Arrears Calculator

Diunggah oleh

spsdelDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Arrears Calculator

Diunggah oleh

spsdelHak Cipta:

Format Tersedia

Calculation Sheet of Arrears

Pls fill up your own details to replace RED coloured entries below. This calculation sheet is only for pre-revised scale of S-1 to S-15.

With best compliments from:

SP SHARMA, SR. AUDITOR, AN-I SECTION, CGDA'S OFFICE. (email: surenderpal.sharma @ gmail.com)

Name: SP Sharma

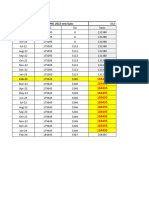

Enter Basic Pay drawn as on 01/01/2006 7425 Percentage of DA*

Enter New Grade Pay 4200 1/1/2006 0

Enter New rate of HRA applicable to you 30 % 1/7/2006 2

Enter Month of Old increment due 2 1/1/2007 4

Enter rate of old Increment 175 1/7/2007 8

Residing in Govt accommodation ? No 1/1/2008 12

Enter New rate of Tpt Allce 1600 1/7/2008 16

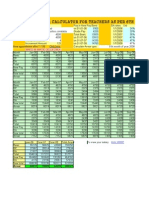

Revised Pay (DUE) Pre-revised Pay (DRAWN) Arrears

Month Basic Pay Grade Pay Total Pay DA Gross Pay Basic Pay DP DA Gross Pay

Jan 2006 13820 4200 18020 0 18020 7425 3713 2673 13811 4209

Feb 2006 13820 4200 18020 0 18020 7600 3800 2736 14136 3884

Mar 2006 13820 4200 18020 0 18020 7600 3800 2736 14136 3884

Apr 2006 13820 4200 18020 0 18020 7600 3800 2736 14136 3884

May 2006 13820 4200 18020 0 18020 7600 3800 2736 14136 3884

June 2006 13820 4200 18020 0 18020 7600 3800 2736 14136 3884

July 2006 14361 4200 18561 0 18561 7600 3800 3306 14706 3855

Aug 2006 14361 4200 18561 371 18932 7600 3800 3306 14706 4226

Sep 2006 14361 4200 18561 371 18932 7600 3800 3306 14706 4226

Oct 2006 14361 4200 18561 371 18932 7600 3800 3306 14706 4226

Nov 2006 14361 4200 18561 371 18932 7600 3800 3306 14706 4226

Dec 2006 14361 4200 18561 371 18932 7600 3800 3306 14706 4226

Jan 2007 14361 4200 18561 742 19303 7600 3800 3990 15390 3913

Feb 2007 14361 4200 18561 742 19303 7775 3888 4082 15745 3558

Mar 2007 14361 4200 18561 742 19303 7775 3888 4082 15745 3558

Apr 2007 14361 4200 18561 742 19303 7775 3888 4082 15745 3558

May 2007 14361 4200 18561 742 19303 7775 3888 4082 15745 3558

June 2007 14361 4200 18561 742 19303 7775 3888 4082 15745 3558

July 2007 14918 4200 19118 1529 20647 7775 3888 4782 16445 4202

Aug 2007 14918 4200 19118 1529 20647 7775 3888 4782 16445 4202

Sep 2007 14918 4200 19118 1529 20647 7775 3888 4782 16445 4202

Oct 2007 14918 4200 19118 1529 20647 7775 3888 4782 16445 4202

Nov 2007 14918 4200 19118 1529 20647 7775 3888 4782 16445 4202

Dec 2007 14918 4200 19118 1529 20647 7775 3888 4782 16445 4202

Jan 2008 14918 4200 19118 2294 21412 7775 3888 5482 17145 4267

Feb 2008 14918 4200 19118 2294 21412 7950 3975 5605 17530 3882

Mar 2008 14918 4200 19118 2294 21412 7950 3975 5605 17530 3882

Apr 2008 14918 4200 19118 2294 21412 7950 3975 5605 17530 3882

May 2008 14918 4200 19118 2294 21412 7950 3975 5605 17530 3882

Jun 2008 14918 4200 19118 2294 21412 7950 3975 5605 17530 3882

Jul 2008 14935 4200 19135 3062 22197 7950 3975 6320 18245 3952

Aug 2008 14935 4200 19135 3062 22197 7950 3975 6320 18245 3952

449203 130200 579403 32307 611710 239625 119819 129108 488552 123158

The above calculations are on the presumption that Your revised worth is as under w.e.f. 1.9.2008

full arrears of Pay & DA will be payable w.e.f. 1.1.2006

and that arrears of HRA and TPT will not be payable.

