DeployRenew2008 f1

Diunggah oleh

raul_iieefDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

DeployRenew2008 f1

Diunggah oleh

raul_iieefHak Cipta:

Format Tersedia

Executive Summary

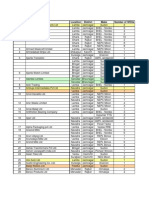

Figure 1. Combination framework of policy incentives as a function

Market Deployment of technology maturity

Stimulate market pull

Technology-neutral Voluntary (green)

competition demand

TGC

Carbon trading (EU ETS) Mature

technologies

(e.g. hydro)

Low cost-gap

technologies

Imposed market risk,

(e.g. wind guaranteed but declining

onshore) minimum return

Continuity, RD&D, create market

attractiveness Price-based: FIP

Capital cost incentives: investment tax Quantity-based: TGC with

credits, rebates, loan guarantees etc. technology banding

Prototype & High cost-gap

demonstration stage technologies Stability, low-risk

(e.g. PV) incentives

technologies (e.g. 2nd Price-based: FIT, FIP

generation biofuels) Quantity-based: Tenders

Development Niche markets Mass market Time

NB: The positions of the various technologies and incentive schemes along the S-curve are an indicative example at a given moment.

The actual optimal mix and timing of policy incentives will depend on specific national circumstances. The level of competitiveness

will also change as a function of the evolving prices of competing technologies.

Recommendations

All governments are encouraged to note the following principles relating to policies

supporting RET deployment:

• Realise the urgency of implementing effective support mechanisms in order to accelerate

the exploitation of the major potential of renewable energy technologies to improve

energy security and tackle climate change;

• Remove and overcome non-economic barriers as a first priority to improve policy and

market functioning;

• Recognise the substantial potential for improvement of policy effectiveness and efficiency

in most countries and learn from good practice;

• Focus on coherent and rigorous implementation of the five fundamental policy design

principles, with the aim of maximising long-term cost efficiency while having regard to

© OECD/IEA, 2008

national circumstances;

25

Anda mungkin juga menyukai

- Indo Solar Expo KW Upload To CASE Website VersionDokumen38 halamanIndo Solar Expo KW Upload To CASE Website VersionhoingchenBelum ada peringkat

- Research Grant Donors: ItidaDokumen5 halamanResearch Grant Donors: ItidaAbdalla Mohamed AbdallaBelum ada peringkat

- Business Environment RIGHTMOVEDokumen7 halamanBusiness Environment RIGHTMOVEslavcheva.petyaBelum ada peringkat

- Bouwmanetal. DefinitiefDokumen22 halamanBouwmanetal. DefinitiefShree SellerBelum ada peringkat

- Introduction To Business EconomicsDokumen15 halamanIntroduction To Business EconomicsANKITA LUTHRA EPGDIB 2018-20Belum ada peringkat

- Kees BerendsDokumen5 halamanKees BerendsJavier LopezBelum ada peringkat

- Session VII: Technology PlanningDokumen23 halamanSession VII: Technology PlanningNarenthran RameshBelum ada peringkat

- 9159-Article Text PDF-33276-3-10-20180129Dokumen11 halaman9159-Article Text PDF-33276-3-10-20180129Aishwarya SwamyBelum ada peringkat

- Optimal Integrated Generation Bidding and Scheduling With Risk Management Under A Deregulated Power MarketDokumen10 halamanOptimal Integrated Generation Bidding and Scheduling With Risk Management Under A Deregulated Power Marketapi-3697505Belum ada peringkat

- Carbon Pricing - Pak DidaDokumen11 halamanCarbon Pricing - Pak DidaIchlasul ArifBelum ada peringkat

- Category Factors Political: PESTLE and SWOT AnalysisDokumen3 halamanCategory Factors Political: PESTLE and SWOT AnalysisNasir BashirBelum ada peringkat

- Ricoh IM C3000 Marketing PlanDokumen16 halamanRicoh IM C3000 Marketing PlanAhmed HadadBelum ada peringkat

