4 24 16 SP Final Master For Team 2 1

Diunggah oleh

api-298975236Deskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

4 24 16 SP Final Master For Team 2 1

Diunggah oleh

api-298975236Hak Cipta:

Format Tersedia

Running Head: STRATEGIC PLAN TEAM 2

Strategic Plan for St John Hospital and Medical Center

Team 2

A project submitted in partial fulfillment

of the requirement for the degree

Master of Arts

Siena Heights University

Southfield, Michigan

April 26, 2016

STRATEGIC PLAN TEAM 2

Note: This paper contains concepts and data that is representative and may not be entirely

true and/or accurate but is being used for purposes of an educational experience.

STRATEGIC PLAN TEAM 2

Background and Overview of St John Hospital and Medical Center

St John Hospital and Medical Center (SJHMC) was founded by the Sisters of St

Joseph (SSJ) in 1952 and is located on the east side of Detroit, Michigan. The SSJ

congregation was founded in France and re-ignited by Mother St. John Fontbonne after

the religious persecution of the French Revolution (St John Hospital and Medical Center

Marketing Archive, 2002). They were committed to helping the poor, the sick, the aged,

and orphansas well as pursuing a life of prayer. In 1834, at the request of Bishop

Rosati of St. Louis, the sisters crossed the Atlantic and settled in Carondolet, Missouri

(St John Hospital and Medical Center Marketing Archive, 2002). A few Sisters settled in

Michigan cities of Kalamazoo and Detroit where they provided elementary and

secondary education, cared for orphaned boys, and performed social work. They

dreamed of building a hospital in Detroit, and in 1928 received permission from Rome to

borrow $1 million for this project. They purchased property and planned to begin

construction. Unfortunately, the stock market crash of 1929 followed by the Great

Depression forced abandoment of the project (St John Hospital and Medical Center

Marketing Archive, 2002).

The Sisters held to their dream of providing the residents of Detroit with

healthcare services that they became known for throughout Michigan. Under the

leadership of Reverend Mother Collette Connors, Superior General, the old Beaupre

Farm also known as The Widows Dower on the eastside of Detroit was purchased in

1943 (St John Hospital and Medical Center Marketing Archive, 2002). World War II

broke out and caused another delay. However, in January of 1950, construction began.

The new hospital opened with 250 beds and received its first patient on May 15, 1952 (St

STRATEGIC PLAN TEAM 2

John Hospital and Medical Center Marketing Archive, 2002). The hospital remains in its

original location and is situated in the eastern ring of the city of Detroit and connects with

the affluent suburban Grosse Pointe communities.

SJHMC is a tertiary plus, teaching hospital with 761 licensed beds, 1,300 member

medical staff and approximately 4,500 associates (St John Providence Health, 2015).

SJHMC is designated as a Level II trauma center and its areas of specialty include but are

not limited to: cardiovascular, emergency medicine, oncology, surgery, pediatrics,

neonatology, neurosciences, imaging and womens health. In addition, the hospital

provides numerous subspecialities in cardiology, pediatrics, oncology, and surgery.

Inpatient psychiatric and acute rehabilitation care is provided in its two distinct units.

SJHMC operates outpatient services through four ambulatory centers located in

neighboring suburbs (Grosse Pointe, St Clair Shores, Harrison Township, and Macomb

Township) in addition to numerous physician practice offices scattered throughout its

geographic catchment area. SJHMC provides medical education to over two hundred

medical residents and students annually.

The determination and mission of the Sisters of St. Joseph is the foundation for

this vital healthcare network that has grown to include thousands of physicians and

healthcare professionals, and multiple facilities that provides numerous services (St John

Hospital and Medical Center Archive, 2002). The network grew stronger when the

Sisters of St. Joseph of Kalamazoo, and the four American Provinces of the Daughters of

Charity of St. Vincent de Paul, announced their decision to create a new health ministry

based on co-sponsorship of the two congregations under a new name, Ascension Health

(St John Hospital and Medical Center Marketing Archive, 2002). Today, Ascension

STRATEGIC PLAN TEAM 2

Health (AH) is the largest Catholic tax-exempt healthcare organization in the country.

SJHMC and its parent, St John Providence Health system (SJP) are part of the AH

Michigan Ministry Market that also includes Genesys (Grand Blanc), Borgess

(Kalamazoo), St Marys (Saginaw and Tawas).

Brief Timeline of Events

1928 Sisters of St Joseph (SSJ) received permission from Rome to build a

hospital on the

eastside of Detroit

1929 Stock market crash necessitated abandonment of the project

1943 SSJ purchased land on Moross Road that was the Beaupre farm and known

as the Widows dower

1950 Construction began and the cornerstone was laid

1952 Hospital opens in May

1985 Major construction project of $117m occurs adding five stories, 12 new

operating rooms, new emergency department, labor & delivery, neonatal intensive

care, pediatrics, laboratory and radiology areas

1999 SSJ and the Daughters of Charity form a new partnership that creates a new

organization called Ascension Health and at the same time the SSJ and Daughters

of Charity SE MI hospitals come together to form St John Providence Health

System (SJP)

1999 Other Michigan Ascension Health ministries include Borgess Medical

Center in Kalamazoo, Genesys Regional Medical Center in Grand Blanc, and St.

Marys Hospitals in Saginaw and Tawas.

2015 Crittenton Hospital in Rochester joins Ascension Health Michigan

ministries

Directional Strategies

Directional strategies play an important role for SJHMC because they help define

the purpose of the organization and guide action plans that will ultimately shape the

future of the organization. Directional strategies are found in the mission, vision, values,

and strategic goals of the organization.

STRATEGIC PLAN TEAM 2

The mission attempts to capture the organizations distinctive purpose or reason

for being. Vision creates a mental image of what leaders want the organization to

achieve when it is accomplishing its purpose or mission. Values are the principles

that are held dear by members of the organization. Strategic goals are those

overarching end results that the organization pursues to accomplish its mission

and achieve its vision. (Ginter, Duncan, & Swayne, 2013, pp. 167-168)

Understanding the organizations mission, vision, values, and aligning its strategic goals

will enhance the organization, boost a competitive edge, and increase performance for

long-term success.

The mission statement for SJHMC states [SJHMC], as a Catholic health

ministry, is committed to providing spiritually centered, holistic care which sustains and

improves the health of individuals in the communities we serve, with special attention to

the poor and vulnerable (St John Providence Health, n.d., p.1). Ginter, et al., (2103)

identify four characteristics that help promote an effective mission statement:

1)

2)

Mission statements should illustrate their purpose.

Mission statements are enduring and should stay relatively stable without

3)

changing its purpose.

Mission statements should show uniqueness within the organization

separating them from other organizations.

4)

Mission statements should provide clarity in terms of scope of operations.

SJHMCs mission statement contains the four characteristics however, there could be

more clarity about the scope of operations. For example, the mission statement mentions

sustaining and improving the health of communities served but it does not describe where

this will be accomplished such as in the inpatient and/or outpatient settings, hospital

services only, or if the scope contains the full care continuum. Overall, the mission

STRATEGIC PLAN TEAM 2

statement appears effective in defining its purpose, however, Ginter, et al., (2013)

developed a strategic thinking map to facilitate the creation of a mission statement. The

strategic thinking map not only assists in the creation of the mission statement but it

assists us in evaluating the SJHMCs mission statement. The following table is the

Strategic Thinking Map completed for SJHMCs mission statement.

