Accounting Eportfolio Assignment

Diunggah oleh

api-302048488Deskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Accounting Eportfolio Assignment

Diunggah oleh

api-302048488Hak Cipta:

Format Tersedia

4/6/2016

Student:SpencerDavis

Date:4/6/16

AcctgCycleProblemonMALSpencerDavis

Instructor:ShaunaHatfield

Assignment:AcctgCycleProblemon

Course:ACCT1110Spring2016MWF

MAL

@9(1)

https://xlitemprod.pearsoncmg.com/api/v1/print/accounting

1/23

4/6/2016

AcctgCycleProblemonMALSpencerDavis

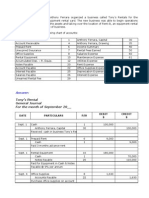

1. MitchelDeliveryServicecompletedthefollowingtransactionsduringDecember2016:

3

(Clicktheicontoviewthetransactions.)

Readtherequirements 4 .

Requirement1.Recordeachtransactioninthejournal.Explanationsarenotrequired.(Recorddebitsfirst,then

credits.Excludeexplanationsfromjournalentries.)

Dec.1:MitchelDeliveryServicebeganoperationsbyreceiving$4,000cashandatruckwithafairvalueof

$18,000fromRadley Mitchel.ThebusinessgaveMitchelcapitalinexchangeforthiscontribution.

Date

Accounts

Debit

Credit

Dec.1

Cash

4,000

Truck

18,000

22,000

Mitchel,Capital

Dec.1:Paid$1,350cashforaninemonthinsurancepolicy.ThepolicybeginsDecember1.

Date

Dec.1

Accounts

PrepaidInsurance

Debit

Credit

1,350

1,350

Cash

Dec.4:Paid$750cashforofficesupplies.

Date

Dec.4

Accounts

OfficeSupplies

Debit

Credit

750

750

Cash

Dec.12:Performeddeliveryservicesforacustomerandreceived$2,500cash.

Date

Dec.12

Accounts

Cash

ServiceRevenue

Debit

Credit

2,500

2,500

Dec.15:Completedalargedeliveryjob,billedthecustomer,$2,800,andreceivedapromisetocollectthe

$2,800withinoneweek.

https://xlitemprod.pearsoncmg.com/api/v1/print/accounting

2/23

4/6/2016

AcctgCycleProblemonMALSpencerDavis

Date

Dec.15

Accounts

AccountsReceivable

Debit

Credit

2,800

2,800

ServiceRevenue

Dec.18:Paidemployeesalary,$1,500.

Date

Dec.18

Accounts

SalariesExpense

Debit

Credit

1,500

1,500

Cash

Dec.20:Received$3,000cashforperformingdeliveryservices.

Date

Dec.20

Accounts

Cash

Debit

Credit

3,000

3,000

ServiceRevenue

Dec.22:Collected$1,900inadvancefordeliveryservicetobeperformedlater.

Date

Dec.22

Accounts

Cash

Debit

Credit

1,900

1,900

UnearnedRevenue

Dec.25:Collected$2,800cashfromcustomeronaccount.

Date

Dec.25

Accounts

Cash

AccountsReceivable

Debit

Credit

2,800

2,800

Dec.27:Purchasedfuelforthetruck,paying$250onaccount.(CreditAccountsPayable)

https://xlitemprod.pearsoncmg.com/api/v1/print/accounting

3/23

4/6/2016

AcctgCycleProblemonMALSpencerDavis

Date

Dec.27

Accounts

Debit

FuelExpense

Credit

250

250

AccountsPayable

Dec.28:Performeddeliveryservicesonaccount,$1,300.

Date

Dec.28

Accounts

Debit

AccountsReceivable

Credit

1,300

1,300

ServiceRevenue

Dec.29:Paidofficerent,$1,400,forthemonthofDecember.

Date

Dec.29

Accounts

Debit

RentExpense

Credit

1,400

1,400

Cash

Dec.30:Paid$250onaccount.

Date

Dec.30

Accounts

Debit

AccountsPayable

Credit

250

250

Cash

Dec.31:Mitchelwithdrewcashof$2,100.

Date

Dec.31

Accounts

Debit

Mitchel,Withdrawals

Credit

2,100

2,100

Cash

PostthetransactionstotheTaccounts.Usethetransactiondatesaspostingreferences.Usea"Bal."posting

referencetoshowtheendingbalanceofeachaccount.Foranyaccountswithazerobalance,selectthe"Bal."

postingreferenceandentera"0"onthenormalsideoftheaccount.

Reviewthejournalentriesyoupreparedabove.

Cash

Dec.1

4,000

1,350 Dec.1

Dec.30

https://xlitemprod.pearsoncmg.com/api/v1/print/accounting

AccountsPayable

250

250 Dec.27

ServiceRevenue

2,500 Dec.12

4/23

4/6/2016

AcctgCycleProblemonMALSpencerDavis

Dec.1

4,000

1,350 Dec.1

Dec.12

2,500

750 Dec.4

Dec.20

3,000

1,500 Dec.18

Dec.22

1,900

1,400 Dec.29

Dec.25

2,800

250 Dec.30

2,100 Dec.31

6,850

Bal.

Dec.30

2,800

Dec.28

1,300

Bal.

1,300

Bal.

Bal.

Bal.

