A Bold Approach in Commodities Paid Off

Diunggah oleh

Kelvin FuHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

A Bold Approach in Commodities Paid Off

Diunggah oleh

Kelvin FuHak Cipta:

Format Tersedia

A Bold Approach in Commodities Paid Off - WSJ

6/6/16, 5:55 AM

This copy is for your personal, non-commercial use only. To order presentation-ready copies for distribution to your colleagues, clients or customers visit

http://www.djreprints.com.

http://www.wsj.com/articles/a-bold-approach-in-commodities-paid-off-1465178463

MARKETS | YOUR MONEY | JOURNAL REPORTS: FUNDS & ETFS

A Bold Approach in Commodities Paid

Off

Chief executive of AMG says the materials company zigged while others zagged

Heinz Schimmelbusch saw something happening in China that others didnt. PHOTO: DAN HALL/PRESTIGE PHOTO

By SIMON CONSTABLE

June 5, 2016 10:01 p.m. ET

The chief executive officer of Amsterdam materials company AMG Advanced

Metallurgical Group NV, Heinz Schimmelbusch, once at the center of a controversial

derivatives trade that cost a staggering $1.3 billion (see related article), is back and

bucking commodities-market trends.

While other companies have suffered stock drops and cut dividends, AMG shares have

soared (up 33.5% in 2015) and the firm paid its first dividend last year. Shares of rivals

such as Rio Tinto PLC, Alcoa Inc. and Glencore PLC, meanwhile, were hammered.

Dr.

JOURNAL REPORT

Insights from The Experts (http://blogs.wsj.com/experts/category/wealth-management/)

Read more at WSJ.com/FundsETFs (http://www.wsj.com/news/types/journal-reports-funds-etfs)

MORE IN INVESTING IN FUNDS & ETFS

Six Ways to Improve 529s (http://www.wsj.com/articles/six-ways-to-improve-529-college-plans-1465178641)

The Summer Rally Myth (http://www.wsj.com/articles/the-markets-summer-rally-myth-1465178580)

Susan Hirsch on Gender (http://www.wsj.com/articles/wall-street-pioneer-hopes-more-females-will-emerge1465178522)

Stock Funds Rose in Month (http://www.wsj.com/articles/funds-struggle-for-points-as-halftime-nears-for2016-market-1465178462)

Low Vol Isnt the Cure (http://www.wsj.com/articles/the-problem-with-low-vol-stock-funds-1465178521)

Schimmelbusch and his team at AMGwhich makes lithium for car batteries and heatresistant coatings for jet engines, among other thingsforesaw the commodities

slowdown in 2012 and started an austerity program to reduce capital expenditure and

working capital, and retire debt. Four years later, the firm is debt-free and ready to

expand.

http://www.wsj.com/articles/a-bold-approach-in-commodities-paid-off-1465178463

Page 1 of 3

A Bold Approach in Commodities Paid Off - WSJ

6/6/16, 5:55 AM

In an interview, Dr. Schimmelbusch explained how the move has paid off. Edited

excerpts follow:

Spotting a discrepancy

WSJ: What did you see in the metals markets that others didnt?

DR. SCHIMMELBUSCH: In 2012 we saw a discrepancy between what our business

partners were telling us about conditions in China and what the official statistics said.

When we asked Chinese-company leaders what was going on they said that they felt the

official statistics didnt necessarily reflect what was happening on the ground. They

were also pessimistic about the availability of bank loans to private enterprises.

We then started to compare the import-export statistics, which didnt seem to match

with the gross-domestic-product announcements. There were so many uncertainties

about what was happening and it didnt fit with the optimism that some of our

colleagues in the industry had.

We knew that Chinese long-term growth was the reason for the commodity boom. If

that was interrupted, the commodity boom would be interrupted, and therefore we

started the austerity drive as a hedge against that.

The program reduced capital expenditure, shrank working capital and we paid down our

debt. We also reduced our risk positions by entering into long-term contracts with our

customers.