1.

2.

3.

4.

5.

6.

Component

Target Customers and clients

Principal services delivered

Geographical domain

Specific values

Explicit philosophy

Other important aspects of distinctiveness

Key Words Reflecting Component

individuals in the community

spiritually centered, holistic care

in communities we serve

spiritually centered

Catholic; holistic care

catholic; especially poor and vulnerable

The above map points out strengths and weaknesses in the SJHMC mission statement.

For example, key words such as holistic, spiritually centered care suggest differentiating

characteristics in providing healthcare. Some weaknesses are that the mission does not

explicitly define the type of healthcare services provided nor defines the geographic area

of the communities served. A proposed alternative mission statement could be:

[SJHMC], as a Catholic health ministry, is committed to providing full continuum of

healthcare services in a spiritually centered, holistic manner which sustains and improves

the health of individuals in the communities we serve primarily in southeastern Michigan

with special attention to the poor and vulnerable.

The vision statement for SJHMC states Our passion for healing calls us to

cultivate trust, advocate wellness and transform healthcare (St John Providence Health,

n.d. p. 1). A vision is a futuristic projection or picture of what success will look like from

a leaders perspective. Effective visions possess four important attributes: idealism,

uniqueness, future orientation and imagery (Ginter, et al., 2013, pg. 179).

STRATEGIC PLAN TEAM 2

A Strategic Thinking Map can also help coordinate the writing of a Vision Statement. The

strategic thinking map can be used to guide leaders in a direction to solely focus on the

future. Ginter, et al., (2013) discussed the five components that are useful in helping

leaders think about the vision statement.

1.

2.

3.

4.

5.

Component

Clear Hope for the future

Challenging and about excellence

Inspirational and emotional

Empower employees first

Memorable and provides guidance

Key Words Reflecting Component

Transform Healthcare

Cultivate trust

Passion for healing

Cultivate trust

Advocate healthcare

St. Johns vision statement possesses all of these components and provides an ambitious

direction.

Values are the fundamental guidelines that shape the organizational culture along

with the mission and vision to ensure we are displaying ethical behavior and standards.

The desired behaviors are outlined in SJHMCs values statement as follows-- We are

called to:

Service of the Poor Generosity of spirit, especially for persons most in need

Reverence Respect and compassion for the dignity and diversity of life

Integrity Inspiring trust through personal leadership

Wisdom Integrating excellence and stewardship

Creativity Courageous innovation

Dedication Affirming the hope and joy of our ministry (St John Providence

Health, n.d.)

Strategic goals should be determined after the mission statement is established to

insure alignment with the organizations purpose and its vision. The mission, vision, and

STRATEGIC PLAN TEAM 2

values of any organization serve as the foundation for goal setting. Strategic goals are

put in place to bring the organizations vision to life. When setting strategic goals, keep in

mind that goal setting should be focused on those areas that are critical to mission

accomplishment (Ginter, et al., 2013, p. 190). SJHMC uses a goal framework with three

themes Healthcare that works, Healthcare that is safe and Healthcare that leaves no one

behind that facilitates alignment with its mission and vision (Ascension Health, 2016).

External Environmental Analysis

General

St. John Hospital and Medical Center is a successful organization due to the

utilization of strategic planning to adapt to changes taking place in the general

environment. Per Ginter, et al., (2013) changes can be classified as competitive,

regulatory, legislative/political, economic, social/demographic, and technological

changes.

Organizations and individuals create change. Therefore, if health care managers

are to become aware of the changes taking place outside their own organization,

they must have an understanding of the types of organizations that are creating

change and the nature of change. (Ginter, et al., (2013, p.45)

A change in the general environment that affects SJHMC is within the social or

demographic category with the rise in the population greater than 65.

STRATEGIC PLAN TEAM 2

10

Per the U.S. Census Bureau (2016), one in five Americans will be elderly by the year

2050. An increase in the geriatric population fueled the need for SJHMC to create a unit

specifically designed for the care of the elderly. With many more American babyboomers entering senior citizenship, it is crucial for more physicians and support staff to

be trained to provide specialized care in the Acute Care for the Elderly (ACE) Unit.

Social workers are available to the patient and their families so that continuing care or

long-term care can be set up when the patient is discharged, if necessary. Services needed

for transition outside the hospital will be essential to aid the patient as the geriatric

population increases and such placement will become more limited. An increased

geriatric population may undoubtedly affect the amount of staffing needed to

accommodate this growing population. SJHMC appears to be planning strategically for

the future by implementing such ACE units and providing extraordinary care for the

communities they serve.

Another change in the general environment that will likely affect SJHMC relates

to the political arena. With the upcoming presidential election, change may occur when a

STRATEGIC PLAN TEAM 2

11

new President is placed in office. Each candidate has different views and goals and

therefore, different agendas are pushed for issues important to him or her. For example,

President Obama pushed for implementation of Obama Care and the Affordable Care Act

(ACA) and George W. Bush pushed for the prescription drug bill. Per Ginter, et. al.,

(2013), the prescription drug bill created by George W. Bush affected the environment of

many organizations and individuals including insurance companies, organizations

representing the elderly, and/or retirees. Similarly, the early healthcare reform initiatives

of the Obama administration resulted in the passage of ACA, however, its

implementation was spread over a number of years and affected virtually all institutions

in the general environment just not healthcare organizations"(Ginter, et. al., 2013, p.46).

Per St. John Providence Faith and Health newsletter (2013), there are many reasons why

the Affordable Care Act was needed such as skyrocketing health care costs, people falling

into health insurance holes, people being rejected for insurance coverage due to preexisting conditions, or being denied coverage due to exceeding their lifetime limit. In

addition, many business owners had difficulty providing and covering health insurance

costs for their employees. Per the U.S. Department of Health and Human Services

(2016), The Affordable Care Act put in place comprehensive health insurance reforms

that have improved access, affordability, and quality in health care for Americans. (p.1)

With SJHMCs continued dedication to providing affordable health care to its patients,

the organization will continue to grow and be successful in the communities in which

they serve.

STRATEGIC PLAN TEAM 2

12

Industry Specific

A major change in the healthcare industrys environment is the growth and

evolution of technology. By staying up-to-date with technology, SJHMCs patients now

have the opportunity to utilize new services such as Spinal Cord Stimulation (SCS) to

automatically adapt to a patients position, activity level and pain relief needs.

SCS is appropriate for patients with chronic or severe pain from herniated disks or

pinched nerves who have not been significantly helped by surgery, are not

candidates for surgery, or have chronic pain syndromes such as complex regional

pain syndrome, failed back surgery syndrome, or painful peripheral neuropathy.

