Tom Yum Koong Crisis

Diunggah oleh

api-3221152910 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

51 tayangan2 halamanThe baht had fluctuated very narrowly between 24.91-25. Baht per dollar, stable price level of 3.3-5.9%, and high interest rate at around 13.25% before the crisis. Large part of the capital had been put into non-productive sectors especially real estate. After the mid-90s a series of external shocks (the devaluation of the Chinese remnimbi and the Japanese yen and the sharp decline in semiconductor prices) adversely affected export revenues.

Deskripsi Asli:

Judul Asli

tom yum koong crisis

Hak Cipta

© © All Rights Reserved

Format Tersedia

DOCX, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniThe baht had fluctuated very narrowly between 24.91-25. Baht per dollar, stable price level of 3.3-5.9%, and high interest rate at around 13.25% before the crisis. Large part of the capital had been put into non-productive sectors especially real estate. After the mid-90s a series of external shocks (the devaluation of the Chinese remnimbi and the Japanese yen and the sharp decline in semiconductor prices) adversely affected export revenues.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

51 tayangan2 halamanTom Yum Koong Crisis

Diunggah oleh

api-322115291The baht had fluctuated very narrowly between 24.91-25. Baht per dollar, stable price level of 3.3-5.9%, and high interest rate at around 13.25% before the crisis. Large part of the capital had been put into non-productive sectors especially real estate. After the mid-90s a series of external shocks (the devaluation of the Chinese remnimbi and the Japanese yen and the sharp decline in semiconductor prices) adversely affected export revenues.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 2

Speculative =

Devaluation =

Stagnant =

Liberalization =

Speculator =

Intervention =

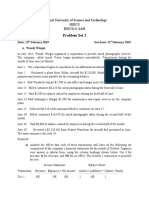

Tom Yum koong crisis

Thailand was another open economy loudly hit

by speculative attacks. It had enjoyed too much

and too recklessly wealth in its good days, the

habit which had given rise to serious imbalances

of a number of the economys components.

After a long period of strict financial regulations

that limited credit expansion of commercial

banks, starting from the beginning of 199

policy of financial market deregulation and

capital account(increasing its ownership of foreign

assets) liberalization. Moreover, with an

exchange rate fixed to a basket of world

dominant currencies especially US dollars, the

Thais had enjoyed a long period of nominal

exchange rate stability as the baht had

fluctuated very narrowly between 24.91-25.59

baht per dollar (Table 1), stable price level of

3.3-5.9%, and high interest rate at around

13.25% before the crisis.

-keeping inflation rate low between 3.36% and

5.7%

-high saving rates situated at around 33.5% of

GDP while its GDP growth had stayed at an

impressive level of 8.08-8.94 during 1991-95

-Thailand had a net capital inflow of US$ 14.239

billion, more than one hundred percent increase

from its net capital inflow three years ago.

-Thailands investment rate ranked 1st place

-growth of bank lending as a percentage of GDP

ratio was 58%, the highest in the East Asian

group

Causes

-The real estate business had become unprofitable.

-and the business owners, thus, had no capacity to pay back their

debts to financial institutions when the maturity came. The

percentage of non-performing loans had risen up to 13% in 1996.

-A large part of the capital had been put into non-productive

sectors especially real estate. Those sectors were non-productive

because they produced non-tradable goods which were sold only

domestically, resulting in less national volume of exports and thus

weaken the economys balance of trade as well as the capital

account.

-The collapse of the Thai baht in July 1997

-After the mid-1990s a series of external shocks (the devaluation of the Chinese

remnimbi and the Japanese yen and the sharp decline in semiconductor prices)

adversely affected export revenues and contributed to slowing economic activity

and declining asset prices in a number of Asian economies. In Thailand, these

events were accompanied by pressures in the foreign exchange market and the

collapse of the Thai baht in July 1997.

After crisis

-In the year after collapse of the baht peg, the value of the most affected East

Asian currencies fell 35-83% against the U.S. dollar (measured in dollars per unit

of the Asian currency), and the most serious stock declines were as great as 4060%.