2,800 Dec.15

0 Bal.

3,000 Dec.20

1,300 Dec.28

0 Bal.

UnearnedRevenue

1,900 Dec.22

1,900 Bal.

9,600 Bal.

SalariesExpense

Dec.18

Bal.

Mitchel,Capital

1,500

1,500

DepreciationExpenseTruck

22,000 Dec.1

750

Bal.

22,000 Bal.

Mitchel,Withdrawals

1,350

Dec.31

1,350

Bal.

2,100

2,100

Bal.

IncomeSummary

FuelExpense

18,000

Dec.27

18,000

Bal.

InsuranceExpense

Truck

750

Dec.1

2,500 Dec.12

PrepaidInsurance

2,800 Dec.25

Dec.1

OfficeSupplies

Dec.4

250 Dec.27

SalariesPayable

AccountsReceivable

Dec.15

250

250

250

AccumulatedDepreciationTruck

RentExpense

Dec.29

0 Bal.

Bal.

1,400

1,400

SuppliesExpense

https://xlitemprod.pearsoncmg.com/api/v1/print/accounting

5/23

4/6/2016

AcctgCycleProblemonMALSpencerDavis

Bal.

Requirement3.PrepareanunadjustedtrialbalanceasofDecember31,2016.(Excludeanyaccountswithazero

balancefromthetrialbalance.)

ReviewtheTaccountsyoupreparedinRequirement1.

MitchelDeliveryService

UnadjustedTrialBalance

December31,2016

Balance

AccountTitle

Debit

Cash

AccountsReceivable

OfficeSupplies

PrepaidInsurance

Truck

Credit

6,850

1,300

750

1,350

18,000

UnearnedRevenue

Mitchel,Capital

22,000

2,100

9,600

1,500

FuelExpense

250

RentExpense

1,400

Mitchel,Withdrawals

ServiceRevenue

SalariesExpense

1,900

$ 33,500 $ 33,500

Total

Requirement4.Journalizetheadjustingentriesusingtheadjustmentdata.Postadjustingentriestothe

Taccounts.

Beginbypreparingtheadjustingentries.(Recorddebitsfirst,thencredits.Excludeexplanationsfromjournal

entries.)

a.AccruedSalariesExpense,$1,500.

Date

Dec.31

Accounts

SalariesExpense

Adj.(a)

SalariesPayable

Debit

Credit

1,500

1,500

b.Depreciationwasrecordedonthetruckusingthestraightlinemethod.Assumeausefullifeoffiveyearsanda

salvagevalueof$9,000.

https://xlitemprod.pearsoncmg.com/api/v1/print/accounting

6/23

4/6/2016

AcctgCycleProblemonMALSpencerDavis

Date

Dec.31

Accounts

Debit

DepreciationExpenseTruck

Adj.(b)

Credit

150

150

AccumulatedDepreciationTruck

c.PrepaidInsuranceforthemonthhasexpired.

Date

Dec.31

Accounts

Debit

InsuranceExpense

Adj.(c)

Credit

150

150

PrepaidInsurance

d.Officesuppliesonhand,$450.

Date

Accounts

Debit

Credit

Dec.31

SuppliesExpense

300

Adj.(d)

OfficeSupplies

300

e.UnearnedRevenueearnedduringthemonth,$400.

Date

Dec.31

Accounts

Debit

UnearnedRevenue

Adj.(e)

Credit

400

400

ServiceRevenue

f.AccruedServiceRevenue,$950.

Date

Dec.31

Accounts

Debit

AccountsReceivable

Adj.(f)

ServiceRevenue

Credit

950

950

PosttheadjustingentriestotheTaccounts.Theunadjustedbalancesoftheaccounts("Bal.")havebeenentered

foryou.Usetheadjustmentandcorrespondinglettersaspostingreferences "Adj.(a)","Adj.(b)",etc.Usea

"Bal."postingreferenceonthelastlineofeachTaccounttoshowtheadjustedbalanceofeachaccount.Forany

accountswithazerobalance,selectthe"Bal."postingreferenceandentera"0"onthenormalsideoftheaccount.

Reviewtheadjustingjournalentriesyoupreparedabove.

Cash

https://xlitemprod.pearsoncmg.com/api/v1/print/accounting

AccountsPayable

ServiceRevenue

7/23

4/6/2016

Bal.

AcctgCycleProblemonMALSpencerDavis

6,850

0 Bal.

400 Adj.(e)

6,850

0 Bal.

950 Adj.(f)

0 Bal.

1,500 Adj.(a)

1,500 Bal.

Bal.

SalariesPayable

AccountsReceivable

Bal.

Adj.(f)

Bal.

UnearnedRevenue

1,300

Adj.(e)

950

2,250

OfficeSupplies

Bal.

Bal.

750

450

Bal.

1,350

150 Adj.(c)

Bal.

Adj.(a)

1,500

Bal.

3,000

22,000 Bal.

22,000 Bal.

DepreciationExpenseTruck

Bal.

Adj.(b)

150

Bal.

150

Mitchel,Withdrawals

Bal.

1,200

Bal.

2,100

Bal.

Adj.(c)

150

2,100

Bal.

150

IncomeSummary

FuelExpense

18,000

Bal.

18,000

Bal.

InsuranceExpense

Truck

1,500 Bal.