(SJHMC Medical Education and Physician Resources, 2013, p. 1)

Such innovation in technology allows for patients to receive care that previous

procedures did not fully correct and allows SJHMC to remain competitive with other area

hospitals. Todays technology also allows for patients and their families to have access to

online medical records twenty-four hours a day through a patient portal on the

organizations website. Patients can schedule appointments, find a physician, a translator,

search all locations, and even pay their bill online which aides in finding care with more

ease and confidence. Physician finder breaks the physicians into categories based on

specialty and gives a description of that doctor including where they are located, phone

number, and other important information such as board certification credentials (St John

Providence Health, 2016). Per the American Health Association (2016), Americas

hospitals have been pioneers in harnessing information technology to improve patient

care, quality and efficiency and share the vision of a health care system where widespread

use of interoperable electronic health records (EHRs) supports improved clinical care,

STRATEGIC PLAN TEAM 2

13

better coordination of care, fully informed and engaged patients, and improved public

health (p.1). The American Health Association also works every day to ensure adequate

privacy and security for patients and their personal health information. (American Health

Association, 2016).

Competitive changes in the industrys environment will also likely affect SJHMC.

For example, health care organizations may be required to consolidate to remain

competitive and to deal with cost pressures. Niche services and other market strategies

will be increasingly important so that SJHMC can draw consumers from other area health

care organizations. Per St. John Providences website (2016) one such market niche

service offered is minimally invasive surgery. The use of minimally invasive surgery

results in less pain, smaller scars, shorter hospital stays, lower rates of complications, and

faster recoveries. It has become the method of choice for a variety of surgical conditions.

The St. John Providence Minimally Invasive Institute continually meets or exceeds local

and national surgical benchmarks. The organization proudly states that in regards to

minimally invasive surgery, We are set apart from other health systems and designed

with strengths in the following areas: size, surgeon experience, innovation and expertise,

education, and satisfaction, (St. John Providence, 2016, p. 1). More challenges in

competition include filling shortages of health care workers.

Service Area Competitor Analysis

The Service Area

St. John Hospital and Medical Center covers a broad geographical area of

approximately 4,390 square miles and a population of approximately 4.5 million people.

The primary service area includes Wayne County that covers 672 square miles and a

STRATEGIC PLAN TEAM 2

14

population 1,820,652 people and Macomb County that covers 570 square miles and

840,978 people. The secondary service area includes Oakland County covering 908

square miles and a population of 1,202,362 people. SJHMC also serves some less

populated counties such as Washtenaw County covering 723 square miles and a

population of 344,791 people, St. Clair County covering 837 square miles and 163,040

people, and lastly, Monroe County covering 680 square miles and a population of

152,021 (Semcog, 2016).

As a tertiary care hospital that specializes in cardiovascular, emergency medicine,

oncology, surgery, pediatrics, neonatology, neurosciences, imaging and womens health

aging population was considered in the service area. In 2010, the population age 65 and

older was 610,665 and is expected to grow to 1,130,643 (85% increase) by the year 2040.

In addition, with a subspecialty of pediatrics, the population under the age of 18 in 2010

was 2,262,070 people and is expected to decrease to 1,949,492 (13.8% decline) by the

STRATEGIC PLAN TEAM 2

15

year 2040 (Semcog, 2016). A percentage of people under the age of 65 are disabled in

the service area with Wayne county at 12.3 %, Oakland County at 7.8%, Macomb County

at 9.4%, Washtenaw County at 5.8%, St. Clair at 12.4%, and Monroe at 9.3% (US

Census, 2016).

St. John Hospital and Medical Centers service area population has a mix of

cultures and varying degrees of education. The majority is white at 68.5% percent,

African American at 21.6%, Asian at 3.6%, Hispanic at 3.9%, multiracial at 2%, and

others not in that mix making up .4%. Education levels vary as well starting with the

population who did not graduate high school at 2.2% and 28.5% with a highest level of

education graduating high school. The people with some college but no degree are

23.2% whereas Associate degree level of education is 7.7% and 17% that hold a

bachelors degree. Lastly, 11.5% of the population has the highest level of education

with graduate degrees (US Census Bureau, 2016).

The median household and per capita incomes vary by county in the service area

of St. John Hospital and Medical Center. Wayne County has a Median Household

income of $41,421 and a per capita income of $22,643. Oakland Countys median

household is $66,436 and a per capita income of $37,089. Macomb County has a median

household income of $54,059 and a per capita income of $27,145. The median

household for Washtenaw County is $60,805 with a per capita income of $34,258. St.

Clair Countys median household is $48,703 and has a per capita of $24,820. Lastly,

Monroe Countys median household income is $54,911 with a per capita of $ 26,617.

These are in line with the entire state of Michigans household income at $49,087 and a

per capita of $26,143 (US Census, 2016).

STRATEGIC PLAN TEAM 2

16

The primary service area of SJHMC has a high percentage of persons in poverty.

The State of Michigans mean is 16.2%. However, Wayne county is higher than the mean

at 24%, but the other counties are lower with Oakland at 10%, Macomb at 12.3%,

Washtenaw at 14.3%, St. Clair at 13.8%, and Monroe at 10.4% (US Census, 2016).

SJHMC serves a diverse population measured in age, race, and economic status.

Having identified the geographical and pertinent demographic information related to the

service area, we will now begin the competitor analysis.

Competitor Analysis

We identified the competitors of St. John Hospital and Medical Center as Henry

Ford Macomb Hospital, DMC- Detroit Receiving Hospital, and Beaumont Hospital Troy.

Henry Ford Macomb Hospital is located in Clinton Township, Michigan and is one of the

top competitors for SJHMC. Henry Ford Macomb Hospital is known as Macomb

Countys most comprehensive health care organizations as well as the fifth largest

employer. In 2007, Henry Ford Macomb Hospital was fully owned by Henry Ford Health

System, which occupies five service area hospitals within the same market HFHS is

known as one of the nations leading clinical and research-based health systems.

Henry Ford Macomb has approximately 638 licensed beds and offers

comprehensive acute and tertiary care. Their specialty services include Heart & Vascular

Institute, Josephine Ford Cancer Institute, womens and childrens services, orthopedics,

and neurosciences. More than 1,000 medical staff, 3,000 staff employees, and 700

community volunteers help to service the community. The American College of Surgeons

Committee on Trauma has verified Henry Ford Macomb Hospital as a Level II-Adult

Trauma Center. (Henry Ford Macomb Hospitals, n.d.).

STRATEGIC PLAN TEAM 2

17

A level II- Adult Trauma Center has the capabilities to initiate definitive care for

all injured patients. Level II Trauma Services include 24- hour staffing, immediate

coverage by general surgeons, orthopedic surgery, neurosurgery, anesthesiology,

emergency medicine, radiology, and critical care. (Henry Ford Macomb Trauma, n.d.).

Henry Ford Macomb Hospital recognizes that they must balance investments in

technology, facilities and our employees with the pressing needs of those we serve

(Henry Ford Macomb Hospital, n.d., p.1).

Henry Ford Macomb Hospital provides services to a large percentage of working

families. This is beneficial because most of these families are insured with private health

care insurance. This hospital is centrally located and is considered to be a local

community based hospital versus a large medical center. In addition to having a local

hospital within the community, Henry Ford Macomb Hospital is part of the Henry Ford

Health System. The hospitals medical staff is primarily independent physicians along

with the employed Henry Ford Medical Group.

