Insights To Action - Understanding True Cost-to-Serve

Diunggah oleh

Wilson Perumal & Company0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

3K tayangan1 halamanQuestions about future scalability cause a high performing HVAC

manufacturer to revisit its product portfolio

Judul Asli

Insights to Action - Understanding True Cost-to-Serve

Hak Cipta

© © All Rights Reserved

Format Tersedia

PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniQuestions about future scalability cause a high performing HVAC

manufacturer to revisit its product portfolio

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

3K tayangan1 halamanInsights To Action - Understanding True Cost-to-Serve

Diunggah oleh

Wilson Perumal & CompanyQuestions about future scalability cause a high performing HVAC

manufacturer to revisit its product portfolio

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 1

HVAC Co, a large manufacturer of HVAC systems, was performing

well, exceeding Wall Streets growth and margin expectations.

While management was pleased with

nancial performance, leading

indicators, in particular SKU and SG&A growth, began to raise

questions on the ability to ef

ciently scale the business in the future.

only gross margin was considered, making it dif

cult to identify

underperforming products to be eliminated.

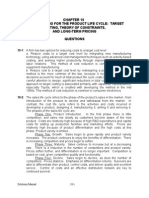

Conversion Cost per Unit by Volume - Old vs Complexity Adjusted

700

In response to a challenging market environment in its recent past,

HVAC Co developed an innovation focus, committing to refresh

a third of the portfolio every year. Simultaneously, management

adopted a good, better, best product strategy, micro-segmenting

the market to align product features, price, and customer needs.

Although these two strategies were initially effective in growing

revenue, they also led to signi

cant product proliferation.

Old Costing Method

Complexity Adj. Costing

600

Conversion Cost Per Unit

While innovation helped grow revenue during

challenging times

Complexity Adjusted Costing

revealed distortions between

3x-6x pervious methods,

particularly for low volume

products

500

400

6x

300

200

3x

100

the true cost of SKU growth was unclear

While market conditions improved, HVAC Co was now left

with a much larger portfolio, growing inventory, and increasing

operating costs. A lack of product portfolio discipline was

further complicated by an operating model which led to product

decisions that were not aligned by channel, supply chain

ow, or

even pro

tability. HVAC Co was a highly matrixed structure with

shared costs and often con

icting incentives. Moreover, these

shared costs were not considered in product decisions.

Management knew that gaining a clearer view of product

pro

tability was the

rst step to understanding the size of the

issue and identifying opportunities for improvement.

Understanding of the cost of complexity

A project team was formed to (1) understand the costs of complexity

across the value chain and (2) identify opportunities for portfolio

optimization. Through a series of interviews, process observations,

and value stream mapping, the team was able to identify the sources

and costs of complexity. They then leveraged this understanding

to develop new allocation methods that accurately quanti

ed the

impact of change overs, demand variation, supply chain costs and

promotional spend down to the product level.

Using data to drive to strategic decisions

From this analysis, management was able to better understand the

different cost structures and pro

t drivers by product line. This led to

immediate portfolio insights. First, the work revealed the true volume

level at which products became operating pro

t positive. Previously,

www.wilsonperumal.com

contact@wilsonperumal.com

Number of products (in order of volume)

Second, this analysis provided a more granular allocation of

an additional 35%-45% of total cost, including supply chain

and rebate costs. Now, instead of a standard mark-up,

management understood how supply chain

ow, channel, and

engineering costs affected product pro

tability. Finally, applying

this approach revealed that an entire product line (one of four

total) was not just pro

t dilutive, but actually pro

t negative. While

this improved view of pro

tability provided actionable insights,

perhaps more importantly, it challenged management to rethink

channel, pricing and product

ow strategies.

Next steps

The journey to portfolio transformation would be a longer term

endeavor, but HVAC Co knew it could take some immediate

steps. First, management focused on rationalizing low incremental

pro

tability products. Second, HVAC Co reviewed all optimization

levers for one key product line including pricing, product

ow

and channel strategy. Finally, the costing model was expanded to

further understand rebates and promotional spend by product.