WSJ: Economistsand you hold a Ph.D. in economicshave a terrible reputation for

forecasting. How did you make sure that your anecdotal evidence was correct?

DR. SCHIMMELBUSCH: Here on our board we have economist Steve Hanke, and he is

informed and knowledgeable about the global currency markets and monetary policy.

We compared notes on my observations about China, and our views reinforced each

others. [Prof. Hanke saw a credit crunch for Chinas private sector developing, which

augured a huge slowdown in that country.]

As part of the process, he ran a model on commodity markets and market participants.

We ended up pretty sure of ourselves.

WSJ: The markets for all commodities are volatile, but its also true that for your products

its more so. Would you explain why that is?

DR. SCHIMMELBUSCH: The volatility of the price of critical materials follows a

certain pattern. When you have an increase in demand, such as the demand for lithium

for use in batteries, then prices explode because the supply of the materials cannot

increase quickly enough to keep up with demand.

Eventually there will be an increase in the supply, and an effort by the end users to use

less of the materials. As that happens, the price explosion comes to an end.

WSJ: Even if Chinas consumption of commodities doesnt rebound, you see a sustained

long-term demand for your products. Why?

DR. SCHIMMELBUSCH: Our success will be a function of long-term technology trends,

because we provide materials that enable these technologies to work.

For instance, we produce graphite and lithium for batteries, and titanium alloys tailored

to the aerospace sector. When you are a producer of titanium alloys you dont need

China. You need the aerospace industry, which is global. When you produce tantalum,

you are depending on the smartphone industry, which isnt regionally defined.

http://www.wsj.com/articles/a-bold-approach-in-commodities-paid-off-1465178463

Page 2 of 3

A Bold Approach in Commodities Paid Off - WSJ

6/6/16, 5:55 AM

Austerity to expansion

WSJ: AMG introduced its first dividend last year. Do you think commodities markets have

hit bottom?

DR. SCHIMMELBUSCH: Our balance sheet has improved enough to have shareholders

participate without disturbing our ability to finance our growth plans.

The dividend also allows those asset managers who are restricted to buying dividendpaying stocks to invest in our shares.

The important thing now is that we are changing from austerity mode to an expansion

strategy because we feel the opportunities are pretty obvious. We are currently deeply

involved in an expansion of our lithium resource in Brazil, partly because the price for

the metal is spiking and growth in demand is stable. The lithium we own was a

byproduct of tantalum production, which is used in smartphones. The huge benefit here

is that much of the extraction costs for the lithium have been covered by the tantalum

mine.

WSJ: The mining and metals industry has a reputation of being dirty; you see it as green.

Please explain.

DR. SCHIMMELBUSCH: Our products enable the aerospace industry to coat turbine

blades with ceramics, which provide a thermal barrier coating. It means the nickelalloyed engine blades can be used at higher temperatures, raising the fuel efficiency and

reducing emission of carbon-dioxide.

Other materials we produce, such as graphite and lithium, allow for energy storage in

batteries.

The same thing is true for titanium alloys, which can replace nickel alloys in the engines.

They are lighter-weight than nickel alloy and very heat resistant.

Mr. Constable is a writer in New York. He can be reached at reports@wsj.com.

Copyright 2014 Dow Jones & Company, Inc. All Rights Reserved

This copy is for your personal, non-commercial use only. Distribution and use of this material are governed by our Subscriber Agreement and by copyright law. For

non-personal use or to order multiple copies, please contact Dow Jones Reprints at 1-800-843-0008 or visit www.djreprints.com.

http://www.wsj.com/articles/a-bold-approach-in-commodities-paid-off-1465178463

Page 3 of 3

Anda mungkin juga menyukai

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Securities Law FrameworkDokumen28 halamanSecurities Law FrameworkKelvin FuBelum ada peringkat

