CH 07

Diunggah oleh

Czarina CasallaJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

CH 07

Diunggah oleh

Czarina CasallaHak Cipta:

Format Tersedia

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.

com

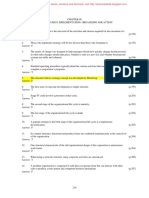

CHAPTER 07

STRATEGY FORMULATION: CORPORATE STRATEGY

True/False

1.

Corporate strategy deals with the choice of direction for the firm as a whole.

Answer: T

2.

Corporate parenting is the coordination of cash flow among units.

Answer: F

A merger is a transaction involving two or more corporations in which stock is exchanged, but

from which only one corporation survives.

Answer: T

(p.137)

(p.137)

3.

4.

Vertical integration is going backward on an industrys value chain.

Answer: F

Forward integration is the degree to which a firm operates vertically in multiple locations on an

industrys value chain from extracting raw materials to manufacturing to retailing.

Answer: T

(p.139)

(p.140)

5.

6.

Conglomerate diversification is diversifying into an industry unrelated to its current one.

Answer: T

Exporting grants rights to another company to open a retail store using the franchisers name and

operating system.

Answer: F

(p.140)

(p.143)

7.

Turnkey operations are typically contracts for the construction of operating facilities in exchange

for a fee.

Answer: T

(p.143)

8.

(p.145)

9.

A no change strategy is a decision to do nothing new in a worsening situation, but instead to act as

though the companys problems are only temporary.

(p.147)

Answer: F

10.

A turnaround strategy emphasizes the improvement of operational efficiency and is probably more

appropriate when a corporations problems are pervasive, but not yet critical.

(p.148)

Answer: T

11.

Bankruptcy is the termination of the firm.

Answer: F

(p.150)

12.

Bankruptcy involves giving up management of the firm to the courts in return for some settlement

of the corporations obligations.

(p.150)

Answer: T

13.

BCG stands for Boston Consulting Group.

Answer: T

(p.151)

14.

Cash cows are market leaders typically at the peak of their product life cycle and are usually able

to generate enough cash to maintain their high share of the market.

Answer: F

179

(p.152)

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com

15.

Eventually, cash cows become stars.

Answer: F

(p.152)

16.

The GE Business Screen is based on long-term industry attractiveness and business

strength/competitive position.

Answer: T

A companys attractiveness is composed of its market size, the market rate of growth, the extent

and type of government regulation, and economic and political factors.

Answer: T

(p.152)

17.

(p.154)

18.

The competitive strength of a product is based only on its market share.

Answer: F

(p.154)

19.

One advantage of portfolio analysis is that it is not easy to define product/market segments.

Answer: F

(p.155)

20.

One disadvantage of portfolio analysis is that it provides an illusion of scientific rigor.

Answer: T

(p.155)

Multiple Choice

21.

Which strategy specifies the firm's overall direction in terms of its general orientation toward

growth, the industries or markets in which it competes, and the manner in which it coordinates

activities and transfers resources among business units?

a.

b.

c.

d.

e.

22.

23.

(p.138)

portfolio strategy

directional strategy

parenting strategy

cooperative strategy

functional strategy

Which kind of corporate strategy deals with the industries or markets in which the firm competes

through its products and business units?

a.

b.

c.

d.

(p.137)

corporate strategies.

directional strategies.

cooperative strategies.

functional strategies.

business strategies.

Which kind of corporate strategy deals with the firm's overall orientation toward growth?

a.

b.

c.

d.

e.

24.

corporate

functional

divisional

organizational

business

Strategies that include the flow of financial and other resources to and from a companys product

lines and business units can be referred to as

a.

b.

c.

d.

e.

(p.137)

portfolio strategy

directional strategy

parenting strategy

cooperative strategy

180

(p.137)

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com

e.

25.

Which kind of corporate strategy deals with the manner in which the firm coordinates activities

and transfers resources and cultivates capabilities among product lines and business units?

a.

b.

c.

d.

e.

26.

28.

mergers

strategic alliances

diversification

acquisitions

concentration

mergers

strategic alliances

diversification

acquisitions

concentration

Which external growth strategy is a partnership of two or more corporations or business units to

achieve mutually beneficial strategic objectives?

a.

b.

c.

d.

e.

30.

(p.139)

Which external growth strategy occurs when a corporation is completely absorbed as an operating

subsidiary or division of the acquiring firm?

(p.139)

a.

b.

c.

d.

e.

29.

(p.138)

stability

growth

consolidation

retrenchment

expansion

Which external growth strategy involves two or more corporations joining in a stock exchange

and from which only one corporation survives?

a.

b.

c.

d.

e.

(p.137)

portfolio strategy

directional strategy

parenting strategy

cooperative strategy

functional strategy

Which one of the following directional strategies is most frequently used in corporations?

a.

b.

c.

d.

e.

27.

functional strategy

mergers

strategic alliances

diversification

acquisitions

concentration

Which of the following is NOT a reason why the growth strategy is so seductive?

a.

b.

c.

d.

e.

(p.139)

There are more opportunities for advancement and promotion.

A corporation that experiences successful growth is thought of positively by the

marketplace and potential investors.

A large and growth-oriented corporation has more clout and influence.

A growing firm can cover up mistakes and inefficiencies because of the increase in cash

flow revenue.

A large and growing firm attracts more acquisition offers.

181

(p.139)

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com

31.

The collection of unused resources of a company is known as

a.

b.

c.

d.

e.

32.

33.

b.

c.

d.

e.

full internal vertical integration.

tapered integration.

horizontal integration.

external vertical integration.

quasi-integration.

