Selection-26 - 55 PDF

Diunggah oleh

Anonymous fu1jUQDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Selection-26 - 55 PDF

Diunggah oleh

Anonymous fu1jUQHak Cipta:

Format Tersedia

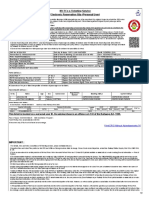

2015 W-2 and EARNINGS SUMMARY

Employee Reference Copy

Wage and Tax

Statement

OMB No.

W-2

2015

Copy C for employeesrecords.

Dept.

d Control number

Corp.

Employer

1. The following

1545-0008

use only

121737 NCN2/EMQ 296600

c

This blue Earnings Summary section is included with your W-2 to help describe portions in more detail.

The reverse side includes general information that you may also find helpful.

information

Gross Pay

1854

reflects your final 2015 pay stub plus any adjustments

Social Security

Tax Withheld

4704.15

291.66

Box 17 of W-2

Box 4 of W-2

Employers name, address, and ZIP code

EXAMINATION

MANAGEMENT

SERVICES INC

3050REGENT

BOULEVARD

100

IRVING TX 75063

Fed. Income

Tax Withheld

SUI/SDI

Medicare Tax

Withheld

488.56

Box 2 of W-2

submitted by your employer.

TX. State Income Tax

Box 14 of W-2

68.21

Box 6 of W-2

2. Your Gross Pay was adjusted as follows to produce your W-2 Statement.

Batch

#02844

Wages, Tips, other

Compensation

Box 1 of W-2

e/f Employees name, address, and ZIP code

DEANDRA K SCOTT

4406 AUSTIN CIRCLE

TEMPLE TX 76502

b

Employers FED ID number

Wages, tips, other comp.

Social security wages

Medicare wages and tips

Social security tips

Gross Pay

Reported W-2 Wages

a

Employees SSA number

Federal income tax withheld

Social security tax withheld

Medicare tax withheld

75-1444139

Social Security

Wages

Box 3 of W-2

Medicare

Wages

Box 5 of W-2

TX. State Wages,

Tips, Etc.

Box 16 of W-2

4,704.15

4,704.15

4,704.15

4,704.15

4,704.15

4,704.15

631-40-8601

4704.15

488.56

4704.15

291.66

4704.15

68.21

8 Allocated tips

Verification Code

3. Employee W-4 Profile.

10 Dependent care benefits

12a See instructionsfor box 12

11 Nonqualified plans

DEANDRA K SCOTT

4406 AUSTIN CIRCLE

TEMPLE TX 76502

12b

12c

12d

13 Stat emp. Ret. plan 3rd party sick pay

14 Other

To change your Employee W-4 Profile Information,

file a new W-4 with your payroll dept.

Social Security Number: 631-40-8601

Taxable Marital Status: SINGLE

Exemptions/Allowances:

____________________

FEDERAL:

STATE:

15 State Employers state ID no. 16 State wages, tips, etc.

0

No State Income Tax

TX

17 State income tax

18 Local wages, tips, etc.

19 Local income tax

20 Locality name

Wages, tips, other comp.

2015

Federal income tax withheld

4704.15

3

Social security wages

Medicare wages and tips

Social security tax withheld

Medicare tax withheld

Control number

Corp.

Employer

use only

121737 NCN2/EMQ 296600

c

Social security wages

Medicare wages and tips

1854

Control number

a Employees SSA number

Employers FED ID number

75-1444139

7

Verification Code

Medicare tax withheld

Dept.

Social security wages

Medicare wages and tips

Control number

291.66

68.21

Corp.

Employer

use only

1854

Employers FED ID number

8 Allocated tips

Social security tips

Federal income tax withheld

Social security tax withheld

Medicare tax withheld

488.56

4704.15

4704.15

291.66

Dept.

68.21

Corp.