- Spice VC Q3+2018+NAV+Report+-+Management+NotesDokumen10 halamanSpice VC Q3+2018+NAV+Report+-+Management+NotesKelvin FuBelum ada peringkat

- Q3-17 Onex How We Are InvestedDokumen2 halamanQ3-17 Onex How We Are InvestedKelvin FuBelum ada peringkat

- PGII Annual Impact Report 2017 LVFDokumen38 halamanPGII Annual Impact Report 2017 LVFKelvin FuBelum ada peringkat

- CREFW Summer2017Dokumen52 halamanCREFW Summer2017Kelvin FuBelum ada peringkat

- Navis Press Release Dunkin Donuts Au Bon PainDokumen1 halamanNavis Press Release Dunkin Donuts Au Bon PainKelvin FuBelum ada peringkat

- Neuberger Berman - PE Finance Associate PostingDokumen2 halamanNeuberger Berman - PE Finance Associate PostingKelvin FuBelum ada peringkat

- Dealogic Global Loans Review First Nine Months 2015 FinalDokumen2 halamanDealogic Global Loans Review First Nine Months 2015 FinalKelvin FuBelum ada peringkat

- Research Administration at Johns Hopkins UniversityDokumen16 halamanResearch Administration at Johns Hopkins UniversityKelvin FuBelum ada peringkat

- Befood Slides Week1 OptDokumen84 halamanBefood Slides Week1 OptKelvin FuBelum ada peringkat

- Finance 2midterm 2010 - SolutionsDokumen5 halamanFinance 2midterm 2010 - SolutionsKelvin FuBelum ada peringkat

- Op Paris - The Noob GuideDokumen6 halamanOp Paris - The Noob GuideKelvin FuBelum ada peringkat

- Modern Energy Services For Health Facilities in Resource-Constrained Settings WHO ReportDokumen104 halamanModern Energy Services For Health Facilities in Resource-Constrained Settings WHO ReportKelvin FuBelum ada peringkat

- 2013-07-01 P8A SG (Maybank Kim E) Cordlife Group - The Cords That Bind Initiate at BUY (... 1.29, CLGL SP, Healthcare)Dokumen35 halaman2013-07-01 P8A SG (Maybank Kim E) Cordlife Group - The Cords That Bind Initiate at BUY (... 1.29, CLGL SP, Healthcare)Kelvin FuBelum ada peringkat

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- 2023 DPWH Standard List of Pay Items Volume II DO 6 s2023Dokumen103 halaman2023 DPWH Standard List of Pay Items Volume II DO 6 s2023Alaiza Mae Gumba100% (1)

- BNI Mobile Banking: Histori TransaksiDokumen1 halamanBNI Mobile Banking: Histori TransaksiWebi SuprayogiBelum ada peringkat

- PaySlip 05 201911 5552Dokumen1 halamanPaySlip 05 201911 5552KumarBelum ada peringkat

- Irda CircularDokumen1 halamanIrda CircularKushal AgarwalBelum ada peringkat

- Lecture 6Dokumen19 halamanLecture 6salmanshahidkhan100% (2)

- Correlations in Forex Pairs SHEET by - YouthFXRisingDokumen2 halamanCorrelations in Forex Pairs SHEET by - YouthFXRisingprathamgamer147Belum ada peringkat

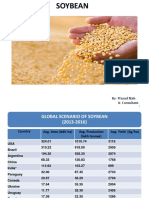

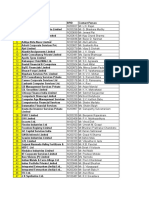

- Soybean Scenario - LaturDokumen18 halamanSoybean Scenario - LaturPrasad NaleBelum ada peringkat

- 002016-2017 S2S TRAINING PROPOSAL SLAC On THE DEVT OF SCHOOL MRFDokumen7 halaman002016-2017 S2S TRAINING PROPOSAL SLAC On THE DEVT OF SCHOOL MRFBenjamin MartinezBelum ada peringkat