1,500

Bal.

Bal.

PrepaidInsurance

1,900 Bal.

10,950 Bal.

SalariesExpense

Mitchel,Capital

300 Adj.(d)

Bal.

400

9,600 Bal.

250

250

AccumulatedDepreciationTruck

RentExpense

0 Bal.

Bal.

150 Adj.(b)

150 Bal.

Bal.

1,400

1,400

SuppliesExpense

Bal.

Adj.(d)

https://xlitemprod.pearsoncmg.com/api/v1/print/accounting

300

8/23

4/6/2016

AcctgCycleProblemonMALSpencerDavis

Adj.(d)

300

Bal.

300

Requirement5.PrepareanadjustedtrialbalanceasofDecember31,2016.(Excludeanyzerobalanceaccounts

fromtheadjustedtrialbalance.)

ReviewtheTaccountsyoupreparedinRequirement4.

MitchelDeliveryService

AdjustedTrialBalance

December31,2016

Balance

AccountTitle

Cash

Debit

$

AccountsReceivable

OfficeSupplies

PrepaidInsurance

Truck

Credit

6,850

2,250

450

1,200

18,000

AccumulatedDepreciationTruck

SalariesPayable

1,500

UnearnedRevenue

1,500

Mitchel,Capital

22,000

2,100

10,950

3,000

DepreciationExpenseTruck

150

InsuranceExpense

150

FuelExpense

250

RentExpense

1,400

300

Mitchel,Withdrawals

ServiceRevenue

SalariesExpense

SuppliesExpense

Total

36,100 $

150

36,100

Requirement6.PrepareMitchelDeliveryService'sincomestatementandstatementofowner'sequityforthe

monthendedDecember31,2016,andtheclassifiedbalancesheetonthatdate.Ontheincomestatement,list

expensesindecreasingorderbyamountthatis,thelargestexpensefirst,thesmallestexpenselast.

Beginbypreparingtheincomestatement.Listexpensesindecreasingorderbyamountthatis,thelargest

expensefirst,thesmallestexpenselast.

ReviewtheAdjustedTrialBalancecompletedinRequirement5.

https://xlitemprod.pearsoncmg.com/api/v1/print/accounting

9/23

4/6/2016

AcctgCycleProblemonMALSpencerDavis

MitchelDeliveryService

IncomeStatement

MonthEndedDecember31,2016

Revenues:

ServiceRevenue

Expenses:

SalariesExpense

RentExpense

SuppliesExpense

300

FuelExpense

250

DepreciationExpenseTruck

150

InsuranceExpense

150

TotalExpenses

NetIncome(Loss)

10,950

3,000

1,400

5,250

5,700

Preparethestatementofowner'sequity.Enteranyincreasesincapitalpriortothesubtotalandanydecreasesto

capitalbelowthesubtotal.(Entera"0"foranyzerobalances.Useaminussignorparenthesestoshowadecrease

inretainedearnings.)

ReviewtheAdjustedTrialBalancecompletedinRequirement5.

MitchelDeliveryService

StatementofOwner'sEquity

MonthEndedDecember31,2016

Mitchel,Capital,December1,2016

Ownercontribution

0

22,000

5,700

Netincomeforthemonth

(2,100)

Ownerwithdrawal

Mitchel,Capital,December31,2016

27,700

25,600

PrepareMitchelDeliveryService'sclassifiedbalancesheetonDecember31,2016.(Excludeanyzerobalance

accountsfromthebalancesheet.)

ReviewtheAdjustedTrialBalancecompletedinRequirement5.

https://xlitemprod.pearsoncmg.com/api/v1/print/accounting

10/23

4/6/2016

AcctgCycleProblemonMALSpencerDavis

MitchelDeliveryService

BalanceSheet

December31,2016

Assets

CurrentAssets:

Cash

6,850

OfficeSupplies

PrepaidInsurance

1,200

PrepaidInsurance

1,200

TotalCurrentAssets

450

PlantAssets:

Truck

Less: AccumulatedDepreciationTruck

TotalPlantAssets

10,750

18,000

(150)

TotalAssets

17,850

28,600

Liabilities

CurrentLiabilities:

SalariesPayable

UnearnedRevenue

1,500

1,500

TotalLiabilities

3,000

Owner'sEquity

Mitchel,Capital

25,600

TotalLiabilitiesandOwner'sEquity

28,600

Requirement7.JournalizetheclosingentriesandposttotheTaccounts.

Beginbyjournalizingtheclosingentries.(Recorddebitsfirst,thencredits.Excludeexplanationsfromjournal

entries.)

Startbyclosingrevenues.

ReviewtheAdjustedTrialBalancecompletedinRequirement5.

Date

Dec.31

Accounts

ServiceRevenue

Clos.(1)

IncomeSummary

Debit

Credit

10,950

10,950

Closeexpensesfortheperiod.

https://xlitemprod.pearsoncmg.com/api/v1/print/accounting

11/23

4/6/2016

AcctgCycleProblemonMALSpencerDavis

ReviewtheAdjustedTrialBalancecompletedinRequirement5.

Date

Dec.31

Accounts

IncomeSummary

Debit

Credit

5,250

Clos.(2)

SalariesExpense

3,000

DepreciationExpenseTruck

150

InsuranceExpense

150

FuelExpense

250

RentExpense

1,400

SuppliesExpense

300

CloseIncomeSummary.