Employer

121737 NCN2/EMQ 296600

c

a Employees SSA number

75-1444139

4704.15

use only

1854

Employers name, address, and ZIP code

EXAMINATION

MANAGEMENT

SERVICES INC

3050REGENT

BOULEVARD

100

IRVING TX 75063

631-40-8601

Social security tips

Employers name, address, and ZIP code

EXAMINATION

MANAGEMENT

SERVICES INC

3050REGENT

BOULEVARD

100

IRVING TX 75063

Social security tax withheld

121737 NCN2/EMQ 296600

c

Employers name, address, and ZIP code

4704.15

d

Wages, tips, other comp.

488.56

4704.15

68.21

Dept.

Federal income tax withheld

4704.15

291.66

4704.15

LLC

Wages, tips, other comp.

488.56

4704.15

d

ADP,

EXAMINATION

MANAGEMENT

SERVICES INC

3050REGENT

BOULEVARD

100

IRVING TX 75063

Employers FED ID number

631-40-8601

a Employees SSA number

75-1444139

8 Allocated tips

Social security tips

631-40-8601

8 Allocated tips

10 Dependent care benefits

10 Dependent care benefits

10 Dependent care benefits

11 Nonqualified plans

12a See instructions for box 12

11 Nonqualified plans

12a

12

11 Nonqualified plans

12a

14 Other

12b

14 Other

12b

14 Other

12b

12c

12c

12c

12d

12d

12d

13 Stat emp. Ret. plan 3rd party sick pay

13 Stat emp. Ret. plan 3rd party sick pay

13 Stat emp. Ret. plan 3rd party sick pay

e/f Employees name, address and ZIP code

e/f Employees name, address and ZIP code

e/f Employees name, address and ZIP code

DEANDRA K SCOTT

4406 AUSTIN CIRCLE

TEMPLE TX 76502

DEANDRA K SCOTT

4406 AUSTIN CIRCLE

TEMPLE TX 76502

DEANDRA K SCOTT

4406 AUSTIN CIRCLE

TEMPLE TX 76502

15 State Employers state ID no. 16 State wages, tips, etc.

15 State Employers state ID no. 16 State wages, tips, etc.

15 State Employers state ID no. 16 State wages, tips, etc.

TX

TX

TX

17 State income tax

18 Local wages, tips, etc.

17 State income tax

19 Local income tax

20 Locality name

19

Federal Filing Copy

Wage and Tax

Statement

OMB

W-2

Copy B to be filed with employees

Local income tax

No. 1545-0008

17 State income tax

20 Locality name

19

TX.State Reference

Wage and Tax

Statement

2015 W-2

Federal IncomeTax Return.

18 Local wages, tips, etc.

Copy

Local income tax

OMB

No. 1545-0008

20 Locality name

TX.State Filing Copy

Wage and Tax

Statement

OMB

2015 W-2

Copy 2 to be filed with employeesState IncomeTax Return.

18 Local wages, tips, etc.

2015

Copy 2 to be filed with employeesState IncomeTax Return.

No. 1545-0008

Anda mungkin juga menyukai

- 2014 W-2 and Earnings SummaryDokumen2 halaman2014 W-2 and Earnings SummaryjaviercreatesBelum ada peringkat

- StatementDokumen2 halamanStatementLuis HarrisonBelum ada peringkat

- Tax FormsDokumen2 halamanTax FormsBridget May Cruz100% (1)

- Langford Market Corp Form W-2Dokumen4 halamanLangford Market Corp Form W-2sohcuteBelum ada peringkat

- W-2 Form Details Employee PayDokumen4 halamanW-2 Form Details Employee PayMark OasayBelum ada peringkat

- w22009 167305638-1Dokumen1 halamanw22009 167305638-1Jamie-Rose Michie0% (1)

- Elina Shinkar w2 2014Dokumen2 halamanElina Shinkar w2 2014api-318948819Belum ada peringkat

- Selection 26 144Dokumen1 halamanSelection 26 144Anonymous fu1jUQBelum ada peringkat

- 20212Dokumen2 halaman20212carriemccabeBelum ada peringkat

- Income Tax Return For Single and Joint Filers With No DependentsDokumen3 halamanIncome Tax Return For Single and Joint Filers With No Dependentsラジャゴバラン サンカラナラヤナンBelum ada peringkat