Results

Identi

ed opportunities to improve EBITDA

by 3%-5% via portfolio optimization

Developed a more accurate costing model

and established decision criteria for product

portfolio reviews

Wilson Perumal & Company, Inc.

Wilson Perumal & Company, Ltd.

One Galleria Tower, 13355 Noel Road

Suite 1100 Dallas, TX 75240

Longcroft House, 2/8 Victoria Avenue

London EC2M 4NS, United Kingdom

Anda mungkin juga menyukai

- Michael Porter's Value Chain: Unlock your company's competitive advantageDari EverandMichael Porter's Value Chain: Unlock your company's competitive advantagePenilaian: 4 dari 5 bintang4/5 (1)

- How to Manage Future Costs and Risks Using Costing and MethodsDari EverandHow to Manage Future Costs and Risks Using Costing and MethodsBelum ada peringkat

- Daniels IBT 16e Final PPT 05Dokumen16 halamanDaniels IBT 16e Final PPT 05Ola FathallaBelum ada peringkat

- Portfolio OptimizationDokumen12 halamanPortfolio OptimizationWilson Perumal & CompanyBelum ada peringkat

- Portfolio OptimizationDokumen12 halamanPortfolio OptimizationWilson Perumal & CompanyBelum ada peringkat

- How To Achieve Cost Savings From Supply Chain Management Techniques That WorkDokumen6 halamanHow To Achieve Cost Savings From Supply Chain Management Techniques That WorkAriel KozakevichBelum ada peringkat

- Business Environment Solved MCQs (Set-1)Dokumen6 halamanBusiness Environment Solved MCQs (Set-1)Shree Prakash GuptaBelum ada peringkat

- Ten Axioms of FinanceDokumen2 halamanTen Axioms of Financemuhammadosama100% (5)

- Insights To Action Tackling Complexity in Small OrganizationsDokumen1 halamanInsights To Action Tackling Complexity in Small OrganizationsWilson Perumal & CompanyBelum ada peringkat

- Advantages and Disadvantages of Activity Based Costing With Reference To Economic Value AdditionDokumen34 halamanAdvantages and Disadvantages of Activity Based Costing With Reference To Economic Value AdditionMuntazir Haider100% (10)

- Rapid Growth Led To Organizational Complexity For A Pharmaceutical Research CompanyDokumen1 halamanRapid Growth Led To Organizational Complexity For A Pharmaceutical Research CompanyWilson Perumal & CompanyBelum ada peringkat

- Complexity Obscures Efficiency: Managing A Misaligned Operating ModelDokumen1 halamanComplexity Obscures Efficiency: Managing A Misaligned Operating ModelWilson Perumal & CompanyBelum ada peringkat

- Answer To Questions: Strategic Cost Management - Solutions ManualDokumen8 halamanAnswer To Questions: Strategic Cost Management - Solutions ManualKyla Roxas67% (6)

- Insights To Action - New Operating Model Often Needed...Dokumen1 halamanInsights To Action - New Operating Model Often Needed...Wilson Perumal & CompanyBelum ada peringkat

- Insights To Action: Eliminating Process and Organizational ComplexityDokumen1 halamanInsights To Action: Eliminating Process and Organizational ComplexityWilson Perumal & Company0% (1)

- Target Costing PDFDokumen44 halamanTarget Costing PDFAnonymous dPkadxxBelum ada peringkat

- WPC Vantage Point - Creating A Culture of Operational Discipline That Leads To Operational ExcellenceDokumen12 halamanWPC Vantage Point - Creating A Culture of Operational Discipline That Leads To Operational ExcellenceWilson Perumal & CompanyBelum ada peringkat

- WP&C Operating ModelDokumen16 halamanWP&C Operating ModelWilson Perumal & CompanyBelum ada peringkat

- Premium CH 16 Monopolistic CompetitionDokumen24 halamanPremium CH 16 Monopolistic CompetitionMelgy Viora Aquary ArdianBelum ada peringkat

- Target CostingDokumen32 halamanTarget Costingapi-3701467100% (3)

- Chapter 13 - Cost planning for product life cycleDokumen51 halamanChapter 13 - Cost planning for product life cycleRenard100% (1)

