Cost Report Reconciled Cost Report For 2013-14 (13 Cost) at Bhart Coking Coal Limited

Diunggah oleh

RanjitJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Cost Report Reconciled Cost Report For 2013-14 (13 Cost) at Bhart Coking Coal Limited

Diunggah oleh

RanjitHak Cipta:

Format Tersedia

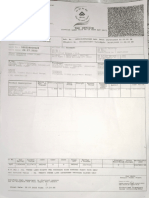

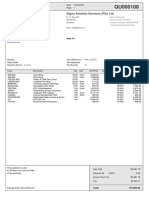

COST REPORT

RECONCILED COST REPORT FOR 2013-14 (13TH COST)

@

BHART COKING COAL LIMITED

OVERALL BCCL

2013

PARTICULARS

2013-14

LAST YEAR

CURRENT YEAR

ACTUAL

BUDGET

ACTUAL

U.G.PROD.(LT)

31.53

32.00

27.04

O.CC. PROD-DEPTT(LT)

130.17

158.00

121.02

DEPTT.PROD. (UG+OC)(LT)

161.69

190.00

148.06

HIRED. PROD (LT)

150.44

136.00

178.08

TOTAL PROD. (LT)

312.13

326.00

326.14

REV. PROD. (LT)

312.13

326.00

326.14

INTERNAL CONSUM (LT)

0.76

1.00

0.70

N.S.COAL (LT)

311.37

325.00

325.44

DEPTT.OBR (L.CUM)

328.16

378.00

356.64

CONTRACTUAL OBR (L.CUM).

644.36

482.00

596.39

TOTAL REVENUE O.B.R

(L.CUM.)

972.52

860.00

953.03

COMPOSITE PROD (L.CUM.) IN

O.C..

1154.91

1051.10

1147.45

MANPOWER (NO.)

MANSHIFT-ACTUAL (L.S.)

127.40

121.72

123.44

MANSHIFT-ADJUSTED (L.S.)

127.40

121.72

123.44

O.M.S (Te)

2.45

2.68

2.64

E.M.S.(Rs.)

2400.22

2673.18

2628.66

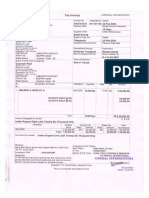

EXPENDITURE (Rs Lakhs)

Amount

Rs/Te

Amount

Rs/Te

Amount

Rs/Te

SALARY AND WAGES

165290

530.85

176853

544.16

180033

553.20

NORMAL OVERTIME

1600

5.14

1575

4.85

1797

5.52

SUNDAY OVERTIME (PROD.)

8291

26.63

8617

26.51

9000

27.65

SUNDAY OVERTIME (MAINT.)

9156

29.41

7134

21.95

8869

27.25

LEAD&LIFT

0.01

0.01

0.02

FALLBACK

682

2.19

582

1.79

426

1.31

PERKS

120767

387.86

130614

401.89

124352

382.10

PROD. INCENTIVE

0.00

0.00

0.00

LLTC/LTC/RRF

1065

3.42

1368

4.21

952

2.93

GRATUITY(CASH)

23755

76.29

26396

81.22

20422

62.75

OTHER PERKS

95946

308.14

102850

316.46

102978

316.43

PROV. FOR NCWA/I.R

0.00

0.00

0.00

TOTAL SALARY & WAGES

305789

982.08

325379

1001.17

324482

997.06

ADMN EXP-AREA OFFICE

35756

114.83

38335

117.95

40463

124.33

HEAD OFFICE

24708

79.35

28199

86.77

15105

46.41

ADMN. EXPENSES

60464

194.19

66534

204.72

55568

170.75

STORES .EXPLOSIVE

14679

47.14

18317

56.36

14300

43.94

TIMBER

1123

3.61

1045

3.22

783

2.41

P.O.L

16935

54.39

22818

70.21

23849

73.28

HEMM SPARES

6202

19.92

6902

21.24

6044

18.57

OTHER STORES

4900

15.74

6243

19.21

5532

17.00

HEMM & OTHER SPARES

11102

35.65

13145

40.45

11576

35.57

TOTAL STORES

43839

140.79

55325

170.23

50508

155.20

POWER PURCHASED

25400

81.57

28584

87.95

25140

77.25

OWN GENERATION

575

1.85

597

1.84

883

2.71

POWER (INCL. GT sets)