(p.140)

take over a function previously supplied by a former

employer.

take over a function previously provided by a supplier or by

a distributor.

acquire a company of similar objective.

sell a company encumbered with debt.

expand to countries with strong trade alliances.

A disadvantage of vertical integration is that it

a.

b.

c.

d.

e.

36.

concentration.

conglomerate integration.

concentric diversification.

stability.

retrenchment.

The purpose of vertical growth is to

a.

35.

(p.139)

Ford Motor Company's use of company resources to build its River Rouge Plant outside of Detroit

so that iron ore could enter into one end of the plant and a finished automobile could exit out of

the other end is called

(p.140)

a.

b.

c.

d.

e.

34.

organizational trash.

organizational slack.

organizational capacity.

organizational acquisition.

organizational formula.

The most logical strategy for a corporation having a strong competitive position possessing a

high market share in a highly attractive industry is

a.

b.

c.

d.

e.

(p.139)

creates exit barriers.

improves coordination of activities.

increases the cost of improvement of coordination and control.

creates entry barriers.

avoids time consuming tasks.

The purchase of Carrolls Foods for its hog-growing facilities by Smithfield Foods, the worlds

largest pork processor, is an example of

a.

b.

c.

d.

e.

(p.140)

forward integration.

horizontal integration.

backward integration.

transferred integration.

mass integration.

182

(p.140)

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com

37.

The ability for Nike to manufacture its own shoes and then build stores for distribution is an

example of

a.

b.

c.

d.

e.

38.

39.

41.

42.

(p.140)

forward, backward

vertical, backward

backward, vertical

backward, forward

mass, forward

When a firm internally makes 100% of its key supplies and completely controls its distributors,

this is known as

a.

b.

c.

d.

e.

(p.140)

population theory.

institution theory.

transaction cost economics.

trickle down economics.

transaction growth theory.

In many cases, _____ integration is more profitable than _____ integration.

a.

b.

c.

d.

e.

40.

forward integration.

horizontal integration.

backward integration.

transferred integration.

mass integration.

The theory that proposes that vertical integration is more efficient than contracting for goods and

services in the marketplace when the transaction costs of buying goods on the open market

becomes too great is known as

a.

b.

c.

d.

e.

(p.140)

(p.140)

full integration.

vertical integration.

mass integration.

economical integration.

strategic integration.

A firm that produces part of its own requirements and buys the rest from outside suppliers is what

type of vertical integration?

a.

full integration

b.

long-term contracts

c.

backwards integration

d.

taper integration

e.

quasi integration

(p.141)

A firm which gets most of its requirements from an outside supplier that is under its partial control

is what type of vertical integration?

(p.141)

a.

b.

c.

d.

e.

full integration

long-term contracts

backwards integration

taper integration

quasi integration

183

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com

43.

According to transaction cost economics, which of the following is NOT a reason for a firm to

prefer vertical integration over contracting to purchasing supplies or services in the open market?

a.

b.

c.

d.

e.

44.

45.

47.

48.

e.

(p.142)

insourcing.

outsourcing.

resource building.

resource placement.

resource allocation.

As defined by the text, synergy is the concept

a.

b.

c.

d.

(p.142)

long-term contract.

short-term contract.

binding contract.

integrated contract.

outsourced contract.

When resources are purchased from outsiders through long-term contracts instead of being made

in-house, this process is referred to as

a.

b.

c.

d.

e.

(p.141)

drafting a market agreement.

selling a market agreement.

negotiating a market agreement.

safeguarding a market agreement.

settling disputes.

An agreement between two separate firms to provide agreed-upon goods and services to each

other for a specified period of time is known as a(n)

a.

b.

c.

d.

e.

(p.142)

forward vertical growth.

diversification

backward vertical growth.

captive company strategy.

horizontal integration.

All of the following factors reflect transaction costs EXCEPT

a.

b.

c.

d.

e.

46.

a high level of uncertainty surrounds the transaction.

a company's management does not want to rely on outsiders for important raw

materials.

the transaction occurs frequently.

assets involved in the transaction are highly specialized.

all of the above are reasons to favor contracting over vertical integration.

A firm's expansion into other geographic locations and/or increasing the range of products and

services offered to current markets is called

a.

b.

c.

d.

e.

(p.141)

that involves adding different products or divisions to the corporation.

that supports the acquisition of one corporation by another.

that two firms can generate more profits together than separately.

that a corporation can enter one or more businesses that are necessary to manufacture its

own product.

that two functional areas of a corporation can coordinate their work as a team.

184

(p.143)

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com

49.

Which strategy did KLM choose when it joined forces with Northwest Airlines?

a.

b.

c.

d.

e.

50.

51.

c.

d.

e.

53.

54.

(p.143)

product-market synergy.

financial considerations.

employee satisfaction.

similar product offerings.

market demand.

With concentric diversification, the focus is on

a.

b.

c.

d.

e.

(p.143)

Timing is critical to ensure entry into the industry before competitors.

Indicated when managers are primarily concerned with the criterion of return on

investment.

Emphasis is on financial synergy rather than on the product-market synergy.

Appropriate for companies wishing to take advantage of their competitive position

strengths as they diversify out of an unattractive industry.

May be appropriate corporate strategy when a firm's competitive position is only average

and industry attractiveness is low.

With conglomerate diversification, the focus is on

a.

b.

c.

d.

e.

(p.143)

concentration.

horizontal growth.

concentric diversification.

vertical growth.

conglomerate diversification.

Which of the following is NOT descriptive of the characteristics of conglomerate diversification?

a.

b.