- TGDokumen2 halamanTGpr995Belum ada peringkat

- W 2Dokumen6 halamanW 2prads1259Belum ada peringkat

- I Pay Statements ServncoDokumen2 halamanI Pay Statements ServncoPablito Padilla100% (2)

- Resume of Msnetty42Dokumen2 halamanResume of Msnetty42api-25122959Belum ada peringkat

- Marylynn Huggins - Clifden Ut State Tax Return 2013Dokumen4 halamanMarylynn Huggins - Clifden Ut State Tax Return 2013api-2573405260% (1)

- January 6, 2021 Zechariah Kennedy 612 Colony Lakes DR Lexington, SC 29073-6742Dokumen8 halamanJanuary 6, 2021 Zechariah Kennedy 612 Colony Lakes DR Lexington, SC 29073-6742Zechariah Kennedy100% (1)

- Monica L Lindo Tax FormDokumen2 halamanMonica L Lindo Tax Formapi-299234513Belum ada peringkat

- W2Dokumen1.223 halamanW2Doru OanceaBelum ada peringkat

- TAXES w2 REGAL HospitalityDokumen2 halamanTAXES w2 REGAL Hospitalityoskar_herrera2012Belum ada peringkat

- Fasfa DocsDokumen10 halamanFasfa DocsKira Rivera100% (1)

- StubsDokumen2 halamanStubsAnonymous 8C2bCutL0100% (2)

- Federal Direct Stafford/Ford Loan Federal Direct Unsubsidized Stafford/Ford Loan Master Promissory Note William D. Ford Federal Direct Loan ProgramDokumen10 halamanFederal Direct Stafford/Ford Loan Federal Direct Unsubsidized Stafford/Ford Loan Master Promissory Note William D. Ford Federal Direct Loan ProgramBrittany LyBelum ada peringkat

- Federal Electronic Filing Instructions: Tax Year 2018Dokumen13 halamanFederal Electronic Filing Instructions: Tax Year 2018Adonis TorrefielBelum ada peringkat

- Tax File 2106 Ss FileingDokumen5 halamanTax File 2106 Ss FileingWALLAUERBelum ada peringkat

- Edgar JDokumen2 halamanEdgar Japi-585014034Belum ada peringkat

- File 1040 U.S. Individual Income Tax ReturnDokumen2 halamanFile 1040 U.S. Individual Income Tax Returnmarcel100% (1)

- U.S. Individual Income Tax Return: Filing StatusDokumen2 halamanU.S. Individual Income Tax Return: Filing Statuskenneth kittleson100% (1)

- FTF1299519215531Dokumen3 halamanFTF1299519215531Leslie Washington100% (1)

- Profit or Loss From Business: Schedule C (Form 1040) 09Dokumen2 halamanProfit or Loss From Business: Schedule C (Form 1040) 09John Bean100% (1)

- ChecksDokumen2 halamanChecksbranch_dawnBelum ada peringkat

- Ka/Lfh: Lee A Vinal Inc 401 Aiken Ave DRACUT, MA 01826Dokumen4 halamanKa/Lfh: Lee A Vinal Inc 401 Aiken Ave DRACUT, MA 01826Jonathan Seagull LivingstonBelum ada peringkat

- Chasity D EnglishDokumen7 halamanChasity D EnglishbpspillkillBelum ada peringkat

- W2 & Earnings: Vanessa Sapien GonzalezDokumen4 halamanW2 & Earnings: Vanessa Sapien GonzalezVANESSA SAPIEN GONZALEZBelum ada peringkat

- 2020 Tax Return Documents (DERICK BROOKS A)Dokumen2 halaman2020 Tax Return Documents (DERICK BROOKS A)Patricia100% (2)

- Federal Direct Stafford/Ford Loan Federal Direct Unsubsidized Stafford/Ford Loan Master Promissory Note William D. Ford Federal Direct Loan ProgramDokumen10 halamanFederal Direct Stafford/Ford Loan Federal Direct Unsubsidized Stafford/Ford Loan Master Promissory Note William D. Ford Federal Direct Loan ProgramRhaxma ConspiracyBelum ada peringkat