- ADL Cost Reduction Telecom IndustryDokumen4 halamanADL Cost Reduction Telecom IndustryPrashant PathakBelum ada peringkat

- GHG Report 2016 The Different Approaches To Carbon Markets GFDokumen2 halamanGHG Report 2016 The Different Approaches To Carbon Markets GFChoky SimanjuntakBelum ada peringkat

- Ports by PPP - TAMP As Market Regulator: Anirudh Reddy, Project Lead, Tata Strategic Management GroupDokumen4 halamanPorts by PPP - TAMP As Market Regulator: Anirudh Reddy, Project Lead, Tata Strategic Management Groupshyam anandjiwalaBelum ada peringkat

- Role of GovDokumen23 halamanRole of GovbvtamsenBelum ada peringkat

- Res4Med - Atc 2016 "Integration of Renewable Energy Solutions in The Electricity Markets"Dokumen12 halamanRes4Med - Atc 2016 "Integration of Renewable Energy Solutions in The Electricity Markets"NassimBelum ada peringkat

- Telecom Cost StructureDokumen16 halamanTelecom Cost Structurepuneet1955Belum ada peringkat

- 03pa JS 4 1 PDFDokumen6 halaman03pa JS 4 1 PDFMarcelo Varejão CasarinBelum ada peringkat

- Himont Case StrategyDokumen11 halamanHimont Case StrategyayushBelum ada peringkat

- Tassey 1991Dokumen17 halamanTassey 1991nijas bolaBelum ada peringkat

- IPCC Synthesis Report: Costs of Mitigation MeasuresDokumen14 halamanIPCC Synthesis Report: Costs of Mitigation MeasuresTiborBelum ada peringkat

- International MarketingDokumen110 halamanInternational Marketingbittu.abhishek99Belum ada peringkat

- D6.4 - FLEXYNETS-TRADING PoliciesDokumen42 halamanD6.4 - FLEXYNETS-TRADING PoliciesMuhammad Zaki Tamimi MohamadBelum ada peringkat

- 12-Energy Efficiency Business Opportunities - Dir. Patrick T. AquinoDokumen35 halaman12-Energy Efficiency Business Opportunities - Dir. Patrick T. AquinoChristopher BalbuenaBelum ada peringkat

- Non Residential Charging Infrastructure Provision Final Impact AssessmentDokumen44 halamanNon Residential Charging Infrastructure Provision Final Impact AssessmentLuke HainesBelum ada peringkat

- 2023 - 11 - 30 Snam Our Journey To Decarbonization - SnamDokumen19 halaman2023 - 11 - 30 Snam Our Journey To Decarbonization - SnampkasarakBelum ada peringkat

- 20.9 Vinod Thomas 20 Sep - Financial and Market-Based Interventions Post-GlasgowDokumen24 halaman20.9 Vinod Thomas 20 Sep - Financial and Market-Based Interventions Post-GlasgowHa TuanBelum ada peringkat

- The Zero Subsidy Renewables OpportunityDokumen44 halamanThe Zero Subsidy Renewables OpportunityTBelum ada peringkat

- Financial ForecastingDokumen22 halamanFinancial Forecastingjodi setya pratamaBelum ada peringkat

- Exogenous Cost Allocation in Peer-To-Peer Electricity MarketsDokumen12 halamanExogenous Cost Allocation in Peer-To-Peer Electricity MarketsRAVI RAKESHKUMAR TRIVEDIBelum ada peringkat

- Automotive (DTDokumen7 halamanAutomotive (DTS raoBelum ada peringkat

- TLIMP 1.2 Ecology As StrategyDokumen28 halamanTLIMP 1.2 Ecology As StrategygpowerpBelum ada peringkat

- Mergers and Acquisitions in The Telecommunications Industry: Myths and RealityDokumen9 halamanMergers and Acquisitions in The Telecommunications Industry: Myths and RealityRomi S. SethiBelum ada peringkat

- Standardization in Technology-Based Markets: Gregory TasseyDokumen16 halamanStandardization in Technology-Based Markets: Gregory TasseyReneBelum ada peringkat