- Cost Management: A Case for Business Process Re-engineeringDari EverandCost Management: A Case for Business Process Re-engineeringBelum ada peringkat

- Ch13 000Dokumen44 halamanCh13 000cirujeffBelum ada peringkat

- Cost Planning For The Product Life Cycle: Target Costing, Theory of Constraints, and Strategic PricingDokumen44 halamanCost Planning For The Product Life Cycle: Target Costing, Theory of Constraints, and Strategic PricingMuhamad SyofrinaldiBelum ada peringkat

- Chapter 10 Cost Planning For The ProductDokumen44 halamanChapter 10 Cost Planning For The ProductMuhamad SyofrinaldiBelum ada peringkat

- Sol10 4eDokumen44 halamanSol10 4eCalvin NguyễnBelum ada peringkat

- Using Cycle Time To Measure Performance and Control Costs in Focused FactoriesDokumen22 halamanUsing Cycle Time To Measure Performance and Control Costs in Focused FactoriesHajar RajabBelum ada peringkat

- BUS 2011A Financial Management and Control Activity Based Costing and Management Accounting Technique ReportDokumen14 halamanBUS 2011A Financial Management and Control Activity Based Costing and Management Accounting Technique ReportJoe FarringtonBelum ada peringkat

- Strategic Cost Management - A - STDokumen14 halamanStrategic Cost Management - A - STAnkush KriplaniBelum ada peringkat

- Costing SystemsDokumen4 halamanCosting SystemszeeshanBelum ada peringkat

- Implementing Activity-Based Costing in the Food Processing IndustryDokumen18 halamanImplementing Activity-Based Costing in the Food Processing IndustryNishant Singh Chauhan100% (1)

- 14 Chapter5 PDFDokumen18 halaman14 Chapter5 PDFASHISH COMPUTER AND PHOTOCOPYBelum ada peringkat

- Executive Summary 2 Background 3: Project Background. Company Background. Project Roles. Objectives and ScopeDokumen27 halamanExecutive Summary 2 Background 3: Project Background. Company Background. Project Roles. Objectives and ScopeSamBelum ada peringkat

- Strategic Cost Management Cost Planning For Product Life-Cycle: Life-Cycle Costing and Long-Term Pricing Target Costing and Theory of ConstraintsDokumen12 halamanStrategic Cost Management Cost Planning For Product Life-Cycle: Life-Cycle Costing and Long-Term Pricing Target Costing and Theory of ConstraintsNune SabanalBelum ada peringkat

- Marginal Costing ProjectDokumen27 halamanMarginal Costing ProjectMeerarose travlsBelum ada peringkat

- Profitability Analysis Using Activity Based Costing PDFDokumen5 halamanProfitability Analysis Using Activity Based Costing PDFWilly BaronBelum ada peringkat

- Chapter 10 Operations and Supply Chain ManagemetDokumen6 halamanChapter 10 Operations and Supply Chain ManagemetArturo QuiñonesBelum ada peringkat

- Chap 010Dokumen38 halamanChap 010Tendy WatoBelum ada peringkat

- Citeseerx - Ist.psu - Edu Viewdoc Download Doi 10.1.1.203Dokumen15 halamanCiteseerx - Ist.psu - Edu Viewdoc Download Doi 10.1.1.203MeraSultanBelum ada peringkat

- ABC for E-Commerce Cost ControlDokumen6 halamanABC for E-Commerce Cost Controlمحمد عقابنةBelum ada peringkat

- Chap 005Dokumen11 halamanChap 005abhinaypradhan50% (2)

- Accenture High Performance Cost AccountingDokumen16 halamanAccenture High Performance Cost AccountingogbomoshoBelum ada peringkat

- Polejewski / German Cost Accounting vs. ABCDokumen8 halamanPolejewski / German Cost Accounting vs. ABCAnastasiaBelum ada peringkat

- Cost Planning For The Product Life Cycle: Target Costing, Theory of Constraints, and Strategic PricingDokumen44 halamanCost Planning For The Product Life Cycle: Target Costing, Theory of Constraints, and Strategic PricingSunny Khs100% (1)