25974

83.42

29181

89.79

26023

79.96

TRANSPORT OF COAL

11078

35.58

14573

44.84

14187

43.59

TRANSPORT OF SAND

759

2.44

927

2.85

154

0.47

ROPEWAYS DEBIT

843

2.71

751

2.31

695

2.14

TRANS-COAL,SAND

&ROPEWAY

12681

40.73

16251

50.00

15036

46.20

RECOVERY FOR

TRANS.CHARGES

8604

27.63

10827

33.31

11235

34.52

TRANSPORT OF COAL(NET)

2474

7.95

3746

11.53

2952

9.07

0.00

0.00

0.00

HIRING OF EQUIPMENT

SURFACE MINER

SURFACE MINER REJECT

REHABILITATION OF

EQUIPMENT

HIRED HEMM-OBR

51727

HIRED HEMM-COAL

11693

HIRED HEMM-BACK FILLING

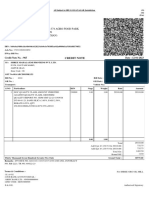

EXPENDITURE (Rs Lakhs)

Amount

Rs/Te

Amount

Rs/Te

Amount

Rs/Te

CONTRACTUAL OBR

58507

187.90

51392

158.13

63420

194.87

OTHER CONRACTS

7481

24.03

9575

29.46

9388

28.85

PURCHASE REPAIRS

3254

10.45

4002

12.31

4980

15.30

WORKSHIP-OWN

8406

27.00

9005

27.71

9512

29.23

-DEBIT

4589

14.74

4721

14.53

3640

11.18

12994.74

41.73

13726

42.23

13152

40.41

WELFARE EXPENSES

33849

108.71

39678

122.09

35439

108.90

C.I.S.F.

12236

39.30

20500

63.08

12379

38.04

DEMURRAGE

1361

4.37

1341

4.13

1115

3.43

UNDERLOADING

8186

26.29

8108

24.95

11548

35.48

OTHER MISC.EXP:-GROSS

4548

14.61

4425

13.62

4917

15.11

LESS:MISC.INCOME

9225

29.63

10061

30.96

11203

34.42

OTHER MISC EXP.LESS RECEIPT

17106

54.94

24313

74.81

18756

57.63

EXP. ON WATER MANAGEMENT

32

0.10

46

0.14

40

0.12

BENEFIT OF REST DAY

0.00

0.00

0.00

OTHER (TO BE SPECIFIED)

14

0.05

0.00

49

0.15

SUB-TOTAL

573380

1841.48

624575

1921.77

605606

1860.88

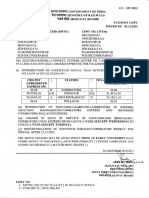

V.R.S.

0.00

0.00

0.00

SERVICE CHARGES TO CIL

0.00

374

1.15

1626

5.00

PROV. FOR STOCK

DETERIORATION

0.02

0.00

54

0.17

PROV. FOR STORE

OBSOLECENCE

37

0.12

0.00

361

1.11

OBR ADJ.

-1539

-4.94

-2500

-7.69

-9903

-30.43

INTEREST ON L TERM LOAN

0.00

0.00

0.00

INTERST ON W. CAPITAL

1686

5.41

1500

4.62

2510

7.71

INTEREST

1685.5

5.41

1500

4.62

2510

7.71

DEPRECIATION

19078

61.27

22500

69.23

23975

73.67

PROV. FOR LAND RECLMATION

4393

14.11

1863

5.73

-4667

-14.34

SUBSIDY FOR STOWING

-422

-1.35

-500

-1.54

-397

-1.22

PROV. FOR GRATUITY-ACTR

3556

11.42

6500

20.00

-14812

-45.51

PROV. FOR LEAVE ENCASHACTR

9115

29.27

6000

18.46

1269

3.90

PROV. FOR SUNDRY DEBTORS

18082

58.07

5000

15.38

14673

45.09

SUB TOTAL

53992

173.40

40737

125.34

14689

45.14

TOTAL COST

627372

2014.89

665312

2047.11

620295

1906.02

SALE VALUE OF PROD-GRADE

497525

1597.87

546775

1682.38

503591

1547.42

E-SALE (ADDITIONAL)