(p.142)

concentration.

horizontal growth.

concentric diversification.

vertical growth.

conglomerate diversification.

Growth through diversification out of an industry into an unrelated industry is called

a.

b.

c.

d.

e.

52.

A retrenchment strategy using horizontal integration through internal means.

A horizontal integration strategy.

A stability strategy using concentric diversification.

A growth strategy using vertical integration through external means.

A retrenchment strategy using a concentration method.

Adding a related or complementary product to a corporation's business units is called

a.

b.

c.

d.

e.

(p.142)

product-market synergy.

market demand.

financial considerations.

diverse product offerings.

economic indicators.

185

(p.143)

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com

55.

An MNC uses which international strategy for entering a foreign market by simply shipping

goods produced in the company's home country to other countries for marketing to minimize risk

and to experiment with a specific product?

a.

b.

c.

d.

e.

56.

c.

d.

e.

(p.145)

reduces the risks of expropriation.

enhances the policy of the host countrys takeover of the

firm.

promotes skepticism among other countries not involved

in the merger.

encourages competitors to work with the company.

increases revenues by 20%.

An MNC uses which international strategy for entering a foreign market by purchasing another

company already operating in the area developing synergistic benefits gained from acquiring

strong complementary product lines and a good distribution network?

a.

b.

c.

d.

e.

(p.145)

5%

7%

17%

27%

37%

One benefit of a U.S. company entering a joint venture with an international firm is the joint

venture

a.

b.

59.

licensing

joint ventures

production sharing

exporting

acquisitions

The rate of joint venture formation between U.S. companies and international partners has been

growing _____ annually since 1985.

a.

b.

c.

d.

e.

58.

licensing

joint ventures

production sharing

exporting

acquisitions

An MNC uses which international strategy for entering a foreign market by associating itself with

a firm in the host country or a government agency in that country to combine resources and

expertise needed for the development of a new product or technologies?

(p.145)

a.

b.

c.

d.

e.

57.

(p.145)

licensing

joint ventures

production sharing

exporting

acquisitions

186

(p.145)

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com

60.

An MNC uses which international strategy for entering a foreign market by combining the higher

labor skills and technology available in the developed countries with the lower cost labor

available in the developing countries?

a.

b.

c.

d.

e.

61.

b.

c.

d.

e.

62.

b.

c.

d.

e.

b.

c.

d.

e.

64.

(p.146)

as a way in which an MNC may contract with a foreign government or local firm to trade

raw materials for certain resources belonging to the MNC.

as a way in which an MNC can take total control of operations by either starting a

business from scratch or acquiring a firm already established in the host country.

when a corporation chooses to build a facility from scratch allowing it the freedom to

design the plant, choose suppliers, and hire a work force.

when an MNC has a large amount of management talent available and chooses to

use its personnel to assist a firm in a host country for a specified fee and period of

time.

when an MNC typically contracts for construction of operating facilities in exchange for

a fee.

One study of various growth projects revealed that the most successful growth strategy was

a.

b.

c.

d.

e.

(p.145)

a way in which an MNC may contract with a foreign government or local firm to trade

raw materials for certain resources belonging to the MNC.

a way in which an MNC can take total control of operations by either starting a business

from scratch or acquiring a firm already established in the host country.

when a corporation chooses to build a facility from scratch allowing it the freedom to

design the plant, choose suppliers, and hire a work force.

when an MNC has a large amount of management talent available and chooses to use its

personnel to assist a firm in a host country for a specified fee and period of time.

typically contracts for construction of operating facilities in exchange for a fee.

Management contracts are used in international dealings

a.

(p.145)

a way in which an MNC may contract with a foreign government or local firm to trade

raw materials for certain resources belonging to the MNC.

a way in which an MNC can take total control of operations by acquiring a firm already

established in the host country.

when a corporation chooses to build a facility from scratch allowing it the freedom

to design the plant, choose suppliers, and hire its work force.

when an MNC has a large amount of management talent available and chooses to use its

personnel to assist a firm in a host country for a specified fee and period of time.

typically contracts for construction of operating facilities in exchange for a fee.

In international dealings, turnkey operations are

a.

63.

licensing

joint ventures

production sharing

exporting

acquisitions

In international dealings, green-field development is/are

a.

(p.145)

vertical growth.

horizontal growth.

concentric diversification.

conglomerate diversification.

a combination of vertical growth and conglomerate diversification.

187

(p.146)

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com

65.

Research comparing concentric with conglomerate diversification concludes that

a.

b.

c.

d.

e.

66.

67.

c.

d.

e.

69.

(p.147)

horizontal integration strategy

no change strategy

retrenchment strategy

pause/proceed with caution strategy

profit strategy

Which strategy is most appropriate for a company in an industry in which the future is expected to

continue as an extension of the present?

(p.147)

a.

b.

c.

d.

e.

70.

(p.147)

Useful in the short-run but can be dangerous if followed too long.

Most appropriate for reasonably successful corporations in a reasonably predictable

environment.

Appropriate when the industry is facing modest or no-growth potential.

Appropriate when the industry is in decline.

Key environmental forces are in the process of unpredictable change.

Which strategy is most appropriate as a temporary strategy to enable a corporation to consolidate

its resources after prolonged rapid growth in an industry now facing an uncertain future?

a.

b.

c.

d.

e.

(p.146)

external growth appears to be superior financially to internal growth.

internal growth appears to be superior financially to external growth.

there appears to be no financial advantage to either.

acquisitions have a lower survival rate than new internally generated business ventures.

strategic alliances are superior to both.

The stability strategy is appropriate for all BUT ONE of the following circumstances?

a.

b.