- Graduation Project - Cost AllocationDokumen77 halamanGraduation Project - Cost Allocationmalikaliraza100% (1)

- FinalDokumen7 halamanFinallayansafsouf1Belum ada peringkat

- Irm 04Dokumen14 halamanIrm 04Fahmid Ul IslamBelum ada peringkat

- Activity-Based Costing: A Guide to Calculating True Product CostsDokumen3 halamanActivity-Based Costing: A Guide to Calculating True Product CostsRoikhanatun Nafi'ahBelum ada peringkat

- MB 0044 AssignmentDokumen7 halamanMB 0044 Assignmentrana_dipaBelum ada peringkat

- Chap 010Dokumen38 halamanChap 010Steven Andrian GunawanBelum ada peringkat

- Memo 709 v2013Dokumen11 halamanMemo 709 v2013WesleyBelum ada peringkat

- Postponement For Profitability 065283Dokumen14 halamanPostponement For Profitability 065283akashkrsnaBelum ada peringkat

- SSRN Id644561Dokumen12 halamanSSRN Id644561yoyo.yy614Belum ada peringkat

- Abc Report ScriptDokumen2 halamanAbc Report ScriptKim DedicatoriaBelum ada peringkat

- Activity Based CostingDokumen7 halamanActivity Based CostingYiorgos KoutsokostasBelum ada peringkat

- Inventory and Production ManagementDokumen23 halamanInventory and Production ManagementWatiq KhanBelum ada peringkat

- Strategic Importance of Supply Chain ManagementDokumen6 halamanStrategic Importance of Supply Chain ManagementCharlie MaineBelum ada peringkat

- Master of Business Administration - MBA Semester 2 MB 0044 - Production and Operation Management (4 Credits) (Book ID:B1627) AssignmentDokumen8 halamanMaster of Business Administration - MBA Semester 2 MB 0044 - Production and Operation Management (4 Credits) (Book ID:B1627) AssignmentVikas WaliaBelum ada peringkat

- Integrated Cost Management in The Internal Value ChainDokumen18 halamanIntegrated Cost Management in The Internal Value ChainCharles MsibiBelum ada peringkat

- SCM Assignment GRP-FDokumen4 halamanSCM Assignment GRP-FSK Sabbir Ahmed100% (1)

- Strategic Cost Management QuestionsDokumen8 halamanStrategic Cost Management QuestionsPiter Bocah NangkaBelum ada peringkat

- Variance AnalysisDokumen8 halamanVariance AnalysisRamen MondalBelum ada peringkat

- Manufacturing and Distribution IndustryDokumen2 halamanManufacturing and Distribution IndustryJessa Mae LabinghisaBelum ada peringkat

- Supply Chain ManagementDokumen9 halamanSupply Chain Managementkc605711Belum ada peringkat

- The Activity Based Costing and Target Costing As Modern Techniques in Determination of Product CostDokumen5 halamanThe Activity Based Costing and Target Costing As Modern Techniques in Determination of Product CostdevinaBelum ada peringkat

- 1.1 What Is A Supply Chain?Dokumen5 halaman1.1 What Is A Supply Chain?chitraBelum ada peringkat

- Project Management On New Product Development and New Product Launch in The Automotive Industry Project Management Represents The Combination Between KnowDokumen7 halamanProject Management On New Product Development and New Product Launch in The Automotive Industry Project Management Represents The Combination Between KnowapoorvaBelum ada peringkat

- Assignment: 1 Submitted By: Sagar Arora A00118051 Submitted To: Prof. Chetan PagareDokumen6 halamanAssignment: 1 Submitted By: Sagar Arora A00118051 Submitted To: Prof. Chetan PagareSharry AroraBelum ada peringkat

- Decision Costing Case StudyDokumen2 halamanDecision Costing Case StudyMahesh BendigeriBelum ada peringkat

- Target Costing: Kenneth Crow DRM AssociatesDokumen6 halamanTarget Costing: Kenneth Crow DRM AssociatesAhmed RazaBelum ada peringkat

- Lewis-Samuel1995 Chapter TechnologicalBenchmarkingACase PDFDokumen10 halamanLewis-Samuel1995 Chapter TechnologicalBenchmarkingACase PDFBhaswati PandaBelum ada peringkat