ReviewtheAdjustedTrialBalancecompletedinRequirement5.

Date

Dec.31

Accounts

IncomeSummary

Clos.(3)

Debit

Credit

5,700

5,700

Mitchel,Capital

Closewithdrawals.

ReviewtheAdjustedTrialBalancecompletedinRequirement5.

Date

Dec.31

Accounts

Mitchel,Capital

Clos.(4)

Mitchel,Withdrawals

Debit

Credit

2,100

2,100

PosttheclosingentriestotheTaccounts.Use"Clos."andthecorrespondingnumberasshowninthejournalentry

aspostingreferences "Clos.(1)","Clos.(2)",etc.Theadjustedbalanceofeachaccounthasbeenenteredforyou.

Postanyclosingentriestotheaccountsandthencalculatethepostclosingbalance("Bal.")ofeachaccount

(includingthosethatwerenotclosed).Foranyaccountswithazerobalanceafterclosing,entera"0"onthe

normalsideoftheaccount.ForIncomeSummary,calculateandenterthebalance("Bal.")beforepostingtheentry

tocloseouttheaccount.PosttheentrytocloseIncomeSummaryaccountonthesamelineasyouenteredthe

balancepriortoclosing(thesecondline)andthenshowthepostclosingbalance("Bal.")onthelast(third)lineof

theaccount.

Reviewtheclosingjournalentriesyoupreparedabove.

https://xlitemprod.pearsoncmg.com/api/v1/print/accounting

12/23

4/6/2016

AcctgCycleProblemonMALSpencerDavis

Cash

AccountsPayable

ServiceRevenue

Bal.

6,850

0 Bal.

Clos.(1)

10,950

10,950 Bal.

Bal.

6,850

0 Bal.

0 Bal.

1,500 Bal.

1,500 Bal.

SalariesPayable

AccountsReceivable

UnearnedRevenue

SalariesExpense

Bal.

2,250

1,500 Bal.

Bal.

3,000

Bal.

2,250

1,500 Bal.

Bal.

OfficeSupplies

Mitchel,Capital

Bal.

450

2,100

Bal.

450

PrepaidInsurance

5,700 Clos.(3)

25,600 Bal.

1,200

Bal.

2,100

Bal.

1,200

Bal.

2,100 Clos.(4)

Bal.

150

Bal.

Bal.

150

Bal.

IncomeSummary

Bal.

18,000

Clos.(2)

5,250

Bal.

18,000

Clos.(3)

5,700

10,950 Clos.(1)

5,700 Bal.

150 Bal.

150 Bal.

FuelExpense

Bal.

250

Bal.

250 Clos.(2)

0 Bal.

AccumulatedDepreciationTruck

150 Clos.(2)

Truck

150 Clos.(2)

InsuranceExpense

DepreciationExpenseTruck

Mitchel,Withdrawals

Bal.

22,000 Bal.

3,000 Clos.(2)

RentExpense

Bal.

1,400

Bal.

1,400 Clos.(2)

SuppliesExpense

Bal.

300

Bal.

300 Clos.(2)

Requirement8.Prepareapostclosingtrialbalance.(Excludeanypermanentaccountswithazerobalancefrom

thepostclosingtrialbalance.)

ReviewtheTaccountsyoupreparedinRequirement7.

https://xlitemprod.pearsoncmg.com/api/v1/print/accounting

13/23

4/6/2016

AcctgCycleProblemonMALSpencerDavis

MitchelDeliveryService

PostClosingTrialBalance

December31,2016

Balance

AccountTitle

Cash

Debit

$

6,850

2,250

450

1,200

18,000

AccountsReceivable

OfficeSupplies

PrepaidInsurance

Truck

Credit

AccumulatedDepreciationTruck

SalariesPayable

1,500

UnearnedRevenue

1,500

Mitchel,Capital

25,600

Total

150

28,750 $ 28,750

1:MoreInfo

Dec.

MitchelDeliveryServicebeganoperationsbyreceiving$4,000cashandatruckwithafairvalueof

$18,000fromRadley Mitchel.ThebusinessgaveMitchelcapitalinexchangeforthiscontribution.

Paid$1,350cashforaninemonthinsurancepolicy.ThepolicybeginsDecember1.

Paid$750cashforofficesupplies.

12

Performeddeliveryservicesforacustomerandreceived$2,500cash.

15

Completedalargedeliveryjob,billedthecustomer,$2,800,andreceivedapromisetocollectthe

$2,800withinoneweek.

18

Paidemployeesalary,$1,500.

20

Received$3,000cashforperformingdeliveryservices.

22

Collected$1,900inadvancefordeliveryservicetobeperformedlater.

25

Collected$2,800cashfromcustomeronaccount.

27

Purchasedfuelforthetruck,paying$250onaccount.(CreditAccountsPayable)

28

Performeddeliveryservicesonaccount,$1,300.

29

Paidofficerent,$1,400,forthemonthofDecember.

30

Paid$250onaccount.

31

Mitchelwithdrewcashof$2,100.