Henry Ford Macomb Hospital has a few potential weaknesses such as the

population age bracket within Macomb County. They are young, healthy families that

may not require as much healthcare assistance as the elderly population. This could cause

a lower number of patient visits. The potential of splitter private physicians who also

practice out of SJHMC and or Beaumont Troy could cause other issues. The clinical

aspect of being a Level II facility anything requiring more care would be transferred out

to another facility or location, which causes frustration for patient quality of care. Lastly,

there is lack of teaching programs within all of the Henry Ford Health System. The

potential for patient care volumes to fluctuate upon the age and health of the population

STRATEGIC PLAN TEAM 2

18

in the suburbs can cause significant drawbacks for patients looking for the best quality

services and highest technology.

The Detroit Medical Center (DMC) is a health system located in the metropolitan

Detroit area and is comprised of nine specialty hospitals (Detroit Medical Center, n.d.).

The DMC considers itself a leading academic healthcare provider with more than 2,000

licensed beds and 3,000 affiliated physicians. DMC is a competitor of SJHMC more as a

combined health system rather than one or more of its nine hospitals due to the location

within the service area. However, for purpose of this competitor analysis, the focus will

be on one of the nine DMC hospitals, DMC Detroit Receiving Hospital, that is ranked

10th for discharges in the service area with 6,643 discharges or 3.5% market share.

DMC Detroit Receiving Hospital is Michigans first Level 1 Trauma Center and

its primary service is in emergency medicine (Detroit Medical Center, n.d.). In addition

to emergency medicine and complex trauma, the hospital provides services in critical

care, orthopedics, neurosciences, nephrology, pulmonology, diabetes, geriatrics, and

urology (Detroit Medical Center, n.d.). Due to its trauma status and emergency expertise,

DMC Detroit Receiving Hospital is a model for local, regional, state and national

emergency preparedness (Detroit Medical Center, n.d.). DMC Detroit Receiving has a

verified burn center that is one of 43 in the country as well as a 24/7 hyperbaric oxygen

program (Detroit Medical Center, n.d.).

As a Level 1 Trauma Center, DMC Detroit Receiving Hospital may be the

recipient of high acute complex trauma cases that generally have a higher payment rate

than other services. The hospitals strenght in emergency medicine can be a feeder for its

other specialty services such as orthopedics and neurosciences. The City of Detroit has a

STRATEGIC PLAN TEAM 2

19

growing population of people over the age of 65 years and this population generally

requires higher utilization of health care services. However, an influx of young

professionals are moving into Detroit due to the number of recent investments and

employer moves to the city. This could result in a positive outlook for healthcare

services.

A potential weakness of DMC Detroit Receiving Hospital is that it is located in

the heart of the City of Detroit where the population has decreased significantly each year

and has a higher than average persons living in poverty. This can influence the number of

patients seeking medical care and the ability to be paid for the services provided. Patients

seeking elective care may avoid DMC Detroit Receiving due to its high level emergency

care.

Beaumont Health System is made up of 8 hospitals and 3337 beds (Beaumont

Health System, 2016). However, for the purpose of this competitor analysis, the focus

will Beaumont Hospital in Troy, MI. The focus is due to its ranking of number 2 in the

service area. This is an outpatient and in-patient hospital with 458 beds. It offers centers

of excellence in pediatrics, cancer, digestive health, heart and vascular, neuro science,

orthopedics, urology, and womens health. It also specializes in emergency care, family

medicine, laboratory services, radiology, rehabilitation services, and surgical services

(Beaumont Health System, 2016).

Beaumont Troy has a Healthgrade five star rating in coronary interventional

procedures, (inpatient) defibrillator procedures, heart attack heart failure, respiratory

failure, sepsis, Esophageal/Stomach Surgeries, gall bladder removal surgery, pancreatitis,

stroke, hip replacement, chronic obstructed pulmonary disease, and pneumonia

STRATEGIC PLAN TEAM 2

20

(Healthgrade, 2016). Beaumont Troy is also recognized by The Joint Commission as

a primary stroke center (Beaumont Health System, 2016).

For the past five years, Beaumont Troy has gained in market share. In 2011,

Beaumont Troy had a market share of 9.1% and SHMC had a market share of 16%. In

2015, that gap is closing with Beaumont Troys market share of 11.6% compared to

SJHMCs of 13.9%. Beaumont Troy gained market share from a gap 6.9% to 2.3% with

SJHMC (Michigan Business Directory, 2015).

One of Beaumonts advantages is a relatively good payer mix. They have more

commercial and private insured patients than other surrounding hospitals and the location

of the hospital is desirable. It is in the heart of the suburbs on all sides so it draws from

the wealthiest areas. The reputation of the medical staff is solid. Lastly, their advertising

campaign is a strength due to its longstanding, consistent branding campaign in the

market

Beaumont Troys potential weakness is that the strong clinical reputation came

from its primary tertiary hospital Beaumont- Royal Oak. The recent merger with

Oakwood and Botsford could be a distraction due to a focus on internal structuring and

/or reorganization.

Internal Environmental Analysis

Note: This section contains concepts and data that is representative and may not be

entirely true and/or accurate but is being used for purposes of an educational experience.

Service Delivery

Establishing a competitive advantage is critical to an organizations long-term

success and sustainability. Organizations should strive to widen the performance gap

between themselves and competitors (Ginter, et al., 2013, p. 129). One of the ways to

STRATEGIC PLAN TEAM 2

21

widen the performance gap is to create value for patients and other key stakeholders. The

value chain model by Ginter, et al., (2013) suggests that organizations look at value

creation in the service delivery activities such as pre-service, point-of-service, and afterservice. For purposes of this exercise, we analyzed point-of-service activities and the

following strengths and weaknesses were identified.

Point of Service

Strengths

Weaknesses

Expertise of Medical staff including broad

Shortage of primary care physicians

specialty coverage

Emergency department and trauma capabilities Large medical center to navigate for

Caregivers aligned with values and provide

services

Shortage of nurses and other

holistic care

Innovative service offerings in many

caregivers

Innovative and niche services are

specialties such as oncology, cardiology,

costly and often not reimbursed in

surgery and orthopedics

Niche service offerings in womens health and

early years

Marketing efforts focus on system

oncology

Medical education programs with residents

versus specialty services

Some patients prefer not to have

treatment by residents

Safety protocols followed through delivery of

service

Next, we evaluated the competitive relevance for strengths and weaknesses by

determining the value, rareness, imitability, and sustainability of resources, competencies,

and capabilities at the point of service.