- SmaDokumen20 halamanSmaVan AnhBelum ada peringkat

- Capital Equipment Purchasing: Optimizing the Total Cost of CapEx SourcingDari EverandCapital Equipment Purchasing: Optimizing the Total Cost of CapEx SourcingBelum ada peringkat

- Getting Product Portfolio Management Right: PDMA Boston ChapterDokumen32 halamanGetting Product Portfolio Management Right: PDMA Boston ChapterWilson Perumal & Company100% (1)

- DrinkCo Insight To Action: The Three Facets of An Effective Go-To-Market StrategyDokumen1 halamanDrinkCo Insight To Action: The Three Facets of An Effective Go-To-Market StrategyWilson Perumal & CompanyBelum ada peringkat

- Executive Insights: The Impacts of Brexit On The Food and Beverage SectorDokumen1 halamanExecutive Insights: The Impacts of Brexit On The Food and Beverage SectorWilson Perumal & CompanyBelum ada peringkat

- IA Volume 2016 Issue8 PDFDokumen1 halamanIA Volume 2016 Issue8 PDFWilson Perumal & CompanyBelum ada peringkat

- Insights To Action - Eliminating Process and Organizational ComplexityDokumen1 halamanInsights To Action - Eliminating Process and Organizational ComplexityWilson Perumal & CompanyBelum ada peringkat

- Insights To Action - Balancing Distribution Center & Transportation CostsDokumen1 halamanInsights To Action - Balancing Distribution Center & Transportation CostsWilson Perumal & CompanyBelum ada peringkat

- Insights To Action - Eliminating Process and Organizational ComplexityDokumen1 halamanInsights To Action - Eliminating Process and Organizational ComplexityWilson Perumal & CompanyBelum ada peringkat

- Capitalising On Brexit' Uncertainty: 3 Key Questions For Business LeadersDokumen4 halamanCapitalising On Brexit' Uncertainty: 3 Key Questions For Business LeadersWilson Perumal & CompanyBelum ada peringkat

- The Brexit Agenda: How Business Leaders Can Prepare For The UnknownDokumen4 halamanThe Brexit Agenda: How Business Leaders Can Prepare For The UnknownWilson Perumal & CompanyBelum ada peringkat

- Insights To Action - Complexity & CapacityDokumen1 halamanInsights To Action - Complexity & CapacityWilson Perumal & CompanyBelum ada peringkat

- Insights To Action - Reducing Infrastructure Costs To Maintain Profitability in A Declining MarketDokumen1 halamanInsights To Action - Reducing Infrastructure Costs To Maintain Profitability in A Declining MarketWilson Perumal & CompanyBelum ada peringkat

- How Can M&S Keep It Simple' To Escape High-Street Woes?Dokumen1 halamanHow Can M&S Keep It Simple' To Escape High-Street Woes?Wilson Perumal & CompanyBelum ada peringkat

- The Brexit Agenda: How Business Leaders Can Prepare For The UnknownDokumen4 halamanThe Brexit Agenda: How Business Leaders Can Prepare For The UnknownWilson Perumal & CompanyBelum ada peringkat

- Insights To Action - A Large Portfolio Hurts Inventory, Capacity, & ProfitabilityDokumen1 halamanInsights To Action - A Large Portfolio Hurts Inventory, Capacity, & ProfitabilityWilson Perumal & CompanyBelum ada peringkat

- WPC Spotlight - Yardstyck - VFDokumen1 halamanWPC Spotlight - Yardstyck - VFWilson Perumal & CompanyBelum ada peringkat

- Insights To Action - Dedicated Resourcing Model Drives Staffing EfficiencyDokumen1 halamanInsights To Action - Dedicated Resourcing Model Drives Staffing EfficiencyWilson Perumal & CompanyBelum ada peringkat

- WPC Complexity WorkshopDokumen1 halamanWPC Complexity WorkshopWilson Perumal & CompanyBelum ada peringkat