2:Requirements

https://xlitemprod.pearsoncmg.com/api/v1/print/accounting

14/23

4/6/2016

AcctgCycleProblemonMALSpencerDavis

1. Recordeachtransactioninthejournalusingthefollowingchartofaccounts.Explanationsarenotrequired.

Cash

Mitchel,Withdrawals

AccountsReceivable

IncomeSummary

OfficeSupplies

ServiceRevenue

PrepaidInsurance

SalariesExpense

Truck

DepreciationExpenseTruck

AccumulatedDepreciationTruck

InsuranceExpense

AccountsPayable

FuelExpense

SalariesPayable

RentExpense

UnearnedRevenue

SuppliesExpense

Mitchel,Capital

2. PostthetransactionsintheTaccounts.

3. PrepareanunadjustedtrialbalanceasofDecember31,2016.

4. Journalizetheadjustingentriesusingthefollowingadjustmentdataandalsobyreviewingthejournalentries

preparedinRequirement1.PostadjustingentriestotheTaccounts.

Adjustmentdata:

a. AccruedSalariesExpense,$1,500.

b. Depreciationwasrecordedonthetruckusingthestraightlinemethod.Assumeausefullifeof5years

andasalvagevalueof$9,000.

c. PrepaidInsuranceforthemonthhasexpired.

d. OfficeSuppliesonhand,$450.

e. UnearnedRevenueearnedduringthemonth,$400.

f.

AccruedServiceRevenue,$950.

5. PrepareanadjustedtrialbalanceasofDecember31,2016.

6. PrepareMitchelDeliveryService'sincomestatementandstatementofowner'sequityforthemonthended

December31,2016,andtheclassifiedbalancesheetonthatdate.Ontheincomestatement,listexpenses

indecreasingorderbyamountthatis,thelargestexpensefirst,thesmallestexpenselast.

7. JournalizetheclosingentriesandposttotheTaccounts.

8. PrepareapostclosingtrialbalanceasofDecember31,2016.

3:MoreInfo

https://xlitemprod.pearsoncmg.com/api/v1/print/accounting

15/23

4/6/2016

Dec.

AcctgCycleProblemonMALSpencerDavis

MitchelDeliveryServicebeganoperationsbyreceiving$4,000cashandatruckwithafairvalueof

$18,000fromRadley Mitchel.ThebusinessgaveMitchelcapitalinexchangeforthiscontribution.

Paid$1,350cashforaninemonthinsurancepolicy.ThepolicybeginsDecember1.

Paid$750cashforofficesupplies.

12

Performeddeliveryservicesforacustomerandreceived$2,500cash.

15

Completedalargedeliveryjob,billedthecustomer,$2,800,andreceivedapromisetocollectthe

$2,800withinoneweek.

18

Paidemployeesalary,$1,500.

20

Received$3,000cashforperformingdeliveryservices.

22

Collected$1,900inadvancefordeliveryservicetobeperformedlater.

25

Collected$2,800cashfromcustomeronaccount.

27

Purchasedfuelforthetruck,paying$250onaccount.(CreditAccountsPayable)

28

Performeddeliveryservicesonaccount,$1,300.

29

Paidofficerent,$1,400,forthemonthofDecember.

30

Paid$250onaccount.

31

Mitchelwithdrewcashof$2,100.

4:Requirements

https://xlitemprod.pearsoncmg.com/api/v1/print/accounting

16/23

4/6/2016

AcctgCycleProblemonMALSpencerDavis

1. Recordeachtransactioninthejournalusingthefollowingchartofaccounts.Explanationsarenotrequired.

Cash

Mitchel,Withdrawals

AccountsReceivable

IncomeSummary

OfficeSupplies

ServiceRevenue

PrepaidInsurance

SalariesExpense

Truck

DepreciationExpenseTruck

AccumulatedDepreciationTruck

InsuranceExpense

AccountsPayable

FuelExpense

SalariesPayable

RentExpense

UnearnedRevenue

SuppliesExpense

Mitchel,Capital

2. PostthetransactionsintheTaccounts.

3. PrepareanunadjustedtrialbalanceasofDecember31,2016.

4. Journalizetheadjustingentriesusingthefollowingadjustmentdataandalsobyreviewingthejournalentries

preparedinRequirement1.PostadjustingentriestotheTaccounts.

Adjustmentdata:

a. AccruedSalariesExpense,$1,500.

b. Depreciationwasrecordedonthetruckusingthestraightlinemethod.Assumeausefullifeof5years

andasalvagevalueof$9,000.

c. PrepaidInsuranceforthemonthhasexpired.

d. OfficeSuppliesonhand,$450.

e. UnearnedRevenueearnedduringthemonth,$400.

f.

AccruedServiceRevenue,$950.

5. PrepareanadjustedtrialbalanceasofDecember31,2016.

6. PrepareMitchelDeliveryService'sincomestatementandstatementofowner'sequityforthemonthended

December31,2016,andtheclassifiedbalancesheetonthatdate.Ontheincomestatement,listexpenses

indecreasingorderbyamountthatis,thelargestexpensefirst,thesmallestexpenselast.