Point of Service

Value (High or Low)

Resources

High

Competencies

High

Capabilities

High

STRATEGIC PLAN TEAM 2

Rare (Yes or No)

Imitability (Difficult or Easy)

Sustainability (Yes or No)

22

Yes

Difficult

Yes

Yes

Difficult

Yes

Yes

Difficult

Yes

Service delivery activities (pre-service, point-of-service, after-service)are the

fundamental value creation activities (Ginter, et al., 2013, p. 132). Point-of-service is

the most critical dimension for creating value for healthcare organizations. Sure, it is

nice to be called in advance, pre-registered and so forth. However, the actual

performance or delivery of a specific service is critical to meeting the needs of the

patient. Using the above evaluation tools, the point-of-service delivery of SJHMC can be

considered a strength with competitive advantage. The strengths identified are of high

value and are mostly rare due to the clinical specialization and/or expertise. For example,

the emergency department alone cannot support a Level II trauma designation. There

needs to be competency and skill in other areas such as critical care, imaging, surgery,

and nursing to support the designation. There are resources and expertise that is

considered rare. The skill set or resources may be imitable with difficulty due to the high

cost associated with acquiring the resources to support the various services.

Clinical operations are provided in an professional and efficient manner. SJHMC

clinical departments are benchmarked using Truven Health Analytics in addition to being

benchmarked with like hospitals within Ascension Health. Clinical safety is a priority for

SJHMC and this is demonstrated via safety initiatives (Ascension Health , 2014).

Marketing is a centralized function and therefore, there is more focus on the

system-wide services versus that solely of SJHMC. Key stakeholders have a natural

attachment to a particular hospital(s) and desire to see their respective hospital promoted.

STRATEGIC PLAN TEAM 2

23

SJHMC offers community outreach sessions where prospective patients can attend to

hear about a niche service (St John Providence Health System, 2016).

Patient satisfaction is an on-going challenge as it is for most hospitals. The

Hospital Consumer Assessment of Healthcare Providers and Systems (HCAHPS) Survey

was developed with the intent to have a standardized method for patients to assess his/her

experience. SJHMC pursues initiatives to improve the patient experience (T. Marx,

personal communication April 1, 2016).

Organizational Structure

The value chain model by Ginter, et al., (2013) suggests that organizations look at

value creation not only in the service delivery activities of an organization but also in the

support activities of the organization. Support activities include organizational culture,

organizational structure, and strategic resources. For purposes of this exercise, we

analyzed the organizational structure of SJHMC and the following strengths and

weaknesses were identified.

Organizational Structure

TYPE: Functional (see note A below)

Strengths

Leverage national contract pricing for

Weaknesses

Product selection is not always the preferred

goods and services

Supply chain team is highly competent

product by key stakeholders

Physician preference is not always considered

New product or formulary analysis is

in the product selection process

National workgroups determine product or

robust and research based

Passionate and loyal caregivers

service selection

Shortage of patient caregivers

STRATEGIC PLAN TEAM 2

Standardized policies and procedures

Cash position and strong balance sheet

24

Inability to respond to special needs

Limitations on capital spending to achieve

cash goals in addition to priorities across the

national system

Note A: SJHMC operates within an organizational structure that encompasses all three

types of hierarchical designs described by Ginter, et al., (2103) as functional, divisional,

and matrix. For example, there are functional support areas such as supply chain,

finance, human resources, and legal that support all hospitals within St John Providence

Health System (SJP). SJHMC operates within the East Region (Division) of SJP and

certain regional structures exist. Lastly, the organizations functions and regions have

matrix reporting to SJP, Ascension Michigan, and Ascension Health national office. The

above strengths and weaknesses congealed around specific functions therefore, the

functional type was chosen.

Next, we evaluated the competitive relevance for strengths and weaknesses by

determining the value, rareness, imitability, and sustainability of resources, competencies,

and capabilities of the organizational structure.

Organizational Structure

TYPE: Functional (see note A above)

Resources

Value (High or Low)

High

Rare (Yes or No)

No

Imitability (Difficult or Easy)

Difficult

Sustainability (Yes or No)

Yes

Competencies

High

No

Difficult

Yes

Capabilities

High

Yes

Difficult

Yes

Organizational structure is an important support system with its purpose to

effectively and efficiently facilitate service delivery (Ginter, et al., 2013, p. 135).

STRATEGIC PLAN TEAM 2

25

Using the above evaluation tools, the organizational structure of SJHMC can be generally

described as a strength. The strengths identified are of high value though not all rare.

The skill set or resources may be imitable with difficulty. There is expertise that renders

the capability as rare and thus, a competitor may have to steal in order to imitate.

SJHMCs supply chain support system facilitates the service delivery by insuring

goods and services are acquired at competitive rates. The ability to leverage national

purchasing power through Group Purchasing Organizations (GPO), exclusive contracts,

and other vehicles is a strength.

The [organizational] structure should have enough flexibility to allow for

responding to special needs (Ginter, et al., 2013, p. 135). System procurement activities

can be rigid due to restrictions of GPOs and/or other barriers block the ability to purchase

the desired supply or product.

While SJHMC has strengths in organizational structure, a major impediment to

service delivery is in the human resource support area with issues that hinder timely

talent acquisition. The talent management function moved from a regional authority

matrix to a national authority matrix and this could result in less knowledge of the local

environment.

Being part of a national healthcare organization changes local dynamics.

However, many value creation opportunities continue to emerge by being a part of the

largest Catholic, tax-exempt healthcare system in the nation. For example, SJHMC

participated in numerous quality initiatives that were grant funded to promote health and

well being of its patients (Ascension Health, 2014). Another benefit of being part of a

large national health system is the ability to work with strategic vendor partners in

STRATEGIC PLAN TEAM 2

26

developing new products and/or technologies. The cash position of SJHMC and in turn,

SJP and AH, provides borrowing power to finance growth initiatives with days cash on

hand of 250 as of March 31, 2015 (Ascension Health, 2015).

Strategy Formulation and Evaluation

Overview

Strategy formulation of a healthcare organization such as SJHMC is no easy task.

Strategic thinking involves an awareness of the environment; intellectual curiosity that

is always gathering, organizing, and analyzing information; and the willingness to be

open to creative ideas and solutions (Ginter, et al, 2013, p. 208). Strategy formulation

should draw from the directional strategies developed by the organization and answer

three questions- 1) what is the organization doing now that it should stop doing? 2) what

is the organization not doing but should start doing? and 3) what is the organization doing

that should be done differently? The mission of SJHMC as committed to providing

spiritually centered, holistic care which sustains and improves the health of individuals in

the communities we serve and the vision of Our passion for healing calls us to cultivate

trust, advocate wellness and transform healthcare (St John Providence, 2016, p. 1), we

are confident our strategy formulation will align with the directional strategies. Our

strategy formulation and evaluation will focus on SJHMCs pediatric program.

Adaptive Strategy

Adaptive strategy provides the primary methods for achieving the vision within

the organization (Ginter, et al., 2013, p. 211). We learned in the service area analysis that

pediatric population is declining and baby boomers are aging. In addition, strong

competitors exist for Pediatrics (Beaumont and DMC Children's) that also have strong

STRATEGIC PLAN TEAM 2

27

programs. While SJHMC enjoys strong market share today, the market share may

decline. According to Rappleye (2015), Dr. Bauer (a health futurist and medical

economist) said healthcare will account for 15 to 19 percent of GDP by the end of the

decade. He forecasts a 15 percent chance of growth, 45 percent chance of stagnation and

a 40 percent chance of decline (para. 6). For these reasons, we decided to take the

adaptive strategy of maintenance of scope with a focus on enhancing market share. In this

type of strategy, the goal is to maintain market share and keep services at their current

level. Environmental influences affecting the products or services should be carefully

analyzed to determine when significant change is imminent (Ginter, et al., 2013, p. 227).