Enjoy the booty !! BASIC PAY 14935

GRADE PAY 4200

40% of arrears works out to 49263 DA 3062

60% of arrears works out to 73895 TPT 1888

HRA 5741

*Percentage of DA Rates: GROSS PAY 29826

As per news on media and internet, the %age rates of DA have not

been spelt out. The DA rates selected above are only presumptive.

However, flexibility has been provided to select the actual rates of

DA as and when announced and then see your revised booty !!

Anda mungkin juga menyukai

- Six Pay ArrearsDokumen5 halamanSix Pay ArrearsshricystrustBelum ada peringkat

- Calculation Sheet of Arrears (W Promotion Option)Dokumen4 halamanCalculation Sheet of Arrears (W Promotion Option)santoshingoleBelum ada peringkat

- Arrears and New Pay Calculator (Up To PB 2)Dokumen4 halamanArrears and New Pay Calculator (Up To PB 2)ajmermukhtar100% (2)

- Arrear Calculations: Old Scale New Scale Arrears Basic DP DA Total Pa Da TotalDokumen4 halamanArrear Calculations: Old Scale New Scale Arrears Basic DP DA Total Pa Da TotalalokjiBelum ada peringkat

- Gujarat Six Pay CalculatorDokumen2 halamanGujarat Six Pay Calculator0028311493% (15)

- Arrears Are RsDokumen15 halamanArrears Are Rsnavdeepsingh.india8849Belum ada peringkat

- Modified Calculator For Railway Running StaffDokumen3 halamanModified Calculator For Railway Running Stafforkut100% (3)

- MAHIDA Six Pay Calculator Fo Teachers and StaffsDokumen4 halamanMAHIDA Six Pay Calculator Fo Teachers and Staffsgeetmans100% (1)

- Sixth Pay Commission Arrear Calculator For TeachersDokumen7 halamanSixth Pay Commission Arrear Calculator For Teachersmandeepkumardagar100% (35)

- ArrearsDokumen2 halamanArrearsm_sreeharshaBelum ada peringkat

- San Arrear CalcuDokumen16 halamanSan Arrear Calcubachchu singhBelum ada peringkat

- Annual Salary Statement (2006 - 2007) : CCA 300 TPT 800 HRA 1 Y 1, N 0 HRA Rate 30Dokumen12 halamanAnnual Salary Statement (2006 - 2007) : CCA 300 TPT 800 HRA 1 Y 1, N 0 HRA Rate 30rcscwcBelum ada peringkat

- Maharashtra State 6PC Arrears Calculator UpdatedDokumen9 halamanMaharashtra State 6PC Arrears Calculator UpdatedRajesh Nage100% (15)

- Loading... : Product LinksDokumen28 halamanLoading... : Product Linkss_lakkoju100% (8)

- Pc-Arrears-Pb3 - PAY COMMISSION CALCULATORDokumen20 halamanPc-Arrears-Pb3 - PAY COMMISSION CALCULATORmohan9813032985@yahoo.com100% (2)

- 6pc CalDokumen2 halaman6pc Calsarang_vkBelum ada peringkat

- Six Pay Latest Calculator by Jitendra Patel GozariaDokumen2 halamanSix Pay Latest Calculator by Jitendra Patel Gozariaanon-6428050% (1)

- Arrears and Expected Pay As On April-2008: Name:ShriDokumen6 halamanArrears and Expected Pay As On April-2008: Name:Shrianon-741455100% (3)

- 7th Pay Commission Charge AllowanceDokumen4 halaman7th Pay Commission Charge AllowanceAkash SaggiBelum ada peringkat

- Due Drawn Trial LatestDokumen6 halamanDue Drawn Trial Latestajayguleria2Belum ada peringkat

- 6thpaycalculation Tamilnadu Govt NewDokumen102 halaman6thpaycalculation Tamilnadu Govt Newsenthilvayal100% (4)

- Caculation of IT Tax (INDIA)Dokumen11 halamanCaculation of IT Tax (INDIA)aks1296Belum ada peringkat

- 6 CPC Arrears Pay CalculatorDokumen2 halaman6 CPC Arrears Pay CalculatorBiman Kumar Pal100% (86)

- August 18-CalculationDokumen1 halamanAugust 18-Calculationgopinath1954Belum ada peringkat

- 6PC Arrears CalculatorDokumen6 halaman6PC Arrears Calculatoranon-530704Belum ada peringkat