7. JournalizetheclosingentriesandposttotheTaccounts.

8. PrepareapostclosingtrialbalanceasofDecember31,2016.

YOUANSWERED:

Date

Dec.22

Accounts

UnearnedRevenue

Debit

Credit

1900

nothing

nothing

1900

nothing

nothing

nothing

nothing

nothing

nothing

ServiceRevenue

https://xlitemprod.pearsoncmg.com/api/v1/print/accounting

17/23

4/6/2016

AcctgCycleProblemonMALSpencerDavis

Date

Dec.30

Accounts

Debit

Cash

AccountsPayable

nothing

nothing

Credit

250

nothing

nothing

250

nothing

nothing

nothing

nothing

Cash

AccountsPayable

Dec.1

4000

1350 Dec.1

Dec.30

Dec.12

2500

750 Dec.4

Dec.20

3000

1500 Dec.18

Dec.22

1900

1400 Dec.29

Dec.25

2800

250 Dec.30

nothing

nothing

2100 Dec.31

nothing

nothing nothing nothing

nothing

nothing nothing nothing

nothing

nothing

nothing nothing

nothing

nothing nothing nothing

nothing

nothing nothing nothing

6850

nothing nothing

Bal.

0 nothing nothing

nothing

nothing

Bal.

250

ServiceRevenue

250 Dec.27

nothing

nothing

2500 Dec.12

nothing

nothing nothing nothing

nothing

nothing

2800 Dec.15

nothing

nothing

nothing

nothing

3000 Dec.20

nothing

nothing

1300 Dec.28

0 Bal.

SalariesPayable

AccountsReceivable

nothing nothing nothing nothing

UnearnedRevenue

9600 Bal.

SalariesExpense

Dec.15

2800

2800 Dec.25

nothing

nothing

1900 Dec.22

Dec.18

1500 nothing nothing

Dec.28

1300

nothing nothing

nothing

nothing nothing nothing

nothing

nothing nothing nothing

Bal.

1300

nothing nothing

nothing

nothing

Bal.

OfficeSupplies

Dec.4

nothing

Bal.

Mitchel,Capital

750

nothing nothing

nothing

nothing

nothing

nothing nothing

nothing

750

nothing nothing

nothing

nothing

Bal.

22,000 Dec.1

1500 nothing nothing

DepreciationExpenseTruck

nothing

nothing nothing nothing

nothing nothing nothing

nothing

nothing nothing nothing

nothing

Bal.

22000 Bal.

0 nothing nothing

PrepaidInsurance

Dec.1

1900 Bal.

Mitchel,Withdrawals

InsuranceExpense

1350

nothing nothing

Dec.31

2100 nothing nothing

nothing

nothing nothing nothing

nothing

nothing nothing

nothing

nothing nothing nothing

nothing

nothing nothing nothing

1350

nothing nothing

Bal.

2100 nothing nothing

Bal.

0 nothing nothing

Truck

IncomeSummary

FuelExpense

Dec.1

18000

nothing nothing

Dec.27

250 nothing nothing

nothing

nothing

nothing nothing

nothing

nothing nothing nothing

18000

nothing nothing

Bal.

Bal.

250 nothing nothing

AccumulatedDepreciationTruck

https://xlitemprod.pearsoncmg.com/api/v1/print/accounting

RentExpense

18/23

4/6/2016

AcctgCycleProblemonMALSpencerDavis

AccumulatedDepreciationTruck

RentExpense

nothing

nothing

nothing nothing

Dec.29

1400 nothing nothing

nothing

nothing

nothing nothing

nothing

nothing nothing nothing

nothing

nothing

Bal.

0 Bal.

1400 nothing nothing

SuppliesExpense

nothing

nothing nothing nothing

nothing

nothing nothing nothing

Bal.

Date

Dec.31

Accounts

Debit

SuppliesExpense

Adj.(a)

0 nothing nothing

SalariesPayable

nothing

nothing

Credit

1500

nothing

nothing

1500

nothing

nothing

nothing

nothing

Cash

Bal.

AccountsPayable

6,850

nothing nothing

nothing

nothing

nothing

nothing

nothing nothing

nothing

nothing

nothing

nothing nothing

nothing

nothing

nothing

nothing nothing nothing

nothing

nothing

400 Adj.(e)

nothing nothing nothing

nothing

nothing

950 Adj.(f)

nothing

nothing

nothing

nothing

nothing

nothing

SalariesPayable

AccountsReceivable

Bal.

Adj.(f)

Bal.

nothing

Bal.

9,600 Bal.

10950 Bal.

0 Bal.

nothing

1500 Adj.(a)

nothing

1500 Bal.

UnearnedRevenue

400

1,900 Bal.

SalariesExpense

1,300

nothing nothing

Adj.(e)

950

nothing nothing

nothing

nothing nothing nothing

Adj.(a)

1500 nothing nothing

2250

nothing nothing

nothing

nothing

Bal.

3000 nothing nothing

OfficeSupplies

Bal.

0 Bal.

ServiceRevenue

1500 Bal.

Mitchel,Capital

1,500 nothing nothing

DepreciationExpenseTruck

750

300 Adj.(d)

nothing

nothing

nothing

nothing nothing

nothing

nothing nothing nothing

nothing

nothing nothing nothing

450

nothing nothing

nothing

nothing nothing nothing

nothing

nothing

22,000 Bal.

Bal.

Bal.

PrepaidInsurance

Bal.

1,350

150 Adj.(c)

https://xlitemprod.pearsoncmg.com/api/v1/print/accounting

Mitchel,Withdrawals

Bal.

2,100 nothing nothing

150 Adj.(b)

150 Bal.

InsuranceExpense

Bal.

