2022 to borrowed was P8.55. The loan was

denominated in NT dollar and the current exchange rate at December 31, 2022 was

P8.50.

The other comprehensive income - translation adjustment presented in equity in 2022 as a

result of hedging:

A. P6,587.50

B. P14,087.50

C. P20,675

D. P0

Problem 10. The A Company acquired the B Company, a foreign subsidiary, on

September 10, 2015. The fair value of the assets of B was the same as their carrying

amount except for land where the fair value was $50,000 greater than carrying amount.

This fair value adjustment has not been recognized in the separate financial statement of

B. Consolidated financial statement are prepared at year end December 31, 2015

requiring translation of all foreign operations results into the presentation currency of

pesos. The following rates of exchange have been identified.

September 10, 2015

December 31, 2015

Average rate for the year ended December 31, 2015

Average rate for the period from September 10 to December 31, 2015

$1.63 : P1

$1.56 : P1

$1.60 : P1

$1.58 : P1

What fair value adjustment is required to the carrying amount of land in the consolidate

Statement of financial position?

A. P30,864

B. P31,250

C. P32,051

D. P31,646

Anda mungkin juga menyukai

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020Dari EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020Belum ada peringkat

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeDari EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeBelum ada peringkat

- Translation - Quizzer 001Dokumen3 halamanTranslation - Quizzer 001Kenneth Bryan Tegerero TegioBelum ada peringkat

- Test2 AfarDokumen24 halamanTest2 AfarZyrelle DelgadoBelum ada peringkat

- Test AfarDokumen24 halamanTest AfarZyrelle Delgado100% (3)

- University of Luzon College of AccountancyDokumen3 halamanUniversity of Luzon College of AccountancyJonalyn May De VeraBelum ada peringkat

- SM09 4thExamReview-2 054657Dokumen4 halamanSM09 4thExamReview-2 054657Hilarie JeanBelum ada peringkat

- Finals Bcacc MQCDokumen12 halamanFinals Bcacc MQCLaurence BacaniBelum ada peringkat

- FAR Problem SET A PDFDokumen11 halamanFAR Problem SET A PDFNicole Aragon0% (1)

- RESA FAR PreWeek (B43)Dokumen10 halamanRESA FAR PreWeek (B43)MellaniBelum ada peringkat

- 01 - Preweek Lecture and ProblemsDokumen15 halaman01 - Preweek Lecture and ProblemsMelody GumbaBelum ada peringkat

- Buscom 2Dokumen5 halamanBuscom 2Janice AbonalesBelum ada peringkat

- Accounts Receivable Accounts Payable: A. P19,500 GainDokumen6 halamanAccounts Receivable Accounts Payable: A. P19,500 GainTk KimBelum ada peringkat

- Assignment 6 - Foreign Currency Transactions and Derivatives PDFDokumen8 halamanAssignment 6 - Foreign Currency Transactions and Derivatives PDFKurt Russel AduvisoBelum ada peringkat

- ReSA B43 AFAR Final PB Exam - Questions, Answers - SolutionsDokumen25 halamanReSA B43 AFAR Final PB Exam - Questions, Answers - SolutionsElaine Joyce GarciaBelum ada peringkat

- Drill 1 - MidtermDokumen3 halamanDrill 1 - MidtermcpacpacpaBelum ada peringkat

- Quiz Foreign Currency Transaction, Hedging & Translation: U AnsweredDokumen25 halamanQuiz Foreign Currency Transaction, Hedging & Translation: U AnsweredDenise Jane RoqueBelum ada peringkat

- 9022 - Financial Statements TranslationDokumen3 halaman9022 - Financial Statements TranslationAljur SalamedaBelum ada peringkat

- Accounting 3 Investment in AssociatesDokumen2 halamanAccounting 3 Investment in AssociatesMina ChouBelum ada peringkat

- 3uk - 2007 - Dec - Q CAT T3Dokumen10 halaman3uk - 2007 - Dec - Q CAT T3asad19Belum ada peringkat

- P2Dokumen18 halamanP2Robert Jayson UyBelum ada peringkat

- Audit Quizzer ProblemDokumen5 halamanAudit Quizzer ProblemJazzy100% (1)

- Pre Board P1 Dec 2020Dokumen26 halamanPre Board P1 Dec 2020k.balaga.513134Belum ada peringkat

- Audit Problem Investments Part 2Dokumen6 halamanAudit Problem Investments Part 2Rio Cyrel CelleroBelum ada peringkat

- Level 1 Mock Quali Q and AsDokumen31 halamanLevel 1 Mock Quali Q and AsJ A M A I C ABelum ada peringkat

- Advance Accounting2 FinalsDokumen6 halamanAdvance Accounting2 FinalsClarice Kristine SalesBelum ada peringkat