68.

conglomerate diversification is always less profitable than concentric diversification.

concentric diversification is always less profitable than conglomerate diversification.

the relationship between relatedness and performance is curvilinear.

neither concentric or conglomerate diversification are ever profitable.

for optimum effectiveness both conglomerate and concentric diversification should be

utilized in tandem.

The controversy surrounding external versus internal growth finds

a.

b.

c.

d.

e.

(p.146)

horizontal integration strategy

no change strategy

retrenchment strategy

pause/proceed with caution strategy

profit strategy

Which strategy is descriptive of a corporation in a mature industry facing a drop in its

attractiveness, opting to decrease short-term discretionary expenses to maintain profits at a certain

level?

(p.147)

a.

b.

c.

d.

e.

horizontal integration strategy

no change strategy

retrenchment strategy

pause/proceed with caution strategy

profit strategy

188

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com

71.

Which strategy is most appropriate for a corporation having a weak competitive position

regardless of the industry's attractiveness, resulting in poor performance, decreased sales and

lost profits?

a.

b.

c.

d.

e.

72.

b.

c.

d.

e.

73.

A form of divestment and is appropriate when corporate problems can be traced to the

poor performance of an SBU or product line.

Occurs when the corporation reduces the scope of some of its functional activities and

becomes "captive" to another firm.

Emphasizes improving operational efficiency and is appropriate when a

corporation's problems are pervasive, but not yet critical.

Occurs when a corporation liquidates all its assets.

It involves adding different products or divisions to the corporation.

b.

c.

d.

e.

(p.148)

Probably most appropriate for a company with a strong competitive position in a

growing industry.

The firm reduces its functional activities to reduce costs.

The firm gains a certainty of sales and production in return for becoming heavily

dependent upon another firm for at least 75% of its sales.

One of its customers makes up a large percentage of the company's sales and wants the

company to keep operating as its supplier.

Management desperately seeks an "angel" to guarantee the company's continued

existence.

Which strategy involves giving up management of the firm to the courts in return for some

settlement of the corporation's obligations?

a.

b.

c.

d.

e.

(p.148)

merger.

liquidation

integration.

divestment.

turnaround.

Which one of the following is NOT a characteristic of a firm that has chosen a captive company

strategy?

a.

75.

(p.148)

The strategy which takes place in two basic phases of contraction and consolidation is

a.

b.

c.

d.

e.

74.

proceed with caution strategy

no change strategy

retrenchment strategy

pause strategy

profit strategy

What is a turnaround strategy?

a.

(p.148)

liquidation

bankruptcy

diversification

divestment

consolidation

189

(p.150)

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com

76.

Which strategy is the termination of the firm because it is in an unattractive industry and the

company is too weak to be sold as a growing concern?

a.

b.

c.

d.

e.

77.

81.

(p.151)

.5.

1.0.

1.5.

2.0.

2.5.

The growth-share matrix of the Boston Consulting Group suggests that the excess cash being

generated by "cash cows" should be used to fund

a.

b.

c.

d.

e.

(p.151)

market leader.

largest competitor.

market challenger.

market lagger.

smallest competitor.

The line separating areas of high and low relative competitive position as gained from the BCG

growth-share matrix method, is set at

a.

b.

c.

d.

e.

(p.151)

its market share.

its gross sales divided by its market share.

its market share multiplied by that of its nearest competitor.

its market share divided by that of the smallest other competitor.

its market share divided by that of the largest other competitor.

A market share ratio above 1.0, calculated by the Boston Consulting Group's growth-share matrix

method, belongs to the

a.

b.

c.

d.

e.

80.

PIMS.

segmentation analysis

portfolio analysis.

industry analysis.

diversification study.

In the Boston Consulting Group's growth-share matrix, the relative competitive position of a

product, division, or corporation is defined as

a.

b.

c.

d.

e.

79.

liquidation

bankruptcy

diversification

divestment

consolidation

One of the most popular aids to developing corporate strategy in multibusiness corporations views

business units in terms of the cash they generate and is called

(p.151)

a.

b.

c.

d.

e.

78.

(p.150)

"dogs."

"question marks."

"stars."

"white knights."

"buckets."

190

(p.151)

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com

82.

New products which are typically introduced in a fast-growing industry are called

a.

b.

c.

d.

e.

83.

87.

d.

e.

(p.152)

effective management.

competitive positioning.

innovative initiative.

industry leadership.

market share.

The BCG growth-share matrix has been criticized because

a.

b.

c.

(p.152)

cash cows.

lost leaders.

dogs.

question marks.

stars.

According to the BCG growth-share matrix, the key to success is

a.

b.

c.

d.

e.

(p.152)

cash cows.

lost leaders.

dogs.

question marks.

stars.

Those products with low market share that do NOT have the potential to bring in much cash are

called

a.

b.

c.

d.

e.

86.

cash cows.

lost leaders.

dogs.

question marks.

stars.

Products that typically bring in far more money than is needed for maintenance of their market

share are called

a.

b.

c.

d.

e.

85.

cash cows.

lost leaders.

dogs.

question marks.

stars.

Market leaders typically at the peak of their product life cycle and usually able to generate enough

cash to maintain their high share of the market are called

(p.151)

a.

b.

c.

d.

e.

84.

(p.151)

it emphasizes marketing expenditures over profits.

it uses too many categories.

it fails to operationalize industry attractiveness and business strength/competitive

position.

high growth markets may not always be the best markets.

product quality is only one aspect of overall competitive position.

191

(p.153)

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com

88.

Which of the following is NOT defined by GE as one of the variables forming industry

attractiveness?

a.

b.

c.

d.

e.