Anda mungkin juga menyukai

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (120)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Bookkeeping Problems Batch 1Dokumen2 halamanBookkeeping Problems Batch 1lanz kristoff racho100% (1)

- Selection - of - A - Pressure - Vessel - Manufacturer PDFDokumen6 halamanSelection - of - A - Pressure - Vessel - Manufacturer PDFNagendra KumarBelum ada peringkat

- Fuzzy AHPDokumen17 halamanFuzzy AHPmsdpardisBelum ada peringkat

- Corporate SustainabilityDokumen17 halamanCorporate SustainabilityShiloh Williams0% (1)

- Sales - Cases 2Dokumen106 halamanSales - Cases 2Anthea Louise RosinoBelum ada peringkat

- Business Basics Test: Please Complete This Puzzle by Finding The Hidden WordsDokumen1 halamanBusiness Basics Test: Please Complete This Puzzle by Finding The Hidden WordsCavene ScottBelum ada peringkat

- Monthly Progress Report ofDokumen50 halamanMonthly Progress Report ofHamayet RaselBelum ada peringkat

- Bbap2103 Akaun PengurusanDokumen10 halamanBbap2103 Akaun PengurusanEima AbdullahBelum ada peringkat

- Problem Set 2Dokumen2 halamanProblem Set 2Rubab MirzaBelum ada peringkat

- PD 198 Local Water DistrictDokumen16 halamanPD 198 Local Water DistrictPaul Pleños TolomiaBelum ada peringkat

- TMF - A Quick Look at Ethan Allen - Ethan Allen Interiors IncDokumen4 halamanTMF - A Quick Look at Ethan Allen - Ethan Allen Interiors InccasefortrilsBelum ada peringkat

- A Product Recall Doesn't Have To Create A Financial Burden You Can't OvercomeDokumen1 halamanA Product Recall Doesn't Have To Create A Financial Burden You Can't OvercomebiniamBelum ada peringkat

- Lunar Rubbers PVT LTDDokumen76 halamanLunar Rubbers PVT LTDSabeer Hamsa67% (3)

- Commercial Invoice Vishvamata WOODWARD FINAL DRIVER BOXDokumen1 halamanCommercial Invoice Vishvamata WOODWARD FINAL DRIVER BOXSiva RamanBelum ada peringkat

- Article of Association of LIMITED LIABILITY COMPANY - NUMBERDokumen15 halamanArticle of Association of LIMITED LIABILITY COMPANY - NUMBERandriBelum ada peringkat

- Introduction of Icici BankDokumen6 halamanIntroduction of Icici BankAyush JainBelum ada peringkat

- Swot Analysis of BSNLDokumen2 halamanSwot Analysis of BSNLNiharika SinghBelum ada peringkat

- IDC IBM Honda Case Study May2017Dokumen6 halamanIDC IBM Honda Case Study May2017Wanya Kumar (Ms.)Belum ada peringkat

- w9 - L2 - Review For Lecture Midterm 2Dokumen14 halamanw9 - L2 - Review For Lecture Midterm 2Rashid AyubiBelum ada peringkat

- Analysis On Apollo Tyres LTDDokumen43 halamanAnalysis On Apollo Tyres LTDCHAITANYA ANNEBelum ada peringkat

- Defining Social InnovationDokumen15 halamanDefining Social InnovationFasyaAfifBelum ada peringkat

- Share Holders Right To Participate in The Management of The CompanyDokumen3 halamanShare Holders Right To Participate in The Management of The CompanyVishnu PathakBelum ada peringkat

- Sap DMSDokumen17 halamanSap DMSRahul Gaikwad100% (1)

- MGMT 324 Midterm Study Guide Summer 2018Dokumen12 halamanMGMT 324 Midterm Study Guide Summer 2018أبومراد أبويوسفBelum ada peringkat

- Kabushi Kaisha Isetan Vs IacDokumen2 halamanKabushi Kaisha Isetan Vs IacJudee Anne100% (2)

- Comparing FTTH Access Networks Based On P2P and PMP Fibre TopologiesDokumen9 halamanComparing FTTH Access Networks Based On P2P and PMP Fibre TopologiesWewe SlmBelum ada peringkat

- 10 Steps To Precision Maintenance Reliability SuccessDokumen11 halaman10 Steps To Precision Maintenance Reliability SuccessElvis DiazBelum ada peringkat

- Ashishgupta3554 ResumeDokumen1 halamanAshishgupta3554 ResumeAshish GuptaBelum ada peringkat

- Training Levies: Rationale and Evidence From EvaluationsDokumen17 halamanTraining Levies: Rationale and Evidence From EvaluationsGakuya KamboBelum ada peringkat

- Roles & Responsibilities of A Maintenance Engineer - LinkedInDokumen4 halamanRoles & Responsibilities of A Maintenance Engineer - LinkedInEslam MansourBelum ada peringkat