- Week 03 - Accounts ReceivablesDokumen4 halamanWeek 03 - Accounts ReceivablesPj ManezBelum ada peringkat

- Afar 2 Practice Test (3rd Year)Dokumen8 halamanAfar 2 Practice Test (3rd Year)Rianne NavidadBelum ada peringkat

- Aud Sample UpdatedDokumen36 halamanAud Sample Updatedreynald john dela cruzBelum ada peringkat

- Far Review - Notes and Receivable AssessmentDokumen6 halamanFar Review - Notes and Receivable AssessmentLuisa Janelle BoquirenBelum ada peringkat

- ENG - Soal Mojakoe Pengantar Akuntansi UAS Genap 2021 - 2022Dokumen9 halamanENG - Soal Mojakoe Pengantar Akuntansi UAS Genap 2021 - 202202Adibah Seila NafazaBelum ada peringkat

- F3 FfaDokumen3 halamanF3 FfaStpmTutorialClass100% (1)

- 9021 - Foreign Currency Transactions and DerivativesDokumen6 halaman9021 - Foreign Currency Transactions and DerivativesAljur SalamedaBelum ada peringkat

- AACA 1 QE (Suggested)Dokumen7 halamanAACA 1 QE (Suggested)JamesBelum ada peringkat

- 2022 April FarDokumen23 halaman2022 April FarXavier Xanders100% (2)

- Liab, SHE, CashvsAccrual, BV & EPSDokumen5 halamanLiab, SHE, CashvsAccrual, BV & EPSMimiBelum ada peringkat

- Questions Problems Pre BQTAP 2018 2019Dokumen12 halamanQuestions Problems Pre BQTAP 2018 2019GuinevereBelum ada peringkat

- P2 Question 2012Dokumen18 halamanP2 Question 2012Jake ManansalaBelum ada peringkat

- Accgov PDFDokumen11 halamanAccgov PDFRicardo PaduaBelum ada peringkat

- AccgovDokumen11 halamanAccgovJanella Patrizia100% (2)

- Income Taxes Batch 4 (Repaired)Dokumen10 halamanIncome Taxes Batch 4 (Repaired)Lealyn Martin BaculoBelum ada peringkat

- ReSA B42 FAR Final PB Exam - Questions, Answers - SolutionsDokumen24 halamanReSA B42 FAR Final PB Exam - Questions, Answers - SolutionsLuna V100% (2)

- 9418 - Financial Statements TranslationDokumen3 halaman9418 - Financial Statements Translationjsmozol3434qcBelum ada peringkat

- Review of The Accounting ProcessDokumen4 halamanReview of The Accounting ProcessMichael Vincent Buan Suico100% (1)

- Adjustments Quiz 1Dokumen5 halamanAdjustments Quiz 1Christine Mae BurgosBelum ada peringkat

- ReSA B46 AFAR Final PB Exam Questions Answers SolutionsDokumen24 halamanReSA B46 AFAR Final PB Exam Questions Answers SolutionsJohair BilaoBelum ada peringkat

- 2024 Becker CPA Financial (FAR) Mock Exam QuestionsDokumen19 halaman2024 Becker CPA Financial (FAR) Mock Exam QuestionscraigsappletreeBelum ada peringkat

- Problems Audit of Liabilitiess PDF FreeDokumen17 halamanProblems Audit of Liabilitiess PDF FreePdf FilesBelum ada peringkat

- Practical Accounting 1Dokumen6 halamanPractical Accounting 1Myiel AngelBelum ada peringkat

- Audit Problem Receivables Part 1Dokumen4 halamanAudit Problem Receivables Part 1Rio Cyrel CelleroBelum ada peringkat

- Intacc ReceivablesDokumen9 halamanIntacc Receivablesaugustokita5Belum ada peringkat

- AFAR Self Test - 9005Dokumen6 halamanAFAR Self Test - 9005King MercadoBelum ada peringkat

- Receivables DiscussionDokumen5 halamanReceivables DiscussionTrazy Jam BagsicBelum ada peringkat

- Midterm Answer KeyDokumen9 halamanMidterm Answer Keylil mixBelum ada peringkat

- Aud 1 and Aud 2 ProblemsDokumen6 halamanAud 1 and Aud 2 ProblemsRomelie M. NopreBelum ada peringkat

- ACP Task 3 (20230328164424)Dokumen2 halamanACP Task 3 (20230328164424)Roque LestieBelum ada peringkat

- 91 - Final Preaboard Afar (Weekends)Dokumen18 halaman91 - Final Preaboard Afar (Weekends)Joris YapBelum ada peringkat

- Mock Mid Term 1 Printed Questions OnlyDokumen16 halamanMock Mid Term 1 Printed Questions OnlyVenkat ChamarthiBelum ada peringkat