0 nothing nothing

19/23

4/6/2016

Bal.

nothing

Bal.

AcctgCycleProblemonMALSpencerDavis

1,350

150 Adj.(c)

nothing

nothing nothing

nothing

nothing nothing nothing

Adj.(c)

150 nothing nothing

1200

nothing nothing

nothing

nothing nothing nothing

Bal.

150 nothing nothing

Bal.

2,100 nothing nothing

Bal.

0 nothing nothing

Truck

IncomeSummary

FuelExpense

Bal.

18,000

nothing nothing

Bal.

nothing

nothing

nothing nothing

nothing

nothing nothing nothing

nothing

nothing

nothing nothing

nothing

nothing nothing nothing

AccumulatedDepreciationTruck

Adj.(b)

150

nothing

nothing

nothing nothing

150

nothing nothing

Bal.

250 nothing nothing

0 Bal.

RentExpense

Bal.

1,400 nothing nothing

nothing

nothing nothing nothing

nothing

nothing nothing nothing

SuppliesExpense

Bal.

0 nothing nothing

Adj.(d)

300 nothing nothing

Bal.

300 nothing nothing

MitchelDeliveryService

IncomeStatement

MonthEndedDecember31,2016

Revenues:

ServiceRevenue

Expenses:

10950

SalariesExpense

DepreciationExpenseTruck

150

InsuranceExpense

150

FuelExpense

250

RentExpense

1400

SuppliesExpense

TotalExpenses

3000

300

NetIncome(Loss)

https://xlitemprod.pearsoncmg.com/api/v1/print/accounting

(5250)

5700

20/23

4/6/2016

AcctgCycleProblemonMALSpencerDavis

MitchelDeliveryService

StatementofOwner'sEquity

MonthEndedDecember31,2016

Mitchel,Capital,December1,2016

18000

Ownercontribution

4000

Netincomeforthemonth

5700

27700

(2100)

Ownerwithdrawal

26600

Mitchel,Capital,December31,2016

MitchelDeliveryService

BalanceSheet

December31,2016

Assets

CurrentAssets:

Cash

OfficeSupplies

PrepaidInsurance

Truck

TotalAssets

CurrentLiabilities:

6850

450

1200

18000

26500

SalariesPayable

1500

Less: UnearnedRevenue

1500

TotalLiabilities

(3000)

TotalLiabilitiesandOwner'sEquity

26500

Liabilities

CurrentLiabilities:

SalariesPayable

1500

UnearnedRevenue

1500

TotalLiabilities

3000

Owner'sEquity

Mitchel,Capital

TotalLiabilitiesandOwner'sEquity

22,000

28600

https://xlitemprod.pearsoncmg.com/api/v1/print/accounting

21/23

4/6/2016

AcctgCycleProblemonMALSpencerDavis

Cash

AccountsPayable

ServiceRevenue

Bal.

6,850

nothing nothing

nothing

nothing

0 Bal.

Clos.(1)

10950

10,950 Bal.

Bal.

6850

nothing nothing

nothing

nothing

0 Bal.

nothing

nothing

0 Bal.

nothing

nothing

nothing

nothing

1,500 Bal.

1500 Bal.

SalariesPayable

AccountsReceivable

UnearnedRevenue

SalariesExpense

Bal.

2,250

nothing nothing

nothing

nothing

1,500 Bal.

Bal.

Bal.

2250

nothing nothing

nothing

nothing

1500 Bal.

Bal.

OfficeSupplies

Mitchel,Capital

Bal.

450

nothing nothing

nothing

2100

Bal.

450

nothing nothing

nothing

nothing

nothing

nothing

PrepaidInsurance

5700 Clos.(3)

25600 Bal.

1,200

nothing nothing

Bal.

Bal.

1200

nothing nothing

Bal.

2,100

0 nothing nothing

Bal.

150

0 nothing nothing

InsuranceExpense

2100 Clos.(4)

Bal.

0 nothing nothing

Bal.

150

0 nothing nothing

IncomeSummary

18,000

nothing nothing

Clos.(2)

5250

10950 Clos.(1)

Bal.

Bal.

18000

nothing nothing

Clos.(3)

5700 nothing nothing

Bal.

nothing

nothing

150 Bal.

250

250 Clos.(2)

0 nothing nothing

0 Bal.

AccumulatedDepreciationTruck

150 Bal.

FuelExpense

Bal.

nothing

150 Clos.(2)

Truck

nothing

150 Clos.(2)

Bal.

3000 Clos.(2)

DepreciationExpenseTruck

Mitchel,Withdrawals

Bal.

22,000 Bal.

3,000

RentExpense

Bal.

Bal.

1,400

1400 Clos.(2)

0 nothing nothing

SuppliesExpense

Bal.