- Cloud Computing ReportDokumen30 halamanCloud Computing ReportjocadaBelum ada peringkat

- Evidencia 8 - Export and or ImportDokumen5 halamanEvidencia 8 - Export and or ImportJohanna JimenezBelum ada peringkat

- METI ZEV Trend in JapanDokumen24 halamanMETI ZEV Trend in JapanKennex TsaiBelum ada peringkat

- Assorted FrameworksDokumen30 halamanAssorted FrameworksPRASHANT KUMARBelum ada peringkat

- 1.investor Presentation April 2018 PDFDokumen35 halaman1.investor Presentation April 2018 PDFYip DavidBelum ada peringkat

- GIZ Auctioning Study - EN PDFDokumen78 halamanGIZ Auctioning Study - EN PDFKen NgoBelum ada peringkat

- Paper 12 PDFDokumen19 halamanPaper 12 PDFDevika ToliaBelum ada peringkat

- Paper 12 PDFDokumen19 halamanPaper 12 PDFDevika ToliaBelum ada peringkat

- Artikel 1 MethodologyDokumen9 halamanArtikel 1 MethodologyWouter van KranenburgBelum ada peringkat

- Discussion Paper: Future Energy Storage Systems For Mobility ApplicationsDokumen48 halamanDiscussion Paper: Future Energy Storage Systems For Mobility ApplicationsAnedo 1909Belum ada peringkat

- Sustainable Competitive AdvantageDokumen25 halamanSustainable Competitive AdvantageRyanRasendriyaBelum ada peringkat

- IBA2.3.2 FiveForcesbDokumen9 halamanIBA2.3.2 FiveForcesbLuísa Oliveira Machado BuenoBelum ada peringkat

- 17 Golam Final (173-183)Dokumen11 halaman17 Golam Final (173-183)Shahid Ahmed KhanBelum ada peringkat

- Nov 9, 2018 - II-VI Finisar Investor PresentationDokumen18 halamanNov 9, 2018 - II-VI Finisar Investor PresentationJack PurcherBelum ada peringkat

- Ie Regtech PotentialDokumen16 halamanIe Regtech Potentialekammumbai2017Belum ada peringkat

- Quantum CIM - May 2019 VFDokumen125 halamanQuantum CIM - May 2019 VFGlori ortuBelum ada peringkat

- Back Bay Battery AnalysisDokumen15 halamanBack Bay Battery AnalysisDavid van G87% (55)

- A Machine Learning Framework For An Algorithmic Trading System PDFDokumen11 halamanA Machine Learning Framework For An Algorithmic Trading System PDFcidsantBelum ada peringkat

- HAMProjectsDokumen26 halamanHAMProjectsarmaanBelum ada peringkat

- Market PotentialDokumen41 halamanMarket Potentialnadjib62Belum ada peringkat

- Internal AnalysisDokumen25 halamanInternal AnalysisCyboBelum ada peringkat

- GECON06 Grid Economic Issues Thanos Courcoubetis Stamoulis FinalDokumen16 halamanGECON06 Grid Economic Issues Thanos Courcoubetis Stamoulis FinalYorgos ThanosBelum ada peringkat

- Future Telco: Successful Positioning of Network Operators in the Digital AgeDari EverandFuture Telco: Successful Positioning of Network Operators in the Digital AgePeter KrüsselBelum ada peringkat

- Innovation Landscape brief: Behind-the-meter batteriesDari EverandInnovation Landscape brief: Behind-the-meter batteriesBelum ada peringkat

- Bioenergetics DLLDokumen2 halamanBioenergetics DLLAlvin PaboresBelum ada peringkat

- Lesson Plan ThermalDokumen3 halamanLesson Plan ThermalGokulraju RangasamyBelum ada peringkat

- Nitrox Hybrid 3.6 5kw SP 5g SmallDokumen19 halamanNitrox Hybrid 3.6 5kw SP 5g Smallaalam khanBelum ada peringkat

- 12.. IceDokumen34 halaman12.. IceVinoth Kumar VinsBelum ada peringkat

- LM Glasfiber Newsletter 2008 - 1Dokumen8 halamanLM Glasfiber Newsletter 2008 - 1Nemanja KomatinovicBelum ada peringkat