- WPC Spotlight - Yardstyck - VFDokumen1 halamanWPC Spotlight - Yardstyck - VFWilson Perumal & CompanyBelum ada peringkat

- WPC Complexity WorkshopDokumen1 halamanWPC Complexity WorkshopWilson Perumal & CompanyBelum ada peringkat

- Indifference CurveDokumen63 halamanIndifference CurveManish Vijay100% (1)

- Unemployment: For Payments Paid To Unemployed People, SeeDokumen100 halamanUnemployment: For Payments Paid To Unemployed People, SeeJastine Mae FajilanBelum ada peringkat

- Is There a Core of Usable Macroeconomics We Should All Believe InDokumen4 halamanIs There a Core of Usable Macroeconomics We Should All Believe InAngie PérezBelum ada peringkat

- Foreign Trade Multiplier: Meaning, Effects and CriticismsDokumen6 halamanForeign Trade Multiplier: Meaning, Effects and CriticismsDONALD DHASBelum ada peringkat

- Marking Bills FileDokumen23 halamanMarking Bills FileGhulam FaridBelum ada peringkat

- Learning OutcomesDokumen3 halamanLearning Outcomesmaelyn calindongBelum ada peringkat

- Monetary Policy: Its Impact On The Profitability of Banks in IndiaDokumen8 halamanMonetary Policy: Its Impact On The Profitability of Banks in IndiaJuber FarediwalaBelum ada peringkat

- Quantitative AptitudeDokumen37 halamanQuantitative AptitudeNil RoyBelum ada peringkat

- Econ 304 HW 2Dokumen8 halamanEcon 304 HW 2Tedjo Ardyandaru ImardjokoBelum ada peringkat

- Hsslive-2.National Income Accounting-SignedDokumen75 halamanHsslive-2.National Income Accounting-SignedNusrat JahanBelum ada peringkat

- 299 Yearbook EngDokumen36 halaman299 Yearbook Engrossminy2Belum ada peringkat

- Economics NSC P1 Memo Nov 2022 EngDokumen22 halamanEconomics NSC P1 Memo Nov 2022 Engxhanti classenBelum ada peringkat

- Final Examination Preparation ScheduleDokumen4 halamanFinal Examination Preparation ScheduleRebecca HopkinsBelum ada peringkat

- SMK 5 AGUSTUS PEKANBARU AKREDITASI “BDokumen7 halamanSMK 5 AGUSTUS PEKANBARU AKREDITASI “BAyuvitaBelum ada peringkat

- Impact of Inflation on Capital BudgetingDokumen56 halamanImpact of Inflation on Capital Budgetingtndofirepi100% (1)

- Group Homework #1 - No Arbitrage PricingDokumen5 halamanGroup Homework #1 - No Arbitrage Pricingym5c23240% (2)

- Millward Brown Optimor Case StudyDokumen2 halamanMillward Brown Optimor Case StudySumit RanjanBelum ada peringkat

- See Jesús Mirás-AraujoDokumen19 halamanSee Jesús Mirás-AraujoGalo GonzálezBelum ada peringkat

- Structural Change and Dual Economy Models ExplainedDokumen19 halamanStructural Change and Dual Economy Models ExplainedibsaBelum ada peringkat

- ECON7Dokumen2 halamanECON7DayLe Ferrer AbapoBelum ada peringkat

- Understanding Unemployment and Labor Force ConceptsDokumen6 halamanUnderstanding Unemployment and Labor Force ConceptsVu Thao NguyenBelum ada peringkat

- Freshman Eco Unit 6Dokumen30 halamanFreshman Eco Unit 6Khant Si ThuBelum ada peringkat

- Defining EntrepreneurshipDokumen15 halamanDefining EntrepreneurshipJoseph KingBelum ada peringkat

- Understanding Global Environment in International BusinessDokumen9 halamanUnderstanding Global Environment in International BusinessSandeep KulkarniBelum ada peringkat

- First Class On Game TheoryDokumen81 halamanFirst Class On Game TheoryRafael Mosquera GómezBelum ada peringkat

- Pricing and The Psychology of Consumption - v1Dokumen1 halamanPricing and The Psychology of Consumption - v1Darshan VBelum ada peringkat