89.

90.

Use the growth rate as the criteria measurement for success.

Assess industry attractiveness.

Plot the firm's future portfolio.

Assess business strength/competitive position.

Plot each SBU's current position.

(p.154)

0.0 (weak) to 10.0 (strong).

1.00 (strong) to 5.0 (weak).

0.0 (strong) to 10.0 (weak).

1.0 (weak) to 7.0 (strong).

1.00 (weak) to 5.0 (strong).

The GE Business Screen has been criticized because

a.

b.

c.

d.

e.

93.

industry profitability

competitive diversity

market growth rate

market size

market share

The range of scores for the business strength axis of the GE Business Screen is from

a.

b.

c.

d.

e.

92.

(p.153)

Which one of the following is NOT one of the four steps recommended for plotting of products or

SBUs on the GE Business Screen?

(p.154)

a.

b.

c.

d.

e.

91.

market share

market size

market growth rate

pricing practices

industry profitability

Which of the following is defined by GE as one of the variables forming business

strength/competitive position?

a.

b.

c.

d.

e.

(p.153)

(p.154)

it is based on the product life cycle.

the categories are too few.

it can get quite complicated and cumbersome.

it is a primitive version of the Directional Policy Matrix.

it is only appropriate for new products or SBUs in developing industries.

The international product portfolio summarizes a host of data on

(p.154)

a.

b.

c.

d.

e.

opportunities and risks.

local partner selection.

economic and political factors.

a country's attractiveness and a product's competitive strength.

MNC/host country relationship.

192

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com

94.

Which of the following is NOT one of the advantages of portfolio analysis?

a.

b.

c.

d.

e.

95.

e.

96.

b.

c.

d.

e.

98.

99.

(p.157)

business-unit fit matrix.

multiple-unit fit matrix.

parenting-unit fit matrix.

joint venture fit matrix.

vertical integration fit matrix.

According to Campbell, Goold, and Alexander in their parenting-fit matrix, those businesses

which are opportunities for improvement by the parent and the parent clearly understands their

critical success factors well are called

a.

b.

c.

d.

e.

(p.156)

the employees.

organizational knowledge.

plant assets.

joint ventures.

licensing agreements.

The summary of various judgments regarding corporate/business unit fit for the corporation as a

whole is referred to as

a.

b.

c.

d.

e.

(p.156)

the core competencies of the parent corporation and on the value created from the

relationship between the parent and its units.

the cash flow among its business units.

whether a business unit should be growing, stabilizing, or retrenching.

acquiring distinctive competencies in the marketplace.

differentiating its activities into separate units and integrating these activities through

complex integrating mechanisms.

According to the text, 75% of a companys value is derived from

a.

b.

c.

d.

e.

(p.155)

It contains value-laden terminology.

It is not easy to define product/market segments.

It relies too heavily on objective judgments.

It suggests the use of standard strategies which may be impractical or may miss potential

opportunities.

It provides an illusion of scientific rigor.

Corporate parenting generates corporate strategy by focusing on

a.

97.

The graphic depiction facilitates communication.

It provides the basis for impartial objectivity from which to make decisions.

It encourages top management to evaluate each of the corporation's businesses

individually.

It raises the issue of cash flow availability for use in expansion and growth.

It stimulates the use of externally oriented data to supplement management's judgment.

Which of the following is NOT one of the limitations of portfolio analysis?

a.

b.

c.

d.

(p.155)

ballast businesses.

heartland businesses.

edge-of-heartland businesses.

alien territory businesses.

value trap businesses.

193

(p.158)

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com

100.

According to the parenting-fit matrix, those businesses which fit very comfortably with the parent

corporation, but contain very few opportunities to be improved by the parent are called

(p.158)

a.

b.

c.

d.

e.

101.

According to Campbell, Goold, and Alexander in their parenting-fit matrix, those businesses

which fit well with parenting opportunities, but are a misfit with the parent's understanding of the

unit's critical success factors are called

a.

b.

c.

d.

e.

102.

ballast businesses.

heartland businesses.

edge-of-heartland businesses.

alien territory businesses.

value trap businesses.

(p.158)

ballast businesses.

heartland businesses.

edge-of-heartland businesses.

alien territory businesses.

value trap businesses.

A corporate strategy that cuts across divisional boundaries to build synergy across business units

to improve the competitive position of one or more business units is called

(p.159)

a.

b.

c.

d.

e.

103.

vertical strategy.

horizontal strategy.

hierarchical strategy.

portfolio strategy.

pyramid strategy.

Business firms that compete with each other not only in one business unit, but in a number of

related business units are said to be engaging in

a.

b.

c.

d.

e.

oligopolistic competition.

strategic competition.

multipoint competition.

laissez-faire competition.

horizontal competition.

194

(p.159)

Anda mungkin juga menyukai

- CH 07Dokumen16 halamanCH 07MonaIbrheemBelum ada peringkat

- Fragen Antworten Multiple Choice eDokumen17 halamanFragen Antworten Multiple Choice eJamal ManxoorBelum ada peringkat

- CH 09Dokumen16 halamanCH 09Czarina CasallaBelum ada peringkat

- MGT603 Strategic Management Solved MCQs From Book by David (Chap 5b)Dokumen10 halamanMGT603 Strategic Management Solved MCQs From Book by David (Chap 5b)Emebet TesemaBelum ada peringkat

- Foundations of Strategy 2nd Edition Grant Test Bank DownloadDokumen11 halamanFoundations of Strategy 2nd Edition Grant Test Bank Downloadallisonpalmergxkyjcbirw100% (18)