- Billing Summary Customer Details: Total Amount Due (PKR) : 2,831Dokumen1 halamanBilling Summary Customer Details: Total Amount Due (PKR) : 2,831Shazil ShahBelum ada peringkat

- BAIN REPORT Global Private Equity Report 2017Dokumen76 halamanBAIN REPORT Global Private Equity Report 2017baashii4Belum ada peringkat

- Contact Details of RTAsDokumen18 halamanContact Details of RTAsmugdha janiBelum ada peringkat

- International Financial Management 8th Edition Eun Test BankDokumen38 halamanInternational Financial Management 8th Edition Eun Test BankPatrickLawsontwygq100% (15)

- Basice Micro - AssignmentDokumen2 halamanBasice Micro - AssignmentRamiah Colene JaimeBelum ada peringkat

- 11980-Article Text-37874-1-10-20200713Dokumen14 halaman11980-Article Text-37874-1-10-20200713hardiprasetiawanBelum ada peringkat

- Business Economics - Question BankDokumen4 halamanBusiness Economics - Question BankKinnari SinghBelum ada peringkat

- Approaches To Industrial RelationsDokumen39 halamanApproaches To Industrial Relationslovebassi86% (14)

- Acknowledgement: MANISHA SIKKA - I Would Also Like To Express My Thanks To My Guide in ThisDokumen78 halamanAcknowledgement: MANISHA SIKKA - I Would Also Like To Express My Thanks To My Guide in ThisKuldeep BatraBelum ada peringkat

- Latihan Soal PT CahayaDokumen20 halamanLatihan Soal PT CahayaAisyah Sakinah PutriBelum ada peringkat

- Smart Home Lista de ProduseDokumen292 halamanSmart Home Lista de ProduseNicolae Chiriac0% (1)

- GEARS September 2013Dokumen128 halamanGEARS September 2013Rodger Bland100% (3)

- Design Analysis of The Lotus Seven S4 (Type 60) PDFDokumen18 halamanDesign Analysis of The Lotus Seven S4 (Type 60) PDFChristian Villa100% (4)

- Circle Rates 2009-2010 in Gurgaon For Flats, Plots, and Agricultural Land - Gurgaon PropertyDokumen15 halamanCircle Rates 2009-2010 in Gurgaon For Flats, Plots, and Agricultural Land - Gurgaon Propertyqubrex1100% (2)

- Asiawide Franchise Consultant (AFC)Dokumen8 halamanAsiawide Franchise Consultant (AFC)strawberryktBelum ada peringkat

- © 2015 Mcgraw-Hill Education Garrison, Noreen, Brewer, Cheng & YuenDokumen62 halaman© 2015 Mcgraw-Hill Education Garrison, Noreen, Brewer, Cheng & YuenHIỀN LÊ THỊBelum ada peringkat

- Agony of ReformDokumen3 halamanAgony of ReformHarmon SolanteBelum ada peringkat

- Session 2Dokumen73 halamanSession 2Sankit Mohanty100% (1)

- 386 - 33 - Powerpoint - Slides - Lipsey - PPT - ch07 (Autosaved)Dokumen46 halaman386 - 33 - Powerpoint - Slides - Lipsey - PPT - ch07 (Autosaved)Ayush KumarBelum ada peringkat

- Fatigue Crack Growth Behavior of JIS SCM440 Steel N 2017 International JournDokumen13 halamanFatigue Crack Growth Behavior of JIS SCM440 Steel N 2017 International JournSunny SinghBelum ada peringkat

- The Possibility of Making An Umbrella and Raincoat in A Plastic WrapperDokumen15 halamanThe Possibility of Making An Umbrella and Raincoat in A Plastic WrapperMadelline B. TamayoBelum ada peringkat

- Application Form For Subscriber Registration: Tier I & Tier II AccountDokumen9 halamanApplication Form For Subscriber Registration: Tier I & Tier II AccountSimranjeet SinghBelum ada peringkat