57436

184.46

62400

192.00

39347

120.90

GROSS SALE VALUE OF RAW

COAL

554962

1782.33

609175

1874.38

542938

1668.32

LESS: DED FOR R. COAL WASH

7301

23.45

4024

12.38

274

0.84

LESS: QUALITY & OTHER DED

8517

27.35

13965

42.97

7729

23.75

TOTAL DEDUCTION

15818

50.80

17989

55.35

8003

24.59

BONUS

231706

744.16

225440

693.66

240610

739.34

NET SALE VALUE OF RAW

COAL

770850

2475.68

816626

2512.70

775545

2383.07

CASH PROFIT/ LOSS ON COAL

197470

634.20

192051

590.93

169939

522.18

PROFIT/ LOSS ON COAL

143478

460.80

151314

465.58

155250

477.05

DO-ON W.COAL

-34442

-32845

-44157

-DO-ON H.COKE

-434

-732

-110

-DO-ON CBM

-260

-354

-325

INT ON POWER BONDS

431

520

316

INT ON SURPLUS FUND

23197

20500

22345

PRIOR PERIOD ADJ.

-385

OTHERS

15600

2685

4770

INT. ON IT REFUND

PROV/CIL INTEREST W/BACK

38074

PROV. FOR DEBTORS

-45

8776

ACCRETION/DECRETION IN

STOCK

23720

13980

23962

170906

155023

208901

OVERALL PROFIT/LOSS

Anda mungkin juga menyukai

- Tentative Vacancies of Combined Graduate Level Examination 2012Dokumen14 halamanTentative Vacancies of Combined Graduate Level Examination 2012amtece12Belum ada peringkat

- Consolidated D.C.B. Period From April-2011 To March-2012. (Provisional)Dokumen5 halamanConsolidated D.C.B. Period From April-2011 To March-2012. (Provisional)Omkar KaraputraBelum ada peringkat

- Sla System Jan'19Dokumen268 halamanSla System Jan'19Efferson SiregarBelum ada peringkat

- Production of QuarriesDokumen111 halamanProduction of QuarriesmaddumasooriyaBelum ada peringkat

- Advance Sales Invoice-SI - 28128-27-Jan-2023 15 - 27 - 06 - 230128 - 103459Dokumen3 halamanAdvance Sales Invoice-SI - 28128-27-Jan-2023 15 - 27 - 06 - 230128 - 103459Vidyanti AnggraeniBelum ada peringkat

- P DataDokumen18 halamanP DataRIDA NOORBelum ada peringkat

- Heat Exchanger Design CalculationDokumen10 halamanHeat Exchanger Design CalculationMuller RezqBelum ada peringkat

- Bom Stub For +18m & +25m Be (Corrected)Dokumen4 halamanBom Stub For +18m & +25m Be (Corrected)Jitendra AgarwalBelum ada peringkat

- Muara Baru OpnameDokumen15 halamanMuara Baru OpnameYogi WidyantoBelum ada peringkat

- CONF ON WT-2013: 2 Engr BNDokumen21 halamanCONF ON WT-2013: 2 Engr BNadjt2engrBelum ada peringkat

- CONF ON WT-2013: 2 Engr BNDokumen21 halamanCONF ON WT-2013: 2 Engr BNadjt2engrBelum ada peringkat

- Trisula - PBG: Perhitungan SapronakDokumen3 halamanTrisula - PBG: Perhitungan SapronakAsrul SaniBelum ada peringkat

- Working Capital For The Year 2006-2007: Current AssetsDokumen6 halamanWorking Capital For The Year 2006-2007: Current AssetsrosyphutelaBelum ada peringkat