- Chapter 7 Strategy Formulation: Corporate Strategy: Strategic Management & Business Policy, 13e (Wheelen/Hunger)Dokumen22 halamanChapter 7 Strategy Formulation: Corporate Strategy: Strategic Management & Business Policy, 13e (Wheelen/Hunger)Anonymous 7CxwuBUJz3Belum ada peringkat

- Growth and Survival of Firms - Part 1Dokumen21 halamanGrowth and Survival of Firms - Part 1Yashjeet Gurung RCS KJBelum ada peringkat

- Quizlet Chap 10Dokumen15 halamanQuizlet Chap 10Kryscel ManansalaBelum ada peringkat

- Test Bank For Foundations of Strategy 2nd Edition DownloadDokumen11 halamanTest Bank For Foundations of Strategy 2nd Edition Downloadchristinedaughertyrwycgtpmxj100% (21)

- Bba Iv TH Semester Business Policy & Stratergic Analysis Module - Iv NotesDokumen74 halamanBba Iv TH Semester Business Policy & Stratergic Analysis Module - Iv NotesShivaniBelum ada peringkat

- Test 4Dokumen9 halamanTest 4Mini matoBelum ada peringkat

- Strategic Management MCQ Chapter 7Dokumen25 halamanStrategic Management MCQ Chapter 7EngMohamedReyadHelesyBelum ada peringkat

- Chapter Test 8Dokumen2 halamanChapter Test 8Trang312100% (1)

- Strategies in Action True/False Chapter ReviewDokumen23 halamanStrategies in Action True/False Chapter ReviewJue Yasin64% (11)

- Ebook Economics of Strategy 5Th Edition Besanko Test Bank Full Chapter PDFDokumen30 halamanEbook Economics of Strategy 5Th Edition Besanko Test Bank Full Chapter PDFJordanLarsonioadm100% (7)

- Economics of Strategy 5th Edition Besanko Test BankDokumen9 halamanEconomics of Strategy 5th Edition Besanko Test Banklucnathanvuz6hq100% (26)

- CH 7 Corporate StrategyDokumen7 halamanCH 7 Corporate StrategyfirasBelum ada peringkat

- CH. 7 Strategy Corporation: Corporate Strategy: (Portfolio Analysis)Dokumen7 halamanCH. 7 Strategy Corporation: Corporate Strategy: (Portfolio Analysis)firasBelum ada peringkat

- Title of The Paper:: Mergers and Acquisitions Financial ManagementDokumen25 halamanTitle of The Paper:: Mergers and Acquisitions Financial ManagementfatinBelum ada peringkat

- Test Bank For Essentials of Strategic Management The Quest For Competitive Advantage 6th EditionDokumen25 halamanTest Bank For Essentials of Strategic Management The Quest For Competitive Advantage 6th Editionariadnemarthaauva100% (19)

- Horizontal IntegrationDokumen1 halamanHorizontal IntegrationAshish PereBelum ada peringkat

- Strategic Management and Competitive Advantage 4Th Edition Barney Test Bank Full Chapter PDFDokumen46 halamanStrategic Management and Competitive Advantage 4Th Edition Barney Test Bank Full Chapter PDFToniPerryptfo100% (5)

- Strategic Management and Competitive Advantage 4th Edition Barney Test BankDokumen25 halamanStrategic Management and Competitive Advantage 4th Edition Barney Test Bankkiethanh0na91100% (22)

- CH 06Dokumen15 halamanCH 06Czarina CasallaBelum ada peringkat

- Unit 8 Coprporate StrategyDokumen37 halamanUnit 8 Coprporate StrategyNoura Ahmed100% (10)

- Test BankDokumen23 halamanTest BankBayan HasanBelum ada peringkat

- STRATEGIC MANAGEMENT UNIT 3 NCEDokumen28 halamanSTRATEGIC MANAGEMENT UNIT 3 NCEBorish LiffinBelum ada peringkat

- Strategic - Chap 7 NotesDokumen7 halamanStrategic - Chap 7 NotesMirna Bachir Al KhatibBelum ada peringkat

- Chapter Eight Exam QuestionsDokumen6 halamanChapter Eight Exam QuestionsRaisa Vina Ramlogan0% (1)

- Chapter 8Dokumen17 halamanChapter 8Meo XinkBelum ada peringkat

- Diversification, Venturing and Corporate Restructuring For National and International BusinessDokumen12 halamanDiversification, Venturing and Corporate Restructuring For National and International BusinessShubh GuptaBelum ada peringkat

- Process of Merger and AcquisitionDokumen5 halamanProcess of Merger and AcquisitionAnupam MishraBelum ada peringkat

- Cooperative Strategies and Strategic Alliances ExplainedDokumen6 halamanCooperative Strategies and Strategic Alliances ExplainedKunjal Patel Bathani100% (1)

- Chap09 GM6e TIFDokumen21 halamanChap09 GM6e TIFradislamyBelum ada peringkat

- Managing Business Diversification StrategiesDokumen36 halamanManaging Business Diversification Strategiestylock96Belum ada peringkat

- Strategic Management Exam Study Guide on Corporate StrategyDokumen13 halamanStrategic Management Exam Study Guide on Corporate StrategyMuhammad AqeelBelum ada peringkat

- Assignment: Submitted ToDokumen7 halamanAssignment: Submitted ToFozle Rabby 182-11-5893Belum ada peringkat

- CH 10Dokumen15 halamanCH 10Czarina CasallaBelum ada peringkat

- Prelim Quiz2Dokumen3 halamanPrelim Quiz2Michael Angelo Laguna Dela FuenteBelum ada peringkat