Bal.

https://xlitemprod.pearsoncmg.com/api/v1/print/accounting

300

300 Clos.(2)

0 nothing nothing

22/23

4/6/2016

AcctgCycleProblemonMALSpencerDavis

MitchelDeliveryService

PostClosingTrialBalance

December31,2016

AccountTitle

Balance

Debit

Credit

Cash

6850

nothing

AccountsReceivable

2250

nothing

450

nothing

1200

nothing

18000

nothing

AccumulatedDepreciationTruck

nothing

150

SalariesPayable

nothing

1500

UnearnedRevenue

nothing

1500

Mitchel,Capital

nothing

25600

OfficeSupplies

PrepaidInsurance

Truck

28150

28150

Total

https://xlitemprod.pearsoncmg.com/api/v1/print/accounting

23/23

Anda mungkin juga menyukai

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- SYBCO AC FIN Financial Accounting Special Accounting Areas IIIDokumen249 halamanSYBCO AC FIN Financial Accounting Special Accounting Areas IIIctfworkshop2020Belum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- FA - Assignment - 01Dokumen17 halamanFA - Assignment - 01Rehan Mehmood63% (8)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Manac Quiz 2 With AnswersDokumen4 halamanManac Quiz 2 With AnswersReymilyn Sanchez78% (9)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Comprehensive Finance Cheat Sheet Collection 1698244606Dokumen52 halamanComprehensive Finance Cheat Sheet Collection 1698244606muratgreywolf100% (1)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Assurance IP 1 Week 1Dokumen1 halamanAssurance IP 1 Week 1rui zhangBelum ada peringkat

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Accounting For Partnership and Corporation Solman Baysa Lupisan 2014 Chapter 3Dokumen18 halamanAccounting For Partnership and Corporation Solman Baysa Lupisan 2014 Chapter 3Eric BaquirBelum ada peringkat

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Test Bank For Taxation For Decision Makers, 2016 Edition by Shirley Dennis Escoffier, Karen Fortin 9781119089087Dokumen29 halamanTest Bank For Taxation For Decision Makers, 2016 Edition by Shirley Dennis Escoffier, Karen Fortin 9781119089087NitinBelum ada peringkat

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Balanced Scorecard SCMDokumen5 halamanBalanced Scorecard SCMudelkingkongBelum ada peringkat

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- Midterm Exam GFGB 6005 003 Fall 2019 Answer Doc FileDokumen13 halamanMidterm Exam GFGB 6005 003 Fall 2019 Answer Doc FileGel viraBelum ada peringkat

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- Financial Analysis Getting A Grip With Accounts Part 1 FEUDokumen31 halamanFinancial Analysis Getting A Grip With Accounts Part 1 FEURommel Cabel CapalaranBelum ada peringkat

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Case DigestDokumen70 halamanCase Digestattycpajfcc100% (2)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- TANESCO Financial Cost of Service - Final Report - Annex To The TADokumen59 halamanTANESCO Financial Cost of Service - Final Report - Annex To The TAharishmnBelum ada peringkat

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Factory Accounting (Online Material) PDFDokumen31 halamanFactory Accounting (Online Material) PDFramkumar100% (1)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- ACC 4041 Tutorial - Investment IncentivesDokumen4 halamanACC 4041 Tutorial - Investment IncentivesAyekurikBelum ada peringkat

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- BugetDokumen13 halamanBugetDeepti Kukreti100% (1)

- Assignment 2Dokumen2 halamanAssignment 2ሔርሞን ይድነቃቸው0% (1)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- (Ahmed Riahi-Belkaoui) Earnings Measurement, DeterDokumen200 halaman(Ahmed Riahi-Belkaoui) Earnings Measurement, DeterdolutamadolutamaBelum ada peringkat

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Infosys Result UpdatedDokumen15 halamanInfosys Result UpdatedAngel BrokingBelum ada peringkat

- 2018-19 Countywide Overtime Monitoring ReportDokumen36 halaman2018-19 Countywide Overtime Monitoring ReportThe Press-Enterprise / pressenterprise.comBelum ada peringkat

- Financial Plan: A. Total Projected CostDokumen8 halamanFinancial Plan: A. Total Projected CostLerry GodonBelum ada peringkat

- NEF Funding-Application-FormsDokumen8 halamanNEF Funding-Application-FormssylvesterBelum ada peringkat

- Financial Management For Decision Makers Canadian 2nd Edition Atrill Solutions ManualDokumen35 halamanFinancial Management For Decision Makers Canadian 2nd Edition Atrill Solutions Manualalmiraelysia3n4y8100% (26)

- ACCA F3 LRP - Answers PDFDokumen72 halamanACCA F3 LRP - Answers PDFAdnanBelum ada peringkat

- Accounting Cycle Comprehensive ProblemDokumen2 halamanAccounting Cycle Comprehensive ProblemKevIn Lam50% (4)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- 266-Gancayco v. CIR G.R. No. L-13325 April 20, 1961Dokumen5 halaman266-Gancayco v. CIR G.R. No. L-13325 April 20, 1961Jopan SJBelum ada peringkat

- ACCTG122 Homework On Partnership LiquidationDokumen2 halamanACCTG122 Homework On Partnership LiquidationJoana TrinidadBelum ada peringkat

- Chapter 4 - Closing Entries - Classified Financial StatementsDokumen17 halamanChapter 4 - Closing Entries - Classified Financial StatementsNaeemullah baigBelum ada peringkat

- Unit 3 Assignment 2 Task 2Dokumen4 halamanUnit 3 Assignment 2 Task 2Noor KilaniBelum ada peringkat

- Class Exercise AccountingDokumen4 halamanClass Exercise AccountingMohsin Farooq100% (1)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Assignment of Fundamental of Accounting IDokumen12 halamanAssignment of Fundamental of Accounting IibsaashekaBelum ada peringkat

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)