- PRC ComparisionDokumen3 halamanPRC ComparisionIshak MohammedBelum ada peringkat

- Sixth Pay Commission Arrears CalculationDokumen4 halamanSixth Pay Commission Arrears CalculationadityansBelum ada peringkat

- Calculation Sheet of Arrears (Incl Promotion/ACP/New Appt)Dokumen6 halamanCalculation Sheet of Arrears (Incl Promotion/ACP/New Appt)slbhartiBelum ada peringkat

- SPC Calculator GeneralDokumen4 halamanSPC Calculator GeneralrajkumarvarierBelum ada peringkat

- Pay Arrear Calculator For Teachers As Per 6Th Pay Commission ReportDokumen7 halamanPay Arrear Calculator For Teachers As Per 6Th Pay Commission ReportparbhBelum ada peringkat

- Salary Statement of Fy 2019 2020Dokumen2 halamanSalary Statement of Fy 2019 2020Sunil UrkudeBelum ada peringkat

- Ajit Arrear StatementDokumen12 halamanAjit Arrear Statementakdas52Belum ada peringkat

- Salary Aks All CitiesDokumen4 halamanSalary Aks All CitiesarunsinghbabyBelum ada peringkat

- AF PensionDokumen6 halamanAF PensionGn MurthyBelum ada peringkat

- TN Pay Comm Arrear CalculatorDokumen3 halamanTN Pay Comm Arrear CalculatorRAVEEVISHAL100% (1)

- 6th Pay ArrearDokumen45 halaman6th Pay Arrearazazahmed shaikh100% (2)

- Madam ExcelDokumen2 halamanMadam ExcelwordofgodbookstallBelum ada peringkat

- Pay Scale Arrear Calculation Especially For PB-4 OfficersDokumen35 halamanPay Scale Arrear Calculation Especially For PB-4 OfficersSurinderSachdeva100% (7)

- Long Term PlanDokumen10 halamanLong Term Planali MehmoodBelum ada peringkat

- Vi PRC Arrear CalculatorDokumen4 halamanVi PRC Arrear Calculatordaniel25100% (2)

- Income Tax Agadan PrapatraDokumen3 halamanIncome Tax Agadan Prapatraat.amitkumarbstBelum ada peringkat

- Nijo Job: Basic HRA Com - All. WBP Bonus Gross PFDokumen1 halamanNijo Job: Basic HRA Com - All. WBP Bonus Gross PFNibin BeenaBelum ada peringkat

- Meil Tractable & Adani FY 20-21/AY 21-22 FY 21-22 Month Credited ITR Month Credited Amount As Per F-16Dokumen3 halamanMeil Tractable & Adani FY 20-21/AY 21-22 FY 21-22 Month Credited ITR Month Credited Amount As Per F-16vijay bolisettyBelum ada peringkat

- Shipment List 04082022Dokumen6 halamanShipment List 04082022Uyên NguyễnBelum ada peringkat

- Gross Pay From July 2017 To June 2018 Faryad Khan GPS BhurariDokumen4 halamanGross Pay From July 2017 To June 2018 Faryad Khan GPS BhurariUsman GhaniBelum ada peringkat

- Part No. Per Day TargetDokumen21 halamanPart No. Per Day Targetmechtek 20Belum ada peringkat

- BSNL Ida Calculator 2008-2009Dokumen6 halamanBSNL Ida Calculator 2008-2009goksyyy100% (2)

- My CPC Arrear Calculator Ver 2Dokumen17 halamanMy CPC Arrear Calculator Ver 2rahulbrooBelum ada peringkat

- All. Budget 2008-Previous Expdt. Present Expenditu Total Closing BalanceDokumen4 halamanAll. Budget 2008-Previous Expdt. Present Expenditu Total Closing BalanceParteek SharmaBelum ada peringkat

- Technical Tables for Schools and Colleges: The Commonwealth and International Library Mathematics DivisionDari EverandTechnical Tables for Schools and Colleges: The Commonwealth and International Library Mathematics DivisionBelum ada peringkat

- Winrar Password Remover 2015 Crack Plus Activation KeyDokumen15 halamanWinrar Password Remover 2015 Crack Plus Activation Keysiyamsanker722160% (5)

- List of PlayStation Store TurboGrafx-16 GamesDokumen3 halamanList of PlayStation Store TurboGrafx-16 Gamesjavi83Belum ada peringkat