- CH 1Dokumen22 halamanCH 1suhayb_1988Belum ada peringkat

- Stakeholder MappingDokumen14 halamanStakeholder MappingChâu Nguyễn Ngọc MinhBelum ada peringkat

- MF0011 - Mergers and AcquisitionsDokumen8 halamanMF0011 - Mergers and Acquisitionsak007420Belum ada peringkat

- Parenting (The Building of Corporate Synergies Through Resource Sharing andDokumen8 halamanParenting (The Building of Corporate Synergies Through Resource Sharing andMalikBelum ada peringkat

- Business Strategy Moves for Boeing and AirbusDokumen16 halamanBusiness Strategy Moves for Boeing and AirbusShravan WadhwaBelum ada peringkat

- M&a 1Dokumen5 halamanM&a 1Richa BansalBelum ada peringkat

- 6 CorporateDokumen16 halaman6 CorporateMoriko Mayhon100% (2)

- Strategy Analysis and Choice ChapterDokumen30 halamanStrategy Analysis and Choice ChapterMss Faiza100% (1)

- Company A Company B Company C: Share Holders' Benefit Market BenefitDokumen6 halamanCompany A Company B Company C: Share Holders' Benefit Market BenefitMuhaiminul IslamBelum ada peringkat

- CH 6Dokumen6 halamanCH 6rachelohmygodBelum ada peringkat

- Chapter 8 Organizational Design and Strategy in A Changing Global EnvironmentDokumen25 halamanChapter 8 Organizational Design and Strategy in A Changing Global EnvironmentTurki Jarallah100% (4)

- Strategic Management TB Chap009Dokumen49 halamanStrategic Management TB Chap009Hooi Fen OngBelum ada peringkat

- Curing Corporate Short-Termism: Future Growth vs. Current EarningsDari EverandCuring Corporate Short-Termism: Future Growth vs. Current EarningsBelum ada peringkat

- HBR's 10 Must Reads on Strategy (including featured article "What Is Strategy?" by Michael E. Porter)Dari EverandHBR's 10 Must Reads on Strategy (including featured article "What Is Strategy?" by Michael E. Porter)Penilaian: 4.5 dari 5 bintang4.5/5 (25)

- The Outsourcing Revolution (Review and Analysis of Corbett's Book)Dari EverandThe Outsourcing Revolution (Review and Analysis of Corbett's Book)Belum ada peringkat

- Strategic Alliances: Three Ways to Make Them WorkDari EverandStrategic Alliances: Three Ways to Make Them WorkPenilaian: 3.5 dari 5 bintang3.5/5 (1)

- Operations Management in Automotive Industries: From Industrial Strategies to Production Resources Management, Through the Industrialization Process and Supply Chain to Pursue Value CreationDari EverandOperations Management in Automotive Industries: From Industrial Strategies to Production Resources Management, Through the Industrialization Process and Supply Chain to Pursue Value CreationBelum ada peringkat

- CH 14Dokumen16 halamanCH 14Czarina CasallaBelum ada peringkat

- CH 11Dokumen15 halamanCH 11Czarina CasallaBelum ada peringkat

- CH 13Dokumen18 halamanCH 13Czarina CasallaBelum ada peringkat

- CH 08Dokumen16 halamanCH 08Czarina CasallaBelum ada peringkat

- CH 12Dokumen15 halamanCH 12Czarina CasallaBelum ada peringkat

- CH 10Dokumen15 halamanCH 10Czarina CasallaBelum ada peringkat

- CH 05Dokumen16 halamanCH 05Czarina CasallaBelum ada peringkat

- chp-13 TaxDokumen11 halamanchp-13 TaxJane Mae CruzBelum ada peringkat

- CH 02Dokumen16 halamanCH 02Czarina CasallaBelum ada peringkat

- CH 06Dokumen15 halamanCH 06Czarina CasallaBelum ada peringkat

- Income Taxes of Estates & Trusts: Income Taxation 6Th Edition (By: Valencia & Roxas) Suggested AnswersDokumen13 halamanIncome Taxes of Estates & Trusts: Income Taxation 6Th Edition (By: Valencia & Roxas) Suggested AnswersJane Mae CruzBelum ada peringkat

- Ch01 PDFDokumen15 halamanCh01 PDFCzarina CasallaBelum ada peringkat

- Environmental Scanning and Industry AnalysisDokumen15 halamanEnvironmental Scanning and Industry AnalysisCzarina CasallaBelum ada peringkat

- 01 Management, The Controller, & Cost AccountingDokumen4 halaman01 Management, The Controller, & Cost AccountingJay-ar PreBelum ada peringkat

- CHP 8Dokumen14 halamanCHP 8Czarina CasallaBelum ada peringkat

- Chapt-14 Withholding TaxDokumen3 halamanChapt-14 Withholding Taxhumnarvios100% (2)

- CHP 12Dokumen17 halamanCHP 12Czarina CasallaBelum ada peringkat

- Chap 3 Concepts of Income2013Dokumen8 halamanChap 3 Concepts of Income2013Quennie Jane Siblos100% (1)

- Chapt 11+Income+Tax+ +individuals2013fDokumen13 halamanChapt 11+Income+Tax+ +individuals2013fiamjan_10180% (15)

- Chapter 10Dokumen4 halamanChapter 10Judith Salome Basquinas0% (1)

- Chap 1 Gen. Prin 2013Dokumen3 halamanChap 1 Gen. Prin 2013Quennie Jane Siblos100% (6)

- Chap 5 Exclude From Gross Income2013Dokumen10 halamanChap 5 Exclude From Gross Income2013Quennie Jane Siblos100% (2)