To validate our decision to maintain scope and enhance market share, we used

two methods to evaluate the fit of the adaptive strategy selected. First, the strategic

position and action evaluation (SPACE) matrix was used. This matrix is used to

determine the strategic profile that will best suit the organization. The SPACE analysis

looks at four areas which are: service area strength or stability position (SP), the stability

of the environment or industry position (IP), the competitive advantage of an organization

or competitive position (CP), and the financial strength of the organization or financial

position (FP) (Ginter, et al., 2013).

The FP ranked five categories that are return on investment, liquidity, leverage, working

capital, and cash flow. The ranking was 1 to 7 with 1 being the best and 7, the worst. The

same ranking was used for the IP in the categories of growth potential, financial stability,

ease of entry into market, resource utilization, and profit potential. SP and CP were

ranked using numbers of -1(Best) to -7 (Worst). SPs categories were rate of inflation,

technological changes, price elasticity of demand, competitive pressure, and barriers to

STRATEGIC PLAN TEAM 2

28

entry into market CPs categories were market share, product quality, customer loyalty,

technical know-how, and control over distributers. Here are the results:

External

Analysis:

Stability Position (SP)

Internal Analysis:

Financial Position (FP)

Return on Investment

(ROI)

Leverage

Liquidity

Working Capital

7

7

Cash Flow

Rate of

Inflation

Technological

Changes

Price Elasticity of

Demand

Competitive Pressure

Barriers to Entry into

Market

Financial Position (FP) Average

Stability Position (SP) Average

-2

-3

-3

-2

-2.6

External

Analysis:

Industry Position (IP)

Internal Analysis:

Competitive Position (CP)

Market Share

-2

Product Quality

-1

Customer Loyalty

Technological knowhow

Control over Suppliers and

Distributors

-2

Competitive Position (CP)

Average

-3

-1

-1

-1.4

FP

Growth

Potential

Financial

Stability

Ease of Entry into

Market

Resource Utilization

Profit

Potential

Industry Position (IP) Average

4

6

4

7

4

5.0

STRATEGIC PLAN TEAM 2

29

SJHMC

7.0

5.0

3.0

CP

1.0

-1.0

-3.0

-5.0

-7.0

SP

According to Ginter, et al. (2013), an aggressive profile indicates the organization

enjoys a competitive advantage, which it can protect with financial strength (p. 273).

This validates our decision of maintaining the scope and keeping market share.

The next method we used to evaluate the fit of the adaptive strategy selected is

the Boston Consulting Group (BCG) analysis. BCG is a portfolio analysis. Portfolio

analysis allows for the assessment of the market position of the healthcare organization as

a whole or its separate programs (Ginter, et al., 2013, p. 267). The BCG analysis looks at

two areas--market share and market growth. We know that SJHMC had 28,698

discharges and a market share of 13.9%. We also know that its top competitor, Beaumont,

had 22,147 discharges and a 11.6% market share (Michigan Business Directory, 2015).

With Dr. Bauers estimates from above of 45 percent chance of stagnation, we used a

conservative estimate of a 1% growth rate. By using these numbers, we can formulate a

matrix. Here is the matrix:

Relative Market Share Position

STRATEGIC PLAN TEAM 2

30

Stars

Question

1.0

Low 0.0

Growth Rate

High

0.20

Dogs

Low 0

High

Low

We can see the BCG matrix puts SJHMC in the Cash Cow segment. Cash cow

services have low market growth but a high market shares and profitability. Thus,

strategies should be directed toward maintaining market dominance through

STRATEGIC PLAN TEAM 2

31

enhancement (Ginter, et al., 2013, p. 271). This solidifies that we have made the right

choice in maintaining scope while enhancing market share.

Market-Entry Strategy

Our adaptive strategy is to maintain scope and this strategy is used when

management believes the past strategy has been appropriate and few changes are required

in the target markets or the organizations products/services (Ginter, et al., 2013, p. 226).

Market entry strategies should assist the organization in achieving the adaptive strategy.

SJHMC has a solid market share in its market area. Therefore, we look to market

strategies that will enhance SJHMCs current position through further internal

development.

SJHMC appears to be progressing forward in the right direction without a need to

make significant changes at this time. However, opportunities typically exist in any

organization to increase efficiency, improve services and/or quality outcomes. SJHMC

should look to existing products or services that it could further develop and/or enhance.

Internal development uses the existing organizational structure, personnel, and capital to

generate new products/services or distributional strategies (Ginter, et al., 2013, p. 237).

By doing so, the organization is able exploit existing resources, competencies, and

capabilities. Internal venture strategy is another potential strategy for SJHMC. For

example, if SJHMC has expertise in neonatology or pediatric surgery, it could look to

sell these services to other hospitals to leverage this internal expertise. Other

enhancement strategies also include improvements of services provided, customer

service, and flexibility to the services offered within the organization.

STRATEGIC PLAN TEAM 2

32

Market entry strategies need to be evaluated based on fit to the external

conditions, internal resources, competencies and capabilities, and organizational goals.

Using Ginter et al.s (2013) model in Table 6-1, p. 210, it appears that the market

strategies selected promote achievement of the adaptive strategy and ultimately the

directional strategies. In addition, SJHMC appears to have the internal competencies but

it is unknown if the internal resources exist to carry out the strategies or if the resources

would have to be obtained.

Linking Strategic Alternatives

Internal Development

Addresses an External

Issue?

Yes; provides key services to a

distinct population of the

community

Draws on Competitive

Advantage or Fixes a

Disadvantage?

Yes; SJHMC has loyal physicians

and caregivers in pediatric

division as well as numerous

pediatric subspecialists

Yes; maintains the health of

community (pediatric population)

and service to the poor and

vulnerable pediatric population

Yes; pediatric services advocates

for wellness for all ages

Fits with Mission &

Values

Moves Org towards

Vision?

Achieves one or more

strategic goals?

Yes; provides healthcare leaving

no-one behind such as pediatric

patients

Internal venture

Yes; provides key

services to a distinct

population of the

community

Yes; leverages internal

expertise

Yes; relates to value of

Courageous Innovation

Yes; cultivates trust with

other hospitals and

potentially transforms

healthcare

Yes; provides healthcare

leaving no-one behind

such as pediatric

patients

Competitive Strategies

Competitive strategies are important to strategy formulation as they also assist the

organization in achieving its directional strategies. Competitive strategies are relational to

STRATEGIC PLAN TEAM 2

33

the market and the organizations competitors. The two types of competitive strategies are

discussed below.

Strategic Posture.

Based upon our adaptive strategy and market entry strategies, it appears that the

posture of SJHMCs pediatric service is that of a defender strategic posture (Ginter, et al.,

2013). Defender organizations try to drive costs down through vertical integration,

specialization of labor, a well-defined organizational structure, centralized control and

standardization, and cost reduction while maintaining quality (Ginter, et al., 2013, p.