- Morehouse Morehouse Daniel Daniel J J: Copy C - For Employee'S RecordsDokumen1 halamanMorehouse Morehouse Daniel Daniel J J: Copy C - For Employee'S RecordsCorey GarrisBelum ada peringkat

- 2014 Form 1040 Individual Income Tax ReturnDokumen9 halaman2014 Form 1040 Individual Income Tax ReturnKuan ChenBelum ada peringkat

- 15 1 03 003887Dokumen1 halaman15 1 03 003887Aryan ChaudharyBelum ada peringkat

- Santos Return PDFDokumen14 halamanSantos Return PDFMark Long75% (4)

- Profit or Loss From Business: Linda Gercken 156-56-8670Dokumen2 halamanProfit or Loss From Business: Linda Gercken 156-56-8670ROB100% (1)

- LifeDokumen11 halamanLifejasBelum ada peringkat

- Fernando Vazquez567935467Dokumen21 halamanFernando Vazquez567935467Richivee100% (2)

- 2018 TaxReturn PDFDokumen6 halaman2018 TaxReturn PDFDavid LeeBelum ada peringkat

- W2 FinalDokumen1 halamanW2 FinalWaqar Hussain100% (1)

- Real 1040 1Dokumen2 halamanReal 1040 1paul100% (1)

- 26 Jan 2020 ReturnDokumen2 halaman26 Jan 2020 Returnsandeep0% (1)

- 2021 W-2 and Earnings SummaryDokumen2 halaman2021 W-2 and Earnings SummaryKawljeet Singh KohliBelum ada peringkat

- Wage and Tax StatementDokumen6 halamanWage and Tax StatementNick RubleBelum ada peringkat

- Income Tax Return 2019Dokumen6 halamanIncome Tax Return 2019Cindy WheelerBelum ada peringkat

- Captura de Pantalla 2022-02-05 A La(s) 4.03.49 A.M.Dokumen4 halamanCaptura de Pantalla 2022-02-05 A La(s) 4.03.49 A.M.Adriana AnsurezBelum ada peringkat

- Amara Enyia's 2017 Tax ReturnDokumen4 halamanAmara Enyia's 2017 Tax ReturnMark Konkol100% (1)

- Form 1040A Tax Credit DetailsDokumen3 halamanForm 1040A Tax Credit DetailsYosbanyBelum ada peringkat

- Health Insurance Forms 1Dokumen1 halamanHealth Insurance Forms 1api-453439542Belum ada peringkat

- RX RX RX: Department of Veterans AffairsDokumen4 halamanRX RX RX: Department of Veterans AffairsThurston3Belum ada peringkat

- Report Details Personal and Financial Information for Christopher StegerDokumen28 halamanReport Details Personal and Financial Information for Christopher StegerChristopher StegerBelum ada peringkat

- FTF 2022-04-19 1650352254304Dokumen8 halamanFTF 2022-04-19 1650352254304Charles GoodwinBelum ada peringkat

- Methods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeDari EverandMethods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeBelum ada peringkat

- Review of Some SMS Verification Services and Virtual Debit/Credit Cards Services for Online Accounts VerificationsDari EverandReview of Some SMS Verification Services and Virtual Debit/Credit Cards Services for Online Accounts VerificationsBelum ada peringkat

- Determination of Income Tax Due and Payable If There Is A Given Creditable Withholding TaxDokumen12 halamanDetermination of Income Tax Due and Payable If There Is A Given Creditable Withholding Taxgellie mare flores100% (1)

- Topic 2 - History of The Jamaican Tax Systems and Tax Administration of JamaicaDokumen35 halamanTopic 2 - History of The Jamaican Tax Systems and Tax Administration of JamaicaaplacetokeepmynotesBelum ada peringkat

- Premium Paid CertificateDokumen1 halamanPremium Paid Certificatemsurendra642Belum ada peringkat

- Income Tax Unit-2 NotesDokumen7 halamanIncome Tax Unit-2 NotesTrial 001Belum ada peringkat

- Compensation IncomeDokumen21 halamanCompensation IncomeRyDBelum ada peringkat

- Notice To Employee: WWW - Irs.gov/efileDokumen2 halamanNotice To Employee: WWW - Irs.gov/efileRODRIGO GRIJALBA CABREJOSBelum ada peringkat