- InvoiceDokumen1 halamanInvoiceRakesh KumarBelum ada peringkat

- 1708-INSP - RP - P - WING - KOT-0 - D - 3413561-2023-11 - PaySlip-KCA-KARACHI - KCA - 1708-INSP - RP - P - WING - KOT (1) - 2024-01-18T202741.781Dokumen1 halaman1708-INSP - RP - P - WING - KOT-0 - D - 3413561-2023-11 - PaySlip-KCA-KARACHI - KCA - 1708-INSP - RP - P - WING - KOT (1) - 2024-01-18T202741.781ghulamunar050Belum ada peringkat

- B4-Pt Sawung Gema Abadi: Perhitungan SapronakDokumen4 halamanB4-Pt Sawung Gema Abadi: Perhitungan SapronakAhmad AsykhiyaniBelum ada peringkat

- M/S. K J S Cement Limited For-6000 TPD Cement PlantDokumen5 halamanM/S. K J S Cement Limited For-6000 TPD Cement Plantvinod_eicsBelum ada peringkat

- Perubahan DraftDokumen1 halamanPerubahan DraftMatt RHSRBelum ada peringkat

- Method of Heat Exchanger Sizing Kern MethodDokumen10 halamanMethod of Heat Exchanger Sizing Kern Methodvazzoleralex6884Belum ada peringkat

- 50 Gas Reservoir SolutionDokumen15 halaman50 Gas Reservoir SolutionMHT allamBelum ada peringkat

- Code Amount Code Amount Code Amount Code Amount Code AmountDokumen3 halamanCode Amount Code Amount Code Amount Code Amount Code AmountMahendraBelum ada peringkat

- TAX INVOICE / Bill of Supply: Utility Bill Cum Notice Jamshedpur Name & Address Bill DetailsDokumen2 halamanTAX INVOICE / Bill of Supply: Utility Bill Cum Notice Jamshedpur Name & Address Bill DetailsCondomsBelum ada peringkat

- Screenshot 2020-03-18 at 11.13.01 AM PDFDokumen2 halamanScreenshot 2020-03-18 at 11.13.01 AM PDFKartik MathukiyaBelum ada peringkat

- Notas FiscaisDokumen2 halamanNotas FiscaisMariana HiathBelum ada peringkat

- Pay BillDokumen40 halamanPay Billbg_narareBelum ada peringkat

- Mibpl Bill - 003Dokumen1 halamanMibpl Bill - 003golu23_1988Belum ada peringkat

- M/S. K J S Cement Limited For-6000 TPD Cement PlantDokumen4 halamanM/S. K J S Cement Limited For-6000 TPD Cement Plantvinod_eicsBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Categorywise Parameters: LT Loss Incl Line Loss Total Load (HP)Dokumen1 halamanCategorywise Parameters: LT Loss Incl Line Loss Total Load (HP)Sachin KhandareBelum ada peringkat

- Monthly Report of Captive Generating SetsDokumen2 halamanMonthly Report of Captive Generating Setsjai parkashBelum ada peringkat

- Texas CHILDREN AT RISK From DIRTY AIR POLLUTIONDokumen3 halamanTexas CHILDREN AT RISK From DIRTY AIR POLLUTIONDEFENDERS OF WILDLIFEBelum ada peringkat

- Muara Baru OpnameDokumen34 halamanMuara Baru OpnameYogi WidyantoBelum ada peringkat

- Ooip Volume MbeDokumen19 halamanOoip Volume Mbefoxnew11Belum ada peringkat

- Ooip Volume MbeDokumen19 halamanOoip Volume Mbefoxnew11Belum ada peringkat

- Besi BetonnnnDokumen3.879 halamanBesi Betonnnnhalo windaBelum ada peringkat

- Kilinochchi Tender Price Schedule - FinalDokumen103 halamanKilinochchi Tender Price Schedule - FinalSurendra ElayathambyBelum ada peringkat

- UPTU RESULT - Roll No. 5270214 To 6740337Dokumen1.061 halamanUPTU RESULT - Roll No. 5270214 To 6740337Rahul MalhotraBelum ada peringkat