- Losses: Income Taxation 6Th Edition (By: Valencia & Roxas) Suggested AnswersDokumen4 halamanLosses: Income Taxation 6Th Edition (By: Valencia & Roxas) Suggested AnswersJane Manumpay50% (4)

- Chapt 7+Dealings+in+Prop2013fDokumen15 halamanChapt 7+Dealings+in+Prop2013fMay May100% (3)

- CHP 6Dokumen44 halamanCHP 6Czarina CasallaBelum ada peringkat

- CHP 4Dokumen13 halamanCHP 4Czarina CasallaBelum ada peringkat

- 2009 F-3 (B) Class NotesDokumen3 halaman2009 F-3 (B) Class Notesasadmir01Belum ada peringkat

- Chap 2 Tax Admin2013Dokumen10 halamanChap 2 Tax Admin2013Quennie Jane Siblos100% (1)

- SAP B1 Preparation GuideDokumen10 halamanSAP B1 Preparation GuideSujit DhanukaBelum ada peringkat

- Saln TemplateDokumen6 halamanSaln TemplateAllan TomasBelum ada peringkat

- Report On Pharmaceutical Industry of BangladeshDokumen27 halamanReport On Pharmaceutical Industry of BangladeshPratikBhowmick0% (1)

- Semi-Finals Fin 3Dokumen3 halamanSemi-Finals Fin 3Bryan Lluisma100% (1)

- Marketing in The World of Hi-Tech & Innovation (MWHTI) : Prakash BagriDokumen13 halamanMarketing in The World of Hi-Tech & Innovation (MWHTI) : Prakash BagriAkshayBelum ada peringkat

- Law Practice QuestionsDokumen15 halamanLaw Practice QuestionsPrayas AmatyaBelum ada peringkat

- Sullivan Ford Auto WorldDokumen15 halamanSullivan Ford Auto WorldMahrosh BhattiBelum ada peringkat

- Cross Boreder DiffinationDokumen5 halamanCross Boreder DiffinationvishalllmBelum ada peringkat

- Foreign Exchange Market InsightsDokumen12 halamanForeign Exchange Market InsightsRuiting Chen100% (1)

- OD427779074597891100Dokumen1 halamanOD427779074597891100Meghendra SharmaBelum ada peringkat

- Movie Gallery growth by focusing on rural marketsDokumen10 halamanMovie Gallery growth by focusing on rural marketsVageesh KumarBelum ada peringkat

- GORR Enterprises seeks 15% IT cost reduction through outsourcing partnershipDokumen9 halamanGORR Enterprises seeks 15% IT cost reduction through outsourcing partnershipShivendra Pal SinghBelum ada peringkat

- Original PDF Applying Ifrs Standards 4th Edition PDFDokumen41 halamanOriginal PDF Applying Ifrs Standards 4th Edition PDFkathleen.jones449100% (34)

- Statement of Financial Position ActivityDokumen3 halamanStatement of Financial Position ActivityHannah Mae JaguinesBelum ada peringkat

- Talent Management StrategiesDokumen16 halamanTalent Management Strategiesgauravbpit100% (12)

- Iso 22000Dokumen5 halamanIso 22000DUOMO INDUSTRIABelum ada peringkat

- BOOKSDokumen31 halamanBOOKSTiganasu ViorelBelum ada peringkat

- Mark Sellers Speech To Investors - Focus On The Downside, and Let The Upside Take Care of ItselfDokumen5 halamanMark Sellers Speech To Investors - Focus On The Downside, and Let The Upside Take Care of Itselfalviss127Belum ada peringkat

- Future of Online PaymentsDokumen22 halamanFuture of Online Paymentser.apsinghBelum ada peringkat

- EBL Recruitment, Training and Performance ManagementDokumen17 halamanEBL Recruitment, Training and Performance ManagementNupur AkterBelum ada peringkat

- Chapter 1-7Dokumen45 halamanChapter 1-7caironsalamBelum ada peringkat

- Mcdonald'sDokumen16 halamanMcdonald'ssanoua8867% (6)

- Reply - EPFO Apex Court Contempt Petition - HPTDC Union PDFDokumen22 halamanReply - EPFO Apex Court Contempt Petition - HPTDC Union PDFSudhaBelum ada peringkat

- Accounts - Redemption of Preference ShareDokumen23 halamanAccounts - Redemption of Preference ShareArunima Jain100% (1)

- Broadband Infraco 2009 Annual ReportDokumen64 halamanBroadband Infraco 2009 Annual ReportItai ChitapiBelum ada peringkat

- Business and Finance Study Manual 2013Dokumen456 halamanBusiness and Finance Study Manual 2013huntinx67% (3)

- Factors Influencing Entrepreneurship (BBA)Dokumen26 halamanFactors Influencing Entrepreneurship (BBA)Kartik SharmaBelum ada peringkat

- Strategic Analysis of Pak Suzuki Motor CompanyDokumen27 halamanStrategic Analysis of Pak Suzuki Motor CompanybasitirfanBelum ada peringkat

- Hegde v. Coupa Software Incorporated Et Al, 3 - 23-Cv-00181, No. 1 (N.D.cal. Jan. 13, 2023)Dokumen17 halamanHegde v. Coupa Software Incorporated Et Al, 3 - 23-Cv-00181, No. 1 (N.D.cal. Jan. 13, 2023)yehuditgoldbergBelum ada peringkat

- Brand Personality Impact on Coffee Shop Customer DecisionsDokumen25 halamanBrand Personality Impact on Coffee Shop Customer DecisionsNhư Nguyễn Thuỵ ThiênBelum ada peringkat