- Afar 01Dokumen11 halamanAfar 01Raquel Villar DayaoBelum ada peringkat

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Dari EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Penilaian: 5 dari 5 bintang5/5 (1)

- Problems 1Dokumen11 halamanProblems 1Kenneth Bryan Tegerero Tegio100% (1)

- DAM - Special ProceedingsDokumen41 halamanDAM - Special ProceedingsKenneth Bryan Tegerero TegioBelum ada peringkat

- RPC 2 - CasesDokumen2 halamanRPC 2 - CasesKenneth Bryan Tegerero TegioBelum ada peringkat

- Preliminary Examination in INCOME TAXATION: Accountancy DepartmentDokumen6 halamanPreliminary Examination in INCOME TAXATION: Accountancy DepartmentKenneth Bryan Tegerero TegioBelum ada peringkat

- Representation - Concealment - Q and A - For DistributionDokumen3 halamanRepresentation - Concealment - Q and A - For DistributionKenneth Bryan Tegerero TegioBelum ada peringkat

- CPA Review - BMBE Notes - 2019Dokumen1 halamanCPA Review - BMBE Notes - 2019Kenneth Bryan Tegerero TegioBelum ada peringkat

- CPA Review - VAT Quizzer - 2019Dokumen11 halamanCPA Review - VAT Quizzer - 2019Kenneth Bryan Tegerero Tegio50% (2)

- Taxation - Review - BSA - LGC, OIC - 2018NDokumen9 halamanTaxation - Review - BSA - LGC, OIC - 2018NKenneth Bryan Tegerero TegioBelum ada peringkat

- Exam - Tax - 2019 - KeyDokumen2 halamanExam - Tax - 2019 - KeyKenneth Bryan Tegerero Tegio0% (1)

- Special Exam TaxDokumen11 halamanSpecial Exam TaxKenneth Bryan Tegerero TegioBelum ada peringkat

- Taxation - Gross Income - Quizzer - 2018 - MayDokumen5 halamanTaxation - Gross Income - Quizzer - 2018 - MayKenneth Bryan Tegerero TegioBelum ada peringkat

- Special Exam TaxDokumen5 halamanSpecial Exam TaxKenneth Bryan Tegerero TegioBelum ada peringkat

- Law On Evidence PointersDokumen6 halamanLaw On Evidence PointersKenneth Bryan Tegerero TegioBelum ada peringkat

- Obe Course Syllabus: BlawregDokumen3 halamanObe Course Syllabus: BlawregKenneth Bryan Tegerero TegioBelum ada peringkat

- AsapDokumen3 halamanAsapKenneth Bryan Tegerero TegioBelum ada peringkat

- Determine Applicable Tax Rates ForDokumen1 halamanDetermine Applicable Tax Rates ForKenneth Bryan Tegerero TegioBelum ada peringkat

- Actrev2 - InvestmentsDokumen19 halamanActrev2 - InvestmentsKenneth Bryan Tegerero Tegio100% (1)

- Special Exam TaxDokumen11 halamanSpecial Exam TaxKenneth Bryan Tegerero TegioBelum ada peringkat

- Chapter 1 - FS AnalysisDokumen40 halamanChapter 1 - FS AnalysisKenneth Bryan Tegerero Tegio100% (2)

- Taxation - Final ExamDokumen4 halamanTaxation - Final ExamKenneth Bryan Tegerero Tegio100% (1)

- Taxation Quiz - ADokumen2 halamanTaxation Quiz - AKenneth Bryan Tegerero TegioBelum ada peringkat

- Special Exam TaxDokumen11 halamanSpecial Exam TaxKenneth Bryan Tegerero TegioBelum ada peringkat

- Const. ContractsDokumen9 halamanConst. ContractsKenneth Bryan Tegerero TegioBelum ada peringkat

- Ward AdviseeDokumen1 halamanWard AdviseeKenneth Bryan Tegerero TegioBelum ada peringkat

- Pre-Test 1 - ProblemsDokumen3 halamanPre-Test 1 - ProblemsKenneth Bryan Tegerero TegioBelum ada peringkat

- Partnership - Operation, LiquidationDokumen4 halamanPartnership - Operation, LiquidationKenneth Bryan Tegerero TegioBelum ada peringkat

- Estate Tax - ProblemsDokumen6 halamanEstate Tax - ProblemsKenneth Bryan Tegerero Tegio100% (2)

- Taxation - Donors-Tax - Quizzer - 2018Dokumen6 halamanTaxation - Donors-Tax - Quizzer - 2018Kenneth Bryan Tegerero Tegio67% (6)