292). Defender characteristics are outlined by Ginter, et al., (2013) as an organization

being capable of developing a single core technology, allowing for cost efficiency,

protecting their marketplace from competition, having the capacity for engaging vertical

integration strategies, emphasizing centralized control/stability, a structured division of

labor, developing a well defined hierarchical communication channel, utilizing cost

control expertise, and maintaining well-defined procedures and methods, as well as a

high degree of formalization or centralization. As discussed in above sections, SJHMC

has demonstrated strength in leveraging its supply chain initiatives to reduce its costs.

There appears to be management emphasis on centralized control and well defined

procedures and methods as being part of a national health system. SJHMC has loyal

physicians and caregivers in the pediatric division and numerous pediatric subspecialists,

as well as the organizations ability to leverage internal expertise. The defender posture

seems to fit with the external environment of SJHMC as indicated by the appropriate

external conditions outlined by Ginter, et al., (2013) for the defender posture strategy

which are a stable external environment, predictable political/regulatory change, slow

STRATEGIC PLAN TEAM 2

34

technological and competitive change, products or services in mature stages of Product

Life Cycle (PLC), relatively long PLCs, and high barriers to entry (Ginter, et al., 2013).

For example, the southeast Michigan market has relatively stable population (Semcog,

2016) and the services that SJHMC offers are in the mature stage of the PLC which can

sustain relative longevity with high barriers to market entry. Despite the upcoming

presidential election, political and regulatory changes are predictable and changes in

technology have slowed. The defender competitive posture also fits with SJHMCs

directional strategies such as its commitment to providing key services that maintain the

health of the community, as well as providing care to a distinct population of the

community such as the poor and vulnerable pediatric population. SJHMCs use of a

defender strategic posture appears to be the best fit for the organization based on the

external conditions, internal resources, competencies, and capabilities.

Strategic Position.

The SJHMC pediatric service line provides care to a well-defined market (people

under 18 years of age) and therefore, could be considered a market segment or focus

strategy (Ginter, et al., 2013). Regardless of being market-side or focused market, there

are two fundamental positioning strategies cost leadership and differentiation (Ginter, et

al., 2013). Differentiation strategies are risky if the organization places too much on

differentiation that pushes costs too high for the market or if the market fails to see,

understand, or appreciate the differentiation (Ginter, et al., 2013, p. 293).

Differentiation requires the ability to distinguish the product or service from other

competitors. Typically this requires technical expertise, strong marketing, a high level of

skill, and an emphasis on product development (Ginter, et al., 2013 p. 293). SJHMC

STRATEGIC PLAN TEAM 2

35

offers a variety of pediatric subspecialties such as genetics, infectious diseases,

nephrology, neurology, and many more (St John Hospital and Medical Center, 2013) that

can be a differentiating factor from its competitors. Thus, SJHMCs pediatric services can

be viewed as unique and of high quality. These differentiating elements can give SJHMC

more control over pricing (Ginter, et al., 2013). Being part of a large national health

system, SJHMC has the ability to work with strategic vendor partners in developing new

products and/or technologies. The largest risk for cost leadership is technological change

and in order to utilize this strategy, the organization must have or develop the ability to

achieve a real cost advantage through state-of-the-art equipment, facilities, and low-cost

operations (Ginter, et al., 2013, p. 293). Due to its supply chain resources as discussed in

the Internal Environment section above, SJHMC can uphold a successful differentiation

strategy and potentially become a cost leader.

Summary and Conclusion

This strategic plan exercise allowed our team to follow the sequential steps and

experience the rigor that Ginter, et al., (2013) outline for developing a strategic plan. As

healthcare leaders, we need to embrace strategic management as a way to create a path

for the future for our organizations and to facilitate achievement of its mission, vision,

and goals. Healthcare leaders must see into the future, create new visions for success,

and be prepared to make significant improvements (Ginter, et al., 2013, p. 6). Strategic

management assists leaders in understanding the dynamics of the organizations external

environment as well as the need to continually improve, adapt, or change to be successful

in achieving the mission, vision, and goals of the organization. Strategic management

encompasses a process that starts with generating ideas based upon what is happening in

STRATEGIC PLAN TEAM 2

36

the external environment (strategic thinking), constructing a plan by diagnosing internal

and external situations (strategic planning), and taking action to achieve the plan and

monitor results (strategic momentum) (Ginter, et al., 2013). Strategic thinkers draw

upon the past, understand the present, and envision an even better future (Ginter, et al.,

2013, p. 13).

STRATEGIC PLAN TEAM 2

37

References

Ascension Health . (2016). Ascension Health Goals. Retrieved April 23, 2016, from

ascensionhealth.org: http://www.ascensionhealth.org/index.php?

option=com_content&view=article&id=17:goals&catid=15:healthcare-that-issafe&Itemid=136.

American Health Association (2016), Health Information Technology, Retrieved April

20, 2016, from AHA.org: http://www.aha.org/advocacy-issues/hit/index.shtml

Beaumont Health System - Beaumont - Troy Campus. (n.d.). Retrieved March 28, 2016,

from http://www.healthgrades.com/hospital-directory/michigan-midetroit/beaumont-health-system-beaumont-troy-campus-hgst80762386230269

Detroit Medical Center. (n.d.). Organization History and Profile. Retrieved March 26,

2016, from DMC.org: http://www.dmc.org/organization-history-and-profile.html

Ginter, P. M., Duncan, W. J., & Swayne, L. E. (2013). Strategic Management of

Healthcare Organizations (Seventh ed.). San Francisco, CA: Jossey-Bass.

Healthgrade. (2016). Retrieved March 29, 2016, from

http://www.healthgrades.com/hospital-directory/michigan-mi-detroit/beaumonthealth-system-beaumont-troy-campus-hgst80762386230269

Henry Ford Macomb Hospital. (n.d.). Henry Ford Macomb Hospital &Trauma Services.

Retrieved March 28, 2016, from https://www.henryford.com/homepage_macomb

Michigan Business Directory. (2015). Retrieved March 29, 2016, from

http://www.healthgrades.com/hospital-directory/michigan-mi-detroit/beaumonthealth-system-beaumont-troy-campus-hgst80762386230269

STRATEGIC PLAN TEAM 2

38

Rappleye, E. (2015, February 20). Stagnation with a chance of decline: Healthcare's 5year forecast. Retrieved April 09, 2016, from

http://www.beckershospitalreview.com/hospital-managementadministration/stagnation-with-a-chance-of-decline-healthcare-s-5-yearforecast.html

Semcog. Southeast Michigan Council Of Governments. (n.d.). Retrieved March 23, 2016,

from http://semcog.org

St John Hospital and Medical Center Marketing Archive. (2002). History of Sisters of St

Joseph and St John Hospital. Detroit, MI.

St John Hospital and Medical Center. (2016). Mission and Values of St. John Providence.

Retrieved March 16, 2016, from St John Providence.org:

http://www.stjohnprovidence.org/aboutsjp/mission/.