- Digi Anal5Dokumen4 halamanDigi Anal5NGOUNEBelum ada peringkat

- Macro Teste de ResistenciaDokumen1 halamanMacro Teste de ResistenciaFelipe MouraBelum ada peringkat

- Analysis of Algorithms: CS 302 - Data Structures Section 2.6Dokumen48 halamanAnalysis of Algorithms: CS 302 - Data Structures Section 2.6Munawar AhmedBelum ada peringkat

- Lexicology Coursebook (Nguyễn Mạnh Hùng)Dokumen33 halamanLexicology Coursebook (Nguyễn Mạnh Hùng)duongnguyen4105Belum ada peringkat

- Departmental Models 641a UpgradeDokumen13 halamanDepartmental Models 641a UpgradeKrish NarajBelum ada peringkat

- EMC Cloud Solution - Security AssignmentDokumen40 halamanEMC Cloud Solution - Security AssignmentwhatstubesBelum ada peringkat

- Pentest Open 08 2013Dokumen76 halamanPentest Open 08 2013Jose Simpson100% (1)

- 2011 Goupil, P. AIRBUS State of The Art and Practices On FDI and FTC in FCSDokumen16 halaman2011 Goupil, P. AIRBUS State of The Art and Practices On FDI and FTC in FCScmpmarinhoBelum ada peringkat

- Cs HCM Person Basic Sync Hcm92 To Cs9Dokumen8 halamanCs HCM Person Basic Sync Hcm92 To Cs9cdahlinBelum ada peringkat

- Fdp-Aiml 2019 PDFDokumen20 halamanFdp-Aiml 2019 PDFkrishna_marlaBelum ada peringkat

- The Ultimate C - C - TS4CO - 1909 - SAP Certified Application Associate - SAP S/4HANA For Management Accounting Associates (SAP S/4HANA 1909)Dokumen2 halamanThe Ultimate C - C - TS4CO - 1909 - SAP Certified Application Associate - SAP S/4HANA For Management Accounting Associates (SAP S/4HANA 1909)KirstingBelum ada peringkat

- K Nearest Neighbor (KNN)Dokumen9 halamanK Nearest Neighbor (KNN)simransolanki003Belum ada peringkat

- Ramdump Modem 2023-09-07 07-20-23 PropsDokumen26 halamanRamdump Modem 2023-09-07 07-20-23 PropsIván Carrera YentzenBelum ada peringkat

- CAA66 ManualDokumen52 halamanCAA66 Manualferna2420Belum ada peringkat

- LTspiceIV FlyerDokumen2 halamanLTspiceIV FlyerAnonymous UZ5xA8Belum ada peringkat

- Th42px74ea PDFDokumen48 halamanTh42px74ea PDFJuan GutierrezBelum ada peringkat

- THEORY For Wein Bridge Oscillator Using Ic 741 Op AmpDokumen1 halamanTHEORY For Wein Bridge Oscillator Using Ic 741 Op AmpPurnima Sri Sai100% (1)

- GX1600 1600e SM Usa Exp Eu Em048n90dDokumen46 halamanGX1600 1600e SM Usa Exp Eu Em048n90dJadi PurwonoBelum ada peringkat

- PPC Portfolio PDFDokumen11 halamanPPC Portfolio PDFMirena Boycheva50% (2)

- Inductor SimulatorDokumen17 halamanInductor SimulatorwindfocusBelum ada peringkat

- 03.10.12. Final Syllabus (M.SC Math)Dokumen24 halaman03.10.12. Final Syllabus (M.SC Math)Devil tigerBelum ada peringkat

- Trends in Transformer ProtectionDokumen26 halamanTrends in Transformer Protectiontashidendup100% (2)

- BTC Mining - Google AramaDokumen1 halamanBTC Mining - Google AramaSuli Mrmassb0% (1)

- Optimization: 1 MotivationDokumen20 halamanOptimization: 1 MotivationSCRBDusernmBelum ada peringkat

- Public Records Report by Alameda County Grand JuryDokumen6 halamanPublic Records Report by Alameda County Grand JuryTerry FranckeBelum ada peringkat

- Future of IT Audit Report - Res - Eng - 0219Dokumen20 halamanFuture of IT Audit Report - Res - Eng - 0219Immanuel GiuleaBelum ada peringkat

- Detector de AmoniacoDokumen4 halamanDetector de AmoniacoSegundo Teofilo Cadenillas CabanillasBelum ada peringkat

- Biological Science 6th Edition Freeman Test BankDokumen21 halamanBiological Science 6th Edition Freeman Test Bankagleamamusable.pwclcq100% (28)