Form-15G - 3rd Page

Diunggah oleh

awadhesh.kumar0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

8 tayangan1 halamanaxis

Hak Cipta

© © All Rights Reserved

Format Tersedia

PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen Iniaxis

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

8 tayangan1 halamanForm-15G - 3rd Page

Diunggah oleh

awadhesh.kumaraxis

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 1

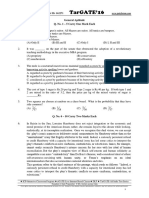

Notes:

1. The declaration should be furnished in duplicate.

2. *Delete whichever is not applicable.

3. #Declaration can be furnished by an individual under section 197A (1) and a person (other than a company or a firm) under

section 197A (1A).

4. **Indicate the capacity in which the declaration is furnished on behalf of a HUF, AOP, etc.

5. Before signing the declaration/verification, the declarant should satisfy himself that the information furnished in this form

is true, correct and complete in all respects. Any person making a false statement in the declaration shall be liable to

prosecution under 277 of the Incometax Act, 1961 and on conviction be punishable

i.

In a case where tax sought to be evaded exceeds twentyfive lakh rupees, with rigorous imprisonment which shall

not be less than 6 months but which may extend to seven years and with fine;

ii.

In any other case, with rigorous imprisonment which shall not be less than 3 months but which may extend to two

years and with fine.

6. The person responsible for paying the income referred to in column 22 of Part I shall not accept the declaration where the

amount of income of the nature referred to in subsection (1) or subsection (1A) of section 197A or the aggregate of the

amounts of such income credited or paid or likely to be credited or paid during the previous year in which such income is to

be included exceeds the maximum amount which is not chargeable to tax.";

Anda mungkin juga menyukai

- History Module4Dokumen31 halamanHistory Module4awadhesh.kumarBelum ada peringkat

- Mrunal Defense Current Affairs 2012-13 - Missiles, Aircraft, Joint ExercisesDokumen14 halamanMrunal Defense Current Affairs 2012-13 - Missiles, Aircraft, Joint Exercisesawadhesh.kumarBelum ada peringkat

- TCSDokumen10 halamanTCSawadhesh.kumarBelum ada peringkat

- C ProgDokumen48 halamanC Progawadhesh.kumarBelum ada peringkat

- Navigating Enterprise ManagerDokumen12 halamanNavigating Enterprise Managerawadhesh.kumarBelum ada peringkat

- Memory Layout of C ProgramsDokumen7 halamanMemory Layout of C Programsawadhesh.kumarBelum ada peringkat

- JJ Act 2015 - Jan 2016Dokumen44 halamanJJ Act 2015 - Jan 2016Anonymous EAineTizBelum ada peringkat

- UGC NET Teaching Aptitude MCQ Collection 3 PDFDokumen37 halamanUGC NET Teaching Aptitude MCQ Collection 3 PDFSatheeshRajuKalidhindi100% (2)

- Memory Layout of C ProgramsDokumen7 halamanMemory Layout of C Programsawadhesh.kumarBelum ada peringkat

- JJ Act 2015 - Jan 2016Dokumen44 halamanJJ Act 2015 - Jan 2016Anonymous EAineTizBelum ada peringkat

- Chapter 13 - Project EvaluationDokumen7 halamanChapter 13 - Project EvaluationsdawdwsqBelum ada peringkat

- Total Notes For UGC Net Paper-1Dokumen42 halamanTotal Notes For UGC Net Paper-1gr_shankar2000289490% (48)

- DigitalDokumen60 halamanDigitalawadhesh.kumarBelum ada peringkat

- UGC-NET Computer ScienceDokumen21 halamanUGC-NET Computer Scienceswastik1100% (2)

- Computer Sciences Glossary For NET JRF Computer Sciences AspirantsDokumen76 halamanComputer Sciences Glossary For NET JRF Computer Sciences AspirantsBiotecnika100% (3)

- Targate'16: Cs Test Id: 162267Dokumen12 halamanTargate'16: Cs Test Id: 162267awadhesh.kumarBelum ada peringkat

- 20201141036452program To Traverse Linear Linked ListDokumen2 halaman20201141036452program To Traverse Linear Linked Listawadhesh.kumarBelum ada peringkat

- Gate CsDokumen14 halamanGate Csawadhesh.kumarBelum ada peringkat

- NP CompletenessDokumen30 halamanNP CompletenesssharmilaBelum ada peringkat

- Gate DocumentDokumen14 halamanGate Documentawadhesh.kumarBelum ada peringkat

- NP CompleteDokumen20 halamanNP Completeawadhesh.kumarBelum ada peringkat

- Gate CNDokumen14 halamanGate CNawadhesh.kumarBelum ada peringkat

- Gate Questions DigitalDokumen13 halamanGate Questions Digitalawadhesh.kumarBelum ada peringkat

- Gate QuesDokumen11 halamanGate Quesawadhesh.kumarBelum ada peringkat

- Gate Questions DigitalDokumen13 halamanGate Questions Digitalawadhesh.kumarBelum ada peringkat

- Gate CSDokumen13 halamanGate CSawadhesh.kumarBelum ada peringkat

- Targate'16: Cs Test Id: 162267Dokumen12 halamanTargate'16: Cs Test Id: 162267awadhesh.kumarBelum ada peringkat

- GATEDokumen13 halamanGATEawadhesh.kumarBelum ada peringkat

- Exp 8Dokumen13 halamanExp 8girlbinodssBelum ada peringkat

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (120)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)