St John Hospital and Medical Center Medical Education and Physician Resources (2013,

Winter). Retrieved March 28, 2016, from St John Providence.org:

http://www.stjohnprovidence.org/updatesandinnovations/2013issues/winter/spinal-cord-stimulation

St John Providence (2013) Faith and Health- Faith Community Partnership Newsletter ,

Retrieved March 29, 2016,

https://www.stjohnprovidence.org/upload/docs/Community

%20Health/MarchApril2013_FaithHealth.pdf

St John Providence Health. (n.d.). About our hospital. Retrieved March 14, 2016, from St

John Providence.org: http://stjohnprovidence.org/newsroom/reporterresources/facts/fact-sheets/st-john-hospital.

STRATEGIC PLAN TEAM 2

39

St John Providence Health. (2016). St John Providence Care Link. Retrieved April 23,

2016, from stjohnprovidence.org: http://www.stjohnprovidence.org/carelink

St John Providence (2016) Main Menu, Retrieved March 28, 2016, from St John

Providence.org: http://www.stjohnprovidence.org/

St John Providence (2016) Services and Specialties, Retrieved March 29, 2016, from St

John Providence.org: http://www.stjohnprovidence.org/minimally-invasivesurgery/

US Census Bureau. (n.d.). Retrieved March 23, 2016 from US Census website:

http://www.census.gov/quickfacts/table/PST045215/26

U.S. Census Bureau (2016) Census Statistics, Retrieved April 20, 2016, from Census.gov

:https://www.census.gov/population/socdemo/statbriefs/agebrief.html

U.S. Department of Health and Human Services (2016), Health Care, Retrieved April 20,

2016, from HHS.gov: http://www.hhs.gov/healthcare/

Anda mungkin juga menyukai

- Final ProjectDokumen14 halamanFinal Projectapi-298975236Belum ada peringkat

- Business Plan MriDokumen17 halamanBusiness Plan Mriapi-298975236100% (1)

- Individual SPC AssignmentDokumen10 halamanIndividual SPC Assignmentapi-298975236100% (1)

- Conceptual BlocksDokumen11 halamanConceptual Blocksapi-298975236100% (3)

- Leadership CompetenciesDokumen5 halamanLeadership Competenciesapi-298975236Belum ada peringkat

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- SGD - Polyuria in Pediatrics: Clinical ExaminationDokumen1 halamanSGD - Polyuria in Pediatrics: Clinical ExaminationREnren ConsolBelum ada peringkat

- Fetal SurvillanceDokumen26 halamanFetal SurvillanceBetelhem EjiguBelum ada peringkat

- EPN I New Book Chapter 1-3Dokumen19 halamanEPN I New Book Chapter 1-3iyanBelum ada peringkat

- Hip Replacement - Physiotherapy After Total Hip ReplacementDokumen11 halamanHip Replacement - Physiotherapy After Total Hip ReplacementShamsuddin HasnaniBelum ada peringkat

- ISUOG Lecture-5-Informed-consent-image-recording-report-writing-ACDokumen34 halamanISUOG Lecture-5-Informed-consent-image-recording-report-writing-ACTansya PurnaningrumBelum ada peringkat

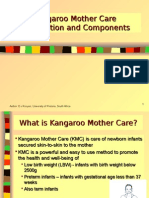

- A. KMC Introduction, Components & BenefitsDokumen25 halamanA. KMC Introduction, Components & BenefitssantojuliansyahBelum ada peringkat

- Data Publikasi Artikel Ilmiah Penelitian Dan Pengabmas Kebidanan FixDokumen9 halamanData Publikasi Artikel Ilmiah Penelitian Dan Pengabmas Kebidanan FixMuhamad Vanny OntaluBelum ada peringkat

- PFC RP Surgical Technique (DePuy)Dokumen43 halamanPFC RP Surgical Technique (DePuy)Sagaram Shashidar100% (1)

- Ajm PrismDokumen102 halamanAjm PrismpoddataBelum ada peringkat

- OBGYN Quick Notes Full - pdf-1162990791Dokumen104 halamanOBGYN Quick Notes Full - pdf-1162990791Delphine Sistawata Akwo100% (3)

- Avalon - FM20 - and - FM30 Bro New PDFDokumen4 halamanAvalon - FM20 - and - FM30 Bro New PDFNugie DamayantoBelum ada peringkat

- An Introduction To Spanish For Health Care Workers Communication and Culture Third EditionDokumen398 halamanAn Introduction To Spanish For Health Care Workers Communication and Culture Third EditionSewist YUL100% (7)

- Brochure BioDentin Eh DukDokumen8 halamanBrochure BioDentin Eh DukLuciano AbbaBelum ada peringkat

- Uterine Prolapse in A Primigravid Woman JournalDokumen13 halamanUterine Prolapse in A Primigravid Woman JournalFadhlyanyBelum ada peringkat

- Syndarogya Proposal Form: Synbk Code Bic Code 9 2 1 0 0 0Dokumen2 halamanSyndarogya Proposal Form: Synbk Code Bic Code 9 2 1 0 0 0Akhil ShastryBelum ada peringkat

- Program Zilele UMF 2016 Sesiune Doctoranzi-Cadre DidDokumen22 halamanProgram Zilele UMF 2016 Sesiune Doctoranzi-Cadre DidCătălin ŞuteuBelum ada peringkat

- Electrical in Medical LocationDokumen32 halamanElectrical in Medical LocationengrrafBelum ada peringkat

- A History of Caesarean Section: From Ancient World To The Modern EraDokumen5 halamanA History of Caesarean Section: From Ancient World To The Modern EraGeorgiana DBelum ada peringkat

- Gilmore v. Fulbright & Jaworski, LLP - Document No. 14Dokumen21 halamanGilmore v. Fulbright & Jaworski, LLP - Document No. 14Justia.comBelum ada peringkat

- Kent Unpublished Materia MedicaDokumen31 halamanKent Unpublished Materia Medicasunnyjamiel63% (8)

- Tools and Techniques To Reduce Pain During Labor To Have A Natural BirthDokumen18 halamanTools and Techniques To Reduce Pain During Labor To Have A Natural BirthAbir Gasmi100% (2)

- Thermography of The Human BodyDokumen9 halamanThermography of The Human Bodylatief dwi pramana bhaktiBelum ada peringkat

- Exam FamilyDokumen2 halamanExam FamilyJonaPhieDomingoMonteroIIBelum ada peringkat

- 2012 Casos HemorrDokumen9 halaman2012 Casos Hemorrjulio leon quirozBelum ada peringkat

- Wocn Ascrs Stoma Site Marking Fecal 2014 PDFDokumen10 halamanWocn Ascrs Stoma Site Marking Fecal 2014 PDFamal.fathullahBelum ada peringkat

- Mendelson Syndrome - StatPearls - NCBI BookshelfDokumen8 halamanMendelson Syndrome - StatPearls - NCBI Bookshelfcesar aBelum ada peringkat

- Kol Slide Kit Atac 100Dokumen43 halamanKol Slide Kit Atac 100api-26302710Belum ada peringkat

- HydroceleDokumen3 halamanHydroceleracmanawalBelum ada peringkat

- Chapter 3 Admission (Hospital Organization)Dokumen5 halamanChapter 3 Admission (Hospital Organization)Reshiram KyuramBelum ada peringkat