- Perpindahan Panas: Tugas 3 (Double PipeDokumen4 halamanPerpindahan Panas: Tugas 3 (Double Pipeiim252575% (4)

- TS 5673 1997 Medchal (1504) 23 3 14 1678815076279Dokumen7 halamanTS 5673 1997 Medchal (1504) 23 3 14 1678815076279Sai KrishnaBelum ada peringkat

- Welding CalculationDokumen32 halamanWelding CalculationDenial Basanovic100% (1)

- Liq Expansion CalculationsDokumen4 halamanLiq Expansion CalculationsGary JonesBelum ada peringkat

- Job Pending 6 Januari 2024 (Perdana - Loreh)Dokumen18 halamanJob Pending 6 Januari 2024 (Perdana - Loreh)Reza SyailendraBelum ada peringkat

- Gratuity Sep 2023Dokumen33 halamanGratuity Sep 2023joseph davidBelum ada peringkat

- Stability Calculation - GeneralDokumen12 halamanStability Calculation - GeneralramlidisaBelum ada peringkat

- Accountability For Fort Portal TB Region: Item Unit Quantity Days Unit Cost (UGX) Amount Received (UGX) Amount Spent (Ugx) Balance (UGX)Dokumen1 halamanAccountability For Fort Portal TB Region: Item Unit Quantity Days Unit Cost (UGX) Amount Received (UGX) Amount Spent (Ugx) Balance (UGX)Num NebBelum ada peringkat

- Tagihan - 04 Feb 2024 - Halaman 1Dokumen3 halamanTagihan - 04 Feb 2024 - Halaman 1aufalitsarrBelum ada peringkat

- B4-Pt Sawung Gema Abadi: Perhitungan SapronakDokumen4 halamanB4-Pt Sawung Gema Abadi: Perhitungan SapronakAhmad AsykhiyaniBelum ada peringkat

- Lista de DefensivosDokumen1 halamanLista de DefensivosMatheus NascimentoBelum ada peringkat

- Credit Note Quality Rebate rb-2223 TR No 016Dokumen1 halamanCredit Note Quality Rebate rb-2223 TR No 016Kapil sharmaBelum ada peringkat

- Encumbrance FormDokumen1 halamanEncumbrance Formsiva krishnaBelum ada peringkat

- Depot at A GlanceDokumen7 halamanDepot at A GlanceSubhash SinghBelum ada peringkat

- Project Names With W. O. NosDokumen6 halamanProject Names With W. O. NosSaid Ahmed SalemBelum ada peringkat

- Assignment 2Dokumen6 halamanAssignment 2Marlisa SalamatBelum ada peringkat

- Gist of Gross Saving Amount in Civil AuditDokumen1 halamanGist of Gross Saving Amount in Civil Auditvinod_eicsBelum ada peringkat

- CC 329 2023 Intro Coimbatore PollachiDokumen1 halamanCC 329 2023 Intro Coimbatore PollachiSasidhar Chowdary UppuluriBelum ada peringkat

- Solar Angle CalculatorDokumen51 halamanSolar Angle CalculatorJeff FainBelum ada peringkat

- Basel 1Dokumen3 halamanBasel 1RanjitBelum ada peringkat

- Economics Basics: Basel II Accord To Guard Against Financial ShocksDokumen2 halamanEconomics Basics: Basel II Accord To Guard Against Financial ShocksRanjitBelum ada peringkat

- Basel 2Dokumen3 halamanBasel 2RanjitBelum ada peringkat

- GC AnswersDokumen3 halamanGC AnswersRanjitBelum ada peringkat

- Large Firms To Pay More For Large LoansDokumen2 halamanLarge Firms To Pay More For Large LoansRanjitBelum ada peringkat

- Negative Interest RateDokumen2 halamanNegative Interest RateRanjitBelum ada peringkat

- Basel 1Dokumen3 halamanBasel 1RanjitBelum ada peringkat

- Annualreport11 12Dokumen175 halamanAnnualreport11 12RanjitBelum ada peringkat

- MS Formulation ProblemsDokumen4 halamanMS Formulation ProblemsRanjitBelum ada peringkat