- Data Pengamatan Dan Hasil Perhitungan HE Revvvvv-1Dokumen16 halamanData Pengamatan Dan Hasil Perhitungan HE Revvvvv-1AhmdMaulanaBelum ada peringkat

- Envirn-Engg Iit KanpurDokumen6 halamanEnvirn-Engg Iit KanpurNbisht25Belum ada peringkat

- Pidato Bahasa Inggris Global WarmingDokumen2 halamanPidato Bahasa Inggris Global WarmingTari MoetsBelum ada peringkat

- Proudly Launching Our Energy Saving Precision ChillerDokumen13 halamanProudly Launching Our Energy Saving Precision ChillerGem OrionBelum ada peringkat

- AmanaCB ASX14Dokumen4 halamanAmanaCB ASX14Pamela AlfordBelum ada peringkat

- McNeil Ocean WaveDokumen19 halamanMcNeil Ocean WaveEmiljonBernardBelum ada peringkat

- Short-Circuit Coordination Harmonic StudiesDokumen5 halamanShort-Circuit Coordination Harmonic StudiesparthaBelum ada peringkat

- Firefly 8Dokumen6 halamanFirefly 8Dr. B. Srinivasa Rao Professor, EEE DepartmentBelum ada peringkat

- Marin Cable JIPDokumen16 halamanMarin Cable JIPtyuBelum ada peringkat

- Centralized Architecture of The Distribution Substation AutomationDokumen154 halamanCentralized Architecture of The Distribution Substation AutomationMichael Parohinog GregasBelum ada peringkat

- Grundfos Pump (Recommended)Dokumen4 halamanGrundfos Pump (Recommended)ianBelum ada peringkat

- British BS 88 FusesDokumen9 halamanBritish BS 88 FusesFelix MutambaBelum ada peringkat

- Learning Packet-Week 3 - EnergyDokumen15 halamanLearning Packet-Week 3 - EnergyVioleta YutucBelum ada peringkat

- Pressure Vessel Inspection PDF FreeDokumen44 halamanPressure Vessel Inspection PDF FreemabroukBelum ada peringkat

- 2.1 T4594-G-QTT-001 - HURE - Kouroussa LV Substations BOQDokumen74 halaman2.1 T4594-G-QTT-001 - HURE - Kouroussa LV Substations BOQJean-Pierre AwuBelum ada peringkat

- ME 522 - Power Plant Engineering - Steam Power Plant - Part 2 - LectureDokumen32 halamanME 522 - Power Plant Engineering - Steam Power Plant - Part 2 - LectureJom Ancheta BautistaBelum ada peringkat

- Numerical Reasoning Test2 QuestionsDokumen11 halamanNumerical Reasoning Test2 QuestionsvarshnnhBelum ada peringkat

- IRENA IEAPVPS End-of-Life Solar PV Panels 2016 PDFDokumen100 halamanIRENA IEAPVPS End-of-Life Solar PV Panels 2016 PDFAndre SBelum ada peringkat

- 1447420817-Power Engineering Eng 9Dokumen1 halaman1447420817-Power Engineering Eng 9icaanmpzBelum ada peringkat

- Abb LTB 170d ManualDokumen12 halamanAbb LTB 170d ManualLloyd Tafadzwa Ndamba100% (1)

- Wind Energy CDM DataDokumen40 halamanWind Energy CDM DataSatyaveer Rhythem Pal100% (1)

- Resco and CapexDokumen6 halamanResco and CapexSurinder KumarBelum ada peringkat

- 0S-ACRP1xx REV01Dokumen2 halaman0S-ACRP1xx REV01Cidi Com100% (1)

- Sl. No Bhel DRG No. NTPC DRG No. Titile of The DocumentDokumen2 halamanSl. No Bhel DRG No. NTPC DRG No. Titile of The DocumentAnjaneyulu BodhanapuBelum ada peringkat

- ThermochemistryDokumen6 halamanThermochemistryrskr_tBelum ada peringkat