- ChekerDokumen6 halamanChekerKenneth Bryan Tegerero TegioBelum ada peringkat

- Fred Bloechl Write UpDokumen5 halamanFred Bloechl Write UpKenneth Bryan Tegerero TegioBelum ada peringkat

- What Is Risk?: Risk Return Trade OffDokumen8 halamanWhat Is Risk?: Risk Return Trade OffLavanya KasettyBelum ada peringkat

- Investment Policy Statement For NIFDokumen11 halamanInvestment Policy Statement For NIFmayorladBelum ada peringkat

- Interactive Brokers - PPT 2021Dokumen16 halamanInteractive Brokers - PPT 2021rahul_madhyaniBelum ada peringkat

- Written Report For Sources of FinanceDokumen4 halamanWritten Report For Sources of FinanceKathiana Pam NicolasBelum ada peringkat

- Andreas B. IntermediateDokumen4 halamanAndreas B. IntermediateAndreasBelum ada peringkat

- ResumeDokumen4 halamanResumeapi-3826517Belum ada peringkat

- Intermediate Accounting RTP May 20Dokumen44 halamanIntermediate Accounting RTP May 20Durgadevi BaskaranBelum ada peringkat

- Rich Dad Poor Dad by Robert Kiyosaki (BOOK SUMMARY & PDF) : o o o o o o o o o o o o oDokumen11 halamanRich Dad Poor Dad by Robert Kiyosaki (BOOK SUMMARY & PDF) : o o o o o o o o o o o o odchandra15100% (2)

- SIP Dynamic CalcyDokumen18 halamanSIP Dynamic CalcyjaickyrenBelum ada peringkat

- Bearish Stop LossDokumen3 halamanBearish Stop LossSyam Sundar ReddyBelum ada peringkat

- Vilander Carecenters Inc Provides Financing and Capital To The Health CareDokumen1 halamanVilander Carecenters Inc Provides Financing and Capital To The Health CareAmit PandeyBelum ada peringkat

- BP'S Office of The Chief Technology Officer (A) : Driving Open Innovation Through An Advocate TeamDokumen2 halamanBP'S Office of The Chief Technology Officer (A) : Driving Open Innovation Through An Advocate TeamsruthiBelum ada peringkat

- RFM Annual Report Financial StatementDokumen7 halamanRFM Annual Report Financial StatementMarceline AbadeerBelum ada peringkat

- Multinational Bank SlogansDokumen55 halamanMultinational Bank SlogansSachin SahooBelum ada peringkat

- Layman's Guide To Pair TradingDokumen9 halamanLayman's Guide To Pair TradingaporatBelum ada peringkat

- Risk ManagementDokumen57 halamanRisk ManagementAvtaar SinghBelum ada peringkat

- Bcbs 279Dokumen37 halamanBcbs 279남상욱Belum ada peringkat

- Portfolio ManagementDokumen36 halamanPortfolio Managementrajujaipur1234Belum ada peringkat

- CB Insights - Fintech Report Q3 2021Dokumen236 halamanCB Insights - Fintech Report Q3 2021Seba CabezasBelum ada peringkat

- Gold ETFDokumen13 halamanGold ETFஅருள் முருகன்Belum ada peringkat

- Cash Flow Statement: Projected Income Statement and Balance SheetDokumen14 halamanCash Flow Statement: Projected Income Statement and Balance SheetAagam SakariaBelum ada peringkat

- Cybercash - The Coming Era of Electronic Money (Preview)Dokumen22 halamanCybercash - The Coming Era of Electronic Money (Preview)Bayu HerkuncahyoBelum ada peringkat

- C11 HedgingDokumen5 halamanC11 HedgingMary Joy CabilBelum ada peringkat

- Benchmarking Cost Savings and Cost AvoidanceDokumen41 halamanBenchmarking Cost Savings and Cost AvoidancesandkngBelum ada peringkat

- NAL Online Training Program Online Rapid Learning Series-VDokumen7 halamanNAL Online Training Program Online Rapid Learning Series-VKripal SinghBelum ada peringkat

- EOC13Dokumen28 halamanEOC13jl123123Belum ada peringkat

- Chapter 8 ExamplesDokumen10 halamanChapter 8 Examplesm bBelum ada peringkat

- Analysis of The Capital Asset Pricing Models in The Saudi Stock MarketDokumen12 halamanAnalysis of The Capital Asset Pricing Models in The Saudi Stock MarketDex BdexxBelum ada peringkat

- RCC Title IDokumen5 halamanRCC Title ITanya Mia PerezBelum ada peringkat

- Presentation 08 Mishkin - Econ12eGE - CH07 To TeacherDokumen25 halamanPresentation 08 Mishkin - Econ12eGE - CH07 To TeacherKutman PamirovBelum ada peringkat