- Essentials of Federal Income Taxation For Individuals and BusinessDokumen860 halamanEssentials of Federal Income Taxation For Individuals and BusinessAbhisek chudalBelum ada peringkat

- Train I.ppt - Vers. 10.21.2018Dokumen103 halamanTrain I.ppt - Vers. 10.21.2018Ellard28 saturnoBelum ada peringkat

- Income Taxation 1Dokumen4 halamanIncome Taxation 1nicole bancoroBelum ada peringkat

- C29. Medicard Phils. Inc. v. CIR, G.R. 222743, April 5, 2017Dokumen11 halamanC29. Medicard Phils. Inc. v. CIR, G.R. 222743, April 5, 2017Maria Jeminah TurarayBelum ada peringkat

- Formal Banquet Event OrderDokumen2 halamanFormal Banquet Event OrderDavina TantryBelum ada peringkat

- Miral N GadhiyaDokumen4 halamanMiral N Gadhiyadr_shaikhfaisalBelum ada peringkat

- Kenya Tax ReceiptDokumen1 halamanKenya Tax ReceiptVictor OsodoBelum ada peringkat

- Srec Alumni Scholarship Scheme 2021 2022Dokumen2 halamanSrec Alumni Scholarship Scheme 2021 2022Sibi SivaBelum ada peringkat

- ReceiptDokumen1 halamanReceiptRubi KumariBelum ada peringkat

- Ms Sub Order LabelsDokumen1 halamanMs Sub Order LabelsShubhamBelum ada peringkat

- Conversion of The OHADA Branch of A Foreign CompanyDokumen9 halamanConversion of The OHADA Branch of A Foreign CompanyBasma chakirBelum ada peringkat

- KAAP-MHB Repair QuotationDokumen1 halamanKAAP-MHB Repair QuotationMohammad Maruf Uddin ManagerBelum ada peringkat

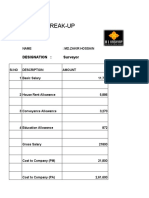

- Salary Break-Up: Designation: SurveyorDokumen7 halamanSalary Break-Up: Designation: Surveyorjs_khoar87Belum ada peringkat

- Determination of Tax & Adjudication of Demand by Proper Officer – Section 74 of CGST Act, 2017 - Taxguru - inDokumen11 halamanDetermination of Tax & Adjudication of Demand by Proper Officer – Section 74 of CGST Act, 2017 - Taxguru - inAdarsh TripathiBelum ada peringkat

- Norwegian tax return for foreign workerDokumen8 halamanNorwegian tax return for foreign workerPaulius KaminskasBelum ada peringkat

- 2.form of Appeal-ATIRDokumen2 halaman2.form of Appeal-ATIRwasim nisar0% (1)

- Annual Investment Program-2018Dokumen3 halamanAnnual Investment Program-2018Shy Pantinople100% (1)

- Kia Motors Manufacturing Georgia PaystubDokumen2 halamanKia Motors Manufacturing Georgia PaystubJames ParkerBelum ada peringkat

- Philippine Income Taxation QuizDokumen4 halamanPhilippine Income Taxation QuizRezhel Vyrneth TurgoBelum ada peringkat

- CTS Employee State Insurance (ESI) PolicyDokumen7 halamanCTS Employee State Insurance (ESI) Policynivasshaan0% (1)

- Supreme Court Rules on Sales Tax Exemption for Government AgenciesDokumen6 halamanSupreme Court Rules on Sales Tax Exemption for Government AgenciesJo DevisBelum ada peringkat

- Investigation 2024 GR 12Dokumen6 halamanInvestigation 2024 GR 12koekoeorefileBelum ada peringkat

- MCQ'S ON PRINCIPLES OF INCOME TAX IN INDIADokumen42 halamanMCQ'S ON PRINCIPLES OF INCOME TAX IN INDIAShree PatilBelum ada peringkat

- Tax Planning With Reference To Financial Management DecisionsDokumen5 halamanTax Planning With Reference To Financial Management Decisionsasifanis70% (10)