- Acquisition Assignment IGate-PatniDokumen17 halamanAcquisition Assignment IGate-PatniRanjitBelum ada peringkat

- Evaluation Sheet For General Fitness For The Profession (GPME-402-E) B.tech-1Dokumen2 halamanEvaluation Sheet For General Fitness For The Profession (GPME-402-E) B.tech-1RanjitBelum ada peringkat

- Email Id - 9818393609 - Linkedin Id: PhotoDokumen2 halamanEmail Id - 9818393609 - Linkedin Id: PhotoRanjitBelum ada peringkat

- Application For Employment - Ver 8.2 PDFDokumen4 halamanApplication For Employment - Ver 8.2 PDFRanjitBelum ada peringkat

- (WWW - Entrance-Exam - Net) - Deloitte Placement Sample Paper 1Dokumen3 halaman(WWW - Entrance-Exam - Net) - Deloitte Placement Sample Paper 1sdeshpande87Belum ada peringkat

- PAFC ProjectDokumen10 halamanPAFC ProjectRanjitBelum ada peringkat

- OOAD Exercise For Practical FileDokumen1 halamanOOAD Exercise For Practical FilePrashant KumarBelum ada peringkat

- Assignment 1Dokumen1 halamanAssignment 1RanjitBelum ada peringkat

- Corporate Social Activity - LAB ReportDokumen10 halamanCorporate Social Activity - LAB ReportRanjitBelum ada peringkat

- BCCL ConsolidatedDokumen12 halamanBCCL ConsolidatedRanjitBelum ada peringkat

- Mixed ConstraintsDokumen6 halamanMixed ConstraintsRanjitBelum ada peringkat

- Markonics Quiz PDFDokumen9 halamanMarkonics Quiz PDFRanjitBelum ada peringkat

- Cost Report Reconciled Cost Report For 2013-14 (13 Cost) at Bhart Coking Coal LimitedDokumen4 halamanCost Report Reconciled Cost Report For 2013-14 (13 Cost) at Bhart Coking Coal LimitedRanjitBelum ada peringkat

- Assignment 1Dokumen1 halamanAssignment 1RanjitBelum ada peringkat

- EcoDokumen8 halamanEcoRanjitBelum ada peringkat

- Retailing and Visual MerchandisingDokumen1 halamanRetailing and Visual MerchandisingRanjitBelum ada peringkat

- WBUT Ten Point ScaleDokumen1 halamanWBUT Ten Point ScaleRanjitBelum ada peringkat

- Recruitment Policies of CompaniesDokumen5 halamanRecruitment Policies of CompaniesRanjitBelum ada peringkat

- Group 5Dokumen30 halamanGroup 5RanjitBelum ada peringkat

- Snob and Bandwagon EffectDokumen6 halamanSnob and Bandwagon EffectRanjitBelum ada peringkat

- E Tax 2Dokumen1 halamanE Tax 2TemesgenBelum ada peringkat

- Signa Aviation Services (Pty) LTD: Bill To: Ship ToDokumen1 halamanSigna Aviation Services (Pty) LTD: Bill To: Ship ToForexx 101Belum ada peringkat

- 2022 Alabama Scorecard FINALDokumen24 halaman2022 Alabama Scorecard FINALJeffrey PoorBelum ada peringkat

- City Assessor Bacolod PDFDokumen6 halamanCity Assessor Bacolod PDFMaya Julieta Catacutan-EstabilloBelum ada peringkat

- SRC Income Tax Drop Off FormDokumen2 halamanSRC Income Tax Drop Off FormArvind MishraBelum ada peringkat

- NDC Vs CIR Source of InterestDokumen4 halamanNDC Vs CIR Source of InterestEvan NervezaBelum ada peringkat

- G.R. No. 166387 January 19, 2009 Commissioner of Internal Revenue, Petitioners, vs. Enron Subic Powercorporation, RespondentsDokumen3 halamanG.R. No. 166387 January 19, 2009 Commissioner of Internal Revenue, Petitioners, vs. Enron Subic Powercorporation, RespondentsbowbingBelum ada peringkat

- Invitation To Bid: Hyderabad Electric Supply Company LimitedDokumen1 halamanInvitation To Bid: Hyderabad Electric Supply Company LimitedFarhan ShaikhBelum ada peringkat

- Philippines, Plaintiff, Versus Quirico Ungab, Accused " and To RestrainDokumen5 halamanPhilippines, Plaintiff, Versus Quirico Ungab, Accused " and To RestrainLeBron DurantBelum ada peringkat

- Form 26QB: Complete Address of The Property Transferee Complete Address of The Property TransferorDokumen2 halamanForm 26QB: Complete Address of The Property Transferee Complete Address of The Property TransferorRabindra SinghBelum ada peringkat

- SG 2Dokumen29 halamanSG 2creatine2Belum ada peringkat

- Case Study 5.2Dokumen5 halamanCase Study 5.2Jessa Beloy100% (6)

- Manning Centre Report On Calgary City CouncilDokumen41 halamanManning Centre Report On Calgary City CouncilCalgary HeraldBelum ada peringkat

- Feasibility Study On Production of RasaposhaDokumen42 halamanFeasibility Study On Production of RasaposhaRutvik ShingalaBelum ada peringkat

- En PDF Toolkit HSS FinancingDokumen14 halamanEn PDF Toolkit HSS FinancingRetno FebriantiBelum ada peringkat

- Conta FinancieraDokumen21 halamanConta FinancieraAdrian TajmaniBelum ada peringkat

- Acca Fa Test 1 - CHP 1,3,4,5 SolnDokumen11 halamanAcca Fa Test 1 - CHP 1,3,4,5 SolnAkash RadhakrishnanBelum ada peringkat

- Articles of IncorporationDokumen4 halamanArticles of Incorporationcoo9486Belum ada peringkat

- CUDOS Token Sale Terms V2OCTDokumen27 halamanCUDOS Token Sale Terms V2OCTDusmanu M. GabrielBelum ada peringkat

- Chapter 16 Homework SolutionsDokumen6 halamanChapter 16 Homework SolutionsJackBelum ada peringkat

- Sensex Crashes 1,000 Pts On Mounting Inflation Worries: Ruling Authority For Direct Tax Cases On CardsDokumen16 halamanSensex Crashes 1,000 Pts On Mounting Inflation Worries: Ruling Authority For Direct Tax Cases On CardsRahulMIBBelum ada peringkat

- Cordova Catholic Cooperative School (Formerly Cordova Academy) Poblacion, Cordova CebuDokumen5 halamanCordova Catholic Cooperative School (Formerly Cordova Academy) Poblacion, Cordova CebuAndrewBelum ada peringkat

- CIR v. AvonDokumen3 halamanCIR v. AvonLucifer MorningBelum ada peringkat

- Module 1 ExamDokumen22 halamanModule 1 ExamRoger Chivas100% (1)

- 2014 Annexcross-Countrydata (Ima Jedna Tabela 112 Bez Brojeva)Dokumen330 halaman2014 Annexcross-Countrydata (Ima Jedna Tabela 112 Bez Brojeva)Jovana LazićBelum ada peringkat

- Program, Projects, Activities: Republic of The Philippines Barangay - City of ZamboangaDokumen5 halamanProgram, Projects, Activities: Republic of The Philippines Barangay - City of ZamboangaArman BentainBelum ada peringkat

- Introduction To Public FinanceDokumen32 halamanIntroduction To Public FinanceClaudine Aguiatan55% (11)

- ITR Acknowledgement T Durga PrasadDokumen1 halamanITR Acknowledgement T Durga PrasadEdu KondaluBelum ada peringkat

- Ghana Tourism Development Plan PDFDokumen362 halamanGhana Tourism Development Plan PDFFelicitas RelatoBelum ada peringkat

- INZ 1003 Self Assess Guide For Residence in NZ 1.0 April 2016Dokumen20 halamanINZ 1003 Self Assess Guide For Residence in NZ 1.0 April 2016Ramin ShabBelum ada peringkat